北米コート紙市場、製品別(コート紙、標準コート上質紙、低コート紙、顔料コート紙、アート紙、エナメル紙など)、コーティング層(片面コーティングおよび両面コーティング)、コーティング材料(粘土、炭酸カルシウム、タルク、カオリン粘土、ワックス、二酸化チタンなど)、仕上げ(光沢、サテン、マット、ダルなど)、コーティング方法(手塗り、ブラシ塗り、機械塗りなど)、仕上げ工程(オンラインカレンダーおよびオフラインカレンダー)、用途(印刷、包装、ラベリングなど) - 2030年までの業界動向と予測。

北米のコート紙市場の分析と洞察

製造工程で仕上げ層またはコーティングを施し、仕上がりと印刷性を向上させた紙。コーティングは、不透明度、明るさ、白さ、色、表面の滑らかさ、光沢、インク受容性など、紙の特定の特性を向上させることを目的としており、完成した紙製品は、意図した用途に必要な特性を備えています。コート紙は、塗布されたコーティングの量によって分類され、ライトコート紙、ミディアムコート紙、ハイコート紙、アート紙(高解像度のアートワークに使用)などがあります。

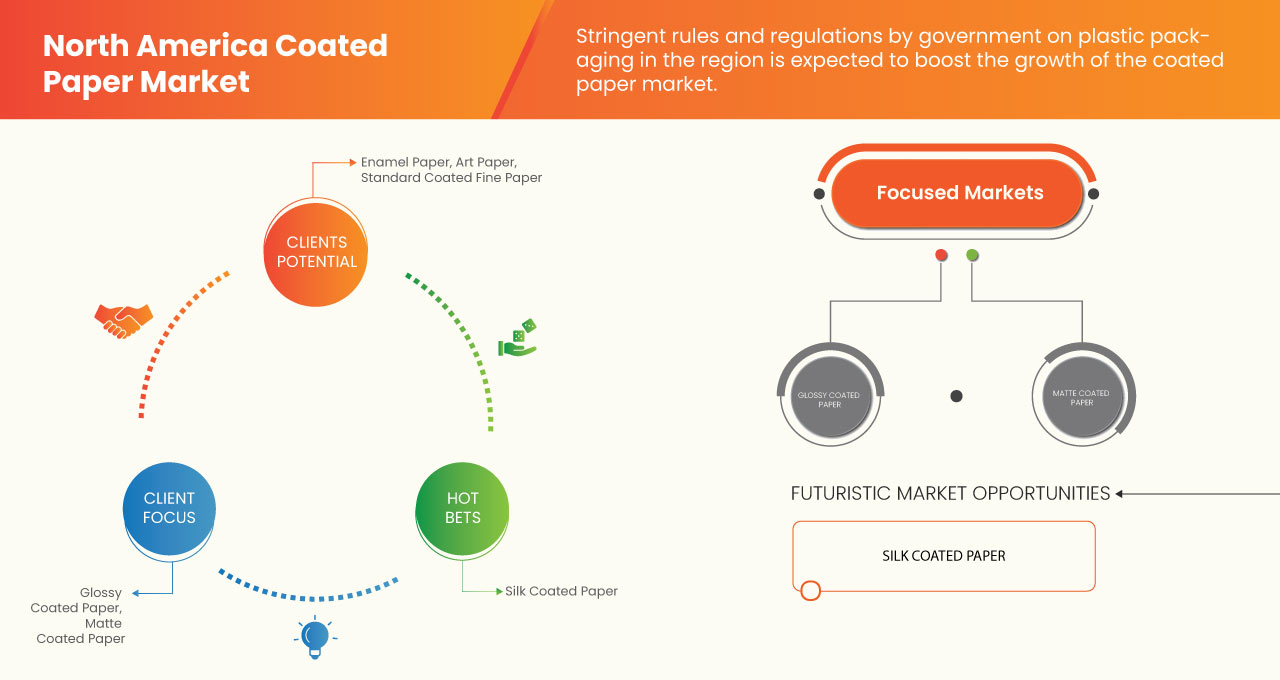

紙コーティング技術の新たな進歩と消費者のライフスタイルの変化および向上により、コーティングされたパッケージング製品に対する大きな需要が生まれ、コーティング紙市場の製造業者にとって大きなチャンスが生まれます。原材料価格の変動は、市場の成長に影響を及ぼすことが予想されます。

