Middle East and Africa Printing Inks / Packaging Inks Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

692.00 Million

USD

1,038.09 Million

2025

2033

USD

692.00 Million

USD

1,038.09 Million

2025

2033

| 2026 –2033 | |

| USD 692.00 Million | |

| USD 1,038.09 Million | |

|

|

|

|

Middle East and Africa Printing Inks / Packaging Inks Market Segmentation, By Technology (Solvent Based, Oil Based, Water Based, UV Curable, LED Curable, EB Curable, and Others), Type (Flexo Inks, Offset Inks, Gravure Inks, Jet Inks, Metal Decorative Inks, Security Inks, and Others), Resin (Polyurethane, Acrylic, Vinyl, Polyamide, Polyketone, Nitrocellulose, and Others), Substrate (Paper and Board, Polyethylene, Aluminum, Polyvinyl Chloride, Polypropylene, Polyvinyl Acetate, Polyolefin, Cellophane, Polyester, Nylon, and Others), Application (Food Packaging, Wall Paper, Corrugated and Soil Board, Panels, Labels, Laminates, Carrier Bags, Aluminum Foils, Shrink Wrap Films, Envelopes, Paper Synthetic Films, Wrapping Paper, Heavy Duty Sacks, Deep Freeze Packaging, Hygiene Packaging, Flower Wrap, and Others) - Industry Trends and Forecast to 2033

Middle East and Africa Printing Inks / Packaging Inks Market Size

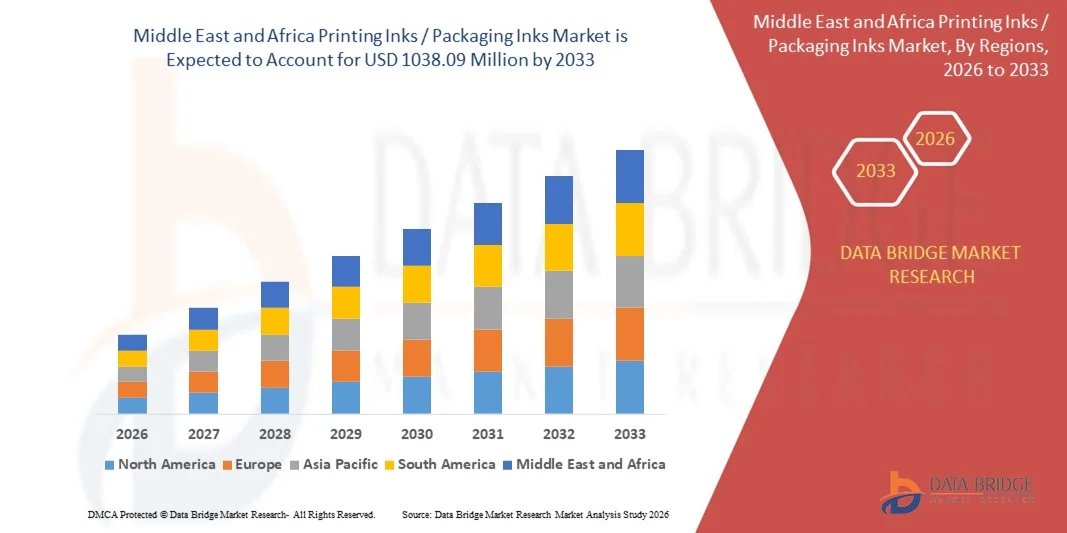

- The Middle East and Africa printing inks / packaging inks market size was valued at USD 692.00 million in 2025 and is expected to reach USD 1038.09 million by 2033, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the increasing demand for high-quality, sustainable, and environmentally friendly inks in the packaging and printing industry, driving innovation across water-based, UV-curable, and low-VOC ink technologies

- Furthermore, rising consumer preference for visually appealing, durable, and food-safe packaging is encouraging manufacturers to adopt advanced printing inks that meet regulatory standards and enhance product aesthetics, significantly boosting industry growth

Middle East and Africa Printing Inks / Packaging Inks Market Analysis

- Printing inks and packaging inks, including flexo, offset, gravure, and digital ink formulations, are essential for delivering high-quality prints on diverse substrates such as paper, board, plastics, and aluminum in commercial and packaging applications

- The escalating demand for these inks is primarily fueled by the growth of packaged goods, e-commerce, and brand differentiation strategies, coupled with increasing environmental regulations that drive the adoption of sustainable and low-migration ink solutions

- South Africa dominated the printing inks / packaging inks market in 2025, due to its well-established food and beverage packaging industry, strong commercial printing base, and growing demand for compliant and high-quality packaging solutions

- Saudi Arabia is expected to be the fastest growing region in the printing inks / packaging inks market during the forecast period due to rapid growth in food processing, pharmaceuticals, and consumer goods packaging under Vision 2030

