North America Wearable Devices in Sports Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

12.28 Billion

USD

48.72 Billion

2025

2033

USD

12.28 Billion

USD

48.72 Billion

2025

2033

| 2026 –2033 | |

| USD 12.28 Billion | |

| USD 48.72 Billion | |

|

|

|

|

North America Wearable Devices in Sports Market Segmentation, By Component (Hardware and Software), Product Type (Pedometers, fitness & Heart Rate Monitors, Smart Fabrics, Smart Camera, Shot Trackers, and Others), Site (Headband, Handheld, Arm & Wrist, Clip, Shoe Sensor, and Others), Application (Step Counts, Calorie Burnt, Heart Rate Monitoring, Sleep Tracking, and Others), End User (Sports Centers, Fitness Centers, Homecare Settings, and Others), Distribution Channel (Independent Retail Store, Hypermarket/Supermarket, Brand Store, and Online Sale Channel)- Industry Trends and Forecast to 2033

North America Wearable Devices in Sports Market Size

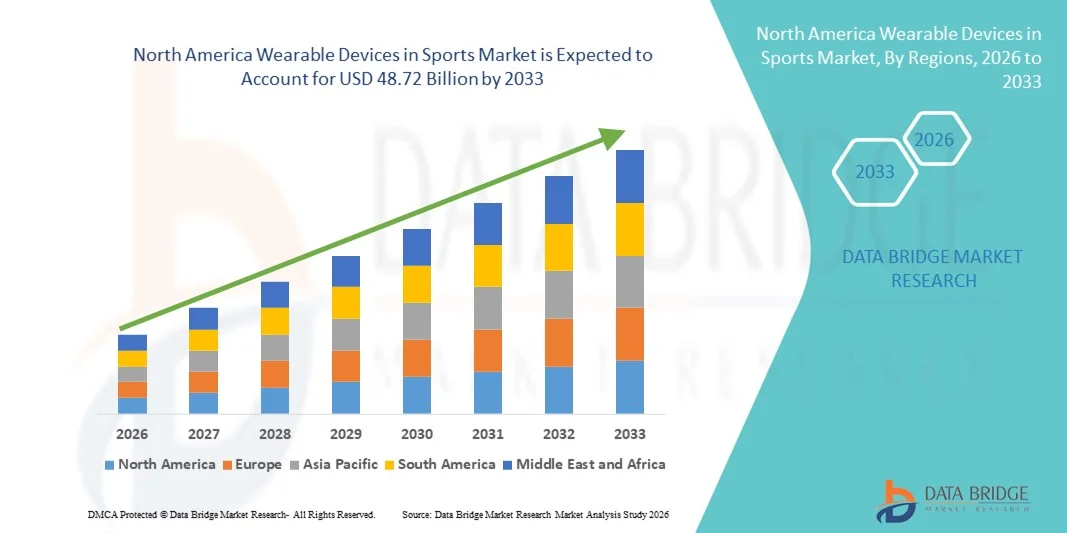

- The North America wearable devices in sports market size was valued at USD 12.28 billion in 2025 and is expected to reach USD 48.72 billion by 2033, at a CAGR of 18.8% during the forecast period

- The market growth is largely fueled by rising consumer adoption of wearable sports technologies, increasing health and fitness awareness, and the integration of advanced sensors and analytics in sports devices

- Furthermore, strong digital infrastructure, high disposable income, and the presence of major tech innovators are driving uptake of user‑friendly, data‑driven wearable solutions for both recreational fitness and competitive sports. Technological advancements and expanding application areas continue to position wearable devices as essential performance and health‑tracking tools, thereby significantly accelerating industry growth across the region

North America Wearable Devices in Sports Market Analysis

- Wearable devices in sports, including smartwatches, fitness trackers, and performance monitoring sensors, are becoming essential tools for both amateur and professional athletes, offering real-time performance tracking, health monitoring, and seamless integration with sports analytics platforms

- The growing demand for sports wearables is primarily driven by increasing health and fitness awareness, the rising adoption of connected devices, and a preference for data-driven training and injury prevention solutions among athletes and fitness enthusiasts

