北米のメチルアクリレート市場、タイプ別(工業用および医薬品)、純度グレード別(99%以下および99%超)、用途別(表面コーティング、化学合成、接着剤およびシーラント、プラスチック添加剤、洗剤、繊維、その他)、エンドユーザー別(塗料およびコーティング、自動車、包装、建設、化粧品、その他) - 2030年までの業界動向および予測。

北米のメチルアクリレート市場の分析と洞察

メチルアクリレートは、アクリル酸やアクリルアミドなどの他の化学物質の製造における化学中間体として使用されます。また、さまざまな樹脂、油、ワックスの溶剤としても使用されます。

しかし、メチルアクリレートは危険な化学物質であり、慎重に取り扱わなければなりません。可燃性があり、空気と接触すると爆発性の過酸化物を形成する可能性があります。また、皮膚や目に炎症を引き起こす可能性があり、飲み込んだり吸い込んだりすると有毒です。

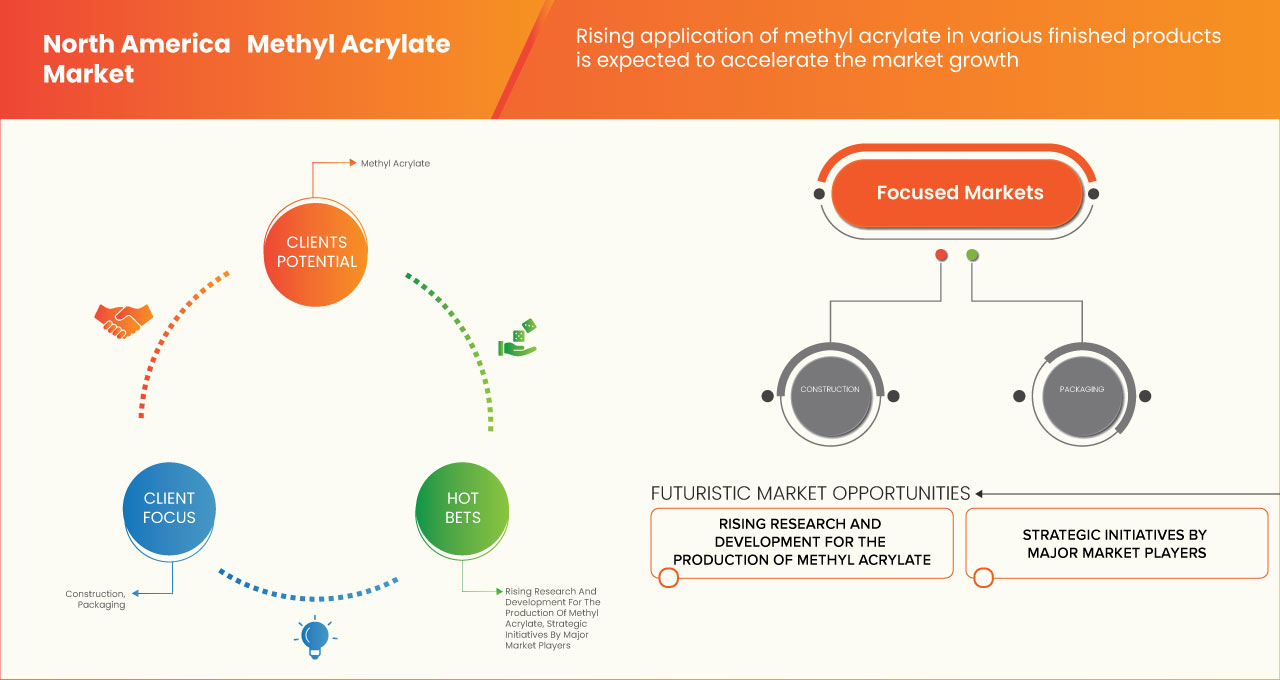

メチルアクリレートの市場は、主にコーティングおよび接着剤業界における最終用途の需要によって推進されています。原材料の入手可能性、規制政策、技術の進歩などの要因も、メチルアクリレートの需要に影響を与えます。

