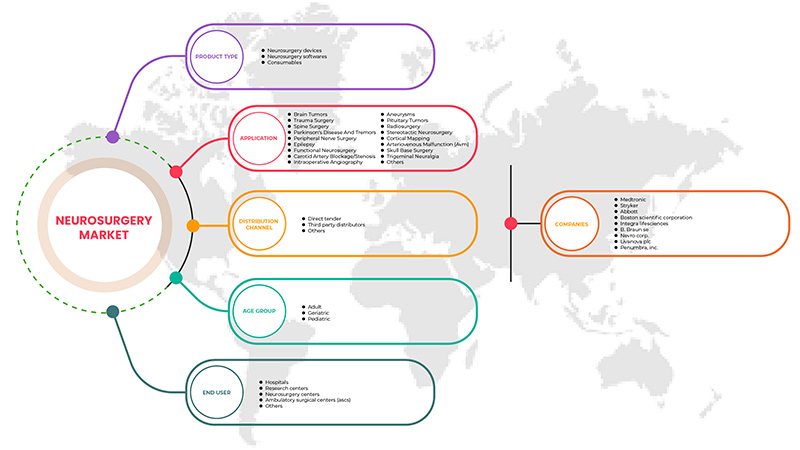

北米の脳神経外科市場、製品タイプ別(脳神経外科用デバイス、脳神経外科用ソフトウェア、消耗品)、用途別(動脈瘤、動静脈奇形(AVM)、脳腫瘍、頸動脈閉塞/狭窄、脳血管手術、皮質マッピング、てんかん、機能的脳神経外科、術中血管造影、パーキンソン病および振戦、末梢神経手術、下垂体腫瘍、放射線手術、頭蓋底手術、脊椎手術、定位脳神経外科、外傷手術、三叉神経痛、その他)、年齢層別(小児、成人、高齢者)、エンドユーザー別(病院、脳神経外科センター、研究センター、外来手術センター、その他)、流通チャネル別(直接入札、サードパーティの販売代理店、その他)業界動向と2029年までの予測

北米の脳神経外科市場の分析と洞察

医療における技術革新とは、臨床診療に変化をもたらす新しい技術の導入と定義できます。脳神経外科は特に技術集約的な外科分野であり、新しい技術は脳神経外科手術技術の大きな進歩の多くに先行しています。現在は、手術中の合併症の可能性を減らすことができる低侵襲性デバイスの開発に重点が置かれています。低侵襲性技術の導入により、医師は電動工具、神経血管塞栓装置、ガンマナイフなどの放射線手術システムなど、高度に専門化された外科器具を使用しています。

さらに、規制基準の強化や神経疾患の発生率の増加など、一連の新しい要因により、高度な治療プロトコルの採用が増加し、そのような治療法がより広く利用可能になるという想定につながっています。これにより、業界と政府のゼロ逸脱の要求が高まり、脳神経外科サービスの需要が促進され、業界間の提携と協力の増加は、脳神経外科市場を押し上げると予想される主な要因です。ただし、神経内視鏡機器と手順にかかるコストの上昇と、訓練を受けた専門家の不足により、予測期間中の市場の成長が抑制される可能性があります。

