北米の細胞・遺伝子治療用解凍装置市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

497.65 Billion

USD

1,459.93 Billion

2025

2033

USD

497.65 Billion

USD

1,459.93 Billion

2025

2033

| 2026 –2033 | |

| USD 497.65 Billion | |

| USD 1,459.93 Billion | |

|

|

|

|

北米の細胞・遺伝子治療用解凍装置市場セグメンテーション:モダリティ(ベンチトップ型およびポータブル型)、サンプル(細胞治療および遺伝子治療)、タイプ(手動解凍システムおよび自動解凍システム)、用途(上流処理および下流処理)、エンドユーザー(血液銀行および輸血センター、病院および診断ラボ、研究機関および学術機関、バイオテクノロジーおよび製薬業界、臍帯血および幹細胞バンク、遺伝子バンクなど)、流通チャネル(直接入札、第三者販売業者など) - 2033年までの業界動向および予測

北米の細胞・遺伝子治療用解凍装置市場規模

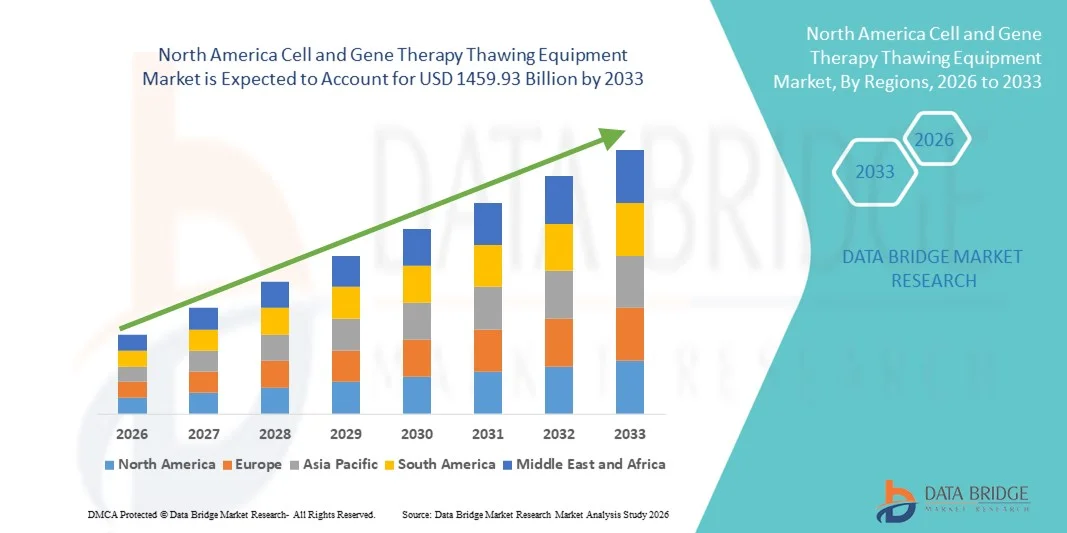

- 北米の細胞・遺伝子治療用解凍装置市場規模は2025年に4976億5000万米ドルと評価され、予測期間中に14.40%のCAGRで成長し、2033年には14599億3000万米ドル に達すると予想されています 。

- 市場の成長は、細胞および遺伝子治療の研究と商業化の急速な拡大と、制御解凍システムの継続的な技術進歩によって主に推進されており、温度精度の向上、細胞損傷の低減、臨床および商業製造環境全体にわたるプロセス標準化の強化につながっています。

- さらに、バイオ医薬品製造および臨床検査室における安全で信頼性が高く、GMPに準拠した解凍ソリューションの需要の高まりにより、細胞および遺伝子治療解凍装置は現代の再生医療ワークフローの重要なコンポーネントとして位置付けられ、細胞および遺伝子治療解凍装置市場全体の成長が大幅に促進されています。

北米の細胞・遺伝子治療用解凍装置市場分析

- 細胞および遺伝子治療用解凍装置は、凍結保存された生物学的材料を制御された均一で汚染のない解凍を保証するように設計されており、細胞の生存率と製品の完全性を維持する役割を果たすため、臨床、研究、商業用の細胞治療ワークフロー全体で不可欠なコンポーネントになりつつあります。

- 細胞および遺伝子治療用解凍装置の需要の高まりは、主に細胞および遺伝子治療パイプラインの急速な拡大、臨床試験活動の増加、および拡張可能で再現可能な製造をサポートする自動化されたGMP準拠のバイオプロセスソリューションの採用の増加によって推進されています。

