中東のポリマー市場、製品別(ポリエチレン(PE)、ポリプロピレン(PP)、アクリロニトリルブタジエンスチレン、ポリアミド(PA)、その他)業界動向と2030年までの予測。

中東ポリマー市場の分析と洞察

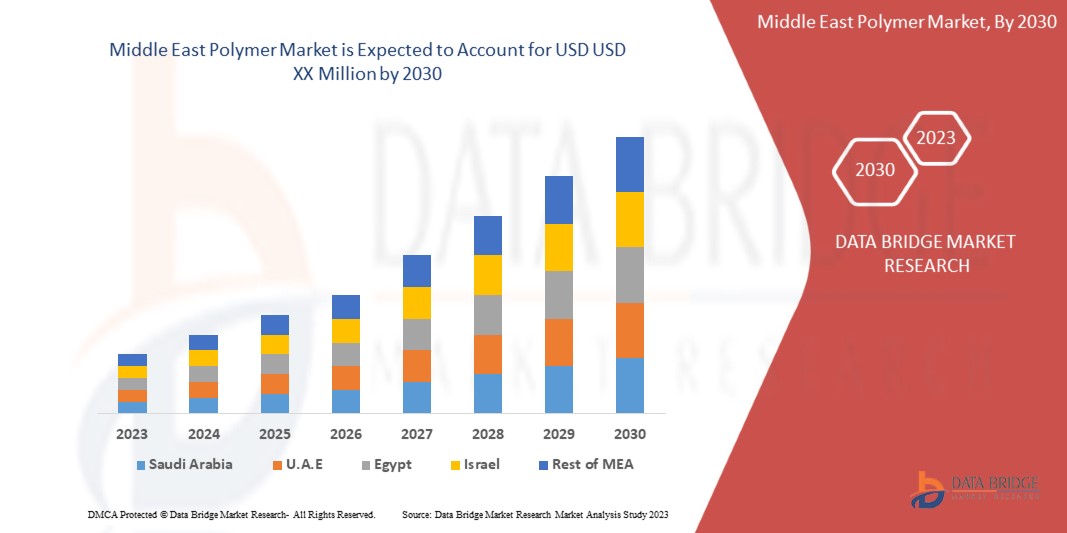

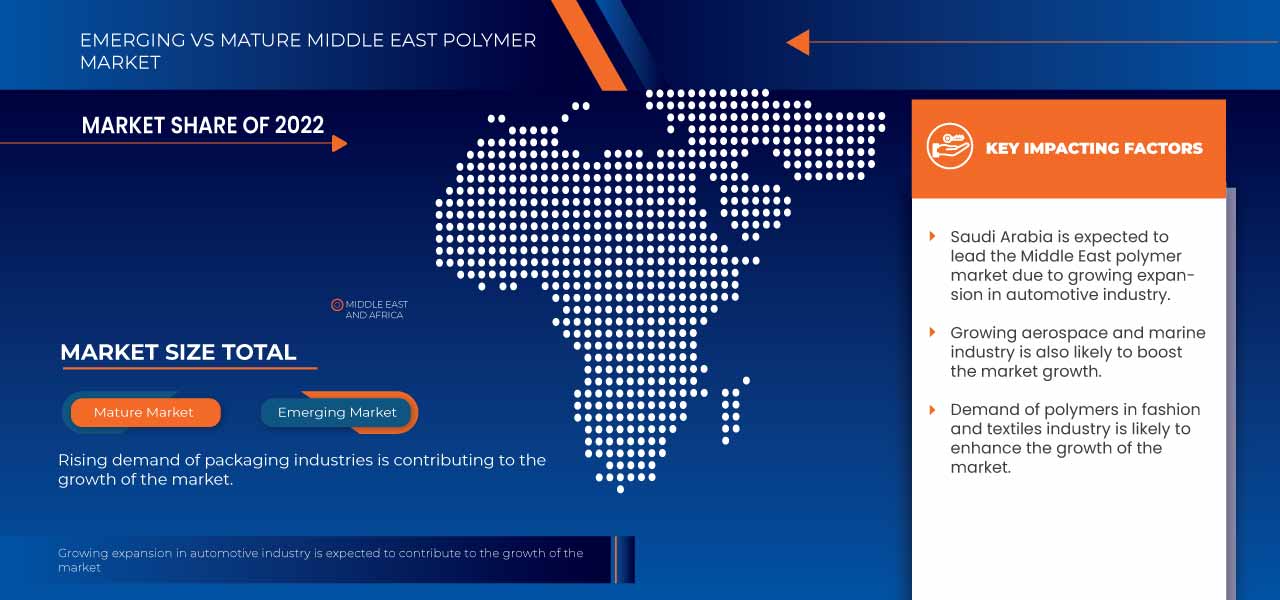

中東のポリマー市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に4.7%のCAGRで成長し、2030年までに752億9596万米ドルに達すると分析しています。中東のポリマー市場の成長を牽引する主な要因は、包装材料、自動車、航空宇宙、海洋、建設などの産業分野からのポリマーベースの製品に対する需要の高まりです。

ポリマーは、重合と呼ばれるプロセスによって、モノマーと呼ばれる小さな分子単位の複数の単位で構成されています。起源に基づいて、ポリマーは天然ポリマーと合成ポリマーに分類されます。天然ポリマーはバイオポリマーとも呼ばれ、シルク、ゴム、セルロース、ウールなどです。合成ポリマーは化学ベースの製品で、主に石油を原料として使用し、実験室で化学反応によって生成される他の触媒や酵素が添加されています。たとえば、ポリスチレン、ナイロン、シリコン、ネオプレン、ポリエチレンなどです。ポリマーは、自動車、航空宇宙、海洋、建設資材、包装、繊維、家庭用品、医療、製薬機器など、さまざまな業界でさまざまな方法で広く使用されています。

中東ポリマー市場レポートでは、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020~2016年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

副産物(ポリエチレン(PE)、ポリプロピレン(PP)、アクリロニトリルブタジエンスチレン、ポリアミド(PA)、その他)、 |

|

対象国 |

国(UAE、サウジアラビア、イスラエル、オマーン、カタール、クウェート、バーレーン、その他の中東諸国)。 |

|

対象となる市場プレーヤー |

SABIC、Lyondellbasell Industries Holdings BV、BASF SE、住友化学株式会社、Saudi Polymer LLC、Qatar Petrochemical Company (QAPCO)QPJSC、Venus Petrochemicals (Bombay) Pvt. Ltd、Middle East Polymers & Chemicals LLC、Petro Rabigh、Exxon Mobil Corporation、Borouge、Reliance Industries Limited。 |

市場の定義

The polymer has many useful properties which make it suitable for various end-use industry applications. It has low strength and hardness but is very ductile and has good impact strength; it will stretch rather than break. Polymer-based products have a good electric insulator, offering electric treeing resistance but can become electrostatically charged. Hence, owing to these properties, the demand for polymers is gaining momentum in various industries such as automotive, electrical and electronics, food and beverage, and