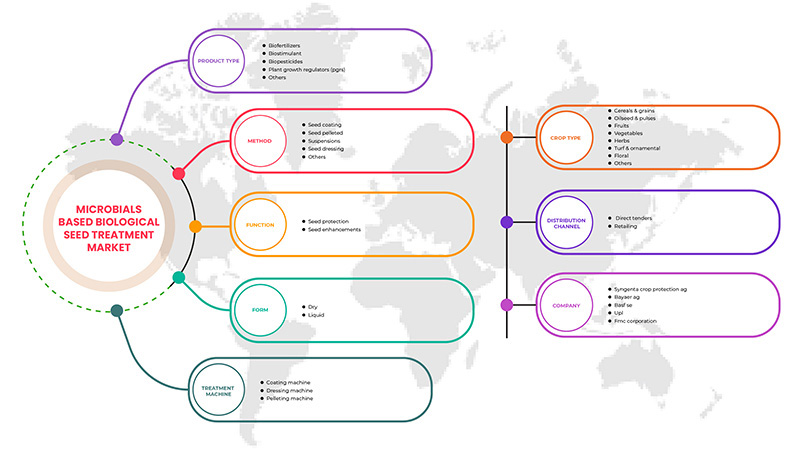

北米の微生物ベースの生物学的種子処理市場、製品別(バイオ肥料、バイオ刺激剤、バイオ農薬、植物成長調整剤(PGR)、その他)、形態別(乾燥および液体)、方法別(種子コーティング、種子ペレット、懸濁液、種子ドレッシング、その他)、処理機械別(コーティング機、ドレッシング機、ペレット化機)、機能別(種子保護、種子エンチャント)、流通チャネル別(直接入札、小売)、作物タイプ別(穀類、油糧種子、豆類、果物、野菜、ハーブ、芝生および観賞用、花卉、その他)業界動向および2029年までの予測。

北米の微生物ベースの生物学的種子処理市場の分析と洞察

化学的に栽培された食品に関連するアレルギーの増加、買収および合併の増加。多くの企業が主要なグローバル企業と提携してバイオ農薬、バイオ刺激剤などの多くの有機およびバイオベースの種子処理製品を発売し、その存在感を拡大して地域全体で製品を利用できるようにすることで、市場の成長が促進されると予想されます。

例えば、

- 2022年2月、ヴァレントバイオサイエンスは、親会社である住友化学の2050年までのカーボンニュートラルの目標をサポートする新しいバイオ刺激剤事業部門を設立しました。この新しい事業部門は、この重要かつ急速に成長している作物生産セグメントにおいて、米国および世界市場向けに、社内および社外で開発された新しい製品でバイオ刺激剤ラインを拡大するように設計されています。

買収と提携により、今後数年間の市場成長が促進されます。一方、有機食品、自然栽培、バイオベースの農薬の使用率が高いため、この地域の市場成長は制限される可能性があります。

