中東およびアフリカのタンパク質加水分解物市場、タイプ別(牛乳、肉、海産物、植物、卵、その他)、供給源別(動物、植物、微生物)、形態別(液体および粉末)、プロセス別(酵素加水分解および酸加水分解)、用途別(動物飼料、乳児栄養、臨床栄養、スポーツ栄養、栄養補助食品、その他)、国別(南アフリカ、エジプト、サウジアラビア、アラブ首長国連邦、イスラエル、その他の中東およびアフリカ)業界動向および2029年までの予測。

市場分析と洞察:中東およびアフリカのタンパク質加水分解物市場

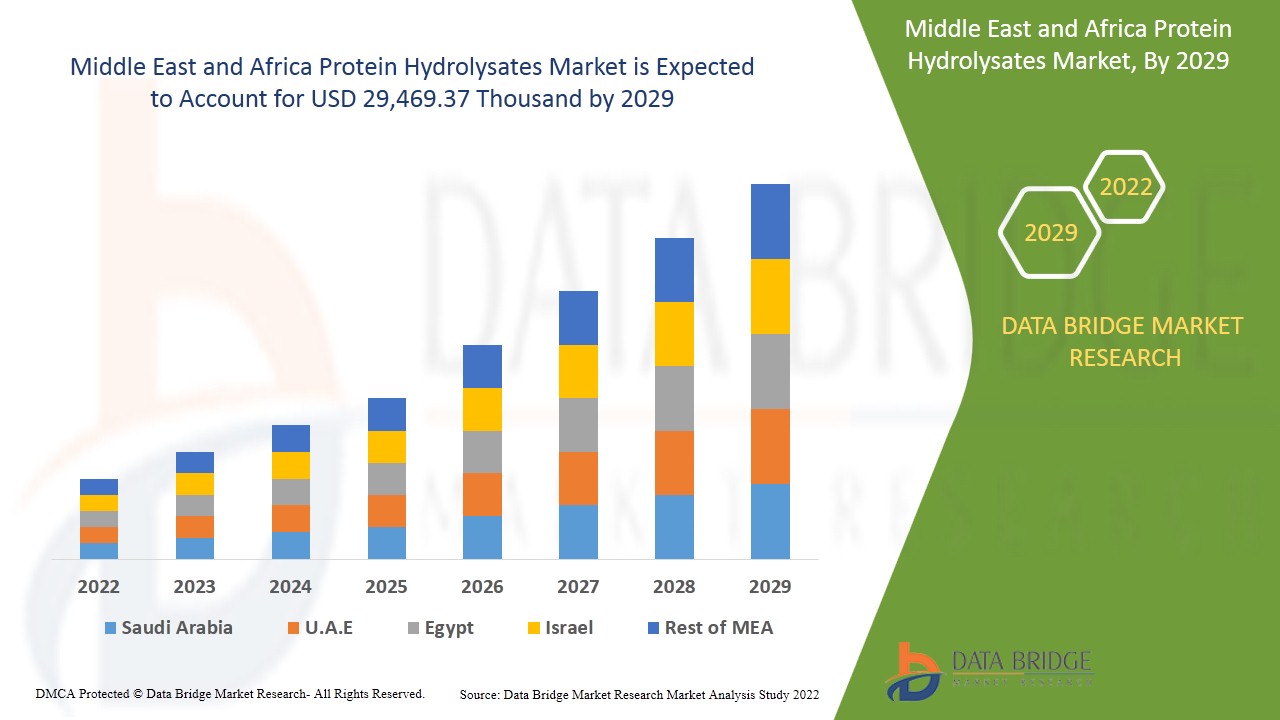

中東およびアフリカのタンパク質加水分解物市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.0%のCAGRで成長し、2029年までに29,469.37千米ドルに達すると予測しています。

タンパク質加水分解物は、精製されたタンパク質源からタンパク質分解酵素を添加し、続いて精製手順を行うことで製造されます。各タンパク質加水分解物は、異なる鎖長のペプチドと遊離アミノ酸の複雑な混合物であり、加水分解度と呼ばれる値で定義できます。これは、スタータータンパク質で切断されたペプチド結合の割合です。このような調製物は、その構成アミノ酸に元の材料と同等の栄養価があり、特別な食事や通常の食品タンパク質を摂取できない患者の栄養補給や水分補給に使用されます。これは、体が完全なタンパク質よりも急速にアミノ酸を吸収するのを助けるなど、多くの健康上の利点があり、したがって栄養素の供給が最大化され、食品および飲料業界でさまざまな用途があります。タンパク質加水分解物の用途は、スポーツ医学で特に使用されています。タンパク質加水分解物に含まれるアミノ酸は、完全なタンパク質よりも体に吸収されやすく、筋肉への栄養素の供給が増えるためです。また、バイオテクノロジー業界では、細胞培養を補うために使用されています。

