北米医薬品添加剤市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

4.69 Billion

USD

7.82 Billion

2024

2032

USD

4.69 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.69 Billion | |

| USD 7.82 Billion | |

|

|

|

|

北米医薬品添加剤市場の細分化、機能別(結合剤および接着剤、崩壊剤、コーティング剤、崩壊剤、可溶化剤、香料、甘味料、 希釈剤、滑沢剤、緩衝剤、乳化剤、防腐剤、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、滑沢剤、キレート剤、消泡剤、その他)、剤形別(固体、半固体、液体)、投与経路別(経口添加剤、局所添加剤、非経口添加剤、その他の添加剤)、エンドユーザー別(製薬会社およびバイオ医薬品会社、契約製剤製造業者、研究機関および学術機関、その他)、流通チャネル別(直接入札、小売販売、その他) - 2032年までの業界動向および予測

北米医薬品添加剤市場規模

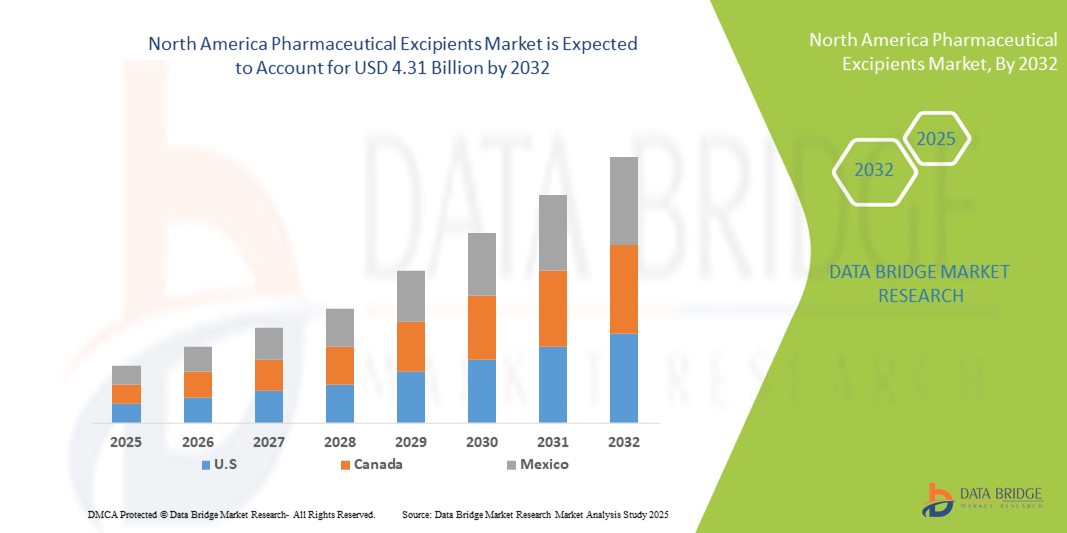

- 北米の医薬品添加剤市場規模は2024年に46億9000万米ドルと評価され、予測期間中に6.6%のCAGRで成長し、2032年までに78億2000万米ドル に達すると予想されています 。

- 市場の成長は、安全で効果的かつ高品質な医薬品製剤に対する需要の高まりに大きく牽引されており、製薬業界全体で先進的な添加剤の採用が進んでいます。経口剤、注射剤、局所剤を含む薬物送達システムにおける継続的なイノベーションも、市場拡大を支えています。

- さらに、患者中心の医薬品開発、規制遵守、そして安定性、バイオアベイラビリティ、製造性を向上させる添加剤の必要性への関心の高まりにより、医薬品添加剤は現代の医薬品製剤における重要な構成要素としての地位を確立しつつあります。これらの要因が重なり、新たな添加剤ソリューションの普及が加速し、業界の成長を大きく後押ししています。

北米医薬品添加剤市場分析

- 医薬品添加剤は、栄養補助食品、栄養補助食品、医薬品製剤の機能性成分として機能し、安定性、効能、味、製品全体の品質を高める能力があるため、商業用途と消費者用途の両方で現代の健康およびウェルネス製品のますます重要な構成要素となっています。

- 医薬品添加剤の需要の高まりは、主に栄養補助食品、機能性食品、栄養補助食品の消費量の増加、消費者の健康意識の高まり、添加剤技術の進歩によって促進されています。

- 米国は、強力な医療インフラ、健康とウェルネスに関する消費者の高い意識、そして大手添加剤サプライヤーの存在に支えられ、2024年には医薬品添加剤市場において71.5%という最大の収益シェアを獲得し、市場を席巻しました。栄養補助食品製剤における継続的なイノベーションと、高品質な添加剤に対する需要の高まりが、市場の成長をさらに牽引するでしょう。