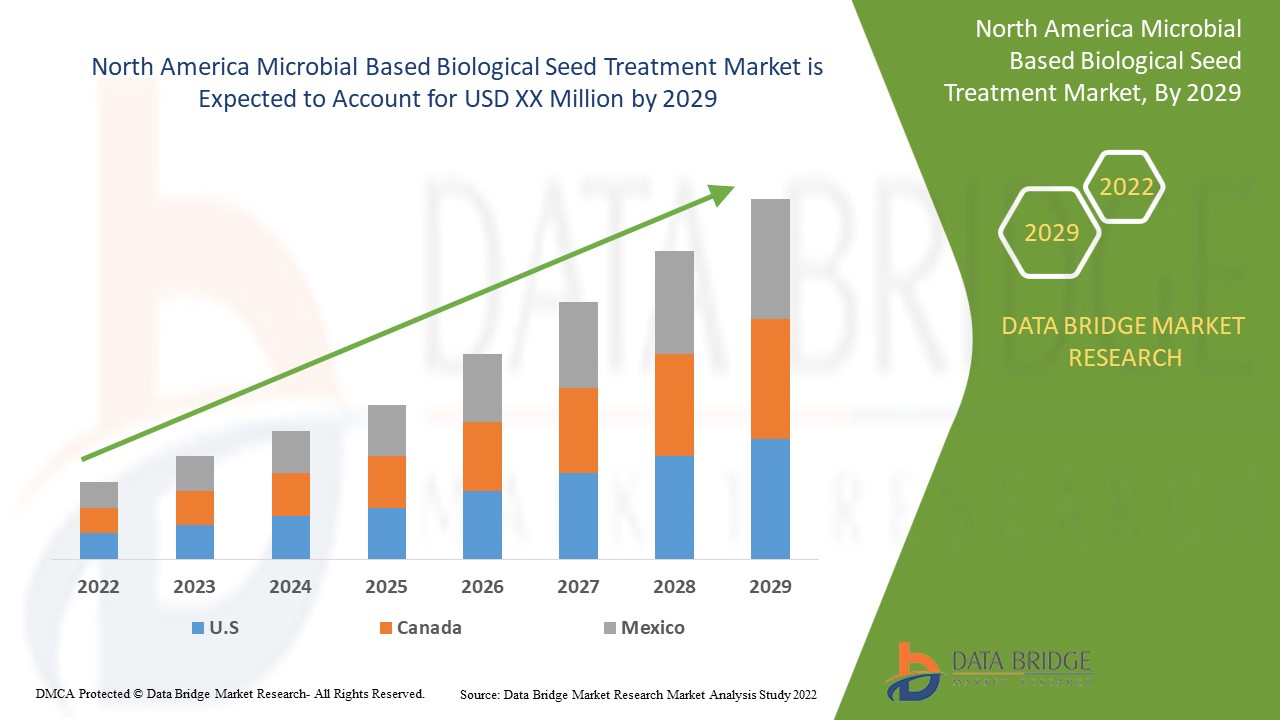

Data Bridge Market Research は、北米の微生物ベースの生物学的種子処理市場は、2022 年から 2029 年の予測期間中に 11.3% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品別(バイオ肥料、バイオ刺激剤、バイオ農薬、植物成長調整剤(PGR)、その他)、形態別(乾燥および液体)、方法別(種子コーティング、種子ペレット、懸濁液、種子ドレッシング、その他)、処理機械別(コーティング機、ドレッシング機、ペレット化機)、機能別(種子保護、種子強化)、流通チャネル別(直接入札、小売)、作物タイプ別(穀類、油糧種子、豆類、果物、野菜、ハーブ、芝生および観賞用、花卉、その他)。 |

|

対象地域 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

Syngenta Crop Protection AG、Bayer AG、BASF SE、UPL、FMC Corporation、ADAMA、Albaugh, LLC.、Arysta LifeScience Corporation、BioWorks Inc.、Croda International Plc、Germains Seed Technology、Hello Nature International、Koppert、Marrone Bio Innovations, Inc.、Novozymes、Plant Health Care plc. 、T.Stanes and Company Limited、Tagros Chemicals India Pvt. Ltd.、Valent BioSciences LLC、Verdesian Life Sciences など。 |

市場の定義

生物学的種子処理は、生きた微生物、植物抽出物、発酵産物、植物ホルモン、さらにはハードケミストリーを含む有効成分を含む幅広いクラスの製品です。生物学的物質は、粉末または液体の形で種子に適用されます。均一なコーティングが種子全体を覆います。このようにして、種子は必要なときに有益な成分を利用できるようになります。生物学的種子処理の有効成分には、真菌や細菌などの微生物、植物抽出物、藻類抽出物が含まれます。アーバスキュラー菌根菌、トリコデルマ属、根粒菌、その他の細菌由来の有益な微生物は、発芽を促進するために播種前に種子に適用されます。生物学的種子で処理された作物は、バイオ刺激剤として機能し、より強く、より生産的になります。この処理により、農業生産量が増加し、植物が病気から身を守り、生物的ストレスを軽減するのに役立ちます。植物の成長をサポートする微生物は根に定着し、生育期全体を通じて作物を保護します。微生物ベースの生物学的種子処理の用途は多岐にわたります。