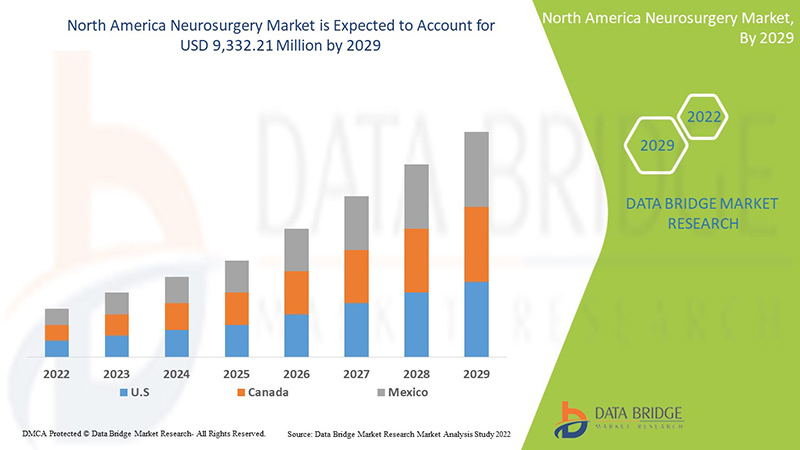

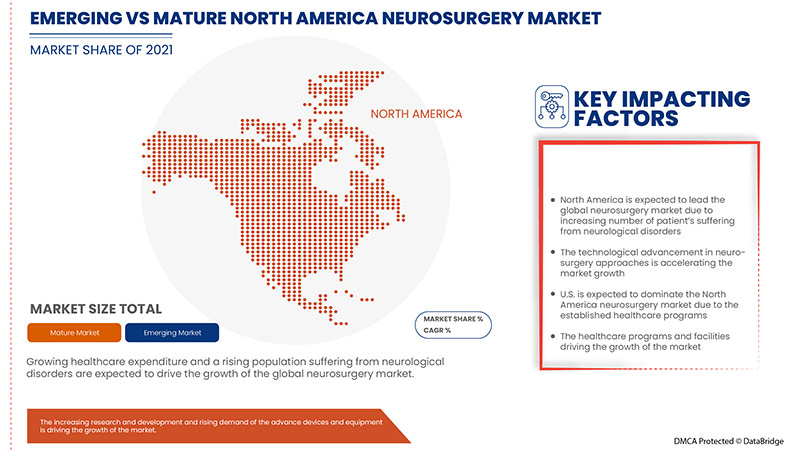

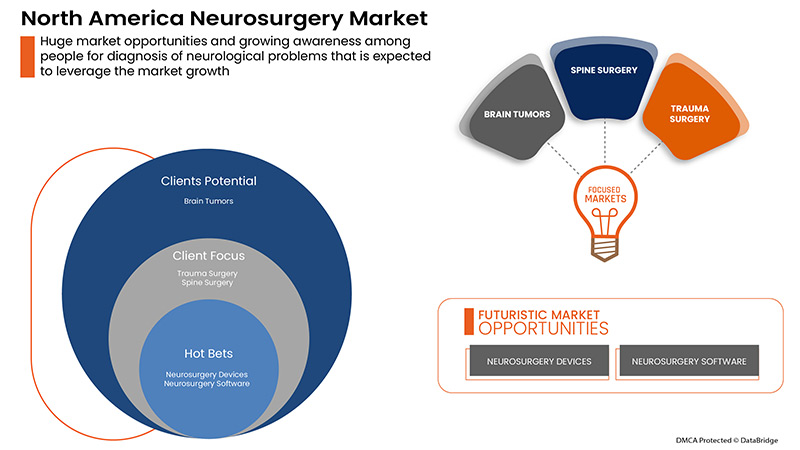

Data Bridge Market Research の分析によると、北米の脳神経外科市場は、予測期間中に 14.3% の CAGR で成長し、2029 年までに 93 億 3,221 万ドルに達する見込みです。北米地域では患者数が増加しているため、「製品タイプ」が市場で最大のタイプ セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品タイプ別(脳神経外科用機器、脳神経外科用ソフトウェア、消耗品)、用途別(動脈瘤、動静脈奇形(AVM)、脳腫瘍、頸動脈閉塞/狭窄、脳血管外科、皮質マッピング、てんかん、機能的脳神経外科、術中血管造影、パーキンソン病および振戦、末梢神経外科、下垂体腫瘍、放射線外科、頭蓋底外科、脊椎外科、定位脳神経外科、外傷外科、三叉神経痛、その他)、年齢層別(小児、成人、高齢者)、エンドユーザー別(病院、脳神経外科センター、研究センター、外来手術センター、その他)、流通チャネル別(直接入札、サードパーティ販売店、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Medtronic、Abbott、Boston Scientific Corporation、Elekta、ALEVA NEUROTHERAPEUTICS、Brainlab AG、adeor medical AG、LivaNova PLC、B. Braun SE、Terumo Medical Corporation、Integra LifeSciences、Stryker、Penumbra, Inc.、KARL STORZ SE & Co. KG、Renishaw plc.、Inomed Medizintechnik GmbH、ANT Neuro、Leica Microsystems など |

