北米の肺がん手術市場

Market Size in USD Billion

CAGR :

%

USD

1,350.62 Million

USD

2,128.15 Million

2021

2029

USD

1,350.62 Million

USD

2,128.15 Million

2021

2029

| 2022 –2029 | |

| USD 1,350.62 Million | |

| USD 2,128.15 Million | |

|

|

|

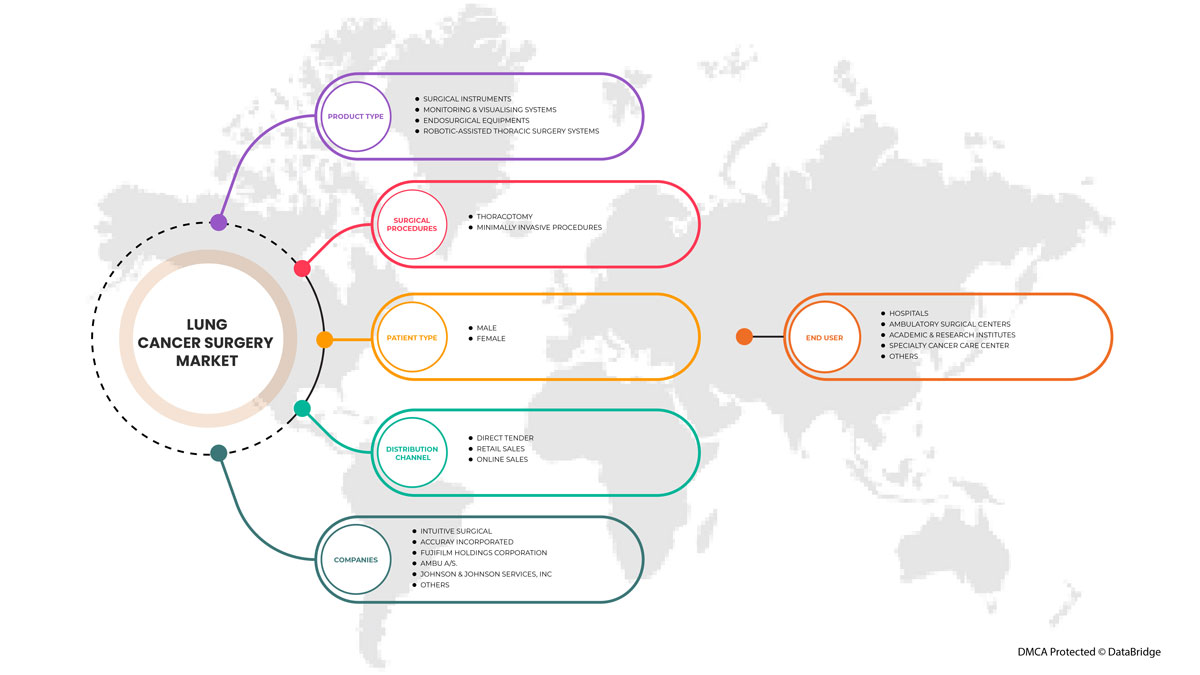

北米の肺がん手術市場、製品タイプ別(手術器具、監視および視覚化システム、内視鏡手術装置、ロボット支援胸部手術システムなど)、手術手順別(開胸術および低侵襲手術)、患者タイプ別(男性および女性)、エンドユーザー別(病院、外来手術センター、学術研究機関、専門がん治療センターなど)、流通チャネル別(直接入札、小売販売、オンライン販売など) - 2029年までの業界動向および予測。

北米の肺がん手術市場の分析と洞察

楔状切除術は、肺がんを少量の正常な組織とともに切除する手術です。部分切除術は、肺の大部分を切除する手術です。肺葉切除術は、肺の 5 つの葉のうち 1 つを切除する手術です。肺全摘出術は、肺全体を外科的に切除する手術です。

