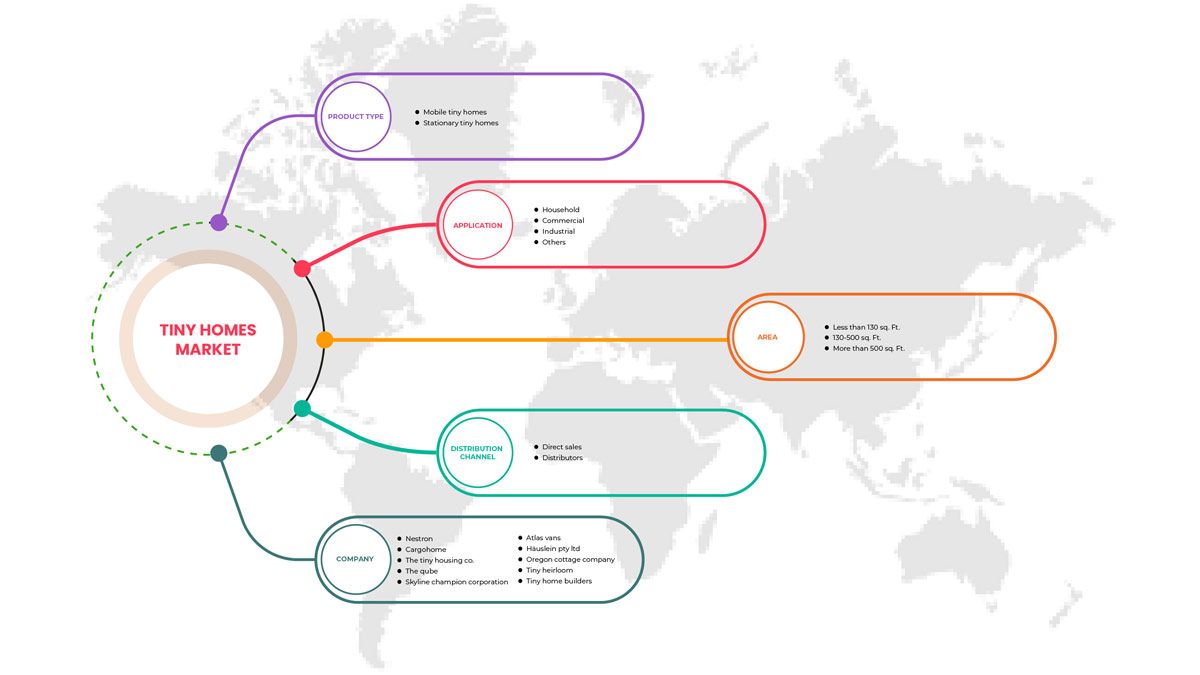

中東およびアフリカの小型住宅市場、製品タイプ別(移動式小型住宅および固定式小型住宅)、面積別(130平方フィート未満、130〜500平方フィート、500平方フィート以上)、用途別(家庭用、商業用、工業用、その他)、流通チャネル別(直接販売および販売代理店)業界動向および2029年までの予測。

中東およびアフリカの小型住宅市場の分析と規模

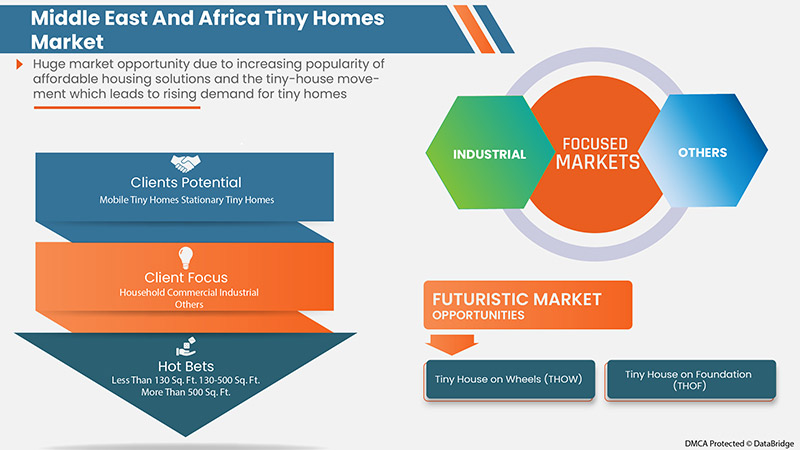

観光活動における小型住宅の利用増加は、中東およびアフリカの小型住宅市場にとって重要な推進力です。インフレの上昇による生活費の上昇、手頃な価格の住宅ソリューションと小型住宅運動の人気の高まりにより、中東およびアフリカの小型住宅市場の成長が促進されると予想されます。

