北米迷走神経刺激市場

Market Size in USD Billion

CAGR :

%

USD

277.17 Million

USD

1,052.22 Million

2021

2029

USD

277.17 Million

USD

1,052.22 Million

2021

2029

| 2022 –2029 | |

| USD 277.17 Million | |

| USD 1,052.22 Million | |

|

|

|

北米の迷走神経刺激市場、製品タイプ別(埋め込み型迷走神経刺激装置および外部迷走神経刺激装置)、生体材料別(セラミック、金属、ポリマー)、用途別(疼痛管理、てんかん発作、肥満管理、うつ病および不安症、その他)、患者タイプ別(成人、小児、高齢者)、エンドユーザー別(病院、外来手術センター、専門センター、その他)、流通チャネル別(直接入札、小売販売、その他)業界動向および2029年までの予測。

北米迷走神経刺激市場の分析と洞察

迷走神経は、代謝恒常性を調節する自律神経系の重要な構成要素であり、求心性および遠心性の経路を介して恒常性を維持する神経内分泌免疫軸の重要な構成要素として機能します。手動または電気刺激を含む迷走神経を刺激するあらゆるアプローチは、迷走神経刺激 (VNS) と呼ばれます。難治性てんかんおよび治療抵抗性うつ病の場合、左頸部 VNS は承認された治療法です。

WHO によると、神経疾患は世界中の全疾病の 4.5% ~ 11% を占めています。迷走神経刺激装置は、てんかん、 うつ病、喘息、心血管疾患を患う患者の治療にも使用されています。

