中東およびアフリカのトラック用冷蔵ユニット市場 - タイプ別 (分割システムおよびルーフマウントシステム)、長さ ( 12 メートル)、用途別 (冷蔵および冷凍)、電源 (エンジン駆動および独立)、電力容量 (5 kW 未満、5 kW - 19 kW、19 kW 以上)、車両タイプ別 (小型商用車 (LCV)、中型および大型商用車、トレーラー (コンテナ)、バス、その他) - 2030 年までの業界動向および予測。

中東およびアフリカのトラック用冷蔵ユニット市場の分析と洞察

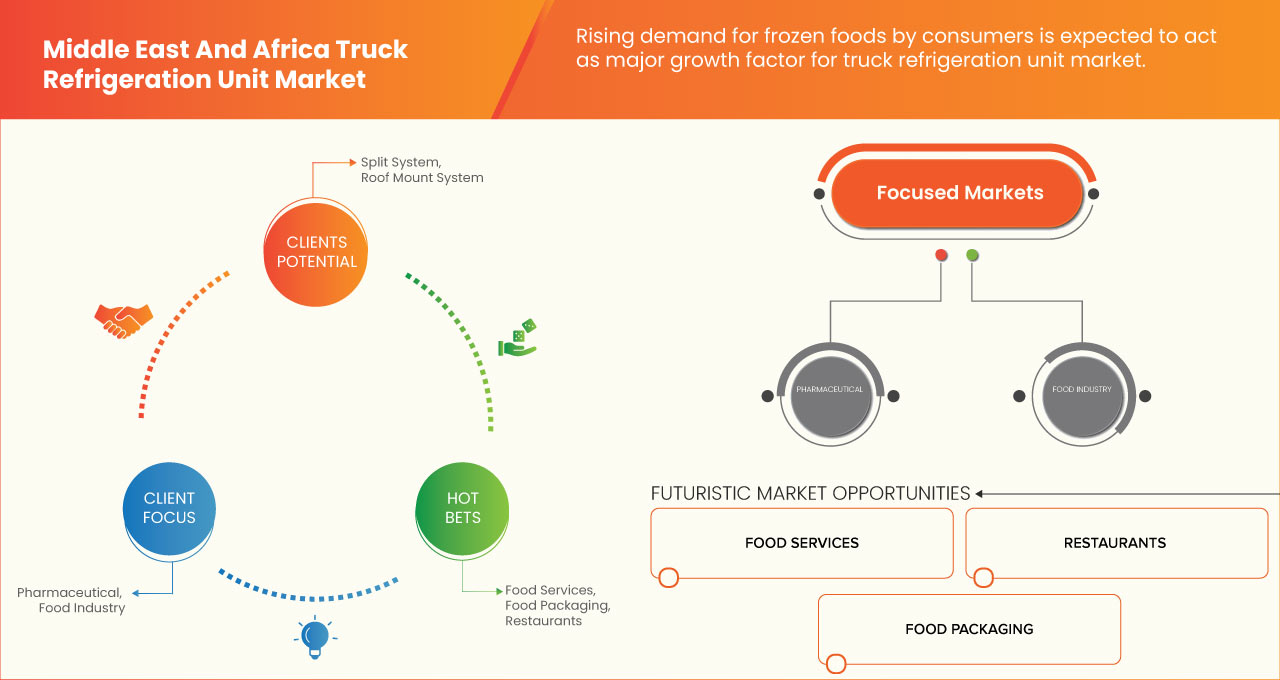

冷凍食品に対する消費者の嗜好の変化により、多くの業界でトラック用冷蔵ユニットの需要が高まっています。さらに、消費者による冷蔵果物や野菜の採用が増加し、世界中で医薬品、ワクチン、一般医薬品、サプリメントの輸送が増加しています。