consumer goods. In the automotive industry, manufacturers are focusing on increasing the efficiency of vehicles by reducing their weight of the vehicles. The polymer material is preferred as it is lightweight and offers easy processability, sealing and stiffness properties. In the food and beverage industry, the consumption of polymers is growing at a rapid pace due to the rising demand for the production of packaging materials for food and beverage. Manufacturers prefer effective packaging to reduce the possibility of food contamination and loss of quality. The use of polymers in fashion, sports, and toys is growing due to their ability to resist physical stresses and durability, provide flexibility in packaging, and allow easy molding of products. In the agriculture industry, the application of polymers is growing owing to increasing demand for drippers, micro tubes, nozzles, and emitting pipes at irrigation fields.

Middle East Polymer Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing expansion in the automotive industry

この現代社会では、自動車や乗り物は、人々がある場所から別の場所へ移動するための主要な商品となっています。自動車は、場所間での商品やサービスの転送など、さまざまな目的の輸送にも使用されています。本質的に、車両は、エンジン、シャーシ、ボディパーツ、タイヤ、駆動トランスミッションとステアリングパーツ、サスペンション、ブレーキ、電気機器で構成されており、これらが機能のために組み合わされています。これとは別に、車のタイプとカテゴリに応じて、外観、機能、快適性を向上させるために、いくつかの追加の高級機器が追加されています。自動車業界の新しい開発では、新しいデザイン機能と快適さに対する顧客からの需要が高まり、さまざまな政府によって課せられたさまざまな規制と安全対策により、余分な機器が追加され、車両の総重量が増加しています。政府機関による環境規制と燃費は、車両設計の主要な重要な要素です。車両の余分な重量と燃費を補うには、軽量構造のデザインと製品を開発することが重要です。これは、ポリプロピレン、ポリウレタン、ポリアミド、PVC、アクリロニトリルブタジエンスチレン、ポリカーボネート(PC)など、金属に比べて軽量なポリマーベースの製品を使用することで実現できます。信頼性の高い機能、軽量、強靭性、耐摩耗性のため、高性能熱可塑性エラストマー(TPE)や液状ゴムなどのポリマーは、タイヤ、外装、内装、ボンネット、騒音、振動、ハーシュネス(NVH)、減衰、照明などの自動車部品の製造に使用され、安全性と快適性を提供すると同時に排出量を削減します。自動車産業の拡大により、中東のポリマー市場ではポリマーの需要が高まると予想されています。

