北米医薬品バイアル市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

7.37 Billion

USD

12.57 Billion

2025

2033

USD

7.37 Billion

USD

12.57 Billion

2025

2033

| 2026 –2033 | |

| USD 7.37 Billion | |

| USD 12.57 Billion | |

|

|

|

|

北米医薬品バイアル市場セグメンテーション、材質別(ガラス、プラスチック、その他)、ネックタイプ別(スクリューネック、クリンプネック、ダブルチャンバー、フリップキャップ、その他)、キャップサイズ別(13~425 mm、15~425 mm、18~400 mm、22~350 mm、24~400 mm、8~425 mm、9 mm、その他)、流通チャネル別(直販、医薬品販売店/薬局、電子商取引、その他)、容量別(1 ml、2 ml、3 ml、4 ml、8 ml、10 ml、20 ml、30 ml、50 ml、その他)、薬剤タイプ別(注射剤、非注射剤)、用途別(経口、経鼻、注射剤、その他)、エンドユーザー別(製薬会社、バイオ医薬品会社、受託開発製造会社、複合薬局、その他)、市場別(非経口、胃腸科、耳鼻咽喉科、その他 - 2033年までの業界動向と予測

北米の医薬品バイアル市場規模

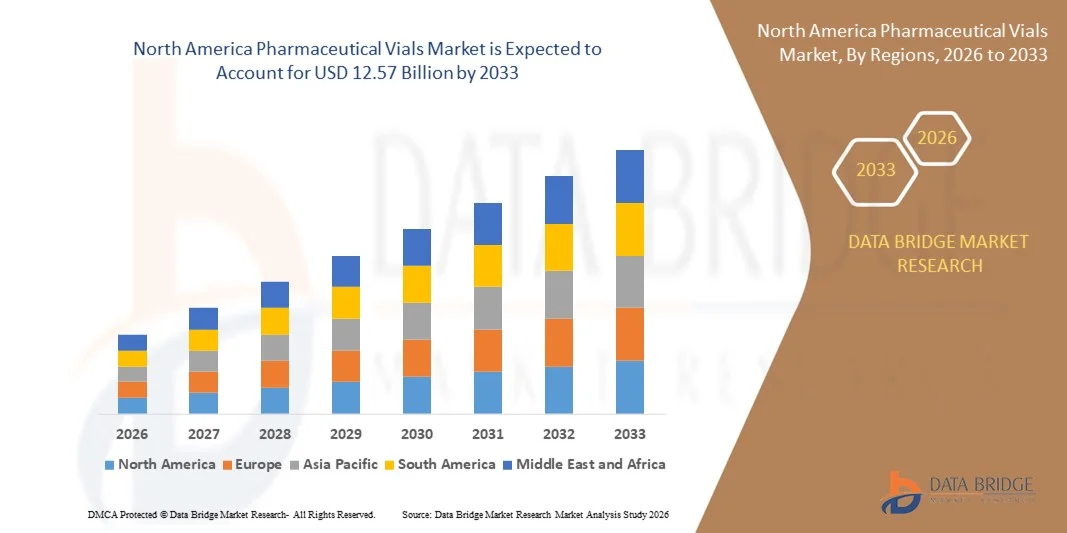

- 北米の医薬品バイアル市場規模は、2025年に73億7,000万米ドルと評価され、 2033年までに125億7,000万米ドルに達すると予測されており、予測期間を通じて6.90%のCAGRを記録しています。

- 市場拡大は主に医薬品生産の増加、薬剤製剤技術の進歩、安全で汚染のない薬剤保管の重要性の高まりによって推進されており、これらが相まって地域全体で高品質のバイアル包装の需要を押し上げています。

- さらに、生物製剤、ワクチン、注射剤への投資の増加と、耐久性、コンプライアンス、効率的な拡張性を備えたパッケージングソリューションの必要性が相まって、医薬品バイアルの採用がさらに促進され、業界全体の成長が加速しています。

北米医薬品バイアル市場分析

- 注射薬、ワクチン、生物製剤の保管と輸送に不可欠な医薬品バイアルは、その無菌性、耐久性、高度な薬物送達技術との互換性により、現代のヘルスケアおよび医薬品製造エコシステムにおいてますます重要になっています。

