北米の自立型電動高さ調節テーブル市場、タイプ別(シングルモーター、デュアルモーター)、用途別(オフィス、商業、工業、家庭用)、販売チャネル別(専門店、スーパーマーケット、ハイパーマーケット、オンライン小売店、その他) - 2029年までの業界動向と予測。

北米の自立型電動高さ調節テーブル市場分析と規模

北米の自立型電動高さ調節テーブル市場は、企業と従業員の両方に提供する数多くのメリットによって牽引されています。現代的な高さ調節可能なデスクの市場は、現代的な高さ調節可能なワークステーションの需要の増加によっても牽引されています。人間の体は、特に通常のオフィス勤務時間中に、快適な姿勢にあるときに自然に最もよく機能します。これにより一般的な健康状態が改善され、現代の高さ調節可能なデスクの市場機会が生まれます。北米の自立型電動高さ調節テーブル市場を制限する主な要因は、上記の代替品に対する需要の増加によるものですが、より高いです。自立型電動高さ調節テーブルの需要の高まりの結果として、生産者は新しいデザインと新しいモデルの製造にさらに力を入れています。

市場の成長を牽引している要因としては、ハイブリッド ワークや在宅勤務文化のトレンド、電動家具への消費者嗜好の変化、製品の環境に優しい性質などが挙げられます。ただし、スマート家具製品と従来の家具の価格差が非常に大きいという制約が、市場の成長を妨げています。