- 米国は、細胞および遺伝子治療研究に対する強力な連邦政府および民間資金、確立されたバイオ医薬品製造エコシステム、臨床試験の集中、自動解凍技術の早期導入、大手治療開発者および機器メーカーの存在に支えられ、2025年には約41.2%という最大の収益シェアで細胞および遺伝子治療解凍装置市場を支配しました。

- カナダは、再生医療への投資の増加、学術機関や政府支援の研究プログラムの拡大、バイオ製造拠点の成長、CDMO活動の増加、先進的な治療法の開発を促進する支援的な規制イニシアチブにより、予測期間中に細胞および遺伝子治療解凍装置市場で最も急速に成長する国になると予想されています。

- 細胞治療セグメントは、承認された細胞ベースの治療の数の増加により、2025年に61.7%の最大の市場収益シェアを占めました。

レポートの範囲と細胞・遺伝子治療用解凍装置市場のセグメンテーション

|

属性 |

細胞・遺伝子治療用解凍装置の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。 |

北米の細胞・遺伝子治療用解凍装置市場動向

制御・自動解凍技術の進歩

- A prominent and accelerating trend in the global gene therapy thawing equipment market is the growing adoption of automated and precisely controlled thawing systems designed to maintain cell and vector viability during post-cryopreservation handling. As gene therapies rely heavily on temperature-sensitive viral vectors and modified cells, consistent and reproducible thawing has become a critical requirement in both clinical and commercial settings

- Manufacturers are increasingly focusing on closed-system and water-free dry thawing technologies, which minimize contamination risks and ensure uniform heat transfer

- For instance, Sartorius has promoted dry thawing solutions for cell and gene therapy workflows to replace conventional water baths, while Cytiva’s TheraCube and related controlled thawing platforms are increasingly used by CDMOs to support GMP-compliant viral vector and cell handling processes, reducing cross-contamination risks and operator-dependent variability

- The integration of real-time temperature monitoring, programmable thawing profiles, and data logging capabilities is further enhancing process control and traceability. These features allow laboratories and biopharmaceutical companies to standardize thawing protocols across multiple sites, ensuring consistent product quality during clinical trials and commercial-scale production

- In addition, the increasing shift toward point-of-care and decentralized manufacturing models is driving demand for compact, portable, and easy-to-operate thawing equipment. Such systems are particularly valuable in hospital pharmacies and clinical centers where gene therapies are prepared immediately prior to patient administration

- This trend toward safer, faster, and more reproducible thawing solutions is reshaping operational standards across the gene therapy workflow, encouraging continuous innovation by equipment manufacturers to meet the evolving needs of advanced biologics production

North America Cell and Gene Therapy Thawing Equipment Market Dynamics

Driver

Rising Demand Driven by Rapid Growth of Gene Therapy Development and Commercialization

- The rapid expansion of gene therapy research, clinical trials, and regulatory approvals is a major driver of the gene therapy thawing equipment market. As an increasing number of gene therapies progress from early-stage development to late-stage trials and commercial launch, the need for reliable and standardized thawing solutions is intensifying

- For instance, the commercialization of FDA-approved gene therapies such as Zolgensma and Luxturna has increased demand for tightly controlled cold-chain handling and thawing systems across hospitals and specialty treatment centers, prompting manufacturers and CDMOs to adopt validated thawing equipment to protect high-value therapies prior to patient administration

- Gene therapies often involve high-value, temperature-sensitive materials such as viral vectors and genetically modified cells, making precise thawing essential to preserve therapeutic efficacy and patient safety. This has led biopharmaceutical companies and contract development and manufacturing organizations (CDMOs) to invest in specialized thawing equipment that supports consistent and validated workflows

- The growing prevalence of genetic disorders, oncology indications, and rare diseases is further accelerating demand for gene therapies, indirectly boosting the adoption of advanced thawing systems across research institutes, manufacturing facilities, and clinical centers

- In addition, increasing funding from governments and private investors to support advanced therapy medicinal products (ATMPs) is strengthening infrastructure development, thereby driving procurement of dedicated gene therapy processing equipment, including thawing systems

Restraint/Challenge

High Equipment Costs and Limited Standardization Across Facilities

- The relatively high cost of specialized gene therapy thawing equipment remains a key challenge, particularly for small biotechnology firms, academic research laboratories, and emerging market players. Compared to conventional thawing methods, advanced automated systems require higher upfront investment, which can limit adoption among cost-sensitive users