- 医薬品バイアルの需要増加の主な要因は、生物製剤およびワクチン生産の急増、臨床研究活動の拡大、病院、研究所、バイオ医薬品施設全体での汚染のない、規制に準拠した一次包装ソリューションへの重点の高まりです。

- 成熟した医薬品インフラ、高い研究開発費、大手製薬会社の強力な存在に支えられ、米国は2025年に35.1%という最大の収益シェアで北米の医薬品バイアル市場を支配し、生物製剤の承認の増加と充填・仕上げ製造能力の拡大によりバイアル消費量が大幅に増加しました。

- カナダは、急速なヘルスケアの拡大、医薬品生産の増加、高度なパッケージング技術への投資の増加により、予測期間中に北米の医薬品バイアル市場で最も急速に成長する地域になると予想されています。

- ガラスセグメントは、その優れた耐薬品性、不活性、そして注射剤や敏感な製剤の業界標準として長年受け入れられていることから、2025年には72.4%という最大の収益シェアで市場を支配しました。

レポートの範囲と北米の医薬品バイアル市場のセグメンテーション

|

特性 |

医薬品バイアルの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

北米の医薬品バイアル市場動向

先進材料とインテリジェントパッケージング技術の採用増加

- 北米の医薬品バイアル市場において、製品の安全性、安定性、そして医薬品サプライチェーン全体の効率性向上を目的とした先進材料とインテリジェント包装技術の統合が進み、重要かつ加速しているトレンドとなっています。この変化は、生物製剤、注射剤、温度感受性治療薬の複雑性の高まりによって推進されています。

- 例えば、コーニングやショットといったメーカーは、強化ガラス組成と化学安定性の向上により破損を低減し、薬剤と容器の相互作用を最小限に抑えた次世代バイアルを導入しています。これらのイノベーションは、より安全な取り扱い、耐久性の向上、そして繊細な医薬品の保護を強化します。

- インテリジェント包装技術も勢いを増しており、トレーサビリティ、リアルタイムモニタリング、品質保証の向上をサポートする機能を備えたバイアルもその一つです。スマートラベル、埋め込み型識別子、デジタル追跡システムにより、メーカーは汚染リスクの検知、温度曝露の監視、そして進化する規制要件への対応に向けたシリアル化システムの合理化が可能になります。

- さらに、機械学習を活用した自動ビジョン検査などの高度な検査システムを統合することで、企業は粒子状物質、微小亀裂、充填レベルの不規則性をこれまでにない精度で検出できるようになり、製品の安全性を高め、製造エラーを削減できます。

- より高度で精密かつ信頼性の高いバイアル技術へのトレンドは、製薬業界全体の期待を一変させています。その結果、Gerresheimer、Stevanato Group、West Pharmaceutical Servicesといった企業は、すぐに充填できる滅菌バイアルや、薬剤適合性を向上させるコーティングソリューションなど、高性能バイアルシステムに多額の投資を行っています。

- 企業がパッケージングプロセスにおける安全性、効率性、規制遵守をますます優先するにつれて、強化された材料科学、改善されたバリア特性、および洗練された品質管理機能を組み込んだ医薬品バイアルの需要が、バイオ医薬品、ワクチン、および注射剤メーカー全体で急速に高まっています。

北米の医薬品バイアル市場の動向

推進力

バイオ医薬品の需要増加と医薬品生産の拡大に伴うニーズの高まり

- 生物製剤、ワクチン、滅菌注射剤の需要の増加と、北米全域での医薬品製造能力の拡大が相まって、高品質の医薬品バイアルの需要増加の主な要因となっています。

- 例えば、大手企業は、特に精密製剤や温度に敏感な医薬品の需要増加に対応し、ワクチンや生物製剤の大規模生産を支えるため、生産能力の拡大や高度なバイアル技術への投資を行っています。これらの戦略的開発は、予測期間中の市場の力強い成長を支えると予想されます。

- 医薬品の安全性に関する規制基準が厳しくなり、製薬会社が汚染リスクを最小限に抑えるために信頼性の高い一次包装を求めるにつれて、耐久性、耐薬品性、無菌性が強化されたバイアルがますます重要になっています。

