中東およびアフリカの特産作物市場、作物タイプ別(果物、野菜、木の実、ハーブ、スパイスなど)、性質別(有機栽培および従来栽培)、用途別(乳製品、ベーカリー、ジュース、ネクター、フルーツベースのドリンク、菓子、スープ、ソース、ドレッシングなど)の業界動向と2029年までの予測。

中東およびアフリカの特産作物市場の分析と規模

果物や野菜、木の実、ドライフルーツ、園芸作物、苗木は、特産作物(花卉栽培を含む)の例です。地形や気候特性により、特定の地域で栽培される外来植物も含まれます。人口増加と一人当たり可処分所得の増加により、消費者の食習慣にパラダイムシフトが見られ、健康的な食品の需要に直接影響を及ぼしています。特産作物の市場を押し上げるその他の要因には、都市化の進行、民族の多様性、健康への懸念、人口動態の変化などがあります。特産作物産業の主な推進力には、特産作物の用途範囲の拡大、政府の取り組みの奨励、自由貿易政策などがあります。ただし、貿易と環境の制約により、拡大は制限されています。

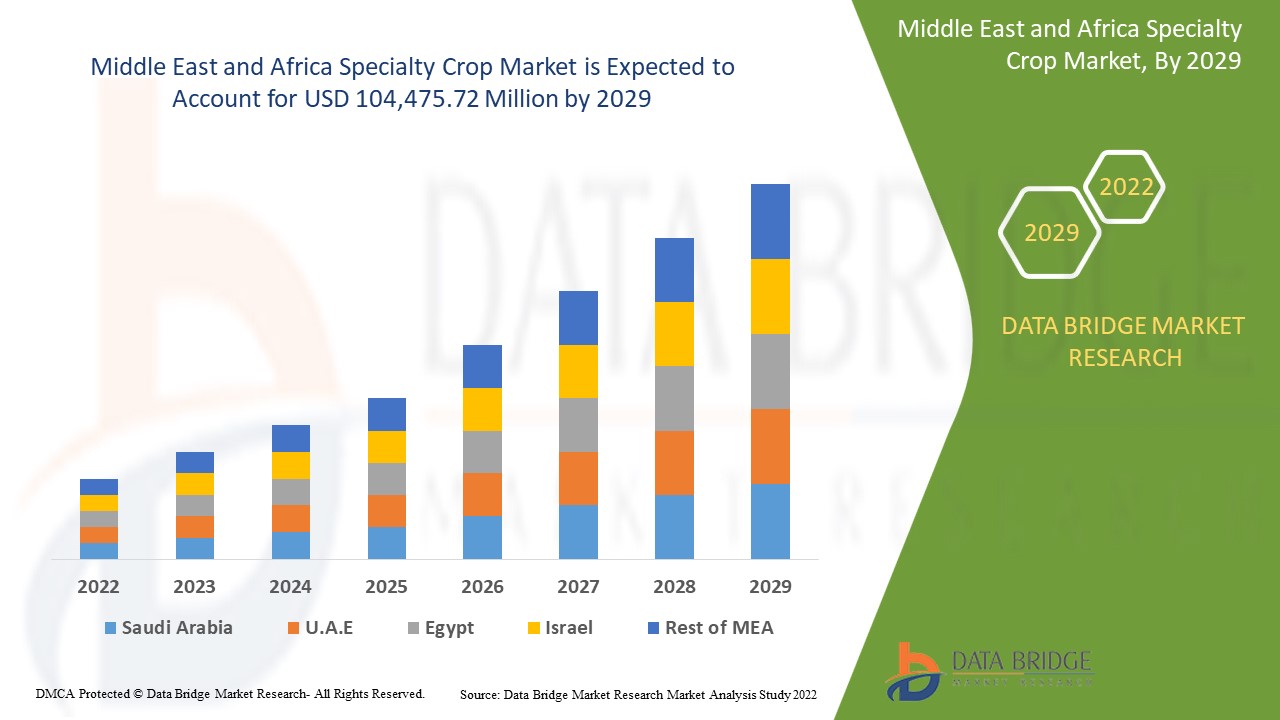

データブリッジマーケットリサーチは、中東およびアフリカの特産作物市場は予測期間中に4.8%のCAGRで成長し、2029年までに1044億7572万米ドルに達すると予測しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、販売数量は百万個、価格は米ドル |

