北米油田特殊化学品市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

973.39 Million

USD

1,416.37 Million

2025

2033

USD

973.39 Million

USD

1,416.37 Million

2025

2033

| 2026 –2033 | |

| USD 973.39 Million | |

| USD 1,416.37 Million | |

|

|

|

|

北米油田特殊化学品市場セグメンテーション、タイプ別(界面活性剤、抗乳化剤、抑制剤、殺生物剤、添加剤、酸、変形剤、ポリマー、摩擦低減剤、乳化剤、鉄制御剤、分散剤、増粘剤、湿潤剤、遅延剤、その他)、地域別(陸上および海上)、用途別(掘削、刺激、生産、石油増進回収(EOR)、セメンチング、改修および仕上げ、その他) - 2033年までの業界動向および予測

北米の油田特殊化学品市場の規模と成長率はどれくらいですか?

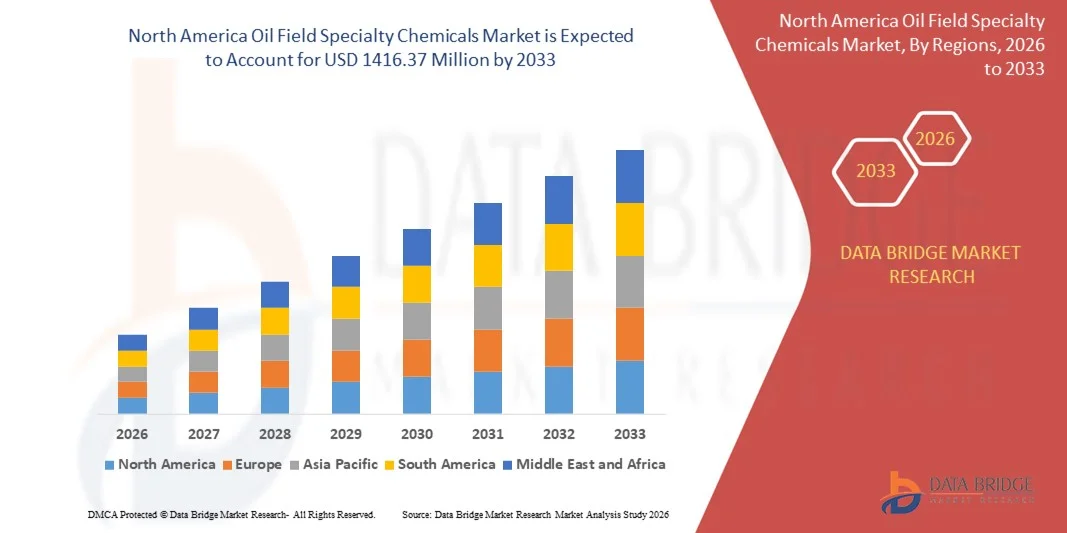

- 北米の油田特殊化学品市場規模は2025年に9億7,339万米ドルと評価され、予測期間中に4.80%のCAGRで成長し、2033年までに14億1,637万米ドル に達すると予想されています 。

- 石油・ガス探査・生産活動の増加、石油増進回収(EOR)技術の需要増加、深海および超深海掘削作業の増加、腐食防止剤および乳化防止剤の使用増加、シェールガス開発の拡大、坑井効率および流量保証の改善への関心の高まりなどが、油田特殊化学品市場の成長を牽引すると予想される主な要因です。

油田特殊化学品市場の主なポイントは何ですか?