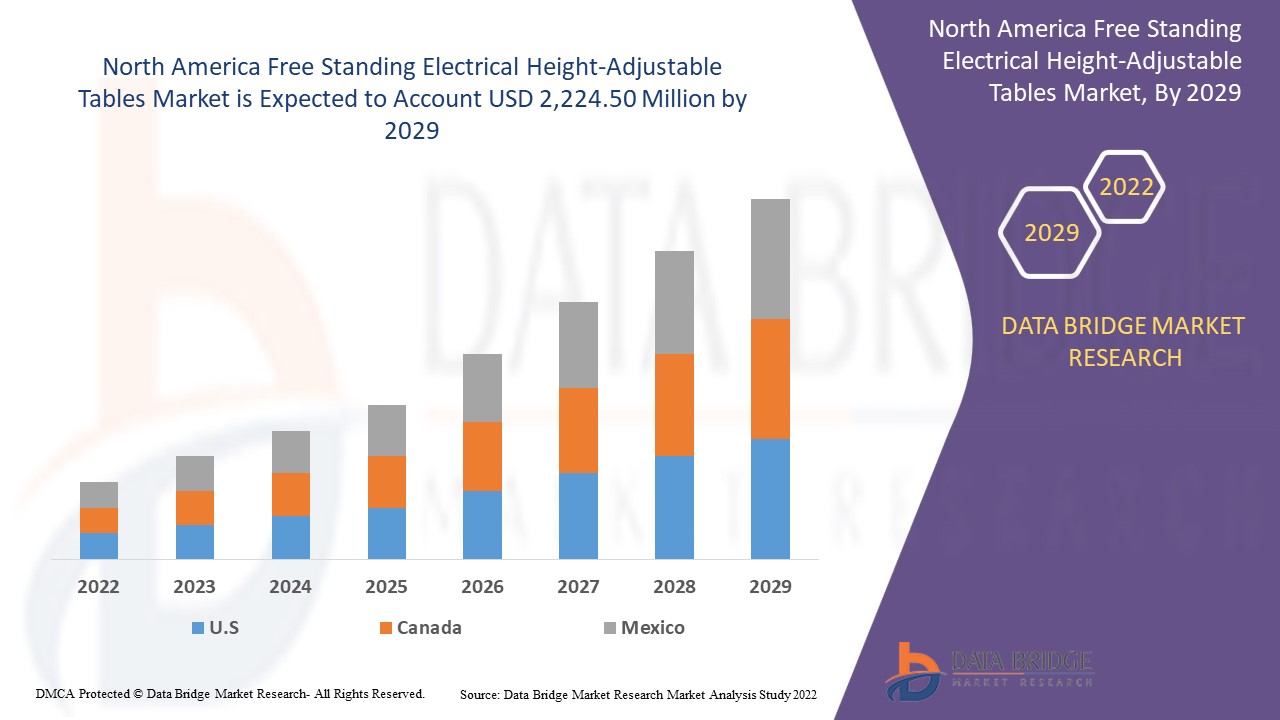

Data Bridge Market Research の分析によると、自立型電動高さ調節テーブル市場は、予測期間中に 7.6% の CAGR で成長し、2029 年までに 22 億 2,450 万米ドルに達すると予想されています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、販売数量は千個、価格は米ドル |

|

対象セグメント |

タイプ別(シングルモーター、デュアルモーター)、用途別(オフィス、商業、工業、家庭用)、販売チャネル別(専門店、スーパーマーケット、ハイパーマーケット、オンライン小売店、その他) |

|

対象地域 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

Conen Products GmbH、ConSet America、North America Furniture Group、HNI Corporation、Schiavello、KI、Fellowes Brands、Ofita、ROL AB、Teknion、PALMBERG、Haworth Inc.、OKAMURA CORPORATION.、Kimball International、Steelcase Inc.、Gispen、Ergomaster、 Inter IKEA Systems BV、CEKA、RAGNARS、Röhr-Bush GmbH & Co. KG、ACTIU Berbegal y Formas SA、KOKUYO CO., LTD.、Kinnarps AB など。 |

市場の定義

自立型電動高さ調節テーブルは、ユーザーが高さを変えるのに役立ちます。背筋と首は非常にリラックスしており、デスクの可動性も十分です。背骨、膝、足首の現代的な選択肢は、高さ調節可能なテーブルです。さらに、ユーザーの集中力と想像力を育みます。座ることと立つことの両方に調整できる高さ調節可能なテーブルは、座ることしかできないものよりも健康的です。健康への悪影響は、長時間の滞在に関連しています。現在のデスクに追加したり取り外したりして、立ったり座ったりを切り替えることができる小型のテーブルトップモデルは、シットスタンドワークステーションのもう 1 つの選択肢です。

自立型電動高さ調節テーブル市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー:

- 職場での従業員の悪い姿勢がもたらす健康リスクについて、現代の組織における認識を高める

たとえば、姿勢が悪いと、関節や筋肉に不必要な負担がかかり、さまざまな健康上の問題を引き起こす可能性があります。これにより、過労や疲労が生じ、慢性的な不快感につながる可能性があります。その結果、腱炎や手根管症候群などの筋骨格疾患 (MSD) が発生する可能性があります。筋肉、血管、神経、靭帯、腱はすべて、これらの症状の影響を受ける可能性があります。今日では、勤務時間中の悪い姿勢によるこれらの健康上の問題に対する人々の認識が高まっています。そのため、組織は、勤務時間中に良い姿勢を保つことができる、自立型電動高さ調節テーブルなどの設備を提供しています。そのため、従業員は悪い姿勢に関連する健康上の問題にあまり直面しません。

例えば、

- 2022年5月、Aayuv Technologies Private Limitedは「従業員の健康と幸福:企業の成長にとって重要なのか?」というブログを公開しました。このブログでは、健康意識をより意識している雇用主に対する需要が高まっているため、最近ではほとんどの組織が最高のインフラを提供していることが明らかになっています。

現代の組織では、悪い姿勢が健康に与える重大な影響についての認識が高まっているため、啓発プログラムを実施したり、オフィスの設備を改善したりしています。これが直接的な原動力となり、市場の成長を後押ししています。