- さらに、充填・仕上げ工程の増加、医薬品製造施設の近代化、自動化への推進により、医薬品バイアルは生産チェーンに欠かせない要素となり、高速充填ラインや高度な検査システムとの互換性を実現しています。

- 正確な投与量、長期保存、そして安全な薬剤保管をサポートする包装へのニーズが高まり、病院、研究機関、バイオ医薬品メーカーにおいて、これらの包装の導入が加速しています。充填済みの滅菌バイアル、強化バリアコーティングバイアル、ポリマーベースの代替品といったイノベーションが、市場拡大にさらに貢献しています。

制約/課題

サプライチェーンの制約と製造コストの高騰に関する懸念

- 原材料、特に医薬品グレードのガラスに影響を与えるサプライチェーンの混乱は、市場の成長を大きく阻害します。ガラスの供給量の変動と製造上のボトルネックは、安定したバイアル供給に依存する製薬会社にとって、生産の遅延やリードタイムの延長につながる可能性があります。

- たとえば、ワクチンや注射薬の需要が高まった時期には、バイアルのサプライチェーンの脆弱性が明らかになり、医療分野全体で不足や生産の遅れが懸念されました。

- これらの課題に対処するには、製造の冗長化、原材料調達の改善、生産設備の近代化への戦略的な投資が必要です。大手企業は、信頼性と効率性の向上を目指し、自動検査、バッチ溶解技術の改良、品質管理システムの強化などを導入しています。

- さらに、コーティングガラスバイアル、すぐに使用できる滅菌バイアル、特殊なポリマーバイアルなど、高度なバイアルは比較的高価であるため、コストに敏感な製薬メーカーにとって障壁となる可能性があります。小規模なバイオテクノロジー企業は、予算の制約により、プレミアムパッケージソリューションの導入に課題を抱える可能性があります。

- 規模の経済と技術の進歩は生産コストの削減に寄与しているものの、価格への敏感さは依然として懸念材料であり、特に利益率の低い注射剤を大量生産する企業においては顕著です。サプライチェーンの最適化、費用対効果の高い材料イノベーション、そして業界全体の連携を通じてこれらの課題を克服することが、持続的な市場成長にとって極めて重要です。

北米医薬品バイアル市場の範囲

北米の医薬品バイアル市場は、材質、ネックタイプ、キャップサイズ、流通チャネル、容量、薬剤タイプ、用途、エンドユーザー、市場に基づいて分類されています。

- 素材別

北米の医薬品バイアル市場は、材質別にガラス、プラスチック、その他に分類されます。ガラスセグメントは、優れた耐薬品性、不活性、そして注射剤や敏感な製剤の業界標準として長年にわたり認められてきたことから、2025年には72.4%という最大の収益シェアで市場を席巻しました。ガラスバイアルは、その高いバリア性と高温滅菌への適合性から、ワクチン、生物製剤、バイオシミラーにおいて引き続き広く好まれています。タイプIホウケイ酸ガラスに対する一貫した規制上の優位性も、このセグメントの優位性をさらに強化しています。

プラスチック分野は、2026年から2033年にかけて最も高いCAGRを達成すると予想されています。これは、破砕耐性の向上、軽量化、抽出物の低減を特徴とする環状オレフィンポリマー(COP)および環状オレフィンコポリマー(COC)バイアルの採用増加に牽引されています。ポイントオブケア用途における柔軟で破損しにくい包装の需要増加も、この傾向を後押ししています。

- ネックタイプ別

ネックタイプに基づいて、市場はスクリューネック、クリンプネック、ダブルチャンバー、フリップキャップ、その他に分類されます。クリンプネックセグメントは、注射剤充填ラインでの広範な使用、強力な密封性、そしてアルミキャップやゴム栓との互換性により、2025年には58.9%という最大の市場シェアを獲得しました。クリンプネックバイアルは、ワクチン、生物製剤、非経口薬の滅菌・無菌包装における業界標準であり、大規模な製薬事業に不可欠な存在となっています。

ダブルチャンバーセグメントは、投与前に再構成を必要とする凍結乾燥製剤に使用される二成分系薬物送達システムの需要増加を背景に、2026年から2033年にかけて最も高いCAGRで成長すると予想されています。個別化医療や複雑な生物学的製剤の普及が進むにつれ、ダブルチャンバーバイアルは、投与精度の向上とユーザーの利便性の高さから、注目を集めています。

