北米の圧縮衣類およびストッキング市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

1.70 Billion

2024

2032

USD

1.15 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.70 Billion | |

|

|

|

|

北米の着圧衣類およびストッキング市場セグメンテーション、製品タイプ別(着圧ストッキング、着圧衣類)、着圧レベル別(中程度の着圧、軽度の着圧、しっかりした着圧、超しっかりした着圧)、用途別(医療用、非医療用)、素材別(ナイロン、スパンデックス、綿、マイクロファイバー、竹繊維、通気性メッシュ/吸湿発散性生地、ウール混紡、リサイクル/オーガニック素材)、性別別(女性、ユニセックス、男性)、流通チャネル別(オフライン、オンライン)、エンドユーザー別(一般消費者、医療機関、スポーツチームおよびクラブ、企業のウェルネスプログラム)、- 2032年までの業界動向および予測

北米の圧縮衣類およびストッキング市場規模

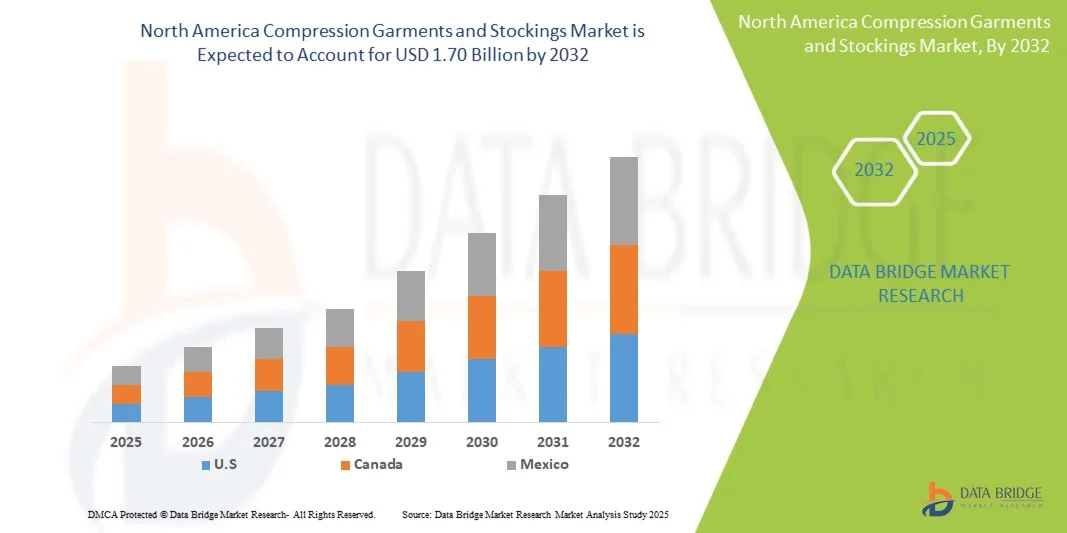

- 北米の圧縮衣類およびストッキング市場規模は2024年に11億5000万米ドルと評価され、予測期間中に5.13%のCAGRで成長し、2032年までに17億米ドル に達すると予想されています 。

- 市場の成長は、静脈疾患に関する意識の高まりと予防医療ソリューションの採用増加によって主に促進されています。

- さらに、高齢者人口の増加、静脈瘤の発症率の増加、手術後の回復期における弾性ストッキングの使用拡大も需要をさらに押し上げています。

北米の圧縮衣類およびストッキング市場分析

- 市場は、静脈疾患、リンパ浮腫、糖尿病性浮腫の増加によって牽引されています。特に高齢者層において、慢性症状の管理と患者の快適性向上のためのソリューションとして、コンプレッションウェアが好まれるようになっています。

- 術後回復やスポーツ後の回復期における使用が需要を押し上げています。アスリートやフィットネス愛好家の間では、血行促進、筋肉疲労の軽減、回復の促進を目的としたコンプレッションウェアの着用が増えており、市場の堅調な牽引力に貢献しています。

- 米国は、医療費の増加、高齢化の進展、圧迫療法のメリットに対する意識の高まり、発展途上国における医療用衣類へのアクセス拡大により、2025年には北米の圧縮衣類およびストッキング市場で78.61%という最大の市場シェアを獲得し、市場をリードすると予想されています。

- 圧迫ストッキングセグメントは、静脈瘤、深部静脈血栓症(DVT)、慢性静脈不全の増加、医師の推奨と病院での使用の増加により、2025年には北米の圧迫衣類およびストッキング市場で70.22%の市場シェアを占めると予想されています。