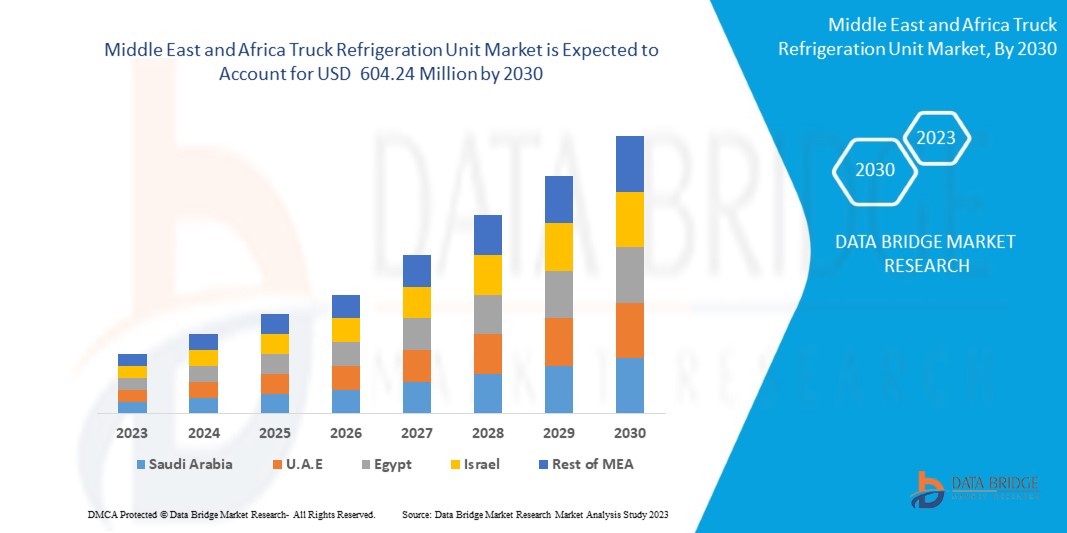

Data Bridge Market Research の分析によると、中東およびアフリカのトラック冷蔵ユニット市場は、2023 年から 2030 年の予測期間中に 3.4% の CAGR で成長し、2030 年までに 6 億 424 万米ドルに達すると予想されています。トラック冷蔵ユニット市場では、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

売上高は百万、販売数量は千個、価格は米ドル |

|

対象セグメント |

タイプ別 (スプリット システムとルーフ マウント システム)、長さ別 (< 8 メートル、8 ~ 12 メートル、> 12 メートル)、用途別 (冷蔵および冷凍)、電源別 (エンジン駆動および独立)、電力容量別 (5 Kw 未満、5 Kw ~ 19 Kw、19 Kw 以上)、車両タイプ別 (小型商用車 (LCV)、中型および大型商用車、トレーラー (コンテナ)、バス、その他) |

|

対象国 |

南アフリカ、エジプト、バーレーン、カタール、クウェート、オマーン、サウジアラビア、UAE、イスラエル、その他の中東およびアフリカ諸国 |

|

対象となる市場プレーヤー |

三菱重工サーマルシステムズ株式会社、ダイキン工業株式会社、キャリア株式会社、サンデン株式会社、モバイルクライメートコントロール株式会社、TRANE TECHNOLOGIES PLC、Klinge Corporation、KRONE、SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD、Schmitz Cargobull 他 |

市場の定義

トラック冷蔵システムは、冷凍食品、野菜、果物、アイスクリーム、ワインなどの生鮮品を販売時点まで適切な温度に保つために、機械式冷蔵システムを備えた冷蔵/リーファー トラックとして使用されます。冷蔵庫は、温度に敏感な商品を輸送するための冷蔵ユニットを備えたトラック、トレーラー、または貨物コンテナです。貨物を「冷蔵」または「生鮮」温度範囲または冷凍温度範囲でサポートするための一般的な代替手段は、LTL (トラック積載量未満) 輸送で利用できます。生鮮食品やその他の生鮮品などの積荷には、通常「冷蔵」温度範囲が使用されます。冷蔵庫は、冷蔵を必要としないドライ貨物をトレーラーで運ぶことがあります。商品を輸送する際には、いくつかの詳細に注意することが重要です。生鮮品や温度に敏感な商品を長距離輸送するには、リーファー トラックを使用する必要があります。最も一般的な例は、冷凍肉や生鮮食品です。

