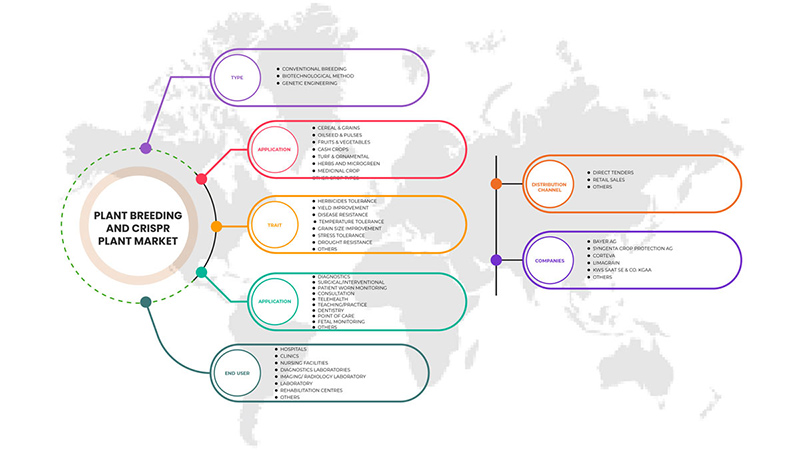

北米の植物育種および CRISPR 植物市場、タイプ別 (従来の方法、バイオテクノロジーによる方法、遺伝子工学)、特性別 (除草剤耐性、耐病性、収量向上、耐熱性、粒度向上、ストレス耐性、干ばつ耐性など)、用途別 (穀類、油糧種子および豆類、果物および野菜、換金作物、芝生および観賞用、ハーブおよびマイクログリーン、薬用作物など) - 2029 年までの業界動向および予測。

北米の植物育種と CRISPR 植物市場の分析と洞察

植物育種と CRISPR 植物は、より優れた遺伝資源を持ち、高収量、より高品質の作物、耐病性などの優れた特性を備えた新しい品種の植物を作成するために重要です。植物育種と CRISPR 植物は、高収量作物を生産して人口の増大する需要を満たすために、ラテンアメリカの農家にとって重要です。また、植物育種と CRISPR 植物は、ラテンアメリカの人口増加による高まる需要を満たすために必要であり、これが市場を牽引する主な要因です。そのため、多くの企業が製造施設を拡張し、ラテンアメリカの農家の間で高まる新しい品種の需要を満たしています。

市場の成長を牽引する要因は、農業分野における植物育種と CRISPR 植物の利点に関する認識の高まりと、ラテンアメリカ地域での植物育種作物の採用率の高さです。植物育種と CRISPR 植物の成長を抑制している要因は、植物育種作物に人間の健康に潜在的に有害となる可能性のある望ましくない毒素が存在することに関する認識の高まりです。

