北米の卵巣がん診断市場

Market Size in USD Billion

CAGR :

%

USD

3,124.06 Billion

USD

5,675.36 Billion

2022

2030

USD

3,124.06 Billion

USD

5,675.36 Billion

2022

2030

| 2023 –2030 | |

| USD 3,124.06 Billion | |

| USD 5,675.36 Billion | |

|

|

|

|

北米の卵巣がん診断市場、製品タイプ別(機器、キット、試薬)、手順タイプ別(生検検査、医療画像検査、血液マーカー検査、遺伝子検査)、がんタイプ別(生殖細胞、上皮性腫瘍、間質細胞腫瘍)、エンドユーザー別(がん診断センター、病院検査室、研究機関など) - 2030年までの業界動向と予測。

北米の卵巣がん診断市場の分析と洞察

卵巣がんは、卵巣(卵子が形成される一対の女性生殖腺の 1 つ)の組織に発生するがんの一種です。卵巣がんのほとんどは、卵巣上皮がん(卵巣の表面の細胞から発生するがん)または悪性胚細胞腫瘍(卵細胞から発生するがん)のいずれかです。卵巣がんの診断に使用される検査と手順には、骨盤検査、画像検査、血液検査、手術などがあります。骨盤検査では、医師が手袋をはめた指を膣に挿入し、同時に腹部に手を押して骨盤内臓器を触診します。

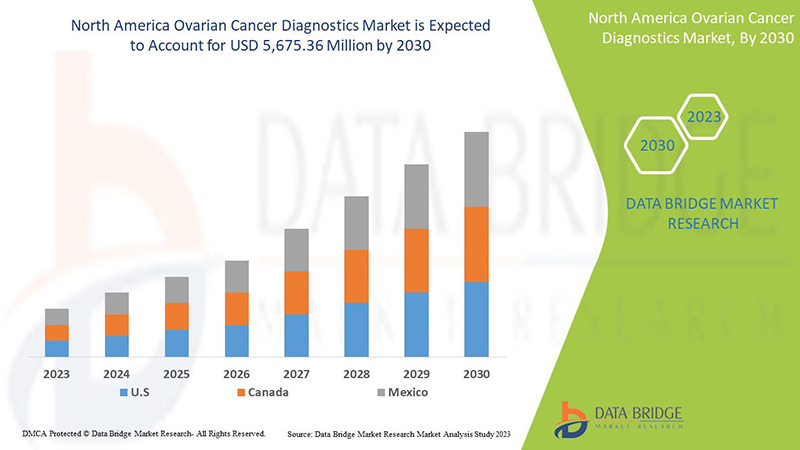

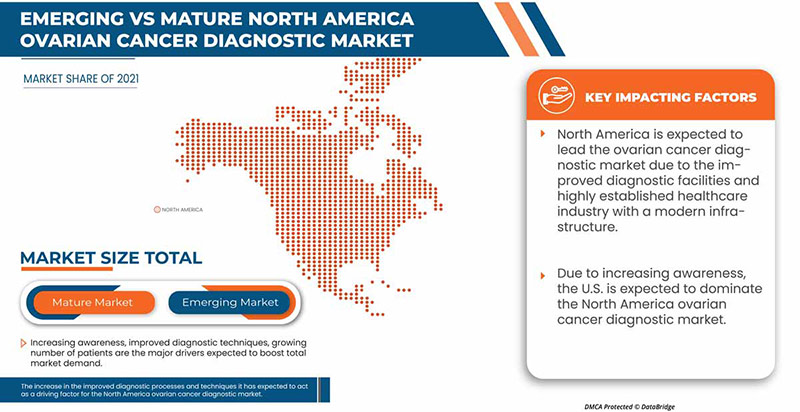

北米の卵巣がん診断市場は、2023年から2030年の予測期間に成長すると予想されています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に7.8%のCAGRで成長し、2022年の31億2,406万米ドルから2030年には56億7,536万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020~2016年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ(機器、キット、試薬)、手順タイプ(生検検査、医療画像検査、血液マーカー検査、遺伝子検査)、がんの種類(胚細胞、上皮性腫瘍、間質細胞腫瘍)、エンドユーザー(がん診断センター、病院検査室、研究機関など)別 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

F. Hoffmann-La Roche Ltd、Tosoh India Pvt. Ltd.、Luminex Corporation、Quest Diagnostics Incorporated、Thermo Fisher Scientific Inc.、Ngenebio、Abbott、Siemens healthcare private limited、Myriad genetics Inc.、Bio-rad laboratories, Inc.、R&d systems, Inc.、Foundation medicine, Inc.、Biosupply ltd、Lcm genect srl、Inex innovate private limited、Abcam plc.、Monobind Inc.、Fujirebio、Mp biomedicals、Biovision Inc.、Boster biotric technology、Biogenix Inc. Pvt. Ltd.、Genway biotech、Lifespan biosciences, Inc. |