|

対象セグメント |

作物の種類(果物、野菜、木の実、ハーブ、スパイスなど)、性質(有機栽培と従来栽培)、用途(乳製品、ベーカリー、ジュース、ネクター、フルーツベースのドリンク、菓子、スープ、ソース、ドレッシングなど)別 |

|

対象国 |

サウジアラビア、南アフリカ、エジプト、UAE、イスラエル、その他の中東およびアフリカ |

|

対象となる市場プレーヤー |

Olam Group、Lamex Food Group Limited、AGT Food and Ingredients、NUTSCO、Herbs N Spices International、Banabay、Fisher Nut Company、Simped Foods Pty Ltd.、SVZ Industrial Fruit & Vegetable Ingredients、Golden Peanut and Tree Nuts、Barnes Williams、Natural Specialty Crops、ULC |

市場の定義

果物や野菜、木の実、ドライフルーツ、園芸作物、苗木は、特産作物(花卉栽培を含む)の例です。地形や気候特性により、特定の地域で栽培される外来植物も含まれます。人口増加と一人当たり可処分所得の増加により、消費者の食習慣にパラダイムシフトが見られ、健康的な食品の需要に直接影響を及ぼしています。特産作物の市場を押し上げる他の要因としては、都市化の進行、民族の多様性、健康への懸念、人口統計学的特性の変化などがあります。

中東およびアフリカの特産作物市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー:

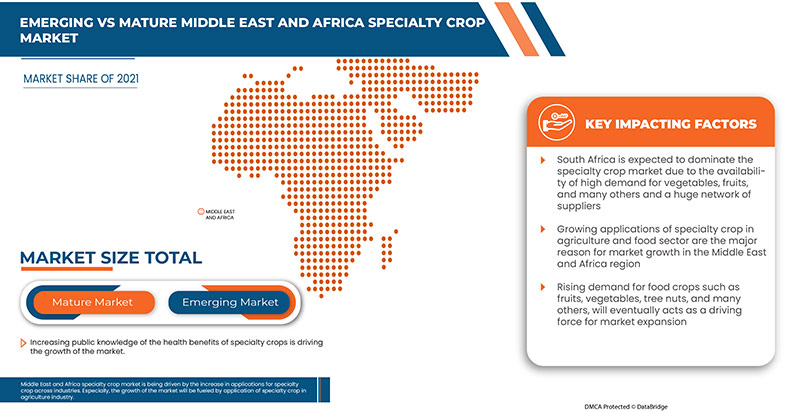

- 特産作物の健康効果に関する一般の知識の向上

果物や野菜、木の実、ドライフルーツ、園芸、花卉栽培を含む苗木はすべて、法律上、特産作物とみなされます。特産作物は、栄養価の高い食品の生産、美的価値や文化的価値の維持、地域経済の成長促進など、多くの利点において、州や地域の価値を大きく高めます。また、独特の農業景観にも貢献します。健康上の利点が数多くあるため、これらの特産作物は今日ますます重要になっています。COVID-19を受けて、人々はさまざまな食品、特に従来の作物よりも健康上の利点が高い特産作物の利点を理解したいという希望を表明しています。

したがって、特産作物の健康、美観、文化的な利点についての人々の意識の高まりは、経済成長に直接影響を及ぼし、市場の成長を促進すると予想されます。

拘束

- 特産作物の栽培施設が限られている

特産作物の生産者は、季節的な労働力に大きく依存しています。農業や畜産業の需要を満たす労働力が不足すると、国の食糧供給、特に新鮮な果物や野菜の供給が危ぶまれる可能性があります。輸送手段が不十分なため、農家は地元の金貸しに農産物を低価格で売らざるを得ません。倉庫が不足しているため、価格が安いときには農家は食料を保管できません。したがって、これらが特産作物の生産量が低い大きな原因です。生産から販売までの施設の不足は、市場の成長に対する大きな障害となります。

