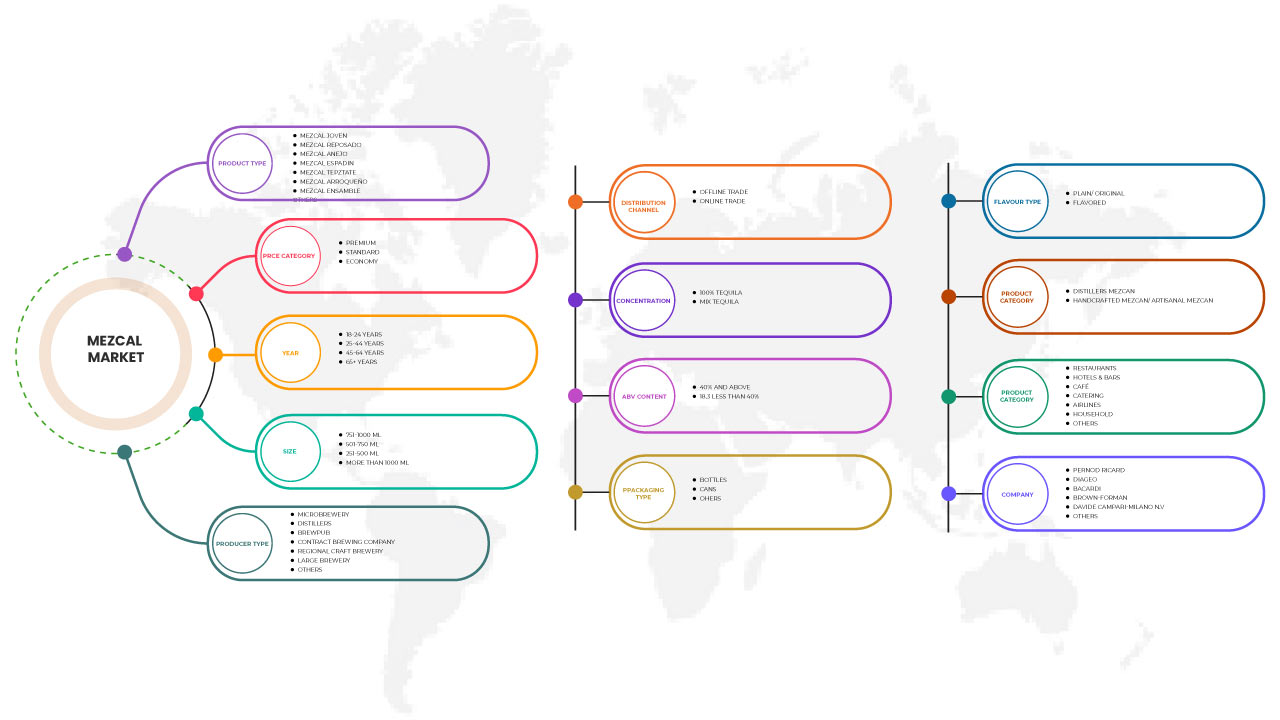

北米メスカル市場、製品タイプ別(メスカル ホベン、メスカル レポサド、メスカル アネホ、メスカル エスパディン、メスカル テプスタテ、メスカル アロケーニョ、メスカル アンサンブルなど)、濃縮度(100% テキーラとミックス テキーラ)、価格帯別(プレミアム、スタンダード、エコノミー)、アルコール度数(40% 以上と 40% 未満)、年別(18~24、25~44、45~64、65 歳以上)、パッケージ タイプ別(ボトル、缶など)、サイズ別(251~500 ml、501~750 ml、751~1000 ml、100 ml 以上)、フレーバー タイプ別(プレーン/オリジナルとフレーバー付き)、生産者タイプ別(地ビール醸造所、蒸留酒製造所、ブリューパブ、契約醸造会社、地域クラフトビール醸造所、大規模醸造所など)、製品カテゴリー(蒸留所のメズカンと手作りのメズカン/職人のメズカン)、エンドユーザー(レストラン、ホテル、バー、カフェ、ケータリング、航空会社、家庭用品など)、流通チャネル(オフライン取引とオンライン取引) - 2029年までの業界動向と予測。

北米メスカル市場の分析と規模

メスカル飲料に対する消費者の需要の増加、先進的でスマートなパッケージングソリューションに対する前向きな見通し、および生産ユニット数の増加は、予測期間中のメスカル市場の需要を促進しています。ただし、重い課税と関税、厳格な規則と規制は、予測期間中のメスカル市場の成長を妨げると予想されます。