- カナダは、予測期間中に医薬品添加剤市場で最も急速に成長する国になると予想されており、政府のヘルスケアイニシアチブ、高度な栄養補助食品の利用可能性の向上、予防医療ソリューションの採用の増加により、2025年から2032年にかけて11.8%のCAGRで拡大すると予測されています。

- 経口添加剤セグメントは、北米における経口ドラッグデリバリーシステムの普及に牽引され、2024年には医薬品添加剤市場において51.2%の収益シェアを占め、市場を牽引しました。経口添加剤は、安定性、一貫した放出プロファイル、そして慢性および急性治療において極めて重要な患者のコンプライアンスを確保します。

レポートの範囲と医薬品添加剤市場のセグメンテーション

|

属性 |

医薬品添加剤の主要市場洞察 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米の医薬品添加剤市場動向

医薬品製剤の機能性と汎用性の向上

- 北米の医薬品添加剤市場において、重要な加速トレンドとなっているのは、栄養補助食品および医薬品製剤の安定性、溶解性、およびバイオアベイラビリティを向上させる多機能添加剤の採用増加です。これらの添加剤は、メーカーが製品性能を最適化し、厳格な品質基準を満たす上で役立っています。

- 例えば、高度なコーティング剤や香料賦形剤は、味を改善し、不快な風味を隠し、一貫した放出プロファイルを確保するために、栄養補助食品や機能性食品に組み込まれており、消費者にとって製品をより魅力的で効果的なものにしています。

- 天然および合成キャリアの使用が増加し、有効成分のカプセル化、劣化からの保護、放出制御が可能になり、最終的には栄養補助食品および医薬品の有効性と保存期間が向上します。

- 複雑な製剤に賦形剤を統合することで、メーカーは治療効果と官能特性、利便性、患者の順守性の向上を組み合わせた多機能製品を開発することができます。

- より多用途で高性能な添加剤へのトレンドは、メーカーと消費者の期待を再構築し、製剤科学におけるイノベーションを促進しています。その結果、大手企業は、タンパク質サプリメント、ビタミン製剤、ミネラル強化栄養補助食品など、特定の用途に合わせた新しい添加剤を開発しています。

- メーカーが製品の品質、有効性、消費者の受容性を優先するにつれ、多機能性、多様な処方との適合性、規制遵守を提供する添加剤の需要は、医薬品および栄養補助食品の両分野で急速に高まっています。

北米の医薬品添加剤市場の動向

ドライバ

高度な医薬品製剤の需要増加によるニーズの高まり

- 患者中心の薬物送達への関心の高まりと、安全で効果的かつ高品質な医薬品への需要の高まりは、業界全体で医薬品添加剤の採用を促進する主要な要因となっています。添加剤は現在、薬物の安定性、溶解性、および生物学的利用能の向上に重要な役割を果たしており、現代の医薬品製造において不可欠なものとなっています。

- 例えば、2024年には、カラコンとアッシュランドが、味覚マスキング剤、放出制御ポリマー、高純度安定剤など、医薬品の性能向上に特化した先進的な添加剤ソリューションを導入しました。こうした大手企業による取り組みは、予測期間中の市場成長を大きく牽引すると予想されます。

- 製薬会社は、患者の服薬コンプライアンスと治療ニーズを満たすために、口腔内崩壊錠、徐放性カプセル、注射用生物製剤などの革新的な製剤を可能にする添加剤をますます求めています。

- バイオ医薬品、バイオシミラー、特殊治療薬を含むバイオ医薬品分野の急速な拡大により、複雑な製剤や敏感なAPIに適した高品質で機能的な賦形剤の需要がさらに高まっています。

- 製剤の簡素化、製造時間の短縮、そして一貫した品質の維持を可能にする、すぐに使える賦形剤ソリューションは、特に大量生産において製薬会社の間で注目を集めています。

- USP、EP、JPなどの国際基準を満たす規制準拠の賦形剤は非常に好まれており、メーカーは安全性と有効性に自信を持つと同時に、製品開発のタイムラインを加速することができます。

- 複数の剤形をサポートし、薬剤の性能を向上させる高度な添加剤の利便性、汎用性、信頼性は、小規模および大規模な医薬品製造に不可欠なものとなっています。

抑制/挑戦

規制遵守と高い開発コスト

- 医薬品添加剤、特に新規グレードや高純度グレードに対する厳格な規制要件は、市場拡大にとって大きな課題となっています。企業はFDA、EMA、その他の国際ガイドラインに準拠する必要があり、これには広範な文書化、試験、検証プロセスが含まれます。