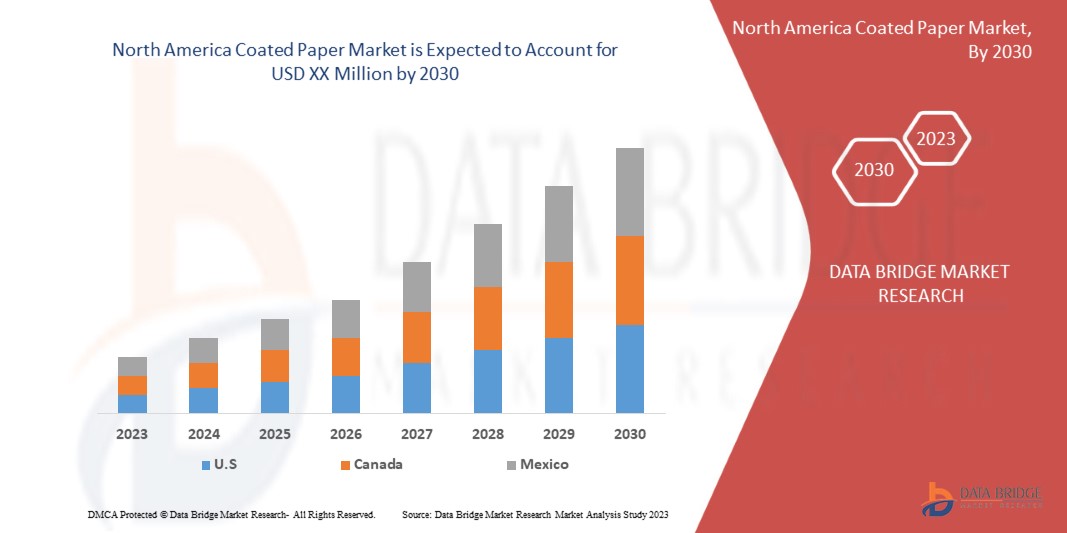

Data Bridge Market Research は、北米のコート紙市場は 2023 年から 2030 年の予測期間中に 4.2% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品(塗工紙、標準上質塗工紙、低塗工紙、顔料塗工紙、アート紙、エナメル紙など)、塗工層(片面塗工、両面塗工)、塗工材料(粘土、炭酸カルシウム、タルク、カオリンクレー、ワックス、二酸化チタンなど)、仕上げ(光沢、サテン、マット、ダルなど)、塗工方法(手塗り、刷毛塗り、機械塗りなど)、仕上げ工程(オンラインカレンダー、オフラインカレンダー)、用途(印刷、包装、ラベル貼りなど) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

王子ホールディングス株式会社、日本製紙株式会社、Stora Enso、Sappi Ltd.、Asia Pulp & Paper (APP) Sinar Mas、skpmil.com、UPM、DS Smith、Dunn Paper Company、Paradise Packaging、Burgo Group Spa、JK Paper、Emami Paper Mills Ltd.、Koehler Holding SE & Co. KG、Lecta、Twin Rivers Paper Company、Svenska Cellulosa Aktiebolaget SCA (Publ)、Billerud Americas Corporation など。 |

市場の定義

コート紙は、重量、表面の光沢、滑らかさ、インク吸収性の低減など、紙に特定の特性を与えるためにポリマーまたは材料の混合物でコーティングされた紙です。包装業界や雑誌での高品質印刷用に紙をコーティングするには、カオリナイト、炭酸カルシウム、ベントナイト、タルクなど、さまざまな材料を使用できます。コート紙は、光沢、半光沢、またはマット仕上げの紙です。コート紙の表面にコーティング剤を塗布すると、明るさ、滑らかさ、またはその他の印刷特性が向上します。ローラーを使用して、コーティング後の紙を研磨します。これにより、繊維間の小さな穴や隙間が埋められ、滑らかで平らな表面が作成されます。