- 発展途上国における石油・ガス上流プロジェクトへの投資の増加と、先進的な掘削流体および生産化学薬品の採用の増加により、油田特殊化学品市場に大きな成長機会が生まれることが期待されています。

- 原油価格の変動、厳しい環境規制、高い運用コスト、化学物質の廃棄と毒性に関する懸念は、油田特殊化学品市場の成長に対する主要な抑制要因となることが予想される。

- 米国は、シェールガスとタイトオイルの生産量の増加、大規模な水圧破砕活動、パーミアン、イーグルフォード、バッケンなどの主要な盆地での継続的な掘削と仕上げ作業により、2024年に北米の油田特殊化学品市場で45.36%という最大の収益シェアを獲得して優位に立った。

- カナダの油田特殊化学品市場は、進行中のオイルサンド生産、シェールガス開発、石油増進回収(EOR)プロジェクトに支えられ、8.21%という最も高い成長率を記録しています。

- 界面活性剤セグメントは、掘削流体、石油増進回収(EOR)、生産オペレーションにおける広範な用途により、2025年には28.6%のシェアで市場をリードしました。界面活性剤は、界面張力の低減、石油置換効率の向上、そして従来型および非従来型の貯留層における流体性能の向上において重要な役割を果たします。

レポートの範囲と油田特殊化学品市場のセグメンテーション

|

属性 |

油田用特殊化学品の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

油田特殊化学品市場の主な傾向は何ですか?

高性能、環境に優しい、用途に特化した油田用特殊化学品への移行が増加

- 油田特殊化学品市場では、複雑な油田環境における掘削効率、生産の最適化、貯留層性能の向上を目的とした高性能かつ用途に特化した化学品の採用が増加しています。

- メーカーは、熱安定性、耐腐食性、高圧高温(HPHT)井戸との適合性を向上させる高度な界面活性剤、抑制剤、ポリマー、摩擦低減剤の開発をますます進めています。

- 環境に優しく生分解性の化学製剤への注目が高まるにつれ、特に沖合や敏感な地域における厳しい環境規制を遵守するためのイノベーションが推進されています。

- 例えば、BASF SE、ハリバートン、ベーカー・ヒューズ、クラリアントなどの企業は、低毒性、水性、高効率の油田化学ソリューションを導入し、操業の持続可能性を向上させています。

- 石油増進回収(EOR)、シェールガス開発、深海探査の需要増加により、特殊で高価値な化学製剤への移行が加速しています。

- 石油・ガス事業がより複雑化し、効率性が重視されるようになるにつれ、油田特殊化学品は、回収率の最大化、ダウンタイムの短縮、油井全体の経済性の向上に不可欠なものとなるでしょう。

油田特殊化学品市場の主な推進要因は何ですか?

- 坑井生産性、流量保証、貯留層寿命を向上させるための効率的な掘削、刺激、生産用化学物質の需要の高まりが市場の成長を牽引しています。

- 例えば、2024年から2025年にかけて、シュルンベルジェ、ハリバートン、ベーカーヒューズなどの大手油田サービスプロバイダーは、非在来型および深海プロジェクトをサポートするために特殊化学品ポートフォリオを拡大しました。

- シェール、タイトオイル、オフショア油田を含む上流の石油・ガス探査への投資の増加により、米国、中東、北米全域で界面活性剤、抗乳化剤、腐食防止剤、殺生物剤の需要が高まっています。

- ナノ対応添加剤や高性能ポリマーなどの化学配合技術の進歩により、化学薬品の消費量を削減しながら効率が向上しています。

- ケミカルフラッディングやポリマー注入などの石油増進回収(EOR)技術の採用増加により、特殊油田化学薬品の持続的な需要が生まれています。

- エネルギー需要の拡大、掘削技術の向上、回収最適化の取り組みに支えられ、油田特殊化学品市場は長期にわたって着実な成長が見込まれています。

油田特殊化学品市場の成長を阻害する要因は何ですか?