- Paper and board segment dominated the market with a market share of 43% in 2025, due to its widespread use in packaging, labeling, and commercial printing. Paper-based substrates offer ease of printing, recyclability, and cost-effectiveness, making them a preferred choice for both manufacturers and brand owners. Strong adoption is further supported by the growing demand for sustainable and recyclable packaging solutions in developed and emerging markets

Report Scope and Printing Inks / Packaging Inks Market Segmentation

|

Attributes |

Printing Inks / Packaging Inks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Printing Inks / Packaging Inks Market Trends

Rising Adoption of Sustainable and Eco-Friendly Inks

- A significant trend in the printing inks and packaging inks market is the growing adoption of sustainable and eco-friendly ink solutions, driven by increasing consumer awareness of environmental impact and the need for safer packaging materials. This trend is pushing manufacturers to develop bio-based, water-based, and low-VOC inks that reduce carbon footprint while maintaining print quality

- For instance, Flint Group and Sun Chemical have introduced water-based and soy-based inks for flexible and paper packaging applications, supporting sustainable practices across the printing and packaging industries. These initiatives help companies meet regulatory standards and cater to environmentally conscious consumers

- The demand for clean-label and recyclable packaging is encouraging brands to integrate inks that are fully compostable or recyclable without compromising color vibrancy. This is shaping product development toward eco-friendly formulations that align with circular economy principles

- Regulatory pressures and sustainability certifications are motivating printing ink manufacturers to innovate with non-toxic pigments and renewable raw materials. Compliance with initiatives such as EU REACH and FSC-certified packaging is guiding market strategies toward safer and greener products

- The market is witnessing increasing collaborations between ink manufacturers and packaging companies to co-develop solutions that ensure high-quality prints on eco-conscious substrates. Such partnerships are driving growth in sustainable packaging inks while meeting functional and aesthetic requirements

- Consumer preference for branded and premium packaging is pushing for inks that combine sustainability with high performance, including improved adhesion, gloss, and print resolution. This trend is reinforcing the shift toward inks that support both brand identity and environmental responsibility

Middle East and Africa Printing Inks / Packaging Inks Market Dynamics

Driver

Growing Demand for High-Quality and Food-Safe Packaging

- The rising need for high-quality packaging that ensures product safety is driving demand for specialized printing inks and packaging inks, particularly in food, beverage, and pharmaceutical segments. These inks must meet stringent safety standards while providing vibrant and consistent print quality

- For instance, Siegwerk and Hubergroup supply food-safe inks that comply with FDA and Swiss Ordinance regulations, enabling brands to package consumables safely without compromising visual appeal. Such inks support both regulatory compliance and enhanced consumer trust in packaged goods

- The expansion of e-commerce and premium packaged products is further increasing the requirement for durable inks that maintain print quality during transportation and storage. Brands seek inks that resist smudging, fading, and chemical interactions with packaging materials

- Advancements in digital and flexographic printing technologies are encouraging the development of inks compatible with high-speed production while maintaining safety standards. This compatibility is enhancing operational efficiency and reducing production downtime

- Sustainability concerns are boosting the preference for inks with reduced volatile organic compounds (VOCs) and heavy metals, supporting eco-friendly packaging initiatives. These developments are reinforcing the integration of quality, safety, and environmental responsibility in ink formulations

Restraint/Challenge

Stringent Environmental and Regulatory Compliance

- The printing inks and packaging inks market faces challenges from strict environmental and regulatory requirements, which limit the types of raw materials and chemicals that can be used in production. Compliance with global and regional regulations adds complexity to product development and supply chain management

- For instance, companies such as Sun Chemical invest heavily in research and development to ensure their inks meet EU REACH, FDA, and other international safety standards, which increases operational costs. These compliance obligations influence formulation choices and constrain rapid innovation

- Meeting emissions standards for volatile organic compounds (VOCs) and hazardous substances requires specialized equipment and continuous monitoring, adding to manufacturing complexity. Companies must balance regulatory adherence with production efficiency and cost management

- The market also faces challenges in recycling and disposal of printed materials containing traditional inks, prompting a shift toward bio-based and water-based alternatives. These requirements affect both product design and post-consumer handling processes

- Maintaining consistent color performance while adhering to stringent regulatory and environmental standards remains a key hurdle for manufacturers. This constraint requires ongoing innovation and investment in safer, more compliant ink technologies to sustain market competitiveness

Middle East and Africa Printing Inks / Packaging Inks Market Scope

The market is segmented on the basis of technology, type, resin, substrate, and application.