北米脳神経外科市場の定義

神経疾患には、認知症、頭痛障害、神経感染症、多発性硬化症、外傷性脳損傷、神経疾患に伴う疼痛、栄養失調に伴う神経疾患、脳卒中、てんかん、パーキンソン病などがあります。これらの疾患は致命的であり、治療法では治癒できません。脳神経外科用機器には、神経内視鏡、定位システム、カテーテル、ペースメーカー、単腔式および二腔式除細動器、植込み型除細動器などがあり、さまざまな脳神経外科手術で使用されます。脳神経外科は、脳腫瘍、事故による脊髄損傷、首や背中の不快感、脊髄液の異常な動きを患う患者の診断に役立ちます。世界中で約 700 万から 1,000 万人がパーキンソン病に苦しんでいます。神経疾患は、世界中で罹患率と障害の主な原因の 1 つです。予測期間中、脳神経外科の技術開発が市場を牽引すると予想されます。人口における神経疾患の発生率と有病率の上昇、および他の従来の手術に対する脳神経外科の優位性により、世界中の脳神経外科市場の成長が促進されると予想されます。さらに、脳腫瘍手術の3次元再構成、脳病変のXナイフ放射線手術、脳腫瘍のMRI、脳腫瘍の局所麻酔手術などの神経外科の進歩により、脳神経外科市場の成長に有利な機会がもたらされると予想されます。

北米の脳神経外科市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 脳神経外科における技術の進歩

現代の脳神経外科が始まって以来、技術の進歩により、脳の形状と機能に関するより徹底した理解が深まり、患者を悩ませている複雑な病状をより効果的に治療できるようになりました。技術の進歩により、従来の機器から新しい技術に基づくエネルギー効率の高い機器への移行がもたらされました。いくつかの最先端技術により、脳神経外科手術が非常に簡単に行えます。脳神経外科手術は特に技術集約型の外科分野であり、新しい技術は、脳神経外科手術技術の大きな進歩の多くに先行しています。画像誘導装置と神経調節装置は、特許と出版物の急速な増加に高い相関性を示しており、市場の成長を促進すると期待される技術拡大の分野であることを示しています。

神経疾患の罹患率の増加に伴い、脳神経外科の需要も増加しています。市場は予測期間中に成長すると予想されています。

さらに、内視鏡技術の導入は市場にとって大きな進歩です。さらに、脳神経外科手術では回復時間が短くなっています。したがって、これらすべての要因が市場成長の原動力となることが期待されています。

- 神経疾患の罹患率の上昇

世界保健機関 (WHO) は、公衆衛生の促進に重要な分野の研究に重点を置いています。最近、WHO は、世界に大きな負担をかけている、頻繁に発生し、障害を引き起こす神経疾患に特に関心を寄せています。神経疾患は、あらゆる年齢層やさまざまな地域で発生しています。神経疾患は、世界中で罹患率と死亡率に大きく影響しています。今後 10 年間で、低所得国および中所得国 (LMIC) における神経疾患の負担は飛躍的に増加すると予想されています。

経鼻出血、脳内出血(ICH)、外傷性脳損傷、慢性疼痛、うつ病、パーキンソン病などの神経疾患の罹患率の上昇が市場の成長を牽引すると予想されます。

そのため、経鼻出血や脳内出血(ICH)などの神経疾患の増加が市場の成長を後押ししています。神経疾患は大きな公衆衛生上の危機となっており、北米の脳神経外科市場の成長を後押しすると期待されています。

拘束

- 脳神経外科手術と機器に関連する高額な費用

A significant increase in the cost of neurosurgical products has been observed in recent years, which end users such as hospitals and neurosurgical centers have to incur. Products such as neurovascular embolization devices, neurovascular coiling devices, and neuroendoscopes are quite costly. Manufacturers are also giving more resources to research and development to introduce cost-effective and advanced technology. Some complex neurosurgeries require extensive time as well as effort, and they are also quite risky. These complex procedures need advanced techniques and skills, and because of this, the cost of equipment and neurosurgeries increases. The maintenance of such facilities and continuous requirement of power supply add up to the cost of the surgeries. Decompressive craniectomy for traumatic brain injury (TBI) is an expensive procedure that is also associated with high morbidity and mortality.