- 人間工学に基づいた家具の幅広い用途への採用の増加

人間工学とは、労働者を職場に強制的に適応させるのではなく、労働者の要求を満たす職場環境を創り出すことです。優れた人間工学設計は、仕事の質と成果を向上させると同時に、労働者の健康も改善することが証明されています。従来のオフィス家具とは異なり、人間工学に基づいた椅子は、ユーザーの体を安全で直立した姿勢に保ち、背骨、首、腰へのストレスを軽減します。これは、首と肩を支えるヘッドレストと、背骨の自然なカーブを維持する背もたれを使用することで実現します。人間工学のもう 1 つの増加傾向は、一部の企業で急速に必須になりつつあるシットスタンド デスクです。これは、従業員が立ち上がってもっと動くようにすることを目的としています。採用が増えているため、人々はさまざまなアプリケーションを使用することに関心を持っています。

例えば、

- ImageWorks Commercial Interiors は、「人間工学に基づいたオフィス家具の将来について知っておくべきこと」に関する洞察を発表しました。現在販売されている人間工学に基づいたオフィス家具には、最新のテクノロジーとクリエイティブなデザインがすでに導入されていますが、それは常に開発の可能性がないということではありません。人間工学に基づいたオフィス家具の将来は、オフィス家具の製造方法を根本的に変える可能性のある革新的なアイデアで溢れています。

市場には幅広い応用範囲があり、今後も高度な技術を活用することでアプリケーションは日々増加し、市場の成長に貢献するでしょう。

拘束

- 通常の家具に比べてスマート家具は高価

スマート家具は、椅子、机、テーブルなどの通常の家具ではなく、インテリジェント システムを備え、コントローラーで制御される、家庭やオフィス向けのモダンなデザインの家具です。そのため、原材料の調達と製造には多額の投資が必要で、製品の最終的な価格は通常の家具よりも高くなります。このため、多くの消費者は、自立型電動高さ調節テーブルなどのスマート家具の購入を避けています。

