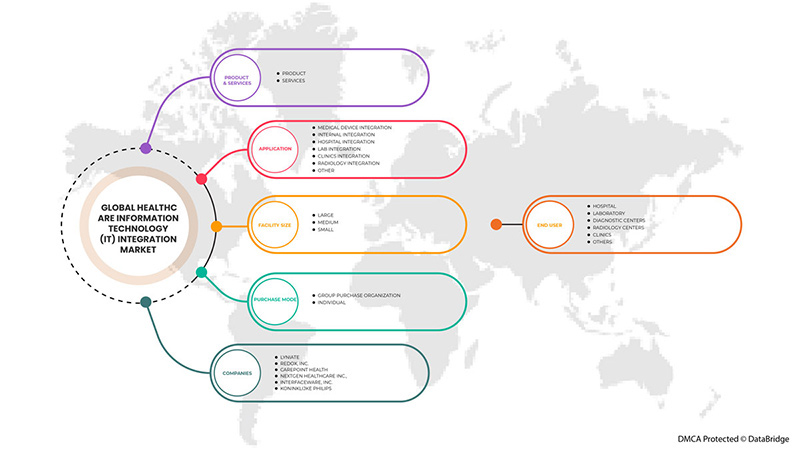

北米のヘルスケア情報技術 (IT) 統合市場、製品とサービス別 (製品とサービス)、アプリケーション別 (医療機器統合、内部統合、病院統合、ラボ統合、診療所統合、放射線科統合)、施設規模別 (大規模、中規模、小規模)、購入モード別 (グループ購入組織、個人)、エンドユーザー別 (病院、ラボ、診断センター、放射線科センター、診療所)、業界動向と 2029 年までの予測。

北米のヘルスケア情報技術 (IT) 統合市場の分析と洞察

ヘルスケア IT 統合により、ヘルスケア システムはデータを収集し、クラウドと交換し、相互に通信して、そのデータを迅速かつ正確に分析できるようになります。モノのインターネット (IoT) は、センサー出力と通信を組み合わせて、監視や診断から配信方法まで、最近まで概念的なものと考えられていたタスクを提供します。センサーは、デバイス、クラウドベース、またはウェアラブルに組み込むことができます。このようなセンサーと ICT の発達により、ヘルスケア部門は現在、診断と予防ケアをサポートし、予防治療の成功の可能性を評価するために使用できる患者データの動的なコレクションを所有しています。

さらに、統合イニシアチブは、多くの場合、範囲が限定されています。医療企業の境界内外のさまざまな臨床およびビジネス ソフトウェア アプリケーション間で情報を移動することが難しいため、統合イニシアチブでは、利用可能な患者データのごく一部のみが統合されます。データ ガバナンス、専門的な医療メッセージング標準、高度なテクノロジへのアクセス、サービス指向アーキテクチャ (SOA) やエンタープライズ アーキテクチャ管理 (EAM) などのシステム統合に関する専門知識を十分に理解する必要があります。CGI の HIIF は、医療組織が必要とする統合を実現するために必要なすべてのパラメータを定義して説明します。