- 航空宇宙および海洋産業の成長

航空宇宙産業は、長年にわたる成長を牽引してきたことから、中東で最も重要な産業の 1 つです。中東は、海外旅行者や貿易にとって人気の接続地であるとともに、ビジネス、観光、レジャーの乗客にとっての主要な目的地でもあります。航空機を製造する際には、優れた強度と軽量さの間の安全なバランスを見つけることが不可欠です。飛行中の飛行機に発生するさまざまな力に耐えるために、航空機の構造は軽量で頑丈で剛性が高くなければなりません。さらに、航空機の全寿命にわたってこれらのストレスに耐えるだけの強度が必要です。各航空機の設計では、積載量、価格、航続距離、速度、燃料効率、耐久性、騒音レベル、必要な滑走路の長さ、その他多数の基準がすべて慎重にバランスが取られています。ポリマーは航空宇宙産業において主要な構成要素です。ポリマーは軽量、耐腐食性、耐衝撃性、耐薬品性、耐久性、コスト効率に優れているため、航空宇宙部品、ナビゲーション機能、構造要素、内部部品の製造に広く使用されており、重量削減と燃料効率の向上に大きく貢献しています。軍用機の場合、軽量ポリマーはレーダー探知を回避するために飛行距離を延ばすのに役立ちます。

機会

- バイオベースポリマーの開発

プラスチックやその他のポリマー製品の廃棄は環境にとって大きな懸念事項です。ポリマーベースのプラスチックは大量に生産され、日常生活でより頻繁に使用されるため、環境に悪影響を及ぼします。これに対抗するために、非生分解性ポリマー材料の代わりとなる生分解性ポリマーが開発されています。生分解性ポリマーはバイオポリマーとも呼ばれ、環境に優しく、使用後に分解できる材料であり、食品廃棄物、動物の排泄物、農業廃棄物、およびデンプンやセルロースなどの他の資源など、さまざまな廃棄物またはバイオ資源から作られています。生分解性材料は、近年、包装、農業、医療、その他の分野での用途でますます人気が高まっています。生分解性ポリマー製品を使用すると、汚染が削減され、結果として減少するため、環境と経済に良い影響を与えると考えられています。持続可能で環境に優しいポリマーの開発は、中東のポリマー市場に機会を提供することが期待されています。

- インフラと製造業の拡大に向けた政府の投資と支援

中東政府は、国の経済発展に直接関係する新しいインフラプロジェクトへの投資に力を入れています。中東は世界における戦略的な位置にあり、貿易、商業、観光、そして急成長中の石油産業の中心地として浮上しています。材料科学と技術の発展に伴い、ポリマー材料は、防水性、耐摩耗性、耐腐食性、耐震性、軽量、優れた強度、遮音性、断熱性、優れた電気絶縁性、鮮やかな色など、その優れた特性により、建設業界でその可能性を発揮しています。給排水管、電線、ケーブルの断熱層、壁断熱材などのポリマー材料は、その優れた特性により、建設で広く使用されています。従来の改質剤によってビチューメンまたはタールに変換されます。ポリマーベースの建設材料は、建物のコーティング、建設材料の保護、美観の向上、耐火性、防水性、断熱性、自己修復性、殺菌性、防食コーティングなどの独自の機能の提供に広く使用されています。さらに、ポリマーバインダーを使用すると、セメントやモルタルの接着力が効果的に向上します。政府機関による新しいインフラプロジェクトへの資金提供と投資、および多くの今後のインフラの建設に関するさまざまなプロジェクトの開発への重点は、適切なアプローチで適切な注意を払えば、ポリマー製造業者と生産者にとって成長の機会となることが期待されます。

