北米の低活動膀胱市場、タイプ別(薬物療法、外科的治療法、尿道補助装置、幹細胞および遺伝子治療)、投与経路別(経口、非経口、その他)、エンドユーザー別(病院、診療所、学術研究機関、その他)、流通チャネル別(病院薬局、小売薬局、その他)業界動向と2029年までの予測

北米の低活動膀胱市場の分析と洞察

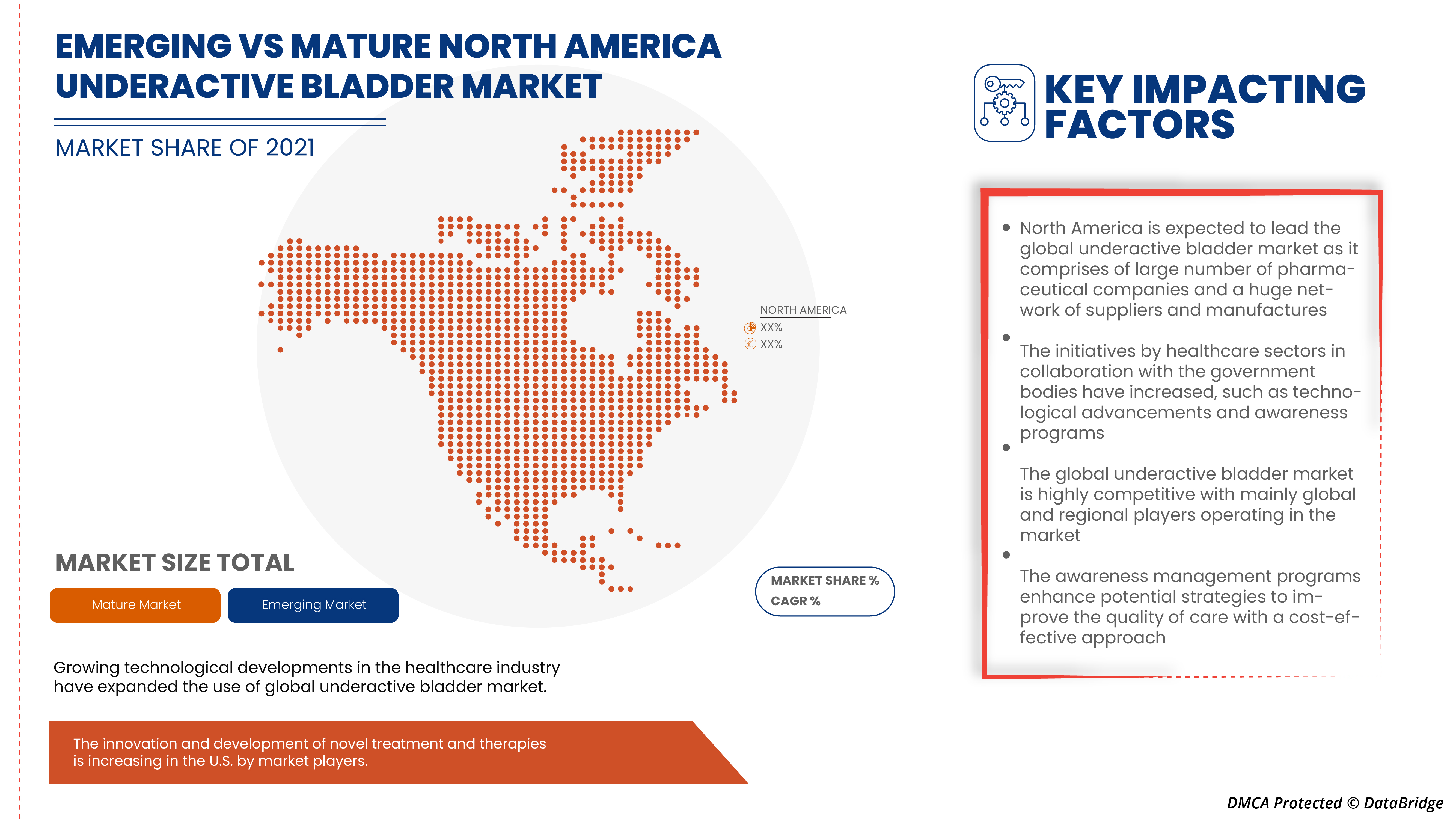

北米の低活動膀胱市場は、神経因性膀胱感染症の発生率の上昇、研究資金の増加、低活動膀胱(UAB)の新しい治療法の開発、パイプライン製品による需要の高まり、および市場の成長につながる研究開発への投資の増加などの要因によって推進されています。現在、医療費は先進国と新興国全体で増加しており、メーカーが新しい革新的な製品を開発するための競争上の優位性を生み出すことが期待されています。さらに、医療費の急増と膀胱障害の有病率の増加は、市場にプラスの影響を与えます。

