中東およびアフリカの産業用マシンビジョン市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

1.83 Billion

2024

2032

USD

4.92 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 1.83 Billion | |

|

|

|

|

中東およびアフリカの産業用マシンビジョン市場のセグメント化、コンポーネント別(ハードウェアおよびソフトウェア)、製品別(スマートカメラ/スマートセンサービジョンシステム、ハイブリッドスマートカメラビジョンシステム、およびPCベース)、タイプ別(2Dビジョンシステム、3Dビジョンシステムおよび1Dビジョンシステム)、展開別(ロボットセルおよび一般)、アプリケーション別(欠陥検出、製品検査、表面検査、包装検査、識別、OCR/OCV、パターン認識、計測、ガイダンスおよび部品追跡、ウェブ検査、およびその他)、エンドユーザー別(自動車、民生用電子機器、食品および包装、医薬品、金属、印刷、航空宇宙、ガラス、ゴムおよびプラスチック、鉱業、繊維、木材および紙、機械、太陽電池パネル製造、およびその他) - 2032年までの業界動向および予測

中東およびアフリカの産業用マシンビジョン市場規模

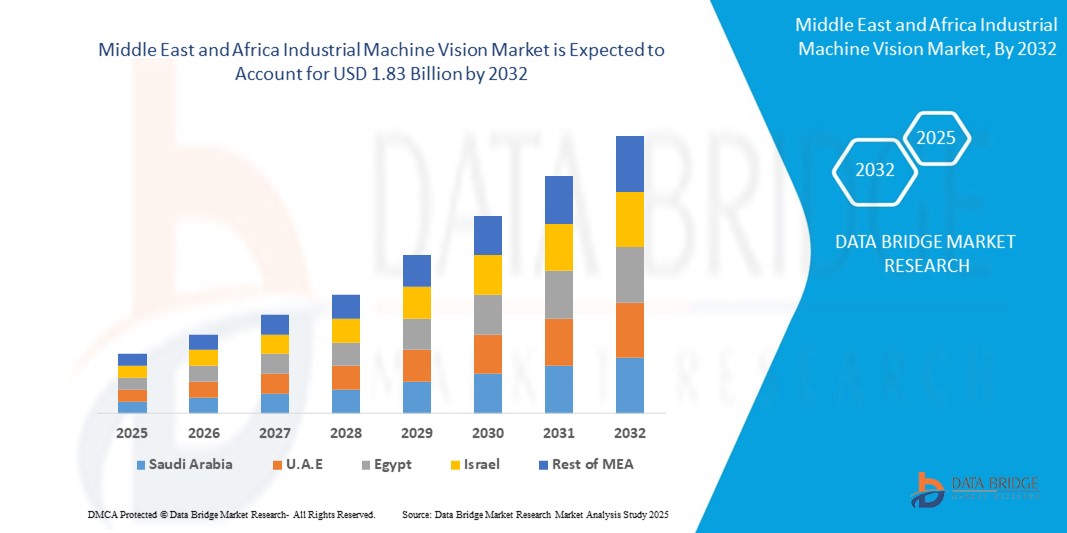

- 中東およびアフリカの産業用マシンビジョン市場規模は2024年に49億2000万米ドルと評価され、予測期間中に6.83%のCAGRで成長し、2032年には18億3000万米ドル に達すると予想されています 。

- 品質管理と検査への関心の高まりは、産業用マシンビジョン市場の大きな牽引力となり、その拡大に重要な役割を果たしています。様々な分野の企業が厳しい品質基準を満たし、競争優位性を維持しようと努力する中で、高度なマシンビジョンシステムへの需要が急増しています。これらのシステムは、検査プロセスの自動化、品質管理における一貫性、精度、効率性の確保に不可欠であり、最終的には市場の成長を牽引します。

中東およびアフリカの産業用マシンビジョン市場分析

- 品質管理と検査への関心の高まりは、産業用マシンビジョン市場の大きな牽引力となり、その拡大に重要な役割を果たしています。様々な分野の企業が厳しい品質基準を満たし、競争優位性を維持しようと努力する中で、高度なマシンビジョンシステムへの需要が急増しています。これらのシステムは、検査プロセスの自動化、品質管理における一貫性、精度、効率性の確保に不可欠であり、最終的には市場の成長を牽引します。

- UAEの産業用マシンビジョン市場は、スマート製造、インフラ開発、イノベーション主導型産業への国の強い重点に支えられ、53.12%の最大の市場シェアを占めると予想されています。

- サウジアラビアの産業用マシンビジョン市場は、産業の多様化とスマートテクノロジーの採用を優先する同国のビジョン2030イニシアチブによって推進され、予測期間中に13.67%の最速CAGRで成長すると予想されています。