北米卵巣がん診断市場の市場定義

卵巣がんは、50 歳から 79 歳の女性に最も多く見られます。世界の高齢者人口が増加し、早期発見と治療が重視されるにつれて、卵巣がんはより蔓延しており、卵巣がん診断市場の発展が加速すると予想されています。早期がん発見に関する意識を高めるための政府の投資を増やし、医療費を増やすことも、ビジネスの成長を促進するでしょう。肥満は卵巣がんの発症に重要な役割を果たしているようです。リスクを高める可能性のあるその他のライフスタイルの選択には、喫煙、飲酒、子供を持たないことなどがあります。卵巣がんは簡単には検出されないため、この病気を発症するリスクのある女性は、病気を早期に特定するために定期的な検査を受ける必要があり、これにより市場が拡大します。

北米の卵巣がん診断市場は、市場プレーヤーの増加と高度なサービスの利用可能性により、予測年度に成長しています。これに伴い、メーカーは市場で新しいサービスを開始するための研究開発活動に取り組んでいます。卵巣がんの診断と開発に関する研究の増加は、市場の成長をさらに後押ししています。ただし、卵巣がんのスクリーニング技術の難しさにより、予測期間中の北米の卵巣がん診断市場の成長が妨げられる可能性があります。

北米の卵巣がん診断市場の動向

ドライバー

- 卵巣がんに対する意識の高まり

卵巣がんに対する意識が高まるにつれて、タイムリーながん検出の需要が高まり、市場の成長につながっています。

卵巣がんは、世界中の女性人口の死亡率上昇の主な原因の 1 つであり、今後 5 年間の市場成長の原動力となっています。卵巣がんや嚢胞がんは、環境要因や遺伝子変異などのさまざまな要因により、より一般的になりつつあります。

卵巣がんは、女性の卵子を生産する器官である卵巣に影響を及ぼすがんの一種です。卵巣がんは症状が漠然としており、がんが胃や骨盤に広がってから発見されることが多く、治癒が困難なため、診断が困難です。

その結果、治療すべきがんのステージを判断するための診断プロセスと技術の向上が求められています。さらに、卵巣がんによる死亡率の上昇が懸念されており、治療を提供できるよう早期発見の重要性が強調されています。

卵巣がんに対する意識の高まりにより、市場成長の原動力となることが期待されています。

- 診断プロセスと技術の改善

スクリーニング検査や診察は、症状のない人のがんなどの病気を検出するために使用されます。卵巣がんのスクリーニング検査を開発するための研究は数多く行われてきましたが、これまでのところ大きな成果は得られていません。卵巣がんのスクリーニングに最もよく使用される 2 つの検査 (完全な骨盤検査に加えて) は、経膣超音波 (TVUS) と CA-125 血液検査です。

TVUS は、超音波棒を膣内に挿入して音波を使用して子宮、卵管、卵巣を調べる検査です。卵巣内の腫瘤 (腫瘍) を見つけるのに役立ちますが、腫瘤が癌か良性かを実際に判断することはできません。スクリーニングに使用すると、見つかった腫瘤のほとんどは癌ではありません。

CA-125 血液検査では、血液中の CA-125 と呼ばれるタンパク質の量を測定します。卵巣がんの女性の多くは、CA-125 値が高くなっています。治療がうまくいけば、高値は下がることが多いため、この検査は、卵巣がんであることがわかっている女性の治療の指針となる腫瘍マーカーとして役立ちます。ただし、CA-125 値を調べることは、卵巣がんのスクリーニング検査ほど有用ではありません。

したがって、診断プロセスと技術の改善の増加により、市場成長の原動力として機能することが期待されます。

拘束

診断コストが高い

世界中で、がん治療のコストが増加しています。医療業界は、がん治療の医療費など、いくつかの課題に直面しています。2010 年のがん治療費は 1,246 億ドルでしたが、がん治療薬の価格と急性期病院治療が主な要因となり、2020 年までに 1,730 億ドルに増加すると予測されています。したがって、診断薬の生産コストの増加が市場の成長を妨げています。

熟練した専門家の不足

診断プロセスに携わる医療専門家には、臨床推論スキルを活用し、患者の健康上の問題を評価および管理する義務と倫理的責任があります。診断が正確でタイムリーに行われると、患者の健康上の問題を正しく理解した上で臨床上の意思決定が行われるため、患者は良好な健康状態を得る可能性が高くなります。熟練した専門家が不足すると、患者の回復プロセスが妨げられ、市場の成長が妨げられる可能性があります。

