北米内部神経刺激装置市場、製品タイプ別(脊髄刺激(SCS)、脳深部刺激、迷走神経刺激、仙骨神経刺激、胃電気刺激)、流通チャネル別(直接入札およびサードパーティサービスプロバイダー) - 2029年までの業界動向と予測。

北米内部神経刺激装置市場分析と洞察

追加療法としての内部神経刺激装置の需要の増加、神経疾患の有病率と発症率の増加、神経刺激装置への資金の増加、内部神経刺激装置の技術的進歩、および製品承認の増加が、市場の成長を促進すると予想されます。

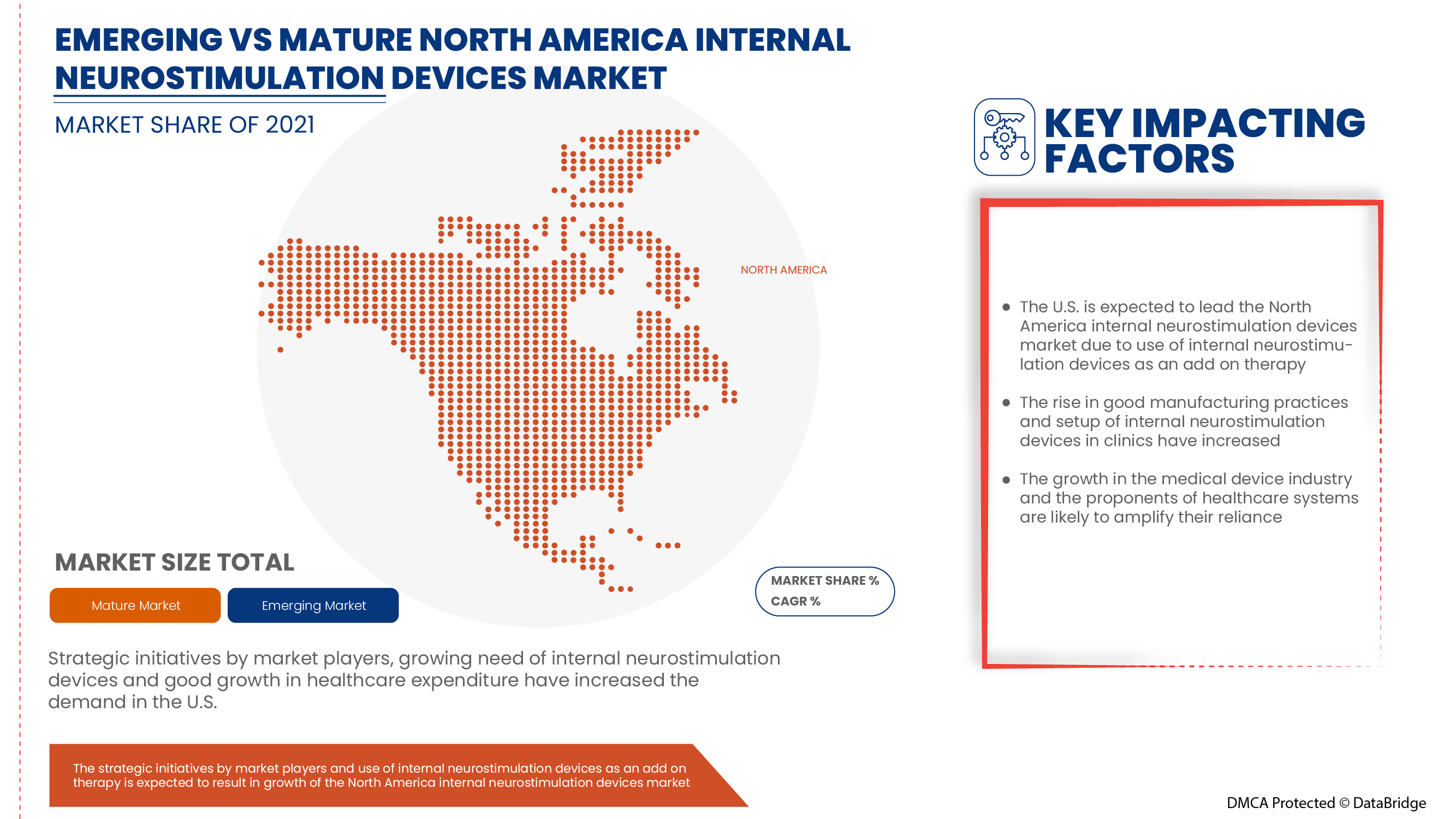

市場プレーヤーによる戦略的取り組みと、内部神経刺激装置に対する公的および民間の市場プレーヤーによる資金の増加により、市場の成長機会が創出されると予想されます。ただし、内部神経刺激装置に関する熟練した訓練を受けた専門家の不足により、このセグメントの成長が抑制されると予想されます。代替画像装置の可用性は、市場の成長に課題をもたらすと予想されます。

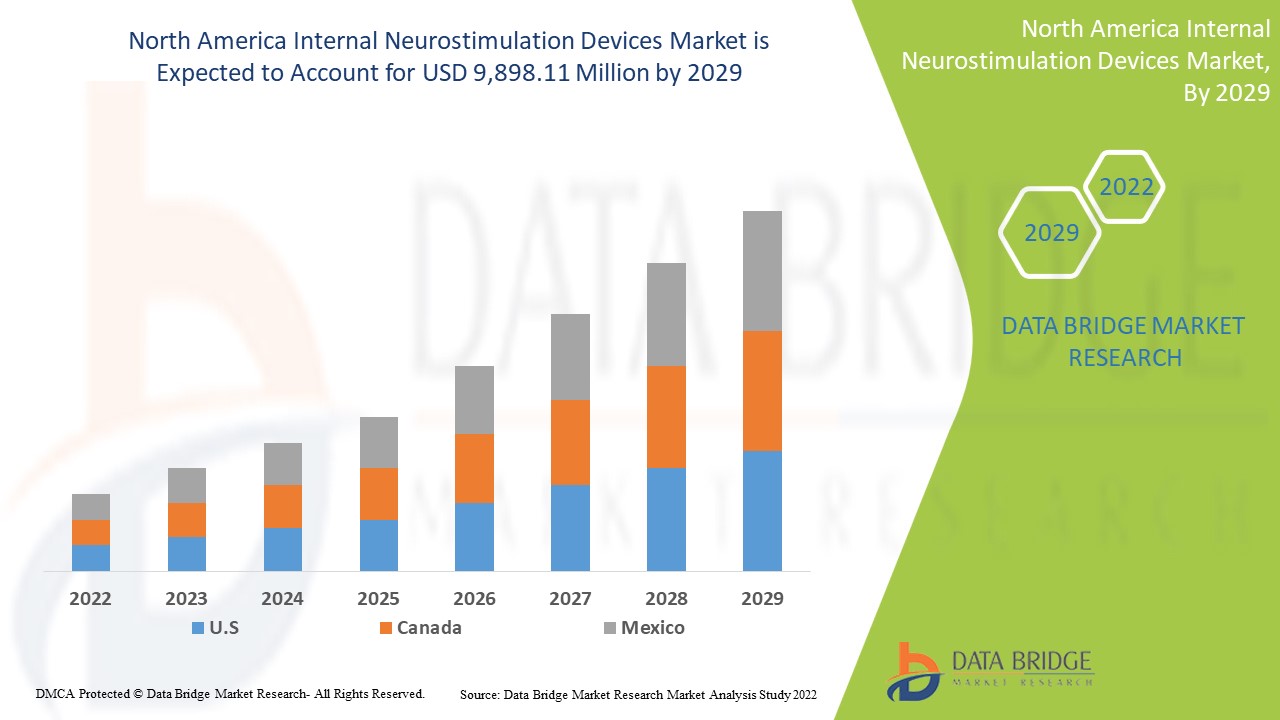

Data Bridge Market Researchは、北米の内部神経刺激装置市場は、2022年から2029年の予測期間中に20.5%のCAGRで成長し、98億9,811万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2024 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品タイプ別(脊髄刺激(SCS)、脳深部刺激、迷走神経刺激、仙骨神経刺激、胃電気刺激)、流通チャネル別(直接入札およびサードパーティサービスプロバイダー) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Medtronic、LivaNova PLC、Abbott、ONWARD、Sequana Medical NV、CIRTEC、Valencia Technologies、Nalu Medical、Inc.、NEVRO CORP.、Stimwave LLC、MicroTransponder Inc.、Newronika SpA、Microsemi(Microchip Technology Inc.の子会社)、Boston Scientific Corporation、Inspire Medical Systems、Inc.、Integer Holdings Corporation、BlueWind Medical、Micro-Leads、Axonics、Inc.など |