- ハードウェアセグメントは、ビジョンシステムの基盤となるカメラ、センサー、レンズ、照明システムへの強い需要に牽引され、2024年には67.4%という最大の収益シェアで市場を支配しました。

レポートの範囲と中東およびアフリカの産業用マシンビジョン市場のセグメンテーション

|

属性 |

中東およびアフリカの産業用マシンビジョンの主要市場洞察 |

|

対象セグメント |

|

|

対象国 |

中東およびアフリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

中東およびアフリカの産業用マシンビジョン市場の動向

AIを活用した品質検査と自動化の導入増加

- 中東・アフリカ(MEA)の産業用マシンビジョン市場における重要な加速トレンドは、自動検査、品質管理、予知保全のためのAI搭載ビジョンシステムの導入拡大です。マシンビジョンと人工知能の統合により、精度が向上し、人的ミスが削減され、製造・物流におけるリアルタイムの意思決定が可能になります。

- 例えば、この地域の企業は、生産ラインにおける欠陥検出のためにAIアルゴリズムを搭載したマシンビジョンシステムを導入しており、製品の一貫性を高め、廃棄を削減しています。これは特に自動車や食品・飲料加工などの業界で顕著です。

- AI駆動型マシンビジョンの使用は、機器からの視覚データを分析して摩耗や潜在的な故障の兆候を早期に特定し、ダウンタイムを最小限に抑えることで、予測メンテナンスもサポートします。

- さらに、UAEとサウジアラビアの政府主導の産業デジタル化プログラムによって支援されている自動化イニシアチブは、企業がよりスマートな検査および監視システムを導入することを奨励している。

- オムロンやコグネックスなどの企業は中東アフリカ地域での存在感を拡大し、地元の製造業や物流のニーズに合わせたAI対応の産業用マシンビジョンシステムを提供しています。

- この傾向は、企業が効率性、安全性、運用インテリジェンスをますます優先するにつれて、MEA市場全体でインダストリー4.0の実践への移行が進んでいることを反映しています。

中東およびアフリカの産業用マシンビジョン市場の動向

ドライバ

産業オートメーションとスマート製造イニシアチブの増加

- サウジビジョン2030やUAEインダストリー4.0イニシアチブなどの国家変革戦略に支えられた産業オートメーションの急速な拡大は、この地域におけるマシンビジョンシステムの導入の大きな原動力となっている。

- 例えば、2024年5月、コグネックス社は地域代理店と提携し、中東全域にマシンビジョンソリューションを提供し、メーカーが生産性と精度を向上させることを可能にしました。

- マシンビジョンシステムは、品質保証を強化し、業務を合理化し、手作業による検査への依存を減らすために、自動車、包装、医薬品の各分野で導入されています。

- 信頼性の高い品質管理、トレーサビリティ、世界的な製造基準への準拠に対する需要の高まりが市場の成長を加速させています。

- さらに、グローバルサプライチェーンにおけるデジタル変革と競争力の必要性から、MEAメーカーは高度な自動化技術を採用するようになり、産業用マシンビジョンが中核的な推進力となっている。

抑制/挑戦

導入コストが高く、技術的専門知識が限られている

- 関心が高まっているにもかかわらず、MEA市場は、カメラ、センサー、AI駆動型ソフトウェアを含むマシンビジョンシステムに必要な初期投資額の高さという課題に直面しています。多くの中小企業にとって、これらのコストは導入の障壁となっています。

- 例えば、アフリカのいくつかの現地メーカーは、予算の制約により依然として手動検査プロセスに依存しており、高度なマシンビジョンソリューションの普及が制限されています。

- もう一つの大きな制約は、マシンビジョンシステムの統合と保守を行うことができる熟練した専門家の不足です。社内に専門知識が不足しているため、外部ベンダーへの依存度が高まり、運用コストが増加しています。

- クラウド接続型ビジョンシステムに関連するサイバーセキュリティの懸念は、データの機密性が高い特定の業界での導入をさらに阻害する。

- オムロンやSICK AGなどの企業は、モジュール式で費用対効果の高いソリューションや、現地での専門知識を構築するためのトレーニングプログラムを提供することで、これらの課題に取り組んでいます。しかし、価格と技術力の不足は依然として課題となっています。

- 地域パートナーシップ、政府のインセンティブ、そして労働力のトレーニングを通じてこれらの課題を克服することは、中東とアフリカ全体でマシンビジョン技術を継続的に導入するために不可欠です。