- For instance, small biotech startups and early-stage academic spin-offs often continue using manual or semi-automated thawing approaches due to the high capital cost of GMP-compliant dry thawing systems, which can be difficult to justify before therapies advance into late-stage clinical trials or commercialization

- In addition, the lack of universal standardization in thawing protocols across different gene therapy products and manufacturing platforms complicates equipment selection and implementation. Variability in container formats, volumes, and temperature requirements often necessitates customized solutions, increasing operational complexity

- Training requirements and integration challenges within existing manufacturing workflows can also act as barriers, especially for facilities transitioning from traditional cryogenic handling methods to fully automated systems

- To overcome these challenges, manufacturers are focusing on developing scalable, versatile, and cost-efficient thawing platforms, along with enhanced user training and validation support. Addressing affordability and interoperability will be critical for enabling broader adoption and sustaining long-term market growth

North America Cell and Gene Therapy Thawing Equipment Market Scope

The market is segmented on the basis of modality, sample, type, application, end user, and distribution channel.

- By Modality

On the basis of modality, the Cell and Gene Therapy Thawing Equipment market is segmented into benchtop and portable systems. The benchtop segment dominated the market with a revenue share of 58.4% in 2025, driven by its widespread use in controlled laboratory and clinical environments. Benchtop systems offer high precision, temperature uniformity, and reproducibility, which are critical for maintaining cell viability during thawing. These systems are extensively adopted in hospitals, blood banks, and pharmaceutical manufacturing facilities. Their compatibility with GMP-compliant workflows further strengthens demand. Benchtop units support high-volume processing, making them suitable for large-scale clinical trials. Integration with automated cell processing systems enhances operational efficiency. Strong regulatory acceptance also supports dominance. High accuracy reduces contamination risks. Continuous technological upgrades improve reliability. Skilled personnel preference further boosts adoption. Established infrastructure in developed regions reinforces leadership. Overall, reliability and scalability drive dominance.

The portable segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by increasing demand for point-of-care and decentralized therapies. Portable systems offer flexibility for bedside and field applications. Growing adoption of personalized cell therapies fuels demand. These systems enable rapid thawing in emergency and remote settings. Rising use in clinical trials increases uptake. Compact design improves mobility and ease of use. Technological advancements enhance temperature accuracy. Expansion of outpatient treatment centers supports growth. Increased adoption in emerging markets boosts demand. Cost-effectiveness compared to benchtop systems supports penetration. Rising investment in mobile healthcare infrastructure accelerates adoption. Overall, portability and convenience drive strong CAGR growth.

- By Sample

On the basis of sample, the market is segmented into cell therapies and gene therapies. The cell therapies segment accounted for the largest market revenue share of 61.7% in 2025, driven by the growing number of approved cell-based therapies. High demand for CAR-T and stem cell therapies significantly contributes to dominance. Cell therapies require precise thawing to preserve viability and functionality. Increased clinical applications in oncology and regenerative medicine support growth. Rising adoption in hospitals and research centers boosts demand. Strong pipeline of cell therapy products strengthens market share. Frequent use in blood banks further supports dominance. Advanced thawing protocols improve clinical outcomes. Regulatory approvals enhance confidence. Expansion of cell therapy manufacturing facilities increases equipment demand. Investment in automation supports scalability. Collectively, these factors sustain leadership.

The gene therapies segment is projected to grow at the fastest CAGR of 10.1% from 2026 to 2033, driven by rapid advancements in genetic engineering. Increasing approvals for gene-based treatments support demand. Gene therapies require controlled thawing to maintain vector stability. Expanding clinical trial activity fuels adoption. Rising investments in rare disease treatment accelerate growth. Improved thawing solutions enhance safety and efficacy. Growing awareness among clinicians supports uptake. Expansion of gene banks increases equipment use. Partnerships between biotech firms drive innovation. Regulatory support for gene therapy accelerates commercialization. Improved cold-chain logistics further support growth. These trends collectively drive high CAGR.

- By Type

On the basis of type, the market is segmented into manual thawing systems and automatic thawing systems. he automatic thawing systems segment dominated the market with a revenue share of 54.9% in 2025, driven by superior consistency and reduced human error. Automated systems ensure precise temperature control and standardized thawing protocols. High adoption in GMP-compliant facilities supports dominance. These systems reduce contamination risks significantly. Increasing preference for automation in biopharma manufacturing boosts demand. Integration with closed-system processing enhances safety. Reduced labor dependency improves efficiency. High throughput capability supports large-scale production. Strong demand from pharmaceutical companies reinforces leadership. Regulatory bodies favor automated processes. Continuous innovation improves system performance. Overall, automation drives dominance.