- キャップサイズ別

北米の医薬品バイアル市場は、キャップサイズに基づいて複数の標準化された寸法に分類されています。13~425mmセグメントは、ワクチン、生物製剤、診断試薬などに広く使用される小容量注射用バイアルで広く使用されていることから、2025年には36.7%の収益シェアで市場をリードしました。自動充填・キャッピング装置との互換性も、採用拡大の要因となっています。

20mmおよび24~400mmセグメント(中規模から大規模市場に分類)は、高容量非経口薬、栄養補助食品、および多回投与バイアルにおける採用の増加に牽引され、2026~2033年にかけて最も高いCAGRを達成すると予想されています。堅牢なシーリングソリューションを必要とする高用量生物学的製剤の開発増加も、成長を支えています。

- 流通チャネル別

流通チャネルに基づいて、市場は直接販売、医薬品販売店/薬局、eコマース、その他に分類されます。バイアルメーカーと製薬会社、CDMO、バイオテクノロジー企業との強固なB2B調達関係により、直接販売は2025年には64.3%のシェアで市場を支配しました。直接供給は品質の一貫性、大量供給、コンプライアンス文書の取得を保証するため、規制対象の医薬品メーカーにとって好ましいチャネルとなっています。

電子商取引セグメントは、利便性、競争力のある価格、迅速な配送オプションを求める研究機関、調剤薬局、小規模メーカーによるオンライン調達の増加を背景に、2026年から2033年にかけて最も高いCAGRで成長すると予測されています。サプライチェーンのデジタル化と、オンラインで認証された医薬品包装の入手しやすさの向上も、成長をさらに促進するでしょう。

- 容量別

容量に基づいて、1mlから50mlまでのバイアルとその他の特殊バイアルが含まれます。10mlセグメントは、ワクチン、生物学的注射剤、抗生物質、および多回投与形式での幅広い使用により、2025年には29.8%という最大の収益シェアを占めました。その汎用性と自動充填ラインとの互換性により、製薬メーカー全体で最も広く採用されている容量の1つとなっています

2mlセグメントは、高効力生物製剤、個別化医療、小用量注射剤の使用量増加により、2026~2033年にかけて最も高いCAGRを記録すると予測されています。また、投与前療法や臨床試験材料の採用増加も、小容量バイアルの需要を支えています。

- 薬剤の種類別

薬剤の種類に基づいて、市場は注射剤と非注射剤に分類されます。注射剤セグメントは2025年に81.5%のシェアで市場を支配し、これはバイオ医薬品、ワクチン、抗生物質、および経腸栄養剤の投与における医薬品バイアルの中心的な役割を反映しています。慢性疾患の有病率の増加とバイオ医薬品製造の急速な拡大は、需要をさらに押し上げています。

非注射剤セグメントは、点眼薬、皮膚科用製剤、吸入療法におけるバイアルの使用増加に牽引され、2026年から2033年にかけて最も高いCAGRを記録すると予想されています。精密包装を必要とする特殊医薬品製剤の増加も成長を支えています。

- 用途別

用途に基づいて、市場は経口、経鼻、注射、その他に分類されます。注射用途セグメントは、非経口薬物送達、ワクチン、および滅菌包装を必要とする高価値の生物学的製剤におけるバイアルの主流の使用に支えられ、2025年には76.2%という最大の市場シェアを占めました。バイオテクノロジーへの投資の増加とワクチン製造能力の拡大は、このセグメントのリーダーシップをさらに強化します

経鼻セグメントは、疼痛管理、ワクチン、慢性疾患治療のための経鼻薬物送達システムの開発増加に牽引され、2026年から2033年にかけて最も高いCAGRで成長すると予測されています。また、針を使わない送達ソリューションの採用増加も、この傾向を加速させています。

- エンドユーザー別

エンドユーザーに基づいて、製薬会社、バイオ医薬品会社、医薬品開発製造受託機関(CDMO)、調剤薬局などに分類されます。臨床試験、商業用医薬品製造、規制に準拠した保管におけるバイアル包装の需要の高さから、製薬会社は2025年に45.6%のシェアで市場を支配しました

