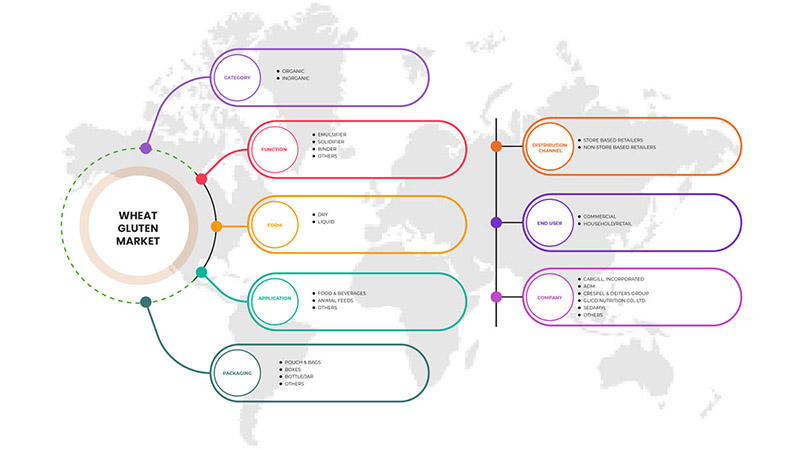

北米の小麦グルテン市場、カテゴリー別(有機および無機)、機能別(乳化剤、凝固剤、結合剤、その他)、形態別(液体および乾燥)、用途別(食品および飲料動物飼料、その他)、包装別(ボトル/ジャー、ポーチおよびバッグ、箱、その他)、流通チャネル別(店舗型小売業者および非店舗型小売業者)、エンドユーザー別(家庭/小売および商業) - 2029年までの業界動向および予測。

北米小麦グルテン市場の分析と洞察

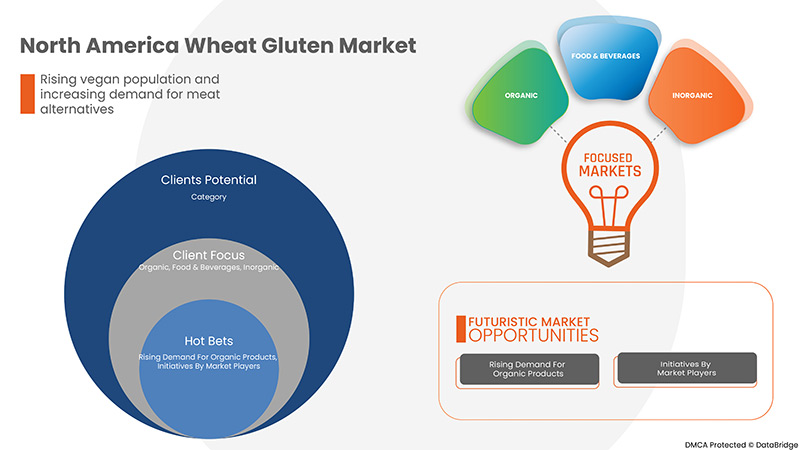

植物由来タンパク質の利点に関する認識の高まり、オーガニック製品に対する需要の高まり、市場関係者による取り組みにより、市場にチャンスが生まれています。しかし、生産と製造のコスト増加、グルテン過敏症、人々の自己免疫反応が市場の成長に対する主な課題となっています。

