北米の遺伝子治療市場、ベクタータイプ別(ウイルスベクターおよび非ウイルスベクター)、方法別(体外および生体内)、用途別(腫瘍性疾患、心血管疾患、感染症、希少疾患、神経疾患、およびその他の疾患)、エンドユーザー別(がん研究所、病院、研究機関、その他) - 2030年までの業界動向および予測。

北米の遺伝子治療市場の分析と洞察

北米の遺伝子治療市場は、市場プレーヤーの増加と高度なサービスや製品の利用可能性により、予測年度に成長すると予想されています。これに伴い、メーカーは市場に新しい製品を投入するための研究開発活動に取り組んでいます。

遺伝子治療とその技術および開発に関する研究の増加により、市場の成長がさらに促進されると予想されます。ただし、この方法を実行する際の倫理的および安全性の懸念により、予測期間中の北米の遺伝子治療市場の成長が妨げられると予想されます。遺伝子工学とヘルスケアの新興かつ先進的な分野である遺伝子治療の需要の増加により、市場に治療および診断アプローチを強化する機会がもたらされると予想されます。

がんや遺伝性疾患に対するより質の高い医療への需要の高まりが、市場の成長を後押しすると予想されます。しかし、診断コストの高さと熟練した資格のある専門家の不足が、市場の成長を阻むと予想されます。

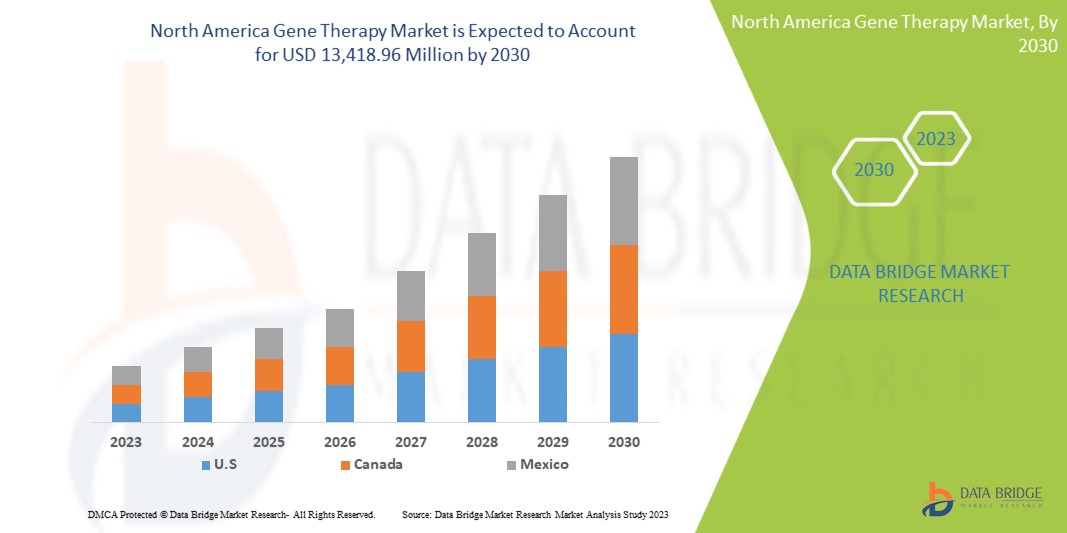

Data Bridge Market Research の分析によると、北米の遺伝子治療市場は、予測期間中に 18.8% の CAGR で成長し、2030 年までに 134 億 1,896 万ドルに達すると予想されています。診断および治療におけるエキソソーム研究製品の使用が増加しているため、製品は市場で最も重要なタイプのセグメントを占めています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

ベクターの種類(ウイルスベクターと非ウイルスベクター)、方法(体外および体内)、用途(腫瘍性疾患、心血管疾患、感染症、希少疾患、神経疾患、その他の疾患)、エンドユーザー(がん研究所、病院、研究機関など)別 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Novartis AG、Kite Pharma(Gilead Sciences, Inc.の子会社)、uniQure NV、Oxford Biomedica、Spark Therapeutics, Inc.、SIBONO、bluebird bio, Inc.、Shanghai Sunway Biotech Co., Ltd.、Biogen、Dendreon Pharmaceuticals LLC.、Amgen Inc.、AnGes, Inc.、Enzyvant Therapeutics GmbHなど |