しかし、治療費が高額なため、患者は高品質で効果的な解決策を受け入れることが困難になっています。そのため、治療手順の高額な費用は、全体的な治療費に悪影響を及ぼします。さらに、UAB の治療に現在使用されている薬剤は、有効性と安全性の観点から臨床的に満足できるものではないため、新しい治療薬の開発が必要になります。

北米の低活動膀胱市場は、市場プレーヤーの増加と新しいパイプライン薬の存在により、予測期間中に成長すると予想されています。これに伴い、メーカーは市場に新しい製品を投入するための研究開発活動に取り組んでいます。

しかし、研究や調査に関連するコストが高いため、市場の成長が抑制され、市場での新製品の発売にさらに影響を与える可能性があります。

革新的で効果的な治療法の新たな開発を促進するための研究開発プログラムの増加と官民パートナーシップの増加が、市場にさらなる影響を与えています。

北米の低活動性膀胱市場レポートは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、目的の目標を達成するお手伝いをします。さまざまな地域の発展途上国における小売ユニットの拡張性と事業拡大、および機械および医薬品製品の安全な流通のためのサプライヤーとのパートナーシップは、予測期間における市場の需要を推進した主な原動力です。

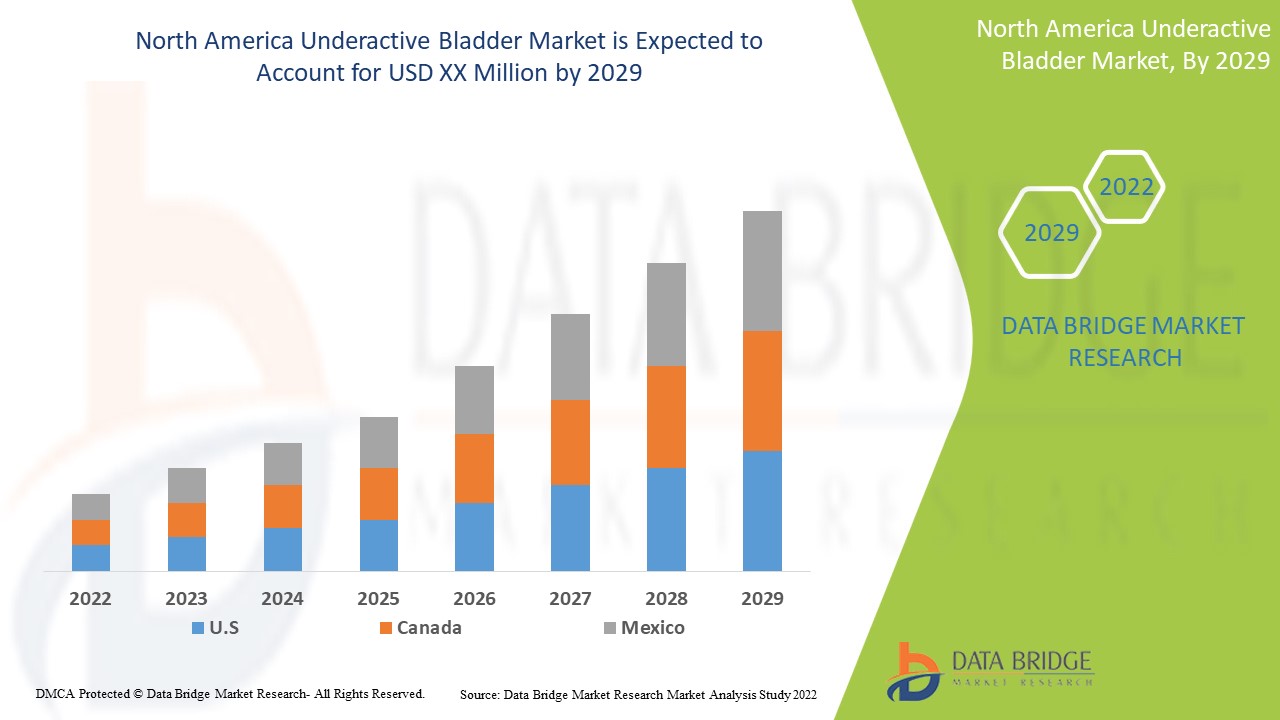

北米の低活動膀胱市場は支援的であり、病気の進行を抑えることを目指しています。Data Bridge Market Research は、北米の低活動膀胱市場は 2022 年から 2029 年の予測期間中に 5.3% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別(薬物療法、外科的治療、尿道補助装置、幹細胞および遺伝子治療)、投与経路別(経口、非経口、その他)、エンドユーザー別(病院、診療所、学術研究機関、その他)、流通チャネル別(病院薬局、小売薬局、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

アステラス製薬株式会社、オーロビンドファーマ、ベーリンガーインゲルハイムインターナショナルGmbH、マクロードファーマシューティカルズ株式会社、オリオン株式会社、小野薬品工業株式会社、ノバルティスAG、ファイザー株式会社、シプラ株式会社、ドクターレディーズラボラトリーズ株式会社、テバファーマシューティカルインダストリーズ株式会社、サンファーマシューティカルインダストリーズ株式会社、アルミラルSA、ベシフロ株式会社、アルケムラボラトリーズなど |

市場の定義

低活動膀胱(UAB)は、排尿時に膀胱の筋肉である排尿筋の収縮力が低下することにより排尿障害を呈する病態であり、すぐに尿意を感じる症状を特徴としており、過活動膀胱(OAB)とは異なる。本発明は、尿流量改善効果、膀胱の過膨張改善効果(膀胱容量減少効果)を有し、UABの予防または治療に有用な、UABの予防または治療に有用な医薬組成物を提供する。

Moreover, it is a disease state which is different from the OAB characterized by urinary urgency which has been attracting attention in recent years. Causes of UAB include autonomic neuropathy such as diabetes and alcoholism, pelvic surgery such as radical hysterectomy and radical rectal cancer, spinal cord diseases such as spina bifida, and disc herniation is also known. Patients suffering from severe and mild bladder disorder-associated problems need pharmacotherapy often cycled with multiple therapies and without adequate relief receiving continued treatments, which also creates an impact on healthcare expenditure.

North America Underactive Bladder Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of these are discussed in detail below:

Drivers

- Increasing prevalence of neurological disorder