そのため、スマート家具製品と従来の家具の間の価格差が非常に大きいため、市場の拡大に大きな支障をきたすと予想されます。

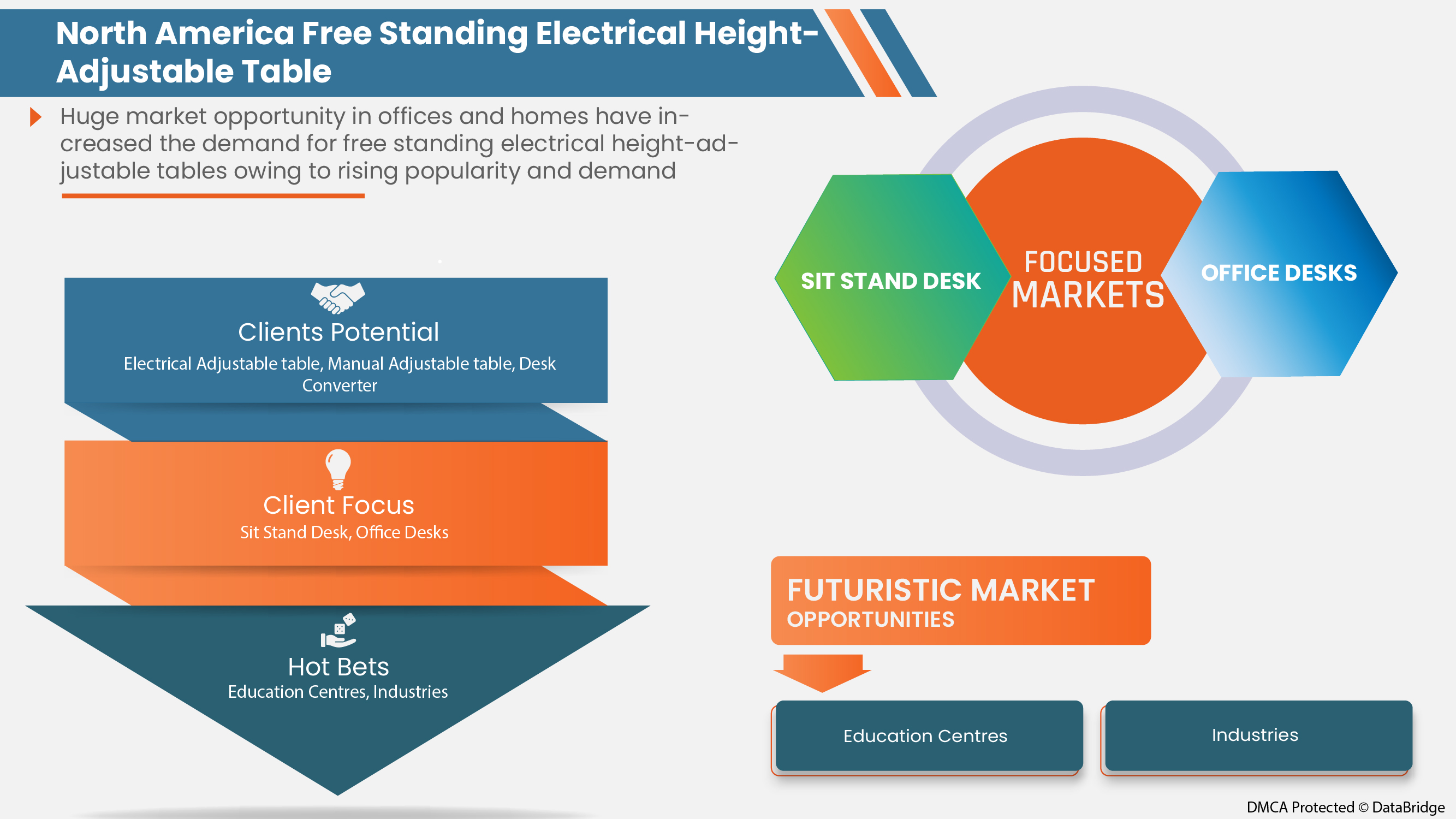

機会

- 実体験型の小売店の出店増加

顧客は、家具製品についてより深く理解するために、小売店を訪れることを好みます。近年、さまざまな支店名を持つ数多くの新しい小売店がさまざまな場所に設立されています。各地域の大多数の顧客は、これらのさまざまな支店にアクセスできます。従業員は、この簡単なアクセスから大きな利益を得るだけでなく、ビジネス自体もより多くの売上を生み出すことができます。

例えば、

- 2022年6月、IKEAはベンガルールに初の大型店舗をオープン。カルナタカ州に3000億ルピーを投資。これによりIKEAの売上が伸びる。

新しい小売店の設置が増えることで、従業員と企業に多くの機会が生まれ、市場の成長につながります。

課題

- High cost of raw material

Most consumers these days favor high-quality goods. High-quality raw materials are needed to produce high-quality goods, which is a prerequisite in the manufacturing process. However, the cost of high-quality raw materials is exorbitant, and only a small number of investors are willing to make that kind of investment. The majority of businesses aren't exhibiting interest in investing in these sectors as a result of the high cost of excellent raw materials.

For instance,

- In August 2021, Henkel published an article on “Furniture industry news: How a raw material cost increase could change the furniture industry as we know it?”. It tells that the high price of raw materials during the COVID-19 pandemic due to less availability leads to increasing prices of the final furniture products

Therefore, the main challenge in the market may be caused by these high raw material prices.

Post-COVID-19 Impact On North America Free Standing Electrical Height-Adjustable Tables Market

Post the pandemic, the demand for free standing electrical height-adjustable tables has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply furniture products to consumers, initially increasing the demand for products. However, post-COVID, the demand for Free standing electrical height-adjustable tables has increased significantly owing to improves general health and productivity at work.