したがって、灌漑、種子、肥料、輸送などのさまざまな作物栽培施設やその他の機能の欠如は、市場の成長に対する制約として機能する可能性があります。

機会

- 農業技術の進歩

Innovative agricultural technological developments are reshaping farming practices and opening up new prospects. This has altered the way crops are raised and produced more effective ways to manage resources. Technology has an unquestionable impact on agriculture today. Researchers and engineers are always putting in a lot of effort to create new technologies that address issues with farming and crop production. There is a need for increased automation in specialty crop production, particularly in response to rising labor costs and the possibility of labor shortages. To solve these issues, technological advancements are being made, along with methods for collecting and sharing data in innovative formats. Technologies such as hi-tech farming, AI technology in agriculture, robotics, drones, sensors, and various other technologies will boost production and make farming more efficient, which will help in the growth of the MEA specialty crop market to expand.

For instance,

- In February 2022, Verdant Robotics expanded its robot-as-a-service (RaaS) model to ensure access for more specialty crop farmers. The first multi-action autonomous farm robot for specialty crops that will enable superhuman farming

- In February 2022, Abundant Robots Inc. developed an automated picking system to solve the problem of apple bruising by using a high-flow suction mechanism that allows apples to be plucked quickly and without harm. The technique also takes into account any difficulties that may arise while plucking several apples grouped together on a branch

Thus, increasing demand for more automated and hi-tech machinery is an important tool for modern agriculture. Making agriculture more advanced in innovation and technology is expected to provide lucrative opportunities and ultimately promote the growth of the MEA specialty crop market.

Challenges

- Adverse climatic condition

Climate change is affecting food system sustainability by influencing farmer livelihoods, consumer choices, and food security through changes in the natural and human components of agroecosystems. Annual precipitation and heavy rainfall events are becoming more common, especially in the spring. An excessive amount of spring rain slows crop establishment, interrupts planting, increases the prevalence of several fungal and bacterial crop diseases, and might cause labor problems due to the delay of field operations. Variations in temperature and precipitation directly impact the quantity and quality of specialty crop production and indirectly impact the scheduling of important farm operations and the economic effects of pests, weeds, and diseases. Adverse weather conditions also hamper the supply chain and transportation of fruits and vegetables.

Furthermore, temperature increases because faster crop growth, resulting in shorter cropping seasons and lower yields. An increase in tropospheric (or ground-level) ozone leads to an increase in oxidative stress in plants, which inhibits photosynthesis and slows plant growth. Extreme events, especially floods and droughts, can harm crops and reduce yields which will ultimately affect the specialty crop market.

Thus, changing climatic conditions have an adverse impact on agriculture. Reducing yield and more pest infestation will challenge farmers and businesses, which may ultimately challenge market growth.

Post-COVID-19 Impact on the Middle East and Africa Specialty Crop Market

Post the pandemic, the demand for specialty crops has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply food products to consumers, initially increasing the demand for products. However, post-COVID, the demand for specialty crops has increased significantly owing to good protein content and other nutrients available.