制約/課題

- ポリマーベースの製品に対する政府の厳しい規制

ポリマーは、モノマーと呼ばれる化学的に小さな単位の集合体で構成されており、そのほとんどは人間と環境の両方に脅威を与えると考えられています。ポリマー製品が持つ健康および環境リスクを克服し、それに対抗するために、いくつかの政府機関とNGO団体は、製品調達と製品輸送に対する厳しい規制、税金を実施しています。その結果、シナリオはますます遵守が困難になっています。環境、社会、ガバナンス(ESG)の問題は、ポリマー業界にとってますます重要になってきており、消費者は社会的および環境的スレッドがほとんどまたはまったくない製品をより重視するようになっています。さらに、環境影響に対する制限に加えて、国内および国際レベルの両方で政府による輸出入に関するいくつかの複雑な状況の強制が、中東地域のポリマー市場を抑制すると予想されます。

- ポリマーの環境への有害な影響

ポリマーは、さまざまな業界でその利点と人気があるにもかかわらず、耐腐食性が高く、性質上分解されないため、環境に非常に有害です。特に、一度使用された使い捨てプラスチックは、ほとんどが埋め立て地の廃棄物となり、徐々に川や海などの水域に流れ込み、水生生物と陸上生物の両方に害を及ぼします。たとえば、水のボトルやその他の同様の材料は、分解するのに最大450年かかる石油ベースのポリマーであるポリエチレンテレフタレート(PET)でできています。ポリマー化合物とポリマー完成品は量が多いためです。ポリマー廃棄物のリサイクルには、ポリマー化合物の分離、粉砕、不純物の分離など、多くのプロセスが含まれ、コストが高くなります。ポリマーの分解の難しさは、環境に悪影響を与えるため、製造業者にとって多くの困難と課題をもたらし、廃棄物への寄与はポリマー市場の成長に対する課題として機能します。

最近の動向

- 2014 年 12 月、トヨタ (GB) PLC の雑誌に、トヨタがナイロン 6 と呼ばれるナノ クレイ ポリアミドを開発したと掲載されています。これは、ナイロン ポリマー ベース材料の層の間に約 5 原子の厚さに剥離された合成クレイです。この技術は、タイヤの転がり抵抗を減らし、塗装、フロントガラス、ヘッドランプ用の超硬質保護コーティングを作成するために進歩しました。この材料は、バンパー、ボディ パネル、燃料タンクなど、より広範囲に使用されています。

- 2018 年 12 月、Bicerano & Associates Consulting, LLC のレポートでは、航空機の内装とタイヤの両方にポリマー マトリックス複合材が使用されていると述べられています。内装パネル、計器パネル、テーブル トップ、バー トップ、カウンタートップ、ドア、キャビネット、トリム、ケーシング、頭上収納棚など、航空機の内装部品の多くは、ポリマーとポリマー マトリックス複合材で作られています。