- The United States dominated the wearable devices in sports market with the largest revenue share of 85.2% in 2025, supported by early adoption of fitness technologies, high disposable incomes, and a strong presence of key technology and sports equipment players, with innovations in AI-enabled performance analytics, biometric monitoring, and connected team training solutions driving substantial growth

- Canada is expected to be the fastest-growing country in the wearable devices in sports market during the forecast period due to increasing participation in sports, rising health awareness, and growing investments in smart sports infrastructure

- Fitness & heart rate monitors segment dominated the wearable devices in sports market with a market share of 41.5% in 2025, driven by their accuracy, ease of use, and ability to provide detailed insights into performance, endurance, and overall health for both casual users and professional athletes

Report Scope and North America Wearable Devices in Sports Market Segmentation

|

Attributes |

North America Wearable Devices in Sports Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Wearable Devices in Sports Market Trends

Advanced Performance Monitoring Through AI and Sensor Integration

- A significant and accelerating trend in the North America wearable devices in sports market is the growing integration of artificial intelligence (AI) and advanced biometric sensors in devices such as smartwatches, heart rate monitors, and fitness bands. This combination of technologies is enhancing real-time performance tracking and personalized training insights

- For instance, Garmin’s Forerunner series leverages AI-driven analytics with heart rate and GPS sensors to provide adaptive training recommendations and detailed performance reports for runners and cyclists. Similarly, Whoop straps monitor recovery, sleep, and strain data to optimize athlete performance

- AI integration enables features such as predictive injury alerts, adaptive coaching recommendations, and intelligent performance analytics. For instance, some Polar devices use AI to identify abnormal heart rate patterns and suggest rest or training adjustments. Furthermore, advanced sensors allow precise monitoring of VO2 max, calories burned, and training load for optimized athletic performance

- The seamless integration of wearables with mobile apps and cloud platforms facilitates centralized tracking of multiple health and performance metrics, enabling athletes and coaches to analyze and manage training, recovery, and overall fitness in a single interface

- This trend towards more intelligent, data-driven, and interconnected wearable devices is reshaping user expectations for sports technology. Consequently, companies such as Fitbit are developing AI-enabled fitness devices with features such as automated activity recognition, real-time heart rate alerts, and personalized coaching suggestions

- The demand for wearable devices offering AI and sensor-driven performance insights is growing rapidly across both amateur and professional sports sectors, as consumers increasingly prioritize data-backed training, recovery optimization, and overall athletic performance

- Wearables are increasingly incorporating gamification and social features, such as virtual challenges and leaderboard comparisons, which enhance user engagement and encourage consistent usage among fitness enthusiasts and athletes

North America Wearable Devices in Sports Market Dynamics

Driver

Rising Health Awareness and Sports Technology Adoption

- The increasing focus on health, fitness, and athletic performance, combined with the growing adoption of connected devices, is a major driver of the North America wearable devices in sports market

- For instance, in March 2025, Apple introduced advanced heart rate monitoring in the Apple Watch Series 10, providing users with ECG, VO2 max, and recovery metrics, which reinforced adoption of wearable devices for performance and health tracking

- As athletes and fitness enthusiasts seek precise data to enhance performance and prevent injuries, wearable devices provide features such as real-time monitoring, activity logging, and personalized coaching recommendations, offering a substantial advantage over traditional fitness methods

- Furthermore, the popularity of smart gyms, virtual training platforms, and interconnected fitness ecosystems is positioning wearable devices as essential tools for integrated performance management

- The convenience of continuous health monitoring, remote coaching insights, and automated performance tracking through wearable devices is propelling adoption in both recreational and professional sports. The availability of user-friendly devices suitable for DIY training further supports market growth

- Government initiatives and corporate wellness programs promoting health monitoring and fitness tracking are encouraging widespread adoption of wearable devices across workplaces, schools, and sports academies

- Advancements in battery life, lightweight design, and water-resistant technology are improving device usability, enabling athletes to wear devices continuously during training, competitions, and recovery periods

Restraint/Challenge

Accuracy Concerns and High Device Costs

- Concerns regarding measurement accuracy, sensor reliability, and data privacy of wearable sports devices pose a significant challenge to wider adoption, as athletes depend on precise performance metrics for training decisions