Recent Developments

- In June 2022, Olam launched Terrascope, a climate technology company, to help businesses realize their net zero goals

- In September 2020, the Fisher Nut Company introduced a new case packaging line due to increased demand for products during COVID-19

Middle East and Africa Specialty Crop Market Scope

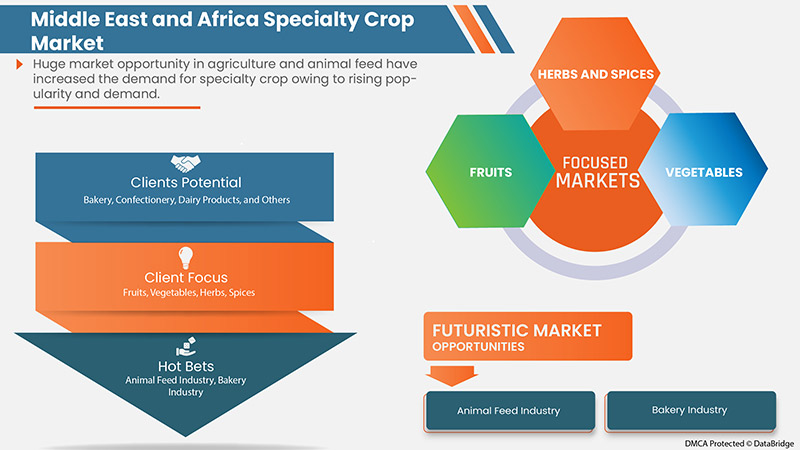

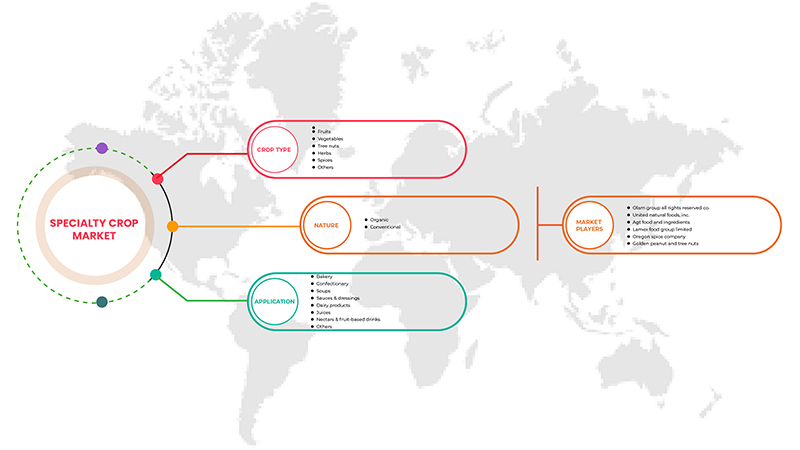

Middle East and Africa specialty crop market is segmented on the basis of crop type, nature, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Crop Type

- Vegetables

- Fruits

- Tree Nuts

- Herbs

- Spices

- Others

On the basis of crop type, the Middle East and Africa specialty crop market is segmented into fruits, vegetables, tree nuts, herbs, spices, and others.

Nature

- Conventional

- Organic

On the basis of product type, the Middle East and Africa specialty crop market is segmented into organic and conventional.

Application

- Dairy Products

- Bakery

- Juices

- Nectars & Fruit-Based Drinks

- Confectionery

- Soups

- Sauces & Dressings

- Others

On the basis of end user, the Middle East and Africa specialty crop market is segmented into bakery, confectionery, soups, sauces & dressings, dairy products, juices, nectars & fruit-based drinks, and others.

Middle East and Africa Specialty Crop Market Regional Analysis/Insights

The Middle East and Africa specialty crop market is analyzed, and market size insights and trends are provided by country, crop type, nature, and application.

The countries covered in the Middle East and Africa specialty crop market report are Saudi Arabia, South Africa, Egypt, U.A.E, Israel, and Rest of Middle East & Africa.