中東ポリマー市場の範囲

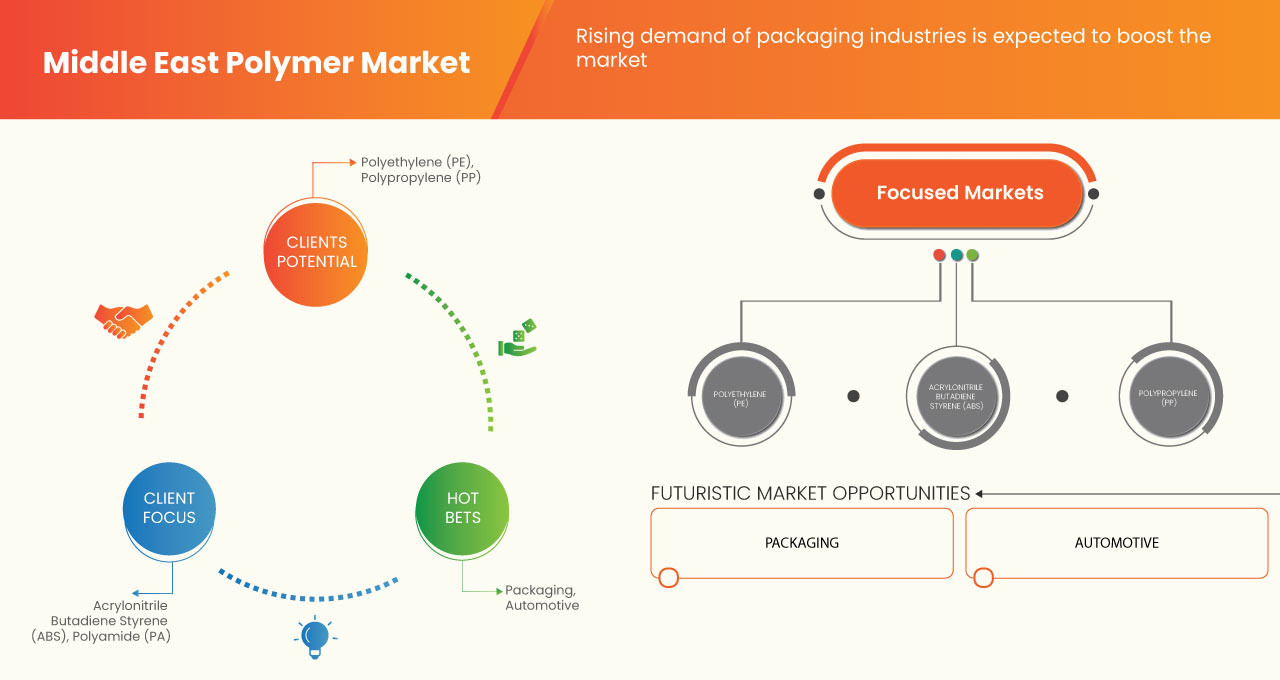

中東のポリマー市場は、製品に基づいて分類されています。セグメント間の成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品

- ポリエチレン(PE)

- ポリプロピレン(PP)

- アクリロニトリルブタジエンスチレン

- ポリアミド(PA)

製品に基づいて、中東のポリマー市場は、ポリエチレン (PE)、ポリプロピレン (PP)、アクリロニトリルブタジエンスチレン、およびポリアミド (PA) に分類されます。

中東ポリマー市場の地域分析/洞察

中東のポリマー市場は、製品と市場規模に基づいてセグメント化されており、上記の情報に基づいて洞察と傾向が提供されます。

中東ポリマー市場に含まれる国は、UAE、サウジアラビア、イスラエル、オマーン、カタール、クウェート、バーレーン、およびその他の中東諸国です。

この地域レポートでは、市場の現在および将来の傾向に影響を与える個々の市場影響要因と市場規制の変更について説明します。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、各国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、国際ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境 中東ポリマー市場シェア分析

中東ポリマー市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、製品のライフライン曲線が含まれます。提供されている上記のデータ ポイントは、中東ポリマー市場に関連する会社の焦点にのみ関連しています。

中東ポリマー市場で活動している主な企業としては、SABIC、Lyondellbasell Industries Holdings BV、BASF SE、住友化学株式会社、Saudi Polymer LLC、Qatar Petrochemical Company (QAPCO)QPJSC、Venus Petrochemicals (Bombay) Pvt. Ltd、Middle East Polymers & Chemicals LLC、Petro Rabigh、Exxon Mobil Corporation、Borouge、Reliance Industries Limitedなどが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST POLYMER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT EXPORT SCENARIO

4.5 PRICE ANALYSIS

4.6 PRODUCTION CAPACITY OVERVIEW

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY

6.1.2 GROWTH IN THE AEROSPACE AND MARINE INDUSTRY

6.1.3 DEMAND FOR POLYMERS IN THE FASHION AND TEXTILES INDUSTRY

6.1.4 RISING DEMAND PACKAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 STRICT GOVERNMENT REGULATIONS ON POLYMER BASED PRODUCT