市場の定義

内部神経刺激装置は外科的に設置される装置です。リードと呼ばれる 1 本以上の細いワイヤを通じて、脊椎近くの硬膜外腔に弱い電気信号を送ります。神経刺激は、脊髄と脳の間を伝わる痛みの信号を遮断することで痛みを和らげます。

神経刺激装置には、電気刺激によって回路内の神経機能を刺激する侵襲的および非侵襲的アプローチが含まれます。体内神経刺激装置の需要増加は、神経刺激装置の次世代技術の進歩によるもので、世界中で衰弱性神経疾患や精神疾患に苦しむ前例のない数の人々に、切望されている治療的緩和を提供しています。現代の神経調節療法は、半世紀以上にわたって増加しており、さまざまな神経刺激戦略につながる偶然の発見や技術の進歩に富んでいます。過去 20 年間で、医療機器技術の革新により、これらの神経刺激システムの進化が加速し始めました。

患者が使用する便利な体内神経刺激装置は、迷走神経刺激です。迷走神経刺激装置は、電気刺激で迷走神経を刺激する装置を使用します。埋め込み型迷走神経刺激装置は現在、てんかんやうつ病の治療薬として FDA の承認を受けています。迷走神経は体の両側に 1 本ずつあり、脳幹から首を通り胸部と腹部まで伸びています。今後、閉ループ刺激やリモート プログラミングなどのソフトウェアの進歩により、体内神経刺激装置はよりパーソナライズされ、利用しやすい技術になるでしょう。体内神経刺激装置の将来は、生活の質をさらに向上させることが期待されています。

北米内部神経刺激装置市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 慢性尿失禁の治療に関する意識の向上

患者と医療提供者の意識の高まりと、排泄ケアサービスへのアクセスの向上は、ケア提供の改善における重要な要因でした。尿失禁 (UI) と下部尿路症状 (LUTS) は一般的であり、あらゆる年齢層の多くの女性と男性に苦痛をもたらします。神経学におけるインプラント体内神経刺激装置の意識の高まりは、先進的で痛みのない体内神経刺激装置の発見と開発に向けた研究開発関連投資の増加を意味し、市場の成長を促進することが期待されます。

- 体内神経刺激装置の技術的進歩

内部神経刺激装置の技術開発では、神経調節技術が利用されており、電気または薬剤を標的部位に直接送達します。神経調節および内部神経刺激装置と治療法は人生を変えるものです。技術開発により、神経機能がプログラム可能な方法で調節され、乱れた神経活動が調整されます。結果は、最小限のエラーで提供できます。

例えば、

- In May 2022, ONWARD introduced the ARC implantable pulse generator (IPG) to stimulate the spinal cord to restore movement and autonomic function for people with SCI and other conditions that impact mobility

The approval for the internal neurostimulation devices would result in the device being declared safe to use and ready for post-marketing approval. It would result in the supply and distribution of MRI machines to the developing markets in the U.S. demographics. Hence, the rise in product approvals is expected to propel the North America internal neurostimulation devices market growth.