UAB is a common neurological condition in which nerves and muscles do not work together very well resulting in prolonged urination time with or without a sensation of incomplete bladder emptying. In this condition, the detrusor muscles underperform for their contraction activity which is characterized by a slow urinary stream, hesitancy, and straining to void, with or without a feeling of incomplete bladder emptying, sometimes with storage symptoms even. Thus, the bladder either does not empty or empties only partially which is due to the bladder muscles being unable to release urine properly.

As a result, patients with UAB may have various urination symptoms and may be accompanied by a large amount of residual urine. Complications of urinary retention due to aggravation and Urinary Tract Infections (UTIs) due to chronic residual urine are often seen and have become a problem. Moreover, it is a disease state which is different from the OAB characterized by urinary urgency which has been attracting attention in recent years. Thus, the increasing prevalence of neurogenic bladder disorders is expected to drive market growth. This will lead to an increased demand for treatment that can detect patients as well, due to which there will be expected lucrative growth in the market.

- Rising health care expenditure

The instruments, manpower, and medical management in case of any harm to researchers, insurance, transportation, ethics committee fee, data processing, and other consumables lead to major cost involvement for the market players. The healthcare expenditure comprises all healthcare services, testing devices, family planning activities, and emergency aid designated for health. National Health Accounts provide many indicators based on expenditure collected within an internationally recognized framework. The factors determining any country's healthcare expenditure are income (per capita GDP), technological progress and variation in medical practice, and health systems characteristics.

The rise in healthcare expenditure simultaneously helps healthcare organizations and government bodies increase the research activities on menopause drugs, their upcoming clinical trials, and R&D activities. Also, the cost involved in the production and manufacturing of the new products, the market players require adequate allocation of funds and resources, hence, the government acts as a helping hand in this scenario. Growing healthcare expenditure is also beneficial for further economic development and growth of the healthcare sector. In addition, the increase in disposable income of the population is a favorable factor. Hence, rising healthcare expenditure is expected to drive market growth in the future.