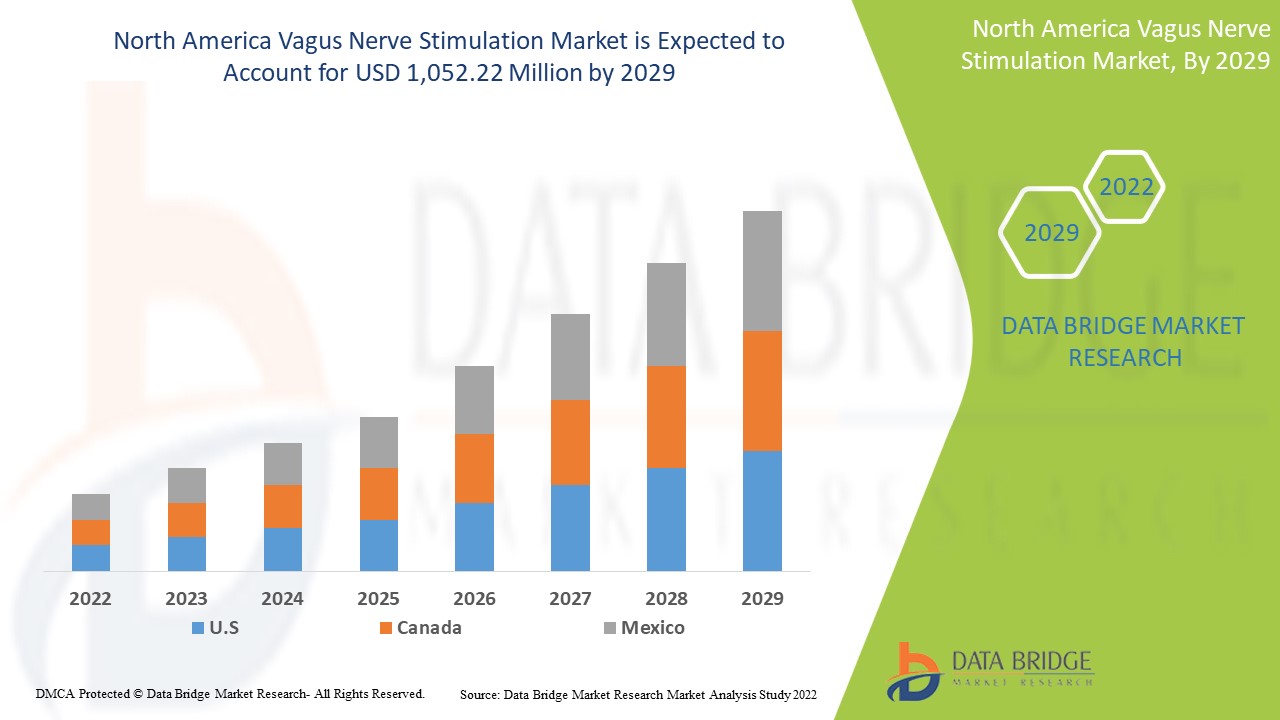

北米の迷走神経刺激市場は、2022年から2029年の予測期間に成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に18.0%のCAGRで成長し、2021年の2億7,717万米ドルから2029年には10億5,222万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ(埋め込み型 VNS デバイスおよび外部 VNS デバイス)、生体材料(セラミック、金属、ポリマー)、用途(疼痛管理、てんかん発作、肥満管理、うつ病および不安症など)、患者タイプ(成人、小児、高齢者)、エンドユーザー(病院、外来手術センター、専門センターなど)別。 |

|

対象国 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

Medtronic、LivaNova PLC、electroCore, Inc.、Cirtec、Brain Control Co. Limited、Soterix Medical Inc.、SetPoint Medical、MicroTransponder Inc、Parasym Ltd、tVNS Technologies GmbH など。 |

市場定義: 北米迷走神経刺激市場

迷走神経は、人の脳幹から首、胸部、腹部まで伸びる長い脳神経です。これは副交感神経系の一部で、人が休んでいる間に体の機能を調整するため、一般的に休息・消化系と呼ばれています。迷走神経は、消化器系や肺、心臓、肝臓などの臓器から人の脳にメッセージを送ります。消化、心拍数、呼吸数など、いくつかの臓器の機能を制御します。血管運動活動と反射神経を司ります。また、発声、気分、免疫も調整します。また、人の耳、副鼻腔、食道の感覚機能にも影響を及ぼします。

VNS では、胸部の皮膚の下にパルス ジェネレーターを挿入します。ペースメーカーに似たこの埋め込み型デバイスは、迷走神経を介して脳に定期的な電気パルスを送ります。パルス ジェネレーターの上に付属の磁石を置くことで、追加の刺激を与えることができます。呼吸法、ヨガ、投薬などのリラクゼーション テクニックは、迷走神経の活動に影響を与え、不安や気分関連の症状を和らげる効果を高めます。VNS は個人の身体的健康を改善し、てんかんやうつ病などのいくつかの症状に効果があります。この治療法は、リラクゼーションを促進し、炎症を軽減する効果があるため、人の体に治癒効果をもたらします。

市場動向: 北米の迷走神経刺激市場

ドライバー

- 神経疾患の有病率と発症率の増加

神経疾患は、低所得国でも高所得国でも、すべての疾患の 4.5% ~ 11% の原因となっています。その影響は悪性腫瘍、胃腸疾患、呼吸器疾患に比べて大きく、今後数年間で増加すると予想されています。米国では、神経疾患も大幅に増加しており、今後 20 年間、この増加傾向は続くと予想されています。これらの神経疾患の有病率は 0.9% ~ 4% (人口 100,000 人あたり 970 ~ 4,100 人) と報告されており、平均は約 2.3% (人口 100,000 人あたり 2,390 人) です。最も一般的な神経疾患の 1 つであるてんかんは、地球上のほぼすべての国に影響を及ぼしています。この疾患を患う人の大半は、人口の多い国で見られます。この有病率の上昇により、VNS などのさまざまなツールや治療法の需要が高まっています。より多くの神経疾患が VNS で治療されています。他の臨床用途に加えて、世界中で神経疾患がかなり蔓延しているため、てんかんやうつ病などの神経疾患の治療にも役立ちます。

- 需要に応えるために革新的な非侵襲性迷走神経刺激装置を導入

従来の VNS デバイスは患者の体内に埋め込まれ、必要に応じて電気刺激を提供する迷走神経にリードが取り付けられます。革新的なデバイスの需要の高まりと技術の進歩により、小型の埋め込み型 VNS デバイスが市場に導入されるようになりました。これらの小型の埋め込み型デバイスは、患者と医療提供者にさまざまな臨床上の利点をもたらします。革新的なデバイスの導入により、市場の成長が促進されると予想されます。

市場プレーヤーが常に革新と新製品の発売に注力してきた結果、非侵襲性VNS(nVNS)デバイスが市場に登場しました。これらのデバイスは、経皮VNS(tVNS)デバイスとしても知られています。

- 製品承認数の増加

VNS デバイスの承認は、米国 FDA と EU によって管理されています。FDA は、市販前承認申請 (PMA) の提出に関する最終プロトコル、または製品開発プロトコル (PDP) の完了通知を発行します。