北米の微生物ベースの生物学的種子処理市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

-

農業用生物由来植物成長製品の発売増加

バイオ殺虫剤、バイオネマチサイド、バイオ殺菌剤、バイオ除草剤などのバイオ農薬の製造業者による発売数の増加は、市場成長の主な原動力の 1 つです。農作物や環境に対する化学農薬の有害な影響に関する意識が高まるにつれて、農業実践のための有機または天然および生物学的製品の需要が農家の間で高まっています。この要因は市場の成長を推進します。農家は、生産性を高め、汚染を減らすことで環境をサポートするために、天然源から抽出され、簡単に分解される農薬を採用しています。

例えば、

-

マイスターメディアワールドワイドによると、2021年3月、ボタニカルソリューション社とシンジェンタは、ボトリティスシネレアの防除に役立つボトリストップというバイオ殺菌剤をメキシコで発売した。

-

アグロスペクトラム・インディアによると、2020年3月、バイエルAGは中国でバイオ殺菌剤セレナーデを発売した。

-

2020年4月、シンジェンタはノボザイムズと提携し、TAEGROという名のバイオ殺菌剤を商品化した。

The increase in the number of launches by the major manufacturers with the growing demand for natural and biological seed treatment products among farmers to support the sustainable farming practice may drive the growth of the microbials based biological seed treatment market.

Opportunities

- Strategic initiatives taken by companies

The use of microorganisms as biological alternatives is becoming increasingly crucial due to the growing public and regulatory pressure to reduce the use of chemical pesticides. Microorganisms can function as biostimulants and effectively against various pests by making it easier for plants to access and absorb soil-bound nutrients, boosting their tolerance to environmental stress, and assisting them during different growth phases.

Companies are making strategies, launches, and plans to fulfill consumer demands and raise awareness toward sustainable agriculture, providing more opportunities for manufacturers to expand.

Companies in Vietnam have always focused on introducing innovative solutions to help farmers tackle challenges in their daily activities and, at the same time, increase crop yields and quality while being environmentally friendly. Launching new products and technologies harness innovation and address challenges in agriculture.

For instance,

- In June 2022, Syngenta launched its new seed treatment product VICTRATO. The revolutionary nematode control product VICTRATO is based on Syngenta's TYMIRIUMTM technology and offers a creative approach to the challenging issue. All major nematode species and fungal diseases are efficiently controlled without compromising the health of the soil or plants. It is a very simple product with a minimal active ingredient dosage

- In March 2022, Evonik's introduced BREAK-THRU Products for seed treatment applications. BREAK-THRU BP 787 is a biodegradable, microplastic-free substitute for conventional binder solutions. BREAK-TRHU BP 787 functions as a binding component when combined with silica (such as Aerosil 200) because of its miscibility with water

- In July 2021, Rizobacter and Marrone Bio expanded their strategic alliance to provide a new seed treatment in Brazil. Rizonem, a biological seed treatment for nematodes and soil-dwelling insects, will be available in Brazil's row crops through an expanded distribution arrangement. The effectiveness of Rizonema against important nematode species in soybeans and corn has been demonstrated in numerous regulatory trials in Brazil.

Thus, companies' strategic innovations and new products to meet consumer demands promote market growth in the forecast period.

Restraints/Challenges

- Government Regulatory barriers for biological seed treatment products

Different nations and regions have different regulatory environments for active biological components. In some countries, biologicals must be registered under specific laws, or they could be registered similarly to chemical plant protection products. Sometimes there are fewer data requirements, and other times there might not even be a clearly defined registration process. The EU demands that a biopesticides product's efficacy be quantified and demonstrated to support label claims. Only permitted biopesticides can be lawfully utilized for crop protection. According to OECD recommendations, biopesticides should only be approved if they pose little risk.