- For instance, reports of inconsistent heart rate readings in budget fitness trackers have made some consumers hesitant to adopt wearable devices for professional training purposes

- Addressing these concerns through advanced calibration, AI-enhanced analytics, secure data encryption, and transparent privacy policies is crucial for building consumer trust. Companies such as Garmin and Polar emphasize sensor accuracy and encryption to assure users. In addition, the relatively high cost of premium wearable devices compared to basic fitness trackers can limit adoption among price-sensitive consumers, particularly casual athletes or budget-conscious fitness enthusiasts

- While entry-level devices are becoming more affordable, advanced features such as continuous ECG monitoring, recovery analytics, and GPS tracking often come with a premium price tag

- Overcoming these challenges through enhanced sensor technology, consumer education on device usage, and development of cost-effective wearable solutions will be vital for sustained market growth

- Limited interoperability between different wearable brands and sports apps can restrict user experience and data consolidation, creating barriers for athletes who rely on multiple devices and analytics platforms

- Concerns about device durability and wear-and-tear during high-intensity sports or outdoor activities may deter long-term adoption, particularly among professional athletes requiring robust, ruggedized solutions

North America Wearable Devices in Sports Market Scope

The market is segmented on the basis of component, product type, site, application, end user, and distribution channel.

- By Component

On the basis of component, the North America wearable devices in sports market is segmented into hardware and software. Hardware segment dominated the market with the largest revenue share of 62.4% in 2025, driven by the growing demand for fitness and heart rate monitors, smartwatches, and wearable sensors. Athletes and fitness enthusiasts prioritize reliable devices that offer precise data tracking and long battery life. Advanced sensors in hardware provide real-time monitoring of heart rate, calories burned, VO2 max, and activity levels. Integration with mobile apps and sports analytics platforms enhances usability and convenience. Durable, water-resistant, and lightweight designs further drive adoption. Companies such as Garmin, Polar, and Fitbit continue to lead due to brand trust and robust product lines.

The software segment is anticipated to witness the fastest CAGR of 14.8% from 2026 to 2033, fueled by increasing adoption of AI-driven analytics, cloud-based monitoring, and personalized coaching platforms. Software enables athletes to analyze performance data, track progress, and optimize workouts efficiently. Mobile and cloud integration enhances convenience and accessibility for users. Predictive analytics and AI recommendations support injury prevention and training optimization. Subscription-based models encourage recurring revenue and drive market expansion. Software solutions compatible with multiple devices further boost adoption across professional and recreational users.

- By Product Type

On the basis of product type, the market is segmented into pedometers, fitness & heart rate monitors, smart fabrics, smart cameras, shot trackers, and others. Fitness & Heart Rate Monitors segment dominated the market with the largest revenue share of 41.5% in 2025, driven by continuous demand for physiological monitoring, performance optimization, and health tracking. Devices provide real-time heart rate, calorie, and activity tracking, aiding in injury prevention and recovery monitoring. Integration with mobile apps and AI-driven analytics enhances their value for both professional athletes and casual users. Compatibility with multiple sports and fitness activities increases versatility. High accuracy, long battery life, and trusted brand presence contribute to adoption. Leading companies such as Fitbit, Garmin, and Polar have strengthened market dominance through feature-rich devices.

The smart fabrics segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing use in professional sports, physiotherapy, and rehabilitation. Smart fabrics with embedded sensors monitor posture, muscle activity, and body movement without restricting mobility. Connected apparel enables real-time data collection for performance optimization and injury prevention. Technological advances in conductive fabrics and miniaturized sensors make them comfortable and reliable. Rising collaboration between sportswear and tech companies accelerates adoption. Professional athletes and high-performance training programs are driving demand for innovative wearable textiles.

- By Site

On the basis of site, the market is segmented into headband, handheld, arm & wrist, clip, shoe sensor, and others. Arm & Wrist segment dominated the market with the largest revenue share of 44.7% in 2025, driven by the popularity of smartwatches, fitness bands, and heart rate monitors worn on the wrist. Devices offer continuous tracking of heart rate, activity, sleep, and GPS performance data. Mobile app integration enables comprehensive performance analysis. Ergonomic design, water resistance, and long battery life improve usability. Wrist devices are suitable for multiple sports and fitness levels. Leading brands such as Garmin, Fitbit, and Apple enhance credibility and consumer trust.