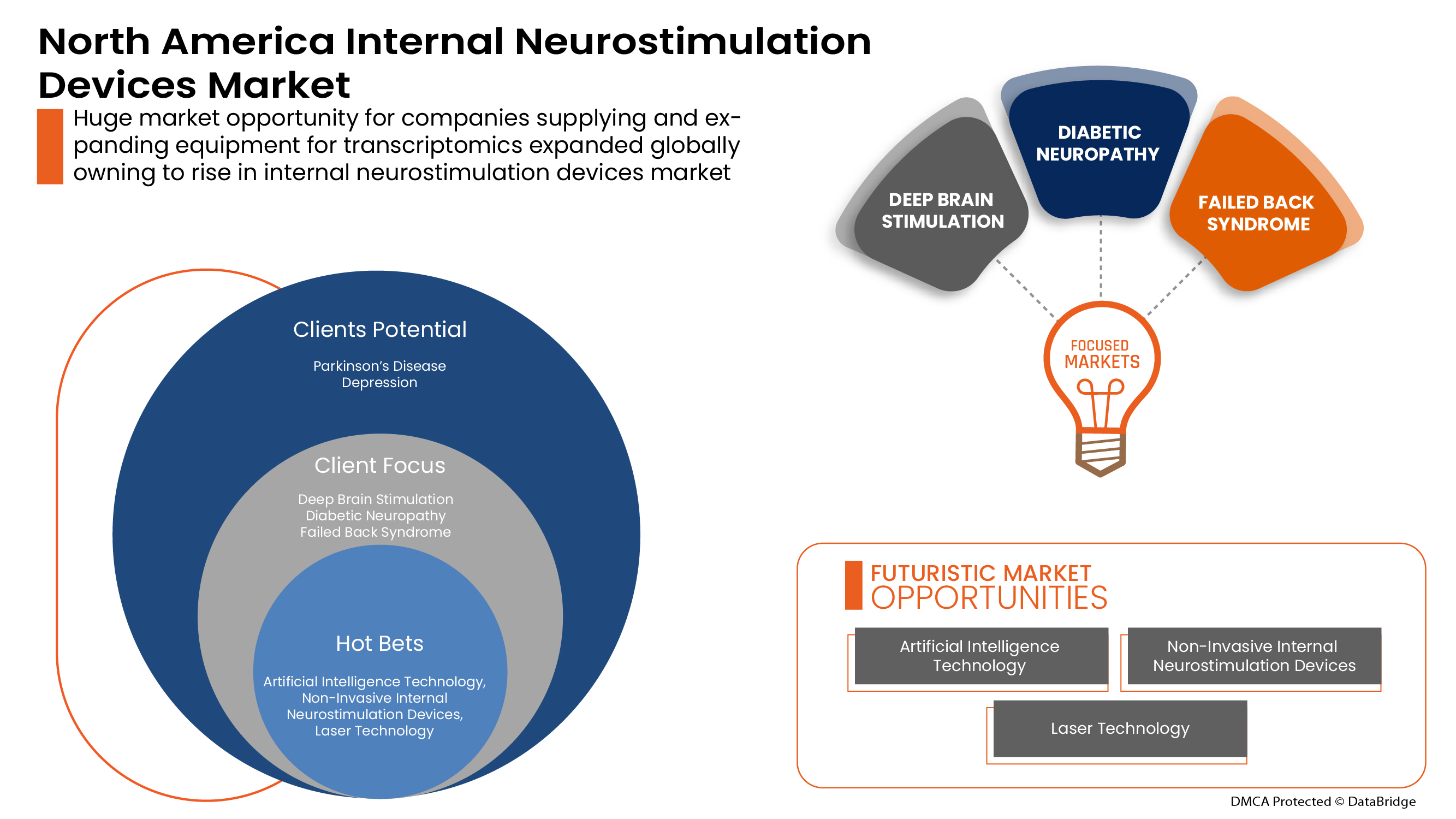

Opportunities

- Recent Product Developments in the Internal Neurostimulation Devices

The growth curve for the North America internal neurostimulation devices market is following an upward trend due to the demand for effective neurovascular therapies is steadily increasing due to the increasing prevalence of neurovascular diseases (such as epilepsy, brain stroke, and cerebral aneurysm) and the severity of diseases (such as discharge and surrounding disorders) in target patients. Due to the rising prevalence and increasing awareness about the seriousness of these diseases, various equipment or devices are manufactured or are under clinical trials.

Thus, product development in recent years has shown the potential of these technologies, and the companies working in this market are trying to get more advanced products, which will act as an opportunity for market growth.

- Strategic Initiatives by the Key Market Player

The demand for internal neurostimulation devices is increasing in the market owing to the increased levels of research and development along with the growth of the North America internal neurostimulation devices market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new devices and equipment, collaborating with other players in the market, and improving business operations and profitability.

- In January 2021, Boston Scientific began shipping their Wave Writer Alpha spinal line trigger frameworks to the U.S.

Thus, the companies operating globally in the neurostimulation devices market are adopting collaboration to increase their product portfolio with advanced technology-rich products to boost their business in various dimensions. Thus, strategic initiatives by key market players are expected to offer significant opportunities for the market players operating in the North America internal neurostimulation devices market.