レポートの範囲と北米の圧縮衣類およびストッキング市場のセグメンテーション

|

属性 |

北米の圧縮衣類とストッキングの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米の圧縮衣類およびストッキング市場動向

「肥満と座りがちな生活習慣の増加」

- 肥満と座りがちな生活習慣の増加に伴い、様々な人口層で着圧衣類やストッキングの使用が増加しています。長時間の座位、運動不足、代謝疾患の増加は、静脈瘤、深部静脈血栓症(DVT)、慢性静脈不全症といった血管疾患の急増につながっています。こうした状況を受けて、循環器系の健康を維持し、下肢のむくみや不快感を軽減するための非侵襲的な予防的・治療的アプローチとして、着圧療法が注目されています。

- 医療従事者は、リスクの高い人だけでなく、一般の人々にも予防的な健康習慣の一環として、コンプレッションウェアを推奨しています。都市化、デスクワーク文化、そして特に先進国における人口の高齢化も、コンプレッションウェアの普及に拍車をかけています。

- 循環器系の健康リスクに対する意識が高まるにつれ、圧縮ウェアは医療およびライフスタイルの用途の両方で人気を集め続け、持続的な市場成長を支えています。

- 肥満と座りがちな生活習慣の増加は、世界中で血管の健康問題に大きく影響を及ぼし続けています。こうしたライフスタイルの傾向が続くにつれ、着圧ウェアのような効果的で非侵襲的なソリューションの必要性が高まっています。

- 医療従事者と消費者の意識の高まりにより、圧迫療法は臨床現場だけでなく、日常の健康習慣にも利用され始めています。こうした変化は、健康志向の高い、リスクの高い層が牽引する市場の持続的な成長の可能性を浮き彫りにしています。

北米の圧縮衣類およびストッキング市場の動向

ドライバ

「スポーツリカバリーにおけるコンプレッションウェアの利用増加」

- 運動パフォーマンスと回復の迅速化への関心の高まりにより、プロアスリートやフィットネス愛好家の間では、コンプレッションウェアの着用が増えています。コンプレッションウェアは、血行促進、筋肉疲労の軽減、むくみの軽減、運動後の回復促進といった効果が認められています。スポーツ医学の専門家や理学療法士は、トレーニング中や試合中の筋肉持久力向上と怪我の予防のために、コンプレッションストッキングやコンプレッションスリーブを頻繁に推奨しています。

- 繊維技術の進歩により、軽量で通気性に優れ、人間工学に基づいて設計された、アスリートのニーズに特化したコンプレッションウェアの製造が可能になりました。さらに、ヨーロッパではレクリエーションスポーツやフィットネス活動への参加が増え、怪我の予防に対する意識も高まっているため、市場はエリートアスリートだけでなく一般の人々にも広がっています。この傾向は、スポーツ専門家からの支持やeコマースプラットフォームを通じた入手しやすさの向上によってさらに後押しされ、コンプレッションウェアはスポーツ後のリカバリーに不可欠な要素として、広く消費者に受け入れられています。

- スポーツリカバリーにおけるコンプレッションウェアの採用増加は、運動後の筋肉疲労、痛み、炎症を軽減する効果に対する認識の高まりを反映しています。アスリートとフィットネス愛好家の両方が、回復時間を短縮し、トレーニング成果を向上させるためにこれらの製品を活用しています。

抑制/挑戦

「適切なフィッティングを行うための訓練を受けた人材が不足している」

- 圧迫衣類やストッキングの適切なフィッティングは、治療効果と患者の快適性を確保するために不可欠です。しかしながら、測定、フィッティング、そして患者への説明を行う熟練した医療従事者の深刻な不足が、欧州市場における大きな課題となっています。サイズの不備や不適切な装着は、圧迫不足、皮膚への刺激、さらには病状の悪化につながり、ユーザーのコンプライアンスと治療成果を低下させる可能性があります。

- この不足は、特にリソースが限られている地域や地方の医療現場で深刻です。血管看護師や認定フィッターといった専門職へのアクセスが限られているからです。さらに、一般開業医や介護士の意識や研修が不足していることも、この問題をさらに悪化させ、最適な処方と使用を妨げています。圧迫療法が在宅ケアや外来ケアにますます浸透する中、適切なフィッティングガイダンスの欠如は、広く効果的な導入を阻む大きな障壁となっています。