Recent Developments

- In July 2022, ACTIU Berbegal y Formas S.A. aim was to innovate to be at the top of the class. The company designs working spaces for the students in the classroom for better study and learning by providing agile and comfortable furniture. The development of advanced technologies has led to good facilities for learning, which will attract other learning institutes to adopt the same. This help in the market growth

- In 2019, Conen Produkte GmbHlaunched a height adjustable mount that is a new trend and also developed in tables that has a great effect on the market in both the sectors for tables as well as mounts, leading to an increase in the market of the company. These techniques also help to table market increase because they involve the same techniques

North America Free Standing Electrical Height-Adjustable Tables Market Scope

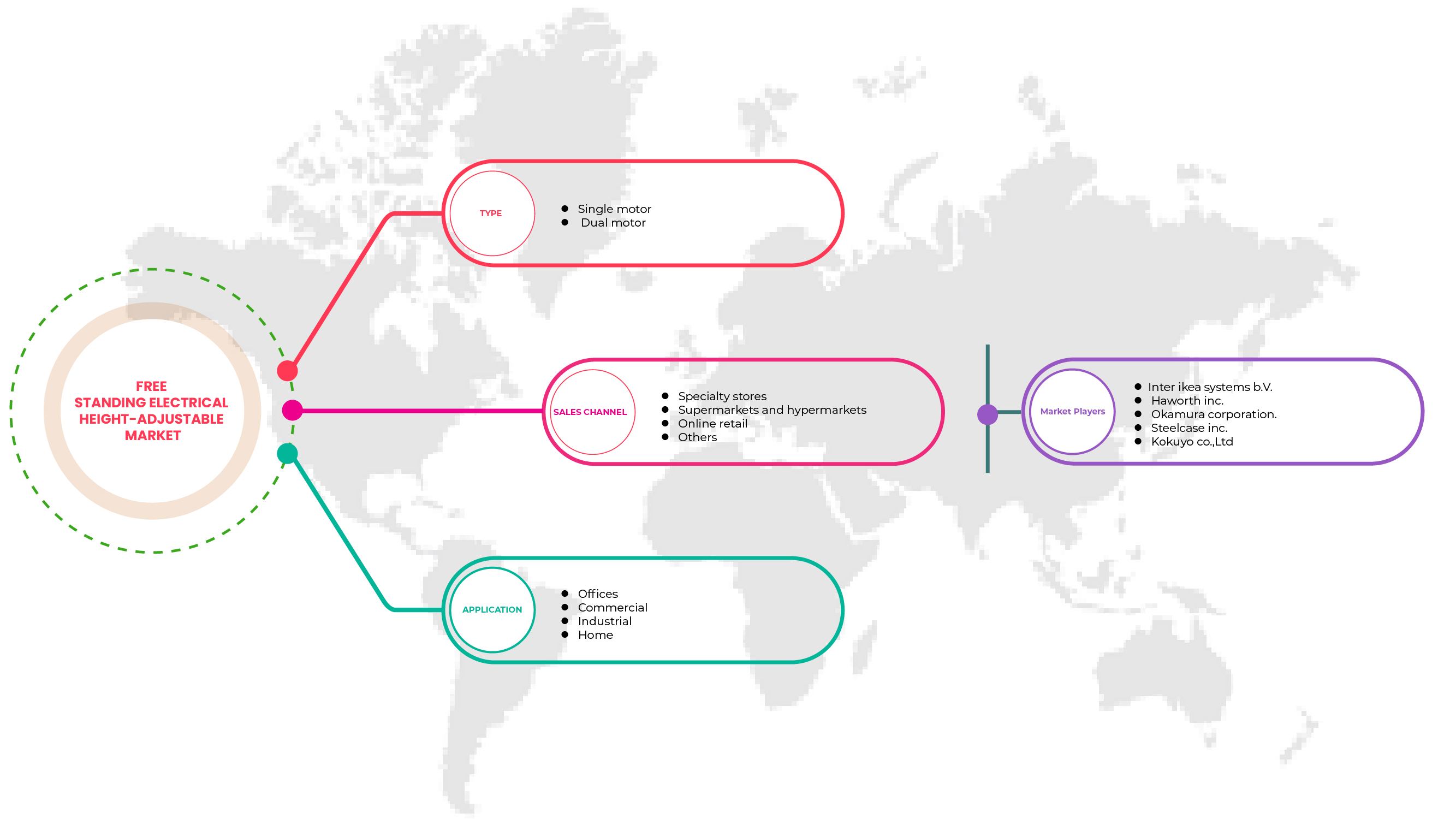

The North America free standing electrical height-adjustable tables market is segmented into three notable segments based on type, application, and sales channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