Furthermore, the biopesticides registration data portfolio required by the regulator is typically a modified version of the one in existence for conventional chemical pesticides. It is utilized by the regulator to perform a risk assessment. It contains details on the method of action, toxicological and ecotoxicological assessments, host range tests, and other factors. The cost of producing this data may discourage businesses from commercializing biopesticides, which are often niche market products.

Therefore, not having an appropriate system for biopesticide registration ensures the safety and does not inhibit commercialization which may negatively impact the microbials based biological seed treatment market.

Post COVID-19 Impact on North America Microbial Based Biological Seed Treatment market

Post the pandemic, the demand for biological seed treatment has increased as there won't be any restrictions on movement, so the supply of products would be easy. In addition, the growing trend of using bio-based organic and natural seed treatment products may propel the market's growth.

The increased demand for microbials based biological seed treatment enables manufacturers to launch innovative and multifunctional seed treatment products, which ultimately increases the demand for microbial based biological seed treatment and has helped the market grow.

Moreover, the high demand for biological seed treatment products will drive the market's growth. Furthermore, the increased demand for organic and natural products after the COVID-19 pandemic resulted in market growth, as consumers were more concerned about their health. Additionally, consumers' interest in new technologies and multipurpose products is expected to fuel the growth of North America microbial based biological seed treatment market.

Recent Developments

- In March 2022, UPL partnered with Kimitec's MAAVi Innovation Center to commercialize North American biostimulant products. This collaboration with the company and its R&D Center MAAVi broadens the offerings that UPL will deliver to support sustainable food production while driving greater profitability for growers

- 2022年2月、ヴァレント・バイオサイエンスは、親会社である住友化学の2050年までのカーボンニュートラルの目標をサポートする新しいバイオ刺激剤事業部門を設立しました。この新しい事業部門は、この重要かつ急成長している作物生産セグメントにおいて、米国および世界市場向けに、社内および社外で開発された新しい製品でバイオ刺激剤のラインを拡大するように設計されています。

北米の微生物ベースの生物学的種子処理市場の範囲

北米の微生物ベースの生物学的種子処理市場は、製品、形態、方法、処理機械、機能、流通チャネル、および作物の種類に基づいてセグメント化されています。これらのセグメントの成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品

- バイオ肥料

- 生体刺激剤

- 生物農薬

- 植物成長調整剤(PGR)

- その他

製品に基づいて、北米の微生物ベースの生物学的種子処理市場は、バイオ肥料、バイオ刺激剤、バイオ農薬、植物成長調整剤(PGR)、その他に分類されます。

形状

- ドライ

- 液体

形態に基づいて、北米の微生物ベースの生物学的種子処理市場は、乾燥型と液体型に分類されます。

方法

- 種子コーティング

- 種子ペレット

- サスペンション

- 種子処理

- その他

方法に基づいて、北米の微生物ベースの生物学的種子処理市場は、種子コーティング、種子ペレット、懸濁液、種子ドレッシング、その他に分類されます。

治療機器

- コーティングマシン

- ドレッシングマシン

- ペレット製造機

処理機械に基づいて、北米の微生物ベースの生物学的種子処理市場は、コーティング機械、ドレッシング機械、およびペレット化機械に分類されます。

関数

- 種子保護

- シード強化

機能に基づいて、北米の微生物ベースの生物学的種子処理市場は、種子保護と種子強化に分類されます。

流通チャネル

- 直接入札

- 小売業

流通チャネルに基づいて、北米の微生物ベースの生物学的種子処理市場は、直接入札と小売に分類されます。

作物の種類

- シリアル・穀物

- 油糧種子および豆類

- 果物

- 野菜

- ハーブ

- 芝生と観賞用植物

- 花柄

- その他

作物の種類に基づいて、北米の微生物ベースの生物学的種子処理市場は、穀類および穀物、油糧種子および豆類、果物、野菜、ハーブ、芝生および観賞用植物、花卉、その他に分類されます。