Opportunity

- Rising urologic complications of diabetes

One of the known causes of UAB includes autonomic neuropathy such as diabetes. Moreover, diabetes is associated with an earlier onset and increased severity of urologic diseases that result in costly and debilitated urologic complications. These urologic complications, including bladder dysfunction and UTIs among others, have a profound effect on the quality of life of both men and women with diabetes. Diabetes and urologic diseases are very common health problems that markedly increase in prevalence and incidence with advancing age. Urologic complications of diabetes are an immediate effect. Diabetes is the most prominent disorder and has a high prevalence globally.

Diabetes-associated bladder complications can be due to an alternation in the detrusor smooth muscles, neuronal dysfunction, and urothelial dysfunction. Depending on the nerves involved, the effects of diabetic neuropathy can range from discomfort and numbness in the legs to complications with the digestive system, the urinary tract, the blood vessels, and the core. The rising data on diabetes will significantly increase the risk of urologic complications of diabetes worldwide. Thus, it is required to recommend future directions for research and clinical care for proper treatment of urologic complications of diabetes. Support from other organizations would also be required to reach the under-developed regions to tackle the neglected complications. Therefore, this signifies that the rise in urologic complications of diabetes is expected to act as an opportunity for market growth.

Restraint/Challenge

- High cost of Research and Development (R&D)

研究開発は、さまざまな種類の患者を治療するための手順を変更する上での前提条件です。新製品の研究開発コストが高いため、徹底した研究と臨床研究が必要です。研究開発のさまざまな臨床段階には巨額の投資が必要であり、市場の成長に影響を与える可能性があります。研究の計画と実行にかかる研究コストと、研究には十分な資金とリソースの割り当てが必要であり、市場の新しい展開に影響を与える可能性があります。製品のコストは、市場の主要な要因です。市場には多くの診断オプションがありますが、コストが高いため、ほとんどの人は診断を避ける傾向があります。診断アプローチは感度と特異性が向上し、テストのコストも増加しています。

この処置のコストが高いのは、処置のさまざまなチェックポイントと、そのような処置を実行するためのハイテクなモダリティの使用によるものです。処置の研究開発コストが高すぎるため、高品質で効果的なソリューションの導入が制限されます。今後、コストが高いと、全体的な処置コストに悪影響が及びます。その結果、低所得国および中所得国における将来の処置の需要が制限されることになります。これは、研究と調査に関連するコストが高いため、市場の成長が抑制され、市場での新製品の発売にさらに影響を与える可能性があることを示唆しています。

COVID-19後の北米低活動膀胱市場への影響

COVID-19は、この地域で広く製品の需要が高まっているため、市場の成長にプラスの影響を与えています。この地域ではさまざまな膀胱疾患の罹患率が上昇しているため、人々はより健康に気を配るようになりました。悪化による尿閉や慢性的な残尿による尿路感染症の合併症がよく見られ、問題となっています。したがって、COVID-19はこの市場にプラスの影響を与えています。

最近の動向

- 2020年6月、ベシフロ社は、成人女性が間欠導尿の代替として29日間使用できる、FDA承認済みの磁気結合型尿道内弁ポンプ装置「inFlow」のメディケア適用を発表しました。これにより、市場での製品化が早まり、製品ビジネスの急速な拡大に貢献します。

- 2020年4月、アステラス製薬ヨーロッパ社は、低活動膀胱の治療を対象とする臨床試験を完了しました。現在、ASP8302は、低活動膀胱患者における薬剤の安全性と忍容性を調査するための第2相臨床試験を実施中です。