The shoe sensor segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by demand in running, basketball, and football training. Shoe sensors provide accurate metrics such as stride length, cadence, pressure distribution, and ground contact time. Integration with apps allows coaches to analyze performance and prevent injuries. Lightweight, durable, and high-precision sensors improve adoption. Professional sports leagues and academies drive market growth. Collaborations between footwear brands and technology providers further accelerate the trend.

- By Application

On the basis of application, the market is segmented into step counts, calorie burnt, heart rate monitoring, sleep tracking, and others. Heart Rate Monitoring segment dominated the market with the largest revenue share of 39.2% in 2025, due to its essential role in optimizing training, preventing overexertion, and monitoring recovery. Continuous heart rate tracking provides critical insights for both athletes and fitness enthusiasts. Mobile apps and AI-driven coaching enhance value. Devices support calorie tracking and stress management. Compatibility with multiple sports increases versatility. Leading wearable brands continue to improve sensor accuracy and software integration, reinforcing dominance.

The sleep tracking segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising awareness of recovery and rest’s role in performance. Wearables monitor sleep stages, duration, and quality, providing AI-based recommendations. Mobile app integration allows correlation of sleep with training and health metrics. Growing demand for holistic wellness drives adoption. Advanced, non-intrusive sensors enhance user experience. Professional athletes and fitness enthusiasts increasingly rely on sleep data for recovery optimization.

- By End User

On the basis of end user, the market is segmented into sports centers, fitness centers, homecare settings, and others. Fitness Centers segment dominated the market with the largest revenue share of 36.8% in 2025, driven by adoption of wearable devices for client monitoring, personalized coaching, and group training programs. Wearables help trainers track member performance, optimize workouts, and enhance engagement. Integration with gym management software provides data-driven insights. Devices enable gamification, goal tracking, and performance challenges. Consumers prefer wearables compatible with gym equipment and mobile apps. Collaborations between brands and fitness chains strengthen market dominance.

The homecare settings segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by adoption for remote health monitoring, rehabilitation, and personalized fitness guidance. Wearables provide heart rate, activity, and recovery tracking at home. Mobile app and cloud integration allow real-time feedback and performance analysis. Rising health awareness and home fitness popularity drive growth. Features such as AI-based injury prevention, fall detection, and automated coaching increase value. Demand is growing among both elderly users and fitness enthusiasts seeking convenience.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into independent retail store, hypermarket/supermarket, brand store, and online sale channel. Online Sale Channel segment dominated the market with the largest revenue share of 47.1% in 2025, driven by convenience, competitive pricing, product variety, and doorstep delivery. Consumers prefer online purchases for detailed product information, reviews, and bundled offers. Subscription-based services and app integration enhance attractiveness. Comparison of brands and features improves buying decisions. E-commerce supports direct-to-consumer sales for major brands. Marketing and promotions online drive significant revenue growth.

The brand store segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by demand for authentic products, expert guidance, and after-sales support. Hands-on experience allows consumers to test devices, consult specialists, and explore features. Awareness of counterfeiting encourages in-store purchases. Companies use stores for product demonstrations, workshops, and loyalty programs. Exclusive product launches and personalized recommendations enhance adoption. Expansion of flagship stores in major cities further drives growth.

North America Wearable Devices in Sports Market Regional Analysis

- The United States dominated the wearable devices in sports market with the largest revenue share of 85.2% in 2025, supported by early adoption of fitness technologies, high disposable incomes, and a strong presence of key technology and sports equipment players

- Consumers in the region increasingly value real-time performance tracking, heart rate monitoring, and personalized coaching features offered by wearable devices. Integration with mobile apps, cloud platforms, and AI-driven analytics further enhances user experience and engagement across diverse fitness and sports activities

- This widespread adoption is further supported by high disposable incomes, advanced digital infrastructure, and a tech-savvy population. The growing interest in home workouts, sports performance optimization, and data-driven training programs establishes wearable devices as essential tools for both professional athletes and fitness enthusiasts across the United States