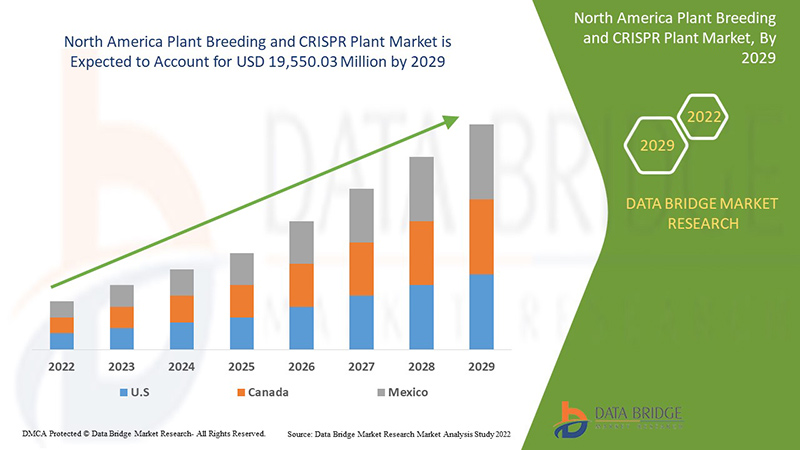

Data Bridge Market Research の分析によると、北米の植物育種および CRISPR 植物市場は、予測期間中に 17.3% の CAGR で成長し、2029 年までに 195 億 5,003 万米ドルに達する見込みです。北米の植物育種および CRISPR 植物の需要が急増しているため、タイプは市場で最大のタイプ セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別(従来の方法、バイオテクノロジーによる方法、遺伝子組み換え)、特性別(除草剤耐性、耐病性、収量向上、耐熱性、粒度向上、ストレス耐性、干ばつ耐性など)、用途別(穀類、油糧種子、豆類、果物、野菜、換金作物、芝生、観賞用、ハーブ、マイクログリーン、薬用作物など) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

BAYER AG、Syngenta Crop Protection AG、Corteva、BASF SE、Limagrain、DLF、Bioceres Crop Solutions、KWS SAAT SE & Co. KGaA、Stine Seed Company. (Stine Seed Farm, Inc. の子会社)、RAGT、InVivo、pairwise、TMG Tropical Improvement & Genetics SA、サカタの種苗、DONMARIO、UPL、Benson Hill Inc.、Yield10 Bioscience, Inc.、Tropic など。 |

北米の植物育種と CRISPR 植物市場の定義

植物育種は、栽培者が作物の品種を開発または改良し、植物ゲノムを温室または分子ツールの助けを借りて操作して目的の遺伝子または形質を取得することにより収穫量を増やすために使用する技術です。植物育種技術では、部位特異的ヌクレアーゼを使用して、DNAを目的のDNAに極めて完璧に変換または標的化します。CRISPRは植物育種に使用される技術で、原核生物由来のCRISPR-Cas遺伝子を使用して植物ゲノムを変更し、優れた有益な形質を持つ生殖質を作成します。植物育種またはCRISPR技術によって生産された作物は、高収量、従来の作物よりも優れた品質、耐病性、除草剤耐性、気候耐性などの特性を備えています。さらに、植物育種方法は、高収量、より高品質の耐病性など、さまざまな利点を提供する作物を作成するために使用されます。また、植物育種とCRISPR技術は、持続可能な作物生産に最適なオプションです。

北米の植物育種と CRISPR 植物市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

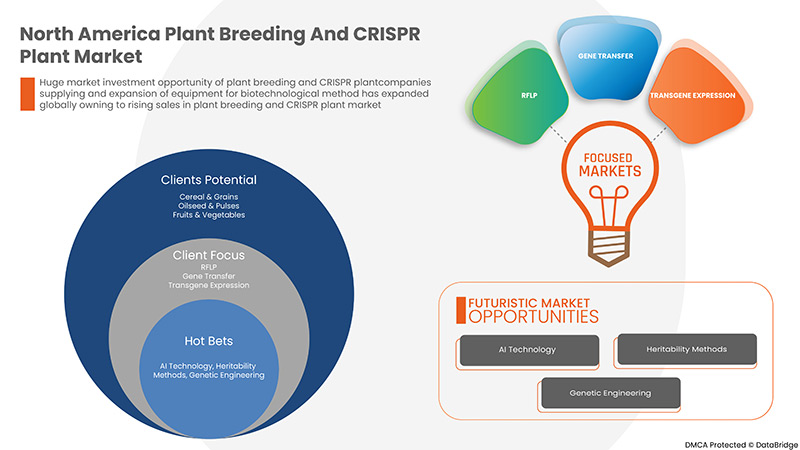

- 植物育種とCRISPR植物の研究開発の増加

植物育種は、DNAを標的にして極めて完璧に変換することで植物に望ましい形質を導入し、植物の形質を変える技術です。植物育種は、作物の生産性を高め、人間や動物が消費する作物の栄養価を高めるために使用されます。CRISPRは、品質や収量の向上、病気や除草剤への耐性の提供などの用途があるため、植物育種で使用される主要かつ重要な技術の1つです。収量を増やして作物の品質を高め、作物の損傷を減らすために組み換え作物の需要が高まるにつれて、この地域では植物育種とCRISPR植物の研究開発が増加しています。高品質の作物を生産するために農家の間で植物育種やCRISPR技術によって生産された作物や植物の需要が高まっており、植物育種とCRISPR植物の研究開発の成長につながっています。

