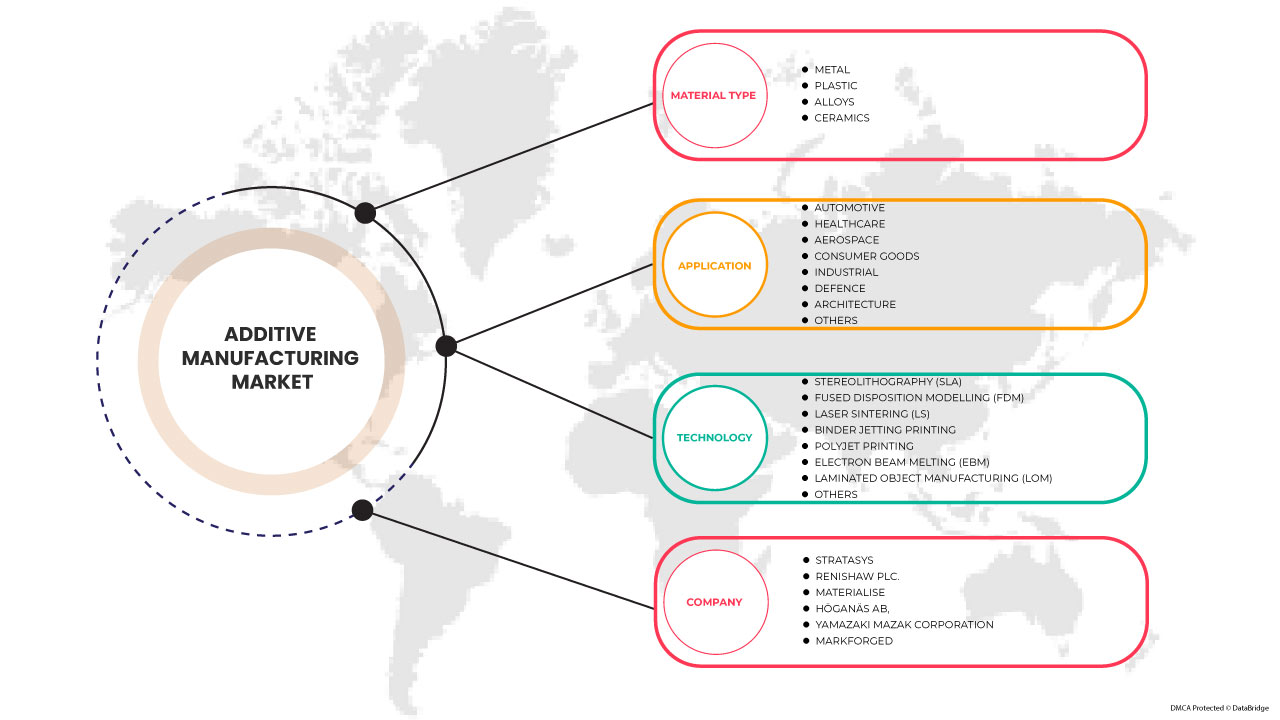

北米の付加製造市場、材料タイプ別(金属、プラスチック、合金、セラミック)、技術別(光造形法(SLA)、熱溶解積層法(FDM)、レーザー焼結法(LS)、バインダージェッティング印刷、ポリジェット印刷、電子ビーム溶融法(EBM)、積層造形法(LOM)、その他)、用途別(自動車、ヘルスケア、航空宇宙、消費財、工業、防衛、建築、その他)市場動向と2030年までの予測。