Restraints/Challenges

- Risks Associated with the Implantation of these Devices

Medical implants carry several hazards, including those related to surgery during installation or removal, infection, and implant failure. The materials used in implants can potentially cause responses in some persons. Every surgical procedure carries some risk. These include bruising, discomfort, swelling, and redness at the surgery site. Thereby will proportionally hamper the growth of implant devices. The increasing awareness about the rising risks related to neurostimulation implants, therefore, may hamper the market's growth.

For instance,

- Implant failure

- Surgical risks during placement or removal

- Risk of implantable device hijacking

- Rising infections

- Materials used in implants might show adverse reactions in patients

The risks mentioned above may hamper the growth of the internal neurostimulation devices market as the risks concerned with the patients are of keen importance. Thus, the awareness of the potential risks of implantable devices is a challenge for the North America internal neurostimulation devices market.

- Lack of Skilled Healthcare Professionals

Neurostimulation devices are implantable, programmable medical devices that deliver electrical stimulation to specific parts of the patient's brain, spinal cord, or peripheral nervous system to help treat various conditions, including chronic pain, movement disorders, epilepsy, and Parkinson's disease. These powerful technologies require a high-cost developmental procedure and skilled professionals to handle sensitive devices. The replacement should be done every 3-6 years after implantation, which is a cost burden and is typically out of pocket for most patients.

Only a relatively small number of patients in poorer nations can afford neurological therapy due to high prices, a weak reimbursement environment, and a lack of skilled healthcare resources. As a result, healthcare facilities are hesitant to spend money on novel or cutting-edge technology, limiting the expansion of the market. Thus, these challenges may hamper the growth of the market.

COVID-19 Impact on the North America Internal Neurostimulation Devices Market

During the pandemic, the North America Internal neurostimulation devices sector focuses on using a combination of biology and information technology. During the COVID-19 pandemic, new therapeutic challenges have been added to the usual ones in the internal neurostimulation devices. Patients with an implantable device for intrathecal infusion need a refill of the pump to avoid abstinence syndrome. Patients with neurostimulation implants can need checkups in case of infection, wound dehiscence, or lead migration.

Recent Developments

- In January 2022, Medtronic received product approval from the Food and Drug Administration (FDA) for Intellis rechargeable neurostimulator, a spinal cord stimulation therapy for treating chronic pain resulting from diabetic peripheral neuropathy. The product approval received resulted in the addition of a new product in the spinal cord stimulation product category. The approval is expected for post-market approval in the U.S. market

- In July 2022, Abbott received approval from the Food and Drug Administration (FDA) for the Infinity deep brain stimulation system to treat depression. The approval received resulted in the rise in the initiation of pre and post-marketing approval and the addition of a new product to the product portfolio