北米コート紙市場の動向

ドライバー

-

高品質の印刷画像に対する需要の増加

コート紙は反射率が高いため、鮮明で鮮やかな画像を印刷できます。さらに、コート紙は未コート紙よりも優れた印刷面を提供し、高品質の印刷を実現します。コート紙は汚れや湿気に強く、非吸収性であるため、印刷に使用するインクが少なくて済みます。コート紙はワックス、粘土、カオリン粘土、ラテックス、酸化チタンなどでコーティングされることが多く、これにより紙がより明るく輝き、印刷された画像の品質が向上します。コート紙は、通常光沢仕上げまたはマット仕上げになっているため、カタログ、新聞折り込み、加工紙製品、セキュリティ ペーパー、雑誌、広告資料など、さまざまな最終用途アプリケーションに使用できます。コート紙は鮮明で精巧な画像を生成するため、印刷目的でよく使用されます。

コート紙は一般に、コートされていない紙よりも重く、印刷ジョブに重量感を与えます。コート紙は、コートされていない紙よりも滑らかでインクの保持力に優れている (吸収性が低い) ため、フラッド ニスやスポット ニス、その他の仕上げコーティングなどの特定の仕上げ技術に適しています。コーティング紙は、高品質の印刷物を提供し、北米のコート紙市場のさまざまな主要企業によって製造されています。

したがって、さまざまな雑誌、パンフレット、リーフレットなどの高品質の印刷物や画像に対する需要の高まりが、北米のコート紙市場の成長を促進すると予想されます。

-

食品業界におけるコート紙の需要増加

Coated papers have multiple applications in different industries including food industry in which coated papers are widely used to wrap the food items globally. Food packaging is moving from plastic to more biodegradable, recyclable paper materials as North America demand for sustainable solutions rises. In order to enhance the quality, better performance and to replace the plastic fillings, the coated papers used need to be of high quality and non-reactive nature.

Waxed paper is suitable for food, primarily for wrapping fish, meat, and chocolate bars, due to its wet and grease resistance, making it especially suitable for direct contact with cheeses, butter, and wrapping chocolate bars and oily food. Because it is resistant to water, oils, and greases, waxed paper helps to preserve food. Resin coated papers are ideal for fresh foods, fatty foods, and wet foods, as well as food grade bags.

Packaging made of polyethylene paper is suitable for direct contact with food, provides freshness assurance, protection, and meets the highest food hygiene standards. Coated papers and burger interleaves are used to wrap counter foods such as meats, cheeses, and cooked foods in supermarkets, butcher shops, delicatessens, and delis. Polyethylene coated papers are used in butchers, delicatessens and supermarkets to wrap fresh food. In fact, high-density polyethylene film acts as a protective barrier against moisture, fat and smells.

Opportunities

-

Consumers' changing and improving lifestyles result in a significant demand for products with coated packaging

Consumers' lifestyles change and improve as their disposable income increases, as does their consumption of healthcare, food and beverage, and home care products, particularly in developing economies. In the years to come, this is anticipated to increase demand for coated paper.

Additionally, brand owners are becoming more and more interested in eco-friendly printing and packaging as a result of the government's regulations restricting single-use plastics. Because of this, manufacturers are moving toward more environmentally friendly printing and packaging techniques, which will help to create oppurtunities in the coated paper market.

Millennials prefer to purchase prepared foods due to their busy lifestyles and growing health consciousness, which is driving the demand for coated packaging materials due to the rising need for modified packaging. This further generates opportunities for market expansion

Restraints/Challenges

- Widespread digitalization across industries limiting the use of paper

There has been an upsurge in the digitalization in all the industries. The ease and more convenience in digitalization is enabling the industrialists to opt for the digital platforms. As the world continues to undergo massive digital transformation, key sectors and industries are adopting digital technology to ensure they are future-ready and well-positioned to make it big globally.