機会

がんの診断と治療にかかる医療費の増加

世界中で、経済パフォーマンスに伴う公衆衛生支出により研究開発活動が拡大していますが、医療業界は医療費支出額で全業界中第 2 位となっています。医療費の増加は、研究開発の機会の提供の改善につながる可能性があります。卵巣がん診断の需要が急増すると予想されます。

がん治療に対する医療費の増加は、患者が手間をかけずに高度な診断と治療を受け、回復を早めることにも役立ちます。医療費は、自己負担(患者が自分の治療費を支払う)、政府支出、健康保険や非政府組織(NGO)の活動などの資金の組み合わせで構成されています。がん治療に対する医療費の増加により、市場成長の機会が生まれます。

課題

がん診断製品の承認と商品化に関する厳格な規制と基準

The stringent regulations for commercialization of any product in the market are proving to be a big challenge for manufacturers of cancer diagnostic products in the U.S. and European region. Every country has its own regulations and has a different body for regulatory procedures.

In the U.S., manufacturers require marketing authorization approval for IVD products for human use. The product must be labeled in accordance with labeling regulations. Establishments involved in the production and distribution of medical devices intended for commercial distribution in the U.S. are required to register with the FDA. Registration provides the FDA with the location of medical device manufacturing facilities and importers. Registration of an establishment is not an approval of the establishment or its devices by the FDA, that is, it does not provide FDA authorization to market the device. Unless exempted, premarketing authorization is required before a device can be placed into commercial distribution in the U.S.

The regulatory requirement for approvals of marketing as well as the declaration of conformity and the time required for regulatory review may vary for different products. The company which fails to get regulatory approval harms the business because without getting approval on the products, manufacturers are not able to launch their product in the market and for this reason, strict regulations and standards for the approval and commercialization of cancer diagnostic products act as a restraining factor for market growth.

Recent Developments

- In November 2022, Myriad genetics Inc. announced that it has acquired Gateway Genomics, LLC, The acquisition strengthens Myriad Genetics’ portfolio of Women’s Health products, expanding access to personalized genetic tests during the reproductive stage of a women’s life and beyond. With SneakPeek, Myriad now serves women earlier in their pregnancy, providing data-driven genetic insights through their lifetime with the Prequel non-invasive prenatal screen, Foresight carrier screen, and MyRisk Hereditary Cancer Test with Risk Score for all ancestries, this will help the company to increase their revenue.

- In October 2022, Quest Diagnostics announced the new phase of collaboration with Decode health, in the starting phase of collaboration, the two parties developed RNA (transcriptome) sequencing capabilities based on both parties' next-generation sequencing, analytics and clinical expertise. The collaboration is significant as biomarker-based data can help reduce the time and cost of developing novel diagnostic tests and identifying new drug targets for different types of cancers (breast, prostate and ovarian cancer). This collaboration helps the company to find innovative paths in the field of R&D and increases the North America presence of the company.

North America Ovarian Cancer Diagnostics Market Scope

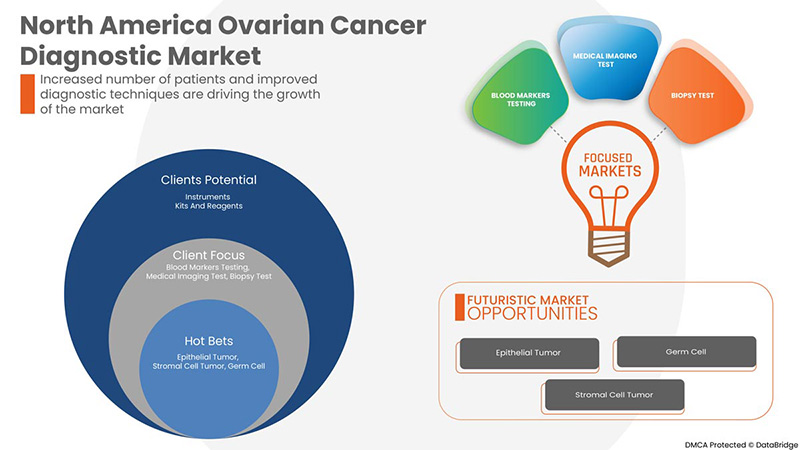

North America ovarian cancer diagnostics market is segmented into product type, procedure type, cancer type and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Instruments

- Kits and Reagents

On the basis of product type, the North America ovarian cancer diagnostics market is segmented into instruments and kits and reagents.

