中東クラス B ベンチトップ歯科用オートクレーブ市場

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

2.18 Billion

2021

2029

USD

1.64 Billion

USD

2.18 Billion

2021

2029

| 2022 –2029 | |

| USD 1.64 Billion | |

| USD 2.18 Billion | |

|

|

|

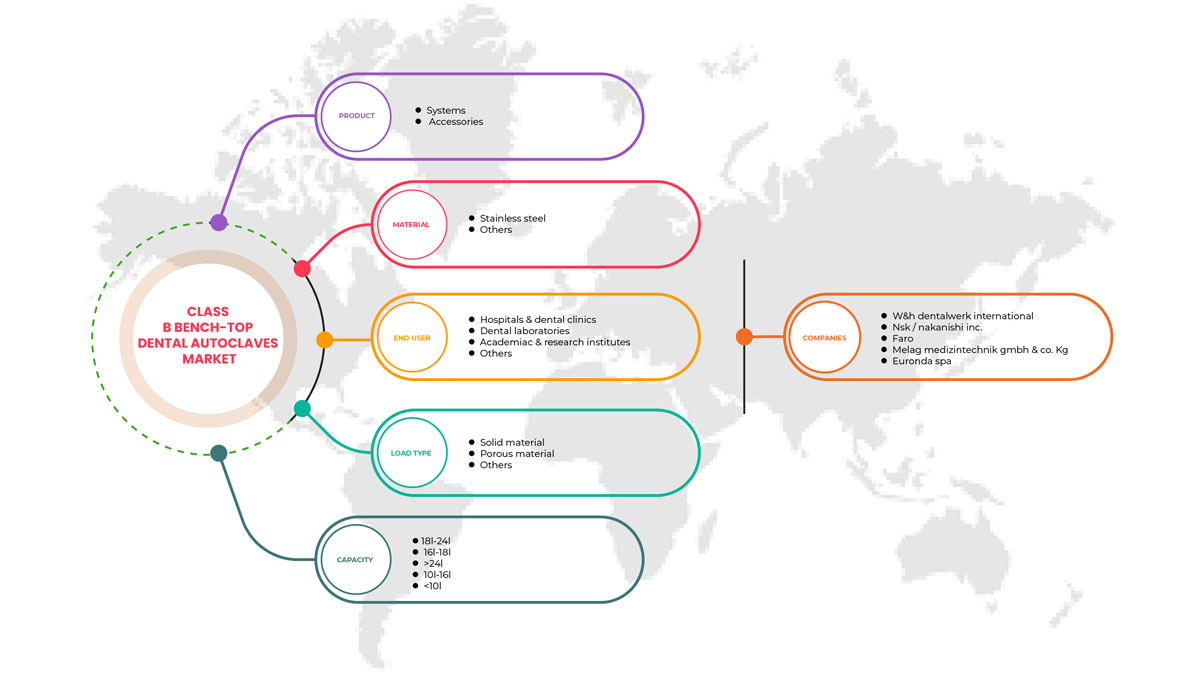

中東クラス B ベンチトップ歯科用オートクレーブ市場、製品別 (システム、アクセサリ)、材質別 (ステンレス鋼、銅)、負荷タイプ別 (多孔質材料、固体材料、その他)、容量別 (24L)、エンドユーザー別 (病院および歯科医院、歯科技工所、学術研究機関、その他) - 2029 年までの業界動向と予測。

中東クラス B ベンチトップ歯科用オートクレーブ市場の分析と洞察

市場の成長を牽引する要因としては、歯科疾患の罹患率の増加、歯科医師や歯科医院の増加、美容歯科処置の需要の増加、院内感染の蔓延などが挙げられます。しかし、厳しい規制や不適切な償還シナリオにより、市場の成長は抑制されると予想されます。