For Instance,

- CII によると、2022 年 3 月の時点で、デジタル ビジネスは単なる Web サイトでの売買を超えて進化しています。デジタルは今や、商品やサービスが適切な人に届くようにしながら交換するための媒体となっています。多面的なマーケットプレイスは、共同商取引を通じてネットワーク効果の力を活用して飛躍的に成長し、継続的にユーザーに価値を生み出しています。

さらに、デジタル化の進展により、業界は自社のウェブサイトのみでサービスや情報を提供できるようになっています。業界のさまざまなメーカーが電子パンフレット、雑誌、年次報告書などに切り替えており、これがコート紙業界にとって大きなマイナスとなっています。メーカーはオンライン媒体、テレビ広告、その他のソーシャルメディアプラットフォームを通じて宣伝を行っており、紙媒体の成長を抑制し、コート紙業界に大きな影響を与えています。

したがって、あらゆる業界でデジタル化が進むと、北米のコート紙市場の成長が妨げられる可能性があります。

COVID-19後の北米コート紙市場への影響

COVID-19はある程度市場に影響を与えています。ロックダウンにより、多くの中小企業の製造と生産が停止し、コート紙の需要も減少し、市場に影響を与えました。多くの義務と規制の変更により、メーカーは市場に新製品を設計して投入することができ、市場の成長に貢献します。

最近の動向

- 2021年12月、Lectaはライナーペーパーの発売を発表しました。Linerset CCK Duoは、裏面に特殊な処理を施したシリコン化用の両面粘土コーティング剥離紙で、同社の製品ポートフォリオを拡大しました。

北米コート紙市場の範囲

北米のコート紙市場は、製品、コーティング層、コーティング材料、仕上げ、コーティング方法、仕上げプロセス、および用途に基づいて、注目すべきセグメントに分割されています。これらのセグメントの成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品

- コート紙

- 標準コート上質紙

- 低コート紙

- 顔料コート紙

- アートペーパー

- エナメル紙

- その他

製品に基づいて、北米のコート紙市場は、コートされた下地紙、標準コートされた上質紙、低コート重量紙、顔料コート紙、アート紙、エナメル紙などに分類されます。

コーティング層

- 片面コーティング

- 両面コーティング

コーティング層に基づいて、北米のコート紙市場は片面コーティングと両面コーティングに分類されます。

コーティング材

- 粘土

- 炭酸カルシウム

- タルク

- カオリン粘土

- ワックス

- 二酸化チタン

- その他

コーティング材料に基づいて、北米のコート紙市場は粘土、炭酸カルシウム、タルク、カオリン粘土、ワックス、二酸化チタンなどに分類されます。

仕上げる

- 光沢

- サテン

- マット

- 鈍い

- その他

仕上げに基づいて、北米のコート紙市場は光沢、サテン、マット、ダル、その他に分類されます。

コーティング方法

- 手塗り

- ブラシコーティング

- 機械コーティング

- その他

コーティング方法に基づいて、北米のコート紙市場は、手塗り、ブラシ塗り、機械塗り、その他に分類されます。

仕上げ工程

- オンラインカレンダー

- オフラインカレンダー

仕上げ工程に基づいて、北米のコート紙市場はオンラインカレンダーとオフラインカレンダーに分類されます。

応用

- 印刷

- 包装とラベル

- その他

用途に基づいて、北米のコート紙市場は印刷、包装、ラベル、その他に分類されます。

北米コート紙市場地域分析/洞察

北米のコート紙市場が分析され、国別および上記に基づいて市場規模の洞察と傾向が提供されます。

北米コーティング市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

米国は、市場シェアと収益の面で北米のコート紙市場を支配すると予想されており、さまざまな業界でコート紙の需要が急増し、エンドユーザーからの消費者需要も高まっているため、予測期間中もその優位性を維持すると予測されています。

レポートの地域セクションでは、市場の現在および将来の傾向に影響を与える個々の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国データの予測分析を提供する際には、北米ブランドの存在と入手可能性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境と北米のコート紙市場シェア分析

北米のコート紙市場の競争状況は、競合他社に関する詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。上記のデータ ポイントは、北米のコート紙市場への会社の重点にのみ関連しています。

