北米整形外科インプラント(歯科インプラントを含む)市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

23.52 Billion

USD

66.62 Billion

2024

2032

USD

23.52 Billion

USD

66.62 Billion

2024

2032

| 2025 –2032 | |

| USD 23.52 Billion | |

| USD 66.62 Billion | |

|

|

|

|

北米整形外科インプラント(歯科インプラントを含む)市場セグメンテーション、製品タイプ別(再建関節置換術、脊椎インプラント、運動保存デバイス/非融合デバイス、歯科インプラント、外傷インプラント、整形生物学、その他)、生体材料別(金属生体材料、セラミック生体材料、ポリマー生体材料、天然生体材料、その他)、手術方法別(開腹手術、低侵襲手術(MIS)、その他)、固定タイプ別(セメント整形外科インプラント、セメントレス整形外科インプラント、ハイブリッド整形外科インプラント)、エンドユーザー別(病院、診療所、外来手術センター、在宅ケア施設、学術研究機関、その他)、流通チャネル別(直接入札、小売販売、その他) - 2032年までの業界動向と予測

北米整形外科インプラント(歯科インプラントを含む)市場規模

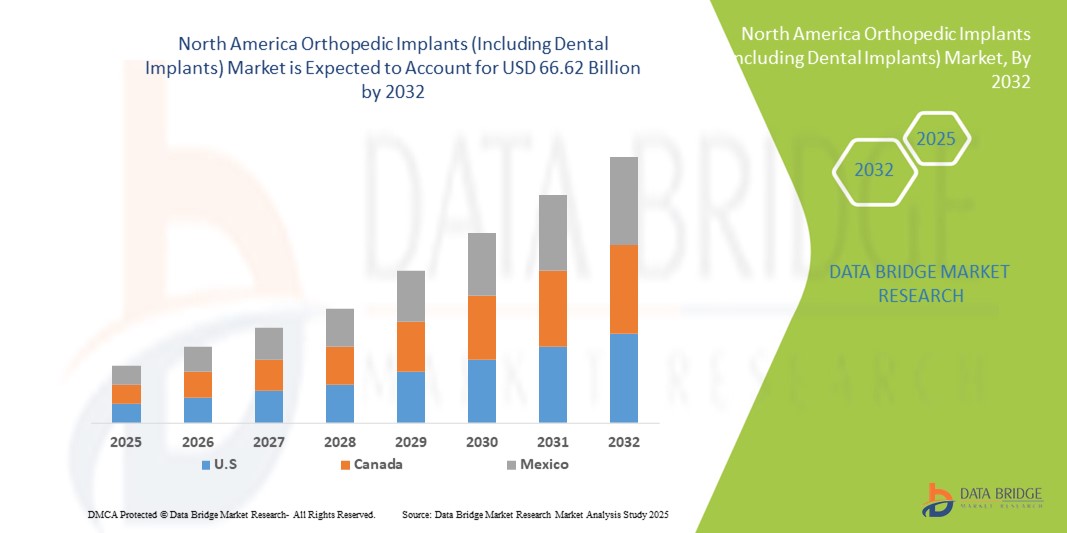

- 北米の整形外科用インプラント(歯科インプラントを含む)市場規模は、2024年に235.2億米ドルと評価され、予測期間中に13.90%のCAGRで成長し、2032年までに666.2億米ドル に達すると予想されています 。

- 市場の成長は、主に筋骨格障害の増加、人口の高齢化、外傷や変形性関節症の発生率の上昇によって促進され、整形外科用インプラントの需要を促進しています。

- さらに、インプラント材料、低侵襲手術技術、および個別化されたインプラントソリューションの進歩により、患者の転帰と回復時間が向上し、整形外科インプラント(歯科インプラントを含む)ソリューションの採用が促進され、業界の成長に大きく貢献しています。