企業が世界規模で事業を拡大しようとする動きが高まることで、市場の成長が促進されるでしょう。

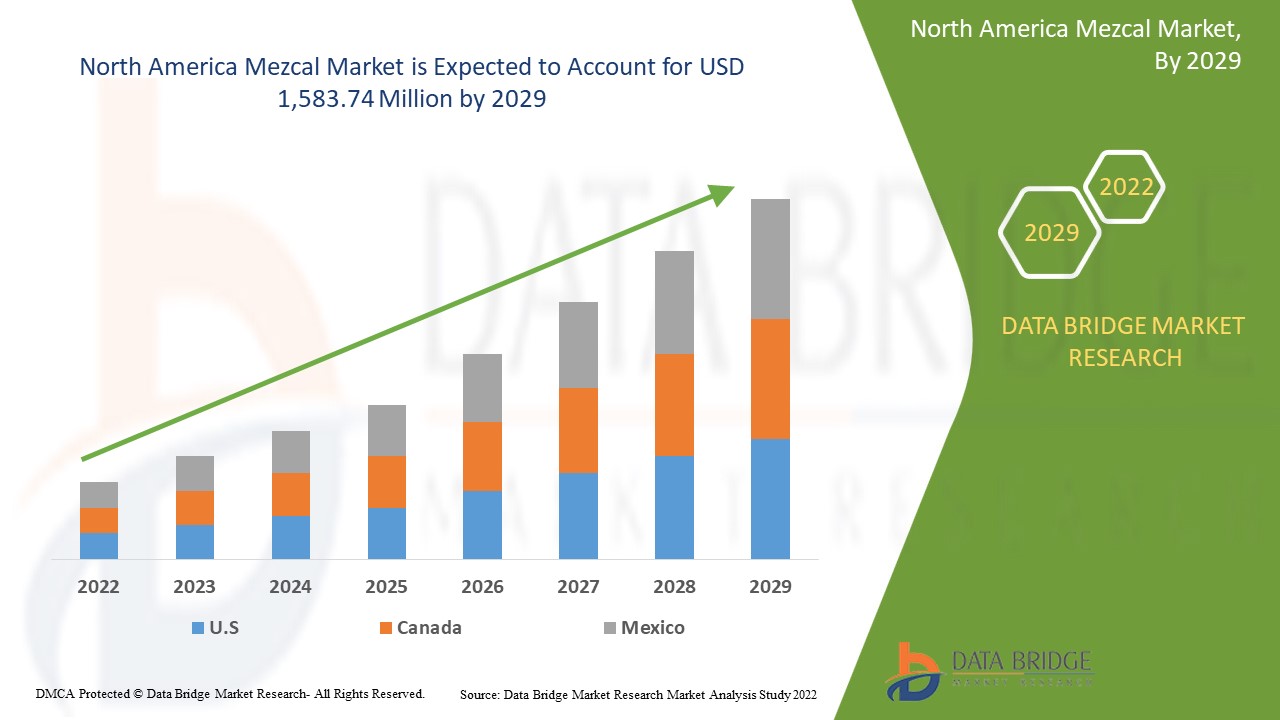

データブリッジ・マーケット・リサーチの分析によると、北米のメスカル市場は予測期間中に年平均成長率26.0%で成長し、2029年までに15億8,374万米ドルに達すると予想されています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、販売数量は百万個、価格は米ドル |

|

対象セグメント |

製品タイプ別(メスカル ホベン、メスカル レポサド、メスカル アネホ、メスカル エスパディン、メスカル テプスタテ、メスカル アロケーニョ、メスカル アンサンブルなど)、濃縮度(100% テキーラとミックス テキーラ)、価格帯別(プレミアム、スタンダード、エコノミー)、アルコール度数(40% 以上と 40% 未満)、年別(18~24、25~44、45~64、65 歳以上)、パッケージ タイプ別(ボトル、缶など)、サイズ別(251~500 ml、501~750 ml、751~1000 ml、100 ml 以上)、フレーバー タイプ別(プレーン/オリジナルとフレーバー付き)、生産者タイプ別(地ビール醸造所、蒸留酒製造所、ブルーパブ、契約醸造会社、地域クラフトビール醸造所、大規模醸造所など)、製品カテゴリ別(蒸留酒製造所)メズカンおよび手作りメズカン/職人技のメズカン)、エンドユーザー(レストラン、ホテル、バー、カフェ、ケータリング、航空会社、家庭など)、流通チャネル(オフライン取引およびオンライン取引) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Davide Campari-Milano NV、BACARDI、Craft Distillers、MADRE MEZCAL、Familia Camarena、Brown‑Forman、Diageo、Pernod Ricard、Rey Campero、Tequila & Mezcal Private Brands SA de CV、Destileria Tlacolula、El Silencio Holdings, INC.、Sauza Tequila輸入会社、Dos Hombres LLC. 、デル・マグエイ、ワハカ・メスカル、ボザル・メスカル・ソンブラ、ペンサドール・メスカル、イリーガル・メスカル |

市場の定義

メスカルは、メキシコの北部の州から南部の州まで、さまざまな農村地域で作られる伝統的な蒸留酒に付けられた名前で、ナワトル語で「焼いたアガベ」を意味します。これらのアルコール飲料は、発酵した糖分を含む「マゲイ」としても知られるアガベ属の種の茎を煮て作られます。これは、煮たアガベ植物の芯の発酵ジュースから作られる伝統的なメキシコの蒸留酒です。

使用されるアガベの種類によってテルペン化合物の含有量が異なること、メスカルの発酵にアガベの葉を使用できるかどうか、アガベの熟成段階の違い、地面に掘った穴で燃える木や熱した石を使ってアガベを調理するとフランや煙のような揮発性物質が発生し、それがアガベに残ること、そして一部のハーブやその他の天然素材(ミミズなど)が、メスカルの風味の違いに寄与している可能性があります。