- 世界保健機関(WHO)によると、ヨーロッパでは2030年までに1,100万人の医療従事者が不足すると予測されており、特に低所得国および低中所得国で大きな影響が出ています。この不足には、圧迫衣などの医療機器の適切な装着について訓練を受けた医療従事者も含まれます。熟練した人員の不足は、効果的な圧迫療法の実施を制限し、不適切な装着、治療効果の低下、患者のコンプライアンスの低下につながります。

- 2021年12月、国立医学図書館(National Library of Medecine)に掲載された研究によると、教育的看護介入により、患者の圧迫療法へのアドヒアランスが大幅に向上し、静脈性下肢潰瘍の再発率が低下しました。この体系的なプログラムには、看護師主導による適切なストッキングの使用、スキンケア、自己モニタリング技術に関するトレーニングが含まれていました。この教育支援を受けた患者は、介入を受けなかった患者と比較して、圧迫ストッキングの着用遵守率が高く、潰瘍の再発率も低かったことが示されました。

- 圧迫療法の効果は、正確なフィッティングと患者教育に大きく依存しており、どちらも熟練した人材を必要とします。しかし、ヨーロッパでは、特にリソースの限られた環境において、専門の医療従事者の不足が、適切な使用とコンプライアンスの妨げとなっています。この制約は、治療成果を損なうだけでなく、患者の不満や治療中止にもつながり、市場拡大の大きな障壁となっています。

北米の圧縮衣類およびストッキング市場の範囲

北米の圧縮衣類およびストッキング市場は、製品タイプ、圧縮レベル、用途、材質、性別、流通チャネル、およびエンドユーザーに基づいて、7 つの主要なセグメントに分類されています。

- 製品タイプ別

製品タイプ別に見ると、市場は圧縮ストッキングと圧縮衣類に分類されます。2025年には、慢性静脈疾患の有病率の上昇、術後の使用の増加、そして予防的および治療的圧縮療法に対する医師の強い推奨により、圧縮ストッキングセグメントが70.22%の市場シェアで市場を席巻すると予想されています。

圧縮ストッキングセグメントは、静脈の健康に対する意識の高まり、高齢化の拡大、スポーツリカバリーや職業上の健康など、医療および非医療用途の両方での採用の増加により、2025年から2032年にかけて5.84%という最も高い成長率を記録すると予想されています。

- 圧縮レベル

用途別に見ると、市場は中等度圧迫、軽度圧迫、強圧迫、超強圧迫に分類されます。2025年には、中等度圧迫セグメントが36.05%と最大の収益シェアを占めました。これは主に、静脈疾患の罹患率の増加、術後リハビリテーションへの導入増加、そしてリンパ浮腫、深部静脈血栓症(DVT)、静脈瘤といった慢性疾患の管理における有効性によるものです。中等度圧迫は、治療効果と患者の快適性のバランスが取れているため、医師にも広く好まれており、予防と治療の両方の用途で最も処方され、一般的に使用されている圧迫レベルとなっています。

- アプリケーション別

用途別に見ると、市場は医療用と非医療用に分類されます。医療用セグメントは、静脈疾患の発生率上昇、術後回復のニーズ、そしてリンパ浮腫、深部静脈血栓症(DVT)、静脈瘤などの慢性疾患に対する圧迫療法の臨床導入増加に牽引され、2025年には60.98%という最大の市場シェアを占めました。

医療用途セグメントは、スポーツパフォーマンス、フィットネス回復、職業上の健康、ライフスタイル関連の予防ケアにおけるコンプレッションウェアの需要増加により、2025年から2032年にかけて最も速いCAGRを達成すると予想されています。

- 素材別

素材別に見ると、市場はナイロン・スパンデックス、綿、マイクロファイバー、竹繊維、通気性メッシュ/吸湿発散性生地、ウール混紡、リサイクル/オーガニック素材に分類されます。ナイロン・スパンデックスは、優れた弾力性、耐久性、そして医療・スポーツ用途に不可欠な安定した圧縮圧力を提供する能力により、2025年には31.45%という最大の市場シェアを獲得しました。

ナイロンとスパンデックスのセグメントは、軽量性、優れた伸縮性、吸湿発散性、医療および非医療の環境での長期使用による着用者の快適性の向上により、2025年から2032年にかけて最も速いCAGRを示すことが予想されています。

- 性別別

性別に基づいて、市場は女性、ユニセックス、男性に分類されます。女性セグメントは、静脈瘤の有病率の上昇、妊娠に伴う静脈の問題、そして医療目的と美容目的の両方でのコンプレッションウェアの普及により、2025年には最大の市場シェア41.84%を占めました。