北米整形外科インプラント(歯科インプラントを含む)市場分析

- 整形外科インプラント(歯科インプラントを含む)は、筋骨格系疾患の増加、人口の高齢化、そして整形外科と歯科の両方における高度な外科手術の導入の増加によって、ますます成長を続けています。これらの要因は、インプラント手術の拡大を促し、生体適合性と機能性を向上させた技術的に高度なインプラントの普及を後押ししています。

- 低侵襲手術への需要の高まりと、インプラント設計および生体材料の技術進歩が相まって、市場をさらに牽引しています。術後転帰と患者の回復促進に対する意識の高まりにより、病院や専門クリニックでは高品質の整形外科用インプラントや歯科用インプラントを導入するようになりました。

- 米国は、2024年には整形外科用インプラント(歯科インプラントを含む)市場において41.5%という最大の収益シェアを獲得し、市場を席巻しました。その特徴は、高度な医療インフラ、高い患者意識、確立されたヘルスケアエコシステム、そして大手インプラントメーカーの強力な存在感です。米国では、3Dプリンティング、生体吸収性材料、そして患者固有のインプラントにおけるイノベーションにより、整形外科用インプラントと歯科用インプラントの両方において大幅な成長が見込まれています。

- カナダは、予測期間中に整形外科インプラント(歯科インプラントを含む)市場で最も急速に成長する国になると予想されており、政府のヘルスケアイニシアチブの増加、筋骨格系の健康に対する患者の意識の高まり、整形外科と歯科の両方での高度なインプラント技術の採用の増加に支えられ、2025年から2032年にかけて10.8%のCAGRで拡大すると予測されています。

- 金属バイオマテリアルセグメントは、主に比類のない機械的強度、耐久性、および実証済みの長期性能により、2024年に整形外科用インプラント(歯科インプラントを含む)市場を支配し、市場収益シェアの58.7%を獲得しました。

レポートの範囲と整形外科インプラント(歯科インプラントを含む)市場セグメンテーション

|

属性 |

整形外科インプラント(歯科インプラントを含む)の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米整形外科インプラント(歯科インプラントを含む)市場動向

インプラント技術と外科手術技術の進歩

- 北米の整形外科インプラント(歯科インプラントを含む)市場において、先進的なインプラント材料と革新的な手術技術の開発は、重要かつ加速的なトレンドとなっています。これらの進歩は、患者の転帰を大幅に改善し、回復時間を短縮し、インプラントの寿命と機能性を向上させています。

- 例えば、3Dプリントされた患者固有のインプラントの導入により、外科医は患者の解剖学的構造に合わせてインプラントの形状とサイズをカスタマイズできるようになり、適合性の向上、合併症の減少、そしてより予測可能な手術結果がもたらされます。同様に、生体吸収性インプラントやコーティングインプラントは、骨結合の改善と術後感染の軽減を目的として導入されています。

- 低侵襲手術技術とロボット支援手術における革新により、インプラントの正確な設置が可能になり、手術精度が向上し、手術外傷が軽減されています。高度な器具とナビゲーションシステムも、最適なアライメントと機能回復を実現する上で外科医をサポートしています。

- チタン合金、ジルコニア、高度架橋ポリエチレンなどの新しい生体材料の統合により、整形外科用インプラントおよび歯科用インプラントの強度、耐久性、生体適合性が向上しました。これらの材料は、関節置換術と歯科修復術の両方でますます好まれています。

- より効果的で信頼性が高く、患者中心のインプラントソリューションへのこの傾向は、整形外科医や歯科医師、そして患者の期待を根本的に変化させています。その結果、この分野の大手企業は、性能と安全性を向上させた次世代インプラントを提供するために、研究開発に多額の投資を行っています。

- 筋骨格系疾患の増加、人口の高齢化、治療オプションの認知度の高まりにより、病院、専門クリニック、外来手術センターでは、技術的に進歩した高性能の整形外科用および歯科用インプラントの需要が急速に高まっています。