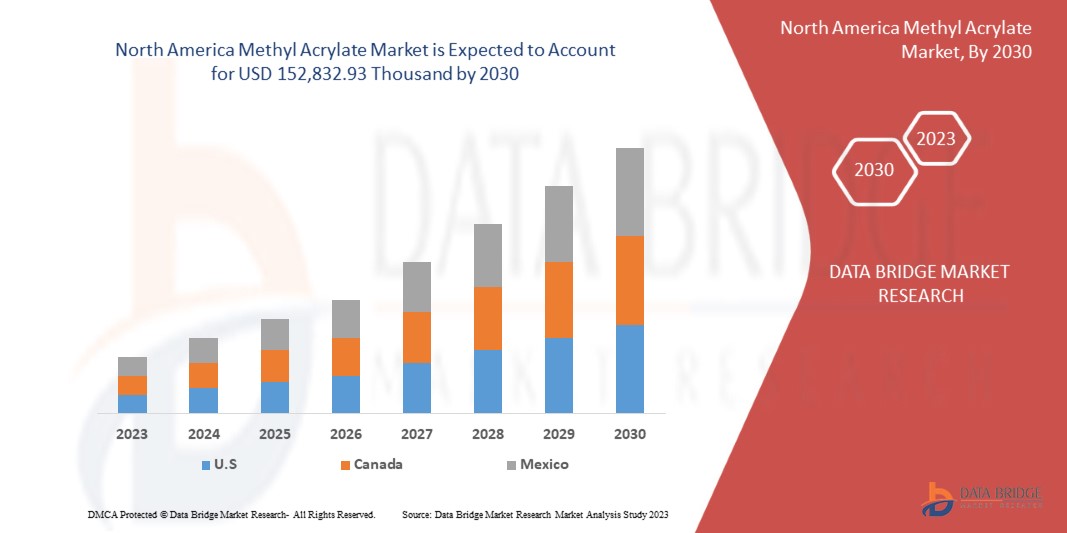

Data Bridge Market Research の分析によると、北米のメチルアクリレート市場は、予測期間中に 6.3% の CAGR で成長し、2030 年までに 152,832.93 千米ドルに達すると予想されています。さまざまな産業用途でメチルアクリレートの使用が増加しているため、このタイプのセグメントが市場で最大のセグメントを占めています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、販売量はトン、価格は米ドル |

|

対象セグメント |

タイプ別(工業用および医薬品)、純度グレード別(99%以下および99%超)、用途別(表面コーティング、化学合成、接着剤およびシーラント、プラスチック添加剤、洗剤、繊維、その他)、エンドユーザー別(塗料およびコーティング、自動車、包装、建設、化粧品、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

三菱ケミカルグループ、日本触媒、LG化学、ダウ、BASF SE、アルケマ、デュポン、エボニック、メルク、ソルベンティス、上海華誼アクリル酸有限公司、SIBUR INTERNATIONAL、ヌーリオン、ジュロングループスー、山東開泰石油化学有限公司など |

市場の定義

メチルアクリレートは、化学式 CH2=CHCOOCH3 の有機化合物です。アクリル酸とメタノールのエステルで、メチルプロピオネートとも呼ばれます。メチルアクリレートは、強い刺激臭のある無色の液体で、非常に可燃性があります。水を含むほとんどの有機溶媒に溶けます。

メチルアクリレートは、主にポリマー、コーティング剤、接着剤、繊維などのさまざまな化学薬品の製造における構成要素として使用されます。塗料、接着剤、コーティング剤の製造に広く使用されているポリ(メチルアクリレート)およびポリ(メチルメタクリレート)の製造に使用されます。また、さまざまなポリマーの架橋剤としても使用されます。

メチルアクリレートは、コポリマーの製造によく使用される反応性モノマーです。エチルアクリレート、ブチルアクリレート、スチレンなどの他のモノマーと共重合されることが多く、得られるポリマーの強度や接着性などの特性が向上します。

北米のメチルアクリレート市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- メチルアクリレートベースの製品の需要増加

安定化メチルアクリレートは、刺激臭のある無色の揮発性液体です。蒸気は目や呼吸器系を刺激する可能性があります。吸入、摂取、または皮膚接触すると非常に有毒です。密度は水より低く (0.957 g/cm3)、水に溶けにくいため、水に浮きます。蒸気は空気より重いです。アクリル繊維、繊維処理、成形樹脂、接着剤、塗料、コーティング、エマルジョンなどの用途の原料です。