女性セグメントは、健康意識の高まり、フィットネス活動への参加の増加、女性ユーザー向けのスタイリッシュで快適な圧縮ソリューションの需要の増加により、2025年から2032年にかけて最も速いCAGRを達成すると予想されています。

- 流通チャネル別

流通チャネルに基づいて、市場はオフラインとオンラインに区分されます。オフラインセグメントは、専門的なフィッティングサポートと即時の製品入手を提供する医療用品店、薬局、病院調達チャネルの強力な存在感により、2025年には59.02%という最大の市場シェアを占めました。

オフラインセグメントは、eコマースの浸透の増加、玄関先への配達に対する消費者の嗜好の高まり、幅広い製品ラインナップの提供、デジタルヘルス意識の高まりにより、2025年から2032年にかけて最も速いCAGRを達成すると予想されています。

- エンドユーザー別

エンドユーザーに基づいて、市場は一般消費者、医療機関、スポーツチーム・クラブ、企業のウェルネスプログラムに分類されます。一般消費者セグメントは、セルフケア意識の高まり、予防医療ソリューションへの需要の高まり、そして日常の快適さとサポートのためのコンプレッションウェアの普及に牽引され、2025年には最大の市場シェア41.30%を占めました。

一般消費者セグメントは、アマチュアおよびプロのアスリート両方において、運動パフォーマンスの向上、筋肉の回復、および怪我の予防を目的としたコンプレッションウェアの採用増加により、2025年から2032年にかけて最も速いCAGRを達成すると予想されています。

北米の圧縮衣類およびストッキング市場の地域分析

- 米国は北米の圧縮衣類およびストッキング市場で最大の78.61%のシェアを占めており、静脈疾患の罹患率の増加、圧縮療法への高い認知度、医療分野とスポーツ分野の両方からの強い需要により、2025年には5.27%という最も高いCAGRで成長すると予測されています。

- 同国の充実した医療インフラ、有利な償還政策、そして高齢化人口の増加は、市場拡大をさらに後押ししています。さらに、フィットネストレンドの高まりと予防的健康意識の高まりも、医療以外の需要に貢献しています。

- 米国は、強力な認知度向上キャンペーン、予防医療の取り組み、オフラインとオンラインの両方の流通チャネルを通じた高品質の圧縮製品への容易なアクセスに支えられ、2025年に北米の圧縮衣類およびストッキング市場で大きなシェアを占めました。

カナダ・北米における圧縮衣類およびストッキング市場の洞察

カナダ北米における着圧衣類・ストッキング市場は、静脈瘤や深部静脈血栓症(DVT)などの慢性静脈疾患の増加、人口の高齢化、そして圧迫療法のメリットに対する意識の高まりを背景に、着実な成長を遂げています。市場は、快適性と効果を高める製造技術の進歩に加え、小売店、オンラインプラットフォーム、医療提供者による導入の増加から恩恵を受けています。男女問わず、幅広い年齢層の消費者が成長に貢献しており、特に若年層は健康増進やライフスタイルの目的で着圧ウェアを利用する傾向が強まっています。今後、技術革新、健康意識の高まり、予防医療へのシフトにより、市場はさらに拡大すると予想され、カナダにおいて着圧衣類は医療、フィットネス、そして日常的な健康ソリューションに不可欠な要素となるでしょう。

北米の圧縮衣類およびストッキング市場シェア

圧縮衣類およびストッキング業界は、主に、次のような定評ある企業によって牽引されています。

- 3M(米国)

- カーディナルヘルス(米国)

- ソックウェル(米国)

- Tynor Orthotics Pvt. Ltd.(インド)

- ジボー(フランス)

- ショールズ・ウェルネス社(米国)

- サーモテック(米国)

- エイムズ・ウォーカー(米国)

- VIMとVIGR(米国)

- リジュバヘルス(米国)

- ゼンサ(米国)

北米の圧縮衣類・ストッキング市場の最新動向

- カーディナル・ヘルスは2024年1月、在宅ソリューション事業の強化を目的として、テキサス州フォートワースに34万平方フィート(約3万平方メートル)の新たな配送センターを建設すると発表しました。この施設は、高度なロボット工学とAIを活用した倉庫システムを導入し、注文処理の効率と安全性を向上させます。既存の倉庫2棟を置き換え、在庫容量を拡張し、1日あたり約1万個の荷物を処理できるようになります。センターは2025年夏までに全面稼働を開始する予定です。