植物育種と CRISPR 植物の研究開発活動の増加により、この地域における植物育種と CRISPR 植物の成長が加速しています。

- 人口増加による食糧生産の需要増加

The growing population is one of the main driving factor for the plant breeding & CRISPR plants. As with the growing population the demand for the food is increasing and there are more number of people to feed which is increasing the need for new technology i.e. plant breeding. The increased demand of food can be fulfilled by increasing the yield of the crop and also by improving the quality, which is only possible with the plant breeding and CRISPR technology. The demand for improved plant varieties is increasing among farmers as well as people to eliminate the food scarcity problem with growing population in North America. The plant breeding & CRISPR plants is the only way to increase the production of crop with better quality to feed more number of mouths in North America. Thus, rising population is increasing the demand of plant breeding & CRISPR plants market.

Therefore, the increase in population is creating the demand of more crop production which leads to the growth of the plant breeding & CRISPR plants market in North America.

Restraint

- High Costs Associated With The Modern Breeding Techniques As Compared To Conventional Breeding Techniques

Conventional breeding relies on mixing traits from different populations within a species and then selecting the entire natural plant for genetic elements. Modern breeding methods often involve in vitro techniques and/or molecular biology in one or more stages of the breeding process. This article describes several techniques including embryo rescue, in vitro selection, somaclonal variation, double haploids and chromosome elimination, and transformation/genetic engineering. Plant breeding is often referred to as a numbers game, and major competitive commodity programs invest heavily in efficient seed treatment, planting, grading, and harvesting methods. As genetic gains accumulate, the bar is gradually raised, and greater and greater investment is required to keep genetic development stable.

Opportunity

-

Fluctuating Whether Condition Will Increase The Opportunity For Plant Breeding & CRISPR Technique

Fluctuating whether conditions is damaging the crop and results in major crop loss which is creating the opportunity for plant breeding & CRISPR plants in North America. As with the help of plant breeding & CRISPR technique the tolerance against the climatic condition such as drought, heavy rainfall and others could be developed which will help resisting the climatic loss to crops. The demand of new variety of crop which offers resistance against harsh climatic condition is on rise which is creating the opportunities for plant breeding & CRISPR plants in North America. The increase in loss of crop due to harsh climatic condition is creating the major opportunities for the market.

したがって、厳しい気候条件による作物被害の増加により、植物育種および CRISPR 植物の需要が増加し、植物育種および CRISPR 植物市場にチャンスが生まれています。

チャレンジ

- 非組織的小売ネットワーク

農業小売ネットワークは、長い期間にわたって劇的な変化を遂げてきました。短期サイクルから複雑で複雑なチェーンへと成長しました。農業小売部門の急速な成長により、サプライチェーンにギャップが生じ、非効率な状態になっています。組織化されていない小売ネットワークには、

- 管理の質が低い

- 調達プロセスの煩雑さ

- 高度に発達した技術

- 品揃えが悪く、価格が高い

- ハイテク機器に対する理解不足

小売ネットワークは農業のより大きな部分に貢献しており、この組織化されていない高度に発達した小売部門は小規模農家や地元の農家にも影響を与えています。高度に発達した機器とそれに関する知識の欠如は、小規模農家にとって困難を伴います。

COVID-19後の北米植物育種とCRISPR植物市場への影響

COVID-19パンデミックは、主に輸送上の制約により、植物育種およびCRISPR植物市場にほとんど影響を与えていません。政府はあらゆる種類の農業活動をロックダウンや混乱の影響から免除しているため、コロナの発生によるそのような影響はありません。実際、農薬会社は、農家のパニック買いにより、昨年と比較して2桁の利益を上げています。植物育種のメリットに対する農家の認識の高まりは、政府の支援につながっています。開発途上国政府は、国レベルおよび村レベルで複数のシードバンクを管理しており、種子処理化学物質で適切に処理された種子を保管して種子の腐敗を防いでいます。

