北米の契約製造市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

65.00 Billion

USD

110.02 Billion

2024

2032

USD

65.00 Billion

USD

110.02 Billion

2024

2032

| 2025 –2032 | |

| USD 65.00 Billion | |

| USD 110.02 Billion | |

|

|

|

|

北米の契約製造市場のセグメンテーション、製品別(医薬品製造および医療機器製造)、エンドユーザー別(製薬会社、バイオテクノロジー会社、バイオファーマ会社、医療機器会社、OEM、研究機関)、流通チャネル別(小売販売、直接入札、その他) - 業界動向と2032年までの予測

北米の契約製造市場規模

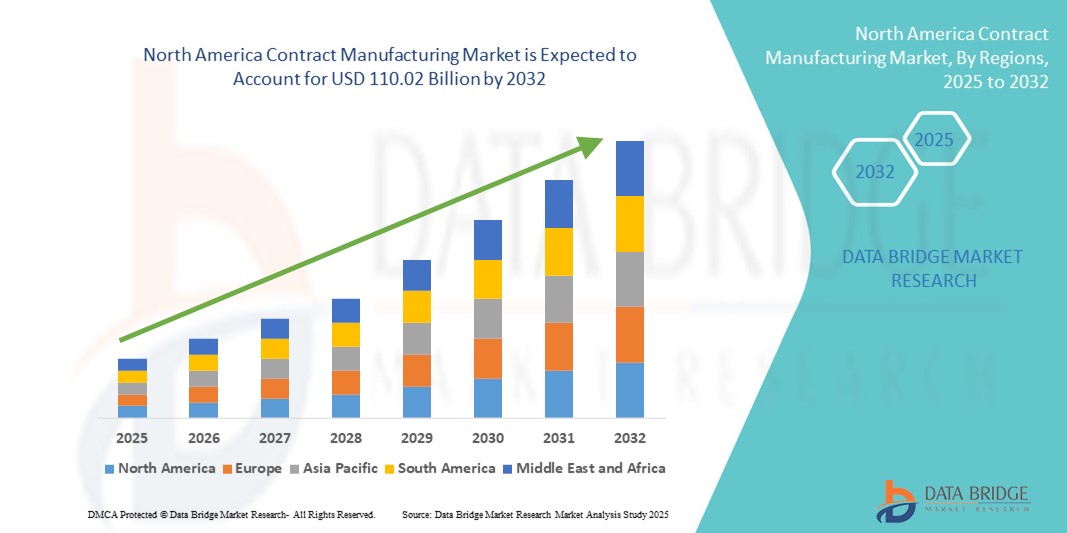

- 北米の契約製造市場規模は2024年に650億米ドルと評価され、予測期間中に6.8%のCAGRで成長し、2032年までに1100億2000万米ドル に達すると予想されています。

- 市場の拡大は、主に、コスト効率と運用の柔軟性を高めるために、医薬品、電子機器、消費財などのさまざまな分野で製造活動をアウトソーシングする傾向の増加によって推進されています。

- さらに、高品質でカスタマイズされた製品への需要の高まりと、迅速な市場投入期間の必要性により、企業は契約製造業者への依存を強めています。こうしたビジネスダイナミクスの変化は、契約製造セクターの成長を加速させ、北米の産業環境におけるその重要な役割を強化しています。

北米の契約製造市場分析

- ブランド品の第三者生産サービスを含む契約製造は、北米の産業戦略において重要な役割を果たしており、さまざまな分野の企業が業務効率を高め、設備投資を削減し、研究開発やマーケティングなどのコアコンピテンシーに集中することを可能にします。

- 契約製造への依存度が高まっている主な要因は、医薬品および医療機器分野におけるコスト効率が高く、拡張可能な生産に対する需要の高まり、製品の複雑性の増大、規制遵守の必要性などである。