- 2024年8月、カーディナル・ヘルスは、米国における倉庫容量の拡大と業務の近代化戦略の一環として、オハイオ州ウォルトンヒルズに249,000平方フィート(約24,000平方メートル)の医療製品配送センターを新設する計画を発表しました。2025年春の稼働開始予定のこの施設は、小規模なソロンの拠点に代わるもので、高度な自動化技術を導入することで、サプライチェーンの効率化と従業員の安全性向上を目指します。

- 2024年11月、カーディナルヘルスは米国でケンドールSCDスマートフロー圧迫システムを発売しました。これはケンドール圧迫シリーズの次世代製品です。この高度なシステムは、血管再充満検知(VRD)技術と患者センシング技術を搭載し、患者一人ひとりに合わせた間欠的空気圧迫を提供することで、血流改善、静脈血栓塞栓症(VTE)の予防、疼痛や腫脹などの静脈うっ滞症状の軽減を実現します。このシステムは、臨床転帰と医療従事者の効率性の両方を向上させることを目指しています。国際的な発売は2025年初頭を予定しています。

- 2024年11月、SanylegはISPOミュンヘン2024への参加を発表し、イタリア製の段階着圧スポーツソックスを展示します。また、同社は初のサステナビリティレポートを発表し、倫理的な製造、環境への責任、従業員の福利厚生への取り組みを強調しました。

- 2024年5月、SockwellはParents.comの「妊婦用着圧ソックス ベスト8」リストに、Bombas、Comrad、Levsoxといったトップブランドと並んで掲載されました。記事では、専門家が推奨するSockwellのデザイン、快適性、15~20mmHgの着圧、そしてむくみや妊娠に伴う不快感の軽減効果が高く評価されました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PATENT ANALYSIS –

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 COMPETITIVE LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY OF SUPPLY

4.3.2 RELIABILITY AND TIMELINESS

4.3.3 COST COMPETITIVENESS

4.3.4 TECHNICAL CAPABILITY AND INNOVATION

4.3.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.3.6 FINANCIAL STABILITY

4.3.7 CUSTOMER SERVICE AND SUPPORT

4.4 BRAND OUTLOOK

4.5 COMPETITIVE BENCHMARKING ACROSS COMPRESSION LEVEL, FABRIC TYPE, AND DISTRIBUTION CHANNEL

4.5.1 COMPRESSION LEVEL BENCHMARKING

4.5.2 FABRIC TYPE BENCHMARKING

4.5.3 DISTRIBUTION CHANNEL BENCHMARKING

4.5.4 COMPETITIVE INSIGHTS

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 PROBLEM RECOGNITION AND AWARENESS