北米の付加製造市場の分析と規模

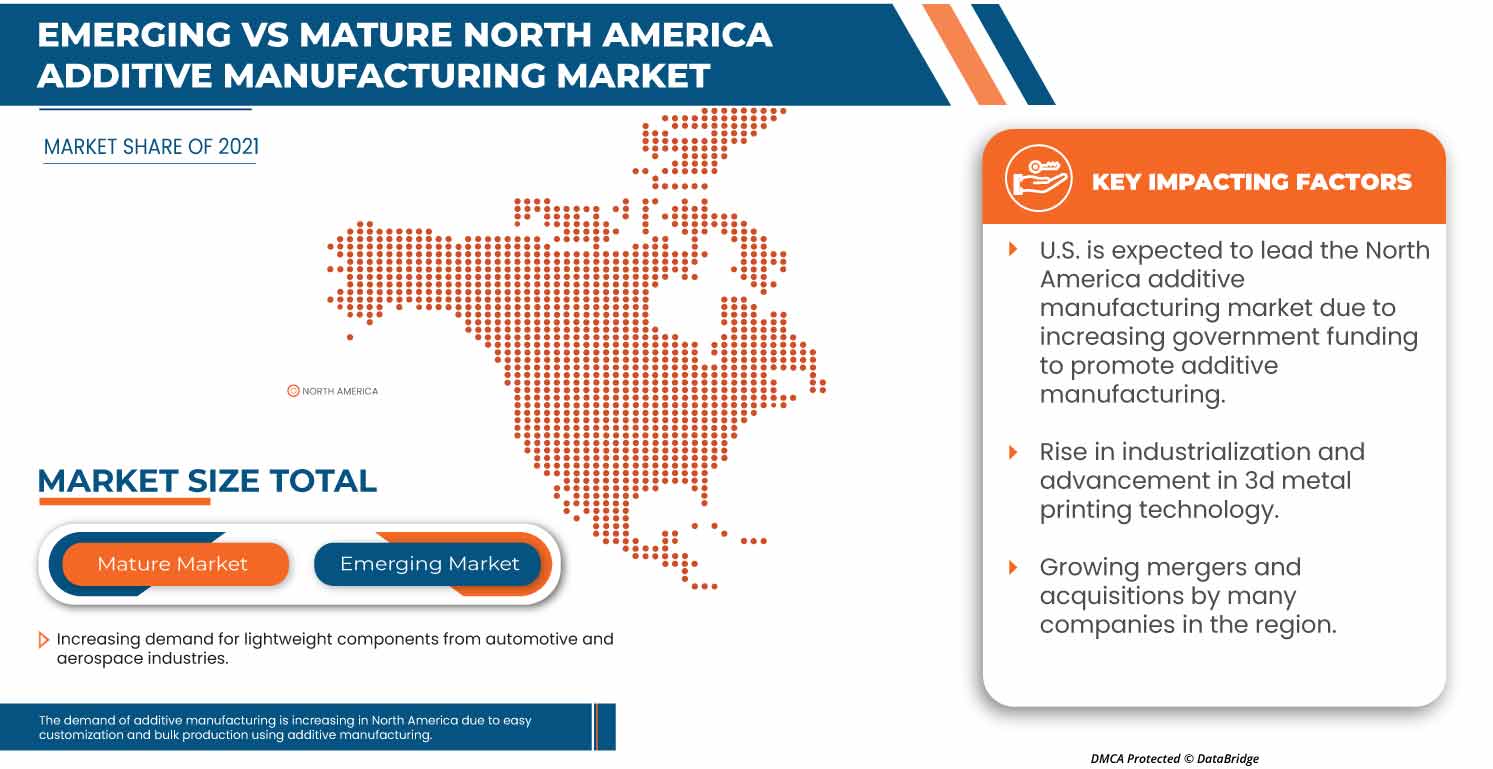

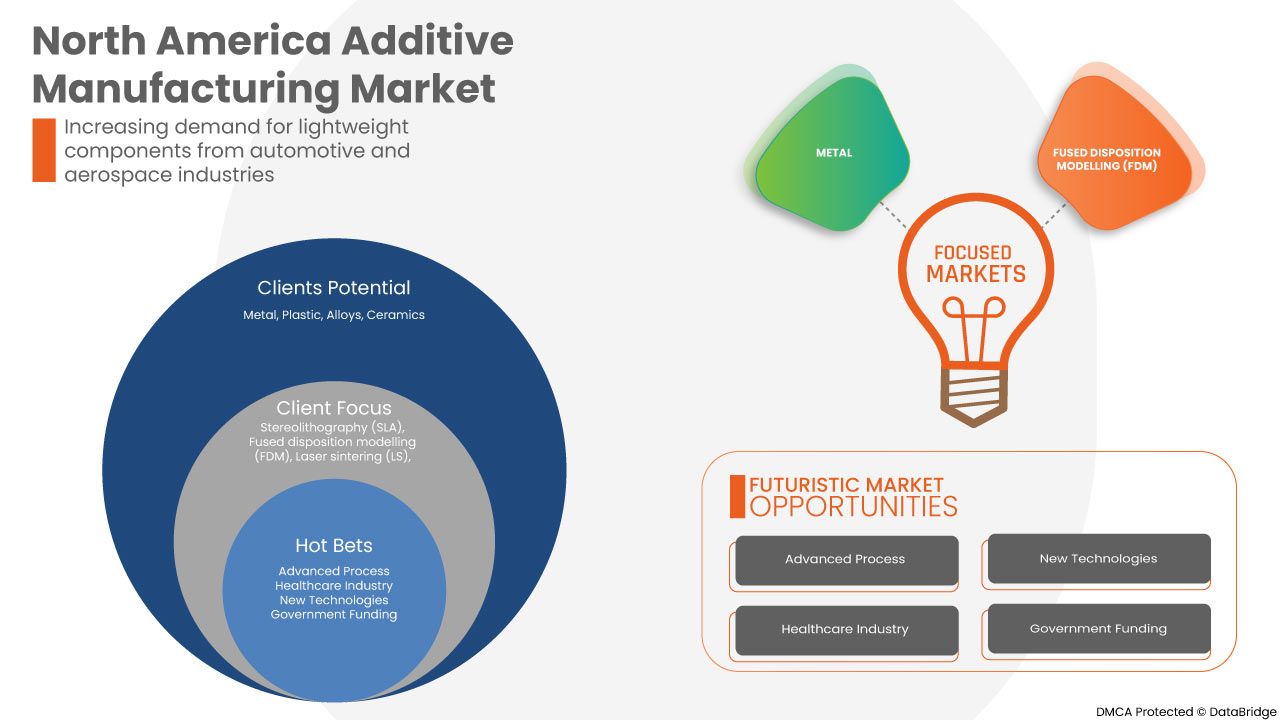

付加製造市場は、糸、布、衣類、衣服の設計、製造、流通に関係しています。原材料は、金属、プラスチック、合金、セラミックなどです。付加製造業界は、多くの国の国民経済に大きく貢献しています。自動車や航空宇宙の分野からの軽量部品の需要の高まりと、3D 金属印刷技術の進歩により、北米の付加製造市場の需要が大幅に増加しました。

北米の付加製造市場レポートでは、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、希望する目標を達成できるようお手伝いします。