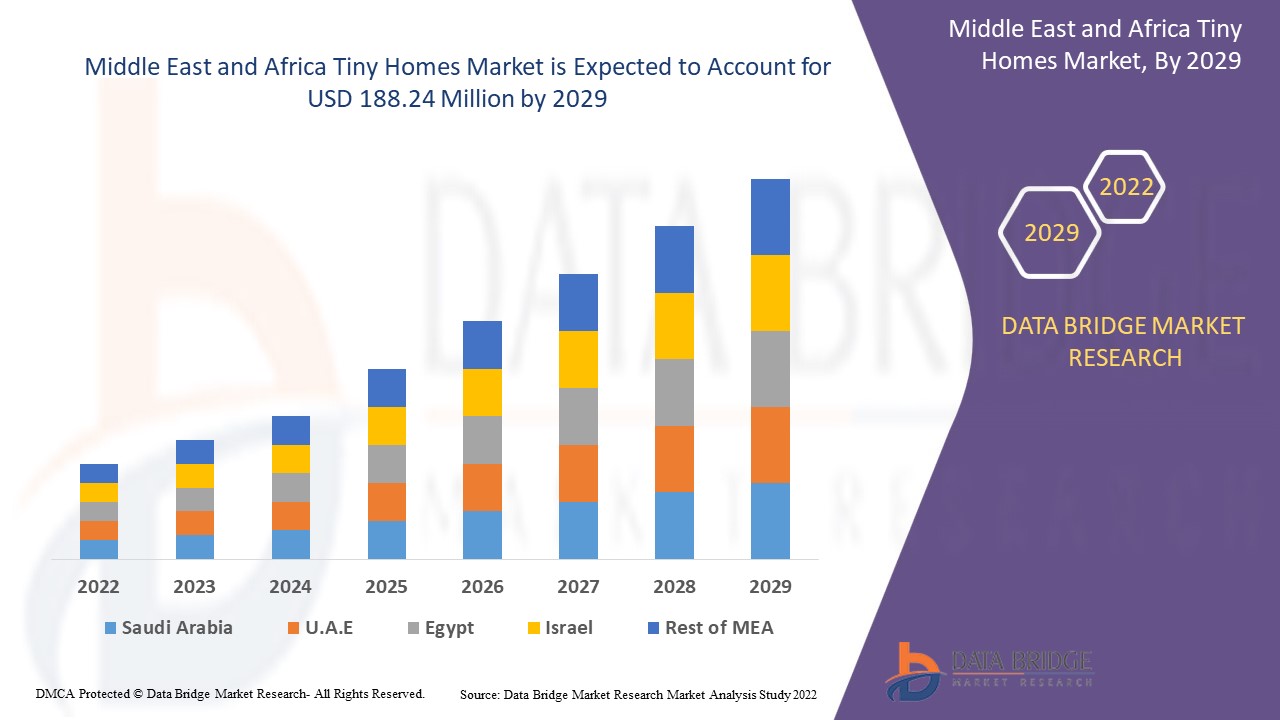

データブリッジ市場調査は、小型住宅市場は予測期間中に3.7%のCAGRで成長し、2029年までに1億8,824万米ドルの価値に達すると予測しています。小型住宅の増加により、「家庭」はそれぞれの市場で最も重要なアプリケーションセグメントを占めています。データブリッジ市場調査チームがまとめた市場レポートには、詳細な専門家分析、輸入/輸出分析、価格分析、生産消費分析、気候連鎖シナリオが含まれています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ (移動式小型住宅と固定式小型住宅)、面積 (130 平方フィート未満、130 ~ 500 平方フィート、500 平方フィート以上)、用途 (家庭用、商業用、工業用、その他)、流通チャネル (直接販売と販売代理店) 別。 |