マゼル市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー:

- メスカルにはさまざまなフレーバーがある

メスカルの品質と真正性は、この飲料の独特のアルコール風味のため、極めて重要です。この風味は、生のアガベ自体に由来する揮発性および非揮発性化合物から生じます。これらには、カプリン酸からリグノセリン酸までの脂肪酸、遊離脂肪酸、β-シトステロール、モノ、ジ、トリアシルグリセロールのグループ、およびアガベの主な炭水化物であるフルクタンが含まれます。アガベの調理プロセスでは温度が高く、pH が低いため、フルクタンはフラン、ピラン、ケトンなどのメイラード化合物を形成する可能性があります。

さらに、アガベ飲料の品質を決定する重要なパラメータは、使用される蒸留システムです。メスカルの香りの構成は非常に複雑です。メスカルのサンプル間の類似点と相違点は、原産地と生産シーズンに加えて、使用される条件と原材料に起因する可能性があります。

例えば、

- メキシコ全土でさまざまなアガベ品種が育っており、それぞれの植物やマゲイは、それが育つ微気候のテロワールを帯び、メスカルの風味に影響を与えます。したがって、メキシコで最も有名なアガベスピリッツはメスカルです。メスカルはどのアガベ種からでも生産できるため、風味の多様性に富んでいます。メスカルの原産地呼称には、オアハカ州、ゲレロ州、サカテカス州、グアナファト州、タマウリパス州、サンルイスポトシ州、ドゥランゴ州、ミチョアカン州が含まれます。

- スピリッツライターのクリス・タンストール氏によると、メスカルに使われる最も一般的なアガベの種類は、トバラ、トバジチェ、テペスタテ、アロケーニョ、エスパディンで、エスパディンは最も一般的なアガベで、メスカルの最大90%を占めています。この2種類のメスカルは100%アガベで作られ、他の材料と混合されており、約80%がアガベです。

メスカルにはさまざまなフレーバーがあるため、消費者は他のクラフトスピリッツよりもメスカルを好みます。さらに、倫理的に調達された製品に対する消費者の関心の高まりと、クラフトビール、コールドプレスジュース、天然成分を使用したスムージーなどの飲料をプレミアムとして宣伝する傾向が、予測期間中の市場の成長を牽引すると予想されます。

- 先進的でスマートなパッケージングソリューションへの前向きな見通し

ワインのパッケージ業界では、スマートで持続可能なソリューションを採用して、製品のパッケージをより消費者志向で環境に優しいものにしています。プレミアム化により、アガベベースの飲料カテゴリーにおける優れた品質と独占性が強調され、ブランドや製品が消費者にとってより魅力的になり、ブランドがより魅力的になり、したがってより高価になります。これは、新しいパッケージ、職人技による生産、高品質の原材料、新しいフレーバー、社会的/環境的メッセージによって実現できます。

さらに、デジタル印刷されたパッケージは、他の印刷プロセスに比べて大幅な節約が可能で、セットアップ コストも低くなります。メーカーは、大量印刷と在庫保管により、大量注文を省くことができます。人気のブランド デザイン会社は、メスカル パッケージにガラス瓶を好みます。デジタル印刷の利点は、今日のパッケージ セクターにとって不可欠です。デジタル印刷は、小~中規模の印刷に最適なプロセスであり、パッケージやディスプレイ用にカスタマイズされた印刷を作成できます。さらに、オンラインで入手できるメスカルのほとんどは、ガラス瓶に詰められています。

例えば、

- 2018 年 4 月、新しいワイン製造会社である TagItWine は、消費者が情報に基づいたワイン購入を行うために必要な適切な情報を提供する新しいアプリを立ち上げました。これにより、消費者は自分の好みに合った完璧な飲み物を見つけられるようになります。このアプリを使用するには、消費者はボトルのバーコードをスキャンするだけです。すると、アプリはブドウ園、ボトラー、販売業者の場所とサブ地域を含むワインの産地を表示します。このデータは、店舗内で何が売れているかをアプリが収集するのにも役立ち、企業がターゲット市場をよりよく理解するのに役立ちます。