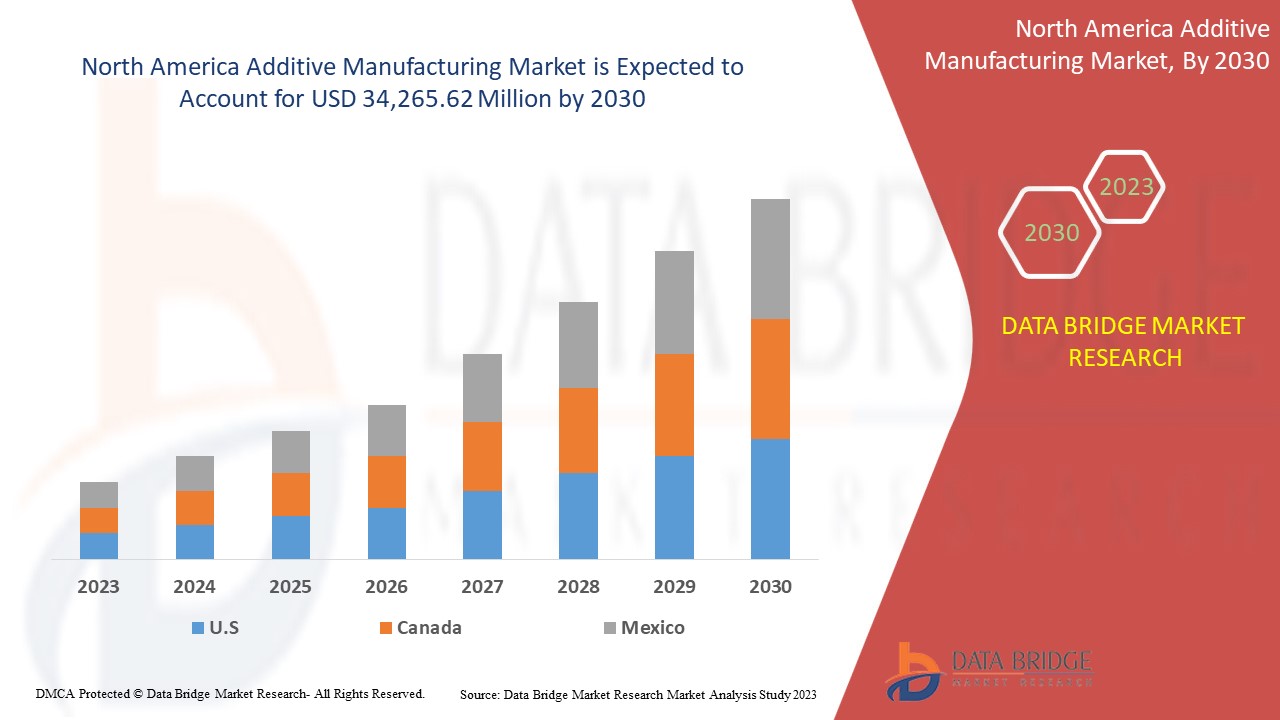

北米の付加製造市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に20.8%のCAGRで成長し、2030年までに342億6562万米ドルに達すると分析しています。付加製造市場の成長を牽引する主な要因は、自動車産業と航空宇宙産業からの軽量部品の需要増加です。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

材料タイプ(金属、プラスチック、合金、セラミック)、テクノロジー(光造形法(SLA)、熱溶解積層法(FDM)、レーザー焼結法(LS)、バインダージェッティング印刷、ポリジェット印刷、電子ビーム溶融法(EBM)、積層造形物製造法(LOM)、その他)、アプリケーション(自動車、ヘルスケア、航空宇宙、消費財、工業、防衛、建築、その他)別。 |

|

対象国 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

ANSYS, Inc、Höganäs AB、EOS、ARBURG GmbH + Co KG、Stratasys、Renishaw plc.、YAMAZAKI MAZAK CORPORATION、Materialise、Markforged、Titomic Limited.、SLM Solutions、Proto Labs、ENVISIONTEC US LLC、Ultimaker BV、American Additive Manufacturing LLC、Optomec, Inc.、3D system Inc.、ExOne.(Desktop Metal, Inc.の子会社)など。 |

市場の定義

積層造形 (AM) は、材料の塊から不要な材料を削り取る減法的な製造方法とは異なります。産業用途における積層造形の使用は、通常、3D 印刷を指します。積層造形は、3D プリンターと 3D プリンター ソフトウェアを使用して 3 次元ファイルを参照しながら、材料を層ごとに追加してオブジェクトを形成します。アプリケーションに応じて、利用可能な一連のテクノロジから適切な積層造形テクノロジが選択されます。

北米の付加製造市場の動向

ドライバー

- 自動車産業や航空宇宙産業からの軽量部品の需要増加

自動車および航空宇宙部門では、機能性能、リードタイムの短縮、軽量化、コスト管理、安全性が重要な部品の納入など、相互に作用する数多くの技術的および経済的目標が求められています。需要を満たし、燃料消費とコスト管理を補うために、技術的性能を向上させ、軽量構造を可能にすることで、経済的および技術的性能の向上に直接つながり、航空業界がより多くのペイロードを運ぶのに役立ち、収益を直接向上させます。積層造形技術は、従来の伝統的な製造とは異なり、一般的な粉末またはワイヤと、より軽量なプラスチックポリマーなどの材料をベースにしたレイヤーバイレイヤー製造を使用します。

- さまざまなエンドユーザー産業における積層造形の利点

航空宇宙などの業界では、その性能向上のために積層造形製品が使用されており、飛行機の部品には、必要な材料が少なく、厳しい環境条件に耐えることができる積層造形製品が使用されています。また、層ごとに材料を形成するプロセスは、航空宇宙業界では、大手企業の航空宇宙部品の製造にとって非常に重要な軽量化と廃棄物削減の利点として活用されています。

急速に革新が進む医療業界では、付加製造製品の利用が医師、患者、研究機関にとって大きな利点となります。付加製造技術が提供する機能プロトタイプ設計を通じて、手術や研究に必要なさまざまな設計の救命ツール、歯科処置で使用するツール、CTスキャン用の手術前モデル、カスタムソーやドリルガイド、筐体、特殊器具の柔軟な設計を作成できるという大きな利点があります。