北米整形外科インプラント(歯科インプラントを含む)市場の動向

ドライバ

筋骨格系疾患の増加と人口の高齢化によるニーズの高まり

- 北米における筋骨格系疾患、骨粗鬆症、関節炎、歯科疾患の増加と高齢者人口の急増は、整形外科用インプラントおよび歯科インプラントの需要の高まりを牽引する大きな要因となっています。高齢者は関節の変性、骨折、歯の喪失にかかりやすいため、市場の成長を促しています。

- 例えば、2023年3月、ジンマー・バイオメット・ホールディングスは、手術精度と患者の回復を向上させることを目的とした、高度な股関節および膝関節置換ソリューションを米国で導入しました。主要企業によるこのような戦略的イノベーションと新製品の発売は、予測期間中の整形外科インプラント(歯科インプラントを含む)業界の成長を牽引すると予想されます。

- 患者がより良い可動性、より早い回復、そして生活の質の向上を重視するようになるにつれ、先端技術を駆使したインプラントの需要が急増しています。これらのインプラントは、生体適合性材料と低侵襲手術技術を用いて開発されることが多く、従来の治療法に比べて大きな利点があります。

- さらに、予防医療や選択的外科手術の人気の高まりが、整形外科や歯科インプラントの導入増加につながっています。歯科の審美性と関節の健康に対する意識の高まりにより、病院や専門クリニックにおいて、高度なインプラント治療を求める人が増えています。

- 耐久性と長寿命を兼ね備えたインプラントの利便性と、整形外科および歯科治療に対する保険適用範囲の拡大が、市場におけるインプラントの普及を促進する重要な要因となっています。3Dプリンティングなどの技術を用いて患者固有のインプラントを設計するためのメーカーによる継続的な研究開発努力も、市場の拡大に貢献しています。

抑制/挑戦

高コストと厳格な規制承認

- 高度な整形外科用インプラントや歯科用インプラントは比較的高額なため、普及拡大の大きな課題となっています。高度なコーティング、カスタムデザイン、ロボット支援手術対応などを備えたプレミアムインプラントは、価格が高額になることが多く、特に発展途上地域や無保険者層など、価格に敏感な患者にとって障壁となる可能性があります。

- さらに、インプラント医療機器に求められる厳格な規制承認プロセスは、製品発売までの期間を大幅に延長します。企業は厳格な安全性、生体適合性、臨床的有効性に関する基準を満たす必要があり、市場参入の遅延や開発コストの増加につながる可能性があります。

- インプラントの拒絶反応、感染症、デバイスの故障といった術後合併症への懸念も、一部の患者や医療従事者の間で躊躇を引き起こしています。こうしたリスクに対処するには、安全性と信頼性を確保するために、堅牢な市販後調査と継続的な製品革新が必要です。

- 熟練した外科医と高度なインフラへの依存も、もう一つの制約です。複雑な整形外科手術や歯科インプラント手術の多くは、専門的な訓練とハイテク設備を必要としますが、小規模な医療機関では必ずしも広く利用できるとは限りません。

- コスト最適化戦略、規制の調和、外科医のトレーニングの強化、よりアクセスしやすいインプラント技術の開発を通じてこれらの課題を克服することが、持続的な市場成長に不可欠となるでしょう。

北米整形外科インプラント(歯科インプラントを含む)市場範囲

市場は、製品タイプ、生体材料、手順、固定タイプ、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 製品タイプ別

製品タイプに基づいて、市場は、再建用関節置換術、脊椎インプラント、運動保持デバイス/非固定デバイス、歯科インプラント、外傷インプラント、整形生物学、その他に分類されます。再建用関節置換術セグメントは、急速に高齢化する人口と変形性関節症および関節リウマチの高い有病率に支えられ、2024年には41.5%という最大の収益シェアで市場を支配しました。北米では、股関節および膝関節置換術が最も一般的に実施されている手術であり、何百万人もの患者が可動性と生活の質を回復するために外科的治療を選択しています。高度に架橋されたポリエチレンやチタン合金などのインプラント生体材料の進歩により、インプラントの寿命が大幅に向上しました。低侵襲技術の採用により、候補者プールがさらに拡大し、早期介入が奨励されています。米国とカナダの償還ポリシーも手術件数の増加をサポートし、市場浸透をさらに促進しています。手術後の生活習慣の改善に対する意識の高まりと、それを支援する政府の健康対策により、関節再建術は引き続き整形外科インプラント市場の基盤となっています。