北米の微生物ベースの生物学的種子処理市場の地域分析/洞察

北米の微生物ベースの生物学的種子処理市場が分析され、上記に基づいて市場規模の洞察と傾向が提供されます。

北米微生物ベースの生物学的種子処理市場レポートでカバーされている国は、米国、カナダ、メキシコです。

米国は、市場シェアと収益の面で、北米の微生物ベースの生物学的種子処理市場を支配すると予想されています。化学的に栽培された食品に関連するアレルギーの増加、北米地域での買収および合併の増加により、予測期間中、その優位性を維持すると予測されています。

レポートの地域セクションでは、市場の現在および将来の傾向に影響を与える個々の市場影響要因と規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、北米ブランドの存在と入手可能性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境と北米の微生物ベースの生物学的種子処理市場シェア分析

競争の激しい北米の微生物ベースの生物学的種子処理市場は、競合他社に関する詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。上記のデータ ポイントは、北米の微生物ベースの生物学的種子処理市場に対する会社の重点にのみ関連しています。

北米の微生物ベースの生物学的種子処理市場で活動している主要企業には、Syngenta Crop Protection AG、Bayer AG、BASF SE、UPL、FMC Corporation、ADAMA、Albaugh, LLC.、Arysta LifeScience Corporation、BioWorks Inc.、Croda International Plc、Germains Seed Technology、Hello Nature International、Koppert、Marrone Bio Innovations, Inc.、Novozymes、Plant Health Care plc. 、T.Stanes and Company Limited、Tagros Chemicals India Pvt. Ltd.、Valent BioSciences LLC、Verdesian Life Sciences などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 RECOMMENDATIONS FROM FAMILY, FRIENDS, AND DEALERS -