- 積層造形による簡単なカスタマイズと大量生産

積層造形カスタマイズは、従来の製造とは異なり、カスタマイズに追加コストがかからず、設計用の特定の金型やツールも必要ありません。必要なのはプロトタイプの 3D 設計だけで、顧客自身で作成できます。カスタマイズが簡単で生産が速いため需要が高く、3D プリンターを使用すると、コストと時間を妨げることなく、独自のデザインを大量生産できます。大量カスタマイズ生産を提供するだけでなく、パーソナライズされたデザインを提供しない相手と比較して、消費者に帰属意識と消費者満足感を与えるユニークな購入者および消費者体験を提供します。また、消費者は自分の選択したデザインを購入することもできます。たとえば、靴メーカーの NIKE は、消費者がためらうことなく自分で色を選択できる 3D デザインで Web サイトで靴を販売しています。このシステムにより、メーカーは顧客を知ることができるため、市場競争に有利になります。

- 3D金属印刷技術の産業化と進歩

工業化の進展に伴い、航空宇宙、自動車、ヘルスケアなどの業界で 3D 金属印刷製品に対する需要が高まっています。航空宇宙ではジェットエンジン用部品やその他の構造部品、自動車業界では靴やその他の電子機器のデザインをカスタマイズするための部品など、さまざまな分野からの需要があり、より効率的に機能し、より高速かつ高精度で製品を生産できる 3D 印刷技術の厳格な開発が求められています。そのため、積層製造技術の進歩と利便性に対する需要が、3D 金属印刷技術の需要の増加につながっています。

機会

- ヘルスケア分野の進歩

医療分野では、すべての患者がユニークであるため、積層造形はパーソナライズおよびカスタマイズされた医療アプリケーションに利用できる可能性が高くなります。医療臨床で最も一般的に使用されているのは、パーソナライズされたインプラントと医療用模型の鋸ガイドです。歯科分野では、積層造形製品はスプリント、歯列矯正器具、歯科模型、ドリルガイドに使用されています。ただし、積層造形製品は人工組織や臓器の作成にも使用され、研究機関での研究目的や医師と患者の診察の合間に使用できます。医療用画像のデジタル化の開発により、デジタル化により患者の解剖学的構造から 3D モデルを再構築できます。パーソナライズされた医療機器の一般的なワークフローは、計算された 3D スキャン方法を使用して患者の解剖学的構造をイメージングまたはキャプチャすることから始まります。このようなデータは、患者の解剖学的構造の 3D モデルを印刷するために使用することも、パーソナライズされたデバイスやインプラントを作成するために使用することもできます。

- 付加製造を促進するための政府資金の増額

付加製造には、デジタルプロセス、通信、画像処理を通じて製造業と工業生産の状況を一変させる大きな可能性があります。付加製造は、航空宇宙、自動車、医療、エレクトロニクス、ファッションなど、さまざまな業界から高い需要があるトレンドのビジネスです。この分野が国の経済に貢献する可能性を見て、各国の政府はこの業界をサポートし、促進するためのさまざまな戦略を打ち出しています。

制約/課題

- 設備や機械のコストが高く、熟練した専門家が不足している

付加製造がもたらすメリットにより、あらゆる 3D 形状やコンポーネントの作成の可能性が大きく広がりました。しかし、すべての企業がこの種の活動を自社のビジネス プロセスに低コストで統合できる能力を備えているわけではありません。付加製造の将来を妨げる最も一般的な原因は、機器の高コストとこの業界の専門家の不足です。

積層造形装置の平均価格は 30 万~ 150 万ドルです。工業用消耗品のコストは 1 個あたり 100 ~ 150 ドルです。ただし、最終価格は、利用可能なすべての材料の中で最も予算に優しい選択肢であるプラスチックなどの選択した材料によって異なります。所要時間もかなり長く、40 cm のオブジェクトを印刷するのに 1 時間以上かかります。

- ソフトウェアの効率性の欠如

レーザー パウダー ベッド フュージョン (PBF) プロセスを使用した積層造形には、従来の製造工程ではコストがかかりすぎたり複雑すぎたりして作成できなかった、複雑で入り組んだ形状や有機構造を作成する機能があります。たとえば、レーザー PBF によって実現される設計の自由度を軽量コンポーネントに活用して、最も複雑な格子構造を作成し、材料をより効率的に使用できます。ただし、レーザー PBF には欠点もあります。構築中に破損する可能性のある薄壁/高アスペクト比の部品、取り外しが困難なサポート構造、表面粗さに対する層状効果、およびアップスキン表面とダウンスキン表面のレーザー設定などの異なるプロセス パラメータ設定が含まれます。