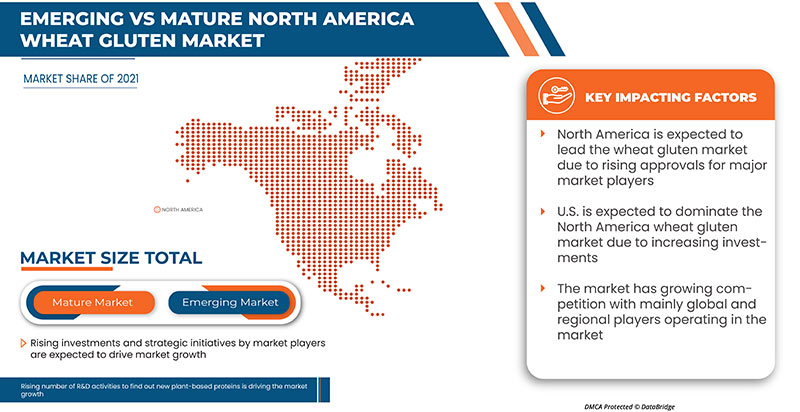

北米の小麦グルテン市場は、市場プレーヤーの増加と市場でのさまざまな植物由来の肉代替品の入手可能性により、予測年度に成長しています。これに伴い、新しい植物由来タンパク質を見つけるための研究開発活動の数も増加しており、市場の成長をさらに後押ししています。ただし、グルテン不耐症による遺伝性および慢性疾患の症例の増加は、予測期間中の市場の成長を妨げる可能性があります。

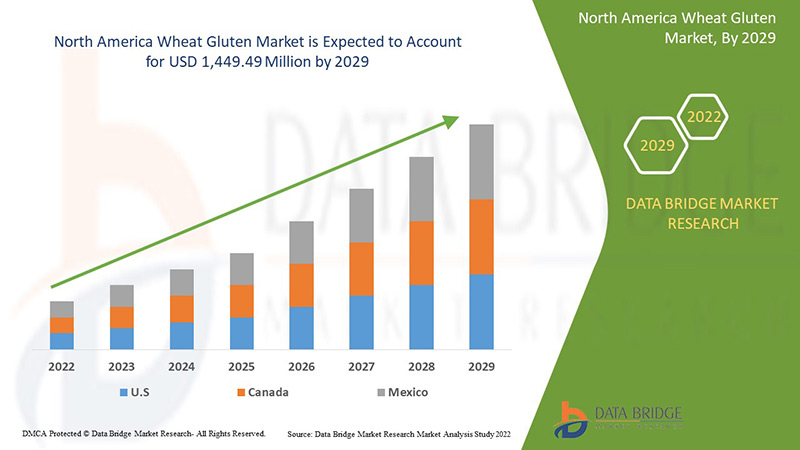

北米の小麦グルテン市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に8.3%のCAGRで成長し、2029年までに14億4,949万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2014~2019年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

カテゴリー(有機および無機)、機能(乳化剤、固化剤、結合剤など)、形状(液体および乾燥)、用途(食品および飲料、動物飼料など)、パッケージ(ボトル/ジャー、ポーチおよびバッグ、箱など)、流通チャネル(店舗型小売業者および非店舗型小売業者)、エンドユーザー(家庭用/小売および商業用)別 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Cargill, Incorporated、ADM、Crespel & Deiters Group、Glico Nutrition Co., Ltd.、Sedamyl、Manildra Group、MGP、Roquette Frères、CropEnergies AG、Anhui Ante Food Co., Ltd.、ARDENT MILLS、Bryan W Nash and Sons、Pioneer Industries Private Limited、Henan Tianguan Group Co. Ltd、Permolex、Meelunie BV、Mühlenchemie GmbH & Co. KG、Royal Ingredients Group、Kröner Stärke、z&f sungold corporation など。 |

市場の定義

小麦グルテンは、セイタン、小麦肉、グルテン肉、グルテンとも呼ばれます。小麦グルテンは、小麦または小麦粉に自然に含まれるタンパク質です。小麦粉生地を水で洗い、デンプン粒をすべて取り除くことで作られます。小麦グルテンパウダーは、硬質小麦粉を水和させてグルテンを活性化することで作られます。その後、水和した塊を加工してデンプンを除去し、グルテンを残します。最後に、グルテンを乾燥させて粉末にします。グルテンの種類によっては、肉に似た糸状または噛みごたえのある食感のものがあります。