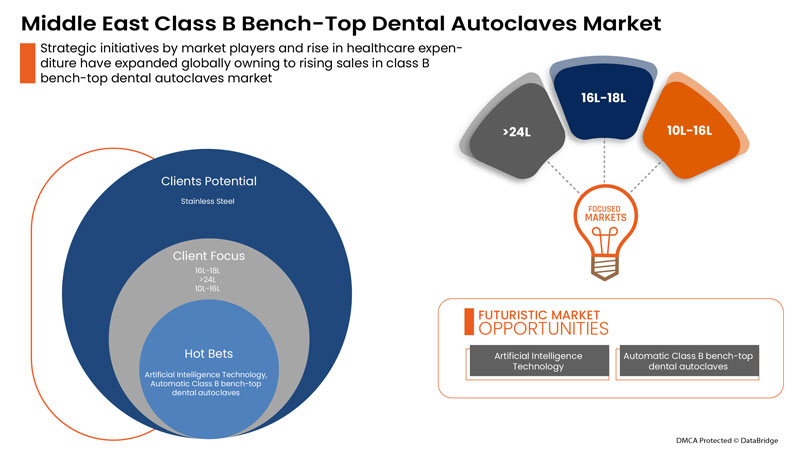

一方、市場プレーヤーによる戦略的取り組み、歯科衛生問題の蔓延率の上昇、あらゆる年齢層での意識の高まり、医療費の増加は、市場成長の機会となる可能性があります。ただし、熟練した専門知識の必要性、歯科技工所でのクラス B ベンチトップ歯科用オートクレーブの実装の課題、規制当局の承認は、市場に課題をもたらす可能性があります。

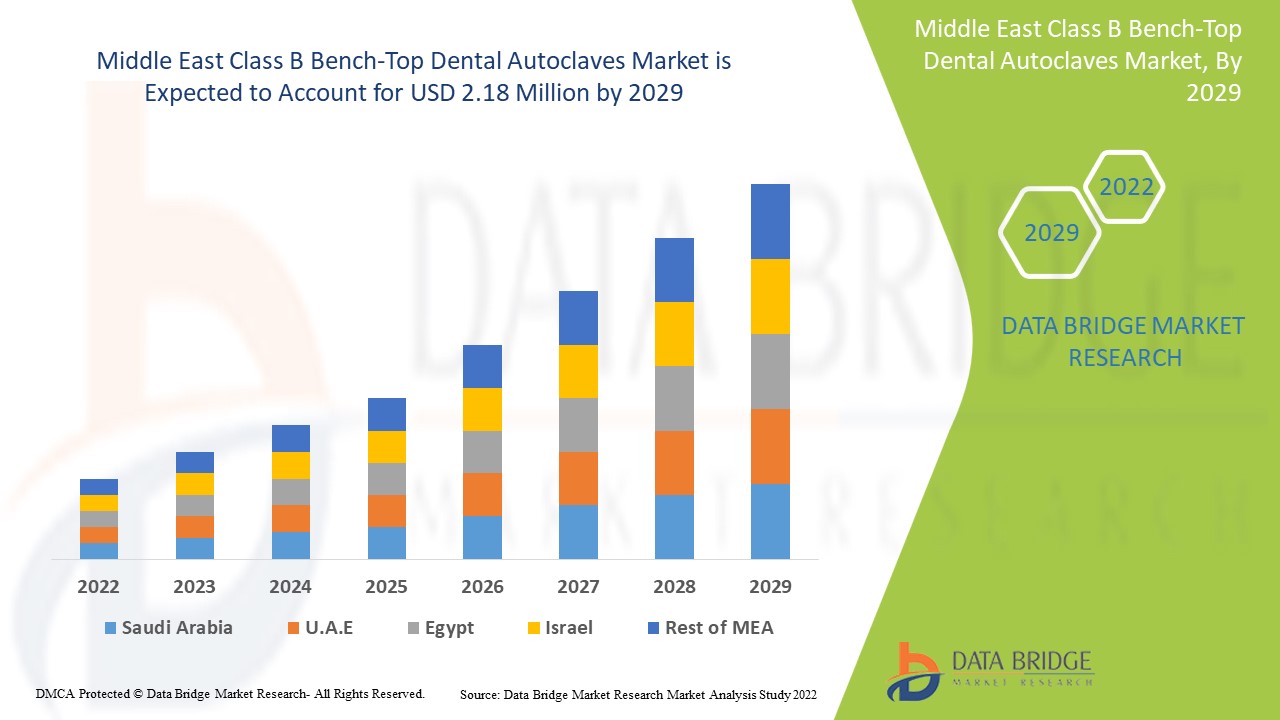

中東のクラスBベンチトップ歯科用オートクレーブ市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.6%のCAGRで成長し、2021年の164万米ドルから2029年には218万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数) |