North America Internal Neurostimulation Devices Market Scope

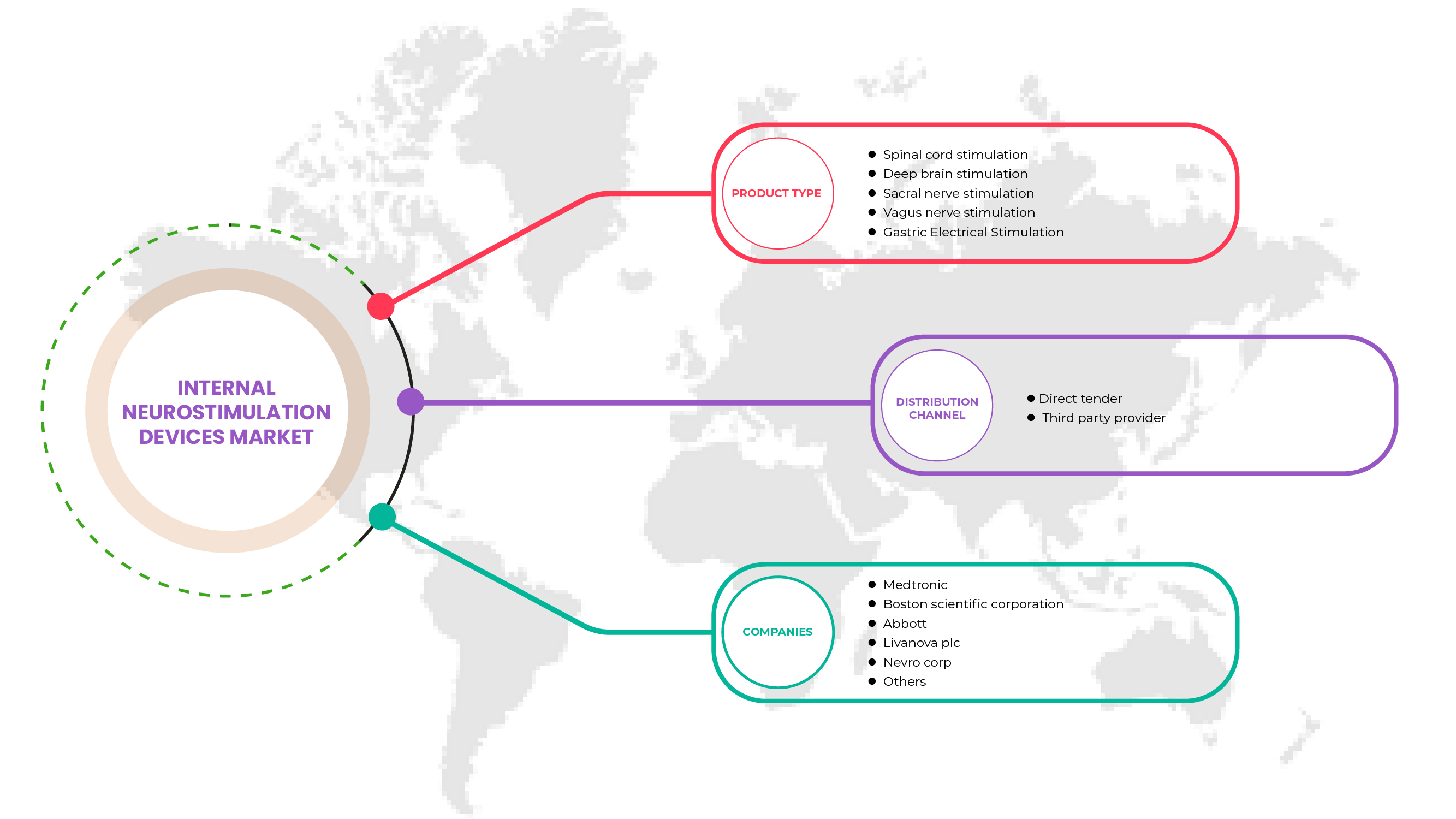

North America internal neurostimulation devices market is categorized into product type and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Spinal Cord Stimulation (SCS)

- Deep Brain Stimulation

- Vagus Nerve Stimulation

- Sacral Nerve Stimulation

- Gastric Electric Stimulation

On the basis of product type, the North America internal neurostimulation devices market is segmented into spinal cord stimulation (SCS), deep brain stimulation, vagus nerve stimulation, sacral nerve stimulation, gastric electric stimulation.

Distribution Channel

- Direct Tender

- Third Party Service Provider

On the basis of distribution channel, the North America internal neurostimulation devices market is segmented into direct tender and third party service provider.

North America Internal Neurostimulation Devices Market Regional Analysis/Insights

North America internal neurostimulation devices market is analyzed, and regions provide market size insights and trends by country, product type, and distribution channel, as referenced above.

Some countries covered in the North America Internal neurostimulation devices market are the U.S., Canada, and Mexico. U.S. is expected to dominate the market due to a rise in research and development activity, integrated internal neurostimulation device requirements in neurology and urinary incontinence treatment, and a rise in public-private sector funding for neurostimulation devices.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と入手可能性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題が販売チャネルに影響を与えることが考慮されています。

競争環境と北米内部神経刺激装置の市場シェア分析

北米内部神経刺激装置市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、北米内部神経刺激装置市場に関連する会社の焦点にのみ関連しています。