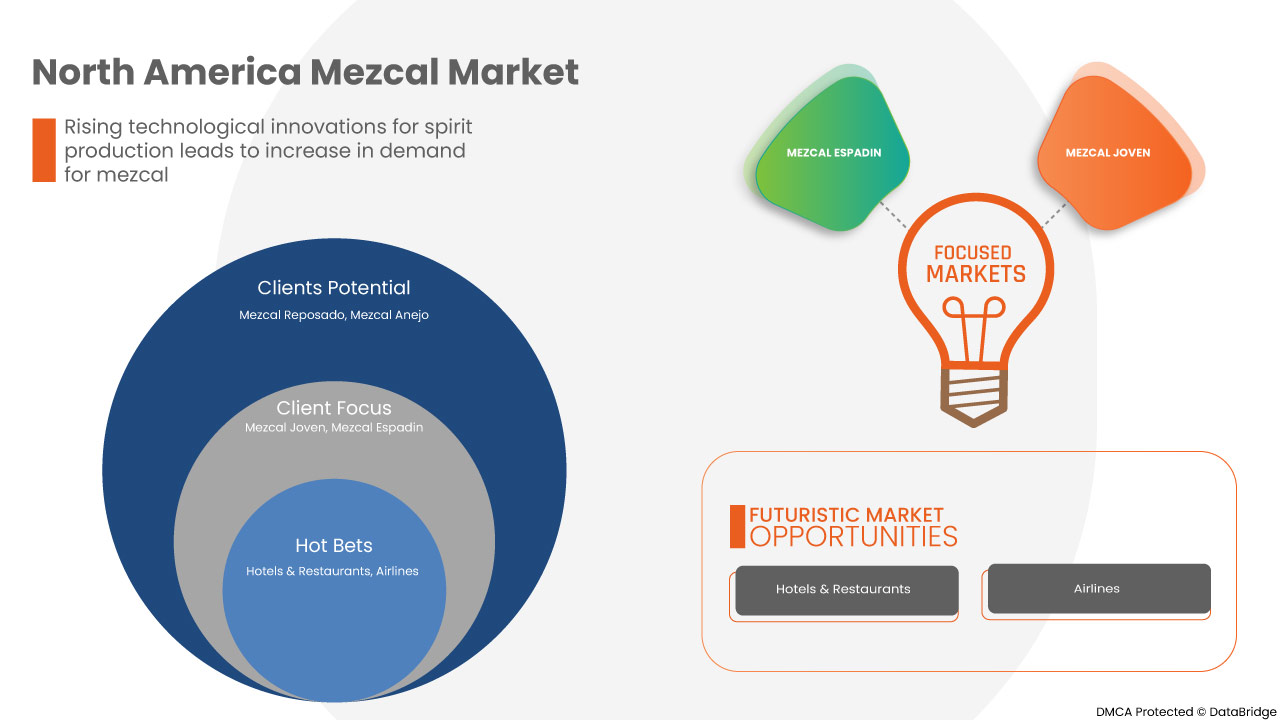

Thus, due to new product launches and developments, an increase in demand for advanced and smart packaging is expected to act as a driver for the North America mezcal market.

Opportunity

- INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

The rapid increase in public awareness of the health advantages of these goods and services is largely responsible for the market's expansion. Another important reason driving the market's expansion is people's awareness of their worries about environmental issues, concerns about those issues, and the health risks associated with consuming unclean and inorganic chemicals. The market's organic products are used to address health issues.

The shifting dietary and lifestyle habits of individuals worldwide are pressuring key market players to produce the same products and develop a dependable and contented customer base over the assessment timeframe. Production is underway that is utilizing the expanding investment for availability and product releases in the worldwide market brilliantly to increase the demand for mezcal products during the assessment timeframe.

Restraints/Challenges

- RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

One of the most rapidly developing industries is the beverage industry, which involves making various drinks such as mezcal. The growing consumer awareness of using natural and organic components in food and drink is predicted to create a challenge in the growth rate of the mezcal industry in the future.

Many fermented foods and beverages contain ethyl carbamate (EC), a known genotoxic carcinogen. Ethyl carbamate is not only carcinogenic but also a known liver toxic agent in humans. Moreover, carbonated beverage consumption has been linked with kidney stones, all risk factors for chronic kidney disease. The increasing number of chronic liver and kidney diseases makes consumers aware of drinking healthfully. People today prefer more non-alcoholic beverages due to such health conditions.

Thus, the rise in chronic health conditions is making consumers aware of the use of non-alcoholic beverages, and this may act as a challenge to the growth of the market.

Recent Developments

- In September 2022, Pernod Ricard announced the creation of a new business unit as part of its Transform & Accelerate strategy to scale up and expand its existing direct-to-consumer and niche B2B geographically.

North America Mazel Market Scope

North America mezcal market is segmented on the basis of twelve notable segments, which are based on product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Mezcal Joven

- Mezcal Reposado

- Mezcal Anejo

- Mezcal Espadin

- Mezcal Tepztate

- Mezcal Arroqueño

- Mezcal Ensamble

- Others

On the basis of product type, North America mezcal market is further segmented into mezcal joven, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño, mezcal ensamble and others.

Concentration

- 100% tequila

- Mix Tequila

On the basis of concentrate, the North America mezcal market is segmented into 100% tequila and mixed tequila.

Price Category

- Premium

- Standard

- Economy

On the basis of price category, the North America mezcal market is segmented into premium, standard, and economy.

ABV Content

- 40% and Above

- Less than 40%

On the basis of abv content, the North America mezcal market is segmented into 40% and above and less than 40%.

.Year

- 18-24 Years

- 25-44 Years

- 45-64 Years

- 65+ Years

On the basis of year, the North America mezcal market is segmented into 18-24 years, 25-44 years, 45-64 years, and 65+ years.

Packaging Type

- Bottle

- Cans

- Others

On the basis of packaging type, the North America mezcal market is segmented into bottles, cans, others.

Size

- Less than 250 Ml

- 251-500 Ml

- 501-750 Ml

- 751-1000 Ml

- more than 1000 Ml

On the basis of size, the North America mezcal market is segmented into less than 250 ml, 251-500 ml, 501-750 ml, 751-1000 ml, more than 1000 ml.