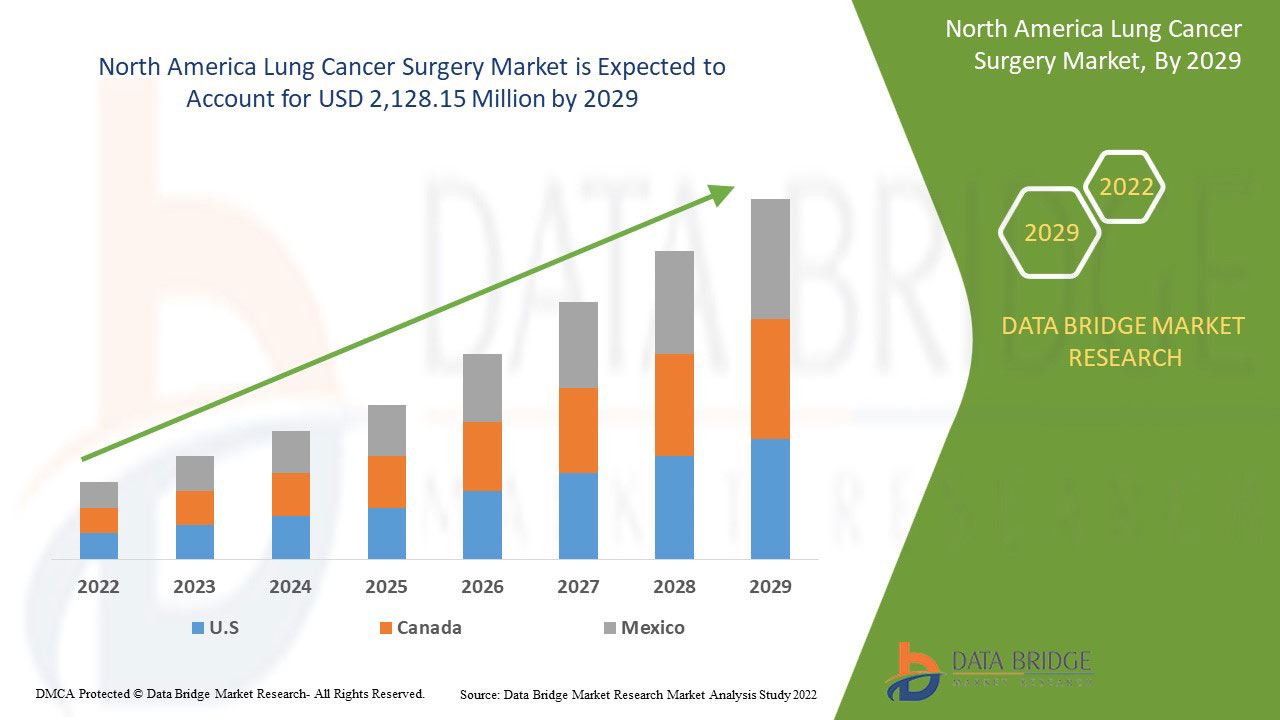

北米の肺がん手術市場は、2022年から2029年の予測期間に大幅な市場成長を遂げると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に5.6%のCAGRで成長し、2021年の13億5,062万米ドルから2029年には21億2,815万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (カスタマイズ可能 2019-2014) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別(手術器具、モニタリングおよび視覚化システム、内視鏡手術装置、ロボット支援胸部手術システムなど)、手術手順別(開胸手術および低侵襲手術)、患者タイプ別(男性および女性)、エンドユーザー別(病院、外来手術センター、学術研究機関、専門がん治療センターなど)、流通チャネル別(直接入札、小売販売、オンライン販売など) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

この市場で取引している主要企業としては、AngioDynamics、Intuitive Surgical、FusionKraft、Surgical Holdings、GerMedUSA、Medtronic、Accuray Incorporated、Teleflex Incorporated、Richard Wolf GmbH、Sontec Instruments、Inc.、asap endoscopic products GmbH、FUJIFILM Holdings America Corporation、Ambu A/S.、Johnson & Johnson Services、Inc.、Olympus Corporation などがあります。 |

市場の定義

肺がんの種類、場所、進行度、その他の医学的問題によっては、肺がん手術の対象となる場合があります。この種の手術は肺がんの治療に用いられます。腫瘍、その周囲の肺組織の一部、そして多くの場合はリンパ節も切除します。肺がんが限局性で転移が予想されない場合、腫瘍を切除する手術が最善の選択肢と考えられています。これには、カルチノイド腫瘍や早期の非小細胞肺がんが含まれます。