- 米国は、先進的な製造インフラ、世界的な製薬・バイオテクノロジー企業の存在、ライフサイエンスと医療技術における強力なアウトソーシングのトレンドに支えられ、2024年には北米の契約製造市場において69.2%という最大の収益シェアを獲得し、市場を席巻した。

- カナダは、政府の有利な政策、製薬投資の拡大、生物製剤や先進治療に対する需要の増加により、予測期間中に北米の契約製造市場で最も急速に成長する国になると予想されています。

- 医薬品製造セグメントは、効率性と規制基準への準拠を求める製薬会社やバイオ製薬会社による医薬品開発と生産のアウトソーシングの増加により、2024年には北米の契約製造市場で59.8%のシェアを占めました。

レポートの範囲と北米の契約製造市場のセグメンテーション

|

属性 |

北米の契約製造業の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米の契約製造市場の動向

高付加価値の専門製造サービスへの移行

- 北米の契約製造市場における顕著かつ進化するトレンドの一つは、特に医薬品、バイオテクノロジー、医療機器といった分野において、高付加価値で専門的な製造サービスの提供への移行です。この変化は、高度な技術力、規制に関する専門知識、そしてエンドツーエンドのサービス提供に対する顧客からの需要の高まりを反映しています。

- 例えば、サーモフィッシャーサイエンティフィックはバイオ医薬品製造におけるCDMOサービスを大幅に拡大しており、一方、キャタレントは高まる顧客ニーズに応えるため、先進的な薬物送達技術とバイオ医薬品の充填・仕上げ能力への投資を続けている。

- 専門的な製造サービスには、高活性API、複雑な滅菌注射剤、遺伝子・細胞治療薬のサポートが含まれることが多くなっています。これらのサービスは、困難な製品処方や厳格な規制環境を乗り越えようとするバイオ医薬品企業にとって不可欠です。

- 医療機器分野では、契約メーカーが3Dプリンティング、自動化、精密ロボットなどの先進技術を取り入れ、ますます複雑化する機器の製造で顧客をサポートしています。

- この専門化への傾向は、開発、スケールアップ、そして商業生産にまたがる統合ソリューションに対する顧客の期待によっても推進されています。製品ライフサイクル全体にわたって、柔軟で技術主導型、そして規制に準拠したサービスを提供できる契約製造業者は、競争上の優位性を得ています。

- その結果、市場は、従来の低コストで量産重視の生産から、品質、市場投入までのスピード、そして高成長の治療および機器分野における革新に重点を置いた長期的な戦略的パートナーシップへと明確な移行を目撃しています。

北米の契約製造市場の動向

ドライバ

効率を最適化するために製薬会社とバイオテクノロジー会社によるアウトソーシングが増加

- 製薬企業やバイオテクノロジー企業による製造プロセスのアウトソーシングの傾向の高まりは、北米の契約製造市場を牽引する大きな要因となっています。アウトソーシングにより、これらの企業は設備投資を削減し、業務を効率化し、複雑で規制の厳しい製品の市場投入までの時間を短縮することが可能になります。

- 例えば、ロンザは2024年2月、中堅・大手バイオ医薬品企業の需要増加に対応するため、米国における商業用バイオ医薬品の製造能力を拡大しました。同様に、レシファームは北米において、複雑な製剤の長期製造契約を継続的に締結しています。

- バイオ医薬品およびバイオシミラー市場の成長と、GMP準拠施設の設立の複雑さおよび高コストが相まって、企業は契約製造ソリューションへとさらに移行しています。

- さらに、特に小規模なバイオテクノロジーのスタートアップ企業がエンドツーエンドの能力を持つパートナーを求めているため、R&Dサポート、臨床試験製造、商業規模の生産を含む統合サービスを提供するCDMOの需要が急速に拡大しています。

- この推進力は北米で特に顕著であり、多くの新興および既存のライフサイエンス企業がイノベーションに注力しているものの、自社生産施設の維持にかかる財務的および運用上の負担を避けたいと考えている。