Flavour type

- Plain/Original

- Flavored

On the basis of flavour, the North America mezcal market is segmented into plain/original, flavored

Producer type

- Microbrewery

- Distillers

- Brewpub

- Contract brewing company

- Regional craft brewery

- Large brewery

- Others

On the basis of producer type, the North America mezcal market is segmented into microbreweries, distillers, brewpubs, contract brewing companies, regional craft breweries, large breweries, and others.

Product category

- Distillers Mezcan

- Handcrafted Mezcan/ Artisanal Mezcan

On the basis of product category, North America mezcal market is segmented into distiller’s mezcan and handicrafted mezcan/artisanal mezcan.

End User

- Restaurants

- Hotels & Bars

- Café

- Catering

- Airlines

- Household

- Others

On the basis of end-user, the North America mezcal market is segmented into restaurants, hotels, bars, café, catering, airlines, households, and others.

Distribution Channel

- Offline Trade

- Online Trade

On the basis of distribution channel, the North America mezcal market is segmented into offline trade, online trade.

North America Mezcal Market Regional Analysis/Insights

North America mezcal market is analyzed and market size insights and trends are provided by country, product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, distribution channel as referenced above.

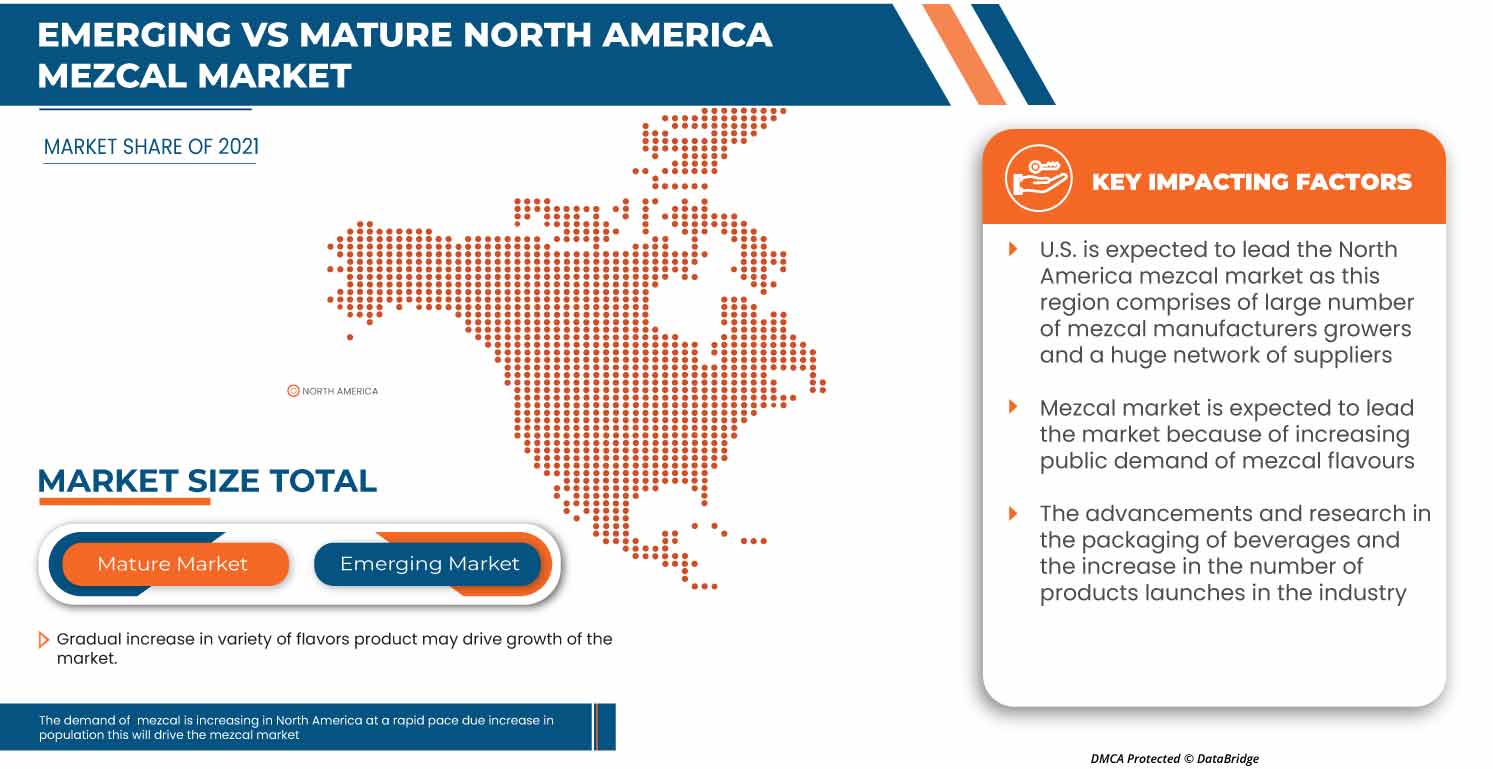

The countries covered in the North America mezcal market report is U.S., Canada, and Mexico.