北米のコート紙市場で事業を展開している主要企業としては、王子ホールディングス株式会社、日本製紙株式会社、Stora Enso、Sappi Ltd.、Asia Pulp & Paper (APP) Sinar Mas、skpmil.com、UPM、DS Smith、Dunn Paper Company、Paradise Packaging、Burgo Group Spa、JK Paper、Emami Paper Mills Ltd.、Koehler Holding SE & Co. KG、Lecta、Twin Rivers Paper Company、Svenska Cellulosa Aktiebolaget SCA (Publ)、Billerud Americas Corporationなどがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COATED PAPER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HIGH-QUALITY PRINT IMAGES

5.1.2 INCREASE IN DEMAND FOR COATED PAPER IN THE FOOD INDUSTRY

5.1.3 RISE IN E-COMMERCE AND ONLINE SHOPPING ACTIVITIES THUS CREATING DEMAND FOR THE PACKAGING INDUSTRY

5.1.4 STRINGENT GOVERNMENT RULES ON PLASTIC PACKAGING

5.2 RESTRAINTS

5.2.1 WIDESPREAD DIGITALIZATION ACROSS INDUSTRIES LIMITING THE USE OF PAPER

5.2.2 NEGATIVE IMPACT OF THE PAPER INDUSTRY ON THE ENVIRONMENT

5.2.3 HIGH INITIAL INVESTMENT IN COATED PAPER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 NEW ADVANCES IN PAPER COATING TECHNOLOGY

5.3.2 CONSUMERS' CHANGING AND IMPROVING LIFESTYLES RESULT IN A SIGNIFICANT DEMAND FOR PRODUCTS WITH COATED PACKAGING

5.3.3 SHIFTING TOWARDS THE ECO-FRIENDLY PRINTING AND PACKAGING FORMATS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN PRICES OF RAW MATERIAL

5.4.2 LOW RECYCLING VALUE FOR COATED PAPER

5.4.3 GOVERNMENT OVERSEAS REGULATIONS FOR IMPORT-EXPORT

6 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 STANDARD COATED FINE PAPER