抑制/挑戦

規制の複雑さと品質コンプライアンス要件

- 北米の契約製造市場における主要な課題の一つは、特に医薬品や医療機器などの分野において、非常に複雑な規制環境への対応です。FDAガイドライン、cGMP基準、その他の規制要件の遵守は、契約製造業者にとって大きな業務負担となります。

- 例えば、FDAの検査プロトコルの変更やサプライチェーンの健全性に対する監視の強化は、生産の遅延やコンプライアンスコストの増加につながる可能性があります。これらの問題は、契約製造業者の評判やリピートビジネス獲得能力に影響を与える可能性があります。

- さらに、大規模で複数の拠点にわたる事業全体で一貫して高い品質を維持するというプレッシャーにより、品質管理システム、データ管理インフラストラクチャ、および人材トレーニングへの多大な投資が必要になることがよくあります。

- コンプライアンス基準を満たさない場合、特にバイオ医薬品などのリスクの高い業界では、コストのかかるリコール、契約の失効、評判の失墜につながる可能性がある。

- これらの課題を克服するため、受託製造業者は、電子バッチ記録、リアルタイム品質監視、AIを活用したコンプライアンス分析といった高度なデジタルツールへの投資を増やしています。しかしながら、規制環境の変化は依然として大きなハードルであり、長期的な成功のためには継続的な監視と適応が不可欠です。

北米の契約製造市場の展望

市場は、製品、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 製品別

製品別に見ると、北米の受託製造市場は医薬品製造と医療機器製造に分類されます。医薬品製造セグメントは、2024年には59.8%という最大の収益シェアを占め、市場を牽引しました。この優位性は、製薬会社やバイオ医薬品会社による医薬品製造のアウトソーシングの増加、特に複雑な製剤、生物製剤、ジェネリック医薬品のアウトソーシングの増加に牽引されています。規制遵守の要件とコスト効率の高い生産ソリューションへの需要の高まりにより、企業は大規模かつ高品質な医薬品製造において、受託製造パートナーへの依存をさらに強めています。

医療機器製造分野は、革新的で小型化された医療機器への需要の高まりと、精密に設計された部品へのニーズにより、2025年から2032年にかけて最も高い成長率を示すと予想されています。技術の複雑化と医療機器スタートアップ企業の増加により、企業はコンプライアンス、試作、精密製造の専門知識を持つ専門の契約メーカーに機器製造を委託する傾向が強まっています。

- エンドユーザー別

北米の受託製造市場は、エンドユーザー別に、製薬会社、バイオテクノロジー会社、バイオ医薬品会社、医療機器会社、相手先ブランド製造会社(OEM)、研究機関に分類されます。2024年には、製薬会社が38.7%という最大の市場収益シェアを占めました。これは、自社設備への投資なしに、生産コストの削減、柔軟性の向上、製造能力の拡張を実現するために、受託製造組織(CMO)を積極的に活用していることが要因です。既存の製薬会社は、低分子医薬品とバイオ医薬品の両方の製造においてCMOへの依存度を高めており、地域全体で安定した需要を生み出しています。

バイオ医薬品企業は、専門的な製造能力を必要とする細胞・遺伝子治療の開発増加により、予測期間中に最も急速な成長を遂げると予想されています。これらの治療の複雑さと規制に準拠した製造プロセスの必要性から、新興企業および中規模バイオ医薬品企業にとってアウトソーシングは好ましい選択肢となっています。

- 流通チャネル別

北米の受託製造市場は、流通チャネルに基づいて、直接入札、小売販売、その他に分類されます。直接入札セグメントは2024年に46.5%と最大のシェアを占めました。政府機関、公衆衛生機関、大規模医療機関は、通常、入札ベースの契約を通じて医薬品および医療製品を一括調達します。このチャネルは、競争力のある価格設定、規制の透明性、そして長期的な供給の信頼性を確保するため、北米における主要な流通形態となっています。