- By Technology

On the basis of technology, the printing inks market is segmented into solvent based, oil based, water based, UV curable, LED curable, EB curable, and others. The water-based segment dominated the market with the largest market revenue share in 2025, driven by its eco-friendly characteristics, low VOC content, and compliance with stringent environmental regulations. Manufacturers and brand owners increasingly prefer water-based inks due to their safe application in food and beverage packaging, as well as their compatibility with a wide range of substrates. The market sees strong adoption of water-based inks due to their ability to deliver high-quality prints while reducing environmental impact and production hazards.

The UV curable segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for high-speed printing, superior print durability, and enhanced resistance to chemicals and abrasion. UV curable inks are increasingly used in premium packaging applications and labels, providing vibrant colors and rapid curing times that improve production efficiency. The integration of UV curable technology with digital and flexible printing processes further accelerates its adoption across various industries.

- By Type

On the basis of type, the printing inks market is segmented into flexo inks, offset inks, gravure inks, jet inks, metal decorative inks, security inks, and others. The flexo inks segment dominated the market with the largest market revenue share in 2025, driven by its widespread use in flexible packaging, corrugated cartons, and labels. Flexo inks are preferred for their fast-drying properties, ability to print on multiple substrates, and cost-effectiveness in large-volume printing operations. Manufacturers favor flexo inks due to their compatibility with automated high-speed printing lines and consistent print quality.

The jet inks segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing adoption of digital printing technologies in packaging and commercial applications. Jet inks enable high-resolution prints, variable data printing, and short-run customizations, making them ideal for modern packaging demands. The increasing trend of e-commerce and personalized packaging also contributes to the accelerated adoption of jet inks across regions.

- By Resin

On the basis of resin, the printing inks market is segmented into polyurethane, acrylic, vinyl, polyamide, polyketone, nitrocellulose, and others. The acrylic segment dominated the market with the largest market revenue share in 2025, driven by its excellent adhesion, color retention, and chemical resistance across various substrates. Acrylic resins are preferred in food and beverage packaging due to their safe, non-toxic properties and ability to deliver high-quality, durable prints. The market also witnesses strong adoption of acrylic resins because of their flexibility in blending with other resins and suitability for diverse printing technologies.

The polyurethane segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its superior mechanical strength, abrasion resistance, and versatility in specialty packaging applications. Polyurethane-based inks are increasingly used in high-end product labels, metal decorative coatings, and flexible packaging requiring enhanced durability. Rising demand for long-lasting and premium packaging solutions drives the accelerated adoption of polyurethane inks globally.

- By Substrate

On the basis of substrate, the printing inks market is segmented into paper and board, polyethylene, aluminum, polyvinyl chloride, polypropylene, polyvinyl acetate, polyolefin, cellophane, polyester, nylon, and others. The paper and board segment dominated the market with the largest market revenue share of 43% in 2025, driven by its widespread use in packaging, labeling, and commercial printing. Paper-based substrates offer ease of printing, recyclability, and cost-effectiveness, making them a preferred choice for both manufacturers and brand owners. Strong adoption is further supported by the growing demand for sustainable and recyclable packaging solutions in developed and emerging markets.

The polyethylene segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing applications in flexible packaging, pouches, and shrink films. Polyethylene substrates provide excellent moisture resistance, durability, and compatibility with modern ink technologies, enhancing print quality and shelf appeal. Rising consumer preference for flexible packaging and extended shelf-life products accelerates the adoption of polyethylene-based printing inks.

- By Application

On the basis of application, the printing inks market is segmented into food packaging, wall paper, corrugated and solid board, panels, labels, laminates, carrier bags, aluminum foils, shrink wrap films, envelopes, paper synthetic films, wrapping paper, heavy-duty sacks, deep freeze packaging, hygiene packaging, flower wrap, and others. The food packaging segment dominated the market with the largest market revenue share in 2025, driven by rising demand for safe, visually appealing, and functional packaging. Printing inks for food packaging are preferred for their compliance with food safety regulations, high color vibrancy, and resistance to moisture and oils. The market sees strong adoption in food packaging due to increasing consumer demand for packaged foods, convenience products, and extended shelf-life solutions.

The labels segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding e-commerce, premium product branding, and regulatory labeling requirements. Label inks require high precision, durability, and compatibility with different packaging substrates, driving innovation in specialty inks. Rising demand for attractive and informative packaging labels accelerates the adoption of label-specific printing inks across multiple industries.