4.6.2 INFORMATION SEARCH

4.6.3 EVALUATION OF ALTERNATIVES

4.6.4 PURCHASE DECISION

4.6.5 POST-PURCHASE BEHAVIOUR

4.6.6 DEMOGRAPHIC INSIGHTS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COST DYNAMICS

4.7.2 MANUFACTURING AND PROCESSING COSTS

4.7.3 REGULATORY COMPLIANCE AND CERTIFICATION COSTS

4.7.4 PACKAGING AND DISTRIBUTION EXPENSES

4.7.5 R&D AND TECHNOLOGICAL INNOVATION COSTS

4.7.6 MARKET-BASED PRICE BENCHMARKS

4.7.7 GEOGRAPHICAL VARIATIONS IN COST STRUCTURES

4.7.8 IMPACT ON PROFITABILITY AND STRATEGIC IMPLICATIONS

4.7.9 CONCLUSION

4.8 PROFIT MARGIN SCENARIO

4.8.1 INTRODUCTION TO PROFIT MARGINS IN MEDICAL TEXTILES

4.8.2 COST STRUCTURES AND MARGIN INFLUENCERS

4.8.3 PROFITABILITY BY PRODUCT TYPE

4.8.4 GEOGRAPHICAL MARGIN COMPARISON

4.8.5 PRIVATE LABELS VS. BRANDED PRODUCTS

4.8.6 IMPACT OF REGULATIONS ON PROFIT MARGINS

4.8.7 DIGITAL DISTRIBUTION AND DIRECT-TO-CONSUMER (D2C) PROFITABILITY

4.8.8 CONCLUSION

4.9 END USER EVOLUTION ANALYSIS – NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.9.1 CONCLUSION

4.1 IMPACT OF SUSTAINABILITY AND CIRCULAR FASHION INITIATIVES ON PRODUCT DEVELOPMENT

4.10.1 RECYCLABLE FIBERS AND ECO-FRIENDLY MATERIALS

4.10.2 CIRCULAR DESIGN AND EXTENDED PRODUCT LIFE

4.10.3 ECO-COMPLIANT INNOVATIONS IN COMPRESSION TECHNOLOGY

4.10.4 MARKET DRIVERS FOR SUSTAINABILITY IN COMPRESSION WEAR

4.10.5 CHALLENGES IN SUSTAINABLE PRODUCT DEVELOPMENT

4.10.6 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 Joint Ventures

4.11.1.2 Mergers and Acquisitions

4.11.1.3 Licensing and Partnership

4.11.1.4 Technology Collaborations

4.11.1.5 Strategic Divestments

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 RAW MATERIAL COVERAGE

4.12.1 INTRODUCTION

4.12.2 FOUNDATION OF RAW MATERIAL USE

4.12.3 DEPENDENCE ON SYNTHETIC FIBERS

4.12.4 INTEGRATION OF NATURAL FIBERS

4.12.5 ADOPTION OF TECHNICAL AND FUNCTIONAL TEXTILES

4.12.6 SUSTAINABLE MATERIAL INNOVATIONS

4.12.7 REGULATORY AND QUALITY COMPLIANCE

4.12.8 SUPPLY CHAIN CONSIDERATIONS

4.12.9 LIFECYCLE AND PERFORMANCE ATTRIBUTES

4.12.10 CONCLUSION

4.13 VALUE CHAIN

4.13.1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET VALUE CHAIN

4.13.2 RAW MATERIAL SOURCING & MANUFACTURING:

4.13.3 PRODUCT DESIGN & COMPONENT MANUFACTURING –

4.13.4 ASSEMBLY, BRANDING & PACKAGING

4.13.5 DISTRIBUTION & END-USE

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 TEXTILE MANUFACTURERS

4.14.3 GARMENT & COMPONENT MANUFACTURERS

4.14.4 DESIGN, TESTING & ASSEMBLY UNITS

4.14.5 DISTRIBUTORS & RETAIL CHANNELS

4.14.6 MEDICAL PROFESSIONALS / PRESCRIBERS

4.14.7 END USERS

4.15 PORTER’S FIVE FORCES

4.15.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.15.2 BARGAINING POWER OF BUYERS/CONSUMERS (MODERATE TO HIGH)

4.15.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.15.4 THREAT OF SUBSTITUTES PRODUCTS ( LOW TO MODERATE)

4.15.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.16 CLIMATE CHANGE SCENARIO

4.16.1 INTRODUCTION

4.16.2 ENVIRONMENTAL CONCERNS

4.16.3 INDUSTRY RESPONSE

4.16.4 GOVERNMENT’S ROLE

4.16.5 ANALYST RECOMMENDATIONS

4.16.6 CONCLUSION

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.18 INTRODUCTION

4.18.1 PROMINENT COMPANIES

4.18.2 SMALL & MEDIUM SIZE COMPANIES

4.18.3 END USERS

4.18.4 CONCLUSION

4.19 STRATEGIC INITIATIVE ASSESSMENTS (CORPORATE WELLNESS PARTNERSHIPS, RETAIL COLLABORATIONS, OEM/ODM ARRANGEMENTS) ACROSS KEY GEOGRAPHIES