最近の開発

- SLM Solutions は 2 月に SLM.Quality をリリースしました。これは、顧客がビルドジョブ評価、プロセス認定、部品認証をより効率的に実行できるようにする品質保証ソフトウェア ソリューションです。単一部品でも連続生産でも、SLM.Quality ソリューションは認定プロセス中に産業顧客をサポートし、主要なプロセス データの追跡可能性と文書化を改善します。この開発により、同社はより多くの顧客を引き付けることができます。

- 2 月に、SLM Solutions と Assembrix は、Assembrix VMS ソフトウェアを世界中の SLM Solutions マシンに統合することに成功したことを共同で発表しました。この新しいパートナーシップにより、OEM による安全な分散型積層造形に対する高まる需要に応え、信頼性の高い国際的な積層造形エコシステムの構築が可能になります。

北米の付加製造市場の展望

北米の付加製造市場は、材料の種類、 技術、および用途に基づいて分類されています。これらのセグメントの成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

材質タイプ

- 金属

- プラスチック

- 合金

- 陶芸

材料の種類に基づいて、北米の付加製造市場は、金属、プラスチック、合金、セラミックの 5 つのセグメントに分類されます。

テクノロジー

- ステレオリソグラフィー(SLA)

- 融合配置モデリング (FDM)

- レーザー焼結(LS)

- バインダージェッティング印刷

- ポリジェット印刷

- 電子ビーム溶解法(EBM)

- 積層造形物製造(LOM)

- その他

技術に基づいて、北米の付加製造市場は、ステレオリソグラフィー (SLA)、熱溶解積層法 (FDM)、レーザー焼結 (LS)、バインダージェッティング印刷、ポリジェット印刷、電子ビーム溶融 (EBM)、積層造形物製造 (LOM) などの 8 つのセグメントに分類されます。

応用

- 自動車

- 健康管理

- 航空宇宙

- 消費財

- 産業

- 防衛

- 建築

- その他

用途に基づいて、北米の付加製造市場は、ヘルスケア、航空宇宙、消費財、工業、防衛、建築、その他の 8 つのセグメントに分類されます。

北米の付加製造市場の地域分析/洞察

北米の付加製造市場は、材料の種類、技術、および用途に基づいて分類されています。

北米の付加製造市場は米国、カナダ、メキシコの3か国で構成されており、この地域では米国が主要市場となっています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境と北米の付加製造市場シェア分析

北米の付加製造市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、北米の付加製造市場に関連する会社の焦点にのみ関連しています。

北米の積層造形市場で活動している著名な企業としては、SLM Solutions、Proto Labs、Stratasys、Renishaw plc.、Materialise、Titomic Limited.、Höganäs AB、YAMAZAKI MAZAK CORPORATION、Markforged、Ultimaker BV、Optomec, Inc.、ExOne. (Desktop Metal, Inc. の子会社)、American Additive Manufacturing LLC、ANSYS, Inc.、ARBURG GmbH + Co KG、ENVISIONTEC US LLC、EOS、3D Systems, Inc. などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 SUPPLY CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES

6.1.2 ADVANTAGES OFFERED BY ADDITIVE MANUFACTURING IN VARIOUS END-USER INDUSTRIES

6.1.3 EASY CUSTOMIZATION AND BULK PRODUCTION USING ADDITIVE MANUFACTURING

6.1.4 RISE IN INDUSTRIALIZATION AND ADVANCEMENT IN 3D METAL PRINTING TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF EQUIPMENT, MACHINERY AND LACK OF SKILLED PROFESSIONAL

6.2.2 LACK OF SOFTWARE EFFICIENCY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENT IN THE HEALTHCARE SECTOR

6.3.2 INCREASING GOVERNMENT FUNDING TO PROMOTE ADDITIVE MANUFACTURING

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO MATERIAL AVAILABILITY, DEVELOPMENT, VALIDATION, AND STANDARDIZATION