さまざまな地域での乳児用調合乳の需要の急増により、タンパク質加水分解物市場の成長が促進されました。タンパク質加水分解物を含む調合乳の摂取は、牛乳調合乳よりも有益であると考えられています。これは、乳製品とは異なり、乳児がタンパク質加水分解物を容易に消化できるためです。このため、中東およびアフリカのタンパク質加水分解物市場の成長が促進されると大いに期待されています。

乳児およびスポーツ栄養のための体重管理製品に対する大きな需要と、機能性食品および栄養食品の消費につながる消費者の健康意識の高まりが、中東およびアフリカのタンパク質加水分解物市場の原動力となっています。ただし、分離物などの代替品が利用可能になることで、市場の成長が抑制されると予想されます。

世界中でビーガン人口が増加しているため、中東およびアフリカのタンパク質加水分解物市場は将来的に成長する可能性があります。

加水分解タンパク質の加工コストが高いため、中東およびアフリカのタンパク質加水分解物市場は近い将来に成長すると予測されています。

この中東およびアフリカのタンパク質加水分解物市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点からの機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

中東およびアフリカのタンパク質加水分解物市場の 範囲と市場規模

中東およびアフリカのタンパク質加水分解物市場は、タイプ、ソース、形式、プロセス、および用途に基づいて 5 つのセグメントに分割されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コア アプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- 中東およびアフリカのタンパク質加水分解物市場は、種類別に牛乳、肉、海産物、植物、卵、その他に分類されています。2022年には、牛乳タンパク質加水分解物セグメントが、顕著な抗高血圧、抗酸化、抗炎症、およびコレステロール低下作用を有するため、中東およびアフリカのタンパク質加水分解物市場で優位に立つと予想されています。

- 中東およびアフリカのタンパク質加水分解物市場は、供給源に基づいて、動物、植物、微生物に分類されます。2022年には、動物ベースの供給源には他の供給源に比べてタンパク質含有量が多いため、動物セグメントが中東およびアフリカのタンパク質加水分解物市場を支配すると予想されます。

- 中東およびアフリカのタンパク質加水分解物市場は、形状に基づいて液体と粉末に分類されます。2022年には、粉末タンパク質加水分解物セグメントが中東およびアフリカのタンパク質加水分解物市場で主流になると予想されます。これは、粉末タンパク質加水分解物が体内でより容易に吸収および利用され、運動後の回復がより効率的かつ迅速になるためです。さらに、加水分解されたタンパク質粉末は、胃痛や腸の問題を引き起こす可能性が低く、さまざまな健康上の利点を提供するため、予測年に需要を押し上げるのに役立ちます。

- プロセスに基づいて、中東およびアフリカのタンパク質加水分解物市場は、酵素加水分解と酸加水分解に分類されます。2022年には、さまざまなプロテアーゼの固有の特異性により処理の範囲を制御できるため、酵素加水分解が中東およびアフリカのタンパク質加水分解物市場を支配すると予想されます。

- 用途に基づいて、中東およびアフリカのタンパク質加水分解物市場は、動物飼料、乳児栄養、臨床栄養、スポーツ栄養、栄養補助食品、その他に分類されます。2022年には、従来の形で十分な量の食物を摂取できない人々に完全または部分的な栄養を提供する栄養補助食品セグメントが中東およびアフリカのタンパク質加水分解物市場を支配すると予想されます。

中東およびアフリカのタンパク質加水分解物市場の国別分析

中東およびアフリカ市場が分析され、種類、ソース、形式、プロセス、アプリケーション別に市場規模の情報が提供されます。

中東およびアフリカのタンパク質加水分解物市場レポートで取り上げられている国は、南アフリカ、エジプト、サウジアラビア、アラブ首長国連邦、イスラエル、その他の中東およびアフリカに分類されています。

- 2022年には、消費者の可処分所得が高いことから、アラブ首長国連邦が中東およびアフリカのタンパク質加水分解物市場を支配すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

中東およびアフリカのタンパク質加水分解物市場における中東およびアフリカ

中東およびアフリカのタンパク質加水分解物市場では、市場向けのさまざまな種類の製品のインストールベースの各国の成長、ライフライン曲線を使用した技術の影響、タンパク質加水分解物の規制シナリオの変更、およびそれらがタンパク質加水分解物市場に与える影響に関する詳細な市場分析も提供されます。データは、2010年から2020年までの履歴期間で利用できます。

競争環境と中東およびアフリカのタンパク質加水分解物市場シェア分析

中東およびアフリカのタンパク質加水分解物市場の競争環境は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務、収益、市場の可能性、研究開発への投資、新しい市場イニシアチブ、中東およびアフリカのプレゼンス、生産拠点と施設、会社の長所と短所、製品の発売、臨床試験パイプライン、ブランド分析、製品承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供された上記のデータポイントは、中東およびアフリカのタンパク質加水分解物市場に関連する会社の焦点にのみ関連しています。

