北米の無人水上車両 (USV) 市場、タイプ別 (水上および水中)、用途別 (防衛、商用、科学研究、その他)、耐久性別 (100~500 時間、1000 時間)、操作別 (遠隔操作水上車両、自律型水上車両)、システム別 (推進力、シャーシ材質、ペイロード、コンポーネント、ソフトウェア、通信)、船体タイプ別 (双胴船 (双胴船)、カヤック (単胴船)、三胴船 (三重船)、硬質インフレータブル船体)、サイズ別 (中型 (4~8 メートル)、小型 (4 メートル未満)、大型 (8~12 メートル)、特大 (12 メートル以上)) – 2030 年までの業界動向と予測。

北米の無人水上車両(USV)市場分析と規模

自律型水上車両(ASV)に電力を供給するための太陽電池の使用が増えていることで、無人水上車両(USV)の成長が加速しています。汚染レベルの増加による水質監視と、科学者が過去の気候条件を研究できるようにする海洋データマッピングの需要が高まっていることで、無人水上車両(USV)の成長が促進されています。さらに、海上安全保障上の脅威の高まりにより、北米海軍は艦隊に自律型水上車両(ASV)を導入するようになり、優位に立つようになり、北米の無人水上車両(USV)市場の成長がさらに加速しています。災害管理サービス、特に捜索救助や予防保守、領土および閉鎖水域の保全の保護における用途の多様化。養殖業界での急速な導入により、リアルタイム監視が可能になり、世界中の水産物の需要の高まりに対応できるため、北米の無人水上車両(USV)市場に大きなチャンスが生まれると予想されています。しかし、衝突検知技術はまだ初期段階にあり、それを真に自律的に実行するために必要な技術的複雑さがさらに増しており、北米の無人水上車両 (USV) 市場の成長にとって課題となっています。

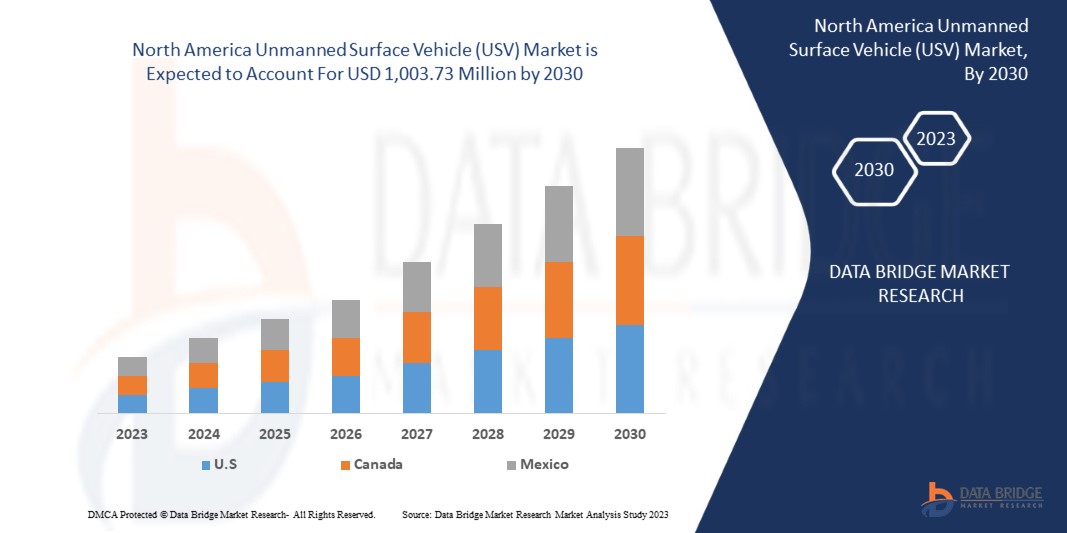

Data Bridge Market Research の分析によると、北米の無人水上車両 (USV) 市場は、予測期間中に 13.8% の CAGR で成長し、2030 年までに 10 億 373 万ドルに達すると予想されています。無人水上車両 (USV) 市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

タイプ (水上および水中)、用途 (防衛、商業、科学研究、その他)、耐久性 (100 ~ 500 時間、100 時間未満、500 ~ 1000 時間、1000 時間超)、操作 (遠隔操作水上車両、自律型水上車両)、システム (推進力、シャーシ材質、ペイロード、コンポーネント、ソフトウェア、通信)、船体タイプ (双胴船 (双胴船)、カヤック (単胴船)、三胴船 (三重船)、硬質インフレータブル船体)、サイズ (中型 (4 ~ 8 メートル)、小型 (4 メートル未満)、大型 (8 ~ 12 メートル)、特大 (12 メートル超)) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