6.2.2 VOLATILITY IN PRICE OF RAW MATERIAL

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT OF BIO-BASED POLYMERS

6.3.2 GOVERNMENT INVESTMENT AND SUPPORT FOR INCREASING INFRASTRUCTURE AND MANUFACTURING

6.4 CHALLENGES

6.4.1 HARMFUL IMPACT OF POLYMERS ON THE ENVIRONMENT

7 MIDDLE EAST POLYMER MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POLYETHYLENE (PE)

7.2.1 BY TYPE

7.2.1.1 HDPE (HIGH DENSITY POLYETHYLENE)

7.2.1.2 LDPE (LOW DENSITY POLYETHYLENE)

7.2.1.3 MDPE (MEDIUM DENSITY POLYETHYLENE)

7.2.2 BY TECHNOLOGY

7.2.2.1 BLOW MOLDING

7.2.2.2 PIPE EXTRUSION

7.2.2.3 FILMS & SHEET EXTRUSION

7.2.2.4 INJECTION MOLDING

7.2.2.5 OTHERS

7.2.3 BY END-USE

7.2.3.1 PACKAGING

7.2.3.2 AUTOMOTIVE

7.2.3.3 INFRASTRUCTURE & CONSTRUCTION

7.2.3.4 CONSUMER GOODS/LIFESTYLE

7.2.3.5 HEALTHCARE & PHARMACEUTICALS

7.2.3.6 ELECTRICAL & ELECTRONICS

7.2.3.7 AGRICULTURE

7.2.3.8 OTHERS

7.3 POLYPROPYLENE (PP)

7.3.1 BY TYPE

7.3.1.1 HOMOPOLYMER

7.3.1.2 COPOLYMER

7.3.1.2.1 BLOCK COPOLYMER

7.3.1.2.2 RANDOM COPOLYMER

7.3.2 BY PROCESS

7.3.2.1 INJECTION MOLDING

7.3.2.2 BLOW MOLDING

7.3.2.3 EXTRUSION

7.3.2.4 OTHERS

7.3.3 BY APPLICATION

7.3.3.1 FIBER

7.3.3.2 FILM AND SHEET

7.3.3.3 RAFFIA

7.3.3.4 FOAM

7.3.3.5 TAPE

7.3.3.6 OTHERS

7.3.4 BY END-USE

7.3.4.1 PACKAGING

7.3.4.2 BUILDING AND CONSTRUCTION

7.3.4.3 AUTOMOTIVE

7.3.4.4 FURNITURE

7.3.4.5 ELECTRICAL AND ELECTRONICS

7.3.4.6 MEDICAL

7.3.4.7 CONSUMER PRODUCTS

7.3.4.8 OTHERS

7.4 ACRYLONITRILE BUTADIENE STYRENE

7.4.1 BY SOURCE

7.4.1.1 ACRYLONITRILE MONOMERS

7.4.1.2 BUTADIENE MONOMERS

7.4.1.3 STYRENE MONOMERS

7.4.2 BY PROCESS

7.4.2.1 INJECTION MOLDING

7.4.2.2 EXTRUSION

7.4.3 BY ADDITIVES

7.4.3.1 GLASS

7.4.3.2 POLYVINYLCHLORIDE (PVC)

7.4.3.3 OTHERS

7.4.4 BY APPEARANCE

7.4.4.1 OPAQUE

7.4.4.2 TRANSPARENT

7.4.4.3 COLOURED

7.4.5 BY APPLICATION

7.4.5.1 CONSTRUCTION

7.4.5.2 AUTOMOTIVE

7.4.5.3 MARINE

7.4.5.4 FURNITURE

7.4.5.5 PLUMBING

7.4.5.6 OTHERS

7.5 POLYAMIDE (PA)

7.5.1 BY TYPE

7.5.1.1 PA 6

7.5.1.2 PA 66

7.5.1.3 BIO POLYAMIDES

7.5.1.4 SPECIALTY POLYAMIDES

7.5.1.5 OTHERS

7.5.2 BY CLASS

7.5.2.1 ALIPHATIC POLYAMIDES

7.5.2.2 SEMI-AROMATIC

7.5.2.3 AROMATIC POLYAMIDES

7.5.3 BY APPLICATION

7.5.3.1 FIBERS

7.5.3.2 WIRE AND CABLES

7.5.3.3 3D PRINTING

7.5.3.4 SPORTS EQUIPMENT

7.5.3.5 ENGINE COMPONENTS

7.5.3.6 BRAKES AND TRANSMISSION PARTS

7.5.3.7 HOUSEHOLD GOODS AND APPLIANCES

7.5.3.8 OTHERS

7.5.4 BY END-USE

7.5.4.1 AUTOMOTIVE

7.5.4.2 ELECTRICAL AND ELECTRONICS

7.5.4.3 TEXTILE

7.5.4.4 AEROSPACE AND DEFENCE

7.5.4.5 PACKAGING

7.5.4.6 CONSUMER GOODS

7.5.4.7 OTHERS

7.6 OTHERS

8 MIDDLE EAST POLYMER MARKET, BY COUNTRY

8.1 SAUDI ARABIA

8.2 U.A.E.

8.3 ISRAEL

8.4 QATAR

8.5 OMAN

8.6 KUWAIT

8.7 BAHRAIN

8.8 REST OF MIDDLE EAST

9 MIDDLE EAST POLYMER MARKET COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

9.2 PRODUCT LAUNCH

9.3 COLLABORATIONS

9.4 EXPANSIONS

9.5 ACHIEVEMENT

9.6 DEVELOPMENTS

9.7 PARTNERSHIP

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SABIC

11.1.1 COMPANY SNAPSHOT

11.1.2 PRODUCT PORTFOLIO

11.1.3 SWOT

11.1.4 REVENUE ANALYSIS

11.1.5 RECENT DEVELOPMENTS

11.2 LYONDELLBASELLINDUSTRIES HOLDINGS B.V

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 SWOT

11.2.4 REVENUE ANALYSIS

11.2.5 RECENT DEVELOPMENTS

11.3 BASF SE

11.3.1 COMPANY SNAPSHOT

11.3.2 PRODUCT PORTFOLIO

11.3.3 SWOT

11.3.4 REVENUE ANALYSIS

11.3.5 RECENT DEVELOPMENT

11.4 SUMITOMO CHEMICAL CO. LTD.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 SWOT

11.4.4 REVENUE ANALYSIS

11.4.5 RECENT DEVELOPMENTS

11.5 EXXON MOBIL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 SWOT

11.5.4 REVENUE ANALYSIS

11.5.5 RECENT DEVELOPMENTS

11.6 BOROUGE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 SWOT

11.6.4 RECENT DEVELOPMENTS

11.7 MIDDLE EAST POLYMERS & CHEMICALS.L.L.C

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 SWOT

11.7.4 RECENT DEVELOPMENT

11.8 PETRO RABIGH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 SWOT

11.8.4 REVENUE ANALYSIS

11.8.5 RECENT DEVELOPMENT

11.9 QATAR PETROCHEMICAL COMPANY(QAPCO)Q.P.J.S.C

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 SWOT

11.9.4 RECENT DEVELOPMENT

11.1 RELIANCE INDUSTRIES LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 SWOT

11.10.4 REVENUE ANALYSIS

11.10.5 RECENT DEVELOPMENT

11.11 SAUDI POLYMER LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 SWOT

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 VENUS PETROCHEMICALS (BOMBAY) PVT.LTD

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 SWOT

11.12.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS, IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 3 MIDDLE EAST POLYMER MARKET, AVERAGE SELLING PRICE, BY POLYMER, 2021-2030 (USD/KILO TONS)