北米遺伝子治療市場の定義

遺伝子治療は、病気を治療または予防するために、根本的な遺伝子の問題に対処する医療戦略です。遺伝子治療手順では、薬物や手術を使用する代わりに、医師は人の遺伝子構成を変更することで問題を治療できます。レーバー先天性黒内障と呼ばれる目の病気や脊髄性筋萎縮症と呼ばれる筋肉の病気など、いくつかの特定の疾患が遺伝子治療で治療されています。遺伝子治療が安全かつ効果的であることを確認するために、他の多くの遺伝子治療の研究が行われています。医療専門家は、有望なゲノム編集技術を人間の病気の治療にすぐに適用することを目指しています。

治療遺伝子を標的細胞にうまく輸送できることは、遺伝子治療を成功させるための最も重要な前提条件です。輸送された遺伝子は細胞壁の核に移動し、そこでタンパク質分子を作るためのモデルとして機能します。その後、主要な治療作用はタンパク質によって生み出されます。たとえば、細胞破壊は腫瘍の治療に使用され、細胞保存は神経変性疾患の場合には使用される可能性があります。ただし、製品の承認と商品化に関する厳格な規制と基準により、市場の成長が抑制されると予想されます。

北米の遺伝子治療市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

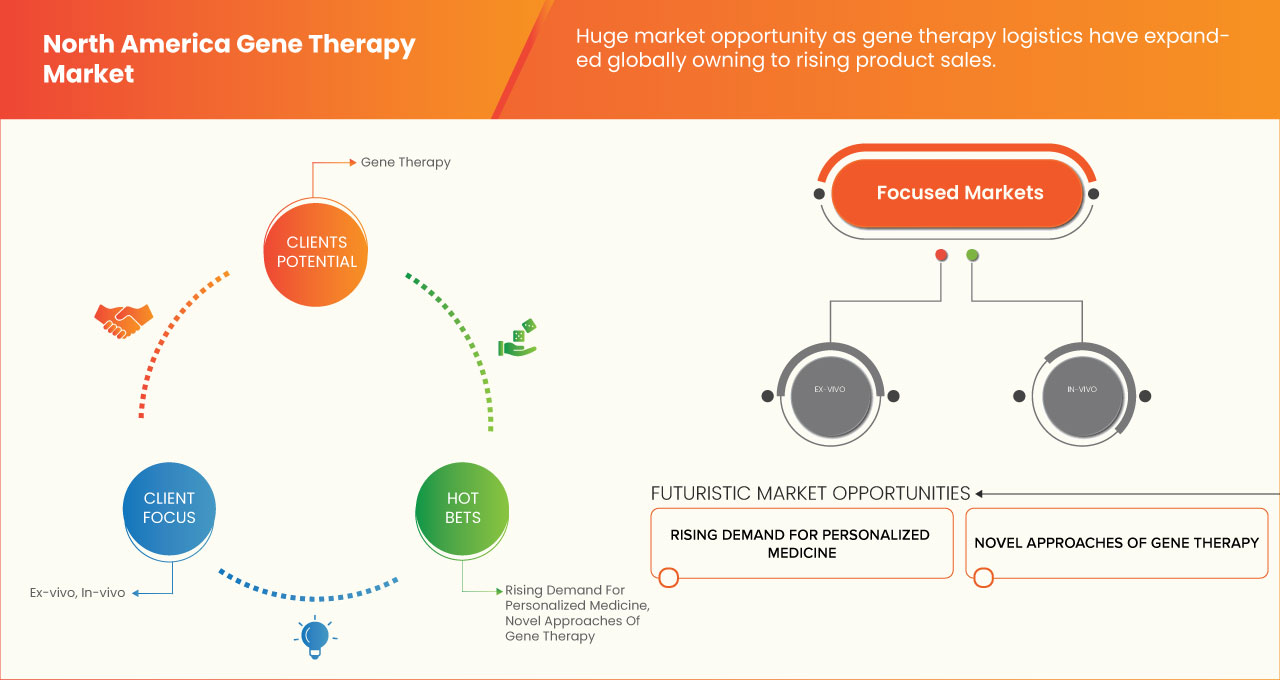

- 遺伝子治療の新たなアプローチ

遺伝子治療は、以前は一時的な治療に過ぎなかった病気に永久的な治療をもたらしました。遺伝子治療は長い間効果がありませんでしたが、近年では効果的で長期的な治療例が記録されています。血液異常、免疫不全、視力障害、神経細胞再生、代謝障害、さまざまな種類の癌など、幅広い遺伝性疾患で有望な結果が得られています。

遺伝子治療は、より特異性が高く、副作用が少ないため、さまざまな病気を「治す」ことができるカスタマイズされた薬になる可能性があります。遺伝子治療とは、一般的に、病気を治療するため、または少なくとも患者の臨床状態を改善するために遺伝物質を移入することを指します。ウイルスを遺伝子ベクターとして使用して、目的の遺伝子を標的細胞に送達することは、遺伝子治療の機能の 1 つの方法です。これらのベクターは、含まれるゲノムの種類に応じて、RNA ベースまたは DNA ベースのウイルスベクターに分類されます。