|

対象国 |

南アフリカ、サウジアラビア、エジプト、イスラエル、アラブ首長国連邦、その他の中東およびアフリカ諸国。 |

市場の定義

小型住宅とは、一般的に、恒久的または移動可能な基礎の上に建てられた、面積が 400 平方フィート未満の単一の住居ユニットを指します。小型住宅は、消費者と地域社会に、購入価格の低減、建設資材の無駄の低減、二酸化炭素排出量の削減、エネルギー消費の大幅な削減など、いくつかの大きな利点をもたらします。

小さな家はここ数十年で進化を遂げ、さまざまなスタイルやデザインが登場し、退職者、初めてのマイホームを探しているカップル、ミニマリストの若者など、あらゆる階層の人々に人気があります。小さな家は、個人の夢、経済目標やライフスタイルの目標、コミュニティのニーズを満たすために使用できる、高品質で手頃な価格の環境に優しい住宅を幅広く提供しています。

中東およびアフリカの小型住宅市場の市場動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

推進要因/機会

- 観光活動における小さな家の利用の増加

世界の多くの地域では、小さな家は乗り物とみなされるため、許可は必要ありません。多くの家族が小さな家に投資し、それを人々に貸し出しています。サービスプロバイダーの中には、さまざまな建築様式や装飾様式の小さな家を貸し出すところもあります。これらのスタイルは、ホテル滞在のユニークな代替手段として、モダンまたはミニマリストから素朴または伝統的までを表現しています。小さな家には、キッチン、リビングスペース、バスルーム、寝室が備わっています。グローバル化、インターネットの普及、ソーシャルメディアの影響の拡大など、さまざまな要因が小さな家の需要を押し上げています。さらに、新しいライフスタイル、可処分所得の増加、消費者の環境意識の高まりにより、小さな家の需要が生まれています。これが今度は、中東およびアフリカの小さな家市場の成長の原動力となることが期待されています。

- インフレの上昇は生活費の上昇につながる

住宅ローンの金利により、消費者はより手頃な住宅オプションを求めるようになりました。また、消費者はメンテナンスの手間が少なく、エネルギー効率が高く、環境に優しい住宅にますます興味を持つようになっています。このような低コストで環境に優しい小さな家への関心と支出の高まりにより、今後数年間で小さな家の需要が増加すると予想されます。したがって、中東とアフリカの小さな家市場は、生活費の上昇と住宅ローンの高金利によって牽引されていると考えられます。

- 手頃な価格の住宅ソリューションと小さな家運動の人気の高まり

小型住宅は革新的で手頃な住宅ソリューションであるため、人気が高まっています。建築に必要なスペース、土地、コストが少なく、基本的なアメニティを維持できます。暖房、冷房、固定資産税、住宅のメンテナンスにかかる費用を節約できます。メンテナンス費用がかさむ大型住宅と比べ、小型住宅では電気、水道、エネルギーを大幅に節約できます。

タイニーハウス運動は、スモールハウス運動とも呼ばれ、居住空間を縮小し、簡素化し、本質的に「より少ないもので暮らす」ことを目指しています。INTERNATIONAL CODE COUNCIL, INC. によると、タイニーハウスとは「ロフトを除いて、床面積が最大 37 平方メートル (400 平方フィート) の住居ユニット」とされています。タイニーハウス運動を拡大するために、人々は多くの努力をしてきました。

- メンテナンスの負担が少なく、環境にも優しい

小さな家の温度を制御するために窓に透明な金属酸化物コーティングを使用するケースが増えており、従来の家に比べて必要な電子部品や備品の数が大幅に少なくなっています。面積とスペースが小さいため、従来の家に比べてメンテナンス費用が少なくなります。そのため、小さな家はメンテナンスの負担が少なく、環境に優しいため、中東およびアフリカの小さな家市場を牽引すると予想されています。

- 消費者の嗜好が環境に優しい住宅へと移行

More consumers are also being more proactive in their pursuit of adopting a more sustainable lifestyle, whether by selecting products with ethical or environmentally sustainable practices and values or by no longer purchasing certain products because they have concerns about sustainability practices or values. For most consumers, adopting a more sustainable lifestyle starts at home, recycling, composting or reducing food waste. People are also increasingly choosing the tiny home lifestyle by embracing the philosophy and freedom that comes with downsizing the living space by simplifying and living with less.

