中東およびアフリカのハンガー市場、製品別(プラスチックハンガー、木製ハンガー、ステンレス鋼、アルミニウム合金、その他)、用途別(商業用および家庭用)、販売形態別(小売およびオンライン)、業界動向および2030年までの予測。

中東およびアフリカのハンガー市場の分析と洞察

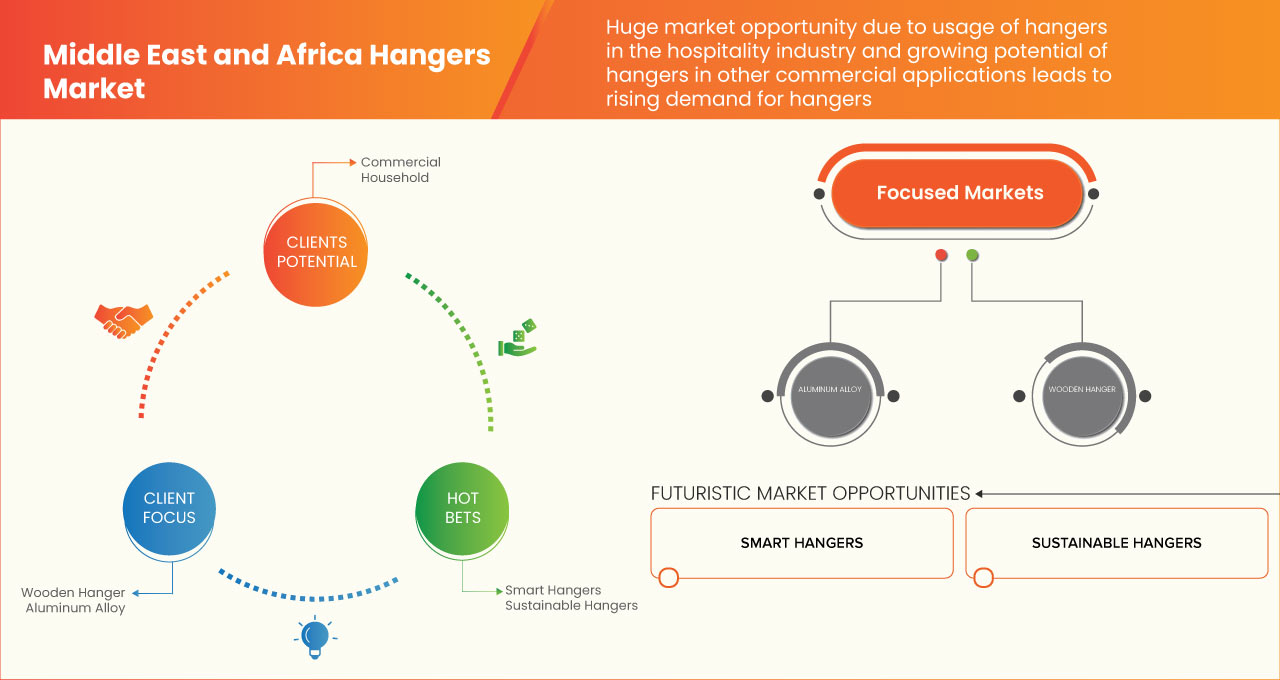

中東およびアフリカのハンガー市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に4.0%のCAGRで成長し、2030年までに105,878.22千米ドルに達すると分析しています。中東およびアフリカのハンガー市場の成長を牽引する主な要因は、継続的な成長につながる活気のある小売およびホスピタリティ部門です。

衣類ハンガー、コートハンガー、またはコートハンガーは、コート、ジャケット、セーター、シャツ、ブラウス、またはドレスをシワなく掛けられるように、人間の肩の形状/輪郭に沿って作られた吊り下げ装置であり、ズボンやスカートを掛けるための下部バーが付いています。

中東およびアフリカのハンガー市場レポートでは、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響、新たな収益源に関する分析機会、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新などの詳細が提供されています。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、希望する目標を達成できるようお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

製品(プラスチックハンガー、木製ハンガー、ステンレス、アルミ合金、その他)、用途(商業用、家庭用)、販売形態(小売、オンライン)。 |

|

対象国 |

南アフリカ、エジプト、サウジアラビア、アラブ首長国連邦、イスラエル、その他の中東およびアフリカ諸国。 |

|

対象となる市場プレーヤー |

MAINETTI、M&B Hangers、EISHO CO., LTD.、hangers.com、Whitmor, Inc.、GUILIN IANGO HOME COLLECTION CO.,LTD.、mawa-hangers.com.、NAHANCO、Bend & Hook、Concept Mannequins など。 |

市場の定義

一般的なハンガーは、さまざまな方法で衣類を掛けることができるハンガーの一種です。金属、木材、プラスチックで作ることができます。一般的なハンガーには多くの用途があります。衣類を干すなどの個人的な用途や、商品を展示するなどの商業用途に使用できます。また、カーテンやドレープを掛けるなど、さまざまな用途に使用できます。

中東およびアフリカのハンガー市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 小売業とホスピタリティ業界の活況が継続的な成長につながる