肺がん手術市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

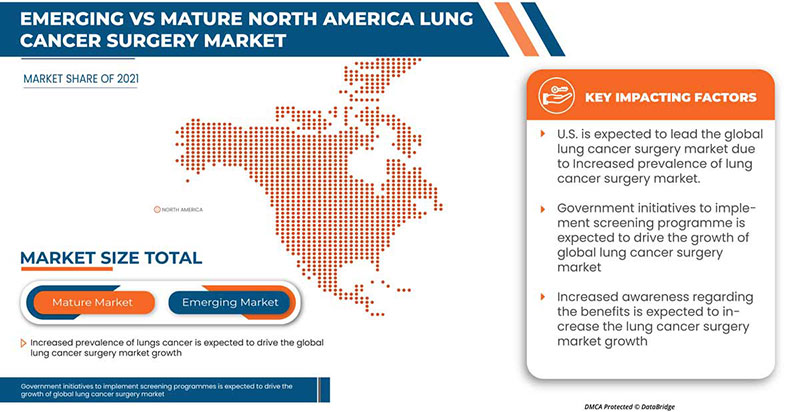

- 肺がんの罹患率の増加

肺がんは、世界中で男女ともに最も一般的な死亡原因です。発展途上国のさまざまな国や人々でタバコの流行が始まったため、肺がんの発生率と死亡率は世界的に増加しています。気管がんや気管支がんを含む肺がんは、個人や家族に重い負担をかけ、世界の健康に対する脅威と広くみなされています。肺がんは、肺の細胞組織の制御されない増殖を特徴とする悪性腫瘍です。男性と女性の両方で、2番目に多く診断され、すべてのがんの中で最も死亡率が高いがんです。GLOBOCANによると、肺がんは世界中で最も多く診断される悪性腫瘍で、年齢標準化発生率は10万人年あたり22.5です。男性は女性よりも肺がんを発症する可能性が高くなります。しかし、1990 年代半ば以降、ほとんどの先進国で男性患者の発生率は減少し、女性患者の発生率は着実に増加しています。

- ヘルスケア分野における技術の進歩

肺がんの手術では、技術の進歩が非常に重要です。技術の進歩の重要性は、今や私たちの生活のほぼすべての側面に及んでいます。しかし、最も重要な利点は、医療における技術の進歩によるものです。治療のための新しい方法論を開発することで、医療システムの技術はより効果的になります。最近の技術の進歩により、何百万人もの命が救われ、生活の質が向上しました。

肺がんは、あらゆる年齢の人々にとってよく知られた一般的な疾患です。最先端の技術は、この疾患の検査に優れた選択肢を提供するのに役立ちます。したがって、肺がんの治療のための技術的に高度な製品の導入は、市場の成長の原動力として機能します。

- メリットに関する認識の向上

非営利、民間、公的機関による肺がんに関する啓発活動の拡大が、市場の成長を後押ししています。これらの取り組みは、偏見や汚名を減らし、病気を予防し、研究を促進することを目的としています。

上記の記述は、さまざまな組織による啓発プログラムが多数実施されているため、肺がんに関する国民の意識が高まっており、早期に診断されれば治癒可能な肺がんについて人々が知っていることを示しています。したがって、国民の意識向上は、肺がん手術市場の推進力として機能しています。