2022年には、南アフリカが中東およびアフリカの特産作物市場を支配すると予想されています。南アフリカは特産作物の最大の市場です。農業と食品消費の需要の高まりが、中東およびアフリカの特産作物市場の成長の主な理由です。さらに、中東およびアフリカ地域では食品市場が着実に成長しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮され、国別データの予測分析が提供されます。

競争環境と中東・アフリカの特産作物市場シェア分析

中東およびアフリカの特殊作物市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、企業概要、企業財務、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点および施設、生産能力、企業の強みと弱み、製品の発売、製品の幅広さと幅広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、中東およびアフリカの特殊作物市場への企業の重点にのみ関連しています。

特殊作物市場で事業を展開している主要企業としては、Olam Group、Lamex Food Group Limited、AGT Food and Ingredients、NUTSCO、Herbs N Spices International、Banabay、Fisher Nut Company、Simped Foods Pty Ltd.、SVZ Industrial Fruit & Vegetable Ingredients、Golden Peanut and Tree Nuts、Barnes Williams、Natural Specialty Crops、ULC などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE MIDDLE EAST & AFRICA SPECIALTY CROP MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION OF THE MIDDLE EAST & AFRICA SPECIALTY CROP MARKET

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF MIDDLE EAST & AFRICA SPECIALTY CROP MARKET

4.3.1 COMPANIES PROVIDING MORE OPTIONS IN SPECIALTY CROP PRODUCTS DUE TO THE RISING HEALTHY LIFESTYLE TREND

4.3.2 COMPANIES PROVIDING ONLINE AND DOORSTEP DELIVERY SERVICES DUE TO THE TREND OF CONVENIENCE IN PURCHASING PRODUCTS

4.4 TECHNOLOGICAL TRENDS

4.5 SUPPLY CHAIN OF MIDDLE EAST & AFRICA SPECIALTY CROPS MARKET

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 PROCESSING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA SPECIALTY CROP MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING INCLINATION OF THE CONSUMERS TOWARD VEGAN FOOD, NATURAL AND HEALTHY FOODS