歯科インプラント分野は、修復歯科および審美歯科の需要の高まりを背景に、2025年から2032年にかけて8.9%のCAGRで最速の成長が見込まれています。加齢、外傷、歯周病による歯の喪失率の上昇により、耐久性のある歯科ソリューションのニーズが拡大しています。従来の入れ歯よりも歯科インプラントが受け入れられる傾向が高まっていることは、より自然で永久的な代替品への移行を反映しています。CAD/CAM、3Dイメージング、誘導手術などのデジタル歯科技術の統合により、インプラントの設置が合理化され、臨床結果が向上しています。患者が美しさと機能性を重視する傾向が強まっているため、審美歯科のトレンドも成長を後押ししています。北米における歯科観光と、特定のインプラント手術に対する保険適用範囲の拡大が、普及をさらに加速させています。これらの要因が相まって、歯科インプラントは整形外科インプラント分野で最も急速に成長している製品カテゴリーとなっています。

- バイオマテリアル

生体材料に基づいて、市場は金属生体材料、セラミック生体材料、ポリマー生体材料、天然生体材料、その他に分類されます。金属生体材料セグメントは、2024年に58.7%という最大の市場収益シェアを獲得しました。これは主に、比類のない機械的強度、耐久性、そして実証済みの長期性能によるものです。チタンとその合金は、優れた生体適合性と骨結合性により、整形外科用および歯科用インプラントのゴールドスタンダードであり続けています。ステンレス鋼とコバルトクロム合金も、その耐荷重性から、特に外傷および再建インプラントにおいて広く使用されています。数十年にわたる臨床データによって金属インプラントの安全性と信頼性が実証されており、外科医の間で最も信頼される選択肢となっています。永久インプラントと一時インプラントの両方において、金属生体材料の汎用性は整形外科分野におけるその優位性を強化しています。さらに、メーカーは骨結合を強化するために、表面改質インプラントや多孔質金属インプラントを導入しています。これらの革新により、金属生体材料は今後もインプラント学において中心的な役割を果たし続けることになります。

セラミックバイオマテリアル分野は、整形外科および歯科インプラント用途における利用増加に牽引され、2025年から2032年にかけて9.4%のCAGR(年平均成長率)で最速の成長を遂げると予想されています。特にジルコニアセラミックは、優れた耐摩耗性、生体適合性、そして天然歯のような審美性から注目を集めています。細菌付着を最小限に抑え、低アレルギー性ソリューションを提供できることから、歯科インプラントとして非常に魅力的です。整形外科手術では、摩耗を軽減しインプラントの寿命を延ばすため、人工股関節置換術においてセラミックオンセラミックベアリングの使用が増えています。アレルギーや過敏症を持つ患者向けに金属を使用しない代替品へのトレンドも、需要をさらに押し上げています。骨再生を促進する生体活性セラミックの研究と革新により、その臨床的有用性が拡大しています。これらの利点を総合的に考慮すると、セラミックはバイオマテリアル市場における変革をもたらす成長ドライバーとしての地位を確立しています。

- 手順別

手順に基づいて、市場は開腹手術、低侵襲手術(MIS)、その他に分類されます。開腹手術セグメントは、外傷修復、脊椎矯正、主要な関節再建などの複雑な整形外科的介入の標準であり続けるため、2024年には54.1%という最大の市場シェアを占めました。開腹手術では手術部位を直接視覚化できるため、外科医は複雑なインプラント配置中に高い制御力を得ることができます。MISは急速に成長していますが、解剖学的複雑さと患者固有の状態のため、多くの症例で依然として開腹手術が必要です。開腹手術の経験がある訓練を受けた外科医が広く利用可能であることは、その優位性をさらに強化しています。さらに、整形外科的介入の大きな部分を占める緊急外傷の場合、開腹手術が必要になることがよくあります。北米の病院はまた、手順の継続性を確保する開腹手術のための設備が整っています。そのため、低侵襲方法の革新にもかかわらず、開腹手術は市場をリードし続けています。