6.2.1 TWO-COATED

6.2.1.1 MACHINE COATED

6.2.1.2 HAND-COATED

6.2.1.3 BRUSH-COATED

6.2.1.4 OTHERS

6.2.2 ONE-SIDE COATED

6.2.3 MACHINE COATED

6.2.4 BRUSH-COATED

6.2.5 OTHERS

6.3 COATED GROUND WOOD PAPER

6.3.1 TWO-COATED

6.3.1.1 MACHINE COATED

6.3.1.2 HAND-COATED

6.3.1.3 BRUSH-COATED

6.3.1.4 OTHERS

6.3.2 ONE-SIDE COATED

6.3.3 MACHINE COATED

6.3.4 HAND-COATED

6.3.5 BRUSH-COATED

6.3.6 OTHERS

6.4 ART PAPER

6.4.1 TWO-COATED

6.4.1.1 MACHINE COATED

6.4.1.2 HAND-COATED

6.4.1.3 BRUSH-COATED

6.4.1.4 OTHERS

6.4.2 ONE-SIDE COATED

6.4.2.1 MACHINE COATED

6.4.2.2 HAND-COATED

6.4.2.3 BRUSH-COATED

6.4.2.4 OTHERS

6.5 PIGMENT COATED PAPER

6.5.1 TWO-COATED

6.5.1.1 MACHINE COATED

6.5.1.2 HAND-COATED

6.5.1.3 BRUSH-COATED

6.5.1.4 OTHERS

6.5.2 ONE-SIDE COATED

6.5.2.1 MACHINE COATED

6.5.2.2 HAND-COATED

6.5.2.3 BRUSH-COATED

6.5.2.4 OTHERS

6.6 ENAMEL PAPER

6.6.1 TWO-COATED

6.6.1.1 MACHINE COATED

6.6.1.2 HAND-COATED

6.6.1.3 BRUSH-COATED

6.6.1.4 OTHERS

6.6.2 ONE-SIDE COATED

6.6.2.1 MACHINE COATED

6.6.2.2 HAND-COATED

6.6.2.3 BRUSH-COATED

6.6.2.4 OTHERS

6.7 LOW COAT WEIGHT PAPER

6.7.1 TWO-COATED

6.7.1.1 MACHINE COATED

6.7.1.2 HAND-COATED

6.7.1.3 BRUSH-COATED

6.7.1.4 OTHERS

6.7.2 ONE-SIDE COATED

6.7.2.1 MACHINE COATED

6.7.2.2 HAND-COATED

6.7.2.3 BRUSH-COATED

6.7.2.4 OTHERS

6.8 OTHERS

6.8.1 TWO-COATED

6.8.1.1 MACHINE COATED

6.8.1.2 HAND-COATED

6.8.1.3 BRUSH-COATED

6.8.1.4 OTHERS

6.8.2 ONE-SIDE COATED

6.8.2.1 MACHINE COATED

6.8.2.2 HAND-COATED

6.8.2.3 BRUSH-COATED

6.8.2.4 OTHERS

7 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER

7.1 OVERVIEW

7.2 TWO-SIDE COATED

7.3 ONE-SIDE COATED

8 NORTH AMERICA COATED PAPER MARKET, BY FINISH

8.1 OVERVIEW

8.2 GLOSS

8.3 SATIN

8.4 MATTE

8.5 DULL

8.6 OTHERS

9 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND LABELLING

9.2.1 STANDARD COATED FINE PAPER

9.2.2 COATED GROUND WOOD PAPER

9.2.3 ART PAPER

9.2.4 PIGMENT COATED PAPER

9.2.5 ENAMEL PAPER

9.2.6 LOW COAT WEIGHT PAPER

9.2.7 OTHERS

9.3 PRINTING

9.3.1 STANDARD COATED FINE PAPER

9.3.2 COATED GROUND WOOD PAPER

9.3.3 ART PAPER

9.3.4 PIGMENT COATED PAPER

9.3.5 ENAMEL PAPER

9.3.6 LOW COAT WEIGHT PAPER

9.3.7 OTHERS

9.4 OTHERS

9.4.1 STANDARD COATED FINE PAPER

9.4.2 COATED GROUND WOOD PAPER

9.4.3 ART PAPER

9.4.4 PIGMENT COATED PAPER

9.4.5 ENAMEL PAPER

9.4.6 LOW COAT WEIGHT PAPER

9.4.7 OTHERS

10 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS

10.1 OVERVIEW

10.2 ONLINE CALENDARING

10.3 OFFLINE CALENDARING

11 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD

11.1 OVERVIEW

11.2 MACHINE COATED

11.3 HAND-COATED

11.4 BRUSH-COATED

11.5 OTHERS

12 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL

12.1 OVERVIEW

12.2 CALCIUM CARBONATE

12.2.1 PRECIPITATED CALCIUM CARBONATE (PCC)

12.2.2 GROUND CALCIUM CARBONATE (GCC)

12.3 KAOLIN CLAY

12.4 CLAY

12.5 TITANIUM DIOXIDE

12.6 WAX

12.7 TALC

12.8 OTHERS

13 NORTH AMERICA COATED PAPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COATED PAPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SAPPI

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BILLERUD AMERICAS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UPM

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DS SMITH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 STORA ENSO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 OJI HOLDINGS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 NIPPON PAPER INDUSTRIES CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 LECTA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EMAMI PAPER MILLS LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.10.1 COMPANY SNAPSHOT

16.10.2 RECENT FINANCIALS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 DUNN PAPER COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 KOEHLER HOLDING SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BURGO GROUP S.P.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JK PAPER

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 ASIA PULP & PAPER (APP) SINAR MAS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 TWIN RIVERS PAPER COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SKPMILL.COM

16.17.1 COMPANY SNAPSHOT

16.17.2 RECENT FINANCIALS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 PARADISE PACKAGING

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 3 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 5 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 7 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 9 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 11 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 13 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 15 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 17 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 19 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 21 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 23 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 25 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 27 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 29 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 31 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 33 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 35 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)(B2C)