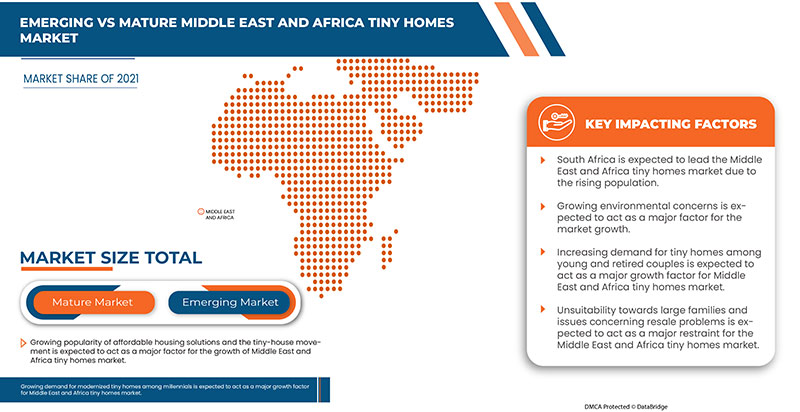

Furthermore, factors including rising living costs, increasing environmental consciousness, and rising government initiatives are creating demand in the Middle East and Africa tiny homes market. Furthermore, shifting consumer preference toward environmentally friendly homes may provide opportunities for the growth of the Middle East and Africa tiny homes market.

- Introduction of sustainable 3D printed tiny homes

The use of concrete 3D printing technology, which incorporates digital technology and the application of material technology, helps in creating various shapes and designs. It allows architects to build various shapes, such as curves, spheres, and others, in much less time and cost. 3D printing technology is an upcoming technology in the construction industry. However, there is a need to upgrade the conventional or standard methods for construction with the help of technological advancements. This, in turn, provides new opportunities for the growth of the Middle East and Africa tiny homes market.

Restraints/Challenges

- Low preference towards tiny homes over conventional homes

Tiny houses don't require much land to build compared to conventional homes. But many towns make it difficult to build one. Zoning laws often include a minimum size for dwellings. Such as, in North Carolina, the tiny home must be at least 150 square feet to get a building permit, and 100 square feet must be added for every additional occupant. These zoning regulations can prohibit people from buying land and building their own tiny houses on it. Sometimes to get a loan to build a tiny home is another challenge. Sometimes it is 'impossible to take standard mortgage loans as banks don't consider a tiny house to have enough value to make good collateral.

- Growing number of residential buildings

Consumers who move to their new spaces and renovate older ones stay in residential buildings. Changing lifestyle and increased disposable income motivates consumers to live in buildings and big spaces to maintain their standard and status. Due to this reason, people prefer to stay in residential buildings. Thus, a growing number of residential construction is expected to restrain the Middle East and Africa tiny homes market.

- Unsuitable for large families and issues concerning resale problems

Tiny homeowners often struggle to regulate the temperature in their homes. As a result, water builds up on the windows, walls, and furniture. There is a lack of proper ventilation and cooling systems in tiny homes. Many people who move into tiny homes with the dream of traveling later realize that it is difficult to move home from one place to another. In most cases, a bigger truck is required to be attached, drastically increasing the costs. Also, the belongings need to be tied down so that they do not fall and break while moving.

Moreover, more vulnerability to natural disasters along with limited awareness. Furthermore, the unsuitability of tiny homes for large families and issues concerning the resale of tiny homes may challenge the growth of the Middle East and Africa tiny homes market.