エルビットシステムズ社、ラファエルアドバンストディフェンスシステムズ社、ボーイング社、ユーテック社、シーフロアシステムズ社、シーロボティクス社、セイルドローン社、ディープオーシャンエンジニアリング社、コングスベルグマリタイムテクノロジーズ社、アトラスエレクトロニック社、クリアパスロボティクス社、テレダインテクノロジーズ社、テキストロン社、ECAグループ、5Gマリタイム |

市場の定義

無人水上艇 (USV) は、人間の乗員を必要とせずに航行できる水上艇です。オペレーターが遠隔操作することも、自力で航行できるように事前にプログラムすることもできます。通常は急速充電可能なリチウムイオン電池または太陽エネルギーで駆動し、主に海洋探査や海洋目的に使用されます。

無人水上車両にはさまざまな利点があり、商業、研究、防衛、捜索救助など、さまざまな用途に使用できます。水産養殖などのさまざまな産業分野での採用が着実に増加しており、災害管理目的に使用できる理想的な車両になる可能性が非常に高いです。

北米の無人水上車両(USV)市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

- クリーンな海洋のための無人機の需要増加

海洋汚染は年々深刻化しています。さらに、地球の表面の約 75% は水で覆われており、そのうち 97.5% は海水、2.5% は淡水です。人口の急増により、飲料水やその他の用途で淡水の必要性が高まっています。

しかし、工業化と北米化の進展により、水質汚染が急増しています。大量のプラスチック廃棄物が海に流れ込み、水を汚染しています。さらに、石油とガスの探査と輸送の歴史において、水生生物と水質を破壊した石油流出が何度も発生しています。これに加えて、化学物質による汚染は健康、環境、経済上の懸念事項であり、このような水資源の浄化が求められています。

- 非対称脅威の増大と防衛における無人水上車両(USV)の活用

無人水上車両は、ここ数年、海軍の目的において革命的な変化を遂げています。これらの車両は、多数のタスクを実行するツールから、高度な自律性で動作できるシステムへと進化しています。さらに、ほとんどの国は、異なる防衛部門によって策定された異なる戦略のために、戦争の非対称性に直面しています。

しかし、非対称戦争は紛争を表すこともあります。このような紛争には、非正規戦争の戦略と戦術が伴うことがよくあります。非対称脅威のリソースは、個人、組織、または国家が政府、軍隊、または何らかの貴重な資産を標的にして、資産を獲得したり国家を破壊したりする攻撃を指すことができます。これらの攻撃は、違法な麻薬密売、航空機事故、海上捜索調査、ペイロードの配送など、あらゆる形式の攻撃やその他のタイプのアプリケーションから保護するために、国によって継続的に監視される必要があります。

機会

- 災害管理におけるUSVの需要増加

災害は、自然災害であれ人為災害であれ、人命、環境、さらには人工建造物に容赦ない影響を及ぼします。人為災害は、石油流出、重金属、森林火災など多岐にわたります。具体的には、ディープウォーター・ホライズン石油流出事故(2010年)、チェルノブイリ原発事故(1986年)、カリフォルニア山火事(2018年)などが挙げられます。

災害に対する意識は長年にわたって高まってきており、地上、空中、水中ロボットが災害管理 (DM) に使用されているにもかかわらず、水上車両は普及し始めたばかりです。水上車両は主に捜索救助の目的で使用されますが、搭載された地震計やその他の海底圧力センサーの助けを借りて地殻変動の検出に使用することもできます。

制約/課題

- 無人水上車両(USV)の衝突検知能力の欠如

無人水上車両は、商業、軍事、研究の幅広い用途で利用が拡大しています。これらの車両は、単独で動作して完全に自律的に動作することも、オペレーターが制御して進路をナビゲートし、機能を制御することも可能です。

自律走行車は衝突検知の技術的な複雑さに直面しています。これらの車両は他の海洋車両と簡単に衝突する可能性があるため、車両に適切な衝突システムがないことが市場にとって大きな制約となっています。

- 政府と民間企業による投資の増加

半世紀以上前、戦争は各国が全力攻撃に注力し、武力誇示によって戦われました。しかし、時代が進み技術が進歩するにつれ、さまざまな経済が同時に発展し、偵察や監視などの他の要素に頼るようになりました。そこで、北米のリーダーたちは、より効率的なものにするために、自律型水上車両 (ASV) に焦点を移しました。ASV は、一般に大型軍艦や戦艦に随伴したり、水中の機雷や罠を探知したりするために使用できます。

It is becoming essential to increase investment in unmanned platforms with an impenetrable command network. USVs have the potential to become the centrepiece for various maritime operations. This is further propelled by rising skirmishes between various economies resulting in trade wars, illegal land captures and surveillance. As a result, rising investments by North America naval forces to strengthen their capability as well as investments by private entities, is the factor which will create an opportunity for growth of the market.