TYPE

- Single Motor

- Dual Motor

On the basis of type, the North America free standing electrical height-adjustable tables market is segmented into single-motor, and dual motor.

APPLICATION

- Offices

- Commercial

- Industrial

- Home

On the basis of application, the North America free standing electrical height-adjustable tables market is segmented into offices, commercial, industrial, and home.

SALES CHANNEL

- Specialty Stores

- Supermarkets And Hypermarkets

- Online Retail

- Others

On the basis of sales channels, the North America free standing electrical height-adjustable tables market is segmented into specialty stores, supermarkets, hypermarkets, online retail, and others.

North America Free Standing Electrical Height-Adjustable Tables Market Regional Analysis/Insights

The North America free standing electrical height-adjustable tables market is analyzed, and market size insights and trends are provided based on as referenced above.

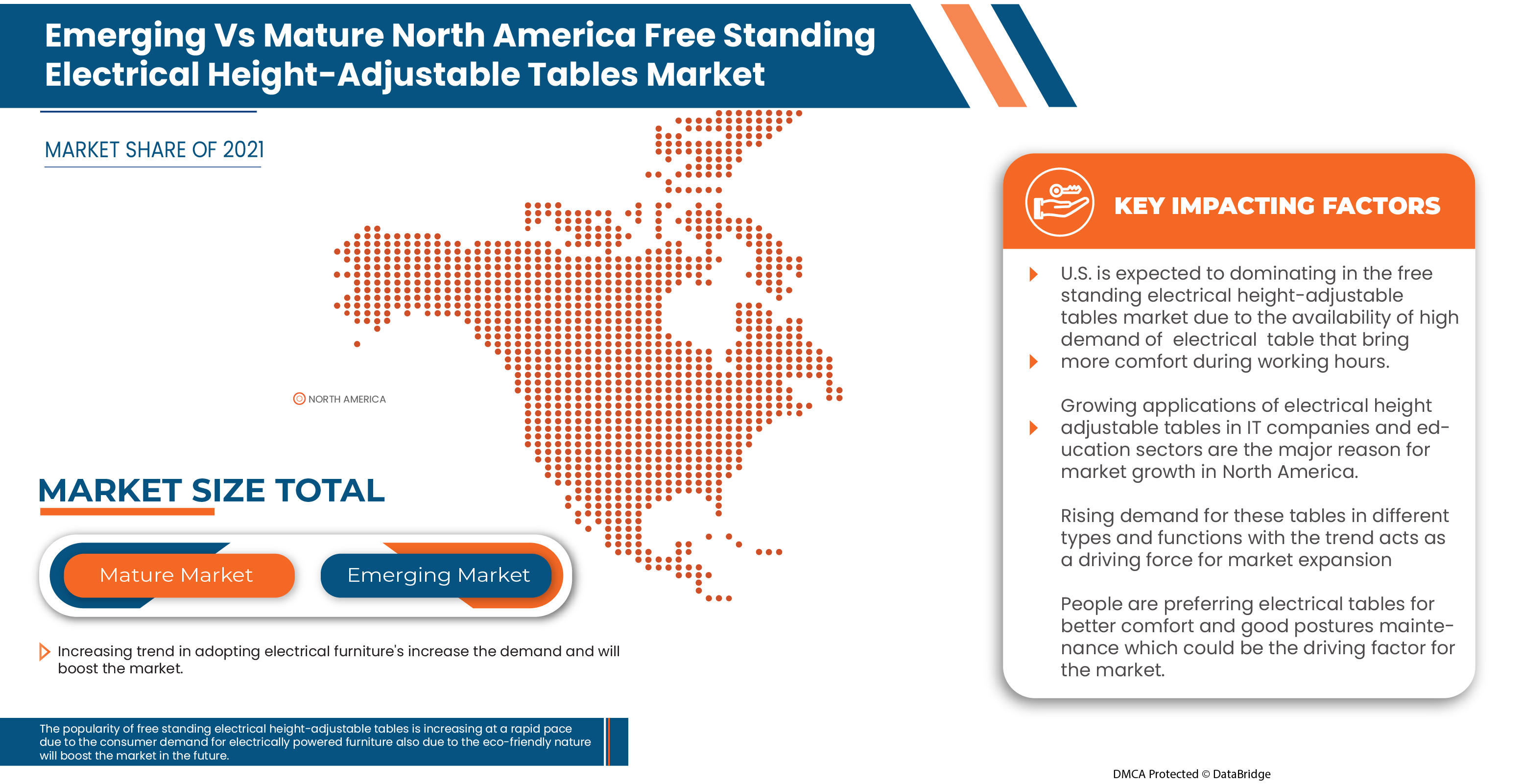

The countries covered in the North America free standing electrical height-adjustable tables market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America free standing electrical height-adjustable tables market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the Growing demand for these tables is the major reason for the growth of free standing electrical height adjustable tables in the North America region.