例えば、

-

FDA は、てんかんおよびうつ病の治療に埋め込み型迷走神経刺激装置を承認しました。さらに、北米では、てんかん、うつ病、および疼痛の治療に外科的埋め込みを必要としない新しい nVNS デバイスが承認されました。

VNS機器の承認が下りれば、その機器は安全に使用できると宣言され、市販後承認の準備が整う。これにより、北米地域の発展途上市場へのMRI機器の供給と流通が可能になる。したがって、製品承認の増加が市場の成長を促進すると予想される。

-

近年の製品開発

併用療法は単独療法よりはるかに効果的で、副作用も追加されません。難治性膀胱疾患の患者にとって、併用療法は安全で効果的な代替療法です。さまざまな標的療法戦略を組み合わせることが、膀胱疾患の患者を緩和する最善の方法です。患者の難治性治療には、経口薬と行動療法を考慮する必要があります。仙骨神経調節、ボツリヌス毒素 A の排尿筋内注射、経皮的脛骨神経刺激など、さまざまな高度な標的療法が利用可能です。これらは高度な治療法であり、経口薬よりも効果的です。

機会

-

主要市場プレーヤーによる戦略的取り組み

研究開発レベルの向上により、VNS デバイスの需要は市場で増加しています。それに伴い、革新的な医薬品への要望も市場の成長を後押ししています。そのため、トップ市場プレーヤーは、新しいデバイスや機器を開発するとともに、市場の他のプレーヤーと協力して、事業運営と収益性の向上を目指す新しい戦略を実行しています。

The companies operating in the North America region in this market are adopting collaboration as a strategy to increase their product portfolio with advanced technology-rich products to boost their business in various dimensions. Thus, increasing strategic initiatives by key market players are expected to offer significant opportunities for market players operating in the market

-

Rising government initiatives for neurological disease

The purpose of funding for VNS devices is to encourage applications seeking to develop devices for various neurological disorders. Novel devices should move beyond existing electrical or magnetic stimulation and develop new stimulation techniques capable of increased spatiotemporal precision as well as multi-focal, closed-loop approaches. Therefore, the funding by the government would result in the safety of the patient and cost savings. In addition, hospitals and healthcare agencies would administer this treatment at a lower price through collaboration with government organizations. Hence, the advancements in R&D activities and funding by the government will act as an opportunity for this market growth.

Restraint/Challenge

- High maintenance and device costs to restrain adoption of vagus nerve stimulators

The rise in the cost of VNS devices is due to technological development and increased demand for nVNS devices by neurologists in hospitals, clinics, nursing facilities, and ambulatory surgical centers. Overhead costs can help explain why hospitals charge so much for stimulation devices. The increased intricacy and cost of VNS devices, technological innovations, and robust investments would increase the costs. The increased cost would result in delayed treatment of patients in hospitals and clinics. Hence, the increased cost of VNS devices is expected to restrain market growth.

Post-COVID-19 Impact on North America Vagus Nerve Stimulation Market

The COVID-19 outbreak had a drastic effect on North America healthcare with the U.S. being amongst the countries most severely impacted. The pandemic had a negative impact on the market growth, on account of a temporary halt in research activities in this field, coupled with the low influx of patients in hospitals and diagnostic centers.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities, product launches, and strategic partnerships to improve the technology and test results involved in the pharmacogenetics testing market.

Recent Development

- In May 2022, electroCore, Inc. announced that the gammaCore Sapphire non-invasive Vagus Nerve Stimulator will be available in 130 National Spine and Pain Centers (NSPC) affiliated locations across the U.S. for patients suffering from pain associated with different forms of primary headache. This would help the organization to develop more revenue.