専門家の大多数は、遺伝子治療がこれまでの DNA 研究の最も興味深い用途になる可能性があることに同意しています。遺伝子移送剤の単純な静脈注射は、将来的には、安定した部位特異的な染色体統合とそれに続く遺伝子発現のための標的細胞を探し出すために、薬として遺伝子を投与するために使用される可能性があります。世界中の研究者によってテストされ、従来の治療に組み込まれている革新的な技術を使用した遺伝子治療の必要性が予測されており、北米の遺伝子治療市場の成長の原動力となることが期待されています。

- 遺伝性疾患の増加

この地域のいくつかの国では、出生前死亡率と新生児死亡率のかなりの割合が遺伝性疾患と先天性疾患によるものです。多くの多因子疾患も遺伝的要因によって起こることがよくあります。体内のあらゆる細胞に本質的に存在する遺伝子変異が、多くの遺伝性疾患を引き起こします。したがって、これらの疾患は多くの身体系に影響を及ぼすことが多く、その大部分は治療できません。

例えば、

- 西オーストラリア州政府によると、保健省は、およそ10人中6人が遺伝的に関連する病気に罹患すると指摘している。遺伝性疾患は軽度から非常に重度までさまざまである。西オーストラリア州で生まれた新生児の3~5%が遺伝性疾患または先天異常を抱えている。

突然変異、化学物質や放射線への曝露などにより、遺伝性疾患が発生する可能性があります。一部の疾患は遺伝子治療で治療されていますが、遺伝性疾患の治療計画の大半は、根本的な遺伝子異常を変化させません。このため、遺伝子異常の有病率はすべての年齢層で大幅に増加しており、実質的にすべての地理的地域が北米の遺伝子治療市場の成長の原動力となることが期待されています。

拘束

- 遺伝子治療の高コスト

遺伝子治療と呼ばれる新しい治療法では、患者のゲノムの遺伝情報を置き換えたり、削除したり、導入したりして、病気を治療します。遺伝子治療はまだ初期段階ですが、かつては治療不可能だった病気の治療、さらには治癒に非常に有望であることがすでに示されています。遺伝子治療の価格は、多くの国でまだ完全に管理されておらず、ケースごとに決定されており、多くの場合、一括前払いに重点が置かれています。

例えば、

- 2023年2月にWeb MDに掲載されたニュース記事によると、ヘムジェニックスは記録を更新しているが、決して例外ではない。2022年9月には、まれな神経疾患の治療薬であるスカイソナが300万ドルで発売された。そのわずか1か月前には、遺伝性血液疾患の遺伝子治療薬であるジンテグロが280万ドルで市場にデビューした。乳幼児の命を奪う遺伝性疾患である脊髄性筋萎縮症の治療薬であるゾルゲンスマは、2019年に210万ドルの費用がかかった。