中東およびアフリカの産業用マシンビジョン市場の展望

市場は、コンポーネント、製品、タイプ、展開、アプリケーション、エンドユーザーに基づいてセグメント化されています。

- コンポーネント別

コンポーネントベースでは、産業用マシンビジョン市場はハードウェアとソフトウェアに区分されます。ハードウェアセグメントは、ビジョンシステムの基盤となるカメラ、センサー、レンズ、照明システムへの旺盛な需要に支えられ、2024年には67.4%という最大の収益シェアで市場を牽引しました。自動車、エレクトロニクス、パッケージング業界における高性能画像取得デバイスへの需要は、ハードウェアの採用を継続的に促進しています。さらに、CMOSセンサーと高解像度カメラの進歩も、この優位性を強化しています。

ソフトウェア分野は、AIを活用した画像処理、ディープラーニングアルゴリズム、そしてデータ分析による検出精度の向上と自動化への需要の高まりを背景に、2025年から2032年にかけて21.2%という最も高いCAGRを達成すると予想されています。人間の介入をより少なくするインテリジェントで適応型のビジョンシステムへの移行が進む中、ソフトウェアは将来の市場拡大の重要な推進力となることが注目されています。

- 製品別

製品ベースでは、産業用マシンビジョン市場は、スマートカメラ/スマートセンサービジョンシステム、ハイブリッドスマートカメラビジョンシステム、PCベースシステムの3つに分類されます。PCベースシステムは、優れた処理能力、柔軟性、そして自動車、半導体、航空宇宙産業における複雑な検査タスクへの適合性に支えられ、2024年には52.8%という最大の収益シェアを占めました。マルチカメラ構成と高度なソフトウェアアプリケーションへの対応能力も、PCベースシステムの継続的な優位性につながっています。

一方、スマートカメラ/スマートセンサービジョンシステム分野は、コンパクトでコスト効率が高く、ユーザーフレンドリーなソリューションへの需要の高まりにより、2025年から2032年にかけて22.6%という最も高いCAGRを記録すると予測されています。スマートカメラは配線の削減、メンテナンスの軽減、AIを活用した機能の統合といったメリットがあり、食品、包装、エレクトロニクス業界の中小規模メーカーにとって非常に魅力的な選択肢となっています。

- タイプ別

産業用マシンビジョン市場は、種類別に1Dビジョンシステム、2Dビジョンシステム、3Dビジョンシステムに分類されます。2Dビジョンシステムセグメントは、欠陥検出、バーコード読み取り、包装検査、組立検証など幅広い用途に支えられ、2024年には61.3%という最大の収益シェアを占めると予測されています。コスト効率、設置の容易さ、そして確立された信頼性が、多様な業界における2Dビジョンシステムのリーディングポジションを支えています。

3Dビジョンシステム分野は、ロボット工学、自動車、エレクトロニクス業界での導入増加に支えられ、2025年から2032年にかけて23.4%という最速のCAGRで成長すると予想されています。3Dシステムは、奥行き認識、正確な空間測定、高度なパターン認識機能を備えているため、ビンピッキング、ロボットガイダンス、複雑な組立検査などのアプリケーションに不可欠なものとなっています。

- 展開別

導入事例に基づき、産業用マシンビジョン市場はロボットセルと一般の2つに分類されます。一般導入セグメントは、スタンドアロン検査ステーション、品質管理、包装ラインでの幅広い導入に支えられ、2024年には68.9%という最大の市場収益シェアを獲得しました。その柔軟性と費用対効果の高さから、食品、印刷、消費財業界の中小企業から大企業まで、幅広く導入されています。

ロボットセルセグメントは、マシンビジョンと産業用ロボットの統合が加速する中で、2025年から2032年にかけて20.8%という最も高いCAGRを記録すると予測されています。ロボットセルは、インダストリー4.0やスマート製造の取り組みと連携し、リアルタイムガイダンス、精密組立、自動欠陥検出を可能にします。人件費の上昇と、自動車・エレクトロニクス分野における自動化の需要が、このトレンドをさらに押し上げています。

- アプリケーション別

用途別に見ると、産業用マシンビジョン市場は、欠陥検出、製品検査、表面検査、包装検査、識別、OCR/OCV、パターン認識、計測、ガイダンスおよび部品追跡、ウェブ検査、その他に分類されます。自動車、電子機器、医薬品製造において品質保証が依然として重要な要素であるため、製品検査セグメントは2024年には26.5%の収益シェアを占め、市場を牽引するでしょう。リコール削減とコンプライアンス強化への貢献が、需要を押し上げています。

ガイダンスおよび部品追跡セグメントは、製造業における組立、ビンピッキング、材料処理へのロボットビジョンシステムの導入が進むにつれ、2025年から2032年にかけて24.1%という最も高いCAGRで成長すると予測されています。製造業における自律型ロボットや協働型ロボットの台頭により、正確な部品追跡とナビゲーションに対する需要がさらに高まっています。