北米の低活動膀胱市場の範囲

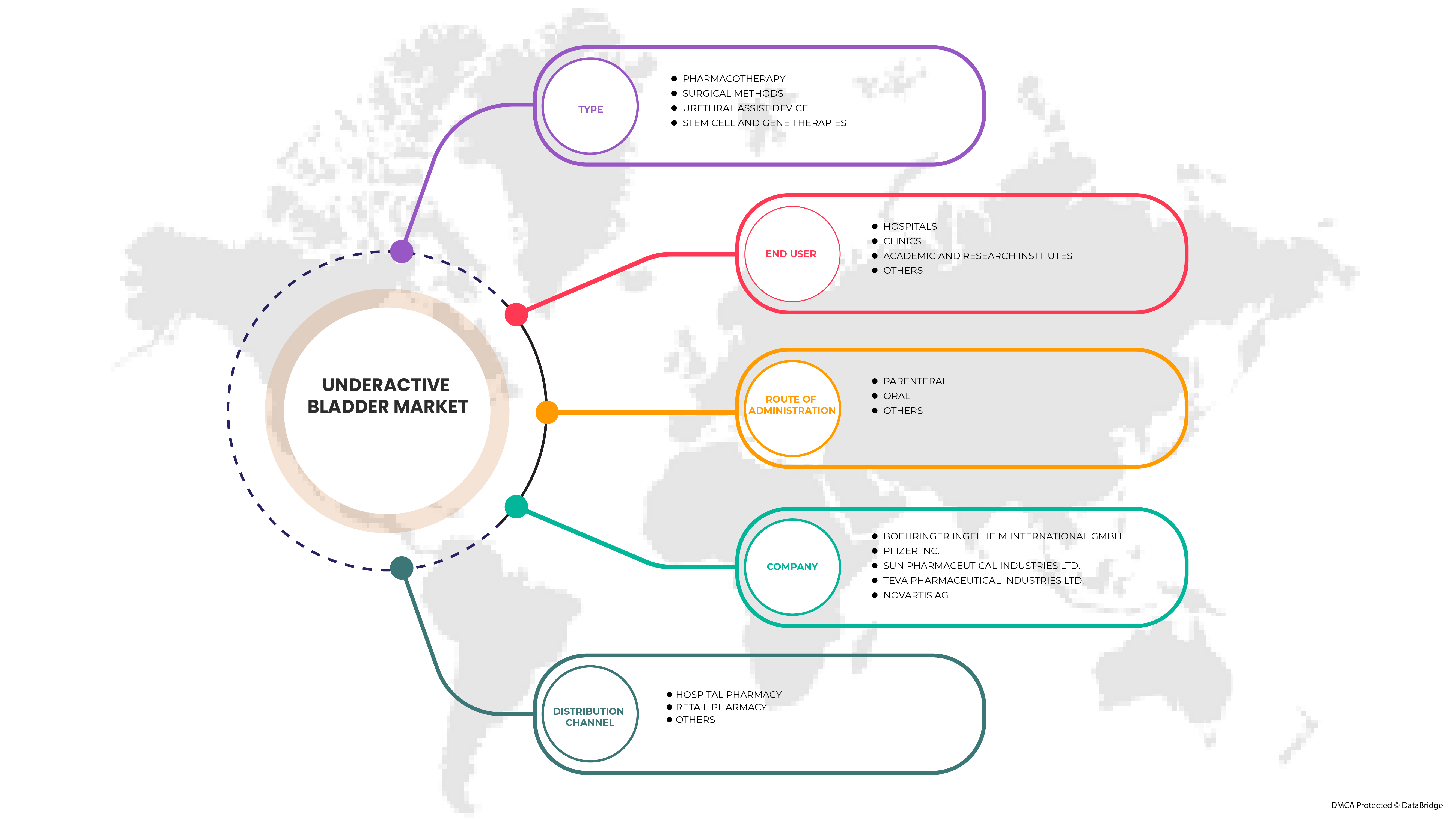

北米の低活動膀胱市場は、タイプ、投与経路、エンドユーザー、流通チャネルに基づいて 4 つの主要なセグメントに分類されます。セグメント間の成長は、ニッチな成長分野と市場へのアプローチ戦略を分析し、コア アプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

タイプ

- 薬物療法

- 手術方法

- 尿道補助装置

- 幹細胞と遺伝子治療

タイプに基づいて、市場は薬物療法、外科的治療法、尿道補助装置、幹細胞および遺伝子治療に分類されます。

投与経路

- オーラル

- 非経口

- その他

投与経路に基づいて、市場は経口、非経口、その他に分類されます。

エンドユーザー

- 病院

- クリニック

- 学術研究機関

- その他

エンドユーザーに基づいて、市場は病院、診療所、学術研究機関、その他に分類されます。

流通チャネル

- 病院薬局

- 小売薬局

- その他

流通チャネルに基づいて、市場は病院薬局、小売薬局、その他に分類されます。

北米の低活動膀胱市場の地域分析/洞察

北米の低活動膀胱市場が分析され、上記のようにタイプ、投与経路、エンドユーザー、流通チャネル別に市場規模の洞察と傾向が提供されます。

北米の低活動膀胱市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

- 2022年には、尿失禁(UI)、UABなどの膀胱の問題の発生率の上昇により、北米の低活動性膀胱障害市場が成長すると予想されています。さらに、加齢とともに膀胱制御の問題などの膀胱の問題のリスクが高まるため、高齢者人口の増加も市場の成長を牽引しています。UIとUABの有病率も加齢とともに上昇し、高齢者は人口の中で最も急速に増加しているセグメントです。