4.19.1 CORPORATE WELLNESS PARTNERSHIPS: INTEGRATING COMPRESSION SOLUTIONS INTO HOLISTIC HEALTH FRAMEWORKS

4.19.2 RETAIL COLLABORATIONS

4.19.3 OEM/ODM ARRANGEMENTS: COST-OPTIMIZED, CUSTOM-BUILT MANUFACTURING PARTNERSHIPS

4.19.4 GEOGRAPHY-SPECIFIC STRATEGIES

4.19.5 STRATEGIC DECISIONS CROSS-FUNCTIONAL NORTH AMERICA STRATEGY: UNIFYING PARTNERSHIPS FOR MARKET SYNERGY

4.19.6 CONCLUSION

4.2 TECHNOLOGICAL ADVANCEMENTS

4.20.1 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.20.2 SMART COMPRESSION TEXTILES AND WEARABLE SENSORS

4.20.3 3D KNITTING AND SEAMLESS CONSTRUCTION TECHNOLOGIES

4.20.4 ADVANCED AND FUNCTIONAL MATERIALS

4.20.5 AI-POWERED CUSTOMIZATION AND ON-DEMAND MANUFACTURING

4.20.6 INTEGRATION WITH DIGITAL THERAPEUTICS AND TELEHEALTH

4.20.7 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.20.8 AUTOMATION AND QUALITY CONTROL IN MANUFACTURING

4.20.9 CONCLUSION

4.21 TARIFFS & IMPACT ON THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.1 OVERVIEW

4.21.2 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

4.21.4 VENDOR SELECTION CRITERIA DYNAMICS

4.21.5 IMPACT ON SUPPLY CHAIN

4.21.5.1 Introduction

4.21.5.2 RAW MATERIAL PROCUREMENT

4.21.5.3 Manufacturing and Production

4.21.5.4 Logistics and Distribution

4.21.5.5 Conclusion

4.21.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.6.1 SUPPLY CHAIN OPTIMIZATION

4.21.6.2 JOINT VENTURE ESTABLISHMENTS

4.21.7 IMPACT ON PRICES

4.21.7.1 Influence of Raw Material and Textile Innovations

4.21.7.2 Technological Advancements and Customization

4.21.7.3 Regulatory Compliance and Quality Standards

4.21.7.4 Logistics, Distribution, and Retail Dynamics

4.21.7.5 Sustainability and Ethical Production

4.21.7.6 Economic and North America Trade Factors

4.21.8 REGULATORY INCLINATION

4.21.8.1 Evolving Classification Standards

4.21.8.2 Compliance and Quality Assurance

4.21.8.3 Cross-Border Challenges

4.21.8.4 Digital Integration and Regulation

4.21.8.5 Geopolitical Situation

4.21.8.6 Trade Partnerships Between the Countries

4.21.8.7 Free Trade Agreements

4.21.8.8 Alliances Establishments

4.21.8.9 Conclusion

4.21.9 STATUS ACCREDITATION (INCLUDING MFTN) IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.9.1 Medical Accreditation and Regulatory Compliance

4.21.9.2 Voluntary Certifications and Quality Seals

4.21.9.3 Role of MFTN (Medical Functional Textile Network)

4.21.9.4 Accreditation as a Strategic Differentiator

4.21.9.5 Domestic Course of Correction in the North America Compression Garments and Stockings Market

4.21.9.6 Incentive Schemes to Boost Production Outputs

4.21.9.7 Establishment of Special Economic Zones / Industrial Parks

4.21.9.8 Conclusion

4.22 PRICING ANALYSIS

4.23 PRODUCTION CONSUMPTION ANALYSIS

4.24 COMPANY COMPARATIVE ANALYSIS AND POSITIONING MATRICES FOR LIFESTYLE VS. THERAPEUTIC BRANDS

4.24.1 COMPANY COMPARATIVE ANALYSIS: LIFESTYLE VS. THERAPEUTIC FOCUS

4.24.2 POSITIONING MATRIX INSIGHTS:

4.24.2.1 BAUERFEIND AG

4.24.2.2 3M

4.24.2.3 CARDINAL HEALTH

4.24.2.4 THUASNE

4.24.2.5 LOHMANN & RAUSCHER GMBH & CO. KG

5 REGULATION COVERAGE

5.1 INTRODUCTION

5.2 PRODUCT CODES

5.3 CERTIFIED STANDARDS

5.4 SAFETY STANDARDS

5.5 MATERIAL HANDLING AND STORAGE

5.6 TRANSPORT AND PRECAUTIONS

5.7 HAZARD IDENTIFICATION

5.8 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING OBESITY AND SEDENTARY LIFESTYLES