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Free Standing Electrical Height-Adjustable Tables Market Share Analysis

The Competitive North America free standing electrical height-adjustable tables market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the North America free standing electrical height adjustable tables market.

北米の自立型電動高さ調節テーブル市場で事業を展開している主要企業には、Conen Products Gmbh、Conset America、North America Furniture Group、Hni Corporation、Schiavello、Ki、Fellowes Brands、Ofita、Rol Ab、Teknion、Palmberg Okamura Corporation、Kimball International、Steelcase Inc.、Gispen、Ergomaster、Ikea、Ceka、Ragnars、Röhr-Bush Gmbh & Co. Kg などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF CONSUMERS

4.2 LIST OF KEY RAW MATERIALS

4.3 LIST OF SUPPLIERS

4.4 MARKET DYNAMICS AND EXPANSION PLANS (M&A)

4.4.1 MARKET DYNAMICS

4.4.2 EXPANSION PLANS (M&A)

4.5 TOP MANUFACTURES SALES PRICES (USD/UNIT) -

4.6 TOP MANUFACTURERS TOTAL SALES

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL & COMPONENTS

5.2 PRODUCTION & ASSEMBLY

5.3 RETAILERS & DISTRIBUTION

5.4 END-USERS

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROW IN AWARENESS IN MODERN ORGANIZATIONS ABOUT THE HEALTH RISKS BROUGHT ON BY EMPLOYEES' BAD POSTURE IN THE WORKPLACE