- 特殊な結合剤、可溶化剤、安定剤を含む新しい賦形剤グレードの研究、開発、スケールアップにかかる高コストは、市場参入を目指す中小企業や新興企業にとって障壁となる可能性がある。

- これらの規制およびコスト関連の課題に対処するには、堅牢な品質保証システム、検証された製造プロセス、そしてコンプライアンスとタイムリーな承認を確保するための規制当局との緊密な連携が必要です。

- BASF、ダウ、DFEファーマ、アッシュランドなどの大手企業は、厳格な品質基準の遵守を重視し、検証済みの性能と安全性プロファイルを備えた添加剤を提供することで、製薬メーカー間の信頼を築いています。

- 特に注射剤や生物製剤などの敏感な製剤に使用される添加剤については、広範な安全性と有効性の試験が必要となるため、製品の発売が遅れ、運用コストが増加する可能性があります。

- 制御放出システムや標的送達システムに使用されるような特殊な賦形剤の開発コストが高いため、特に新興市場においてコストに敏感なメーカーによる採用が制限される可能性がある。

- イノベーション、費用対効果の高い生産、規制ガイダンスへの投資を通じてこれらの課題を克服することは、医薬品添加剤市場の持続的な成長に不可欠であり、安全性、性能、アクセス性のバランスを確保します。

北米医薬品添加剤市場の範囲

市場は、機能性、剤形、投与経路、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 機能別

医薬品添加剤市場は、機能性に基づいて、結合剤・接着剤、崩壊剤、コーティング剤、可溶化剤、香料、甘味料、希釈剤、滑沢剤、緩衝剤、乳化剤、防腐剤、酸化防止剤、吸着剤、溶剤、皮膚軟化剤、流動化剤、キレート剤、消泡剤、その他に分類されます。結合剤・接着剤セグメントは、錠剤の凝集性、機械的強度、および医薬品剤形における均一性を確保する上で重要な役割を担っており、2024年には32.4%の収益シェアで市場を席巻しました。これらの添加剤は、薬物放出プロファイルを強化し、患者のコンプライアンスを向上させ、幅広い経口製剤と適合性があるため、大規模製造には不可欠です。北米では、ジェネリック医薬品と新規医薬品の両方の製剤に広く使用されており、大手製薬会社は、一貫性と安定性を確保するために高品質の結合剤を優先しています。錠剤の圧縮性と製剤の堅牢性を向上させる上での重要性から、これらはあらゆる生産ラインの定番となっており、強力で持続的な需要に貢献しています。

潤滑剤セグメントは、高速錠剤製造プロセスでの採用増加と経口固形製剤の需要増加に牽引され、2025年から2032年にかけて12.1%という最も高いCAGRを達成すると予想されています。潤滑剤は、錠剤の圧縮および排出時の摩擦を低減し、処理効率を向上させ、機器の摩耗を最小限に抑えます。最適化された薬物放出と患者の安全性のために他の添加剤と組み合わせて使用されることが増えており、急速な成長を促進しています。メーカーは、湿気や熱に敏感な有効成分と互換性のある革新的な潤滑剤処方に注力しています。処方開発のアウトソーシングの傾向の高まりと、拡張性と一貫性を向上させる添加剤の必要性も、このセグメントの成長を後押ししています。北米における規制遵守と厳格な品質基準は、高性能潤滑剤の需要をさらに押し上げ、投資と研究の重要な分野となっています。

- 剤形別

剤形に基づいて、医薬品添加剤市場は固体、半固体、液体に分類されます。処方薬および一般用医薬品における錠剤とカプセル剤の広範な使用により、固形剤形セグメントは2024年に45.3%の市場シェアを占め、市場を支配しました。固形剤は、コスト効率の高い製造、長い保存期間、輸送の容易さを提供するため、メーカーに非常に好まれています。正確な投与、複数の添加剤との適合性、そして患者のコンプライアンスの向上を可能にします。固形剤形は、北米全域の病院、薬局、受託製造施設で広く使用されています。複数の有効成分(API)と放出制御技術を組み込むことができるため、その優位性は高まっています。

液剤セグメントは、2025年から2032年にかけて10.7%という最も高いCAGR(年平均成長率)を達成すると予想されています。これは、より投与しやすい小児、高齢者、そして栄養補助食品向け製剤の需要増加に牽引されています。液剤は吸収が速く、投与量の柔軟性が高いため、嚥下困難を抱える患者にとって理想的です。機能性飲料、経口シロップ、懸濁液の増加も、この採用をさらに加速させています。メーカーは、液剤の溶解性、安定性、そして味のマスキングを向上させる添加剤への投資を進めています。在宅医療やすぐに使用できる液剤のトレンド拡大も、このセグメントの急速な成長に貢献しています。