バイオ医薬品企業セグメントは、特殊な滅菌包装を必要とする生物製剤、細胞療法、遺伝子療法のパイプラインの急増により、2026年から2033年にかけて最も高いCAGRを達成すると予想されています。CDMO(医薬品製造・流通機構)もまた、アウトソーシングのトレンドによりバイアル消費量を急速に増加させています。

- 市場別

市場別に見ると、北米の医薬品バイアル市場には、非経口用、胃腸用、耳鼻咽喉用などが含まれます。非経口用セグメントは2025年に84.1%の収益シェアを占め、病院やバイオ医薬品製造における注射剤用バイアルの広範な使用を反映しています。その優位性は、ワクチン製造、抗生物質、モノクローナル抗体、および生物学的療法と強く結びついています

耳鼻咽喉科(ENT)分野は、精密投与の鼻腔内および耳腔内製剤の需要増加に牽引され、2026年から2033年にかけて最も高いCAGRを達成すると予想されています。鼻腔内ワクチンおよび耳鼻咽喉科治療薬の開発増加は、この分野の成長加速に貢献しています。

北米医薬品バイアル市場地域分析

- 北米の医薬品バイアル市場では、同地域の強力な医薬品製造基盤、高い生物製剤生産、無菌医薬品包装技術の継続的な進歩により、米国が2025年に35.1%という最大の収益シェアで優位を占めました。

- この地域の医療関係者は、特にワクチン、注射剤、そして繊細な生物学的製剤において、医薬品バイアルが提供する信頼性、無菌性、そして化学的安定性を非常に重視しています。この重視は、高品質の一次包装を優先する厳格な規制基準によってさらに強化されています。

- 高度なバイアルタイプの広範な採用は、多額の研究開発投資、大手製薬会社やバイオ製薬会社の存在、充填・仕上げ自動化と汚染制御への重点の高まりによってさらに支えられており、臨床用医薬品製造と商業用医薬品製造の両方においてバイアルが重要なパッケージングソリューションとして確固たる地位を築いています。

米国医薬品バイアル市場に関する洞察

米国の医薬品バイアル市場は、2025年には北米最大の収益シェア81%を獲得しました。これは、同国の高度な医薬品製造能力、強力な生物製剤パイプライン、そして拡大するワクチン生産インフラに牽引されています。バイオテクノロジー企業の急速な成長と、特に遺伝子治療、バイオシミラー、注射用生物製剤における広範な研究開発活動により、高品質の滅菌バイアルに対する需要が引き続き高まっています。さらに、自動充填・仕上げラインの導入増加とFDAの厳格な規制要件により、タイプIホウケイ酸バイアルおよび高性能ポリマーバイアルの使用が促進されています。米国は医薬品の安全性、汚染管理、コールドチェーンの最適化を重視しており、市場の成長をさらに加速させています。さらに、主要な業界リーダーとCDMOの存在は、コーティングバイアル、すぐに使用できるフォーマット、そして高度な検査技術における継続的なイノベーションを支えており、米国をこの地域における主要市場として確固たる地位に押し上げています。

カナダの医薬品バイアル市場の洞察

カナダの医薬品バイアル市場は、医療インフラへの投資拡大、医薬品生産の拡大、滅菌注射剤の国内製造増加に支えられ、予測期間を通じて大幅なCAGRで拡大すると予測されています。高品質で汚染のない包装を促進するカナダ保健省の厳格な規制は、プレミアムガラスおよびポリマーバイアルの採用をさらに促進しています。慢性疾患の罹患率の上昇、臨床試験および生物製剤研究の継続的な拡大は、バイアル消費量の増加に寄与しています。同国では、調剤薬局および専門医薬品メーカーからの需要も増加しています。さらに、カナダは検査室および病院システムのデジタル化と近代化を推進しており、高度なバイアルフォーマットの利用拡大に有利な条件を整えています。持続可能な包装への移行と、精密な薬物送達への重点的な取り組みの強化は、公的および民間の医療セクターの両方で市場の継続的な成長を支えています。