メーカーは、COVID-19後の回復に向けてさまざまな戦略的決定を下しています。各社は、医薬品医療用ディスプレイ市場に関わる技術とテスト結果を改善するために、複数の研究開発活動、製品の発売、戦略的パートナーシップを行っています。

最近の動向

- 2022年8月、バイエルは既存の投資を拡大し、持続可能な低炭素油糧種子生産者であるカバークレス社の過半数株式を取得しました。この投資はバイエルの持続可能性への取り組みを果たし、既存の投資家であるバンジとシェブロン/農家の専門知識を活用して、カバークレス社へのバイエルの既存の投資を活用し、油糧種子を再生可能燃料やカバークロップを通じて生態系に利益をもたらす動物飼料に商品化することで新たな収益源を獲得し、農業の炭素排出量を削減し、窒素肥料への依存を減らすのに役立ちます。これは同社の事業拡大に役立っています。

北米の植物育種とCRISPR植物市場の展望

北米の植物育種および CRISPR 植物市場は、タイプ、特性、および用途に細分化されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コアアプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

北米の植物育種および CRISPR 植物市場(タイプ別)

- 従来の育種

- バイオテクノロジーの方法

- 遺伝子工学

タイプに基づいて、北米の植物育種および CRISPR 植物市場は、従来の育種、バイオテクノロジーの方法、および遺伝子工学に分類されます。

北米の植物育種とCRISPR植物市場(特性別)

- 除草剤耐性

- 収量向上

- 耐病性

- 温度耐性

- 粒度の改善

- ストレス耐性

- 干ばつ耐性

- その他

特性に基づいて、植物育種およびCRISPR植物市場は、除草剤耐性、耐病性、収量向上、耐熱性、粒度向上、ストレス耐性、干ばつ耐性、その他に分類されます。

- 北米の植物育種および CRISPR 植物市場(用途別)

- シリアル&穀物

- 油糧種子と豆類

- 果物と野菜

- 現金作物

- 芝生と観賞用植物

- ハーブとマイクログリーン

- 薬用作物

- その他の作物

用途に基づいて、植物育種および CRISPR 植物市場は、穀類および穀物、油糧種子および豆類、果物および野菜、換金作物、芝生および観賞用、ハーブおよびマイクログリーン、薬用作物などに分類されます。

北米の植物育種と CRISPR 植物市場の地域分析/洞察

北米の植物育種および CRISPR 植物市場が分析され、市場規模情報、タイプ、特性、用途が提供されます。

この市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

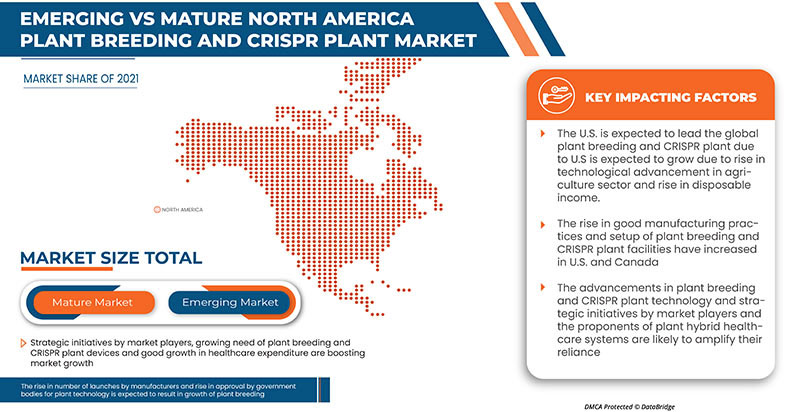

2022年には、GDPが高く最大の消費者市場に主要な市場プレーヤーが存在するため、米国が優位に立つでしょう。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米の植物育種と CRISPR 植物市場シェア分析

北米の植物育種および CRISPR 植物市場の競争状況では、競合他社ごとに詳細が提供されます。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、北米の植物育種および CRISPR 植物市場への会社の重点にのみ関連しています。