- 投与経路

医薬品添加剤市場は、投与経路に基づいて、経口添加剤、局所添加剤、非経口添加剤、その他の添加剤に分類されます。北米における経口ドラッグデリバリーシステムの普及に牽引され、2024年には経口添加剤セグメントが51.2%の収益シェアを占め、市場を牽引する見込みです。経口添加剤は、安定性、一貫した放出プロファイル、そして慢性および急性治療において極めて重要な患者の服薬コンプライアンスを確保します。錠剤、カプセル剤、散剤などに広く使用され、医薬品製造の基盤を形成しています。メーカーは、大規模生産、規制遵守、そして製剤革新のために、高品質の経口添加剤を優先的に採用しています。

非経口用添加剤セグメントは、注射剤、生物製剤、先進治療薬の導入拡大に支えられ、2025年から2032年にかけて11.8%という最も高いCAGR(年平均成長率)を達成すると予想されています。これらの添加剤は、非経口製剤の無菌性、安定性、適合性を確保するために不可欠です。北米におけるワクチン、モノクローナル抗体、バイオ医薬品の需要増加が、急速な成長を牽引しています。高度な添加剤は、注射剤の溶解性を高め、免疫原性を低下させ、有効性を維持します。病院ネットワークと受託製造組織の拡大も、この傾向をさらに後押ししています。

- エンドユーザー別

医薬品添加剤市場は、エンドユーザーに基づいて、製薬・バイオ医薬品企業、契約製剤メーカー、研究機関・学術機関、その他に分類されます。製薬・バイオ医薬品企業セグメントは、大規模生産要件、厳格な品質基準遵守、そして製剤における高度な添加剤への継続的な需要により、2024年には48.6%の収益シェアで市場を牽引しました。これらの企業は、製剤の安定性向上、バイオアベイラビリティの向上、そして多様な剤形における患者のコンプライアンス確保のために、添加剤に大きく依存しています。北米における大量生産、継続的な製品イノベーション、そして厳格な規制遵守は、このセグメントの優位性をさらに強化しています。さらに、製薬・バイオ医薬品企業は、添加剤の性能を最適化するための研究開発に投資しており、このセグメントは市場の礎となっています。慢性疾患の増加、そしてジェネリック医薬品やスペシャリティ医薬品の需要と相まって、新技術の普及が進み、着実な成長を続けています。

医薬品開発・製造のアウトソーシング化の高まりを受け、契約製剤メーカーセグメントは2025年から2032年にかけて10.5%という最も高いCAGR(年平均成長率)を達成すると予想されています。契約製剤メーカーは、北米において、製剤の効率性、拡張性、そして規制ガイドラインへの準拠を向上させるため、特殊な添加剤への依存度を高めています。個別化医療、新規剤形、バイオ医薬品への需要の高まりは、カスタマイズされた添加剤ソリューションの必要性を高めています。このセグメントの企業は、製品の安定性、溶解性、そして患者の受容性を高める高性能添加剤に注力しています。さらに、北米全域における契約研究・製造サービスの拡大はさらなる成長機会をもたらし、このセグメントを市場イノベーションの重要な推進力としています。

- 流通チャネル別

医薬品添加剤市場は、流通チャネルに基づいて、直接入札、小売販売、その他に分類されます。大手製薬メーカーによる一括調達の慣行と添加剤サプライヤーとの長期契約により、直接入札セグメントは2024年に42.1%の収益シェアを占め、市場を支配しました。直接入札により、メーカーは一貫した品質を確保し、規制遵守を維持し、大規模な調達を通じてコスト効率を達成することができます。確立されたサプライチェーンと戦略的パートナーシップへの依存が、このセグメントの優位性を強化しています。さらに、直接入札モデルは、大量生産において高品質の添加剤をタイムリーに入手できることを保証し、医薬品製剤の中断のない製造とイノベーションをサポートします。

小売販売セグメントは、一般用医薬品、栄養補助食品、機能性サプリメントに対する消費者需要の高まりを背景に、2025年から2032年にかけて9.8%という最も高い年平均成長率(CAGR)を達成すると予想されています。小売薬局ネットワーク、eコマースプラットフォームの拡大、そして健康とウェルネスに関する消費者意識の高まりが、急速な成長を牽引する主要な要因です。小売流通は、新興医薬品ブランド、調剤薬局、そして地元メーカーに、特殊な添加剤への小規模なアクセスを提供しています。さらに、セルフメディケーションや予防医療ソリューションの人気が高まっていることも、北米全域で小売チャネルの採用を促進し続けています。