The cost associated with neurosurgery procedures is quite high, which is expected to act as a restrain for the market growth.

Opportunity

-

Rising awareness about neurological disorders

With the rising North America population, a large portion of the geriatric section is getting affected with neurological disorders such as epilepsy, Parkinson's disease, stroke, brain tumor, dementia, and multiple sclerosis, among others. So, understanding neurological disorders is important, and awareness about neurological conditions can lead to seeking medical attention, which results in proper diagnosis and effective treatment. All neurological disorders account for 82.8%. The massive fold increases the burden of neurological disorders that can be attributed to a lack of awareness about neurological disorders and treatment, which lead to delayed detection, and lack of access to quality healthcare and rehabilitation centers. Rising healthcare programs and increasing funding from governments and public healthcare agencies help reduce the burden of neurological disorders and develop neurological products that act in favor of market growth.

Rising awareness about neurological disorders is beneficial for the neurosurgery market. In most regions, many governmental and non-governmental are carry some awareness programs for the early detection of neurological conditions.

Challenge

- Alternative treatments for neurological disease

Drug therapies are the first line of treatment for the treatment of neurological conditions. Neurosurgical procedures are opted only if non-surgical treatments are not effective. Complementary and alternative treatments are increasingly employed to supplement neurosurgical treatment in neurosurgery. This includes acupuncture, naturopathic medicine, chiropractic treatment, and ayurvedic medicine among others. More recently, doctors have become increasingly receptive to the use of alternative treatments, and scientific studies on the safety and effectiveness of complementary and alternative options are taken through the national institutes of health, which may act as a challenge to the growth of the neurosurgery market.

Thus, alternative treatment options are expected to offer significant challenges for the North America neurosurgical market.

Post-COVID-19 Impact on North America Neurosurgery Market

The COVID-19 outbreak had a drastic effect on North America healthcare, with the U.S. amongst the countries most severely impacted. The pandemic has had a negative impact on the neurosurgery market growth on account of the temporary halt in research activities in this field, coupled with the low influx of patients in hospitals and diagnostic centers. Moreover, the impact of COVID-19 pandemic on neurosurgical products delivery is challenging the neurosurgeons for getting delivery of surgical products.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology in the neurosurgery market.

Recent Developments

- In March 2022, Medtronic, a leader in healthcare technology, announced their first patient implants in the TITAN 2 pivotal study that evaluated the safety and efficacy of Medtronic's investigational implantable tibial neuromodulation (TNM) device in people with overactive bladder (OAB). Implantable TNM has the potential to give relief to millions who suffer from bladder incontinence through a new approach that provides greater convenience and more options for physicians and patients. This will help the company to evaluate the safety and efficacy of its products

- In April 2022, Abbott announced that it had launched an upgraded version of its NeuroSphere myPath digital health app with enhanced functionality that will help doctors more closely track their patients as they trial Abbott neurostimulation devices to address their chronic pain. This upgrade is part of Abbott's commitment to connected care technology and is intended to put people in control of their health and facilitate better communication with their doctors. This has helped the company to enhance its product use by launching the app

North America Neurosurgery Market Scope

The North America neurosurgery market is segmented into product type, application, age group, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Product Type

- Neurosurgery devices

- Neurosurgery software

- Consumables

On the basis of product type, the North America neurosurgery market is segmented into neurosurgery devices, neurosurgery software, and consumables.

By Application

- Aneurysms

- Arteriovenous malformation (AVM)

- Brain tumors

- Carotid artery blockage/stenosis

- Cerebrovascular surgery

- Cortical mapping

- Epilepsy

- Functional neurosurgery

- Intraoperative angiography

- Parkinson's disease and tremors

- Peripheral nerve surgery

- Pituitary tumors

- Radiosurgery

- Skull base surgery

- Spine surgery

- Stereotactic neurosurgery

- Trauma surgery

- Trigeminal neuralgia

- Others

On the basis of application, the North America neurosurgery market is segmented into aneurysms, arteriovenous malformation (AVM), brain tumors, carotid artery blockage/stenosis, cerebrovascular surgery, cortical mapping, epilepsy, functional neurosurgery, intraoperative angiography, Parkinson's disease and tremors, peripheral nerve surgery, pituitary tumors, radiosurgery, skull base surgery, spine surgery, stereotactic neurosurgery, trauma surgery, trigeminal neuralgia, others.