米国には大手企業が存在し、製造施設の数も増加しているため、この地域では米国が優位に立つと予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境と北米の低活動膀胱市場シェア分析

北米の低活動性膀胱市場の競争環境は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、北米の低活動性膀胱市場に対する会社の焦点にのみ関連しています。

市場で活動している主要企業は次のとおりです。

- アステラス製薬株式会社

- オーロビンドファーマ。

- ベーリンガーインゲルハイムインターナショナルGmbH

- マクロード製薬株式会社

- オリオン株式会社

- 小野薬品工業株式会社

- ノバルティスAG

- ファイザー株式会社

- シプラ株式会社

- ドクター・レディーズ・ラボラトリーズ株式会社

- テバ製薬株式会社

- サンファーマシューティカルインダストリーズ株式会社

- アルミラル、SA

- ベシフロ株式会社

- アルケムラボ。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と国、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 THE IMPORTANCE OF UNDERSTANDING PATENTS-

4.4.1 DOXAZOSIN

4.4.2 BETHANECHOL CHLORIDE

4.4.3 TAMSULOSIN HYDROCHLORIDE

4.5 CLINICAL TRIALS FOR UNDERACTIVE BLADDER

4.5.1 EU CLINICAL TRIALS REGISTER-

4.6 MERGER & ACQUISITION IN HEALTHCARE INDUSTRY

4.7 M&A DEALS IN 2021 BY TARGET COMPANY TERRITORY:

4.8 CROSS-BORDER DEALS:

4.9 OUTLOOK FOR 2022:

4.1 PATIENT ENROLMENT STRATEGIES

4.11 FACTORS AFFECTING PATIENT RECRUITMENT:

4.12 CHALLENGES:

4.13 PATIENT FUNNEL ANALYSIS:

4.14 RECOMMENDATIONS

4.14.1 USE OF TECHNOLOGY:

4.14.2 PARTICIPANT CHARACTERISTICS:

4.14.3 RECRUITER CHARACTERISTICS:

4.14.4 SYSTEMS & PROCEDURES:

4.14.5 LOCATION:

4.14.6 NATURE OF RESEARCH:

4.15 CONCLUSION:

4.16 UNDERACTIVE BLADDER PATIENT FLOW DIAGRAM

4.17 WHAT CAUSES UNDERACTIVE BLADDER?

4.17.1 CAUSES OF UNDERACTIVE BLADDER INCLUDE

4.17.2 TESTS TO EVALUATE UNDERACTIVE BLADDER

4.18 UNDERACTIVE BLADDER INVESTIGATIONAL PRODUCTS-

5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF NEUROGENIC DISORDER

6.1.2 INCREASE IN RESEARCH AND DEVELOPMENT OF UNDERACTIVE BLADDER TREATMENT

6.1.3 FAVOURABLE REIMBURSEMENT SCENARIO

6.1.4 RISING HEALTHCARE EXPENDITURE

6.2 RESTRAINTS

6.2.1 HIGH COST OF RESEARCH AND DEVELOPMENT

6.2.2 STRINGENT GOVERNMENT REGULATIONS ON NEW PRODUCTS APPROVAL

6.3 OPPORTUNITIES

6.3.1 RISING UROLOGIC COMPLICATIONS OF DIABETES

6.3.2 PRESENCE OF NOVEL PIPELINE DRUGS

6.3.3 IMPROVING A BETTER HEALTHCARE SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF PROPER TREATMENT

6.4.2 RISK INVOLVED DURING TREATMENT OF UNDERACTIVE BLADDER

7 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 PHARMACOTHERAPY

7.2.1 ALPHA-BLOCKERS

7.2.2 MUSCARINIC AGONISTS

7.2.3 CHOLINESTERASE INHIBITOR

7.2.3.1 BY DRUGS

7.2.3.1.1 TAMSULOSIN

7.2.3.1.2 DOXAZOSIN

7.2.3.1.3 DISTIGMINE

7.2.3.1.4 BETHANECHOL

7.2.3.1.5 OTHERS

7.2.4 BY PRODUCT TYPES

7.2.4.1 GENERICS

7.2.4.2 BRANDED

7.2.4.2.1 FLOMAX

7.2.4.2.2 ALFADIL

7.2.4.2.3 GRAVITOR

7.2.4.2.4 URIVOID

7.2.4.2.5 OTHERS

7.3 SURGICAL METHODS

7.3.1 SURGICAL NERVE STIMULATION

7.3.2 REDUCTION CYSTOPLASTY

7.3.3 SURGERIES FOR BLADDER OBSTRUCTION

7.3.4 INJECTION INTO EXTERNAL SPHINCTER

7.3.5 OTHERS

7.4 URETHRAL ASSIS DEVICE

7.4.1 INFLOW INTRAURETHRAL VALVE PUMP

7.5 STEM CELL AND GENE THERAPIES

7.5.1 NERVE GROWTH FACTOR

7.5.2 GLIAL-CELL DERIVE NEUTOPHIC FACTORGLIAL

7.5.3 NEUTOPHIN-3 DERIVES FROM GLIALL CELLS

8 NORTH AMERICA UNDERACTIVE BLADDER MARKET,BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 PARENTERAL

8.3 ORAL

8.4 OTHERS

9 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 CLINICS

9.4 ACADEMIC AND RESEARCH

9.5 OTHERS

10 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 HOSPITAL PHARMACY

10.3 RETAIL PHARMACY

10.4 OTHERS

11 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 PFIZER INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 TEVA PHARMACEUTICAL INDUSTRIES LTD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NOVARTIS AG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DR. REDDY’S LABORATORIES LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ASTELLAS PHARMA INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ORION CORPORATION.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ALKEM LABS.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ALMIRALL, S.A

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 AUROBINDO PHARMA.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 CIPLA INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 GLENWOOD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MACLEODS PHARMACEUTICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 ONO PHARMACEUTICAL CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 VESIFLO, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 TOTAL 40 DOXAZOSIN DRUGS WERE DISCONTINUED FROM THE MARKET

TABLE 2 TOTAL 38 DOXAZOSIN DRUGS ARE STILL IN THE MARKET

TABLE 3 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (DOXAZOSIN) BY COMPANY

TABLE 4 TOTAL 58 DRUGS DISCONTINUED

TABLE 5 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (BETHANECHOL CHLORIDE) BY COMPANY

TABLE 6 OUT OF 3,128 STUDIES ON BLADDER DISORDER, ONLY 22 STUDIES ARE ONGOING FOR THE UAB-

TABLE 7 THESE CLINICAL TRIALS ARE MOSTLY RECRUITING/ONGOING IN DIFFERENT REGIONS OF THE WORLD-