北米の小麦グルテン市場の動向

ドライバー

- ビーガン人口の増加と肉代替品の需要増加

グルテンは、小麦、大麦、ライ麦などの穀物に自然に含まれるタンパク質です。小麦グルテンは、グリアジンとグルテニンのタンパク質分画で構成されています。グリアジンには、水素結合、疎水結合、分子内ジスルフィド相互作用を伴う単一のポリペプチド鎖が含まれますが、グルテニンには分子間ジスルフィド相互作用が含まれます。小麦グルテンと小麦デンプンは、小麦粉の湿式加工中に生成される経済的に重要な副産物です。小麦グルテンは商品食品成分であり、主に焼き菓子や加工肉製品に使用されています。水和して混合すると、パン生地のガス保持能力に関与する非常に伸縮性のある弾性構造を形成するなど、独特の特性があります。小麦粉やその他の添加物と組み合わせて使用することで、大豆を含まないテクスチャー製品を製造できます。

世界中でビーガン人口が増加しており、肉の代替品に対する需要も高まっています。人々は植物由来のタンパク質の健康上の利点をより意識するようになり、小麦グルテンが肉の代替品として機能するビーガンライフスタイルに移行しつつあります。

- 高タンパク質食を好む消費者の傾向が高まっている

消費者の多くは、いくつかの理由から高タンパク質の食事を好みます。そのいくつかは、タンパク質は人体と筋肉の構成要素であり、体と脳の活動に不可欠であり、健康で活動的な生活に重要であるということです。グルテンは小麦から抽出できる高タンパク質の食事の 1 つです。グルテンには、抗酸化物質、繊維、ビタミン B、ビタミン E、マグネシウム、鉄、葉酸などのビタミンやミネラルとともに、高タンパク質が含まれています。

さらに、近年、高タンパク質の食事や製品は栄養に大きな影響を与え、十分な栄養はすべての人にとって健康的なライフスタイルの重要な側面であるため、食品中のタンパク質摂取に対する消費者の考え方を変えました。さまざまな研究で植物性タンパク質の健康上の利点が示されており、一般の認識が大幅に高まっています。その結果、消費者は高タンパク質を豊富に含む食事を好むようになりました。

- 新たな植物由来タンパク質を発見するための研究開発活動の増加

The demand for high protein-rich diets is increasing among people and hence, the number of research has increased to find out proteins. As animal-based proteins are causing most health hazards, people are getting shifted to vegan lifestyles gradually, across the globe. Plant-based proteins are rich in vitamins as well as minerals and have great health benefits as per recent studies. Wheat gluten is one of the plant proteins which is used as a meat alternative and a protein-rich diet by most people worldwide.

Most of the human population is preferring high-protein diets from plant sources due to several health benefits and to overcome diseases caused by the intake of animal-based protein diets. So, the number of R&D is increasing to find out new plant-based proteins in various ways to fulfill the demand.

Opportunities

-

Growing awareness regarding the benefits of plant-based proteins

Various plant-based protein products are available in the market due to changing taste preferences of consumers. One of them is wheat gluten and its products which are in high demand. The plant-based protein market such as wheat gluten is having a strong demand and growth in bakeries, functional beverages and other food. The plant-based proteins are easily available due to their wide usage in various industries. Wheat gluten is used in various products such as animal feed products that help to minimize the farmers' dependence on traditional sources of protein. Wheat gluten and plant-based protein products include several nutrients and are infused with protein and flavors. Increasing awareness about healthy lifestyles and weight loss management, along with the demand for plant-based protein bars among consumers.

As a result, the need for wheat gluten in various products will act as an opportunity for market growth. Meanwhile, wheat gluten is used in carbonated products to enhance the added flavors.

-

Rising demand for organic products

The demand for organic products is increasing at a high speed. Organic food ingredients such as plant-based proteins are a perfect protein alternative to meat or other non-vegetarian products that consumers can consume daily. All essential amino acids and high fibers present in organic products make them an ideal substitute for animal proteins.