North America Vagus Nerve Stimulation Market Scope

北米の迷走神経刺激市場は、製品タイプ、生体材料、用途、患者タイプ、エンドユーザー、流通チャネルに区分されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品タイプ

- 埋め込み型 VNS デバイス

- 外部 VNS デバイス

製品タイプに基づいて、市場は埋め込み型 VNS デバイスと外部 VNS デバイスに分類されます。

生体材料

- 陶芸

- メタリック

- ポリマー

生体材料に基づいて、市場はセラミック、金属、ポリマーに分類されます。

応用

- 疼痛管理

- てんかん発作

- 肥満管理

- うつ病と不安

- その他

用途に基づいて、市場は疼痛管理、てんかん発作、肥満管理、うつ病および不安症、その他に分類されます。

患者タイプ

- 大人

- 小児科

- 老年病

患者の種類に基づいて、市場は成人、小児、高齢者に分類されます。

エンドユーザー

- 病院

- 外来手術センター

- 専門センター

- その他

エンドユーザーに基づいて、市場は病院、外来手術センター、専門センター、その他に分類されます。

流通チャネル

- 直接入札

- 小売販売

- その他

流通チャネルに基づいて、市場は直接入札、小売販売、その他に分類されます。

北米迷走神経刺激市場の地域分析/洞察

北米の迷走神経刺激市場が分析され、市場規模の洞察と傾向が、上記のように国、製品タイプ、生体材料、用途、患者タイプ、エンドユーザー、流通チャネル別に提供されます。

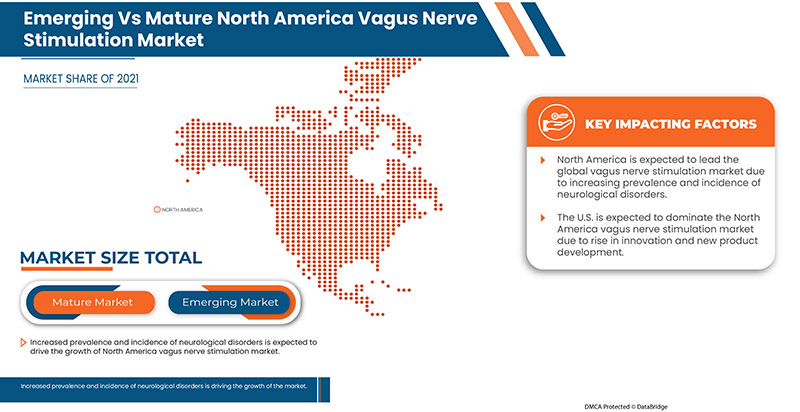

米国は、市場シェアと収益の面で北米の迷走神経刺激市場を支配しており、予測期間中もその優位性を維持し続けるでしょう。これは、この地域における神経疾患の有病率と発症率が高いことによるもので、研究開発投資の増加と新製品の発売が市場の成長を後押ししています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境と北米の迷走神経刺激市場シェア分析

北米迷走神経刺激市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、市場に関連する会社の焦点にのみ関連しています。

この市場で活動している主要企業としては、Medtronic、LivaNova PLC、electroCore, Inc.、Cirtec、Brain Control Co. Limited、Soterix Medical Inc.、SetPoint Medical、MicroTransponder Inc、Parasym Ltd、tVNS Technologies GmbH などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに質問がある場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA VAGUS NERVE STIMULATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LIFELINE CURVE , BY PRODUCT TYPE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 KEY STRATEGIC INITIATIVES

5 REGULATIONS OF NORTH AMERICA VAGUS NERVE STIMULATION MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISORDERS

6.1.2 INNOVATIVE NON-INVASIVE VAGUS NERVE STIMULATION DEVICES INTRODUCED TO MEET DEMAND

6.1.3 RISE IN PRODUCT APPROVALS

6.1.4 PRODUCT DEVELOPMENT IN RECENT YEARS

6.2 RESTRAINTS

6.2.1 HIGH MAINTENANCE AND DEVICE COSTS TO RESTRAIN ADOPTION OF VAGUS NERVE STIMULATORS

6.2.2 RISE IN PRODUCT RECALL

6.2.3 UNFAVORABLE REIMBURSEMENT POLICIES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.2 RISING GOVERNMENT INITIATIVES FOR NEUROLOGICAL DISEASE