ただし、統合 IT ソリューションに関連するコストの上昇と相互運用性に関連する問題により、市場の成長が抑制されると予想されます。

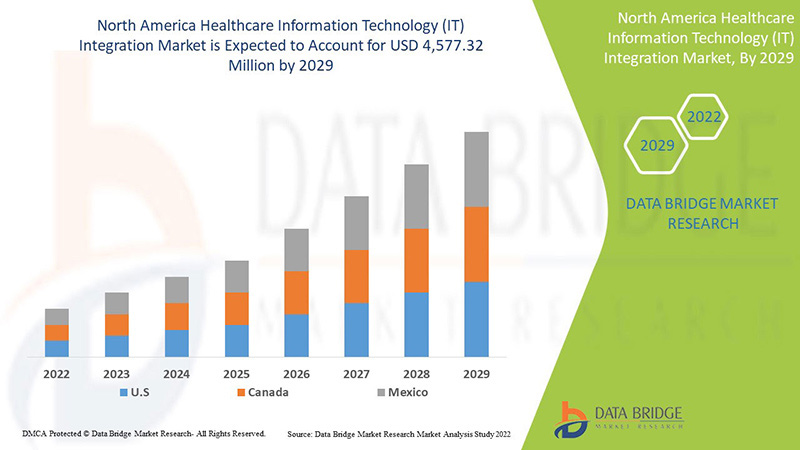

Data Bridge Market Research の分析によると、北米のヘルスケア情報技術 (IT) 統合市場は、予測期間中に 13.4% の CAGR で成長し、2029 年までに 45 億 7,732 万米ドルに達する見込みです。北米では IT ソリューションとサービスの需要が急増しているため、製品とサービスが市場で最大のセグメントを占めています。この市場レポートでは、価格分析、特許分析、技術の進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品とサービス別 (製品およびサービス)、アプリケーション別 (医療機器統合、社内統合、病院統合、研究所統合、診療所統合、放射線科統合)、施設規模別 (大規模、中規模、小規模)、購入モード別 (グループ購入組織および個人)、エンドユーザー別 (病院、研究所、診断センター、放射線科センター、診療所)。 |

|

対象国 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

Lyniate、Redox, Inc.、carepoint health、Nextgen Healthcare Inc.、Interfaceware, Inc.、Koninklijke Philips、Oracle、AVI-SPL, INC.、Allscripts Healthcare solutions, Inc、Epic systems corporation、Qualcomm life Inc.、Capsule technologies Inc.、Orion health、Quality syetems, Inc.、Cerner corporation、Intersystems corporation、Infor Inc.、GE Healthcare、MCKESSON Corporation、Meditech など。 |

北米ヘルスケア情報技術 (IT) 統合市場の定義

医療 IT 統合 (医療情報技術) は、医療業界の情報システムの設計、開発、作成、使用、保守に関わる IT の分野です。自動化され相互運用可能な医療情報システムは、医療と公衆衛生の改善、コストの削減、効率の向上、エラーの削減、患者満足度の向上、外来および入院医療提供者への償還の最適化を継続します。医療 IT の重要性は、患者ケアの質に影響を与える進化する技術と変化する政府政策の組み合わせから生まれます。医療情報技術 (IT) 統合製品には、インターフェイス/統合エンジン、医療機器統合ソフトウェア、メディア統合ソリューションなどがあり、サービスには実装と統合、サポートと保守、トレーニングと教育、コンサルティングがあります。医療 IT により、医療提供者は医療情報を安全に使用および共有することで、患者ケアをより適切に管理できるようになります。ほとんどのアメリカ人向けに安全でプライベートな電子医療記録を開発し、必要なときに必要な場所で電子的に医療情報を利用できるようにすることで、医療 IT は医療の質を向上させると同時に、医療のコスト効率を高めることができます。医療 IT の助けにより、医療提供者は次のことが可能になります。患者の健康に関する正確で完全な情報。これにより、医療提供者は、定期診察でも医療上の緊急事態でも、可能な限り最善のケアを提供できます。提供されるケアをより適切に調整する機能。これは、患者が深刻な病状を抱えている場合に特に重要です。これは、患者がこの利便性を選択した際に、インターネットを介して患者とその家族の介護者と情報を安全に共有する方法です。

さらに、電子医療記録やその他の医療 IT ソリューションの急速な導入は、市場に大きな影響を与える原動力の 1 つです。さらに、患者データを医療システムに統合する緊急の必要性と、医療 IT 統合ソリューションを導入するための有利な政府政策、資金提供プログラム、イニシアチブは、市場の成長の主な原動力です。

北米のヘルスケア情報技術 (IT) 統合市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 電子健康記録やその他の医療ITソリューションの急速な導入

患者データは複雑で機密性が高く、構造化されていないことがよくあります。この情報を医療提供プロセスに組み込むことは、患者ケアを改善する機会を実現するために解決しなければならない課題です。電子健康記録 (HER) は 10 年以上使用されていますが、患者データのセキュリティを向上させるための各国政府の取り組みにより、市場は最近加速しています。