メキシコの医薬品バイアル市場の洞察

メキシコの医薬品バイアル市場は、医薬品製造能力の拡大、医療改善に対する政府の重点の高まり、多国籍医薬品開発会社による投資の増加を背景に、予測期間中に注目すべきCAGRで成長すると予想されています。ジェネリック注射剤とワクチンの需要増加は、高品質のバイアル包装の必要性に大きく貢献しています。さらに、北米サプライチェーンの戦略的な生産拠点としてのメキシコの役割は、信頼性が高く費用対効果の高いバイアル形式の採用を促進しています。同国では規制遵守がますます重視され、公的医療施設の近代化も市場の拡大を後押ししています。契約製造の採用増加と中小規模の製薬会社の拡大も、ガラス製バイアルとポリマー製バイアルの両方の需要を支えています。市場が進化し続けるにつれて、メキシコは地域のバイアル生産と流通においてますます重要な役割を果たすことが期待されます。

北米の医薬品バイアル市場シェア

医薬品バイアル業界は、主に、次のような定評ある企業によって牽引されています。

• Gerresheimer AG(ドイツ)

• SCHOTT AG(ドイツ)

• Stevanato Group(イタリア)

• Vetter Pharma-Fertigung GmbH & Co. KG(ドイツ)

• BD(Becton, Dickinson and Company)(米国)

• Nipro Corporation(日本)

• Catalent, Inc.(米国)

• AptarGroup, Inc.(米国)

• Pfizer Packaging Solutions(米国)

• Sartorius AG(ドイツ)

• Ompi(SGD Pharma)(フランス)

• Rexam(現在はBall Corporationの傘下)(英国)

• Aseptic Technologies(フランス)

• Alpha Pro Tech(カナダ)

• Rommelag Group(ドイツ)

• Gerresheimer Regensburg GmbH(ドイツ)

• Thermo Fisher Scientific(米国)

• SCHOTT Kaisha Ltd.(日本)

• Pfizer Glass & Vial Solutions(米国)

• Spartek Group(英国)

北米の医薬品バイアル市場の最近の動向は何ですか?

- 2024年4月、医薬品包装のリーディングカンパニーであるGerresheimer AGは、バイオ医薬品および注射剤に使用される高品質のガラス製およびポリマー製バイアルの需要の高まりに対応するため、北米の生産施設を拡張することを発表しました。この取り組みには、高度な成形および検査技術の導入が含まれており、無菌性、精度、および規制遵守の確保に対する同社のコミットメントを強化します。この戦略的投資は、急成長を遂げている北米の医薬品バイアル市場におけるGerresheimerの地位を強化するものです。

- 2024年3月、Schott Pharmaは米国で「Everic® pure」バイアルの新製品ラインを発表しました。このバイアルは、抽出物および感受性の高い生物学的製剤との相互作用を低減するように設計されています。次世代注射剤向けに設計されたこれらのバイアルは、薬剤の安定性と性能を向上させます。今回の発売は、Schottの高性能一次包装におけるイノベーションへの取り組みと、先進的な治療法を開発する製薬企業を支援する継続的な取り組みを強調するものです。

- 2024年3月、West Pharmaceutical Servicesは、米国のバイアル部品製造拠点全体に高度な自動化・品質検査プラットフォームを導入すると発表しました。このシステムは、高精度光学検査とデジタルモニタリングを活用し、注射剤包装の欠陥を削減し、一貫した品質を確保します。この進歩は、北米のバイアルサプライチェーンにおける製造信頼性の向上に向けたWestのコミットメントを象徴するものです。

- 2024年2月、ステバナートグループは、製薬会社およびバイオテクノロジー会社向けに、すぐに使用できる(RTU)滅菌バイアルへのアクセス拡大を目指し、米国の大手CDMO(医薬品製造・流通機構)と戦略的提携を締結しました。この提携は、サプライチェーンの効率性向上と、充填・包装能力に対する需要の高まりへの対応、そして医薬品開発・生産期間の短縮を目指しています。この取り組みは、ステバナートが統合型バイアル包装ソリューションの強化に注力していることを反映しています。

- 2024年1月、コーニング・インコーポレイテッドは北米で開催された主要な業界イベントにおいて、最新のValor® Glassバイアルのイノベーションを披露しました。次世代の耐久性、破損の低減、そして優れた耐薬品性を強調した製品です。新製品は高速充填ラインと繊細な製剤要件に対応するように設計されており、医薬品メーカーの医薬品安全性と業務効率を向上させる高度な包装ソリューションの提供に向けたコーニングの継続的な取り組みを示しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。