小売販売セグメントは、特に薬局やオンラインプラットフォームを通じて消費者向け医療製品の入手しやすさが向上し、需要が高まっている医療機器セグメントにおいて、予測期間中に着実に成長すると予想されます。

北米の契約製造市場の地域分析

- 米国は、先進的な製造インフラ、世界的な製薬・バイオテクノロジー企業の存在、ライフサイエンスと医療技術における強力なアウトソーシングのトレンドに支えられ、2024年には北米の契約製造市場において69.2%という最大の収益シェアを獲得し、市場を席巻した。

- この地域は、高度な技術力、コンプライアンスの専門知識、医薬品や医療機器のカテゴリーにわたる複雑な製造ニーズをサポートする能力を備えた、契約開発製造組織(CDMO)の強力なエコシステムの恩恵を受けています。

- この広範な採用は、世界的な製薬本社、成熟した医療インフラ、そして好ましい規制環境の存在によってさらに支えられており、北米はライフサイエンスと医療業界全体にわたる高品質のアウトソーシング製造ソリューションの優先拠点としての地位を確立しています。

米国契約製造市場インサイト

米国の受託製造市場は、確立された医薬品・医療機器産業と、エンドツーエンドのソリューションを提供する大手CDMOの存在に牽引され、2024年には北米で最大の収益シェア(69.2%)を獲得しました。米国の強力な規制枠組み、堅牢な医療インフラ、そして多額の研究開発投資は、企業による複雑な製造プロセスのアウトソーシングを後押ししています。生物製剤、遺伝子治療、個別化医療へのトレンドの高まりは、米国における専門的な受託製造能力の必要性をさらに高め、この地域における米国の優位性を強固なものにしています。

カナダの契約製造市場の洞察

カナダの契約製造市場は、政府の好ましい政策、製薬・バイオテクノロジー分野への投資増加、そして高度な製造能力に対する需要の高まりに支えられ、予測期間を通じて高い年平均成長率(CAGR)で成長すると予測されています。カナダはイノベーションを重視し、熟練労働者へのアクセスと米国市場への近接性を兼ね備えているため、契約製造にとって魅力的な拠点となっています。さらに、臨床試験と医薬品開発におけるカナダの役割の拡大は、柔軟で規制遵守を遵守した製造ソリューションを提供するCDMOにとって、ビジネスチャンスを拡大しています。

メキシコの契約製造市場の洞察

メキシコの契約製造市場は、費用対効果の高い製造環境と米国市場に近い戦略的な立地条件を背景に、予測期間中に大幅な年平均成長率(CAGR)で成長すると予想されています。医薬品および医療機器の生産能力の向上に加え、USMCAなどの有利な貿易協定も相まって、効率的で拡張性の高い契約製造パートナーを求める多国籍企業を惹きつけています。メキシコの産業基盤の拡大、製造投資に対する政府の支援、そしてヘルスケア製品への需要の高まりが、市場の成長をさらに後押ししています。

北米の契約製造市場シェア

北米の契約製造業界は、主に次のような老舗企業によって牽引されています。

- サーモフィッシャーサイエンティフィック社(米国)

- キャタレント社(米国)

- ロンザグループAG(スイス)

- ジュビラント・ホリスター・スティアーLLC(米国)

- レシファームAB(スウェーデン)

- サムスンバイオロジックス株式会社(韓国)

- パセオン社(米国)

- バクスターインターナショナル社(米国)

- アッヴィ契約製造(米国)

- PCIファーマサービス(米国)

- ウェスト・ファーマシューティカル・サービス社(米国)

- ベーリンガーインゲルハイム バイオエクセレンス(ドイツ)

- BD(米国)

- メディックス・バイオケミカ・グループ(フィンランド)

- 無錫AppTec株式会社(中国)

- アルカミコーポレーション(米国)

- Aenova Group GmbH(ドイツ)

- エボニック インダストリーズ AG(ドイツ)

- カンブレックス・コーポレーション(米国)

- 味の素バイオファーマサービス(日本)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。