By Age Group

- Pediatric

- Adult

- Geriatric

On the basis of end user, the North America neurosurgery market is segmented into pediatric, adult, and geriatric.

By End User

- Hospitals

- Research centers

- Neurosurgery centers

- Ambulatory surgical centers (ASCS)

- Others

On the basis of end user, the North America neurosurgery market is segmented into hospitals, neurosurgery centers, research centers, ambulatory surgical centers, and others

By Distribution Channel

- Direct tender

- Third party distributors

- Others

On the basis of distribution channel, the North America neurosurgery market is segmented into direct tender, third party distributors, and others.

North America Neurosurgery Market Regional Analysis/Insights

The North America neurosurgery market is analyzed, and market size information is provided by product type, application, age group, end user, and distribution channel.

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, North America is expected to dominate due to the presence of key market players in the largest consumer market with high GDP. The U.S is expected to dominate the North America neurosurgery market and grow due to the rise in technological advancement in neurosurgical equipment.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米の脳神経外科市場シェア分析

北米の脳神経外科市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、北米の脳神経外科市場への会社の重点にのみ関連しています。

北米の脳神経外科市場で活動している主要企業としては、Medtronic、Abbott、Boston Scientific Corporation、Elekta、ALEVA NEUROTHERAPEUTICS、Brainlab AG、adeor medical AG、LivaNova PLC、B. Braun SE、Terumo Medical Corporation、Integra LifeSciences、Stryker、Penumbra, Inc.、KARL STORZ SE & Co. KG、Renishaw plc.、Inomed Medizintechnik GmbH、ANT Neuro、Leica Microsystems などがあります。

調査方法: 北米脳神経外科市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA NEUROSURGERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 REGULATIONS OF THE NORTH AMERICA NEUROSURGERY MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 TECHNOLOGICAL ADVANCEMENT IN NEUROSURGERY

6.1.2 RISING PREVALENCE OF NEUROLOGICAL CONDITIONS

6.1.3 DEVELOPMENTS IN SURGICAL EQUIPMENT

6.2 RESTRAINTS

6.2.1 THE HIGH COST ASSOCIATED WITH NEUROSURGERIES AND EQUIPMENT

6.2.2 UNFAVOURABLE REIMBURSEMENT POLICIES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS ABOUT NEUROLOGICAL DISORDERS

6.3.2 INCREASING NUMBER OF KEY PLAYERS IN MARKET

6.3.3 ADVANCE PRODUCT DEVELOPMENT AND LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 ALTERNATIVE TREATMENTS FOR NEUROLOGICAL DISEASE