機会

-

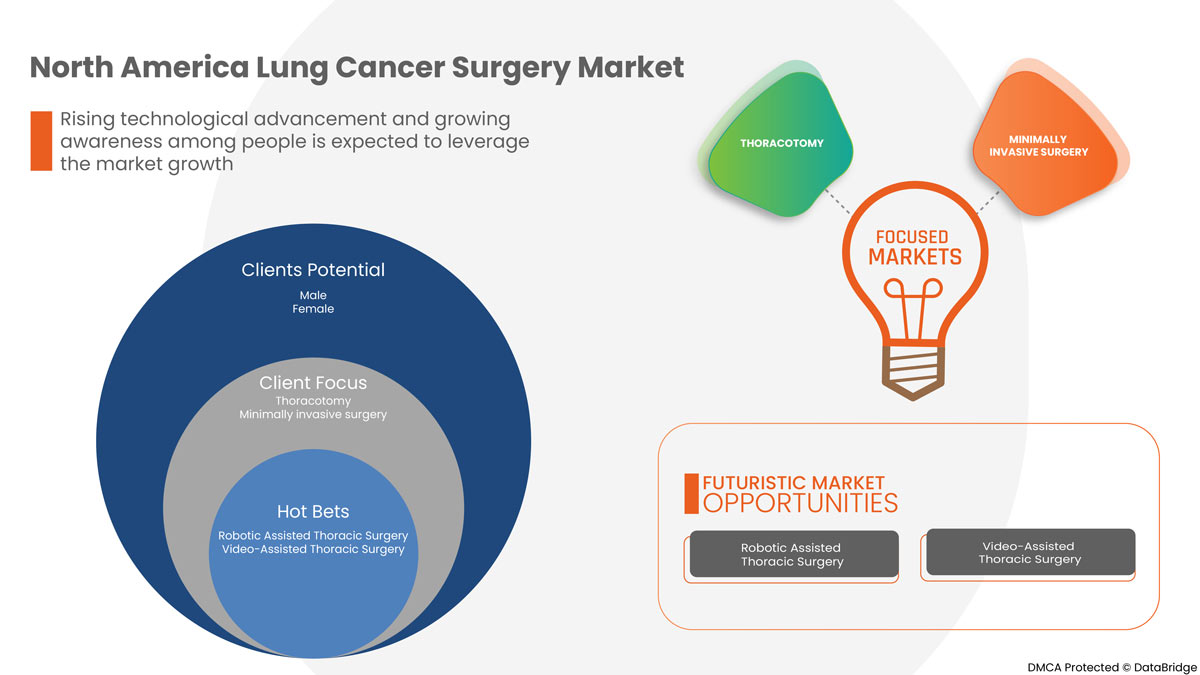

肺がん手術における低侵襲技術の台頭

手術は、早期の非小細胞肺がん (NSCLC) に対する標準的な治療法です。現在、従来の開腹手術よりも低侵襲手術 (MIS) が好まれています。ビデオ補助胸腔鏡手術 (VATS) やロボット補助胸腔鏡手術 (RATS) などの MIS 手術は、術後の問題を軽減し、入院期間を短縮することがわかっています。そのため、新しい低侵襲技術が導入されています。

低侵襲技術に対する需要の高まりは、経済成長とヘルスケア部門の成長にも有益であり、市場におけるより優れた高度な医療技術の開発に大きな影響を与えるため、特に有益です。したがって、肺がん手術における低侵襲技術の急増は、肺がん手術市場にとって大きなチャンスです。

制約/課題

しかし、肺がん手術技術への障壁や、一部の地域での肺がん手術プロセスの高コストにより、肺がん手術の成長が妨げられ、市場の成長が妨げられる可能性があります。さらに、医療技術業界における激しい競争と海外資格取得までの長いリードタイムは、市場の成長にとって困難な要因となる可能性があります。

この肺がん手術市場レポートでは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリュー チェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場の成長、アプリケーションのニッチと優位性、製品の承認、製品の発売、地理的拡張、市場における技術革新などの詳細が提供されます。肺がん手術市場に関する詳細情報を取得するには、アナリスト ブリーフについて Data Bridge Market Research にお問い合わせください。当社のチームが、市場の成長を達成するための情報に基づいた市場決定を行うお手伝いをします。

COVID-19による肺がん手術市場への影響

ヘルスケア、医療機器サービス、自動車、製薬など、すべての業界が新型コロナウイルスによって深刻な混乱に陥っています。この流行により、サプライチェーンの混乱や大規模製造業の停止が発生し、世界のほぼすべての国の経済に影響を及ぼしています。非小細胞肺がんの診断部門もパンデミックの影響を受けました。患者は、ウイルスに感染することを恐れて、診断や治療を受けるよりも家に留まることを選択します。世界中で、COVID-19パンデミックの間、多くの人がCOVID-19や、心血管疾患、糖尿病、腎臓の問題などのCOVID-19後の後遺症に苦しみました。症例が増加するにつれて、ヘルスケアシステムはCOVID-19の封じ込めに重点を置き、その過程でがんなどの他の慢性疾患の診断と治療を遅らせました。その結果、パンデミックのシナリオは肺がんの診断業界に悪影響を及ぼすと予測されています。その結果、COVID-19患者は病院や診療所の利用可能なベッドをすべて占有し、肺がん患者への注意は薄れました。さらに、市場の成長は、クリニックのアクセス性の問題、社会的排除、人口のロックダウンの影響を受けており、これらはすべて紹介と患者の流れを遅らせています。