Even if they are not always fully curative, gene therapies can be really transforming. The main barrier to accessing gene therapy is cost. The treatment landscape for many rare genetic illnesses will undergo significant change as additional gene therapy products become available, providing patients with potentially curative alternatives for the first time. The difficulty of making sure that all patients, not just a small group with financial means and privileged access to technology, may benefit from these cutting-edge therapies must be addressed by healthcare systems around the world. However, due to the high cost of the treatments

Opportunity

-

Rise in strategic acquisition and partnership among organizations

Recently, different organizations are stepping forward for partnership and collaboration to develop various gene therapy products that are essential for detecting genetic disorders. Not only this, with the help of partnerships and agreements both the companies can develop a new suite of technologies and platforms that will help to detect diseases.

With the help of a long-term agreement, both companies can provide dimensional pricing of gene therapy products in response to consumer demand in the market. Such partnership and mutual agreement not only benefit both the companies but are also creating a lot of opportunities for the market to grow.

For instance,

-

In July 2022, Novartis Pharmaceuticals UK announces the launch of the Novartis Biome UK Heart Health Catalyst 2022, in a world-first investor partnership with Medtronic ltd, RYSE Asset Management, and Chelsea and Westminster Hospital NHS Foundation Trust and its official charity CW+

Therefore, a rise in collaboration & partnerships is further expected to create a lot of opportunities for the market to grow

Challenge

- Stringent regulations for gene therapy products

The use of gene therapy across the globe is rapidly increasing, with the growth of the aged population and several chronic diseases which are preventable by early diagnosis and timely treatments. At the same time, the players of the gene therapy in the market have to follow certain regulations to get approval from the upper authorities for the launching of the product in a region. These stringent guidelines need to be followed, and this is one of the most difficult tasks among all the steps. The pre-market approval of various gene therapy products varies from one country to another.

For instance,

- In 2022, according to the information provided by Food and Drug Administration (FDA), the Center for Biologics Evaluation and Research (CBER) regulates cellular therapy products, human gene therapy products, and certain devices related to cell and gene therapy. CBER uses both the Public Health Service Act and the Federal Food Drug and Cosmetic Act as enabling statutes for oversight.

Hence, stringent regulations for gene therapy products is different for different countries which is expected to act as a challenge in the market growth.

Recent Developments

- In December 2022 Kite Pharma, Inc., and Daiichi Sankyo Co., Ltd. announced that the Japan Ministry of Health, Labour and Welfare (MHLW) has approved Yescarta (axicabtagene ciloleucel), a chimeric antigen receptor (CAR) T-cell therapy, for the initial treatment of patients with relapsed/refractory large B-cell lymphoma (R/R LBCL): diffuse large B-cell lymphoma, primary mediastinal large B-cell lymphoma, transformed follicular lymphoma, and high-grade B-cell lymphoma. Only patients who have not previously had a transfusion of CAR T cells directed against the CD19 antigen should be treated with Yescarta

- In December, Ferring Pharmaceuticals announced the U.S. Food and Drug Administration (FDA) approved Adstiladrin (nadofaragene firadenovec-vncg), a novel adenovirus vector-based gene therapy, for the treatment of adult patients with high-risk, Bacillus Calmette-Guérin (BCG)-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS) with or without papillary tumors. This has helped the company to expand their product portfolio

North America Gene Therapy Market Scope

The North America gene therapy market is segmented into four notable segments based on vector type, method, application, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY VECTOR TYPE

- Viral Vector

- Non-Viral Vector

On the basis of vector type, the North America gene therapy market is segmented into viral and non-viral vector.

BY METHOD

- Ex-Vivo

- In-Vivo

On the basis of method, the North America gene therapy market is segmented into ex vivo and in vivo.