Middle East and Africa Printing Inks / Packaging Inks Market Regional Analysis

- South Africa dominated the printing inks / packaging inks market with the largest revenue share in 2025, driven by its well-established food and beverage packaging industry, strong commercial printing base, and growing demand for compliant and high-quality packaging solutions

- The country’s role as a regional manufacturing and distribution hub for packaged goods, supported by expanding retail networks and increasing exports of processed foods and consumer products, continues to sustain strong demand for printing and packaging inks

- Rising focus on sustainable packaging, gradual adoption of water-based and low-VOC inks, and the presence of global ink suppliers such as Sun Chemical and Siegwerk reinforce South Africa’s leading position. Ongoing investments in modern printing technologies and packaging infrastructure further strengthen its dominance across the regional market

Saudi Arabia Printing Inks / Packaging Inks Market Insight

Saudi Arabia is projected to record the fastest CAGR in the Middle East and Africa printing inks and packaging inks market from 2026 to 2033, supported by rapid growth in food processing, pharmaceuticals, and consumer goods packaging under Vision 2030. For instance, companies such as Napco National Packaging Company and Taghleef Industries are expanding flexible and sustainable packaging operations, driving demand for high-performance and food-safe inks. Increasing localization of packaging production, rising adoption of eco-friendly materials, and strong government support for industrial diversification are accelerating market growth. Expanding retail consumption, growing exports, and investments in advanced packaging technologies position Saudi Arabia as the fastest-growing market in the region.

South Africa Printing Inks / Packaging Inks Market Insight

South Africa is witnessing steady growth in the printing inks and packaging inks market, driven by consistent demand from food, beverage, pharmaceutical, and personal care packaging sectors. Growth in organized retail, rising preference for branded packaging, and increasing regulatory focus on food safety are supporting demand for high-quality and compliant inks. Packaging printers are gradually shifting toward water-based and environmentally responsible ink solutions to meet sustainability goals. Continued investment in commercial printing, regional export packaging, and collaboration with international ink manufacturers strengthens South Africa’s contribution to market growth within the Middle East and Africa region.

Middle East and Africa Printing Inks / Packaging Inks Market Share

The printing inks / packaging inks industry is primarily led by well-established companies, including:

- DIC CORPORATION (Japan)

- SAKATA INX CORPORATION (Japan)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- TOYO INK SC HOLDINGS CO., LTD. (Japan)

- hubergroup Deutschland GmbH (Germany)

- Flint Group (Switzerland)

- Kao Collins Corporation (U.S.)

- SICPA HOLDING SA (Switzerland)

- T&K TOKA Corporation (Japan)

- TOKYO PRINTING INK MFG CO., LTD (Japan)

- Sun Chemical Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Zeller+Gmelin GmbH & Co. KG (Germany)

- Wikoff Color Corporation (U.S.)

Latest Developments in Middle East and Africa Printing Inks / Packaging Inks Market

- In May 2024, Flint Group expanded its TerraCode range with the introduction of TerraCode Bio, an environmentally friendly product line featuring bio-based extenders and coatings for the corrugated packaging market. This launch strengthens Flint Group’s position in the sustainable packaging inks segment, addressing the rising demand for eco-conscious materials and offering corrugated converters solutions that combine regulatory compliance with enhanced print performance. The addition of bio-based components supports market trends toward reduced carbon footprint and aligns with growing consumer preference for green packaging

- In May 2024, DuPont unveiled Artistri PN1000 low-viscosity pigment inks at drupa 2024, highlighting improved optical density and food-contact compliance. This launch positions DuPont to capture the expanding market for high-performance, food-safe inks, particularly in packaging applications where visual appeal and regulatory adherence are critical. By offering inks that meet stringent safety standards without compromising print quality, DuPont reinforces its competitiveness in the specialty pigment and packaging inks segment

- In March 2024, DIC India inaugurated a toluene-free liquid ink plant in Gujarat with a 10,000-ton annual capacity, representing an investment of INR 1.1 billion (~USD 0.013 billion). This facility addresses the growing market need for environmentally friendly, low-VOC inks in India and neighboring regions. The plant enables DIC to scale production of sustainable inks, strengthen supply reliability, and meet the rising demand from packaging and printing sectors seeking compliance with stricter environmental and health regulations

- In February 2024, Flint Group introduced Novasens P670 PRIME, a Low-Odor, Low-Migration (LOLM) process ink range designed for sheetfed offset packaging printers globally. This development enhances the company’s market offering by providing printers with solutions that improve operational efficiency, reduce waste, and support sustainability objectives. The LOLM formulation aligns with the increasing industry focus on food-safe inks, helping printers meet regulatory standards while maintaining high-quality printing performance

- In January 2024, ALTANA, a specialty chemicals group, completed the acquisition of Silberline Group’s business, a U.S.-based developer and producer of effect pigments for applications including automotive coatings, printing inks, plastics, protective coatings, and packaged consumer goods. This strategic acquisition expands ALTANA’s market presence in high-value pigment applications, strengthens its portfolio in specialty inks, and enhances its ability to offer innovative solutions that cater to evolving demands in decorative and functional packaging markets

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。