Recent Developments

- In October 2022, ECA GROUP designed Critical Design Review to promote autonomous robotic systems in the 3rd generation MCM program. This product has helped the company to expand its product portfolio and enhance the offerings to the customers

- In April 2019, Kongsberg Maritime launched a brand-new unmanned surface vehicle (USV) and sounder USV System. The sounder USV system is a multipurpose platform that was designed to work across different market segments, including surveys. This has helped the company to enhance its product offerings and to grow in the market

North America Unmanned Surface Vehicle (USV) Market Scope

North America unmanned surface vehicle (USV) market is segmented six notable segments, which are based on type, application, endurance, operation, system, hull type, size. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Sub-Surface

On the basis of type, the North America unmanned surface vehicle (USV) market is segmented into surface and sub-surface.

Application

- Defense

- Commercial

- Scientific Research

- Others

On the basis of application, the North America unmanned surface vehicle (USV) market has been segmented into defense, commercial, scientific research, and others.

Endurance

- 100-500 Hours

- <100 Hours

- 500-1000 Hours

- >1000 Hours

On the basis of endurance, the North America unmanned surface vehicle (USV) market has been segmented into 100-500 hours, <100 hours, 500-1000 hours, and >1000 hours.

Operation

- Remote Operated Surface Vehicle

- Autonomous Surface Vehicle

On the basis of operation, the North America unmanned surface vehicle (USV) market is segmented into remote operated surface vehicle, and autonomous surface vehicle.

System

- Propulsion

- Chassis Material

- Payload

- Component

- Software

- Communication

On the basis of system, the North America unmanned surface vehicle (USV) market is segmented into propulsion, chassis material, payload, component, software, and communication.

Hull Type

- Catamaran (Twin Hulls)

- Kayak (Single Hull)

- Trimaran (Triple Hulls)

- Rigid Inflatable Hull

On the basis of hull type, the North America unmanned surface vehicle (USV) market is segmented into catamaran (twin hulls), kayak (single hull), trimaran (triple hulls), and rigid inflatable hull.

Size

- Medium (4 to 8 M)

- 小(4メートル未満)

- ラージ(8〜12メートル)

- 特大(12m以上)

北米の無人水上車両(USV)市場は、サイズに基づいて、中型(4〜8 m)、小型(4 m未満)、大型(8〜12 m)、特大(12 m以上)に分類されます。

北米の無人水上車両(USV)市場の地域分析/洞察

北米の無人水上車両 (USV) 市場が分析され、市場規模の洞察と傾向が、上記のように国、タイプ、アプリケーション、耐久性、操作、システム、船体タイプ、サイズ別に提供されます。

無人水上車両 (USV) 市場レポートの対象国は、米国、カナダ、メキシコです。

海底地図作成、水質検査、橋梁などのインフラの導入増加により、米国は北米の無人水上車両(USV)市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境と北米の無人水上車両(USV)市場シェア分析

北米の無人水上車両 (USV) 市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、無人水上車両 (USV) 市場に関連する会社の焦点にのみ関連しています。

北米の無人水上車両(USV)市場で活動している主要企業には、Elbit Systems Ltd.、Rafael Advanced Defense Systems Ltd.、Boeing、Utek、Seafloor Systems, Inc.、SeaRobotics Corporation、Saildrone Inc.、Deep Ocean Engineering, Inc.、Kongsberg Maritime、L3Harris Tecnologies, Inc.、ATLAS ELEKTRONIK GmbH、Clearpath Robotics Inc.、Teledyne Technologies Incorporated、Textron Inc.、ECA GROUP、5G Marineなどがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR UNMANNED VEHICLES FOR CLEANING OCEAN

5.1.2 INCREASING ASYMMETRIC THREATS AND USE OF UNMANNED SURFACE VEHICLES (USV) IN DEFENSE

5.1.3 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION

5.1.4 INCREASING USE OF UNMANNED SURFACE VEHICLE (USV) FOR OCEANOGRAPHY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF UNMANNED UNDERWATER VEHICLE (UUV) AS AN ALTERNATIVE

5.2.2 LACK OF COLLISION DETECTION CAPABILITY OF UNMANNED SURFACE VEHICLE (USV)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR USV FOR DISASTER MANAGEMENT