4.2.2 RESEARCH

4.2.3 IMPULSIVE

4.2.4 ADVERTISEMENT:

4.2.4.1 TELEVISION ADVERTISEMENT

4.2.4.2 ONLINE ADVERTISEMENT

4.2.4.3 IN-STORE ADVERTISEMENT

4.2.4.4 OUTDOOR ADVERTISEMENT

4.3 FACTORS INFLUENCING PURCHASING DECISION

4.3.1 SUSTAINABLE AGRICULTURE

4.3.2 NEW COMBINATIONS

4.3.3 BIOSTIMULANTS

4.4 NEW PRODUCT LAUNCH STRATEGY

4.4.1 OVERVIEW

4.4.2 NUMBER OF PRODUCT LAUNCHES

4.4.2.1 LINE EXTENSION

4.4.2.2 NEW PACKAGING

4.4.2.3 RE-LAUNCHED

4.4.2.4 NEW FORMULATION

4.4.3 DIFFERENTIAL PRODUCT OFFERING

4.4.4 MEETING CONSUMER REQUIREMENT

4.4.5 PACKAGE DESIGNING

4.4.6 PRODUCT POSITIONING

4.4.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING PROCESS

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 REGULATORY FRAMEWORK

6.1 BIOSCIENCE SOLUTIONS

6.1.1 U.S.

6.1.2 NCBI

6.1.3 FSSAI

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES

7.1.2 INCREASE IN LAUNCHES OF BIOLOGICAL PLANT GROWTH PRODUCTS FOR AGRICULTURE

7.1.3 INCLINATION TOWARD THE SUSTAINABLE AGRICULTURE

7.1.4 GROWING ADOPTION OF ORGANIC FARMING

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF MICROBES

7.2.2 GOVERNMENT REGULATORY BARRIERS FOR BIOLOGICAL SEED TREATMENT PRODUCTS

7.3 OPPORTUNITIES

7.3.1 BIOENCAPSULATION TECHNOLOGY FOR BIOLOGICAL SEED TREATMENT

7.3.2 RISE IN ENVIRONMENTAL POLLUTION CAUSED BY CHEMICAL PESTICIDES

7.3.3 RISE IN AWARENESS ABOUT BIOSTIMULANTS

7.3.4 STRATEGIC INITIATIVES TAKEN BY COMPANIES

7.4 CHALLENGES

7.4.1 HIGH PRICES OF BIOPESTICIDES

7.4.2 AVAILABILITY OF CHEMICAL-BASED SUBSTITUTES

8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BIO PESTICIDES

8.2.1 BIO INSECTICIDES

8.2.1.1 BACILLUS THURINGIENSIS

8.2.1.2 METARHIZIUM ANISOPLIAE

8.2.1.3 BEAUVERIA BASSIANA

8.2.1.4 VERTICILLIUM LECANII

8.2.1.5 BACULOVIRUS

8.2.1.6 OTHERS

8.2.2 BIO FUNGICIDES

8.2.2.1 BACILLUS

8.2.2.2 TRICHODERMA VIRIDE

8.2.2.3 PSEUDOMONAS

8.2.2.4 STREPTOMYCES

8.2.2.5 TRICHODERMA HARZIANUM

8.2.2.6 OTHERS

8.2.3 BIONEMATICIDES

8.2.3.1 BACILLUS FIRMUS

8.2.3.2 OTHERS

8.2.4 BIO HERBICIDES

8.3 BIO STIMULANTS

8.4 BIO FERTILIZERS

8.4.1 NITROGEN FIXING BIO FERTILIZERS

8.4.1.1 RHIZOBIA BACTERIA

8.4.1.2 AZOSPIRILLUM

8.4.1.3 FRAMKIA

8.4.2 OTHERS

8.5 PLANT GROWTH REGULATORS (PGRS)

8.6 OTHERS

9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.2.1 WETTABLE POWDER

9.2.2 DRY GRANULES

9.2.3 WATER DIPS

9.3 LIQUID

9.3.1 SUSPENSION CONCENTRATE

9.3.2 EMULSIFIABLE CONCENTRATE

9.3.3 SOLUBLE LIQUID CONCENTRATE

10 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD

10.1 OVERVIEW

10.2 SEED DRESSING

10.3 SEED COATING

10.3.1 FILM COATED

10.3.2 BIOPRIMED

10.3.3 SLURRY COATED

10.4 SEED PELLETED

10.5 SUSPENSIONS

10.5.1 BACTERIAL SUSPENSION

10.5.2 SPORE SUSPENSION

10.5.3 CONIDIAL SUSPENSION

10.6 OTHERS

11 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINE

11.1 OVERVIEW

11.2 DRESSING MACHINE

11.3 COATING MACHINE

11.4 PELLETING MACHINE

12 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 SEED PROTECTION

12.2.1 DISEASE CONTROL

12.2.2 INVERTEBRATE PEST CONTROL

12.2.3 WEED CONTROL

12.3 SEED ENHANCEMENTS

12.3.1 SEED PRIMING

12.3.1.1 IMPROVED YIELD

12.3.1.2 DROUGHT RESISTANCE

12.3.1.3 SALINITY RESISTANCE

12.3.1.4 OTHERS

12.3.2 SEED DISINFECTION

13 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAILING

14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE

14.1 OVERVIEW

14.2 CEREALS & GRAINS

14.2.1 WHEAT

14.2.2 RICE

14.2.3 MAIZE

14.2.4 BARLEY

14.2.5 OTHER

14.3 OILSEED & PULSES

14.3.1 SOYBEAN

14.3.2 COTTONSEED

14.3.3 PEANUT

14.3.4 RAPESEED

14.3.5 PEA

14.3.6 GRAM

14.3.7 CHICKPEAS

14.3.8 LENTIL

14.3.9 OTHERS

14.4 FRUITS

14.4.1 BANANA

14.4.2 APPLE

14.4.3 ORANGE

14.4.4 GRAPES

14.4.5 STRAWBERRIES

14.4.6 PINEAPPLE

14.4.7 MANGOES

14.4.8 POMEGRANATE

14.4.9 PEACH

14.4.10 PASSIONFRUIT

14.4.11 WATERMELON

14.4.12 OTHERS

14.5 VEGETABLES

14.5.1 SOLANAECEOUS

14.5.1.1 EGGPLANT

14.5.1.2 PEPPER

14.5.1.3 TOMATO

14.5.1.4 OTHERS

14.5.2 CUCURBITS

14.5.2.1 CUCUMBER

14.5.2.2 ZUCCHINI

14.5.2.3 BITTERGOURD

14.5.2.4 BOTTLEGOURD

14.5.2.5 SQUASH

14.5.2.6 OTHERS

14.5.3 ROOT & BULB

14.5.3.1 CARROTS

14.5.3.2 BEET ROUTE

14.5.3.3 ONION

14.5.3.3.1 RED ONION

14.5.3.3.2 WHITE ONION

14.5.3.4 RADISHES

14.5.3.5 RUTABAGA

14.5.3.6 OTHERS

14.5.4 BRASSICA

14.5.4.1 CABBAGE

14.5.4.2 PAK CHOI

14.5.4.3 SPINACH

14.5.4.4 CAULIFLOWER

14.5.4.5 LETTUCE

14.5.4.6 BROCCOLI

14.5.4.7 ARUGULA

14.5.4.8 MUSTARD

14.5.4.9 OTHERS

14.5.5 LARGE CROPS

14.5.5.1 BEAN

14.5.5.2 SWEETCORN

14.5.5.3 BABYCORN

14.5.5.4 OTHERS

14.6 HERBS

14.6.1 BASIL

14.6.2 CILANTRO

14.6.3 PARSLEY

14.6.4 DILL

14.6.5 OTHERS

14.7 FLORAL

14.8 TURF & ORNAMENTAL

14.9 OTHERS

15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SYNGENTA CROP PROTECTION AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BAYER AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 BASF SE

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 UPL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 FMC CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 ALBAUGH, LLC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 ARYSTA LIFESCIENCE CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BIOWORKS INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 CRODA INTERNATIONAL PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GERMAINS SEED TECHNOLOGY

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLO NATURE INTERNATIONAL