北米の植物育種および CRISPR 植物市場で活動している主要企業には、BAYER AG、Syngenta Crop Protection AG、Corteva、BASF SE、Limagrain、DLF、Bioceres Crop Solutions、KWS SAAT SE & Co. KGaA、Stine Seed Company (Stine Seed Farm, Inc. の子会社)、RAGT、InVivo、pairwise、TMG Tropical Improvement & Genetics SA、SAKATA SEED CORPORATION、DONMARIO、UPL、Benson Hill Inc.、Yield10 Bioscience, Inc.、Tropic などがあります。

調査方法: 北米の植物育種と CRISPR 植物市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET: CONSUMER BUYING BEHAVIOUR

3.1.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

3.1.2 RESEARCH

3.1.3 IMPULSIVE

3.1.4 ADVERTISEMENT:

3.1.5 TELEVISION ADVERTISEMENT

3.1.6 ONLINE ADVERTISEMENT

3.1.7 IN-STORE ADVERTISEMENT

3.1.8 OUTDOOR ADVERTISEMENT

4 SUPPLY CHAIN OF NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

4.1 BAYER

4.1.1 PROCUREMENT

4.1.2 SUSTAINABILITY IN THE SUPPLY CHAIN

4.1.3 BAYER TRANSPORTATION AND ENVIRONMENT SAFETY IN SUPPLY CHAIN-

4.2 SYNGENTA GROUP

4.2.1 WORKING WITH SUPPLIERS

4.2.2 KEY PERFORMANCE INDICATORS AND BASIS OF PREPARATION-

4.3 UPCOMING TRENDS

5 BRAND COMPETITIVE ANALYSIS NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET

6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN R&D FOR PLANT BREEDING & CRISPR PLANTS