しかし、肺がん手術の市場は、COVID-19の症例が若干緩和され、患者が治療のためにクリニックや病院に来るようになるため、肺がんの診断と手術の需要が増加するため、成長する可能性がある。COVID-19の症例数は減少しており、北米地域全体でワクチン接種が増加している。

最近の開発

- オリンパスは2021年5月、FDA 510(k)承認済みのBF-UC190F気管支内超音波(EBUS)気管支鏡の市場投入を本日発表しました。これは、針生検による低侵襲性肺がん診断およびステージング用の強力なEBUSデバイスポートフォリオに新たに追加されたものです。

北米の肺がん手術市場の範囲

北米の肺がん手術市場は、製品タイプ、手術手順、患者タイプ、エンドユーザー、流通チャネルに区分されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品タイプ

- 手術器具

- 監視・可視化システム

- 内視鏡手術機器

- ロボット支援胸部手術システム

- その他

製品タイプに基づいて、北米の肺がん手術市場は、手術器具、監視および視覚化システム、内視鏡手術装置、ロボット支援胸部手術システムなどに分類されます。

手術手順

- 開胸術

- 低侵襲手術

北米の肺がん手術市場は、手術手順に基づいて、開胸手術と低侵襲手術に分類されます。

患者タイプ

- 男

- 女性

患者タイプに基づいて、北米の肺がん手術市場は男性と女性に分けられます。

エンドユーザー

- 病院

- 外来・外科センター

- 学術研究機関

- 専門がんケアセンター

- その他

エンドユーザーに基づいて、北米の肺がん手術市場は、病院、外来および外科センター、学術研究機関、専門がんケアセンターなどに分類されます。

流通チャネル

- 直接入札

- 小売販売

- オンライン販売

- その他

流通チャネルに基づいて、北米の肺がん手術市場は、直接入札、小売販売、オンライン販売、その他に分類されます。

肺がん手術市場の地域分析/洞察

肺がん手術市場が分析され、市場規模の洞察と傾向が、上記のように国、製品タイプ、手術手順、患者タイプ、エンドユーザー、流通チャネル別に提供されます。

米国は、市場シェアと市場収益の面で北米の肺がん手術市場を支配しており、予測期間中もその優位性を維持し続けるでしょう。これは、同国における腫瘍外科手術プロセスの検証と妥当性確認の必要性が高まり、研究開発が急速に進んでいるためです。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、グローバル ブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境と肺がん手術市場シェア分析

肺がん手術市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供された上記のデータ ポイントは、肺がん手術市場に対する会社の重点にのみ関連しています。

肺がん手術市場で活動している主要企業としては、AngioDynamics、Ackermann、Scanlan International、KLS Martin Group、Wexler Surgical、Lepu Medical Technology (Beijing) Co., Ltd.、Intuitive Surgical、FusionKraft、Surgical Holdings、GerMedUSA、Medtronic、Accuray Incorporated、Teleflex Incorporated、KARL STORZ SE & Co. KG、TROKAMED GmbH、Richard Wolf GmbH、Sontec Instruments, Inc.、asap endoscopic products GmbH、FUJIFILM Holdings America Corporation、Ambu A/S.、Johnson & Johnson Services, Inc.、Olympus Corporationなどが挙げられます。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