The manual thawing systems segment is expected to grow at the fastest CAGR of 8.6% from 2026 to 2033, driven by affordability and simplicity. Manual systems are widely used in small laboratories and academic institutes. Low capital investment supports adoption. Growing research activities in emerging economies boost demand. Flexibility in handling different sample types supports growth. Increasing training programs improve usage accuracy. Adoption in early-stage clinical research supports expansion. Rising number of small biotech startups fuels demand. Easy maintenance supports preference. Portability advantages further enhance use. Growing decentralization of therapy processing supports growth. Collectively, these factors drive CAGR expansion.

- By Application

On the basis of application, the market is segmented into upstream processing and downstream processing. The downstream processing segment held the largest market revenue share of 57.3% in 2025, driven by its critical role in final therapy preparation. Accurate thawing during downstream processing ensures product integrity. Increasing commercialization of cell and gene therapies boosts demand. High dependency on controlled thawing supports dominance. Adoption in manufacturing facilities strengthens revenue share. Stringent quality control requirements enhance equipment use. Advanced downstream workflows require precise temperature management. Rising production volumes increase usage frequency. Regulatory emphasis on consistency supports adoption. Integration with fill-finish operations enhances demand. Strong pharmaceutical investment supports growth. These factors sustain leadership.

The upstream processing segment is anticipated to grow at the fastest CAGR of 9.0% from 2026 to 2033, driven by expanding research activities. Early-stage cell expansion requires reliable thawing. Increasing R&D investment boosts adoption. Growth in academic research supports demand. Technological innovation improves upstream efficiency. Rising number of clinical trials fuels growth. Automation integration enhances scalability. Increased focus on process optimization supports expansion. Growing biotech startup activity boosts demand. Adoption in pilot-scale manufacturing increases usage. Improved reproducibility supports preference. Overall, upstream expansion drives CAGR growth.

- By End User

On the basis of end user, the market is segmented into blood banks and transfusion centers, hospitals and diagnostic laboratories, research laboratories and academic institutes, biotechnology and pharmaceutical industry, cord blood and stem cell banks, gene banks, and others. The biotechnology and pharmaceutical industry segment dominated the market with a revenue share of 36.8% in 2025, driven by large-scale therapy manufacturing. High-volume production requires advanced thawing equipment. Increasing commercial approvals support dominance. Investment in automation enhances efficiency. Strong R&D pipelines drive demand. Global expansion of manufacturing facilities boosts adoption. Regulatory compliance requires precise thawing. High capital availability supports equipment upgrades. Strategic partnerships enhance market position. Increasing outsourcing activities support usage. Continuous process optimization sustains leadership. These factors maintain dominance.

The cord blood and stem cell banks segment is expected to grow at the fastest CAGR of 9.4% from 2026 to 2033, driven by rising awareness of stem cell preservation. Increasing birth rates in emerging regions boost storage demand. Growing use in regenerative medicine supports adoption. Improved thawing technologies enhance cell viability. Government initiatives promote stem cell banking. Expanding private banking facilities fuel growth. Rising medical tourism supports demand. Technological advancements improve operational efficiency. Increasing clinical applications drive usage. Expansion of storage infrastructure supports CAGR. Growing consumer awareness boosts enrollment. These trends drive strong growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third-party distributor, and others. The direct tender segment dominated the market with a revenue share of 48.6% in 2025, driven by bulk procurement by hospitals and pharmaceutical companies. Direct sourcing ensures cost efficiency and quality assurance. Government-funded institutions prefer tender-based procurement. Long-term supply contracts ensure stability. Standardization of equipment supports operational efficiency. Strong supplier-buyer relationships reinforce dominance. Large-scale manufacturing facilities rely on direct procurement. Tender processes support regulatory compliance. Inclusion of service agreements enhances value. Reduced intermediary costs support preference. High-volume purchasing drives dominance. These factors sustain leadership.

The third-party distributor segment is projected to grow at the fastest CAGR of 8.9% from 2026 to 2033, driven by expanding reach in emerging markets. Distributors facilitate access for small and mid-sized facilities. Local presence improves service delivery. Growing private healthcare infrastructure boosts demand. Flexible purchasing options support adoption. Improved logistics enhance availability. Manufacturers benefit from reduced operational burden. Rising healthcare spending supports distributor networks. Increasing number of biotech startups rely on distributors. After-sales support enhances customer retention. Market expansion in remote regions fuels growth. These factors drive strong CAGR expansion.