- エンドユーザー別

エンドユーザー別に見ると、産業用マシンビジョン市場は、自動車、家電、食品・包装、医薬品、金属、印刷、航空宇宙、ガラス、ゴム・プラスチック、鉱業、繊維、木材・紙、機械、太陽光パネル製造、その他に分類されます。自動車分野は、組立ラインの自動化の進展、精密検査の需要、品質保証要件の高まりを背景に、2024年には31.7%という最大の収益シェアを占めると予測されています。ビジョンシステムは、自動車製造における欠陥検出、ロボット誘導、部品検証に不可欠です。

医薬品分野は、厳格な規制基準、シリアル化の需要、医薬品の包装・ラベルにおける正確な検査の必要性を背景に、2025年から2032年にかけて22.9%という最も高いCAGRを達成すると予想されています。コンプライアンスの確保、エラーの削減、製品の安全性維持を目的としたマシンビジョンの導入増加により、この分野は最もダイナミックな成長分野となっています。

産業用マシンビジョン市場の地域分析

- UAEの産業用マシンビジョン市場は、スマート製造、インフラ開発、イノベーション主導型産業への国の強い重点に支えられ、53.12%の最大の市場シェアを占めると予想されています。

- 産業用ビジョンソリューションは、物流、梱包、自動車組立ラインに統合されつつあり、UAEの自動化と高度な品質保証への取り組みを反映しています。ドバイとアブダビはデジタルトランスフォーメーションとAIを活用した技術への投資をリードしており、市場の成長見通しをさらに高めています。

- さらに、UAEは地域の貿易拠点としての役割を担っており、輸出と規制遵守を支援する信頼性の高い検査システムの需要が高まっています。

サウジアラビアの産業用マシンビジョン市場の洞察

サウジアラビアの産業用マシンビジョン市場は、予測期間中に13.67%という最も高いCAGRで成長すると予想されています。これは、産業の多様化とスマートテクノロジーの導入を優先する同国のビジョン2030イニシアチブの推進力によるものです。製造業では、特に自動車、食品・飲料、医薬品において、世界的な品質基準を満たすために高度な検査システムの導入が進んでいます。急速な都市化とインフラ開発プロジェクトも、包装、識別、安全検査におけるマシンビジョンソリューションの需要を高めています。政府が支援する強力なデジタル変革プログラムとスマート産業への外国投資が、導入をさらに加速させています。

南アフリカの産業用マシンビジョン市場に関する洞察

南アフリカの産業用マシンビジョン市場は、鉱業、自動車、食品加工分野における自動化ニーズの高まりを背景に、着実な成長が見込まれています。現地の産業界は、業務効率の向上、ミスの削減、そして国際品質基準への適合確保のために、ビジョンベースのシステムを導入しています。包装検査、欠陥検出、ガイダンスシステムへの需要は、特に消費財および輸出志向の産業で高まっています。さらに、政府による産業オペレーションの近代化推進、そしてロボット工学やスマート製造の導入拡大も、全国的にマシンビジョンソリューションの需要を押し上げています。

中東およびアフリカの産業用マシンビジョン市場シェア

産業用マシンビジョン業界は、主に次のような定評ある企業によって牽引されています。

- オムロン株式会社(日本)

- ソニーセミコンダクタソリューションズ株式会社(日本)

- コグネックスコーポレーション(米国)

- SICK AG(米国)

- テレダインFLIR LLC(米国)

- ナショナルインスツルメンツ社(米国)

- インテルコーポレーション(米国)

- ケイデンス・デザイン・システムズ社(米国)

中東およびアフリカの産業用マシンビジョン市場の最近の動向は何ですか?

- 2024年3月、コグネックスは、全く新しいプラットフォームを採用した次世代ハンドヘルドバーコードスキャナ「DataMan 8700シリーズ」を発売しました。このデバイスは、高度な性能と使いやすさを備え、事前の調整やオペレータのトレーニングは不要です。このリリースは、コグネックスの業務の簡素化と、業界への高性能スキャンソリューションの提供という注力をさらに強化するものです。

- 2024年2月、オムロンオートメーションは、より高速な関節と強化された安全機能を備えた協働ロボットTM Sシリーズをインドで発売しました。これらのイノベーションは、共有ワークスペースにおける工場の効率を大幅に向上させます。この発売は、産業オートメーションにおける安全で生産性の高い協働ロボットの発展に向けたオムロンのコミットメントを強調するものです。

- 2023年3月、キーエンス株式会社は、高度な画像処理、高速検査、そしてユーザーフレンドリーな操作性により、産業オートメーションの強化を目指したビジョンシステム「VSシリーズ」を発表しました。このシステムは、特に品質管理と製造効率の向上に適しています。この発表は、幅広い産業用途に最先端のビジョン技術を提供するというキーエンスの強い意志を示すものです。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。