TABLE 36 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 37 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 39 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 41 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 43 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 45 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 47 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 49 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 51 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 53 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 55 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 57 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 59 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 61 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 63 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 65 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 67 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 69 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 71 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 73 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 75 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 77 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 79 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 81 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 83 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 85 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 87 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 89 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 91 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 93 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 95 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 97 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 99 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 101 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 103 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 105 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 107 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 109 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 111 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 113 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 115 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 117 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 119 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 121 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 123 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 125 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (KILO TON)

TABLE 127 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 128 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 130 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 131 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 133 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 135 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 137 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 139 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 141 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 143 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 145 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 147 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 149 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 151 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 153 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 155 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 157 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 159 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 161 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 163 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 165 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 167 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 169 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 171 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 173 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 175 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 176 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 178 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 179 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 181 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 183 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 184 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 185 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 186 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 187 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 188 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 189 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 190 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 192 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 193 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 195 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 196 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 197 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 199 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 200 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 201 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 202 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 203 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 204 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 205 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 206 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 207 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 208 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 209 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 210 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 211 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 212 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 213 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 214 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 215 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 216 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 217 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 218 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 219 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 220 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 221 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 222 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 223 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 224 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 225 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 226 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 227 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 228 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 229 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 230 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 231 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 232 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 233 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 234 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 235 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 236 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 237 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 238 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 239 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 240 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 241 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 242 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 243 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 244 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 245 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 246 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 247 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 248 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 249 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 250 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 251 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 252 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 253 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 254 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 255 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 256 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 257 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 258 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 259 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 260 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 261 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 262 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 263 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 264 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 265 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 266 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 267 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 268 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 269 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 270 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 271 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 272 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 273 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 274 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 275 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 276 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 277 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 278 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 279 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 280 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 281 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 282 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 283 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 284 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 285 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 286 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 287 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 288 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 289 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 290 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 291 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 292 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 293 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 294 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 295 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 296 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 297 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 298 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 299 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 300 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 301 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 302 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 303 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 304 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 305 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 306 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 307 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 308 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 309 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 310 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 311 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 312 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 313 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 314 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 315 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 316 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 317 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 318 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 319 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 320 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 321 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 322 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 323 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 324 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 325 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 326 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 327 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 328 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 329 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 330 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 331 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 332 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 333 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 334 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 335 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 336 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 337 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 338 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 339 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 340 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 341 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 342 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 343 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 344 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 345 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 346 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 347 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 348 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 349 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 350 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 351 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 352 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 353 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 354 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 355 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 356 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 357 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 358 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 359 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 360 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 361 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 362 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 363 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 364 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 365 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 366 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 367 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 368 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 369 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 370 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 371 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 372 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 373 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 374 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 375 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 376 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 377 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 378 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 379 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 380 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 381 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 382 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 383 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 384 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 385 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 386 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 387 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 388 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 389 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 390 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 391 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 392 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 393 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 394 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 395 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 396 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 397 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 398 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 399 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 400 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 401 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 402 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 403 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 404 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 405 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 406 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 407 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 408 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 409 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 410 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 411 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

図表一覧

FIGURE 1 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COATED PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COATED PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COATED PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COATED PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COATED PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COATED PAPER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COATED PAPER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA COATED PAPER MARKET VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF COATED PAPER IN FOOD INDUSTRY IS DRIVING THE COATED PAPER MARKET IN THE FORECAST PERIOD

FIGURE 12 STANDARD COATED FINE PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COATED PAPER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COATED PAPER MARKET

FIGURE 14 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2022

FIGURE 16 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2022

FIGURE 17 NORTH AMERICA COATED PAPER MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA COATED PAPER MARKET: BY FINISHING PROCESS, 2022

FIGURE 19 NORTH AMERICA COATED PAPER MARKET: BY COATING METHOD, 2022

FIGURE 20 NORTH AMERICA COATED PAPER MARKET: BY COATING MATERIAL, 2022

FIGURE 21 NORTH AMERICA COATED PAPER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA COATED PAPER MARKET: BY PRODUCT (2023-2030)

FIGURE 26 NORTH AMERICA COATED PAPER MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。