HITECH によって課せられた規制要件により、EHR と EMR の採用が促進されました。市場の成長を加速させているもう 1 つの重要な要因は、責任医療組織 (ACO) の数が増加し、EHR と EMR の需要が増加していることです。

デンマーク、スウェーデン、フランス、カナダなどの他の国々でも、政府の取り組みにより EHR の導入が奨励され、医療費の抑制のために EHR の有意義な使用が義務付けられています。

さらに、IT サービスは、病院、看護部門、薬局、健康保険会社など、医療システム全体のさまざまなエンドユーザーを統合するのに役立ちます。ただし、このデータを統合し、リアルタイムで利用できるようにすることは、医療専門家が効果的な意思決定を行うために不可欠です。したがって、今後数年間で EHR システムの成長が予想されるため、病院はさまざまな病院システムを EHR と統合して能力を強化することに重点を置き、医療情報技術 (IT) 統合市場の開発機会を生み出すことになります。

- 遠隔医療サービスと遠隔患者モニタリングソリューションの需要増加

現在、遠隔医療サービスはモニタリングとコンサルティングの目的で求められています。ヘルスケア ソリューションの進歩により、教育コンテンツの提供や患者と医療提供者間の途切れないコミュニケーションの確保が可能になりました。遠隔患者モニタリング ソリューションの運用が成功するかどうかは、医療機器と情報通信技術 (ICT) 機器の統合が成功し、遠距離での医療サービスの提供が可能になるかどうかにかかっています。

医師や看護師は病院内でコンピューターを使わずにほとんどの時間を過ごしているため、外出時に患者の記録を持ち歩くのは困難です。その結果、多くの市場プレーヤーがヘルスケアITソリューション向けにモバイルアプリなどのモバイルプラットフォームを提供し始めています。

コンピューティングの進歩により、高度なブロードバンド、モバイル、ネットワーキング、遠隔患者モニタリング、高解像度ビデオ会議、EHR など、選択肢がますます増えています。これにより、ソリューション プロバイダーが医療情報技術を統合する大きな機会が生まれています。接続された医療機器で構成される IoT 医療ネットワークを通じて、自宅にいる患者の血圧、体重、血糖値、心電図、体温などのバイタル サインを遠隔でモニタリングでき、患者データは看護師や医師に自動的に送信されます。

コネクテッド ヘルスケア環境により、医師は患者の状態を遠隔で監視し、調整することができます。コネクテッド ヘルス テクノロジーには、スマート センサー テクノロジー、高度な接続性、インターフェイスの強化、データ分析が含まれます。これらの進歩により、患者の受け入れが改善され、クリニックへの通院回数が減るため、医療費の削減につながります。さらに、実装コストは高額になる可能性がありますが、これらのテクノロジーは多くの企業の業務のスピードアップに役立っています。

技術の進歩により、これらのソリューションは、リモート モニタリングと患者のコンプライアンス、ひいては生活の質の向上に重要な役割を果たします。したがって、リモート モニタリング ソリューションとリモート デバイスに対する需要の高まりにより、今後数年間で北米のヘルスケア情報技術 (IT) 統合ソリューション プロバイダーの成長が促進されると予想されます。

拘束

- 相互運用性に関連する問題

The heterogeneity of health information systems possesses major challenges for the successful implementation and use of health informatics solutions. Many countries do not have specific IT standards for storing and exchanging data, which leads to interoperability issues. While there are many different data storage, transport, and security standards, implementing and integrating these interoperability standards presents a major challenge for care providers, and health and medical IT solution providers. Due to the lack of a single health information system to meet all the administrative, clinical, technical, and laboratory requirements of major healthcare providers, interoperability requirements and interoperability standards have become important. Vendors also follow different data formats and standards due to poor knowledge or lack of technical knowledge of the defined standards, which makes it difficult to share real-time data with partner systems, which increases the cost of healthcare IT integration. Issues with data quality and integrity, non-compliance with established standards, lack of qualified professionals, and variation in uptime between healthcare providers are among the issues acting as a major obstacles to implementing a fully interoperable healthcare IT infrastructure. These factors are expected to restrain the growth of the market.