6.4.2 MISCONCEPTIONS AMONG SMALL AND MEDIUM-SCALE MANUFACTURERS ABOUT THE PROTOTYPING PROCESS

7 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 METAL

7.2.1 METAL, BY MATERIAL TYPE

7.2.1.1 STEEL

7.2.1.2 ALUMINUM (ALUMIDE)

7.2.1.3 TITANIUM

7.2.1.4 SILVER

7.2.1.5 GOLD

7.2.1.6 OTHERS

7.3 PLASTIC

7.3.1 PLASTIC, BY MATERIAL TYPE

7.3.1.1 ACRYLONITRILE BUTADIENE STYRENE

7.3.1.2 POLYLACTIC ACID (PLA)

7.3.1.3 NYLON

7.3.1.4 PHOTOPOLYMERS

7.3.1.5 OTHERS

7.3.2 OTHERS, BY MATERIAL TYPE

7.3.2.1 POLYPROPYLENE

7.3.2.2 HIGH DENSITY POLYETHYLENE

7.3.2.3 POLYCARBONATE

7.3.2.4 POLYVINYL ALCOHOL

7.4 ALLOYS

7.4.1 ALLOYS, BY MATERIAL TYPE

7.4.1.1 TOOL STEELS AND MARAGING STEELS

7.4.1.2 COMMERCIALLY PURE TITANIUM AND ALLOYS

7.4.1.3 ALUMINUM ALLOYS

7.4.1.4 NICKEL-BASED ALLOYS

7.4.1.5 COBALT-CHROMIUM ALLOYS

7.4.1.6 COPPER-BASED ALLOYS

7.5 CERAMICS

7.5.1 CERAMICS, BY MATERIAL TYPE

7.5.1.1 GLASS

7.5.1.2 SILICA

7.5.1.3 QUARTZ

7.5.1.4 OTHERS

8 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 STEREOLITHOGRAPHY (SLA)

8.3 FUSED DISPOSITION MODELLING (FDM)

8.4 LASER SINTERING (LS)

8.4.1 LASER SINTERING (LS), BY TECHNOLOGY

8.4.1.1 SELECTIVE LASER MELTING (SLM)

8.4.1.2 SELECTIVE LASER SINTERING (SLS)

8.4.1.3 DIRECT METAL LASER SINTERING

8.5 BINDER JETTING PRINTING

8.6 POLYJET PRINTING

8.7 ELECTRON BEAM MELTING (EBM)

8.8 LAMINATED OBJECT MANUFACTURING (LOM)

8.9 OTHERS

9 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 HEALTHCARE

9.4 AEROSPACE

9.5 CONSUMER GOODS

9.6 INDUSTRIAL

9.7 DEFENCE

9.8 ARCHITECTURE

9.9 OTHERS

10 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 CERTIFICATION

11.3 ACHIEVEMENT

11.4 LAUNCH

11.5 MERGER

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ANSYS, INC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 HÖGANÄS AB

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATE

13.3 EOS

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ARBURG GMBH + CO KG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 STRATASYS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 AMERICAN ADDITIVE MANUFACTURING LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 ENVISIONTEC US LLC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 EXONE. (A SUBSIDIARY OF DESKTOP METAL, INC.)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 MATERIALISE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 MARKFORGED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 OPTOMEC, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 PROTO LABS

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 ANNUAL REPORTS, AND SEC FILINGRECENT UPDATES

13.13 RENISHAW PLC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 SLM SOLUTIONS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 TITOMIC LIMITED.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 ULTIMAKER BV

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATE

13.17 YAMAZAKI MAZAK CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

13.18 3D SYSTEM, INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STEREOLITHOGRAPHY (SLA) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FUSED DISPOSITION MODELLING (FDM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BINDER JETTING PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYJET PRINTING IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRON BEAM MELTING (EBM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA LAMINATED OBJECT MANUFACTURING (LOM) IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTHCARE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CONSUMER GOODS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDUSTRIAL IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA DEFENCE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA ARCHITECTURE IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 U.S. ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.S. PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 48 U.S. LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.S. ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 50 CANADA ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 57 CANADA LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 58 CANADA ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 MEXICO ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 60 MEXICO METAL IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 61 MEXICO PLASTIC IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO OTHERS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO ALLOYS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO CERAMICS IN ADDITIVE MANUFACTURING MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 MEXICO ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 MEXICO LASER SINTERING (LS) IN ADDITIVE MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 MEXICO ADDITIVE MANUFACTURING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA ADDITIVE MANUFACTURING MARKET

FIGURE 2 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR LIGHTWEIGHT COMPONENTS FROM THE AUTOMOTIVE AND AEROSPACE INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE METAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ADDITIVE MANUFACTURING MARKET

FIGURE 17 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE, 2022

FIGURE 18 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY TECHNOLOGY, 2022

FIGURE 19 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 25 NORTH AMERICA ADDITIVE MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。