Post-COVID-19 Impact on Middle East and Africa Tiny Homes Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the market has experienced a downfall in sales due to the shutdown of retail outlets and the restrictions on customer access over the past few years.

However, the growth of the market post-pandemic period is attributed to more people working from home and increased disposable income. This has led to an increased demand for a sustainable, eco-friendly, and affordable housing solution. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve their offerings. They are enhancing its market share by exploring different retail channels and expanding into new regions.

This Middle East and Africa tiny homes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the tiny homes market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In October 2019, Häuslein Pty Ltd launched two new tiny house models - the Little Sojourner and the Grand Sojourner. The products are the smallest and the largest new addition to the family of high-end tiny houses, respectively. The newly launched products will help the company enhance its market presence with high-quality tiny houses.

Middle East and Africa Tiny Homes Market Scope

The Middle East and Africa tiny homes market is segmented on the basis of product type, area, application, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Mobile Tiny Homes

- Stationary Tiny Homes

Based on product type, the Middle East and Africa tiny homes market is segmented into mobile tiny homes and stationary tiny homes.

Area

- Less Than 130 Sq. Ft.

- 130-500 Sq. Ft.

- More Than 500 Sq. Ft.

Based on the area, the Middle East and Africa tiny homes market is segmented into less than 130 sq. ft., 130-500 sq. ft., and more than 500 sq. ft.

Application

- Household

- Commercial

- Industrial

- Others

Based on application, the Middle East and Africa tiny homes market is segmented into household, commercial, industrial, and others.

Distribution Channel

- Direct Sales

- Distributors

Based on distribution channel, the Middle East and Africa tiny homes market is segmented into direct sales and distributors.

Middle East and Africa Tiny Homes Market Regional Analysis/Insights

The Middle East and Africa tiny homes market is analyzed, and market size insights and trends are provided by country, product type, area, application, and distribution channel, as referenced above.

The countries covered in the Middle East and Africa tiny homes market report are South Africa, Saudi Arabia, Egypt, Israel, United Arab Emirates, and the rest of the Middle East and Africa.

In 2022, South Africa is expected to dominate the Middle East and Africa tiny homes market due to rising inflation leading to a rise in living costs.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Tiny Homes Market Share Analysis

中東およびアフリカの小型住宅市場の競争環境は、競合他社によって詳細が提供されています。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などが含まれます。提供されている上記のデータ ポイントは、中東およびアフリカの小型住宅市場に関連する会社の焦点にのみ関連しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TINY HOMES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 3D PRINTING IN TINY HOMES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 OVERVIEW

4.2.2 COMPLEX BUYING BEHAVIOR

4.2.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.2.4 HABITUAL BUYING BEHAVIOR

4.2.5 VARIETY SEEKING BEHAVIOR

4.2.6 CONCLUSION

4.3 LIST OF SUPPLIERS & DISTRIBUTORS

4.3.1 MIDDLE EAST AND AFRICA

4.4 CONSUMERS ANALYSIS

4.5 REGULATION COVERAGE

4.5.1 INTERNATIONAL RESIDENTIAL CODE (IRC)

4.5.1.1 GENERAL

4.5.1.2 DEFINITIONS

4.5.1.3 CEILING HEIGHT

4.5.1.4 LOFTS

4.5.1.5 EMERGENCY ESCAPE AND RESCUE OPENINGS

4.5.1.6 ENERGY CONSERVATION

4.5.2 NATIONAL FIRE PROTECTION ASSOCIATION (NFPA)

4.5.3 RV INDUSTRY ASSOCIATION

4.5.4 U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD)

4.5.5 NATIONAL ORGANIZATION OF ALTERNATIVE HOUSING (NOAH)

5 REGIONAL SUMMARY

5.1 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF TINY HOMES IN TOURISM ACTIVITIES

6.1.2 RISING INFLATION LEADS TO A RISE IN LIVING COSTS

6.1.3 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS AND THE TINY-HOUSE MOVEMENT