7.1.2 THE INCREASE IN ADOPTION OF ERGONOMIC FURNITURE IN A WIDE RANGE OF APPLICATIONS

7.1.3 RAISE IN HEALTH CONSCIOUSNESS AMONG EMPLOYEES

7.1.4 A TREND IN CONSUMER PREFERENCE FOR ELECTRICALLY POWERED FURNITURE

7.1.5 THE INCREASING TREND OF HYBRID WORKING OR WORK FROM HOME CULTURE MAY INCREASE THE DEMAND

7.2 RESTRAINTS

7.2.1 THE HIGH EXPENSE OF SMART FURNITURE VERSUS REGULAR FURNITURE

7.2.2 HIGH COST FOR REPLACEMENT IF ANY PART IS NOT WORKING PROPERLY

7.2.3 HIGH AVAILABILITY OF SUBSTITUTE PRODUCTS

7.3 OPPORTUNITIES

7.3.1 DIFFERENT PRODUCT CATEGORIES IN NEW DESIGNS AND SOLUTIONS ACCORDING TO THE DEMAND

7.3.2 INCREASING OPENINGS OF RETAIL STORES FOR PHYSICAL EXPERIENCE

7.3.3 EXPANSION OF ONLINE RETAIL AND DISTRIBUTION CHANNEL

7.4 CHALLENGES

7.4.1 HIGH COST OF RAW MATERIAL

7.4.2 LACK OF INVESTMENTS FROM END-USER COMPANIES

7.4.3 INTENSE MARKET COMPETITION BY MANUFACTURERS

8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE MOTOR

8.3 DUAL MOTOR

9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OFFICES

9.2.1 HIGH-RISE

9.2.2 MID-RISE

9.2.3 LOW-RISE

9.3 COMMERCIAL

9.3.1 EDUCATIONAL INSTITUTIONS

9.3.2 HEALTHCARE FACILITIES

9.3.3 RESEARCH LABORATORIES

9.3.4 AIRPORTS

9.3.5 RAILWAYS AND METRO STATIONS

9.3.6 HOTELS

9.3.7 MANUFACTURING

9.3.8 BUS STOPS AND STATIONS

9.3.9 RESTAURANTS AND BARS

9.3.10 RETAILS

9.3.11 WAREHOUSES

9.3.12 SHIPPING YARDS

9.3.13 OTHERS

9.4 INDUSTRIAL

9.4.1 PHARMACEUTICALS FACTORY

9.4.2 FOOD AND BEVERAGE

9.4.3 MANUFACTURING

9.4.4 OIL AND GAS

9.4.5 OTHERS

9.5 HOME

9.5.1 CONDOMINIUM

9.5.2 TOWN HOUSE

9.5.3 SINGLE FAMILY HOME

9.5.4 OTHERS

10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 SUPERMARKETS AND HYPERMARKETS

10.4 ONLINE RETAIL

10.5 OTHERS

11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTER IKEA SYSTEMS B.V.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 HAWORTH INC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OKAMURA CORPORATION.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 STEELCASE INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 KOKUYO CO., LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ACTIU BERBEGAL Y FORMAS S.A.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CEKA

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CONEN PRODUCTS GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSET AMERICA

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 FELLOWES INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ERGOMASTER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GISPEN

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NORTH AMERICA FURNITURE GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 HNI CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 KI

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 KIMBALL INTERNATIONAL INC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 KINNARPS AB

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 OFITA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 PALMBERG BÜROEINRICHTUNGEN + SERVICE GMBH

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 RAGNARS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 ROEHR-BUSH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 ROL AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 SCHIAVELLO INTERNATIONAL

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TEKNION

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 THE LIST OF SUPPLIERS:

TABLE 2 THE TOP MANUFACTURES SALES PRICES (USD/UNIT) FOR FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES:

TABLE 3 THE TOTAL SALES OF ELECTRICAL HEIGHT-ADJUSTABLE TABLE BASED COMPANIES ARE LISTED BELOW:

TABLE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 8 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 12 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 14 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 16 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 18 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 20 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 24 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 26 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 28 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 30 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 32 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 34 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 36 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 38 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 40 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 44 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 46 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 48 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 50 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 52 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 59 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 60 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 61 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 62 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 63 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 64 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 66 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 68 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 70 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 72 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 73 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 74 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 75 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 76 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 77 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 78 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 79 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 80 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 82 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 86 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 87 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 88 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 89 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 90 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 91 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 92 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 94 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

図表一覧

FIGURE 1 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 10 THE INCREASED TREND HYBRID WORKING OR WORK FROM HOME CULTURE IS EXPECTED TO DRIVE THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE SINGLE MOTOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 14 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2021

FIGURE 15 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNELS, 2021

FIGURE 17 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT ADJUSTABLE TABLES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。