|

対象セグメント |

製品 (システム、アクセサリ)、材質 (ステンレス鋼、銅)、負荷タイプ (多孔質材料、固体材料、その他)、容量 (<10L、10L-16L、16L-18L、18L-24L、>24L)、エンドユーザー (病院、歯科医院、歯科技工所、学術研究機関、その他) |

|

対象国 |

南アフリカ、サウジアラビア、UAE、エジプト、イスラエル、その他の中東諸国 |

|

対象となる市場プレーヤー |

Tecno-Gaz SpA、Celitron Medical Technologies Kft、MELAG Medizintechnik GmbH & Co. KG、LTE Scientific Ltd、2022、NSK / Nakanishi Inc.、NEWMEDなど |

市場の定義

クラス B のベンチトップ歯科用オートクレーブは、滅菌前の真空サイクルによって定義されます。クラス B は最高のオートクレーブ クラスと見なされ、固体、タイプ A の中空器具、タイプ B の中空器具、多孔質負荷、および包装された器具を含むすべての負荷の滅菌に使用できます。クラス B のベンチトップ オートクレーブは、EN 867-5:2001 で概説されている標準 EN 13060 に従って、Helix テストをクリアする必要があります。これは、滅菌前の分割真空を使用することによってのみ達成できます。滅菌後の真空乾燥により、滅菌プロセス全体の後にすべての負荷が完全に乾燥します。クラス B 滅菌器は、すべての歯科医院に必須のオートクレーブです。器具の非常に効果的で安全な滅菌を提供します。STERICOX クラス b オートクレーブは EN13060 標準を満たし、23 リットルの容量で提供され、経済的な価格で最も好まれるブランドです。クラス B 歯科用滅菌器は、医師、スタッフ、患者の安全を守るために、医療および歯科で広く使用されています。多孔質材料、繊維、袋入り製品、タービン、ワンド、チップなど、さまざまな種類の荷物をクラス B 歯科用オートクレーブで効果的に滅菌できます。

中東クラス B ベンチトップ歯科用オートクレーブ市場の動向

ドライバー

-

歯科疾患の増加

口腔衛生とは、話す、噛む、笑うなどを可能にする健康な歯茎、歯、口腔顔面系を指します。最も一般的な歯科疾患には、虫歯、歯周病、口腔がんなどがあります。世界保健機関の報告によると、世界で約23億人が永久歯の虫歯に悩まされており、そのうち約5億3000万人の子供が乳歯の虫歯に悩まされています。

虫歯は、細菌、宿主の感受性、時間、食物など、さまざまな要因が複雑に絡み合って発生します。口腔衛生の悪さなどの不衛生な習慣は虫歯の原因となり、永久歯の成長と成熟に影響を及ぼします。また、糖分の多い食品を大量に摂取すると、歯の空洞化を引き起こします。再利用可能な歯科器具は、体液によって汚染されているため、滅菌は必須のステップです。

歯科疾患の数が増えるにつれて、歯科機器を介した感染や交差汚染の可能性も高まります。したがって、歯科疾患の増加により、クラス B のベンチトップ歯科用オートクレーブの可用性と使用が市場拡大を促進すると予測されています。

したがって、虫歯、歯の腐食、口腔がんなどの歯科疾患の増加により、中東のクラス B ベンチトップ歯科用オートクレーブ市場の成長が促進されると予想されます。

-

美容歯科治療の需要増加

審美歯科は、見た目も感触も素晴らしいという完全な幸福感を生み出すことで、口腔の健康という概念を高めます。審美歯科は時とともに進歩しており、新しい歯科材料は優れた結果を生み出します。審美歯科の発展は、単に歯を矯正する以上の、顔のより大きく、より永続的な変化への扉を開きました。したがって、審美歯科処置の需要は、クラス B のベンチトップ オートクレーブの市場成長を促進しました。これは、クラス B のベンチトップ オートクレーブには、チャンバーからすべての空気を除去する強力な真空ポンプが備わっており、歯科処置に必要な器具のあらゆる部分を効果的に滅菌できるためです。そのスピードとユーザー フレンドリーなインターフェイスにより、医療従事者の間で需要が高まっています。