The U.S.is expected to dominate the mezcal market due to the positive outlook toward advanced and smart packaging solutions

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境とメスカル市場シェア分析

北米メスカル市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、北米メスカル市場への会社の重点にのみ関連しています。

北米のメスカル市場で取引を行っている主要企業は、Davide Campari-Milano NV、BACARDI、Craft Distillers、MADRE MEZCAL、Familia Camarena、Brown‑Forman、Diageo、Pernod Ricard、Rey Campero、Tequila & Mezcal Private Brands SA de CV です。 、Destileria Tlacolula、El Silencio Holdings, INC.、サウザ テキーラ インポート会社名、Dos Hombres LLC. 、デル・マグエイ、ワハカ・メスカル、ボザル・メスカル・ソンブラ、ペンサドール・メスカル、イリーガル・メスカルなど。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF NORTH AMERICA MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 NORTH AMERICA MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 NORTH AMERICA MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

8 NORTH AMERICA MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 NORTH AMERICA MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

9.1 OVERVIEW

9.2 SOCIAL FACTORS

9.3 CULTURAL FACTORS

9.4 PSYCHOLOGICAL FACTORS

9.5 PERSONAL FACTORS

9.6 ECONOMIC FACTORS

9.7 PRODUCT TRAITS

9.8 MARKET ATTRIBUTES

9.9 NORTH AMERICA CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

9.1 CONCLUSION

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

10.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

10.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

10.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS NORTH AMERICALY

10.2 RESTRAINTS

10.2.1 HEAVY TAXATION AND DUTIES

10.2.2 STRINGENT RULES AND REGULATIONS

10.3 OPPORTUNITIES

10.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

10.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

10.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

10.4 CHALLENGES

10.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

10.4.2 HIGH COST OF MEZCAL

11 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE

11.1 OVERVIEW

11.2 MEZCAL ESPADIN

11.2.1 BY CONCENTRATION

11.2.1.1 100% TEQUILA

11.2.1.2 MIX TEQUILA

11.2.2 BY ABV CONTENT

11.2.2.1 40% AND ABOVE

11.2.2.2 LESS THAN 40%

11.3 MEZCAL JOVEN

11.3.1 BY CONCENTRATION

11.3.1.1 100% TEQUILA

11.3.1.2 MIX TEQUILA

11.3.2 BY ABV CONTENT

11.3.2.1 40% AND ABOVE

11.3.2.2 LESS THAN 40%

11.3.3 BY DISTILLATION

11.3.3.1 COPPER

11.3.3.2 STEEL

11.4 MEZCAL REPOSADO

11.4.1 BY CONCENTRATION

11.4.1.1 100% TEQUILA

11.4.1.2 MIX TEQUILA

11.4.2 BY ABV CONTENT

11.4.2.1 40% AND ABOVE

11.4.2.2 LESS THAN 40%

11.4.3 BY DISTILLATION

11.4.3.1 COPPER

11.4.3.2 STEEL

11.5 MEZCAL ANEJO

11.5.1 BY CONCENTRATION

11.5.1.1 100% TEQUILA

11.5.1.2 MIX TEQUILA

11.5.2 BY ABV CONTENT

11.5.2.1 40% AND ABOVE

11.5.2.2 LESS THAN 40%

11.5.3 BY DISTILLATION

11.5.3.1 COPPER

11.5.3.2 STEEL

11.6 MEZCAL ENSAMBLE

11.6.1 BY CONCENTRATION

11.6.1.1 100% TEQUILA

11.6.1.2 MIX TEQUILA

11.6.2 BY ABV CONTENT

11.6.2.1 40% AND ABOVE

11.6.2.2 LESS THAN 40%

11.7 MEZCAL ARROQUEÑO

11.7.1 BY CONCENTRATION

11.7.1.1 100% TEQUILA

11.7.1.2 MIX TEQUILA

11.7.2 BY ABV CONTENT

11.7.2.1 40% AND ABOVE

11.7.2.2 LESS THAN 40%

11.8 MEZCAL TEPEZTATE

11.8.1 BY CONCENTRATION

11.8.1.1 100% TEQUILA

11.8.1.2 MIX TEQUILA

11.8.2 BY ABV CONTENT

11.8.2.1 40% AND ABOVE

11.8.2.2 LESS THAN 40%

11.9 OTHERS

11.9.1 BY CONCENTRATION

11.9.1.1 100% TEQUILA

11.9.1.2 MIX TEQUILA

11.9.2 BY ABV CONTENT

11.9.2.1 40% AND ABOVE

11.9.2.2 LESS THAN 40%

12 NORTH AMERICA MEZCAL MARKET, BY CONCENTRATION

12.1 OVERVIEW

12.2 100% TEQUILA

12.3 MIX TEQUILA

13 NORTH AMERICA MEZCAL MARKET, BY PRICE CATEGORY

13.1 OVERVIEW

13.2 PREMIUM

13.3 STANDARD

13.4 ECONOMY

14 NORTH AMERICA MEZCAL MARKET, BY ABV CONTENT

14.1 OVERVIEW

14.2 40% AND ABOVE

14.3 LESS THAN 40%

15 NORTH AMERICA MEZCAL MARKET, BY YEAR

15.1 OVERVIEW

15.2 25-44

15.3 45-64

15.4 18-24

15.5 65+

16 NORTH AMERICA MEZCAL MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 BOTTLE

16.3 CANS

16.4 OTHERS

17 NORTH AMERICA MEZCAL MARKET, BY SIZE

17.1 OVERVIEW

17.2 751-1000 ML

17.3 501-750 ML

17.4 251-500 ML

17.5 MORE THAN 1000 ML

18 NORTH AMERICA MEZCAL MARKET, BY FLAVOR TYPE

18.1 OVERVIEW

18.2 FLAVORED

18.2.1 CITRUS FRUITS

18.2.1.1 ORANGE

18.2.1.2 LEMON

18.2.1.3 GRAPE FRUIT

18.2.1.4 OTHERS

18.2.2 FLORALS

18.2.3 SMOKED

18.2.4 GREEN PEPPER

18.2.5 OTHERS

18.3 PLAIN/ORIGINAL

19 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE

19.1 OVERVIEW

19.2 MICROBREWERY

19.3 DISTILLERS

19.4 BREWPUB

19.5 REGIONAL CRAFT BREWERY

19.6 CONTRACT BREWING COMPANY

19.7 LARGE BREWERY

19.8 OTHERS

20 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY

20.1 OVERVIEW

20.2 DISTILLERS MEZCAL

20.3 HANDCRAFTED/ARTISANAL MEZCAL

21 NORTH AMERICA MEZCAL MARKET, BY END USE

21.1 OVERVIEW

21.2 HOTELS AND BARS

21.3 RESTAURANTS

21.3.1 RESTAURANTS, BY TYPE

21.3.1.1 CHAIN RESTAURANTS

21.3.1.2 INDEPENDENT

21.3.2 RESTAURANTS, BY SERVICE CATEGORY

21.3.2.1 FULL SERVICE RESTAURANTS

21.3.2.2 QUICK SERVICE RESTAURANTS

21.4 CAFE

21.5 AIRLINES

21.6 CATERING

21.7 HOUSEHOLD

21.8 OTHERS

22 NORTH AMERICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 OFFLINE TRADE

22.2.1 NON-STORE BASED RETAILERS

22.2.1.1 VENDING MACHINE

22.2.1.2 OTHERS

22.2.2 STORE BASED RETAILER