レポートで取り上げられている主要企業には、BRF Middle East and Africa、Novozymes、Azelis、Scanbio Marine Group AS、Bioiberica SAU、Kemin Industries Inc.、Copalis、Bio-marine Ingredients Ireland、Titan Biotech、ZXCHEM USA INC.、SUBONEYO Chemicals Pharmaceuticals P Limited、New Alliance Dye Chem Pvt. Ltd.、Janatha Fish Meals & Oil Products、NAN Group、SAMPIなどがあります。

DBMR アナリストは競争上の強みを理解し、競合他社ごとに個別に競争分析を提供します。

例えば、

- 2021年10月、当社の社会的投資を戦略的に指揮する民間団体であるBRF研究所は、Our Part For The Whole Fundの公示の3回目の選定を完了しました。このイニシアチブには370件を超える応募があり、その中から50件が選ばれ、雇用と収入の創出、健康と緊急時の対応、食品安全、社会保障に焦点を当てたさまざまな分野で総額180万レアルの投資が行われました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND IN WEIGHT MANAGEMENT PRODUCTS FOR INFANT AND SPORTS NUTRITION

5.1.2 INCREASING HEALTH AWARENESS AMONG CONSUMERS LEADING TO CONSUMPTION OF FUNCTIONAL AND NUTRITIONAL FOODS

5.1.3 RISING DEMAND ACROSS A DIVERSE RANGE OF APPLICATIONS

5.1.4 INCREASED USAGE OF FISH PROTEIN HYDROLYSATE IN AQUAFEED

5.2 RESTRAINTS

5.2.1 HEALTH ISSUES RELATED TO HIGH AND LONG TERM CONSUMPTION OF PROTEIN-BASED DIET

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.2.3 AVAILABILITY OF ALTERNATIVES SUCH AS ISOLATES AND CONCENTRATES

5.3 OPPORTUNITIES

5.3.1 INCREASING VEGAN POPULATION ACROSS THE GLOBE

5.3.2 HIGH DEMAND FOR ORGANIC FOOD INGREDIENTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCTION COST OF HYDROLYZED PROTEIN

5.4.2 LACK OF AWARENESS IN DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE

7.1 OVERVIEW

7.2 MILK

7.2.1 MILK, BY TYPE

7.2.1.1 WHEY

7.2.1.2 CASEIN

7.3 MEAT

7.3.1 MEAT, BY TYPE

7.3.1.1 BOVINE

7.3.1.2 POULTRY

7.3.1.3 SWINE

7.4 PLANT

7.4.1 PLANT, BY TYPE

7.4.1.1 SOY

7.4.1.2 WHEAT

7.4.1.3 OTHERS

7.5 EGGS

7.6 MARINE

7.6.1 MARINE, BY TYPE

7.6.1.1 FISH

7.6.1.1.1 FISH, BY TYPE

7.6.1.1.1.1 TUNA

7.6.1.1.1.2 SALMON

7.6.1.1.1.3 OTHERS

7.6.1.2 ALGAE

7.7 OTHERS

8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ANIMALS

8.3 PLANTS

8.4 MICROBES

9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS

10.1 OVERVIEW

10.2 ENZYMATIC HYDROLYSIS

10.3 ACID HYDROLYSIS

11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIETARY SUPPLEMENTS

11.3 INFANT NUTRITION

11.4 SPORTS NUTRITION

11.5 ANIMAL FEED

11.6 CLINICAL NUTRITION

11.7 OTHERS

12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

13.5 PARTNERSHIPS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BRF MIDDLE EAST & AFRICA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 NOVOZYMES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 AZELIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 SCANBIO MARINE GROUP AS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 BIOIBERICA S.A.U

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 KEMIN INDUSTRIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 COPALIS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 BIO-MARINE INGREDIENTS IRELAND

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 JANATHA FISH MEAL & OIL PRODUCTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NAN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 NEW ALLIANCE DYE CHEM PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 SAMPI

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SUBONEYO CHEMICAL PHARMACEUTICALS P LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

15.14 TITAN BIOTECH

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ZXCHEM USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE - 350400 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE – 350400 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 5 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 7 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 10 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 13 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 16 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 18 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA FISH IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (TONNE)

TABLE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ANIMALS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA PLANTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MICROBES IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA POWDER IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA LIQUID IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ENZYMATIC HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ACID HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA INFANT NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA ANIMAL FEED IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (TONNE)

TABLE 41 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 43 MIDDLE EAST AND AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 54 U.A.E. MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.A.E. MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.A.E. MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.A.E. FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.A.E. PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.A.E. PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 U.A.E. PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 U.A.E. PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 62 U.A.E. PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 65 SAUDI ARABIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 76 SOUTH AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 87 EGYPT MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 98 ISRAEL MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ISRAEL MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 ISRAEL MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 ISRAEL FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 ISRAEL PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 ISRAEL PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 104 ISRAEL PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 ISRAEL PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 106 ISRAEL PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASED DEMAND FOR INFANT NUTRITION AND SPORTS NUTRITION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

FIGURE 18 WORLD CAPTURE FISHERIES FROM 1950 TO 2018

FIGURE 19 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY SOURCE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY PROCESS, 2021

FIGURE 23 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。