北米の内部神経刺激装置市場で活動している主要企業としては、Medtronic、LivaNova PLC、Abbott、ONWARD、Sequana Medical NV、CIRTEC、Valencia Technologies、Nalu Medical, Inc.、NEVRO CORP.、Stimwave LLC、MicroTransponder Inc.、Newronika SpA、Microsemi(Microchip Technology Inc. の子会社)、Boston Scientific Corporation、Inspire Medical Systems, Inc、Integer Holdings Corporation、BlueWind Medical、Micro-Leads、Axonics, Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 THE CATEGORY VS TIME GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 PIPELINE ANALYSIS FOR INTERNAL NEUROSTIMULATION DEVICES MARKET

5 REGULATIONS OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

6 EPIDEMIOLOGY OF DISEASES

6.1 INCIDENCE OF ISCHEMIA

6.2 INCIDENCE OF PARKINSON'S DISEASE

6.3 INCIDENCE OF FAILED BACK SYNDROME

6.4 INCIDENCE OF TREMOR

6.5 INCIDENCE OF DEPRESSION

6.6 INCIDENCE OF URINE INCONTINENCE

6.7 INCIDENCE OF FECAL INCONTINENCE

6.8 INCIDENCE RATE OF EPILEPSY

6.9 INCIDENCE OF GASTROPARESIS

6.1 PREVALENCE OF OBESITY

7 EPIDEMIOLOGY OF NEUROSTIMULATION PROCEDURES

7.1 NUMBER OF SPINAL CORD STIMULATION (SCS) PROCEDURES

7.1.1 NUMBER OF TEST PROCEDURES

7.1.2 NUMBER OF IMPLANTATION PROCEDURES

7.2 NUMBER OF DEEP BRAIN STIMULATION PROCEDURES

7.3 NUMBER OF VAGUS NERVE STIMULATION PROCEDURES

7.4 NUMBER OF SACRAL NEVER STIMULATION PROCEDURES

7.5 NUMBER OF TRANSCRANIAL MAGNETIC STIMULATION (TMS) PROCEDURES

7.6 NUMBER OF INTERMITTENT THETA BURST STIMULATION (ITBS) PROCEDURES

7.7 NUMBER OF TRANSCRANIAL DIRECT ELECTRICAL STIMULATION (TDCS) PROCEDURES

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISORDERS

8.1.2 DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY

8.1.3 INCREASED FUNDING FOR THE NEUROSTIMULATION DEVICES

8.1.4 TECHNOLOGICAL ADVANCEMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.1.5 RISE IN PRODUCT APPROVALS

8.2 RESTRAINTS

8.2.1 RISE IN COST OF THE DEEP BRAIN STIMULATION DEVICES

8.2.2 RISKS NOTICED WHILE USING THE INTERNAL NEUROSTIMULATION DEVICES

8.2.3 RISE IN PRODUCT RECALL

8.2.4 AVAILABILITY OF ALTERNATE IMAGING DIAGNOSTIC DEVICES

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

8.3.2 RECENT PRODUCT DEVELOPMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.3.3 DEMAND FOR MINIMALLY INVASIVE SURGERY

8.4 CHALLENGES

8.4.1 RISKS ASSOCIATED WITH THE IMPLANTATION OF THESE DEVICES

8.4.2 LACK OF SKILLED HEALTHCARE PROFESSIONALS

9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SPINAL CORD STIMULATION

9.2.1 SPINAL CORD STIMULATION, BY TYPE

9.2.1.1 BATTERY

9.2.1.1.1 RECHARGEABLE

9.2.1.1.2 NON-RECHARGEABLE

9.2.1.2 LEAD

9.2.1.2.1 PERCUTANEOUS

9.2.1.2.2 PADDLE

9.2.2 SPINAL CORD STIMULATION, BY APPLICATION

9.2.2.1 ISCHEMIA

9.2.2.2 CHRONIC LOW BACK PAIN (CLBP)

9.2.2.3 DIABETIC NEUROPATHY

9.2.2.4 FAILED BACK SYNDROME

9.3 DEEP BRAIN STIMULATION

9.3.1 DEEP BRAIN STIMULATION, BY TYPE

9.3.1.1 SINGLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.2 DOUBLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.3 BATTERY