6.4.2 STRINGENT REGULATIONS FOR APPROVAL OF MEDICAL DEVICES

7 NORTH AMERICA NEUROSURGERY MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 NEUROSURGERY DEVICES

7.2.1 NEUROMODULATION DEVICES

7.2.1.1 INTERNAL NEUROMODULATION DEVICES

7.2.1.1.1 SPINAL CORD STIMULATION DEVICES

7.2.1.1.1.1 RECHARGEABLE

7.2.1.1.1.2 NON- RECHARGEABLE

7.2.1.1.2 DEEP BRAIN STIMULATION DEVICES

7.2.1.1.2.1 SINGLE-CHANNEL DEEP BRAIN STIMULATION

7.2.1.1.2.2 DUAL-CHANNEL DEEP BRAIN STIMULATION

7.2.1.1.3 SACRAL NERVE STIMULATION DEVICES

7.2.1.1.3.1 IMPLANTABLE

7.2.1.1.3.2 EXTERNAL

7.2.1.1.4 VAGUS NERVE STIMULATION DEVICES

7.2.1.1.4.1 INVASIVE

7.2.1.1.4.2 EXTERNAL

7.2.1.1.5 GASTRIC ELECTRICAL STIMULATION DEVICES

7.2.1.1.5.1 LOW FREQUENCY GASTRIC ELECTRICAL STIMULATORS

7.2.1.1.5.2 HIGH FREQUENCY GASTRIC ELECTRICAL STIMULATORS

7.2.1.1.6 EXTERNAL NEUROMODULATION DEVICES

7.2.1.1.6.1 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

7.2.1.1.6.2 TRANSCRANIAL MAGNETIC STIMULATION (TMS)

7.2.1.1.6.3 OTHERS

7.2.2 NEURO-INTERVENTIONAL DEVICES

7.2.2.1 EMBOLIZATION COILS

7.2.2.1.1 DETACHABLE

7.2.2.1.2 PUSHABLE

7.2.2.2 CAROTID STENTS

7.2.2.3 INTRACRANIAL STENTS

7.2.2.4 NEUROVASCULAR THROMBECTOMY

7.2.2.4.1 COIL RETRIEVERS

7.2.2.4.2 ASPIRATION DEVICES

7.2.2.4.3 STENT RETRIEVERS

7.2.2.5 INTRASSACULAR DEVICES

7.2.2.6 BALLOONS

7.2.2.7 OTHERS

7.2.3 NEUROSURGERY SURGICAL POWER TOOLS

7.2.3.1 DRILL

7.2.3.1.1 PNEUMATIC NEUROSURGICAL DRILLS

7.2.3.1.2 ELECTRICAL NEUROSURGICAL DRILLS

7.2.3.2 SAW

7.2.3.3 OTHERS

7.2.4 NEUROSURGICAL NAVIGATION SYSTEMS

7.2.5 CEREBROSPINAL FLUID (CSF) MANAGEMENT DEVICES

7.2.5.1 CSF SHUNTS

7.2.5.2 EXTERNAL DRAINAGE SYSTEM

7.2.6 NEUROSURGICAL MICROSCOPE

7.2.7 CRANIAL STABILIZATION

7.2.8 NEUROENDOSCOPY DEVICES

7.2.9 INTRA OPERATIVE IMAGING

7.2.10 BRAIN MONITORING

7.2.11 NEUROSURGICAL EVACUATION DEVICES

7.2.12 STEREOTACTIC SYSTEMS

7.2.13 ULTRASONIC ASPIRATOR

7.2.14 BIPOLAR EQUIPMENT

7.3 NEUROSURGERY SOFTWARE

7.3.1 IMAGING NEUROSURGERY SOFTWARE

7.3.2 PRE-OPERATION PLANNING NEUROSURGERY SOFTWARE

7.3.3 OTHERS

7.4 CONSUMABLES

8 NORTH AMERICA NEUROSURGERY MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 PEDIATRIC

8.3 ADULT

8.4 GERIATRIC

9 NORTH AMERICA NEUROSURGERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BRAIN TUMORS

9.3 TRAUMA SURGERY

9.4 SPINE SURGERY

9.5 PARKINSON’S DISEASE AND TREMORS

9.6 PERIPHERAL NERVE SURGERY

9.7 EPILEPSY

9.8 FUNCTIONAL NEUROSURGERY

9.9 CAROTID ARTERY BLOCKAGE/STENOSIS

9.1 INTRAOPERATIVE ANGIOGRAPHY

9.11 CEREBROVASCULAR SURGERY

9.12 ANEURYSMS

9.13 PITUITARY TUMORS

9.14 RADIOSURGERY

9.15 STEREOTACTIC NEUROSURGERY

9.16 CORTICAL MAPPING

9.17 ARTERIOVENOUS MALFUNCTION (AVM)

9.18 SKULL BASE SURGERY

9.19 TRIGEMINAL NEURALGIA

9.2 OTHERS

10 NORTH AMERICA NEUROSURGERY MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 ACUTE CARE HOSPITALS

10.2.2 LONG-TERM CARE HOSPITALS

10.2.3 NURSING FACILITIES

10.2.4 REHABILITATION CENTERS

10.3 RESEARCH CENTERS

10.4 NEUROSURGERY CENTERS

10.5 AMBULATORY SURGICAL CENTERS (ASCS)

10.6 OTHERS

11 NORTH AMERICA NEUROSURGERY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 NORTH AMERICA NEUROSURGERY MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA NEUROSURGERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MEDTRONIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 STRYKER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ABBOTT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 INTEGRA LIFESCIENCES (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ADEOR MEDICAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ADVANTIS MEDICAL IMAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALEVA NEUROTHERAPEUTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ANT NEURO