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 KOPPERT

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MARRONE BIO INNOVATIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 NOVOZYMES

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PLANT HEALTH CARE PLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 TAGROS CHEMICALS INDIA PVT. LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 T.STANES AND COMPANY LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 VALENT BIOSCIENCES LLC

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VERDESIAN LIFE SCIENCES

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表のリスト

TABLE 1 PRICES OF BIOPESTICIDES

TABLE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIO STIMULANTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT GROWTH REGULATORS (PGRS) IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEED DRESSING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SEED PELLETED IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SUSPENSION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DRESSING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA COATING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PELLETING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SEED PRIMING IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIRECT TENDERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETAILING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION))

TABLE 45 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLORAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA TURF & ORNAMENTAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 60 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 U.S. BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.S. BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 U.S. DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 101 U.S. LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 103 U.S. SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 104 U.S. SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 105 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 106 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 107 U.S. SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 108 U.S. SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 109 U.S. SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 110 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.S. ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.S. ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.S. BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.S. LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.S. HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 CANADA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 CANADA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 CANADA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 CANADA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 CANADA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 CANADA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 131 CANADA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 CANADA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 134 CANADA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 135 CANADA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 136 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 137 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 138 CANADA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 CANADA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 CANADA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 150 CANADA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 151 CANADA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 153 CANADA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 MEXICO BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 MEXICO NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 MEXICO BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 MEXICO BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 MEXICO BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 160 MEXICO BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 MEXICO DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 MEXICO LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 165 MEXICO SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 166 MEXICO SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 167 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 168 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 170 MEXICO SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 171 MEXICO SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES DRIVING THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 11 BIOPESTICIDES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

FIGURE 15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT, 2021

FIGURE 16 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY FORM, 2021

FIGURE 17 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY METHOD, 2021

FIGURE 18 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY TREATMENT MACHINES, 2021

FIGURE 19 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET: BY FUNCTION, 2021

FIGURE 20 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY CROP TYPE, 2021

FIGURE 22 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。