5.1 INCIDENCE OF LUNG CANCER, BY COUNTRY

5.2 TREATMENT RATE BY GENDER

5.3 MORTALITY BY GENDER

6 REGULATIONS OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASED PREVALENCE OF LUNG CANCER DISEASES

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF HEALTHCARE

7.1.3 INCREASED AWARENESS REGARDING THE BENEFITS

7.1.4 GOVERNMENT INITIATIVES TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

7.1.5 RISE IN AIR POLLUTION AND SURGE IN SMOKING

7.2 RESTRAINTS

7.2.1 HIGH COST OF LUNG CANCER SURGERY

7.2.2 INSUFFICIENT FUNDING FOR CANCER AND ASSOCIATED DISORDERS

7.2.3 STRINGENT REGULATORY FRAMEWORKS

7.3 OPPORTUNITIES

7.3.1 RISE OF MINIMALLY INVASIVE TECHNIQUES IN LUNG CANCER SURGERY

7.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

7.3.3 INCREASE IN RESEARCH AND DEVELOPMENT EFFORTS IN THE HEALTHCARE INDUSTRY

7.4 CHALLENGES

7.4.1 DEARTH OF SKILLED ONCOLOGISTS

7.4.2 HEALTH RISK OF LUNG CANCER SURGERIES

8 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SURGICAL INSTRUMENTS

8.2.1 HAND INSTRUMENTS

8.2.1.1 STAPLER

8.2.1.2 FORCEPS

8.2.1.3 ELECTRIC HOOK

8.2.1.4 RETRACTORS

8.2.1.5 CLAMPS

8.2.1.6 SCISSORS

8.2.1.7 ELEVATORS

8.2.1.8 HEMOCLIP APPLIERS

8.2.1.9 ULTRASOUND SCALPEL

8.2.1.10 RIB SHEARS

8.2.1.11 CUTTERS

8.2.1.12 NEEDLE HOLDER

8.2.1.13 TROCAR

8.2.1.14 OTHERS

8.2.2 POWERED SURGICAL EQUIPMENT

8.2.2.1 ADVANCED ENERGY INSTRUMENTS

8.2.2.1.1 ADVANCED BIPOLAR INSTRUMENTS

8.2.2.1.2 OTHERS

8.2.2.2 BASIC ENERGY INSTRUMENTS

8.2.2.2.1 BIPOLAR INSTRUMENTS

8.2.2.2.2 MONOPOLAR INSTRUMENTS

8.3 MONITORING & VISUALISING SYSTEM

8.3.1 CAMERAS & VIDEO SUPPORT

8.3.2 BRONCHOSCOPES

8.3.3 ENDOSCOPIC TROCARS WITH OPTICAL VIEWS

8.3.4 THORACOSCOPES

8.3.5 MEDIASTINOSCOPES

8.3.6 OTHERS

8.4 ENDOSURGICAL EQUIPMENTS

8.5 ROBOTIC ASSISTED SURGERY SYSTEMS

8.6 OTHERS

9 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE

9.1 OVERVIEW

9.2 THORACOTOMY

9.2.1 LOBECTOMY

9.2.1.1 SURGICAL INSTRUMENTS

9.2.1.2 MONITORING & VISUALISING SYSTEMS

9.2.1.3 ENDOSURGICAL EQUIPMENT

9.2.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.1.5 OTHERS

9.2.2 SLEEVE RESECTION

9.2.2.1 SURGICAL INSTRUMENTS

9.2.2.2 MONITORING & VISUALISING SYSTEMS

9.2.2.3 ENDOSURGICAL EQUIPMENT

9.2.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.2.5 OTHERS

9.2.3 SEGMENTECTOMY

9.2.3.1 SURGICAL INSTRUMENTS

9.2.3.2 MONITORING & VISUALISING SYSTEMS

9.2.3.3 ENDOSURGICAL EQUIPMENT

9.2.3.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.3.5 OTHERS

9.2.4 PNEUMONECTOMY

9.2.4.1 SURGICAL INSTRUMENTS

9.2.4.2 MONITORING & VISUALISING SYSTEMS

9.2.4.3 ENDOSURGICAL EQUIPMENT

9.2.4.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.4.5 OTHERS

9.2.5 OTHERS

9.3 MINIMALLY INVASIVE SURGERIES

9.3.1 VIDEO-ASSISTED THORACIC SURGERY (VATS)

9.3.1.1 SURGICAL INSTRUMENTS

9.3.1.2 MONITORING & VISUALISING SYSTEMS

9.3.1.3 ENDOSURGICAL EQUIPMENT

9.3.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.1.5 OTHERS

9.3.2 ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS)