-

歯科医師と歯科医院の数の増加

世界中で歯科疾患の数が増加しているため、歯科専門家と歯科医院のニーズも増加しています。高度な器具の使用には訓練された歯科専門家が必要であるため、発展途上国と先進国の両方で歯科医師の数が急増しています。

したがって、歯科医の人口と歯科技工所の数の増加が、予測期間中の市場の成長を促進すると予想されます。

機会

-

あらゆる年齢層で歯の健康問題の増加と意識の高まり

歯の問題は見過ごされがちで、それが大きな歯の問題につながります。さまざまな年齢層で口腔または歯の感染症が増加しています。そのため、政府機関はさまざまな歯科保健関連のガイドラインを制定しています。さらに、政府機関と医療機関は、さまざまな健康決議やプログラムを通じて、感染症を制御するための意識を広めています。

歯科保健プログラムの拡大は、市場におけるより優れた高度な歯科製品の開発に大きな影響を与えます。そのため、あらゆる年齢層における歯科問題と意識の高まりは、中東のクラス B ベンチトップ歯科用オートクレーブ市場にとって大きなチャンスとなります。

-

主要プレーヤーの戦略的取り組み

研究の質が劇的に向上し、研究の機会が増えているのは、主要な市場プレーヤーがさまざまな戦略的イニシアチブをとっているためです。彼らは長年にわたり、製品の発売、コラボレーション、合併、買収など、さまざまなイニシアチブをとっています。したがって、彼らは市場でより多くの機会をリードし、創出することが期待されています。

ヘルスケア製品のサプライヤーには、業界の継続的な成長、創造性、および存続可能性を確保するために、新しいテクノロジー企業とうまく連携する大きなチャンスがあります。テクノロジー対応のテクノロジーを導入するヘルスケア企業は、患者ケアのための新しい商品の形態を模索し、プロセスを合理化し、患者の関与を高めることになります。

企業は、より信頼性の高い結果とサービスを提供するために、新たな取り組みを開始し、他の主要企業と協力しています。

中東のクラス B ベンチトップ歯科用オートクレーブ市場における大手企業による戦略的な製品発売、承認、買収、合併は、さまざまな地域の企業にチャンスをもたらしました。この戦略により、企業は市場での足跡を強化することができます。したがって、戦略的イニシアチブは、市場プレーヤーが収益成長を加速するための絶好の機会であると予測されます。

制約/課題

-

歯科衛生に関する意識の欠如

発展途上国における歯科衛生意識の欠如により、世界的な歯科用オートクレーブ市場の発展が妨げられると予想されています。

たとえば、口腔疾患は世界中で一般的であり、人々の健康と世界経済に悪影響を及ぼしています。

大多数の国では口腔疾患の罹患率が引き続き増加していますが、これは主に人々が口腔保健施設にアクセスしにくいことと、歯科衛生に関する知識が不足していること(その結果、人々は歯科衛生の重要性を認識していない)が原因です。

-

プロセスへの配慮が不十分

歯科医院やその他の外来診療施設で滅菌プロセスに十分な注意を払わないと、患者が汚染された器具、インプラント、その他の重要なアイテムにさらされる可能性があります。汚染されたアイテムを使用前に一貫して効果的に洗浄、消毒、滅菌しないと、患者が毒性の強い病原体にさらされる場合があります。患者は、特に滅菌組織や血管系に入ることを意図した汚染されたアイテムに接触する可能性があります。

これらは、予測期間中に市場の成長を抑制する要因の一部です。

最近の開発

- 2021年12月、LTE Scientific Ltd、2022、2022は製品ウェブサイトをアップグレードしました。新しい製品ウェブサイトのアップグレードと開発により、顧客の間で今後の歯科用滅菌器とローディングシステムについての認識が高まりました。また、市場プレーヤー間のパートナーシップと歯科ラボ間での歯科用滅菌器の配布にもつながりました。