Opportunity/ Challenges

- Data Integration Related Challenges

Information related to patients have created from different departments. At all points of treatment within the healthcare organization, making it a more highly information-intensive industry and reliable patient records, however, it is essential to give reliable information by combining huge amounts of data in order to produce comprehensive and trustworthy patient records because a variety of medical equipment and diagnostic instruments are used in healthcare systems and is a growing need to connect all of these systems to assist healthcare practitioners in responding quickly at various care delivery points.

Several information management applications, including asset management systems, imaging systems, email management systems, forms management systems, clinical information systems, workforce management systems, database management systems, content management systems, revenue cycle management systems, clinical and non-clinical workflow systems, and customer relations management systems that, have been invested in by numerous healthcare organizations. As healthcare organizations are increasingly adopting various healthcare IT systems, there is a greater need to integrate different types of IT systems into the IT architecture of the organization to ensure the optimum utilization of these systems and aid in accurate decision-making. The successful combination of healthcare IT systems with other systems is a focus of IT infrastructure development projects in healthcare organizations.

Thus, each organization in healthcare uses different systems, and there is a high chance of misdiagnosis and improper examination of the report due to the data integration that demolishes the usage of healthcare information technology, which can act as a challenge to the market growth.

Post-COVID-19 Impact On North America Healthcare Information Technology (IT) Integration Market

The COVID-19 outbreak had a drastic effects on North America healthcare, with the UK amongst the countries most severely impacted. Due to the COVID-19 outbreak, all healthcare clinics are under immense pressure, and healthcare facilities worldwide have been overcrowded by the daily visits of numerous patients. The rising prevalence of coronavirus disease has driven the demand for accurate diagnosis and treatment devices in several countries worldwide. In this regard, connected care technologies have proven to be very helpful. They allow healthcare providers to monitor patients using digitally connected noninvasive devices such as home blood pressure monitors and pulse oximeters. Moreover, the rapid spread of this disease in North America has led to a shortage of hospital beds and healthcare workers. As a result, connected medical devices were increasingly adopted to monitor vital signs, and a similar trend is likely to be observed in the coming years

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmacogenetics testing market.

Recent Developments

- In August 2022, Cognizant announced that it has been selected by AXA UK & Ireland as a technology partner to help consolidate, modernize and manage part of its IT operations. AXA UK & Ireland is transforming its technology ecosystem to create a more digitally-enabled, modern, and agile IT environment that is data-rich, secure, and sustainable with lower overall cost. Cognizant will provide integrated IT services spanning service desk support and maintenance, end-user computing, application development and maintenance, cloud operations, and IT infrastructure management. This has helped the company to expand its business.

- In July 2022, NXGN Management, LLC, have demonstrated its award-winning NextGen Office, the only Electronic Health Record (EHR) integrated into the American Podiatric Medical Association (APMA) Registry, at the group’s annual conference held on July 28 to 31 in Orlando. NextGen Healthcare is a founding partner of the APMA Registry, which provided clinically relevant insights to NextGen Healthcare clients. This has helped the company to show its products in APMA and get recognition.

North America Healthcare Information Technology (IT) Integration Market Scope

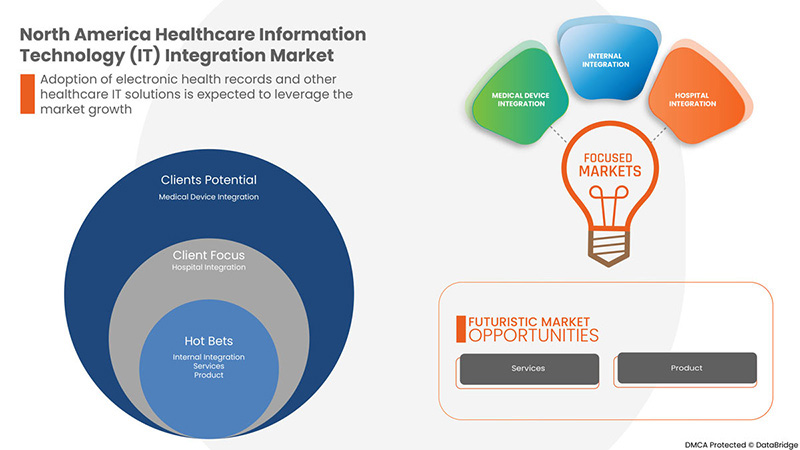

North America healthcare information technology (IT) integration market is segmented into product & services, application, facility size, purchase mode, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Product & Services

- Product

- Services

On the basis of product & services, the North America healthcare information technology (IT) integration market is segmented into products, and services.