低侵襲手術(MIS)分野は、患者の早期回復と術後合併症の軽減への需要が高まる中、2025年から2032年にかけて10.2%という最も高いCAGRで成長すると予測されています。MIS技術は切開部が小さく、出血量の減少、感染リスクの低減、入院期間の短縮につながります。ロボット支援システム、コンピューターナビゲーション、術中画像の進歩により、MISはより安全で高精度になっています。若年で活動的な患者の間で、ダウンタイムを最小限に抑えた手術への需要が高まっていることも、この傾向を後押ししています。外科医のMIS技術の訓練はますます進んでおり、医療施設全体でMISへのアクセスが拡大しています。外来手術や日帰り手術に対する有利な償還ポリシーも、MISの導入を促進しています。技術の進化に伴い、MISは今後10年間で整形外科インプラント市場を大きく変えると予想されています。

- 固定タイプ別

固定タイプに基づいて、市場はセメント整形外科インプラント、セメントレス整形外科インプラント、ハイブリッド整形外科インプラントに分類されます。セメントレス整形外科インプラントセグメントは、主に自然な骨の成長を促進し、長期的な生物学的固定を実現する能力により、2024年には46.8%のシェアで市場を支配しました。外科医は、耐久性と再手術率の低下を理由に、若年で活動的な患者にセメントレスインプラントを推奨する傾向が高まっています。多孔質コーティングと表面改質によりオッセオインテグレーションが大幅に改善され、広く受け入れられるようになりました。患者はまた、セメントの経時的な分解に伴う合併症を軽減するため、セメントレスインプラントを好みます。画像技術と外科的精度の進歩により、セメントレス固定の成果はさらに向上しています。革新的なセメントレス設計を提供する大手メーカーの強力な存在が、このセグメントの優位性を強化しています。生物学的に統合されたソリューションへの移行に伴い、セメントレスインプラントは最も好まれる固定タイプであり続けるでしょう。

ハイブリッド整形外科インプラント分野は、セメント固定法とセメントレス固定法の最適なバランスを提供することから、2025年から2032年にかけて8.1%のCAGRで最速の成長を記録すると予想されています。ハイブリッド固定法は、1つの方法だけでは不十分な可能性のある再手術や複雑な症例で特に価値があります。セメント固定法の即時安定性とセメントレス統合の長期的利点を組み合わせることで、ハイブリッドは優れた臨床結果をもたらします。多様な解剖学的ニーズを持つ患者のために、膝関節および股関節置換術でハイブリッド法を採用する外科医が増えています。複雑な症例におけるカスタマイズされたソリューションへの需要の高まりも、ハイブリッド法の採用をさらに後押ししています。ハイブリッド固定法に対応するインプラント設計の継続的な革新も、この分野を牽引しています。患者固有のアプローチが普及するにつれて、ハイブリッドインプラントは力強い成長を遂げる態勢が整っています。

- エンドユーザー別

エンドユーザーに基づいて、市場は病院、診療所、外来手術センター、在宅ケア環境、学術研究機関、その他に分類されます。病院セグメントは、高度な整形外科および歯科手術の中心拠点であり続けるため、2024年には62.3%という最大の収益シェアを占めました。病院は、包括的なインフラストラクチャ、高度なスキルを持つ専門家、および小規模施設では不可能な複雑な手順を管理する能力の恩恵を受けています。インプラントメーカーとの強力な関係により、安定した製品供給と最新技術へのアクセスが保証されます。北米の償還モデルは、病院ベースの手順を中心に設計されており、その優位性をさらに強化しています。外傷および救急治療のために病院に流入する患者の増加も、このリーダーシップに貢献しています。さらに、教育病院と研究センターは、新しいインプラント技術の導入の最前線にあり、その影響力をさらに高めています。これらの理由から、病院は整形外科インプラントの採用を引き続きリードするでしょう。