BY APPLICATION

- Oncological Disorders

- Cardiovascular Diseases

- Infectious Disease

- Rare Diseases

- Neurological Disorders

- Other Diseases

On the basis of application, the North America gene therapy market is segmented into oncological disorders, cardiovascular diseases, infectious diseases, rare diseases, neurological disorders, and other diseases.

BY END USER

- Cancer Institutes

- Hospitals

- Research Institutes

- Others

On the basis of end user, the North America gene therapy market is segmented into cancer institutes, hospitals, research institutes, and others.

North America Gene Therapy Market Regional Analysis/Insights

The North America gene therapy market is segmented into four notable segments based on vector type, method, application, and end user.

The countries covered in this market report are U.S., Canada, and Mexico.

U.S. is expected to grow due to rise in technological advancement in gene therapy products market.

The U.S. dominates North America region due to strong presence of key players Novartis AG, Kite Pharma. Germany dominates Europe region due to the mass production of gene therapy products and increasing demand from emerging markets and expansion. China dominates Asia-Pacific region due to due to increasing customer inclinations towards minimally invasive medical processes.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米の遺伝子治療市場シェア分析

北米遺伝子治療市場の競争状況では、競合他社ごとに詳細が提供されます。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品の承認、製品の幅と幅、アプリケーションの優位性、製品タイプのライフライン曲線が含まれます。提供されている上記のデータ ポイントは、北米遺伝子治療市場への会社の重点にのみ関連しています。

北米の遺伝子治療市場で活動している主要企業には、ノバルティスAG、カイトファーマ(ギリアド・サイエンシズの子会社)、ユニキュアNV、オックスフォード・バイオメディカ、スパーク・セラピューティクス、SIBONO、ブルーバード・バイオ、上海サンウェイ・バイオテック、バイオジェン、デンドレオン・ファーマシューティカルズLLC、アムジェン、アンジェス、エンジヴァント・セラピューティクスGmbH、オーデュボン・バイオサイエンスなどがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GENE THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE ANALYSIS

5 UPDATE ON GERMLINE GENE THERAPY

5.1 GERMLINE GENE THERAPY

6 NORTH AMERICA GENE THERAPY MARKET, MO

6.1 DRIVERS

6.1.1 NOVEL APPROACHES TO GENE THERAPY

6.1.2 INCREASING PREVALENCE OF GENETIC DISORDERS

6.1.3 THE GROWING INVESTMENT BY BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

6.1.4 GROWING DEMAND FOR PERSONALIZED MEDICINE

6.2 RESTRAINTS

6.2.1 HIGH COST OF GENE THERAPY

6.2.2 ETHICAL AND SAFETY CONCERNS

6.2.3 COMPLEXITY OF GENE THERAPY

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION AND PARTNERSHIP AMONG ORGANIZATIONS

6.3.2 RISING APPROVAL FOR GENE THERAPY PRODUCTS

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS FOR GENE THERAPY PRODUCTS

6.4.2 LONG-TERM SAFETY AND EFFICACY

7 NORTH AMERICA GENE THERAPY MARKET, BY VECTOR TYPE

7.1 OVERVIEW

7.2 VIRAL VECTOR

7.2.1 ADENOVIRUS

7.2.2 RETROVIRUS

7.2.3 LENTIVIRUS

7.2.4 ADENO-ASSOCIATED VIRUS

7.2.5 VACCINIA VIRUS

7.2.6 HERPES SIMPLEX VIRUS

7.2.7 OTHERS

7.3 NON-VIRAL VECTOR

7.3.1 LIPOFECTION

7.3.2 INJECTION OF NAKED DNA

8 NORTH AMERICA GENE THERAPY MARKET, BY METHOD

8.1 OVERVIEW

8.2 EX-VIVO

8.3 IN-VIVO

9 NORTH AMERICA GENE THERAPY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGICAL DISORDERS

9.3 CARDIOVASCULAR DISEASES

9.4 INFECTIOUS DISEASES

9.5 RARE DISEASES

9.6 NUEROLOGICAL DISORDERS

9.7 OTHER DISEASES

10 NORTH AMERICA GENE THERAPY MARKET, BY END USER

10.1 OVERVIEW

10.2 CANCER INSTITUTES

10.3 HOSPITALS

10.4 RESEARCH INSTITUTES

10.5 OTHERS

11 NORTH AMERICA GENE THERAPY MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA GENE THERAPY MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 COMPANY PROFILES