North America Cell and Gene Therapy Thawing Equipment Market Regional Analysis

- The North America cell and gene therapy thawing equipment market is poised to grow at a robust CAGR during the forecast period, driven by the rapid expansion of the biopharmaceutical sector, strong investments in regenerative medicine, and rising clinical adoption of cell- and gene-based therapies across the region. The presence of advanced healthcare infrastructure, a mature regulatory framework, and a high concentration of therapy developers is accelerating demand for precise and reliable thawing solutions

- The increasing number of clinical trials, late-stage pipeline assets, and commercialization of approved cell and gene therapies is significantly boosting demand for contamination-free and controlled thawing equipment, which is critical to maintaining cell viability, consistency, and therapeutic effectiveness during manufacturing and point-of-care preparation

- In addition, North America’s role as a global hub for biopharmaceutical manufacturing and contract development services is accelerating the adoption of standardized and GMP-compliant thawing systems across research laboratories, CDMOs, and hospital-based treatment centers, particularly as automation and closed-system processing gain importance in advanced therapy workflows

U.S. Cell and Gene Therapy Thawing Equipment Market Insight

The U.S. cell and gene therapy thawing equipment market dominated the North America region with the largest revenue share of approximately 41.2% in 2025, supported by strong federal and private funding for cell and gene therapy research and a well-established biopharmaceutical manufacturing ecosystem. The country hosts a high concentration of clinical trials across oncology, rare diseases, and genetic disorders, driving consistent demand for precise thawing equipment in both manufacturing and clinical settings. Early adoption of automated and closed-system thawing technologies is further strengthening market growth, as therapy developers focus on scalability, reproducibility, and regulatory compliance. In addition, the presence of leading therapy developers, CDMOs, and equipment manufacturers is reinforcing the U.S.’s leadership position in advanced cell and gene therapy infrastructure.

Canada Cell and Gene Therapy Thawing Equipment Market Insight

Canada cell and gene therapy thawing equipment market is expected to be the fastest-growing country in the cell and gene therapy thawing equipment market during the forecast period, driven by increasing investments in regenerative medicine and the expansion of academic and government-backed research programs. The growth of biomanufacturing hubs and rising CDMO activity are creating strong demand for standardized and scalable thawing equipment to support both clinical research and commercial manufacturing. Supportive regulatory initiatives promoting advanced therapy development, along with growing collaboration between universities, hospitals, and biotech firms, are improving access to modern cell processing technologies. As Canada continues to strengthen its advanced therapy ecosystem, adoption of reliable and automated thawing systems is expected to rise steadily.

North America Cell and Gene Therapy Thawing Equipment Market Share

The Cell and Gene Therapy Thawing Equipment industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- GE HealthCare (U.S.)

- Cytiva (U.S.)

- BioLife Solutions (U.S.)

- Sartorius (Germany)

- Merck KGaA (Germany)

- PHC Holdings Corporation (Japan)

- Panasonic Healthcare (Japan)

- Eppendorf (Germany)

- Helmer Scientific (U.S.)

- B Medical Systems (Luxembourg)

- Brooks Automation (U.S.)

- Asymptote (U.K.)

- MedCision (China)

- Haier Biomedical (China)

Latest Developments in North America Cell and Gene Therapy Thawing Equipment Market

- In March 2023, BioLife Solutions, Inc. introduced an upgraded version of its evo Smart Thawing System equipped with wireless connectivity and an improved user interface, allowing for remote monitoring and traceability in thawing cryopreserved cell therapies — a key improvement for quality control and compliance in clinical and manufacturing workflows

- In February 2023, Sartorius AG announced a strategic collaboration with a leading European biopharmaceutical company to co-develop a fully closed, automated thawing solution tailored for stem cell-derived therapies, aimed at minimizing contamination risk and improving thaw consistency in advanced therapy manufacturing

- In January 2023, Thermo Fisher Scientific Inc. launched its CryoMed Controlled-Rate Thawing System, designed to ensure consistent thawing of critical biological samples with high reproducibility and support regulatory compliance in clinical research and biopharma thawing workflows

- In April 2025, Thermo Fisher Scientific announced a strategic collaboration with Miltenyi Biotec to integrate automated thawing with cell processing workflows for clinical cell therapies, helping to reduce overall processing time and improve cell viability in advanced therapy production

- In May 2025, Stylus Medicine, a biotech startup focused on advanced therapy manufacturing technologies, raised US USD 85 million in funding — backing initiatives that include innovations around thawing and production workflows that address challenges in cell and gene therapy delivery

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。