9.3.2.1 SURGICAL INSTRUMENTS

9.3.2.2 MONITORING & VISUALISING SYSTEMS

9.3.2.3 ENDOSURGICAL EQUIPMENT

9.3.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.2.5 OTHERS

10 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PATIENT TYPE

10.1 OVERVIEW

10.2 MALE

10.2.1 GERIATRIC

10.2.1.1 THORACOTOMY

10.2.1.2 MINIMALLY INVASIVE SURGERIES

10.2.2 ADULTS

10.2.2.1 THORACOTOMY

10.2.2.2 MINIMALLY INVASIVE SURGERIES

10.2.3 PEDIATRIC

10.2.3.1 THORACOTOMY

10.2.3.2 MINIMALLY INVASIVE SURGERIES

10.3 FEMALE

10.3.1 GERIATRIC

10.3.1.1 THORACOTOMY

10.3.1.2 MINIMALLY INVASIVE SURGERIES

10.3.2 ADULTS

10.3.2.1 THORACOTOMY

10.3.2.2 MINIMALLY INVASIVE SURGERIES

10.3.3 PEDIATRIC

10.3.3.1 THORACOTOMY

10.3.3.2 MINIMALLY INVASIVE SURGERIES

11 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC HOSPITALS

12.2.2 PRIVATE HOSPITALS

12.3 AMBULATORY SURGICAL CENTERS

12.4 SPECIALTY CANCER CARE CENTERS

12.5 ACADEMIC AND RESEARCH LABORATORIES

12.6 OTHERS

13 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LUNG CANCER SURGERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 JOHNSON & JOHNSON SERVICES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ACCURAY INCORPORATED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 INTUITIVE SURGICAL

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 FUJIFILM HOLDINGS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AMBU A/S.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ANGIODYNAMICS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACKERMANN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASAP ENDOSCOPIC PRODUCTS GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTPORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 FUSIONKRAFT

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GERMED USA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 KLS MARTIN GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 KARL STORZ SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MEDTRONICS (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 OLYMPUS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTPORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 RICHARD WOLF GMBH.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SURGICAL HOLDINGS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SONTEC INSTRUMENTS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCANLAN INTERNATIONAL

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TELEFLEX INCORPORATED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCTPORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 TROKAMED GMBH.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WEXLER SURGICAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 THE BELOW TABLE SHOWS REGION-SPECIFIC INCIDENCE AGE-STANDARDIZED RATES PER 100,000 BY SEX FOR LUNG CANCER AMONG MEN AND WOMEN IN 2020

TABLE 2 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA POWERED SURGICAL EQUIPMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ADVANCED ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 11 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 14 NORTH AMERICA ENDOSURGICAL EQUIPMENT IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LOBECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SLEEVE RESECTION IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEGMENTECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PNEUMONECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA VIDEO-ASSISTED THORACIC SURGERY (VATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA FEMALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA DIRECT TENDER IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HOSPITALS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SPECIALTY CANCER CARE CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ACADEMIC AND RESEARCH LABORATORIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 50 NORTH AMERICA OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA LUNG CANCER SURGERYMARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LUNG CANCER SURGERY MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA LUNG CANCER SURGERYMARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA LUNG CANCER SURGERY MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA LUNG CANCER SURGERY MARKET: BOTTOM UP APPROACH

FIGURE 6 NORTH AMERICA LUNG CANCER SURGERY MARKET: TOP DOWN APPROACH

FIGURE 7 NORTH AMERICA LUNG CANCER SURGERY MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA LUNG CANCER SURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LUNG CANCER SURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LUNG CANCER SURGERY MARKET: END USER COVERAGE GRID

FIGURE 11 NORTH AMERICA LUNG CANCER SURGERY MARKET SEGMENTATION

FIGURE 12 GROWING PREVALENCE OF CANCER DISEASES, RISE IN AIR POLLUTION, AND SURGE IN SMOKING HABIT IS EXPECTED TO DRIVE THE NORTH AMERICA LUNG CANCER SURGERY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 SURGICAL INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LUNG CANCER SURGERY MARKET

FIGURE 15 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2021

FIGURE 20 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2021

FIGURE 24 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA LUNG CANCER SURGERY MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA LUNG CANCER SURGERY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。