22.2.2.1 HYPERMARKET/SUPERMARKET

22.2.2.2 CONVENIENCE STORES

22.2.2.3 SPECIALTY STORES

22.2.2.4 GROCERY STORES

22.2.2.5 OTHERS

22.3 ONLINE TRADE

22.4 COMPANY OWNED WEBSITE

22.5 E-COMMERCE

23 NORTH AMERICA MEZCAL MARKET, BY REGION

23.1 OVERVIEW

23.1.1 U.S.

23.1.2 MEXICO

23.1.3 CANADA

24 NORTH AMERICA MEZCAL MARKET: COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

25 SWOT ANALYSIS

26 COMPANY PROFILE

26.1 PERNOD RICARD

26.1.1 COMPANY SNAPSHOT

26.1.2 REVENUE ANALYSIS

26.1.3 PRODUCT PORTFOLIO

26.1.4 RECENT DEVELOPMENT

26.2 DIAGEO

26.2.1 COMPANY SNAPSHOT

26.2.2 REVENUE ANALYSIS

26.2.3 PRODUCT PORTFOLIO

26.2.4 RECENT DEVELOPMENTS

26.3 BACARDI

26.3.1 COMPANY SNAPSHOT

26.3.2 PRODUCT PORTFOLIO

26.3.3 RECENT DEVELOPMENT

26.4 DAVIDE CAMPARI-MILANO N.V.

26.4.1 COMPANY SNAPSHOT

26.4.2 REVENUE ANALYSIS

26.4.3 PRODUCT PORTFOLIO

26.4.4 RECENT DEVELOPMENT

26.5 BROWN-FORMAN

26.5.1 COMPANY SNAPSHOT

26.5.2 REVENUE ANALYSIS

26.5.3 PRODUCT PORTFOLIO

26.5.4 RECENT DEVELOPMENT

26.6 BOZAL MEZCAL

26.6.1 COMPANY SNAPSHOT

26.6.2 PRODUCT PORTFOLIO

26.6.3 RECENT DEVELOPMENT

26.7 CRAFT DISTILLERS

26.7.1 COMPANY SNAPSHOT

26.7.2 PRODUCT PORTFOLIO

26.7.3 RECENT DEVELOPMENTS

26.8 DOS HOMBRES LLC.

26.8.1 COMPANY SNAPSHOT

26.8.2 PRODUCT PORTFOLIO

26.8.3 RECENT DEVELOPMENTS

26.9 DEL MAGUEY SINGLE VILLAGE MEZCAL

26.9.1 COMPANY SNAPSHOT

26.9.2 PRODUCT PORTFOLIO

26.9.3 RECENT DEVELOPMENTS

26.1 DESTILERÍA TLACOLULA

26.10.1 COMPANY SNAPSHOT

26.10.2 PRODUCT PORTFOLIO

26.10.3 RECENT DEVELOPMENT

26.11 EL SILENCIO HOLDINGS, INC.

26.11.1 COMPANY SNAPSHOT

26.11.2 PRODUCT PORTFOLIO

26.11.3 RECENT DEVELOPMENTS

26.12 FAMILIA CAMARENA

26.12.1 COMPANY SNAPSHOT

26.12.2 PRODUCT PORTFOLIO

26.12.3 RECENT DEVELOPMENTS

26.13 ILEGAL MEZCAL

26.13.1 COMPANY SNAPSHOT

26.13.2 PRODUCT PORTFOLIO

26.13.3 RECENT DEVELOPMENTS

26.14 KING CAMPERO

26.14.1 COMPANY SNAPSHOT

26.14.2 PRODUCT PORTFOLIO

26.14.3 RECENT DEVELOPMENTS

26.15 MADRE MEZCAL

26.15.1 COMPANY SNAPSHOT

26.15.2 PRODUCT PORTFOLIO

26.15.3 RECENT DEVELOPMENTS

26.16 MEZCAL SOMBRA

26.16.1 COMPANY SNAPSHOT

26.16.2 PRODUCT PORTFOLIO

26.16.3 RECENT DEVELOPMENT

26.17 PENSADOR MEZCAL

26.17.1 COMPANY SNAPSHOT

26.17.2 PRODUCT PORTFOLIO

26.17.3 RECENT DEVELOPMENTS

26.18 SAUZA TEQUILA IMPORT COMPANY

26.18.1 COMPANY SNAPSHOT

26.18.2 PRODUCT PORTFOLIO

26.18.3 RECENT DEVELOPMENTS

26.19 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

26.19.1 COMPANY SNAPSHOT

26.19.2 PRODUCT PORTFOLIO

26.19.3 RECENT DEVELOPMENTS

26.2 WAHAKA MEZCAL

26.20.1 COMPANY SNAPSHOT

26.20.2 PRODUCT PORTFOLIO

26.20.3 RECENT DEVELOPMENT

27 QUESTIONNAIRE

28 RELATED REPORTS

表のリスト

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 4 NORTH AMERICA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 5 NORTH AMERICA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 8 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 11 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 12 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 NORTH AMERICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 16 NORTH AMERICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 17 NORTH AMERICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 18 NORTH AMERICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 20 NORTH AMERICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 23 NORTH AMERICA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MEZCAL MARKET: BY SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 30 NORTH AMERICA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 31 NORTH AMERICA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 45 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 46 U.S. MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 47 U.S. MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 48 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 49 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 50 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 53 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 56 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 59 U.S. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 60 U.S. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 61 U.S. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 62 U.S. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 63 U.S. OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 U.S. MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 68 U.S. MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 69 U.S. MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 U.S. MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 77 U.S. RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 79 U.S. MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 U.S. OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 U.S. NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 U.S. STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 U.S. ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 86 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 87 MEXICO MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 89 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 91 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 92 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 93 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 94 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 95 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 97 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 100 MEXICO MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 101 MEXICO MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 102 MEXICO MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 MEXICO MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 MEXICO OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 MEXICO MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 MEXICO MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 108 MEXICO MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 109 MEXICO MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 110 MEXICO MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 117 MEXICO MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 120 MEXICO MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 MEXICO NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 MEXICO STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 MEXICO ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 127 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 128 CANADA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 129 CANADA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 132 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 135 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 136 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 137 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 138 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 139 CANADA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 140 CANADA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 141 CANADA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 142 CANADA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 143 CANADA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 CANADA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 CANADA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 CANADA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 CANADA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 CANADA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 149 CANADA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 150 CANADA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 151 CANADA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 153 CANADA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 154 CANADA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 155 CANADA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 CANADA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 157 CANADA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 158 CANADA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 159 CANADA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CANADA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 CANADA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 CANADA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 CANADA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 CANADA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 165 CANADA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA MEZCAL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEZCAL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEZCAL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEZCAL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEZCAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEZCAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEZCAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MEZCAL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA MEZCAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEZCAL MARKET: SEGMENTATION

FIGURE 11 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS NORTH AMERICALY AND INCREASING CONSUMER DEMAND FOR MEZCAL IS EXPECTED TO DRIVE THE NORTH AMERICA MEZCAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MEZCAL ESPADIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEZCAL MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA MEZCAL MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEZCAL MARKET

FIGURE 15 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE

FIGURE 16 NORTH AMERICA MEZCAL MARKET: BY CONCENTRATION, 2021

FIGURE 17 NORTH AMERICA MEZCAL MARKET: BY PRICE CATEGORY, 2021

FIGURE 18 NORTH AMERICA MEZCAL MARKET: BY ABV CONTENT, 2021

FIGURE 19 NORTH AMERICA MEZCAL MARKET: BY YEAR, 2021

FIGURE 20 NORTH AMERICA MEZCAL MARKET: BY PACKAGING TYPE, 2021

FIGURE 21 NORTH AMERICA MEZCAL MARKET: BY SIZE, 2021

FIGURE 22 NORTH AMERICA MEZCAL MARKET: BY FLAVOR TYPE, 2021

FIGURE 23 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE

FIGURE 24 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY

FIGURE 25 NORTH AMERICA MEZCAL MARKET: BY END USE, 2021

FIGURE 26 NORTH AMERICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA MEZCAL MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA MEZCAL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 NORTH AMERICA MEZCAL MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。