Procedure Type

- Blood Markers Testing

- Medical Imaging Test

- Biopsy Tests

- Genetic Testing

On the basis of procedure type, the North America ovarian cancer diagnostics market is segmented into blood markers testing, medical imaging test, biopsy tests and genetic testing

Cancer Type

- Epithelial Tumor

- Germ Cell

- Stromal Cell Tumor

On the basis of cancer type, the North America ovarian cancer diagnostics market is segmented into epithelial tumor, germ cell and stromal cell tumor

End User

- Cancer Diagnostic Centers

- Hospital Laboratories

- Research Institutes

- Others

On the basis of end user, the North America ovarian cancer diagnostics market is segmented into cancer diagnostic centers, hospital laboratories, research institutes and others

North America Ovarian Cancer Diagnostics Market Regional Analysis/Insights

The North America ovarian cancer diagnostics market is analyzed, and market size insights and trends are provided by country, product type, procedure type, cancer type and end user, as referenced above.

The countries covered in this market report U.S., Canada and Mexico.

U.S. is dominating the North America ovarian cancer diagnostics market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the high prevalence and incidence of neurological disorders in the region, and growing R&D investments and the launch of new products are boosting the market

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Ovarian Cancer Diagnostics Market Share Analysis

卵巣がん診断市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、卵巣がん診断市場に関連する会社の焦点にのみ関連しています。

北米の卵巣がん診断市場で活動している主要企業には、F. Hoffmann-la roche ltd、Tosoh india pvt. Ltd.、Luminex corporation、Quest diagnostics corporate、Thermo fisher Scientific Inc.、Ngenebio、Abbott、Siemens healthcare private limited、Myriad genetics Inc.、Bio-rad laboratories, Inc.、R&d systems, Inc.、Foundation medicine, Inc.、Abcam plc.、Monobind Inc.、Mp biomedicals、Biovision Inc.、Boster bionomic technology、Biogenix Inc. Pvt. Ltd.、Genway biotech、Lifespan biosciences, Inc などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5 INDUSTRY INSIGHTS

5.1 CONCLUSION

6 REGULATIONS OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING OVARIAN CANCER AWARENESS

7.1.2 IMPROVED DIAGNOSTIC PROCESSES AND TECHNIQUES

7.1.3 INCREASE IN NUMBER OF NEW CASES EVERY YEAR

7.1.4 IMPROVED IMAGING TECHNIQUES

7.2 RESTRAINS

7.2.1 HIGH COST OF DIAGNOSIS

7.2.2 ADVERSE EFFECTS OF THE TREATMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARDS CANCER DIAGNOSTICS

7.4 CHALLENGES

7.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF CANCER DIAGNOSTIC PRODUCTS

7.4.2 LACK OF SKILLED PROFESSIONALS

8 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.3 KITS AND REAGENTS

9 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE

9.1 OVERVIEW

9.2 BLOOD MARKERS TESTING

9.3 MEDICAL IMAGING TEST

9.4 BIOPSY TEST

9.5 GENETIC TESTING

10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 EPITHELIAL TUMOR

10.3 GERM CELL

10.4 STROMAL CELL TUMOR

11 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 CANCER DIAGNOSTIC CENTERS

11.3 HOSPITAL LABORATORIES

11.4 RESEARCH INSTITUTES

11.5 OTHERS

12 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 F. HOFFMANN-LA ROCHE LTD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TOSOH INDIA PVT. LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 LUMINEX CORPORATION (2022)

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 QUEST DIAGNOSTICS INCORPORATED (2022)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 THERMO FISHER SCIENTIFIC INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ABCAM PLC (2022)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 1.7.4 RECENT DEVELOPMENT

15.8 BIOSUPPLY LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIO-RADBIO LABORATORIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIOVISION INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 BIOGENIX INC. PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BOSTER BIOLOGICAL TECHNOLOGY

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FOUNDATION MEDICINE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FUJIREBIO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GENWAY BIOTECH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INEX INNOVATIVE PRIVATE LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 LCM GENETIC SRL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LIFESPAN BIOSCIENCES, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MP BIOMEDICALS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MONOBIND INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 MYRIAD GENETICS, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 NGENEBIO

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 R&D SYSTEMS, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 SIEMENS MEDICAL SOLUTIONS

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 24-MONTH EPISODE-OF-CARE COSTS FOR EARLY-STAGE AND LATE-STAGE CANCERS BY PAYER (USD BILLION)

TABLE 2 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA INSTRUMENTS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA KITS AND REAGENTS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA BLOOD MARKERS TESTING IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL IMAGING TEST IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BIOPSY TEST IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA GENETIC TESTING IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA EPITHELIAL TUMOR IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA GERM CELL IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STROMAL CELL TUMOR IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CANCER DIAGNOSTIC CENTERS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HOSPITAL LABORATORIES IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH INSTITUTES IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN OVARIAN CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 24 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 30 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 32 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY PROCEDURE TYPE, 2021-2030 (USD MILLION)

TABLE 34 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO OVARIAN CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET : SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT OVARIAN CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET IN 2022 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, 2022

FIGURE 19 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 23 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 35 NORTH AMERICA OVARIAN CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。