北米医薬品添加剤市場の地域分析

- 2024年には、北米が医薬品添加剤市場において最大の収益シェアを占め、その牽引役となるでしょう。これは、強力な医療インフラ、健康とウェルネスに関する消費者意識の高まり、そして大手添加剤サプライヤーの存在によるものです。栄養補助食品製剤における継続的なイノベーションと、高品質な添加剤に対する需要の高まりが、市場の成長をさらに後押ししています。

- この地域の消費者と製薬会社は、溶解性、安定性、バイオアベイラビリティ、そして患者のコンプライアンスを向上させる高度な添加剤ソリューションをますます重視しています。革新的な薬物送達システム、放出制御製剤、そして特殊栄養補助食品を支える機能性添加剤の需要は拡大を続けています。

- 広範な採用は、添加剤製造における技術の進歩、規制に準拠した処方、そしてこの地域の主要企業による積極的な研究開発投資によって支えられています。これらの要因が相まって、北米は世界の医薬品添加剤市場における優位性を強化しています。

米国医薬品添加剤市場の洞察

米国の医薬品添加剤市場は、確立された医療インフラ、高い消費者意識、大手添加剤サプライヤーの存在に支えられ、2024年には71.5%という最大の収益シェアで医薬品添加剤市場を席巻しました。栄養補助食品製剤の継続的な革新と高品質の添加剤に対する需要の高まりが、市場拡大をさらに推進しています。米国の製薬会社は、経口、局所、非経口の剤形に高度な添加剤をますます取り入れています。バイオアベイラビリティ、安定性、治療効果を高める機能性添加剤への注目が、重要な成長ドライバーとなっています。研究開発への積極的な投資と、高純度で特殊な添加剤の入手可能性が相まって、革新的な薬物送達システムの開発が促進され、米国市場の主導的地位を支えています。

カナダ医薬品添加剤市場インサイト

カナダの医薬品添加剤市場は、予測期間中に医薬品添加剤市場において最も急速に成長する国になると予想されており、2025年から2032年にかけて年平均成長率(CAGR)11.8%で拡大すると予測されています。この成長は、政府のヘルスケアイニシアチブの強化、先進的な栄養補助食品へのアクセス拡大、そして予防医療ソリューションの導入増加によって牽引されています。カナダの製薬メーカーは、特に栄養補助食品および機能性食品分野において、革新的な医薬品処方を支えるため、高品質で規制に準拠した添加剤を積極的に求めています。カナダは疾病予防、医療インフラの改善、そして研究機関と製薬企業の連携を重視しており、これらの取り組みによって添加剤の導入がさらに加速し、予測期間中の堅調な市場成長が確実視されています。

北米の医薬品添加剤市場シェア

医薬品添加物業界は、主に次のような定評ある企業によって牽引されています。

- ケリーグループ(アイルランド)

- DFEファーマ(オランダ)

- カーギル社(米国)

- Pfanstiehl(米国)

- カラコン(米国)

- MEGGLE GmbH & Co. KG(ドイツ)

- Omya AG(スイス)

- Peter Greven GmbH & Co. KG(ドイツ)

- アッシュランド(米国)

- エボニック インダストリーズ AG(ドイツ)

- ダウ(米国)

- クローダ・インターナショナル(英国)

- ロケット・フレール(フランス)

- ルーブリゾールコーポレーション(米国)

- BASF SE(ドイツ)

- アバンター社(米国)

- ベネオ(ドイツ)

北米医薬品添加剤市場の最新動向

- 2024年3月、インターナショナル・フレーバーズ・アンド・フレグランス(IFF)は、医薬品ソリューション事業をフランスの原料会社ロケット社に、負債を含め最大28億5000万米ドルで売却すると発表しました。この売却には、IFFの医薬品添加剤と、工業用およびメチルセルロース食品用途の両方をサポートするグローバル・スペシャリティ・ソリューションズ部門が含まれます。この取引は2025年上半期に完了する予定であり、IFFは中核となる成長戦略に集中することができます。

- 2025年9月、イーライリリー、ジョンソン・エンド・ジョンソン、ロシュ、アストラゼネカ、ノバルティス、サノフィ、バイオジェン、メルク、アムジェン、ファイザー、ノボノルディスク、アッヴィ、ギリアド・サイエンシズ、シプラといった大手製薬会社は、米国における製造能力を強化するための大規模な投資を発表しました。これらの投資は、サプライチェーンのリスクを軽減し、潜在的な貿易混乱に備えることを目的としており、業界による国内生産強化へのコミットメントを強調しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。