メチルアクリレートは、コーティング、接着剤、繊維、プラスチックなど、さまざまな業界で使用されています。これらの業界の成長により、メチルアクリレートの需要が増加すると予想されます。

したがって、メチルアクリレートベースの製品に対する需要の増加は、市場成長の原動力として機能しています。

- メチルアクリレート製造工程における技術進歩

メチルアクリレートは、ポリマーや樹脂、特にアクリル繊維、コーティング剤、接着剤の製造によく使用されます。また、農薬、医薬品、香水など、さまざまな化学物質の合成における出発物質としても使用されます。

メチルアクリレートを製造する従来の方法は、触媒の存在下でアクリル酸とメタノールを反応させる方法です。この反応は発熱反応であるため、通常は温度を制御するために冷却が必要です。

したがって、メチルアクリレートの製造プロセスにおける技術的進歩は、市場の成長の原動力として機能しています。

拘束

- メチルアクリレート製造に使用される原材料の変動コスト

メチルアクリレートは主に石油化学製品から得られるため、原油価格の変動はメチルアクリレートの生産コストに大きな影響を与える可能性があります。

メチルアクリレートの製造に最も重要な原料の 1 つは、原油または天然ガスから得られるプロピレンです。そのため、これらの商品の価格の変動はプロピレンの価格、ひいてはメチルアクリレートの総生産コストに大きな影響を与える可能性があります。

Crude oil is the main raw material used in the production of many chemicals, including propylene, which is used in the production of methyl acrylate. Therefore, fluctuations in the price of crude oil can significantly affect the production costs of methyl acrylate.

OPPORTUNITY

-

Increasing Demand for Sustainable and Ecofriendly Products

Developing trends in the production of sustainable and environmentally friendly methyl acrylate products are increasing the demand for methyl acrylate in the market.

The increasing use of sustainable and environmentally friendly methyl acrylate products reflects a growing awareness of the importance of environmental sustainability in chemical production. By adopting more sustainable practices and developing ecological products, the industry strives to minimize its environmental impact and respond to the changing needs of customers.

Growing concern for the environment increases the demand for sustainable and environmentally friendly products. Methyl acrylate is a sustainable alternative to traditional petrochemicals and may offer growth opportunities in this area.

Thus, increasing demand for sustainable and eco-friendly products acts as an opportunity for market growth.

CHALLENGE

- Stringent Government Regulations Regarding the use of Methyl Acrylate

Government regulations regarding the use of methyl acrylate vary by country and region. However, some jurisdictions have imposed strict regulations due to concerns about the potential health and environmental effects of the compound.

According to the REACH regulation, companies that produce or import more than one ton of methyl acrylate per year must register it with the European Chemicals Agency (ECHA). The registration process involves providing information on the properties and uses of the substance, as well as the potential danger it may present to human health or the environment.

In general, the REACH regulations for methyl acrylate aim to ensure that its production, import, and use are safe and do not pose a risk to human health or the environment. Companies using or producing methyl acrylate in the EU must comply with these regulations to avoid possible legal and financial penalties.

Hence, the stringent government regulations regarding the use of methyl acrylate act as a challenge to market growth.

Recent Development

- In June 2020, Merck KGaA received approval for BAVENCIO, a PD-L1 targeted NK–cell therapy for the treatment of locally advanced or metastatic urothelial carcinoma. This approval helped the company to enhance its product portfolio for cancer treatment.