The demand for organic ingredients in wheat gluten and its products is due to nutritional diet plans as they have various health benefits such as low diabetes risk, easy digestibility, cardiovascular health and others. The increasing awareness among consumers about the health benefits offered by organic ingredients such as plant-based proteins increased the demand for food and beverage products.

Restraints/Challenges

- Increased cost of production and manufacturing

Wheat gluten has opened doors to improve and support health which plays a major role in the food and beverages industry. But on the other hand, it has led to major costs involved in its production and manufacturing

In some countries around the world, wheat gluten is seen as a solution to the problem of maintaining a healthy lifestyle. However, its manufacturing and production are faced with a multitude of challenges such as staff-intensive labor, increasing amount of raw materials and the need for faster production due to increased demand. These demands need to be met effectively and efficiently. Wheat gluten involves a high capital investment to maintain R&D. The new machinery and equipment include a lot of trials to test the functioning which leads to high capital investments for small and medium enterprises.

- Rising cases of hereditary and chronic disorders due to gluten intolerance

Gluten is a type of protein extracted from wheat and other grains. There are so many cases where gluten intolerance has been found. There are several potential causes of gluten intolerance, including celiac disease, non-celiac gluten sensitivity and wheat allergy. All three forms of gluten intolerance can cause widespread symptoms. Celiac disease is the most severe form of gluten intolerance. It is an autoimmune disease that affects about 1% of the population and may lead to damage to the digestive system. It can cause a wide range of symptoms, including skin problems, gastrointestinal issues, mood changes and more. The common symptoms associated with non-celiac disease are bloating, headache, stomach pain, fatigue, diarrhea and constipation among others. Similarly, the symptoms associated with wheat allergy are skin rash, digestive issues, nasal congestion and anaphylaxis among others.

Due to the impact of gluten intolerance, several disorders including celiac, non-celiac and wheat allergies are being caused which are chronic and hereditary in some cases.

Post-COVID-19 Impact on North America Wheat Gluten Market

COVID-19 had negatively affected the North America wheat gluten market. Lockdowns and isolation during the pandemic caused the closure of most of the shops and the plant-based protein diet supply was affected to a higher extent. Online purchases of plant-based meat alternatives had increased. Thus, COVID-19 affected the market negatively.

Recent Developments

- In January 2022, ADM announced the opening of its first Science & Technology Center in China to establish its high-quality development in the nutrition and health industry. This has helped the company to provide better services to consumers through such innovations in the organization.

- 2022年10月、クレスペル&デイターズグループは、改良された肉製品と肉代替品のための革新的な押し出し物、小麦デンプン、機能性ブレンドを発表しました。肉と代替タンパク質市場に特化したこの展示会での同社のプレゼンスは、機能性小麦原料をベースにした肉製品やビーガンおよびベジタリアン製品の生産のための、新しい、持続可能で経済的な選択肢を提示しています。これには、ハイブリッドおよび植物ベースの代替品向けのLory Texシリーズの革新的なテクスチャーや、加水分解小麦タンパク質が含まれます。これにより、同社は北米市場での存在感を高めることができました。

北米小麦グルテン市場の範囲

北米の小麦グルテン市場は、カテゴリ、機能、形状、用途、パッケージ、流通チャネル、エンドユーザーに基づいて、7 つの主要なセグメントに分割されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