中東クラスBベンチトップ歯科用オートクレーブ市場の範囲

中東のクラス B ベンチトップ歯科用オートクレーブ市場は、製品、材料、負荷タイプ、容量、およびエンドユーザーに分類されています。これらのセグメントの成長は、業界のわずかな成長セグメントを分析し、コア市場アプリケーションを特定するための戦略的な決定を下すための貴重な市場概要と市場洞察をユーザーに提供するのに役立ちます。

製品

- システム

- アクセサリー

製品に基づいて、中東のクラス B ベンチトップ歯科用オートクレーブ市場は、システムとアクセサリに分類されます。

材料

- ステンレス鋼

- 銅

材質に基づいて、中東のクラス B ベンチトップ歯科用オートクレーブ市場は、ステンレス鋼と銅に分類されます。

荷重タイプ

- 固体材料

- 多孔質材料

- その他

負荷タイプに基づいて、中東のクラス B ベンチトップ歯科用オートクレーブ市場は、固体材料、多孔質材料、その他に分類されます。

容量

- <10L

- 10L-16L

- 16L-18L

- 18L-24L

- >24L

容量に基づいて、中東のクラス B ベンチトップ歯科用オートクレーブ市場は、<10L、10L-16L、16L-18L、18L-24L、および>24L に分類されます。

エンドユーザー

- 病院と歯科医院

- 歯科技工所

- 学術研究機関

- その他

エンドユーザーに基づいて、中東のクラス B ベンチトップ歯科用オートクレーブ市場は、病院および歯科医院、歯科研究室、学術研究機関、その他に分類されます。

中東クラス B ベンチトップ歯科用オートクレーブ市場の地域分析/洞察

中東のクラス B ベンチトップ歯科用オートクレーブ市場が分析され、市場規模の洞察と傾向が国、製品、材料、負荷タイプ、容量、およびエンドユーザー別に提供されます。

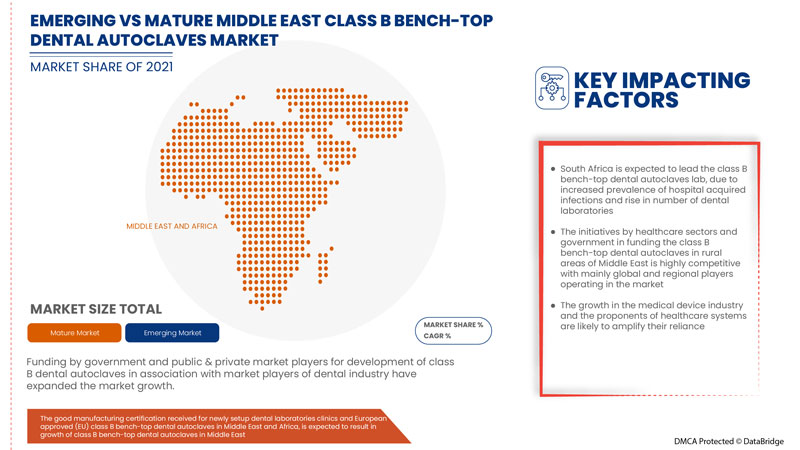

中東のクラス B ベンチトップ歯科用オートクレーブ市場は、南アフリカ、サウジアラビア、UAE、エジプト、イスラエル、その他の中東諸国に分かれています。

院内感染の増加と歯科技工所の増加により、南アフリカはクラス B の卓上歯科用オートクレーブラボをリードすると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、中東ブランドの存在と入手可能性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境と中東クラス B ベンチトップ歯科用オートクレーブ市場シェア分析

中東クラス B ベンチトップ歯科用オートクレーブ市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、生み出される収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、中東クラス B ベンチトップ歯科用オートクレーブ市場への企業の焦点にのみ関連しています。