5.1.2 THE INCREASED FOCUS OF CONSUMERS ON HEALTHY LIVING

5.1.3 INCREASING PUBLIC KNOWLEDGE OF THE HEALTH BENEFITS OF SPECIALTY CROPS

5.2 RESTRAINTS

5.2.1 STRICT REGULATIONS FOR FOOD PRODUCTS

5.2.2 LIMITED CROP GROWING FACILITIES FOR SPECIALTY CROPS

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES AND FREE TRADE POLICIES

5.3.2 ADVANCEMENTS IN AGRICULTURAL TECHNOLOGY

5.4 CHALLENGES

5.4.1 ADVERSE CLIMATIC CONDITION

5.4.2 ALLERGIES ASSOCIATED WITH TREE NUTS CROPS

6 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE

6.1 OVERVIEW

6.2 CONVENTIONAL

6.3 ORGANIC

7 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 DAIRY PRODUCTS

7.2.1 ICE CREAM

7.2.2 CHEESE

7.2.3 MILK-POWDER

7.2.4 SPREADS

7.2.5 OTHERS

7.3 BAKERY

7.3.1 BREADS

7.3.2 CAKES & PASTRIES

7.3.3 BISCUIT & COOKIES

7.3.4 MUFFINS

7.3.5 OTHERS

7.4 JUICES

7.4.1 PINEAPPLE

7.4.2 ORANGE

7.4.3 MOSAMBI

7.4.4 GUAVA

7.4.5 APPLE

7.4.6 STRAWBERRY

7.4.7 OTHERS

7.5 NECTARS & FRUIT-BASED DRINKS

7.6 CONFECTIONERY

7.6.1 CHOCOLATE

7.6.2 CREAM FEELINGS

7.6.3 HARD & SOFT CANDY

7.6.4 GUMS & JELLY

7.6.5 OTHERS

7.7 SOUPS

7.8 SAUCES & DRESSINGS

7.9 OTHERS

8 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE

8.1 OVERVIEW

8.2 FRUIT

8.2.1 COFFEE

8.2.2 BANANA

8.2.3 MANGO

8.2.4 APPLE

8.2.5 CITRUS

8.2.6 GRAPE

8.2.7 GUAVA

8.2.8 STRAWBERRY

8.2.9 LITCHI

8.2.10 COCONUT

8.2.11 AVOCADO

8.2.12 KIWI

8.2.13 GOOSEBERRY

8.2.14 CHERRY

8.2.15 BLACKBERRY

8.2.16 BLUEBERRY

8.2.17 CRANBERRY

8.2.18 CURRANT

8.2.19 CHOKEBERRY

8.2.20 DATE

8.2.21 FIG

8.2.22 OLIVE

8.2.23 BREADFRUIT

8.2.24 CACAO

8.2.25 CHERIMOYA

8.2.26 MACADAMIA

8.2.27 FEIJOA FRUIT

8.2.28 NECTARINE

8.3 VEGETABLES

8.3.1 LENTILS

8.3.2 TOMATOES

8.3.3 CUCUMBER

8.3.4 GARLIC

8.3.5 GARLIC

8.3.6 EGGPLANTS

8.3.7 CARROT

8.3.8 PEPPERS

8.3.9 CAULIFLOWER

8.3.10 PEA (GARDEN, DRY, EDIBLE)

8.3.11 BEET

8.3.12 BROCCOLI

8.3.13 LETTUCE

8.3.14 ASPARAGUS

8.3.15 CELERY

8.3.16 CHIVE

8.3.17 COLLARDS

8.3.18 ARTICHOKE

8.3.19 CELERIAC

8.3.20 EDAMAME

8.3.21 ENDIVE

8.3.22 HORSERADISH

8.3.23 KOHLRABI

8.3.24 LEEK

8.4 TREE NUT

8.4.1 ALMONDS

8.4.2 CASHEWS

8.4.3 HAZELNUTS

8.4.4 MACADAMIA NUTS

8.4.5 PINE NUTS

8.4.6 CHESTNUTS

8.4.7 HICKORY NUTS

8.4.8 BRAZIL NUTS

8.4.9 PECANS

8.4.10 ACORNS

8.5 HERBS

8.5.1 CORIANDER

8.5.2 MINT

8.5.3 BASIL

8.5.4 ALOE VERA

8.5.5 PARSLEY

8.5.6 LAVENDER

8.5.7 ROSEMARY

8.5.8 THYME

8.5.9 DILL

8.5.10 JASMINE

8.5.11 CHIVES

8.5.12 CATNIP

8.5.13 OTHERS

8.6 SPICES

8.6.1 CRUSHED RED PEPPER

8.6.2 GARLIC

8.6.3 GINGER

8.6.4 TURMERIC

8.6.5 CORIANDER SEEDS

8.6.6 CUMIN

8.6.7 BLACK PEPPER

8.6.8 CARDAMOM

8.6.9 CLOVE

8.6.10 FENUGREEK

8.6.11 MUSTARD SEEDS

8.6.12 CURRY POWDER

8.6.13 NUTMEG

8.6.14 CELERY SEEDS

8.6.15 CASSIA BARK

8.6.16 MACE

8.6.17 OTHERS

8.7 OTHERS

9 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY REGION

9.1 MIDDLE EAST & AFRICA

9.1.1 SOUTH AFRICA

9.1.2 SAUDI ARABIA

9.1.3 UAE

9.1.4 KUWAIT

9.1.5 REST OF MIDDLE EAST & AFRICA

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 OLAM GROUP ALL RIGHTS RESERVED CO.

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 UNITED NATURAL FOODS, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 AGT FOOD AND INGREDIENTS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 LAMEX FOOD GROUP LIMITED

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 GOLDEN PEANUT AND TREE NUTS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 OREGON SPICE COMPANY

12.6.1 COMPANY SNAPSHOT

12.6.2 COMPANY SHARE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BANABAY

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 BARNES WILLIAMS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 FARMER DIRECT ORGANIC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 FISHER NUT COMPANY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 FRUIT+ VEG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 HARBOR SPICE CO., INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 HERBS N SPICES INTERNATIONAL

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NATURAL SPECIALTY CROPS, ULC

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 NUTSCO

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 RICE FRUIT COMPANY

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SIMPED FOODS PTY LTD.