North America Methyl Acrylate Market Scope

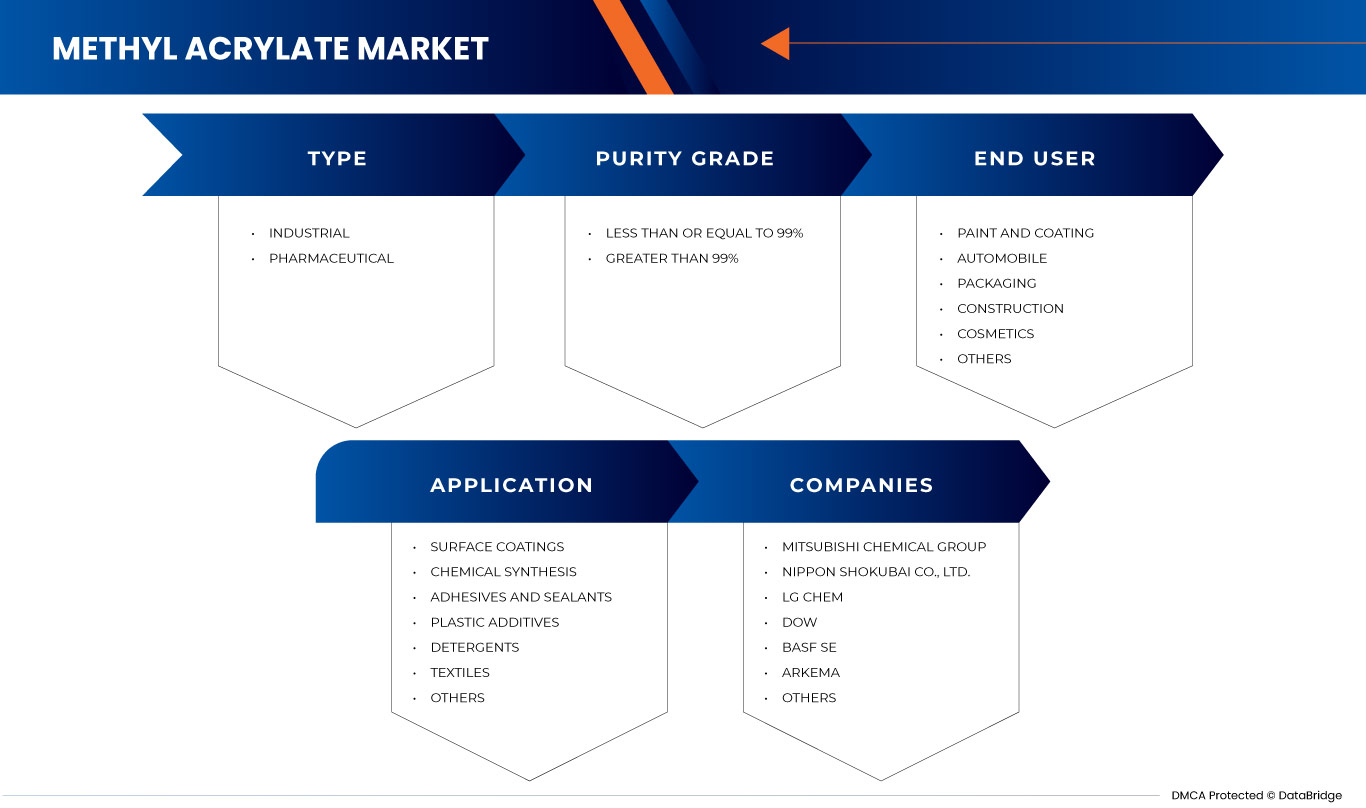

The North America methyl acrylate market is segmented into four notable segments such as type, purity grade, application, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Type