中東およびアフリカのトラック用冷蔵ユニット市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

-

食品や医薬品などの生鮮品の輸送の増加

冷凍食品は、長距離輸送でも品質を維持するために冷蔵輸送が必要です。輸送中の食品は、劣化して本来の価値を失わないように冷蔵する必要があります。農場から工場、そして食卓まで、食品はサプライチェーンの途中でさまざまな健康被害に遭遇する可能性があります。そのため、食品生産ライフサイクルのあらゆる段階で、これらのリスクを抑えて消費者への危害を防ぐために、安全な食品取り扱いの実践と手順が実施されています。

-

消費者の冷凍食品需要の高まり

家庭でも外出先でも使いやすさを高めるパッケージでは、便利な機能が重視されています。開けやすさ、携帯性、片手での使用などの便利な機能は、メイン料理、スナック、さらには食品サービス製品を含む幅広い加工食品の冷凍食品パッケージの革新を推進し続けています。加工食品には扱いやすく柔軟な包装材料が必要なため、便利で使いやすいものになっています。したがって、消費者による冷凍食品の需要の高まりが、市場の需要を牽引すると予想されます。

-

KFCやサブウェイなどのスーパーマーケットやレストランの成長が増加

レストランやスーパーマーケットの成長により、冷凍食品の普及が進んでいます。コロナ禍以降、ライフスタイルの変化や時間短縮により、冷凍食品の利用は飛躍的に増加しています。食品宅配サービスは非常に重要になりましたが、独自の課題ももたらしました。食品の取り扱いプロセス、配達方法、非接触型決済の需要に対する信頼が、レストランの宅配サービスを利用する人々にとって最重要課題となりました。米国で90万人以上が亡くなったことを思い出すと、食品サービス従事者、現場作業員、その他現場に関係する従業員にとって、この状況は長期的な検討課題となります。

機会

-

インドや中国などの国による食品サービス分野への投資の増加

開発途上国にとっての農業関連産業の重要性は、2 つの異なる傾向に照らして評価されます。第 1 に、冷凍加工食品が現在、中東およびアフリカの食品貿易の主流を占めており、これは開発途上国からの輸出と輸入の両方に当てはまります。第 2 に、開発途上国からの食品輸出の構成は大きく変化しており、「非伝統的な輸出」が主導しています。これらの輸出は開発戦略に新たな機会をもたらしますが、後発開発途上国は食品の純輸出国から主に加工製品の純輸入国へと移行しています。

-

衛生的な食品と食品包装に対する大きな需要

食品の安全性は、食品媒介疾患や食中毒から消費者の健康を守るため、消費者にとっても食品加工業者にとっても最も重要なことです。食品を衛生的に生産するには、食品媒介疾患による消費者の病気のリスクを最小限に抑える方法で食品や飲料を取り扱い、準備し、保管する必要があります。食品安全ガイドラインは、食品が汚染され、食中毒を引き起こすのを防ぐことを目的としています。

拘束

-

エネルギー効率の高いACシステムに関連する高コスト

食品輸送車両の空調システムのコストには、原材料の支出と完成品の輸送に必要なコストの両方が含まれます。製造会社は、競争の激しい業界で事業を展開しています。競争するために、これらの企業はコストを削減し、顧客に低価格を提供できる方法を模索しています。生産プロセスでは、原材料の供給と需要が会社のコストを決定する上で非常に重要な役割を果たします。

-

冷凍野菜や果物の摂取に関する健康上の懸念の高まり

高度に加工された食品には、不健康なレベルの砂糖、ナトリウム、脂肪が添加されていることがよくあります。これらの成分は食品の味を良くしますが、摂りすぎると肥満、心臓病、高血圧、糖尿病などの深刻な健康問題につながります。

課題

- 冷凍食品の有害影響に関する認識の欠如

Food hygiene is the condition and measures which are necessary to ensure the safety of food from production to consumption of the food. Lack of food hygiene can lead to food-borne illnesses and even the death of the consumer. Millions of people in the world are suffering from the transmission of diseases by consuming unhygienic food every year.