- 原油価格の変動は探査と生産の支出に大きな影響を与え、油田の特殊化学品の需要に影響を与える。

- 例えば、2024年から2025年にかけて、石油価格の変動とプロジェクトの遅延により、北米のいくつかの上流プロジェクトで化学物質の調達が減少しました。

- 化学物質の毒性、廃棄、沖合排出に関する厳しい環境規制により、コンプライアンスコストが増加し、特定の製剤の使用が制限される。

- 高度なHPHT対応で環境に適合した化学薬品に関連する高い運用コストと配合コストは、小規模事業者による導入を制限します。

- サプライチェーンの混乱と原材料価格の変動は、メーカーにコスト圧力をかけ、利益率を低下させます。

- これらの課題を克服するために、企業は持続可能な配合、費用対効果の高い生産方法、地域特有の化学ソリューションに焦点を当て、油田特殊化学品の市場導入を強化しています。

油田特殊化学品市場はどのようにセグメント化されていますか?

市場はタイプ、場所、用途に基づいて細分化されています。

- タイプ別

油田用特殊化学品市場は、種類別に界面活性剤、抗乳化剤、抑制剤、殺生物剤、添加剤、酸、変形剤、ポリマー、摩擦低減剤、乳化剤、鉄分制御剤、分散剤、増粘剤、湿潤剤、遅延剤、その他に分類されます。界面活性剤分野は、掘削流体、石油増進回収(EOR)、生産オペレーションにおける広範な使用により、2025年には28.6%のシェアで市場を支配しました。界面活性剤は、従来型および非従来型の貯留層の両方において、界面張力の低減、油置換効率の向上、流体性能の向上に重要な役割を果たします。その幅広い適用性、費用対効果、そして継続的な配合改善は、北米の油田における堅調な需要を支えています。

ポリマーセグメントは、EORにおけるポリマー攻法の採用増加、シェールガス探査の増加、粘度制御と流体損失低減の需要増加を背景に、2026年から2033年にかけて最も高いCAGRで成長すると予想されています。高温および高塩分耐性ポリマーの進歩が、成長をさらに加速させています。

- 場所別

油田用特殊化学品市場は、立地に基づいて陸上と沖合に区分されます。2025年には、陸上セグメントが64.2%のシェアを占め、市場を席巻しました。これは、米国、中国、中東のシェール層、タイトオイル貯留層、成熟油田を中心とした陸上での石油・ガス探査活動の活発化に支えられたものです。陸上操業では、大量の掘削流体、生産用化学薬品、腐食防止剤、殺生物剤が必要となるため、特殊化学品の需要は持続的に増加しています。また、沖合プロジェクトに比べて操業コストが低く、物流も容易なことから、陸上セグメントの優位性はさらに高まっています。

オフショア分野は、メキシコ湾、ブラジル、西アフリカなどの地域における深海および超深海探査活動の増加に牽引され、2026年から2033年にかけて最も高いCAGRで成長すると予測されています。オフショア開発への投資増加と厳格なフロー保証要件により、高性能で環境適合性の高い特殊化学品の需要が高まっています。

- アプリケーション別

油田用特殊化学品市場は、用途別に、掘削、刺激、生産、石油増進回収(EOR)、セメンチング、改修・仕上げ、その他に分類されます。生産分野は2025年に31.4%のシェアを占め、市場を牽引しました。これは、生産オペレーションにおいて、油井の寿命全体を通じて流動性、設備の健全性、そして操業効率を維持するために、腐食防止剤、抗乳化剤、スケール防止剤、殺生物剤を継続的に使用する必要があるためです。成熟油田からの生産量最大化への関心の高まりにより、北米における生産用化学品の需要はさらに高まっています。

石油増進回収(EOR)分野は、従来型埋蔵量の減少と、ポリマー攻法や界面活性剤注入といった化学EOR技術の導入拡大を背景に、2026年から2033年にかけて最も高いCAGRを記録すると予想されています。回収率の向上と貯留層寿命の延長への関心の高まりにより、EOR用途における特殊化学品の需要が大幅に加速しています。

油田特殊化学品市場で最大のシェアを占める地域はどこですか?