By Applications

- Medical Device Integration

- Internal Integration

- Hospital Integration

- Lab Integration

- Clinics Integration

- Radiology Integration

- Other

On the basis of application, the North America healthcare information technology (IT) integration market is segmented into medical device integration, internal integration, hospital integration, lab integration, clinic integration, radiology integration and others.

By Facility Size

- Large

- Medium

- Small

On the basis of facility size, the North America healthcare information technology (IT) integration market is segmented into large, medium, and small.

By Purchase Mode

- Group Purchase Organization

- Individual

On the basis of purchase mode, the North America healthcare information technology (IT) integration market is segmented into group purchases, and individual.

By End User

- Hospital

- Laboratory

- Diagnostic Centers

- Radiology Centers

- Clinics

- Others

On the basis of end users, the North America healthcare information technology (IT) integration market is segmented into hospitals, laboratories, diagnostic centers, radiology centers, clinics, and others.

North America Healthcare Information Technology (IT) Integration Market Regional Analysis/Insights

The North America healthcare information technology (IT) integration market is analyzed, and market size information is provided by product & services, application, facility size, purchase mode, and end user.

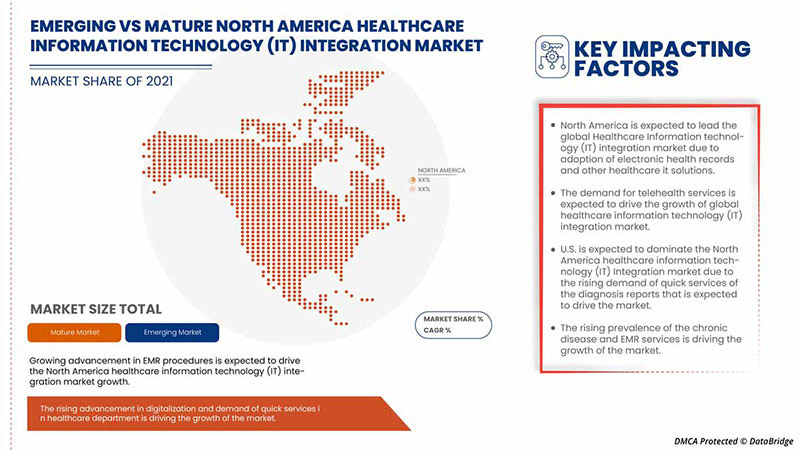

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, North America is dominating due to the presence of key market players in the largest consumer market with high GDP. U.S is expected to grow due to the rise in technological advancement in Healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

競争環境と北米のヘルスケア情報技術 (IT) 統合市場シェア分析

北米のヘルスケア情報技術 (IT) 統合市場の競争状況では、競合他社の詳細が提供されます。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータ ポイントは、北米のヘルスケア情報技術 (IT) 統合市場への会社の重点にのみ関連しています。

北米のヘルスケア情報技術 (IT) 統合市場で活動している主要企業には、Lyniate、Redox、Inc.、carepoint health、Nextgen Healthcare Inc.、Interfaceware、Inc.、Koninklijke Philips、Oracle、AVI-SPL、INC.、Allscripts Healthcare solutions Inc.、Epic systems corporation、Qualcomm life Inc.、Capsule technologies Inc.、Orion health、Quality syetems、Inc.、Cerner corporation、Intersystems corporation、Infor Inc.、GE Healthcare、MCKESSON Corporatio、Meditech などがあります。

調査方法: 北米のヘルスケア情報技術 (IT) 統合市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 U.S. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 U.S. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 U.S. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 49 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 CANADA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CANADA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CANADA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 CANADA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 CANADA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 59 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 CANADA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 MEXICO INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 MEXICO MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 MEXICO MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 69 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 NORTH AMERICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。