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 7 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVES 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 26 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 28 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 47 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E. COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 53 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 55 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 57 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 58 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 59 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 62 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 64 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 66 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 81 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 83 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 84 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 85 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 87 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 88 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 QATAR COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 91 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 93 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 94 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 95 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 96 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 97 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 100 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 102 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 104 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 106 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 107 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 OMAN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 110 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 112 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 114 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 115 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 116 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 117 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 119 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 121 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 123 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 126 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 KUWAIT COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 129 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 130 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 131 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 132 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 133 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 134 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 135 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 136 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 138 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 140 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 141 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 142 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 144 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 145 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 BAHRAIN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 148 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 149 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 150 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 152 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 153 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 154 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

図表一覧

FIGURE 1 MIDDLE EAST POLYMER MARKET

FIGURE 2 MIDDLE EAST POLYMER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST POLYMER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST POLYMER MARKET: MIDDLE EAST MARKET ANALYSIS

FIGURE 5 MIDDLE EAST POLYMER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST POLYMER MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST POLYMER MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST POLYMER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST POLYMER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST POLYMER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST POLYMER MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST POLYMER MARKET: SEGMENTATION

FIGURE 13 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST POLYMER MARKET IN THE FORECAST PERIOD

FIGURE 14 THE POLYETHYLENE (PE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST POLYMER MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST POLYMER MARKET

FIGURE 17 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2022

FIGURE 18 MIDDLE EAST POLYMER MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST POLYMER MARKET: BY PRODUCT (2023-2030)

FIGURE 23 MIDDLE EAST POLYMER MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。