7.1.2 THE SURGE IN THE NORTH AMERICA POPULATION LED TO AN INCREASE IN THE DEMAND FOR FOOD PRODUCTION

7.1.3 RISE IN AWARENESS ABOUT PLANT BREEDING & CRISPR PLANTS THROUGH VARIOUS PROGRAMMES

7.1.4 RISING IN NUMBER OF LAUNCHES BY MANUFACTURERS FOR PLANT BREEDING & CRISPR PLANTS

7.2 RESTRAINTS

7.2.1 HIGH COSTS ARE ASSOCIATED WITH THE MODERN BREEDING TECHNIQUES AS COMPARED TO CONVENTIONAL BREEDING TECHNIQUES

7.2.2 POTENTIAL HAZARD TO HUMAN HEALTH DUE TO UNDESIRED TOXIN GENERATED FROM CROPS PRODUCED BY BREEDING METHOD

7.3 OPPORTUNITIES

7.3.1 FLUCTUATING WEATHER CONDITIONS WILL INCREASE THE OPPORTUNITY FOR PLANT BREEDING & CRISPR TECHNIQUE

7.3.2 INCREASE IN NUMBER OF APPROVAL BY GOVERNMENTAL BODIES FOR PLANT BREEDING

7.4 CHALLENGE

7.4.1 UNORGANIZED RETAIL NETWORK

8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL BREEDING

8.2.1 HYBRIDIZATION

8.2.2 SELECTION

8.2.3 MUTATION BREEDING

8.3 BIOTECHNOLOGICAL METHOD

8.3.1 CELL AND TISSUE CULTURE

8.3.2 MOLECULAR MARKERS

8.3.3 PHENO TYPING

8.4 GENETIC ENGINEERING

8.4.1 RFLP

8.4.2 GENE TRANSFER

8.4.3 TRANSGENE EXPRESSION

8.4.4 SELECTION AND PLANT REGENERATION

9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT

9.1 OVERVIEW

9.2 HERBICIDES TOLERANCE

9.3 YIELD IMPROVEMENT

9.4 DISEASE RESISTANCE

9.5 TEMPERATURE TOLERANCE

9.6 GRAIN SIZE IMPROVEMENT

9.7 STRESS TOLERANCE

9.8 DROUGHT RESISTANCE

9.9 OTHERS

10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CEREAL & GRAINS

10.2.1 MAIZE

10.2.2 WHEAT

10.2.3 RICE

10.2.4 OATS

10.2.5 OTHERS

10.3 OILSEED & PULSES

10.3.1 SOYBEAN

10.3.2 SUNFLOWER

10.3.3 PEA

10.3.4 GRAM

10.3.5 OTHERS

10.4 FRUITS & VEGETABLES

10.4.1 BANANA

10.4.2 POTATO

10.4.3 TOMATO

10.4.4 APPLE

10.4.5 ORANGE

10.4.6 GRAPEFRUIT

10.4.7 BERRIES

10.4.8 CUCUMBERS

10.4.9 CARROTS

10.4.10 EGGPLANT

10.4.11 BROCCOLI

10.4.12 LEAFY GREEN

10.4.12.1 SPINACH

10.4.12.2 LETTUCE

10.4.12.3 CABBAGE

10.4.12.4 KALE

10.4.12.5 OTHERS

10.4.13 OTHERS

10.5 CASH CROPS

10.5.1 COFFEE & TEA

10.5.2 COTTON

10.5.3 SUGARCANE

10.5.4 OTHERS

10.6 TURF & ORNAMENTAL

10.7 HERBS AND MICROGREENS

10.7.1 HERBS

10.7.2 BASIL

10.7.3 WHEATGRASS

10.8 MEDICINAL CROP

10.9 OTHER CROP TYPES

11 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BAYER AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SYNGENTA CROP PROTECTION AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 CORTEVA (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIMAGRAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 KWS SAAT SE & CO. KGAA (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 BASF SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BENSON HILL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BIOCERES CROP SOLUTIONS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DLF

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 DONMARIO ( 2021)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INVIVO.( 2021)

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 PAIRWISE ( 2021)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 PLANASA ( 2021)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 RAGT (2021)

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAKATA SEED CORPORATION ( 2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 STINE SEED COMPANY. (A SUBSIDIARY OF STINE SEED FARM, INC) (2021)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 TMG TROPICAL IMPROVEMENT & GENETICS SA ( 2021)

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 TROPIC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 UPL (2021)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 YIELD10 BIOSCIENCE, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 LABELING REQUIREMENTS FOR GMOS IN THE EUROPEAN UNION

TABLE 2 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HERBICIDES TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA YIELD IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DISEASE RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TEMPERATURE TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GRAIN SIZE IMPROVEMENT IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA STRESS TOLERANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DROUGHT RESISTANCE IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN PLANT BREEDING & CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CEREALS & GRAINS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OILSEEDS & PULSES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CASH CROPS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TURF & ORNAMENTAL IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HERBS AND MICROGREENS IN PLANT BREEDING AND CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MEDICINAL CROP IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHER CROP TYPES IN PLANT BREEDING AND CRISPR PLANT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 51 U.S. PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 63 CANADA PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 CANADA HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO BIOTECHNOLOGICAL METHOD IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CONVENTIONAL BREEDING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENETIC ENGINEERING IN PLANT BREEDING & CRISPR PLANT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY TRAIT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MEXICO CEREAL & GRAIN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO OILSEED & PULSES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO FRUITS & VEGETABLES IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO LEAFY GREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 MEXICO CASH CROPS IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO HERBS AND MICROGREEN IN PLANT BREEDING & CRISPR PLANT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SEGMENTATION

FIGURE 11 INCREASING IMPORTANCE FOR SUSTAINABLE CROP PRODUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CONVENTIONAL BREEDING ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET IN 2022 & 2029

FIGURE 13 SOME OF THE FACTORS THAT AFFECT THE BUYING BEHAVIOR OF CONSUMERS BEFORE PURCHASING-

FIGURE 14 THE WORKFLOW MANUFACTURING PROCESS-

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA ANT BREEDING & CRISPR PLANT MARKET

FIGURE 16 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2021

FIGURE 17 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA PLANT BREEDING AND CRISPR PLANTS MARKET : BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2021

FIGURE 21 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA PLANT BREEDING & CRISPR PLANT MARKET : BY TRAIT, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA PLANT BREEDING AND CRISPR PLANT MARKET: BY TYPE (2022-2029)

FIGURE 33 NORTH AMERICA PLANT BREEDING AND CSIPR PLANT MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。