5.3.2 APPLICATION IN TERRITORIAL AND PROTECTED WATERS

5.3.3 INCREASING INVESTMENTS BY GOVERNMENTS AND PRIVATE PLAYERS

5.3.4 REAL TIME MONITORING OF AQUACULTURE ENVIRONMENTS

5.4 CHALLENGES

5.4.1 DECREASING NAVY BUDGET OF VARIOUS COUNTRIES

6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 SUB-SURFACE

7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DEFENSE

7.2.1 TYPE

7.2.1.1 SURFACE

7.2.1.2 SUB-SURFACE

7.3 COMMERCIAL

7.3.1 BY PURPOSE

7.3.1.1 OCEANOGRAPHY AND ENVIRONMENTAL SCIENCES

7.3.1.2 OIL AND GAS

7.3.1.3 EXPLORATION

7.3.2 BY TYPE

7.3.2.1 SURFACE

7.3.2.2 SUB-SURFACE

7.4 SCIENTIFIC RESEARCH

7.4.1 TYPE

7.4.1.1 SURFACE

7.4.1.2 SUB-SURFACE

7.5 OTHERS

8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE

8.1 OVERVIEW

8.2 100-500 HOURS

8.3 <100 HOURS

8.4 500-1000 HOURS

8.5 >1000 HOURS

9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION

9.1 OVERVIEW

9.2 REMOTE OPERATED SURFACE VEHICLE

9.3 AUTONOMOUS SURFACE VEHICLE

10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM

10.1 OVERVIEW

10.2 PROPULSION

10.3 CHASSIS MATERIAL

10.4 PAYLOAD

10.5 COMPONENT

10.6 SOFTWARE

10.7 COMMUNICATION

11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE

11.1 OVERVIEW

11.2 CATAMARAN (TWIN HULLS)

11.3 KAYAK (SINGLE HULL)

11.4 TRIMARAN (TRIPLE HULLS)

11.5 RIGID INFLATABLE HULL

12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE

12.1 OVERVIEW

12.2 MEDIUM (4 TO 8 M)

12.3 SMALL (LESS THAN 4 M)

12.4 LARGE (8 TO 12 M)

12.5 EXTRA LARGE (ABOVE 12 M)

13 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 L3HARRIS TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 BOEING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 KONGSBERG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TEXTRON, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 5G MARINE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ATLAS ELEKTRONIK GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CLEARPATH ROBOTICS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ECA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELBIT SYSTEMS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IXBLUE SAS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 SAILDRONE, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 TECHNOLOGY PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 SEAFLOOR SYSTEMS, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 SEAROBOTICS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 TELEDYNE TECHNOLOGIES INCORPORATED

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 12 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 U.S. DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 16 U.S. COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 19 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 20 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 21 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 23 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 25 CANADA DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 27 CANADA COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 30 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 31 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 32 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 33 CANADA UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

TABLE 34 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 MEXICO DEFENSE IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY PURPOSE, 2021-2030 (USD MILLION)

TABLE 38 MEXICO COMMERCIAL IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO SCIENTIFIC RESEARCH IN UNMANNED SURFACE VEHICLE (USV) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY ENDURANCE, 2021-2030 (USD MILLION)

TABLE 41 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY OPERATION, 2021-2030 (USD MILLION)

TABLE 42 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SYSTEM, 2021-2030 (USD MILLION)

TABLE 43 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY HULL TYPE, 2021-2030 (USD MILLION)

TABLE 44 MEXICO UNMANNED SURFACE VEHICLE (USV) MARKET, BY SIZE (LENGTH IN METERS), 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: TYPE TIMELINE CURVE

FIGURE 12 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SEGMENTATION

FIGURE 13 INCREASING USE OF UNMANNED SURFACE VEHICLES (USV) IN COMMERCIAL EXPLORATION IS EXPECTED TO DRIVE THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN THE FORECAST PERIOD

FIGURE 14 SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET

FIGURE 16 PLASTICS PRODUCTION ACROSS GLOBE

FIGURE 17 CRUDE OIL PRODUCTION DATA, BY REGION

FIGURE 18 DEFENCE EXPENDITURE ACROSS THE GLOBE

FIGURE 19 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE, 2022

FIGURE 20 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY ENDURANCE, 2022

FIGURE 22 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY OPERATION, 2022

FIGURE 23 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SYSTEM, 2022

FIGURE 24 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY HULL TYPE, 2022

FIGURE 25 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY SIZE, 2022

FIGURE 26 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: BY TYPE (2023-2030)

FIGURE 31 NORTH AMERICA UNMANNED SURFACE VEHICLE (USV) MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。