- Lack of infrastructure

Many frozen food safety testing labs are lacking behind in the infrastructure. It is very difficult to control the presence of highly toxic pesticide residues, antibiotics or heavy metals, and dangerous microorganisms in raw food materials. During processing, the implementation of microbiological controls, such as in a HACCP or GMP program, is basically beyond question because of inadequate plant conditions and infrastructure, staff training, safe water, modern technologies for packaging operations, quality assurance, and standard sanitizing procedures. This is expected to restrain the market's growth.

Recent Development

- In September 2019, MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD was awarded the contract to supply high-tech traction equipment for Construcciones y Auxiliar de Ferrocarriles, S.A. (CAF) company. The company delivered traction equipment for the 88 trains used in the Dutch rail network. This company enhanced its brand value in the market and the customer base

Middle East and Africa Truck Refrigeration Unit Market Scope

The Middle East and Africa truck refrigeration unit market is segmented on the basis of type, length, application, power source, power capacity, and vehicle type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Split System

- Roof Mount System

On the basis of type, the Middle East and Africa truck refrigeration unit market is segmented into split system and roof mount system.

Length

- < 8-Meter

- 8-12-Meter

- >12-Meter

On the basis of length, the Middle East and Africa truck refrigeration unit market is segmented into < 8-meter, 8-12-meter, and >12-meter.

Application

- Chilled

- Frozen

On the basis of application, the Middle East and Africa truck refrigeration unit market is segmented into chilled and frozen.

Power Source

- Engine Powered

- Independent

On the basis of power source, the Middle East and Africa truck refrigeration unit market is segmented into engine powered and independent.

Power Capacity

- Below 5 Kw

- 5 Kw - 19 Kw

- Above 19 Kw

On the basis of power capacity, the Middle East and Africa truck refrigeration unit market is segmented into below 5 kW, 5 kW - 19 kW, and above 19 kW.

Vehicle Type

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles

- Trailer (Container)

- Bus

- Others

所有権に基づいて、中東およびアフリカのトラック冷蔵ユニット市場は、軽商用車(LCV)、中型および大型商用車、トレーラー(コンテナ)、バス、その他に分類されます。

中東およびアフリカのトラック用冷蔵ユニット市場の地域分析/洞察

中東およびアフリカのトラック冷蔵ユニット市場が分析され、タイプ、長さ、用途、電源、電力容量、車両タイプ別に市場規模の洞察と傾向が提供されます。

中東およびアフリカのトラック用冷蔵ユニット市場レポートで取り上げられている国は、南アフリカ、エジプト、バーレーン、カタール、クウェート、オマーン、サウジアラビア、UAE、イスラエル、その他の中東およびアフリカ諸国です。

UAE は、この地域での食品配達事業の増加により、中東およびアフリカのトラック用冷蔵ユニット市場を支配すると予想されています。

レポートの地域セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個々の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、疾病疫学、輸出入関税などのデータポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。また、中東およびアフリカのブランドの存在と入手可能性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国データの予測分析を提供します。

競争環境と中東およびアフリカのトラック用冷蔵ユニット市場シェア分析

中東およびアフリカのトラック用冷蔵ユニット市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、ソリューションの導入、製品の幅広さと幅広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、中東およびアフリカのトラック用冷蔵ユニット市場に関連する会社の焦点にのみ関連しています。

中東およびアフリカのトラック用冷蔵ユニット市場で事業を展開している主要企業としては、三菱重工サーマルシステムズ株式会社、ダイキン工業株式会社、キャリア、サンデン株式会社、モバイル・クライメート・コントロール、TRANE TECHNOLOGIES PLC、クリンゲ・コーポレーション、クローネ、SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD、シュミッツ・カーゴブルなどがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION GRID

2.11 THE MARKET CHALLENGE MATRIX BY TYPE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 NATURAL REFRIGERANTS

4.2.2 ELECTRIC VEHICLES

4.2.3 TRAILER-TOP SOLAR

4.2.4 LIQUID NITROGEN

4.2.5 SMARTER REEFERS

4.2.6 ADVANCED THERMAL MATERIALS

4.3 VALUE CHAIN ANALYSIS

4.4 NUMBER OF UNITS IN THE MARKET

4.5 NUMBER OF UNITS BY TRUCK TYPE

4.6 NUMBER OF UNITS BY PLAYERS

4.7 NUMBER OF UNITS BY REGION

4.8 PRODUCT FLOW FROM UNIT SALE TO USER

4.9 BRAND ANALYSIS

4.1 ECOSYSTEM MARKET MAP

4.11 TOP WINNING STRATEGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TRANSPORTATION OF PERISHABLE GOODS SUCH AS FOOD ITEMS, PHARMACEUTICALS