6.1.4 LESS BURDEN OF MAINTENANCE AS WELL AS ENVIRONMENT FRIENDLY

6.2 RESTRAINTS

6.2.1 LOW PREFERENCE TOWARDS THE TINY HOMES OVER CONVENTIONAL HOMES

6.2.2 LACK OF WELL-ESTABLISHED INFRASTRUCTURE AND LIMITED AWARENESS

6.2.3 GROWING NUMBER OF RESIDENTIAL BUILDINGS

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER PREFERENCE TOWARD THE ENVIRONMENTALLY FRIENDLY HOMES

6.3.2 HIGH INTEREST RATES ON HOME LOANS

6.3.3 INTRODUCTION OF SUSTAINABLE 3D PRINTED TINY HOMES

6.4 CHALLENGES

6.4.1 LIMITED DEMAND FROM DEVELOPING ECONOMIES

6.4.2 UNSUITABLE FOR LARGE FAMILIES AND ISSUES CONCERNING RESALE PROBLEMS

7 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 STATIONARY TINY HOMES

7.3 MOBILE TINY HOMES

8 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY AREA

8.1 OVERVIEW

8.2 130-500 SQ.FT

8.3 LESS THAN 130 SQ.FT

8.4 MORE THAN 500 SQ.FT

9 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HOUSEHOLD

9.3 COMMERCIAL

9.4 INDUSTRIAL

9.5 OTHERS

10 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 DISTRIBUTORS

11 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA TINY HOMES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 PRODUCT LAUNCHES

12.3 PARTNERSHIP

12.4 PARTICIPATION

12.5 AWARDS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NESTRON

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 CARGOHOME

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 THE TINY HOUSING CO.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 THE QUBE

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 SKYLINE CHAMPION CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATLAS VANS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 HÄUSLEIN PTY LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 OREGON COTTAGE COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 TINY HEIRLOOM

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 TINY HOME BUILDERS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 TINY SMART HOUSE, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 TUMBLEWEED TINY HOUSE COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NEW FRONTIER TINY HOMES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 TIMBERCARAFT TINY HOMES

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MUSTARD SEED TINY HOMES LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 AMERICAN TINY HOUSE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 B&B MICRO MANUFACTURING, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 CALIFORNIA TINY HOUSE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 MAVERICK TINY HOMES, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 TINY IDAHOMES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA STATIONARY TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA MOBILE TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA 130-500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LESS THAN 130 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MORE THAN 500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA HOUSEHOLD IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA COMMERCIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA INDUSTRIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA DIRECT SALES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DISTRIBUTORS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 21 SOUTH AFRICA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AFRICA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AFRICA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 SOUTH AFRICA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 SAUDI ARABIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 SAUDI ARABIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 27 SAUDI ARABIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 SAUDI ARABIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.A.E. TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.A.E. TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 31 U.A.E. TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 U.A.E. TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 33 ISRAEL TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 ISRAEL TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 35 ISRAEL TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 ISRAEL TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 EGYPT TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 EGYPT TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 39 EGYPT TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 EGYPT TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 REST OF MIDDLE EAST AND AFRICA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA TINY HOMES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TINY HOMES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TINY HOMES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TINY HOMES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TINY HOMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TINY HOMES MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA TINY HOMES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA TINY HOMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA TINY HOMES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA TINY HOMES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA TINY HOMES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA TINY HOMES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA TINY HOMES MARKET: SEGMENTATION

FIGURE 14 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA TINY HOMES MARKET IN THE FORECAST PERIOD

FIGURE 15 THE STATIONARY TINY HOMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TINY HOMES MARKET IN 2022 & 2029

FIGURE 16 MIDDLE EAST & AFRICA TINY HOMES MARKET: TYPES OF CONSUMER'S BUYING BEHAVIOUR

FIGURE 17 MIDDLE EAST & AFRICA TINY HOMES MARKET: SHARE OF CONSUMER TYPE

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA TINY HOMES MARKET

FIGURE 19 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY AREA, 2021

FIGURE 21 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 MIDDLE EAST AND AFRICA TINY HOMES MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST AND AFRICA TINY HOMES MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST AND AFRICA TINY HOMES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA TINY HOMES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA TINY HOMES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA TINY HOMES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。