13.1 BIOGEN

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SWOT ANALYSIS

13.1.5 PRODUCT PORTFOLIO

13.1.6 RECENT DEVELOPMENT

13.2 KITE PHARMA

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SWOT ANALYSIS

13.2.5 PRODUCT PORTFOLIO

13.2.6 RECENT DEVELOPMENT

13.3 NOVARTIS AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SWOT ANALYSIS

13.3.5 PRODUCT PORTFOLIO

13.3.6 RECENT DEVELOPMENTS

13.4 BRISTOL-MYERS SQUIBB COMPANY.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SWOT ANALYSIS

13.4.5 PRODUCT PORTFOLIO

13.4.6 RECENT DEVELOPMENT

13.5 OXFORD BIOMEDICA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 SWOT ANALYSIS

13.5.5 PRODUCT PORTFOLIO

13.5.6 RECENT DEVELOPMENTS

13.6 AGC BIOLOGICS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ANGES, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 AMGEN INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BLUEBIRD BIO, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CHIESI FARMACEUTICI S.P.A

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DENDREON PHARMACEUTICALS LLC

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 ENZYVANT THERAPEUTICS GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 RODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 FERRING B.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 JANSSEN PHARMACEUTICALS, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MALLINCKRODT.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 ORCHARD THERAPEUTICS PLC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 SHANGHAI SUNWAY BIOTECH CO., LTD.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SIBONO

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SPARK THERAPEUTICS, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 UNIQURE NV.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA VIRAL VECTOR IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA EX-VIVO IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA IN –VIVO IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONCOLOGICAL DISORDERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CARDIOVASCULAR DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA INFECTIOUS DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA RARE DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA NEUROLOGICAL DISORDERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OTHER DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA CANCER INSTITUTES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA HOSPITALS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA RESEARCH INSTITUTES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA GENE THERAPY MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 U.S. GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 30 U.S. NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 32 U.S. GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 U.S. GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 CANADA GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 35 CANADA VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 36 CANADA NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 37 CANADA GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 38 CANADA GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 CANADA GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 MEXICO GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 41 MEXICO VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 44 MEXICO GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 45 MEXICO GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA GENE THERAPY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GENE THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GENE THERAPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GENE THERAPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GENE THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GENE THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GENE THERAPY MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA GENE THERAPY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA GENE THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA GENE THERAPY MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF GENETIC DISORDERS AND GROWING DEMAND FOR PERSONALIZED MEDICINE ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA GENE THERAPY MARKET FROM 2023 TO 2030

FIGURE 12 THE VIRAL VECTOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GENE THERAPY MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GENE THERAPY MARKET

FIGURE 14 NORTH AMERICA GENE THERAPY MARKET: BY VECTOR TYPE, 2022

FIGURE 15 NORTH AMERICA GENE THERAPY MARKET: BY VECTOR TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA GENE THERAPY MARKET: BY VECTOR TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA GENE THERAPY MARKET: BY VECTOR TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA GENE THERAPY MARKET: BY METHOD, 2022

FIGURE 19 NORTH AMERICA GENE THERAPY MARKET: BY METHOD, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA GENE THERAPY MARKET: BY METHOD, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA GENE THERAPY MARKET: BY METHOD, LIFELINE CURVE

FIGURE 22 NORTH AMERICA GENE THERAPY MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA GENE THERAPY MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA GENE THERAPY MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA GENE THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA GENE THERAPY MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA GENE THERAPY MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA GENE THERAPY MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA GENE THERAPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA GENE THERAPY MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA GENE THERAPY MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA GENE THERAPY MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA GENE THERAPY MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 NORTH AMERICA GENE THERAPY MARKET: VECTOR TYPE (2023-2030)

FIGURE 35 NORTH AMERICA GENE THERAPY MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。