TABLE 8 TOP ACQUISITIONS OF 2021 RANKED BY TOTAL DEAL VALUE:

TABLE 9 FDA REQUIRES THE FOLLOWING SCENARIO BEFORE A DRUG IS APPROVED

TABLE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET, TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA STEM CELL AND GENE THERAPIES IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PARENTERAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HOSPITALS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ACADEMIC AND RESEARCH IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HOSPITAL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 40 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 41 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 42 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 43 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 44 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 45 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 46 NORTH AMERICA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 47 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 48 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 49 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 50 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 51 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 52 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 53 U.S. UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 55 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 56 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 57 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 58 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 59 U.S. BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 60 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 61 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 62 U.S. BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 63 U.S. SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 64 U.S. URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 65 U.S. STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 66 U.S. UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 67 U.S. UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 68 U.S. UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 69 CANADA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 71 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 72 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 73 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 74 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 75 CANADA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 76 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 77 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 78 CANADA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 CANADA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 80 CANADA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 81 CANADA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 82 CANADA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 83 CANADA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 84 CANADA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 85 MEXICO UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 87 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 88 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 89 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 90 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 91 MEXICO BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 92 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 93 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 94 MEXICO BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 95 MEXICO SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 96 MEXICO URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 97 MEXICO STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 98 MEXICO UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 99 MEXICO UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 100 MEXICO UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNDERACTIVE BLADDER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNDERACTIVE BLADDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNDERACTIVE BLADDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA UNDERACTIVE BLADDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF NEUROGENIC BLADDER INFECTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN THE FORECAST PERIOD

FIGURE 12 TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA UNDERACTIVE BLADDER MARKET

FIGURE 14 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2021

FIGURE 15 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2021

FIGURE 19 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2021

FIGURE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY TYPE (2022-2029)

FIGURE 35 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。