6.4 CHALLENGES

6.4.1 RISKS ASSOCIATED WITH THE IMPLANTATION OF THESE DEVICES

6.4.2 LACK OF SKILLED HEALTHCARE PROFESSIONALS

6.4.3 STRINGENT REGULATIONS FOR APPROVAL OF MEDICAL DEVICES

7 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 IMPLANTABLE VNS DEVICE

7.3 EXTERNAL VNS DEVICE

8 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL

8.1 OVERVIEW

8.2 METALLIC

8.3 POLYMERIC

8.4 CERAMICS

9 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 EPILEPTIC SEIZURES

9.2.1 IMPLANTABLE VNS DEVICE

9.2.2 EXTERNAL VNS DEVICE

9.3 DEPRESSION AND ANXIETY

9.3.1 IMPLANTABLE VNS DEVICE

9.3.2 EXTERNAL VNS DEVICE

9.4 PAIN MANAGEMENT

9.4.1 IMPLANTABLE VNS DEVICE

9.4.2 EXTERNAL VNS DEVICE

9.5 OBESITY MANAGEMENT

9.5.1 IMPLANTABLE VNS DEVICE

9.5.2 EXTERNAL VNS DEVICE

9.6 OTHERS

10 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE

10.1 OVERVIEW

10.2 ADULTS

10.2.1 IMPLANTABLE VNS DEVICES

10.2.2 EXTERNAL VNS DEVICES

10.3 GERIATRIC

10.3.1 IMPLANTABLE VNS DEVICES

10.3.2 EXTERNAL VNS DEVICES

10.4 PEDIATRIC

10.4.1 IMPLANTABLE VNS DEVICES

10.4.2 EXTERNAL VNS DEVICES

11 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY END USER

11.1 OVERVIEW

11.2 SPECIALTY CENTERS

11.3 HOSPITALS

11.4 AMBULATORY SURGICAL CENTERS (ASCS)

11.5 OTHERS

12 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 OTHERS

13 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ELECTROCORE, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 LIVANOVA PLC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 MEDTRONIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SETPOINT MEDICAL

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TVNS TECHNOLOGIES GMBH

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 NEUROPIX COMPANY LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BRAIN CONTROL CO. LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CIRTEC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 MICROTRANSPONDER INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 PARASYM LTD

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 RESHAPE LIFESCIENCES INC. (2021)

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 SOTERIX MEDICAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA IMPLANTABLE VNS DEVICES IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA EXTERNAL VNS DEVICES IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA METALLIC IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA POLYMERIC IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CERAMICS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ADULTS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GERIATRICS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GERIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SPECIALTY CENTERS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITALS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AMBULATORY SURGICAL CENTERS (ASCS) IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DIRECT TENDER IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RETAIL SALES IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN VAGUS NERVE STIMULATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME)

TABLE 37 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 38 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.S. VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME)

TABLE 52 U.S. VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 53 U.S. VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL, 2020-2029 (USD MILLION)

TABLE 54 U.S. VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 U.S. VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. GERIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. VAGUS NERVE STIMULATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 U.S. VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CANADA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME)

TABLE 67 CANADA VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 68 CANADA VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL, 2020-2029 (USD MILLION)

TABLE 69 CANADA VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 CANADA EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CANADA DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 CANADA PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 CANADA OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA GERIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA VAGUS NERVE STIMULATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 CANADA VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 MEXICO VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME)

TABLE 82 MEXICO VAGUS NERVE STIMULATION MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 83 MEXICO VAGUS NERVE STIMULATION MARKET, BY BIOMATERIAL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO EPILEPTIC SEIZURES IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO DEPRESSION AND ANXIETY IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 MEXICO PAIN MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO OBESITY MANAGEMENT IN VAGUS NERVE STIMULATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO ADULTS IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO GERIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO PEDIATRIC IN VAGUS NERVE STIMULATION MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO VAGUS NERVE STIMULATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 MEXICO VAGUS NERVE STIMULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND FOR INNOVATIVE NON–INVASIVE VAGUS STIMULATION DEVICES AND THE INCREASED PREVALENCE OF NEUROLOGICAL DISORDERS ARE EXPECTED TO DRIVE THE NORTH AMERICA VAGUS NERVE STIMULATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 IMPLANTABLE VNS DEVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VAGUS NERVE STIMULATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA VAGUS NERVE STIMULATION MARKET

FIGURE 14 INCIDENCE OF ADULT-ONSET BRAIN DISORDERS IN THE U.S. IN 2021

FIGURE 15 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY BIOMATERIAL, 2021

FIGURE 20 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY BIOMATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY BIOMATERIAL, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY BIOMATERIAL, LIFELINE CURVE

FIGURE 23 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY APPLICATION, 2021

FIGURE 24 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PATIENT TYPE, 2021

FIGURE 28 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PATIENT TYPE, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PATIENT TYPE, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 44 NORTH AMERICA VAGUS NERVE STIMULATION MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。