外来手術センター(ASC)セグメントは、医療がコスト効率の高い外来ケアモデルへとますます移行する中、2025年から2032年にかけて9.8%という最も高いCAGRで成長すると予想されています。ASCは、低侵襲の整形外科手術や歯科処置をサポートする高度な技術を備えており、従来の病院環境に代わる魅力的な選択肢となっています。患者は、待ち時間の短縮、コストの削減、そしてケアの提供の利便性から、ASCを好みます。保険会社もまた、医療費全体の削減を目的としてASCの利用を奨励しています。日帰り人工関節置換術や外来脊椎手術の増加傾向も、成長をさらに後押ししています。ASCは、リソースをあまり必要としない環境で高品質のケアを提供できるため、その拡大を加速させています。患者と保険者の嗜好が一致し続ける中で、ASCでは整形外科インプラントの利用が急速に増加すると見込まれます。

- 流通チャネル別

流通チャネルに基づいて、市場は直接入札、小売販売、その他に分類されます。病院や大規模な医療ネットワークが大量割引を確保し、信頼性の高い供給を確保するために集中調達モデルを好むため、直接入札セグメントは2024年に49.6%のシェアで市場を支配しました。メーカーと病院の強力なパートナーシップにより、直接入札はインプラント取得のための最も効率的なチャネルとなっています。これらの契約には、トレーニング、サービス、およびメンテナンスパッケージが含まれることが多く、医療提供者にとってより魅力的になっています。直接入札プロセスは、規制基準と品質ベンチマークへの準拠も保証します。複雑な整形外科用インプラントの場合、このチャネルは医療機関に製品のトレーサビリティと安全性に対する自信を提供します。病院からの需要の規模と一貫性は、このセグメントの強みを強化します。コスト効率が引き続き重要な優先事項であるため、直接入札は調達戦略の主な役割を担い続けるでしょう。

小売販売セグメントは、患者主導による歯科インプラントおよび関連アクセサリーの購入増加に支えられ、2025年から2032年にかけて7.6%のCAGRで最速の成長を遂げると予測されています。eコマースプラットフォームや小売薬局の台頭により、インプラントや消耗品は個々の患者にとってより身近なものとなっています。特に歯科治療において、選択的治療を求める患者が小売チャネルを通じて需要を牽引しています。この傾向は、消費者直販型歯科ソリューションの認知度向上とマーケティングの進展によってさらに後押しされています。また、小売店での購入が可能になることで、交換部品やインプラント補助製品の購入における柔軟性も高まります。消費者の医療費支出が増加するにつれ、小売販売は市場の成長においてより重要な役割を果たすようになるでしょう。

北米整形外科インプラント(歯科インプラントを含む)市場地域分析

- 北米は、筋骨格系疾患の増加、人口の高齢化、高度な治療ソリューションへの需要の高まりを背景に、2024年には整形外科用インプラント(歯科インプラントを含む)市場において最大の収益シェアを獲得し、市場を席巻しました。この地域は、大手インプラントメーカーの強力なプレゼンス、高い医療費支出、そして整形外科および歯科技術の継続的な革新といった恩恵を受けています。

- 北米の患者は、低侵襲手術、高度な生体材料、カスタムメイドのインプラントの利用可能性を高く評価しており、これらは回復時間と長期的な転帰の改善につながります。3Dプリンティング、ロボット支援手術、デジタル歯科ソリューションの導入増加は、この地域における市場拡大をさらに加速させています。

- この広範な成長は、強固な医療インフラ、有利な償還政策、そして整形外科および歯科疾患の予防・矯正治療に対する意識の高まりによってさらに支えられています。これらの要因が相まって、北米は歯科インプラントを含む整形外科インプラントの世界的リーダーとしての地位を確立しています。