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 B. BRAUN SE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 BIOINDUCTION

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BRAINLAB AG

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ELEKTA

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMS HANDELS GESELLSCHAFT MBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 INOMED MEDIZINTECHNIK GMBH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 KARL STORZ SE & CO. KG

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 LEICA MICROSYSTEMS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 LIVANOVA PLC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 NEVRO CORP.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 OPTOFINE INSTRUMENTS PVT. LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 PENUMBRA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 RENISHAW PLC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 SYNAPSE BIOMEDICAL INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 TERUMO MEDICAL CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENTS

15.25 MACHIDA ENDOSCOPE CO., LTD.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 NALU MEDICAL, INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 WALLABY MEDICAL

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA NEUROSURGERY DEVICES IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA NEUROSURGERY DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA INTERNAL NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SPINAL CORD STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA DEEP BRAIN STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SACRAL NERVE STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA VAGUS NERVE STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA EXTERNAL NEUROMODULATION DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA NEURO-INTERVENTIONAL DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA EMBOLIZATION COILS IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA NEUROVASCULAR THROMBECTOMY IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA NEUROSURGICAL POWER TOOLS IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRILL IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CEREBROSPINAL FLUID (CSF) MANAGEMENT DEVICES IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NEUROSURGERY SOFTWARE IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA NEUROSURGERY SOFTWARE IN NEUROSURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONSUMABLES IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEUROSURGERY MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PEDIATRIC IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADULT IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA GERIATRIC IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA NEUROSURGERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BRAIN TUMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA TRAUMA SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SPINE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA PARKINSON’S DISEASE AND TREMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PERIPHERAL NERVE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA EPILEPSY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA FUNCTIONAL NEUROSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CAROTID ARTERY BLOCKAGE/STENOSIS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INTERAOPERATIVE ANGIOGRAPHY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CEREBROVASCULAR SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ANEURYSMS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PITUITARY TUMORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA RADIOSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA STEREOTACTIC NEUROSURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORTICAL MAPPING IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ARTERIOVENOUS MALFUNCTION (AVM) IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA SKULL BASE SURGERY IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA TRIGEMINAL NEURALGIA IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA NEUROSURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN NEUROSURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA RESEARCH CENTERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA NEUROSURGERY CENTERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA AMBULATORY SURGICAL CENTERS (ASCS) IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA NEUROSURGERY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DIRECT TENDER IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA OTHERS IN NEUROSURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA NEUROSURGERY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA NEUROSURGERY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NEUROSURGERY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NEUROSURGERY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NEUROSURGERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NEUROSURGERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA NEUROSURGERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA NEUROSURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA NEUROSURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA NEUROSURGERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING PREVALENCE OF NEUROLOGICAL DISEASES, EFFORTS TO DEVELOP THE APPLICATION BASE FOR NEUROMODULATION, AND THE BENEFITS OF NEUROENDOSCOPIC SURGERIES OVER CONVENTIONAL BRAIN SURGERIES ARE EXPECTED TO DRIVE THE NORTH AMERICA NEUROSURGERY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NEUROSURGERY DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA NEUROSURGERY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND, CHALLENGES OF NORTH AMERICA NEUROSURGERY MARKET

FIGURE 14 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA NEUROSURGERY MARKET: BY AGE GROUP, 2021

FIGURE 19 NORTH AMERICA NEUROSURGERY MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA NEUROSURGERY MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA NEUROSURGERY MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 22 NORTH AMERICA NEUROSURGERY MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA NEUROSURGERY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA NEUROSURGERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA NEUROSURGERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA NEUROSURGERY MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA NEUROSURGERY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA NEUROSURGERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA NEUROSURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 NORTH AMERICA NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA NEUROSURGERY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA NEUROSURGERY MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA NEUROSURGERY MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA NEUROSURGERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA NEUROSURGERY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 39 NORTH AMERICA NEUROSURGERY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。