- Industrial

- Pharmaceutical

タイプに基づいて、市場は工業用と医薬品用に分割されます。

純度別

- 99%以下

- 99%以上

純度グレードに基づいて、市場は 99% 以下と 99% 超に分類されます。

アプリケーション別

- 表面コーティング

- 接着剤とシーラント

- 繊維

- プラスチック添加剤

- 化学合成

- 洗剤

- その他

用途に基づいて、市場は表面コーティング、化学合成、接着剤およびシーラント、プラスチック添加剤、洗剤、繊維、その他に分類されます。

エンドユーザー別

- ペイントとコーティング

- 自動車

- パッケージ

- 工事

- 化粧品

- その他

エンドユーザーに基づいて、市場は塗料およびコーティング、自動車、包装、建設、化粧品、その他に分類されます。

北米メチルアクリレート市場の地域分析/洞察

北米のメチルアクリレート市場は、タイプ、純度グレード、用途、およびエンドユーザーに基づいて 4 つの主要なセグメントに分割されています。

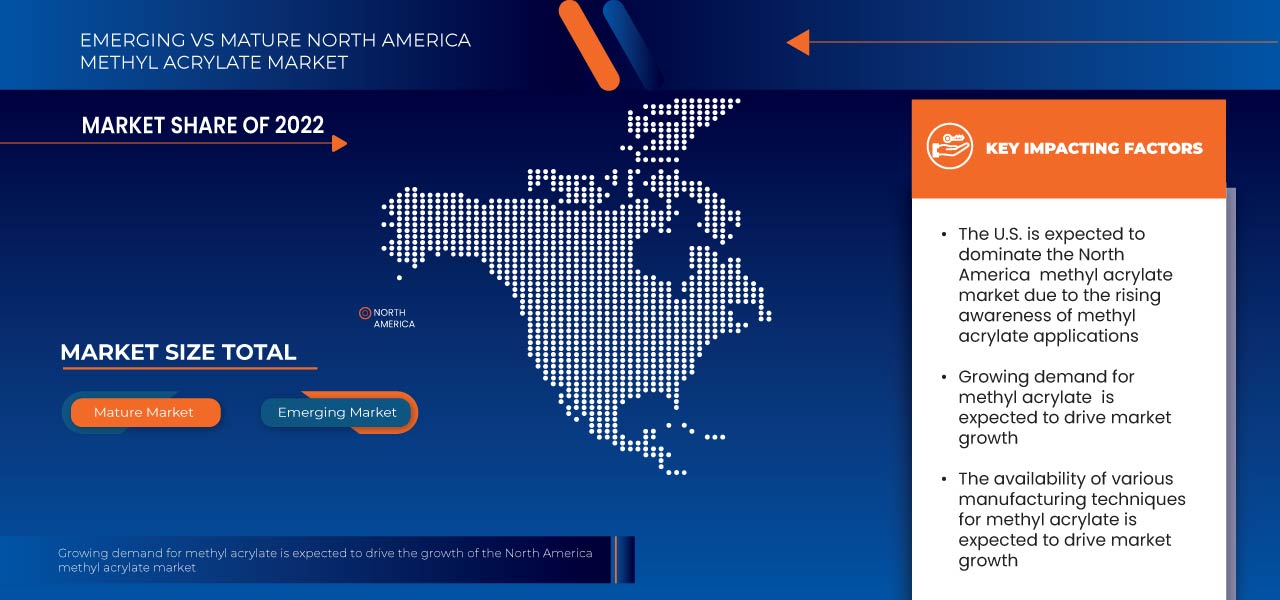

この市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

2023年には、GDPの高い最大の消費者市場に主要な市場プレーヤーが存在するため、米国が市場を独占することになります。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米のメチルアクリレート市場シェア分析

北米のメチルアクリレート市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、製品の幅と幅、アプリケーションの優位性、および技術ライフライン曲線が含まれます。提供されている上記のデータ ポイントは、会社の市場への重点にのみ関連しています。

北米のメチルアクリレート市場で活動している主要な市場プレーヤーとしては、三菱ケミカルグループ、日本触媒、LG Chem、Dow、BASF SE、アルケマ、デュポン、エボニック、メルク、ソルベンティス、上海華誼アクリル酸有限公司、SIBUR INTERNATIONAL、ヌーリオン、ジュロングループスー、山東開泰石油化学有限公司などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL COVERAGE