The U.S. Wearable Devices in Sports Market Insight

The U.S. wearable devices in sports market captured the largest revenue share of 85.2% in 2025 within North America, fueled by the rapid adoption of connected fitness devices and growing interest in data-driven athletic performance. Consumers increasingly prioritize real-time performance tracking, heart rate monitoring, and personalized coaching features offered by smartwatches, fitness bands, and heart rate monitors. The growing trend of home workouts, DIY training programs, and remote fitness guidance further propels the market. In addition, integration with AI-powered analytics, mobile applications, and cloud platforms is significantly enhancing user experience. The presence of key technology players, such as Apple, Garmin, Fitbit, and Whoop, drives innovation and accelerates market growth.

Canada Wearable Devices in Sports Market Insight

The Canada wearable devices in sports market is expected to expand at a substantial CAGR during the forecast period, primarily driven by increasing health and fitness awareness and growing adoption of connected sports devices. The rising number of fitness centers, sports academies, and corporate wellness programs is fostering demand for wearable devices. Canadian consumers also value convenience, accurate performance monitoring, and personalized training insights provided by AI-enabled devices. Integration with mobile apps, cloud platforms, and virtual coaching is further encouraging adoption. The market is seeing growth across both professional and recreational sports applications.

Mexico Wearable Devices in Sports Market Insight

The Mexico wearable devices in sports market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing popularity of fitness tracking, sports monitoring, and wearable health devices among urban populations. Consumers are drawn to devices that offer heart rate monitoring, step tracking, and calorie management. The market is supported by rising disposable incomes, smartphone penetration, and expanding awareness of sports analytics and performance optimization. Online sales channels and retail distribution networks further facilitate accessibility. The adoption of wearable devices in gyms, sports centers, and home settings is expected to continue fueling growth.

North America Wearable Devices in Sports Market Share

The North America Wearable Devices in Sports industry is primarily led by well-established companies, including:

- WHOOP, Inc. (U.S.)

- Oura Health Oy (Finland)

- Garmin Ltd. (U.S.)

- Fitbit, Inc. (U.S.)

- Coros Wearables (U.S.)

- Apple Inc. (U.S.)

- Polar Electro Oy (Finland)

- Suunto Oy (Finland)

- Samsung Electronics Co., Ltd. (South Korea)

- Fitbit International Ltd. (Ireland)

- Under Armour, Inc. (U.S.)

- Nike, Inc. (U.S.)

- Adidas AG (Germany)

- Xiaomi Corporation (China)

- Google LLC (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Oppo (China)

- Sony Corporation (Japan)

- Xsensio AG (Switzerland)

What are the Recent Developments in North America Wearable Devices in Sports Market?

- In September 2025, Polar launched the Polar Loop, its new screen‑free fitness and sleep tracker, making fitness wearables more accessible by eliminating subscription fees and focusing on discreet 24/7 activity, heart‑rate, and sleep monitoring catering to users who prefer minimalist wearables without ongoing costs

- In June 2025, Meta partnered with sports eyewear brand Oakley to launch AI‑powered smart glasses for North America and other regions, marking a move into sports‑oriented wearable tech with high‑resolution cameras, open‑ear speakers, water resistance, and built‑in AI functionality a blend of performance tracking and contextual computing

- In May 2025, WHOOP unveiled its next‑generation wearables WHOOP 5.0 and WHOOP MG featuring advanced health monitoring capabilities such as up to 14‑day battery life, on‑demand ECG heart screening, and blood‑pressure insights in a sleeker form factor. These devices also come with a redesigned app experience aimed at deeper performance and health tracking for athletes and fitness enthusiasts

- In February 2025, the National Hockey League (NHL) announced that officials would wear Apple Watches with custom apps to receive real‑time game information such as clock and penalty timing through haptic alerts, showcasing how wearable sport tech is being integrated into live professional sports operations in North America

- In December 2021, wearable technology was officially named the top fitness trend for 2022 by the American College of Sports Medicine (ACSM) survey of 4,500 fitness professionals highlighting early consumer enthusiasm and industry confidence in fitness wearables well before the 2025 period

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。