6.1.2 RISING USE OF COMPRESSION WEAR IN SPORTS RECOVERY

6.1.3 ADVANCEMENTS IN TEXTILE TECHNOLOGY AND MATERIALS

6.1.4 GROWTH OF HOME-BASED AND OUTPATIENT CARE SERVICES

6.2 RESTRAINTS

6.2.1 SHORTAGE OF TRAINED PERSONNEL FOR PROPER FITTING

6.2.2 LIMITED CLINICAL BACKING IN NON-THERAPEUTIC USE CASES

6.3 OPPORTUNITIES

6.3.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY COMPRESSION FABRICS

6.3.2 COLLABORATION WITH FASHION AND WELLNESS BRANDS

6.3.3 GROWING SALES FROM E-COMMERCE SECTOR

6.4 CHALLENGES

6.4.1 LOW AWARENESS AND DIAGNOSTIC ACCESS IN RURAL AREAS

6.4.2 COMPLEX REGULATORY CLASSIFICATION ACROSS MARKETS

7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COMPRESSION STOCKINGS

7.3 COMPRESSION GARMENTS

8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL

8.1 OVERVIEW

8.2 MODERATE COMPRESSION

8.3 MILD COMPRESSION

8.4 FIRM COMPRESSION

8.5 EXTRA-FIRM COMPRESSION

9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL USE

9.3 NON-MEDICAL USE

10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 NYLON & SPANDEX

10.3 COTTON

10.4 MICROFIBER

10.5 BAMBOO FIBER

10.6 BREATHABLE MESH / MOISTURE-WICKING FABRICS

10.7 WOOL BLENDS

10.8 RECYCLED/ORGANIC MATERIALS

11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER

11.1 OVERVIEW

11.2 WOMEN

11.3 UNISEX

11.4 MEN

12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER

13.1 OVERVIEW

13.2 GENERAL CONSUMERS

13.3 HEALTHCARE INSTITUTIONS

13.4 SPORTS TEAMS & CLUBS

13.5 CORPORATE WELLNESS PROGRAMS

14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

15 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

16.1 SWOT ANALYSIS FOR KEY SEGMENTS BY PRODUCT TYPE

17 DISTRIBUTOR COMPANY PROFILES

17.1 NOVOMED INC PVT. LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS/NEWS

17.2 TS COMPROZONE PVT. LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS/NEWS

17.3 SIMONSEN & WEEL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENTS/NEWS

17.4 YASHODHAN ENTERPRISE

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS/NEWS

17.5 YOGI KRIPA

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS/NEWS

18 MANUFACTURERS, COMPANY PROFILE

18.1 BAUERFEIND

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 SWOT ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 3M

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SWOT ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENTS/NEWS

18.3 CARDINAL HEALTH

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SWOT ANALYSIS

18.3.5 PRODUCT PORTFOLIO

18.3.6 RECENT DEVELOPMENT

18.4 THUSANE

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 SWOT ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 LOHMANN & RAUSCHER GMBH & CO. KG

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 SWOT ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AMES WALKER

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS/NEWS

18.7 CALZIFICIO ZETA SRL

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 CEP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 COMPRESSANA GMBH

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GIBAUD

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GLORIA MED S.P.A.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 HEINZ SCHIEBLER GMBH & CO KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 JUZO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MAXWELL INDIA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MEDI GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 NOVAMED

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 REJUVA HEALTH

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SANYLEG SRL A SOCIO UNICO

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SCHOLL’S WELLNESS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 SWISSLASTIC AG ST. GALLEN

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SIGVARIS GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SOCKWELL

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS/NEWS

18.23 SURGIWEAR

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THERMOTEK

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TYNOR ORTHOTICS PVT. LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 VIM & VIGR

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS/NEWS

18.27 VISSCO NEXT

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS/NEWS

18.28 ZENSAH

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

表のリスト

TABLE 1 BRAND OUTLOOK: COMPRESSION STOCKINGS MARKET

TABLE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKWEAR COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MODERATE COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILD COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA EXTRA-FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA NYLON & SPANDEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA COTTON IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MICROFIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAMBOO FIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA BREATHABLE MESH / MOISTURE-WICKING FABRICS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA WOOL BLENDS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA RECYCLED/ORGANIC MATERIALS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA WOMEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA UNISEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA MEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA HEALTHCARE INSTITUTIONS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SPORTS TEAMS & CLUBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA CORPORATE WELLNESS PROGRAMS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

図表一覧

FIGURE 1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: EXECUTIVE SUMMARY

FIGURE 14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE (2024)

FIGURE 16 INCREASING OBESITY AND SEDENTARY LIFESTYLES IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET FROM 2025 TO 2032

FIGURE 17 THE COMPRESSION STOCKINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET IN 2025 & 2032

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DISTRIBUTION OF PATENTS BY IPC CODE

FIGURE 20 COUNTRY-WISE PATENT COUNT

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 NORTH AMERICA GARMENT AND COMPRESSIBLE STOCKING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA GARMENTS AND COMPRESSION STOCKINGS MARKET

FIGURE 24 DROC ANALYSIS

FIGURE 25 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2024

FIGURE 26 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 28 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2024

FIGURE 30 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, CAGR (2025- 2032)

FIGURE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2024

FIGURE 34 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2024

FIGURE 38 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, CAGR (2025- 2032)

FIGURE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2024

FIGURE 42 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 44 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 46 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2024

FIGURE 50 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 52 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SNAPSHOT (2024)

FIGURE 54 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。