米国整形外科インプラント(歯科インプラントを含む)市場分析

米国の整形外科用インプラント(歯科インプラントを含む)市場は、2024年には41.5%という最大の収益シェアで市場を席巻しました。これは、高度な医療インフラ、高い患者意識、確立されたヘルスケアエコシステム、そしてジンマー・バイオメット、ストライカー、デンツプライシロナといった大手インプラントメーカーの存在を特徴としています。米国では、3Dプリンティング、生体吸収性材料、AI支援プランニングツール、そして手術精度と患者の転帰を向上させる患者固有のインプラントの統合により、整形外科用インプラントと歯科用インプラントの両方で大幅な成長が見込まれています。

カナダ整形外科インプラント(歯科インプラントを含む)市場分析

カナダの整形外科用インプラント(歯科インプラントを含む)市場は、予測期間中に整形外科用インプラント(歯科インプラントを含む)市場において最も急速に成長する国になると予想されており、2025年から2032年にかけて年平均成長率(CAGR)10.8%で拡大すると予測されています。この成長は、政府の医療支援策の強化、高度な病院インフラへの投資の増加、そして筋骨格系の健康に対する患者の意識の高まりに支えられています。さらに、次世代インプラント技術、特に低侵襲整形外科手術やデジタル歯科インプラントの導入が、カナダの市場拡大を加速させています。

北米整形外科インプラント(歯科インプラントを含む)市場シェア

整形外科用インプラント(歯科インプラントを含む)業界は、主に次のような老舗企業によって牽引されています。

- ジマー・バイオメット(米国)

- スミス・アンド・ネフュー(英国)

- メドトロニック(アイルランド)

- ストライカー(米国)

- B.ブラウンSE(ドイツ)

- インテグラライフサイエンスコーポレーション(米国)

- ナラン・メディカル・リミテッド(インド)

- WLゴア・アンド・アソシエイツ社(米国)

- 3M(米国)

- アートレックス社(米国)

- ゼネラル・エレクトリック・カンパニー(米国)

- DJO, LLC(米国)

- サマイ外科(インド)

- バイオホライゾンズ(米国)

- エンビスタ(米国)

- Egifix(インド)

- Institut Straumann AG (スイス)

- カンウェルメディカル株式会社(中国)

- コリングループ(英国)

- グローバス・メディカル(米国)

- コンメッドコーポレーション(米国)

- ボーンテック メディシス Pvt. Ltd.(インド)

- EgiFix Medical(インド)

北米整形外科インプラント(歯科インプラントを含む)市場の最新動向

- 2024年7月、ZimVieはFDA 510(k)承認とGentekR Restorativeの米国での発売を発表し、補綴製品のポートフォリオを拡大し、修復および歯科インプラントソリューションにおける地位を強化しました。

- 2024年12月、ジンマーバイオメットは、ペルソナソリューションPPS大腿骨コンポーネントのFDA承認を取得しました。このコンポーネントは、ペルソナオッセオティ脛骨およびオッセオティ膝蓋骨と組み合わせることで、インプラントの適合性が向上し、関節置換手術の臨床結果が改善されます。

- 2025 年 3 月、ジョンソン・エンド・ジョンソン メドテックは、サンディエゴで開催された AAOS 2025 年次総会でデジタル整形外科の新時代を披露し、手術の精度と効率を高めるデータ駆動型の実現技術や高度なインプラントなど、関節再建、外傷、脊椎、四肢の各分野にわたるイノベーションを紹介しました。

- 2025年1月、ジンマー・バイオメットはパラゴン28を約11億米ドルで買収することで合意したことを発表しました。この買収は、足部および足首の疾患に対するジンマーの外科用インプラント製品の拡充と、骨折、外傷、関節置換分野における強みの強化を目的としています。

- 2025年5月、RevBioは頭蓋皮弁固定用再生骨接着剤について、臨床試験の拡大に関するFDA承認とCMS償還の両方を取得しました。これは、同社の生体材料ベースのインプラント安定化技術にとって大きな前進となります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。