カテゴリー別

- オーガニック

- 無機

カテゴリーに基づいて、市場は有機と無機に分類されます。

機能別

- 乳化剤

- 固化剤

- バインダー

- その他

機能に基づいて、市場は乳化剤、凝固剤、結合剤などに分類されます。

フォーム別

- 液体

- ドライ

形態に基づいて、市場は液体と乾燥に分類されます。

アプリケーション別

- 食品・飲料

- 動物飼料

- その他

用途に基づいて、市場は食品・飲料、動物飼料、その他に分類されます。

パッケージ別

- ボトル/ジャー

- ポーチ&バッグ

- ボックス

- その他

包装に基づいて、市場はボトル/ジャー、ポーチとバッグ、箱、その他に分類されます。

流通チャネル別

- 店舗型小売業者

- 店舗を持たない小売業者

流通チャネルに基づいて、市場は店舗ベースの小売業者と非店舗ベースの小売業者に分類されます。

エンドユーザー別

- 家庭用/小売

- コマーシャル

エンドユーザーに基づいて、市場は家庭用/小売用と商業用に分割されます。

北米小麦グルテン市場の地域分析/洞察

北米の小麦グルテン市場が分析され、市場規模の洞察と傾向が国、カテゴリ、機能、形態、用途、パッケージ、流通チャネル、エンドユーザー別に提供されます。

北米の小麦グルテン市場は、米国、カナダ、メキシコの3か国で構成されています。米国は、市場シェアと市場収益の面で北米の小麦グルテン市場を支配しており、予測期間中もその優位性を維持し続けるでしょう。北米の小麦グルテン市場は、ビーガン人口の増加、肉代替品の需要の増加、高タンパク質の食事に対する消費者の嗜好の高まりにより、成長すると予想されています。

植物由来のタンパク質の利点に関する認識の高まりが、市場の成長をさらに加速させています。さらに、オーガニック製品に対する需要の高まりと市場関係者による取り組みも、市場の成長を後押ししています。

競争環境と北米の小麦グルテン市場シェア分析

北米小麦グルテン市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、市場に対する会社の重点にのみ関連しています。

北米の小麦グルテン市場で活動している主要企業としては、Cargill, Incorporated、ADM、Crespel & Deiters Group、Glico Nutrition Co., Ltd.、Sedamyl、Manildra Group、MGP、Roquette Frères、CropEnergies AG、Anhui Ante Food Co., Ltd.、ARDENT MILLS、Bryan W Nash and Sons、Pioneer Industries Private Limited、Henan Tianguan Group Co. Ltd、Permolex、Meelunie BV、Mühlenchemie GmbH & Co. KG、Royal Ingredients Group、Kröner Stärke、z&f sungold corporationなどがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに質問がある場合は、アナリストへの電話をリクエストしてください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合ったデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場の理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、再開発市場および製品ベースの分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要なデータ数だけ競合他社を、必要な形式とデータ スタイルで追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF NORTH AMERICA WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 NORTH AMERICA WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 NORTH AMERICA WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 NORTH AMERICA WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 NORTH AMERICA WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 NORTH AMERICA WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 NORTH AMERICA WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 NORTH AMERICA WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 NORTH AMERICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 NORTH AMERICA WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 NORTH AMERICA WHEAT GLUTEN MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 NORTH AMERICA NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA WHEAT GLUTEN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 U.S. WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 U.S. WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 U.S. WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 U.S. WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 U.S. BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 U.S. WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 U.S. STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 U.S. WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 U.S. COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 CANADA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 CANADA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 CANADA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 CANADA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 CANADA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 CANADA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 CANADA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 CANADA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 CANADA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 CANADA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 CANADA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 MEXICO WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 MEXICO WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 MEXICO WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 MEXICO FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 MEXICO BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 MEXICO WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 MEXICO COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WHEAT GLUTEN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE NORTH AMERICA WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA WHEAT GLUTEN MARKET

FIGURE 14 NORTH AMERICA WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 NORTH AMERICA WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 NORTH AMERICA WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 NORTH AMERICA WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 NORTH AMERICA WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 NORTH AMERICA WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 NORTH AMERICA WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 NORTH AMERICA WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 NORTH AMERICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 NORTH AMERICA WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 NORTH AMERICA WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 NORTH AMERICA WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 NORTH AMERICA WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 NORTH AMERICA WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 NORTH AMERICA WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。