5.1.2 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS

5.1.3 INCREASING GROWTH OF SUPERMARKETS AND RESTAURANTS SUCH AS KFC, SUBWAY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH ENERGY-EFFICIENT AC SYSTEM

5.2.2 GROWTH IN HEALTH CONCERNS ABOUT THE CONSUMPTION OF FROZEN FRUIT AND VEGETABLES

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN THE FOOD SERVICE SECTORS BY COUNTRIES LIKE INDIA AND CHINA

5.3.2 HUGE DEMAND FOR HYGIENIC FOOD PRODUCTS AND FOOD PACKAGING

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING THE HAZARDOUS EFFECTS OF FROZEN FOOD

5.4.2 LACK OF INFRASTRUCTURE

6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE

6.1 OVERVIEW

6.2 SPLIT SYSTEM

6.3 ROOF MOUNT SYSTEM

7 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH

7.1 OVERVIEW

7.2 < 8-METER

7.3 8-12-METER

7.4 >12-METER

8 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CHILLED

8.3 FROZEN

9 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ENGINE POWERED

9.3 INDEPENDENT

10 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY

10.1 OVERVIEW

10.2 BELOW 5 KW

10.3 5 KW - 19 KW

10.4 ABOVE 19 KW

11 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 LIGHT COMMERCIAL VEHICLES (LCV)

11.2.1 BY TYPE

11.2.1.1 SPLIT SYSTEM

11.2.1.2 ROOF MOUNT SYSTEM

11.3 MEDIUM & HEAVY COMMERCIAL VEHICLES

11.3.1 BY TYPE

11.3.1.1 SPLIT SYSTEM

11.3.1.2 ROOF MOUNT SYSTEM

11.4 TRAILER (CONTAINER)

11.4.1 BY TYPE

11.4.1.1 SPLIT SYSTEM

11.4.1.2 ROOF MOUNT SYSTEM

11.5 BUS

11.5.1 BY TYPE

11.5.1.1 SPLIT SYSTEM

11.5.1.2 ROOF MOUNT SYSTEM

11.6 OTHERS

11.6.1 BY TYPE

11.6.1.1 SPLIT SYSTEM

11.6.1.2 ROOF MOUNT SYSTEM

12 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E

12.1.2 SAUDI ARABIA

12.1.3 ISRAEL

12.1.4 QATAR

12.1.5 KUWAIT

12.1.6 EGYPT

12.1.7 SOUTH AFRICA

12.1.8 BAHRAIN

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARRIER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DENSO CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DAIKIN INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SCHMITZ CARGOBULL.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADVANCED TEMPERATURE CONTROL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KRONE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 GRAYSON

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLINGE CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KIDRON

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MOBILE CLIMATE CONTROL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SUBROS LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 TRANE TECHNOLOGIES PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 UTILITY TRAILER MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDEN CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WEBASTO SE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ZHENGZHOU GUCHEN INDUSTRY CO., LTD.,

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NUMBER OF UNITS IN THE MARKET (THOUSAND)

TABLE 2 ACCORDING TO THE MARKET ESTIMATION DONE BY DBMR, THE NUMBER OF UNITS BY TRUCK TYPE ACROSS THE GLOBE ARE AS FOLLOWS

TABLE 3 NUMBER OF UNITS BY THE PLAYER (USD MILLION)

TABLE 4 NUMBER OF UNITS BY REGION (THOUSAND UNITS)