9.3.1.3.1 RECHARGEABLE

9.3.1.3.2 NON-RECHARGEABLE

9.3.1.4 LEAD

9.3.2 DEEP BRAIN STIMULATION, BY APPLICATION

9.3.2.1 PARKINSON’S DISEASE

9.3.2.2 TREMOR

9.3.2.3 DEPRESSION

9.4 SACRAL NERVE STIMULATION

9.4.1 SACRAL NERVE STIMULATION, BY TYPE

9.4.1.1 BATTERY

9.4.1.2 LEAD

9.5 SACRAL NERVE STIMULATION, BY APPLICATION

9.5.1 URINE INCONTINENCE

9.5.2 FECAL INCONTINENCE

9.6 VAGUS NERVE STIMULATION

9.6.1 VAGUS NERVE STIMULATION, BY TYPE

9.6.1.1 BATTERY

9.6.1.2 LEAD

9.6.2 VAGUS NERVE STIMULATION, BY APPLICATION

9.6.2.1 EPILEPSY

9.6.2.2 OTHERS

9.7 GASTRIC ELECTRICAL STIMULATION

9.7.1 GASTRIC ELECTRICAL STIMULATION, BY TYPE

9.7.1.1 BATTERY

9.7.1.2 LEAD

9.7.2 GASTRIC ELECTRICAL STIMULATION, BY APPLICATION

9.7.2.1 GASTROPARESIS

9.7.2.2 OTHERS

10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY PROVIDER

11 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MEDTRONIC (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 BOSTON SCIENTIFIC CORPORATION (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ABBOTT (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIVANOVA PLC (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NEVRO CORP. (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AXONICS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ALEVA NEUROTHERAPEUTICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIONIC VISION TECHNOLOGIES.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BLUEWIND MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 BIOINDUCTION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 CIRTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FINETECH MEDICAL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GIMER MEDICAL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 INSPIRE MEDICAL SYSTEMS, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGER HOLDINGS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 INBRAIN NEUROELECTRONICS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MAINSTAY MEDICAL

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 MICROSEMI (A WHOLLY OWNDED SUBSIDIARY OF MICROCHIP TECHNOLOGY INC.)

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 MICROTRANSPONDER INC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 MICRO-LEADS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 NALU MEDICAL, INC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 NEURONANO AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 NEURIMPULSE S.R.L.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 NEWRONIKA S.P.A.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 OPTOGENTECH GMBH.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENTS

14.26 ONWARD

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 STIMWAVE LLC (2021)

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SEQUANA MEDICAL NV (2021)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 VALENCIA TECHNOLOGIES

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA PREVALENCE OF OBESITY

TABLE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 7 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 8 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 10 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 15 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 16 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 18 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 19 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 23 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 24 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 28 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 29 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 33 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 34 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DIRECT TENDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA THIRD PARTY PROVIDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 43 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 44 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 46 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 47 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 50 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 51 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 53 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 54 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 57 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 58 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 61 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 65 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 66 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 U.S. NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 72 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 73 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. LEAD IN N NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 75 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 76 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 80 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 82 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 83 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 86 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 90 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 91 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 94 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 95 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 CANADA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 101 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 102 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 104 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 105 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 108 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 109 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 111 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 112 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 116 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 119 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 120 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 123 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 124 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 CANADA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MEXICO NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 130 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 131 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 133 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 134 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 137 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 138 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 140 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 141 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 144 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 145 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 148 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 149 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 152 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 153 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MEXICO NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BOTTOM UP APPROACH

FIGURE 6 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: TOP DOWN APPROACH

FIGURE 7 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: THE CATEGORY VS TIME GRID

FIGURE 10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET SEGMENTATION

FIGURE 11 INCREASE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISEASES AND DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY ARE EXPECTED TO DRIVE THE NORTH AMERICA INTERNAL NEUROSTIMULATIOJ DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SPINAL CORD STIMULATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET IN 2022 TO 2029

FIGURE 13 NORTH AMERICA INCIDENCE OF ISCHEMIA

FIGURE 14 NORTH AMERICA INCIDENCE OF PARKINSON'S DISEASES

FIGURE 15 NORTH AMERICA INCIDENCE OF TREMOR

FIGURE 16 NORTH AMERICA INCIDENCE RATE OF EPILEPSY

FIGURE 17 NORTH AMERICA INCIDENCE RATE OF GASTROPARESIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

FIGURE 19 INCIDENCE OF ADULT ONSET BRAIN DISORDERS IN THE U.S. IN 2021

FIGURE 20 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 25 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。