中東のクラスbベンチトップ歯科用オートクレーブ市場で活動している主要企業には、Tecno-Gaz SpA、Celitron Medical Technologies Kft、MELAG Medizintechnik GmbH & Co. KG、LTE Scientific Ltd、2022、NSK / Nakanishi Inc.、NEWMEDなどがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、中東と地域およびベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 THE CATEGORY VS TIME GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF DENTAL DISORDERS

6.1.2 INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

6.1.3 INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

6.1.4 INCREASED PREVALENCE OF HOSPITAL-ACQUIRED INFECTION

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 INAPPROPRIATE REIMBURSEMENT SCENARIO

6.2.3 INSUFFICIENT ATTENTION TO PROCESS

6.3 OPPORTUNITIES

6.3.1 RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 HIGH COST OF BENCH-TOP DENTAL AUTOCLAVES

6.4.2 LACK OF AWARENESS ABOUT DENTAL HYGIENE

7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SYSTEMS

7.2.1 AUTOMATIC

7.2.2 SEMI-AUTOMATIC

7.2.3 MANUAL

7.3 ACCESSORIES

8 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STAINLESS STEEL

8.3 OTHERS

9 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE

9.1 OVERVIEW

9.2 SOLID MATERIAL

9.2.1 TYPE A SOLID LOADS WITH HOLLOW SECTIONS

9.2.2 TYPE B SOLID LOADS WITH HOLLOW SECTIONS

9.3 POROUS MATERIAL

9.4 OTHERS

10 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 18L-24L

10.3 16L-18L

10.4 >24L

10.5 >10L-16L

10.6 <10L

11 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 DENTAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 MIDDLE EAST CLASS B BENCH TOP DENTAL AUTOCLAVE MARKET BY COUNTRY

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 W&H DENTALWERK INTERNATIONAL

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 NSK/NAKANISHI INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MELAG MEDIZINTECHNIK GMBH & CO. KG

15.3.1 COMPANY SNAPSHOT

15.3.2 1.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FARO

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 EURONDA SPA

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 CELITRON MEDICAL TECHNOLOGIES KFT

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DENTSPLY SIRONA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 FLIGHT DENTAL SYSTEM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 FONA

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 LTE SCIENTIFIC LTD, 2022

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 LABOMIZ SCIENTIFIC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MEDICAL TRADING S.R.L.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MATACHANA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NEU-TEC GROUP INC.

15.15 COMPANY SNAPSHOT

15.15.1 PRODUCT PORTFOLIO

15.15.2 RECENT DEVELOPMENT

15.16 NEWMED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRIORCAVE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STURDY INDUSTRIAL CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TUTTNAUER

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TECNO-GAZ S.P.A.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 ZEALWAY INSTRUMENT INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, BY VOLUME 2020-2029 (UNITS)

TABLE 10 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AFRICA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 14 SOUTH AFRICA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 15 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 16 SOUTH AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 SAUDI ARABIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 20 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 21 SAUDI ARABIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 22 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 23 SAUDI ARABIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 U.A.E. SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.A.E. SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 U.A.E. CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 EGYPT SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EGYPT SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 36 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 37 EGYPT CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 ISRAEL SYSTEM IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 41 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 42 ISRAEL SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 43 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 REST OF MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DATA TRIANGULATION

FIGURE 4 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SNAPSHOT

FIGURE 5 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 6 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: INTERVIEWS: BY REGION AND DESIGNATION

FIGURE 8 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST, CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: THE CATEGORY VS TIME GRID

FIGURE 11 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET SEGMENTATION

FIGURE 12 GROWING APPLICATIONS OF CLASS B BENCH-TOP DENTAL AUTOCLAVES, RISE IN PREVALENCE OF DENTAL DISORDERS AND RISE IN DENTAL PRACTITIONERS, AND INCREASED SAFETY OF HYGIENE AND MAINTENANCE ARE EXPECTED TO DRIVE THE MARKET FOR MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN 2019 AND 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CLASS B BENCH-TOP DENTAL AUTOCLAVE MARKET

FIGURE 15 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2021

FIGURE 16 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 23 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2021

FIGURE 24 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2021

FIGURE 28 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 31 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2021

FIGURE 32 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST & AFRICA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT (2022-2029)

FIGURE 40 MIDDLE EAST CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。