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TRADE SCENARIO

4.3.1 OVERVIEW

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.5 PORTER’S FIVE FORCES

4.6 VENDOR SELECTION CRITERIA

4.7 PESTEL ANALYSIS

4.8 REGULATION COVERAGE

4.9 EXCLUSIVE LIST OF POTENTIAL BUYERS

4.1 EXCLUSIVE PRODUCTS LIST MADE FROM METHYL ACRYLATE WITH ESTIMATED %

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 PRICE INDEX

7 SUPPLY CHAIN ANALYSIS

8 PRODUCTION CAPACITY OVERVIEW

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS

9.1.2 TECHNOLOGICAL ADVANCEMENT IN THE MANUFACTURING PROCESS OF METHYL ACRYLATE

9.1.3 GROWING AWARENESS REGARDING PROPERTIES OF METHYL ACRYLATE

9.2 RESTRAINTS

9.2.1 FLUCTUATING COST OF RAW MATERIALS USED IN METHYL ACRYLATE PRODUCTION

9.2.2 AVAILABILITY OF SUBSTITUTES FOR METHYL ACRYLATE

9.3 OPPORTUNITIES

9.3.1 INCREASING DEMAND FOR SUSTAINABLE AND ECOFRIENDLY PRODUCTS

9.3.2 DEVELOPMENT OF NEW APPLICATIONS USING METHYL ACRYLATE

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF METHYL ACRYLATE

9.4.2 HEALTH AND SAFETY CONCERNS ASSOCIATED WITH THE USE OF METHYL ACRYLATE

10 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 PHARMACEUTICAL

11 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE

11.1 OVERVIEW

11.2 GREATER THAN 99%

11.3 LESS THAN OR EQUAL TO 99%

12 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SURFACE COATINGS

12.3 ADHESIVES AND SEALANTS

12.4 TEXTILES

12.5 PLASTIC ADDITIVES

12.6 CHEMICAL SYNTHESIS

12.7 DETERGENTS

12.8 OTHERS

13 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER

13.1 OVERVIEW

13.2 PAINT AND COATING

13.2.1 GREATER THAN 99%

13.2.2 LESS THAN OR EQUAL TO 99%

13.3 AUTOMOBILE

13.3.1 GREATER THAN 99%

13.3.2 LESS THAN OR EQUAL TO 99%

13.4 PACKAGING

13.4.1 GREATER THAN 99%

13.4.2 LESS THAN OR EQUAL TO 99%

13.5 CONSTRUCTION

13.5.1 GREATER THAN 99%

13.5.2 LESS THAN OR EQUAL TO 99%

13.6 COSMETICS

13.6.1 GREATER THAN 99%

13.6.2 LESS THAN OR EQUAL TO 99%

13.7 OTHERS

14 NORTH AMERICA METHYL ACRYLATE MARKET, BY GEOGRAPHY

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA METHYL ACRYLATE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MITSUBISHI CHEMICAL GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BASF SE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 LG CHEM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 NIPPON SHOKUBAI CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ARKEMA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 DOW

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 DUPONT

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 EVONIK

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 JURONG GROUP SU

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 MERCK KGAA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 NOURYON

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGDONG KAITAI PETROCHEMICAL CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHANGHAI HUAYI ACRYLIC ACID CO. LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SIBUR INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SOLVENTIS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 LIST OF TRADERS

TABLE 2 POTENTIAL BUYERS OF METHYL ACRYLATE

TABLE 3 NORTH AMERICA METHYL ACRYLATE MARKET, ESTIMATED SHARE BY APPLICATION, 2022

TABLE 4 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021 AND 2022 (ASP IN TONS)

TABLE 5 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 7 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (ASP IN TONS)

TABLE 8 NORTH AMERICA INDUSTRIAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA PHARMACEUTICAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREATER THAN 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA LESS THAN OR EQUAL TO 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SURFACE COATINGS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ADHESIVES AND SEALANTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA TEXTILES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA PLASTIC ADDITIVES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA CHEMICAL SYNTHESIS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DETERGENTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD TONS)

TABLE 35 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 37 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 47 U.S. METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 57 CANADA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 67 MEXICO METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 MEXICO METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 70 MEXICO PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 72 MEXICO PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 MEXICO COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

図表一覧

FIGURE 1 NORTH AMERICA METHYL ACRYLATE MARKET

FIGURE 2 NORTH AMERICA METHYL ACRYLATE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METHYL ACRYLATE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METHYL ACRYLATE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA METHYL ACRYLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METHYL ACRYLATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA METHYL ACRYLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA METHYL ACRYLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA METHYL ACRYLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA METHYL ACRYLATE MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 NORTH AMERICA METHYL ACRYLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA METHYL ACRYLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA METHYL ACRYLATE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA METHYL ACRYLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METHYL ACRYLATE MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METHYL ACRYLATE MARKET

FIGURE 17 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 19 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2022

FIGURE 22 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2023-2030 (USD THOUSAND)

FIGURE 23 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, 2022

FIGURE 26 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 27 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, 2022

FIGURE 30 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 31 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA METHYL ACRYLATE MARKET: SNAPSHOT (2022)

FIGURE 34 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2022)

FIGURE 35 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 NORTH AMERICA METHYL ACRYLATE MARKET: TYPE (2023-2030)

FIGURE 38 NORTH AMERICA METHYL ACRYLATE MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。