- 米国は、シェールガスとタイトオイルの生産量の増加、大規模な水圧破砕活動、パーミアン、イーグルフォード、バッケンなどの主要な盆地での継続的な掘削と仕上げ作業により、2024年に北米の油田特殊化学品市場で45.36%という最大の収益シェアを獲得して優位に立った。

- 大手石油・ガス事業者は、油井生産性の向上、流量保証の改善、操業停止時間の削減を目的として、腐食防止剤、抗乳化剤、スケール防止剤、摩擦低減剤などの高度な特殊化学薬品を採用する傾向が高まっています。

- 強力な上流投資、国内エネルギー生産に対する有利な規制支援、高度なインフラ、大手化学メーカーの存在により、米国は北米における油田特殊化学品の革新と消費の地域拠点としての地位を確固たるものにしています。

カナダ油田特殊化学品市場インサイト

カナダの油田用特殊化学品市場は、進行中のオイルサンド生産、シェールガス開発、そして石油増進回収(EOR)プロジェクトに支えられ、8.21%という最も高い成長率を記録しています。掘削流体、生産用化学品、水処理ソリューションに対する需要の高まりは、回収率の向上と複雑な貯留層状況への対応の必要性を背景にしています。環境適合性と低毒性を備えた化学品製剤への注目の高まりに加え、パイプラインおよびミッドストリームインフラへの投資が、市場拡大を加速させています。

メキシコ油田特殊化学品市場洞察

メキシコの市場成長は、メキシコ湾における沖合探鉱活動と成熟した陸上油田の再開発によって支えられています。政府主導の上流部門改革、民間セクターの参入拡大、そして生産最適化への投資は、刺激剤、腐食抑制剤、流動性確保剤の需要を押し上げています。国内の石油生産量増加への関心の高まりにより、メキシコは北米における新興成長市場としての地位を確立しています。

油田特殊化学品市場のトップ企業はどれですか?

油田特殊化学品業界は、主に、次のような定評ある企業によって牽引されています。

- BASF SE(ドイツ)

- ソルベイ(ベルギー)

- ダウ(米国)

- ベーカー・ヒューズ社(米国)

- クラリアント(スイス)

- エボニック インダストリーズ AG(ドイツ)

- ケミラ(フィンランド)

- サーマックス・リミテッド(インド)

- ハンツマンインターナショナルLLC(米国)

- コロニアルケミカル社(米国)

- ジラックス(ロシア)

- イノスペック(米国)

- CES Energy Solutions Corp.(カナダ)

- ステパン社(米国)

- EMEC(イタリア)

- シェブロン・フィリップス・ケミカル・カンパニーLLC(米国)

- クレイトンコーポレーション(米国)

- 嘉興ミダス油田化学製造有限公司(中国)

- ヴェルサリスSpA(イタリア)

- ハリバートン(米国)

- アルベマール・コーポレーション(米国)

北米の油田特殊化学品市場の最近の動向は何ですか?

- 2024年5月、業界ではデジタル化と自動化技術の導入が進み、油田化学品の専門サプライヤーは遠隔監視・制御ソリューションを開発して処理プロセスを最適化し、運用効率を向上させ、よりスマートで効率的な油田運用へのセクターの移行を浮き彫りにしました。

- 2024年3月、特殊油田化学品市場では、大手企業が製品ポートフォリオの拡大と地理的プレゼンスの強化を目的として合併や買収を行うなど、統合活動が継続しており、業界全体が規模、競争力、長期的な成長に重点を置いていることが示されています。

- 2023年10月、ルーブリゾール社は、北米の大手特殊化学品および原料の販売業者および開発業者であるIMCDグループとの新たな販売契約を発表し、ルーブリゾールの市場範囲とサプライチェーン能力を強化しました。

- 2022年7月、ソルベイSAは、事業の合理化と中核成長分野への再注力に向けた取り組みの一環として、石油化学事業の売却の可能性を評価するためにバンク・オブ・アメリカから助言支援を求めると発表した。

- 2022年3月、ハリバートンは次世代化学ソリューションをサポートし、地域の生産能力を強化するために、サウジアラビアに初の油田特殊化学品製造工場を開設し、東半球における同社の事業展開を大幅に拡大しました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。