TABLE 5 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST & AFRICA SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 9 MIDDLE EAST & AFRICA ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 11 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST & AFRICA < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 15 MIDDLE EAST & AFRICA 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 17 MIDDLE EAST & AFRICA >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 19 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST & AFRICA CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 23 MIDDLE EAST & AFRICA FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 25 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 27 MIDDLE EAST & AFRICA ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 29 MIDDLE EAST & AFRICA INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 31 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 33 MIDDLE EAST & AFRICA BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 35 MIDDLE EAST & AFRICA 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 37 MIDDLE EAST & AFRICA ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 43 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 45 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 47 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 49 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 51 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 53 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 55 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 61 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 63 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 65 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 67 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 69 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 71 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 73 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 75 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 77 MIDDLE EAST AND AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 79 MIDDLE EAST AND AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 81 MIDDLE EAST AND AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 85 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 87 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 88 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 89 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 91 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 92 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 93 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 94 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 95 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 96 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 97 U.A.E. LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.A.E. LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 99 U.A.E. MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 101 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 103 U.A.E. BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.A.E. BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 105 U.A.E. OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.A.E. OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 107 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 109 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 110 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 111 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 113 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 114 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 115 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 116 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 117 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 118 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 119 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 121 SAUDI ARABIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 SAUDI ARABIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 123 SAUDI ARABIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 SAUDI ARABIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 125 SAUDI ARABIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SAUDI ARABIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 127 SAUDI ARABIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SAUDI ARABIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 129 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 131 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 132 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 133 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 134 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 135 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 136 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 137 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 138 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 139 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 140 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 141 ISRAEL LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 ISRAEL LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 143 ISRAEL MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 ISRAEL MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 145 ISRAEL TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 ISRAEL TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 147 ISRAEL BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 ISRAEL BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 149 ISRAEL OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 ISRAEL OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 151 QATAR TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 QATAR TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 153 QATAR TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 154 QATAR TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 155 QATAR TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 156 QATAR TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 157 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 158 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 159 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 160 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 161 QATAR TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 162 QATAR TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 163 QATAR LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 QATAR LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 165 QATAR MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 QATAR MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 167 QATAR TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 QATAR TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 169 QATAR BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 QATAR BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 171 QATAR OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 QATAR OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 173 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 175 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 176 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 177 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 179 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 180 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 181 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 182 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 183 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 184 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 185 KUWAIT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 KUWAIT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 187 KUWAIT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 KUWAIT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 189 KUWAIT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 KUWAIT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 191 KUWAIT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 KUWAIT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 193 KUWAIT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 KUWAIT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 195 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 197 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 198 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 199 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 201 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 202 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 203 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 204 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 205 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 206 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 207 EGYPT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 EGYPT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 209 EGYPT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 210 EGYPT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 211 EGYPT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 EGYPT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 213 EGYPT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 EGYPT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 215 EGYPT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 EGYPT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 217 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 219 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 220 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 221 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 222 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 223 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 224 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 225 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 226 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 227 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 228 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 229 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 231 SOUTH AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 SOUTH AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 233 SOUTH AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 SOUTH AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 235 SOUTH AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 SOUTH AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 237 SOUTH AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 SOUTH AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 239 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 241 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 242 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 243 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 244 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 245 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 246 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 247 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 248 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 249 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 250 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 251 BAHRAIN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 BAHRAIN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 253 BAHRAIN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 BAHRAIN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 255 BAHRAIN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 BAHRAIN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 257 BAHRAIN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 BAHRAIN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 259 BAHRAIN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 BAHRAIN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 261 OMAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 262 OMAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 263 OMAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 264 OMAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 265 OMAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 266 OMAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 267 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 268 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 269 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 270 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 271 OMAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 272 OMAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 273 OMAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 OMAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 275 OMAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 OMAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 277 OMAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 OMAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 279 OMAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 OMAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 281 OMAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 282 OMAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 283 REST OF MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 284 REST OF MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS IS EXPECTED TO BE A KEY DRIVER FOR MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SPLIT SYSTEM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET

FIGURE 14 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: BY TYPE, 2022

FIGURE 15 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: BY LENGTH, 2022

FIGURE 16 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2022

FIGURE 17 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2022

FIGURE 18 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2022

FIGURE 19 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2022

FIGURE 20 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY TYPE (2023-2030)

FIGURE 25 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。