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SPECIALTY CROP COMPANY. INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 SVZ INDUSTRIAL FRUIT & VEGETABLE INGREDIENTS

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 3 MIDDLE EAST & AFRICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CONVENTIONAL IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 5 MIDDLE EAST & AFRICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ORGANIC IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 9 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 13 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 19 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 21 MIDDLE EAST & AFRICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA NECTARS & FRUIT-BASED DRINKS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 27 MIDDLE EAST & AFRICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SOUPS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 MIDDLE EAST & AFRICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SAUCES & DRESSINGS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 MIDDLE EAST & AFRICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 35 MIDDLE EAST & AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 MIDDLE EAST & AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 MIDDLE EAST & AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 41 MIDDLE EAST & AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 MIDDLE EAST & AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA OTHERS IN SPECIALTY CROP MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 49 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 51 MIDDLE EAST & AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 53 MIDDLE EAST & AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 55 MIDDLE EAST & AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 57 MIDDLE EAST & AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 59 MIDDLE EAST & AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 61 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 63 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 67 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 69 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 75 SOUTH AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 77 SOUTH AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 79 SOUTH AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 81 SOUTH AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 83 SOUTH AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 85 SOUTH AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 87 SOUTH AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 SOUTH AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 SOUTH AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 SOUTH AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 SOUTH AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 SAUDI ARABIA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 99 SAUDI ARABIA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 101 SAUDI ARABIA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 103 SAUDI ARABIA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 105 SAUDI ARABIA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 107 SAUDI ARABIA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 109 SAUDI ARABIA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 111 SAUDI ARABIA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 SAUDI ARABIA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 SAUDI ARABIA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 117 SAUDI ARABIA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 119 SAUDI ARABIA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 UAE SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 UAE SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 123 UAE FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 124 UAE FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 125 UAE VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 126 UAE VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 127 UAE TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 128 UAE TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 129 UAE HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 130 UAE HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 131 UAE SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 132 UAE SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 133 UAE SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 UAE SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 135 UAE SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 UAE SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 137 UAE BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 UAE BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 139 UAE CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 UAE CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 UAE DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 UAE DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 UAE JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 UAE JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 KUWAIT SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 KUWAIT SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 147 KUWAIT FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 148 KUWAIT FRUITS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 149 KUWAIT VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 150 KUWAIT VEGETABLES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 151 KUWAIT TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 152 KUWAIT TREE NUTS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 153 KUWAIT HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 154 KUWAIT HERBS IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 155 KUWAIT SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 156 KUWAIT SPICES IN SPECIALTY CROP MARKET, BY TYPE 2020-2029 (KILO TONS)

TABLE 157 KUWAIT SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 158 KUWAIT SPECIALTY CROP MARKET, BY NATURE, 2020-2029 (KILO TONS)

TABLE 159 KUWAIT SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 KUWAIT SPECIALTY CROP MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 161 KUWAIT BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 KUWAIT BAKERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 163 KUWAIT CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 KUWAIT CONFECTIONERY IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 165 KUWAIT DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 KUWAIT DAIRY PRODUCTS IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 167 KUWAIT JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 KUWAIT JUICES IN SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 REST OF MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY TYPE, 2020-2029 (KILO TONS)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: SEGMENTATION

FIGURE 10 THE RISING TREND OF EXOTIC FLAVOURS AMONG MILLENNIALS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE VEGETABLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SPECIALTY CROP MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF INDIA FOOD INGREDIENTS

FIGURE 13 VALUE CHAIN OF SPECIALTY CROP

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SPECIALTY CROP MARKET

FIGURE 15 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY NATURE, 2021

FIGURE 16 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET, BY APPLICATION, 2021

FIGURE 17 MIDDLE EAST & AFRICA SPECIALITY CROP MARKET, BY TYPE, 2020-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: SNAPSHOT (2021)

FIGURE 19 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: BY COUNTRY (2021)

FIGURE 20 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA SPECIALTY CROP MARKET: BY TYPE (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA SPECIALTY CROPS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。