今日、小売業は最も急速に発展しているチャネルの 1 つであり、この国の経済成長の拡大に重要な役割を果たしています。近年、顧客はますます小売市場に引き寄せられています。所得構造の変化、ライフスタイルの変化、組織化された小売業は、特に情報技術やビジネス プロセス アウトソーシングなどの急成長している経済セクターの消費者の所得の増加と購買力の増大によって促進され、小売業界の成長を促進する主な要因のほんの一部にすぎません。大規模小売企業は、小売スペース、カテゴリ、範囲、ブランド、量の点で小売環境を支配しています。その事業規模は巨大で、利益率は非常に高く、ディスカウント ショップ、倉庫、スーパーマーケット、デパート、ハイパーマーケット、コンビニエンス ストア、専門店など、さまざまな形式で運営されています。ブランド衣料品市場は最も急速に成長しています。

ホスピタリティ部門はサービス産業の幅広いサブセットであり、2 つの主要カテゴリは、旅行と観光、およびホテル リゾートからホステルまでにわたる住宅です。世界全体のホテル事業は、経済全体と同様に、過去 10 年間で大幅な拡大を遂げました。この並外れた成長により、中東およびアフリカの旅行活動が増加し、レジャーおよびビジネス旅行の宿泊数が数え切れないほど増え、ホテルおよび観光産業に恩恵をもたらしました。

- ハンガー市場では木製ハンガーが人気

人々は毎日ハンガーを使っており、衣服を適切に保管することで恩恵を受けています。そのため、人々がクローゼットのハンガーの種類にあまり注意を払わないのは非常に奇妙です。ハンガーが当然の注目を集めない主な理由は、プラスチック、金属など、ハンガーが比較的安価で簡単に手に入ることが多いためです。木製のハンガーなどの高品質のハンガーの代わりに安価なハンガーを購入して使用することは不利です。

ワイヤーハンガーは便利ですが、衣類を長期間保管するには理想的ではありません。ワイヤーハンガーはあまり長持ちしません。これらのハンガーはすぐに曲がってしまい、ハンガーが変形して衣類に見苦しいへこみができてしまいます。さらに、ワイヤーハンガーは大きなアイテムを掛けることができず、重量の増加で曲がってしまいます。その結果、ワイヤーハンガーを選んだ消費者は、より頻繁に交換しなければならなくなります。同様に、プラスチックハンガーは簡単で手頃な価格ですが、ワイヤーハンガーと同じ問題があります。さらに、プラスチックハンガーは牽引力がないため、アイテムがハンガーから落ちる可能性があります。廃棄すると衣類の寿命が短くなり、環境にも影響を及ぼします。

木製ハンガーはクローゼットの整理に最適な代替品であり、さまざまな理由で好まれています。まず、木製ハンガーは比類のない耐久性を備えており、衣類の重量やサイズに関係なくしっかりと保持します。たとえば、木製ハンガーはコートハンガーや高級スーツハンガーとして適しています。これらのアイテムの重量を支えられるからです。さらに、これらのハンガーはクローゼットにファッショナブルなタッチを加えます。これらのエレガントなハンガーは、統一された美観を作り出し、消費者が高級なワードローブをデザインするのに役立ちます。

- 家庭内での様々なタイプのハンガーの使用が増加している

ハンガーは、衣服を掛けるための道具です。大量の衣服を掛けられることから人気がありました。今ではハンガーはどの家庭にも欠かせないアイテムであり、ハンガーのない生活は想像できません。世帯の規模が劇的に大きくなるにつれて、さまざまな種類のハンガーが人々にとって非常に役立っています。

素材によって、ハンガーの種類はワイヤー、金属、木製、プラスチック、布/サテン/ベルベット、竹、植毛、プチ、抱きしめられるハンガーなどがあります。使いやすさによって、ハンガーの種類はシャツ、パンツ、スーツ、スカートとランジェリー、スカーフ、ネクタイ、靴、セーター、旅行用などがあります。デザイン/機能によって、クリップ、回転、薄型、筒型、ストラップ/ノッチ、シングルバー、刻印入り、カスタム、コンビネーション、ワイドショルダー、滑り止め、ドライ/ウェットハンガーなどがあります。メーカーはリサイクルされた環境に優しいハンガーも製造しています。これらは、家庭でますます使用されるようになっているさまざまなタイプのハンガーです。

機会

- インテリジェントハンガーの革新は衣類乾燥の新たな選択肢です

インテリジェンス ハンガーのイノベーションは、革新的で美しいアプローチを使用して開発された、衣類を乾かすための新しい選択肢です。この電気製品は、低コストの電力費用、実用的なワークステーション、効率的な衣類乾燥という珍しい特徴を備えています。従来のハンガーは通常、衣類を掛けて乾かすために使用されますが、インテリジェントな衣類ハンガーは雨の日でも日光の下でも機能します。インテリジェントな衣類ハンガーは、光と雨滴センサーを使用して晴れの日と雨の日を区別します。これらのセンサーは、衣類を雨から保護し、太陽が照っている間は衣類を通気性のある状態に保ちます。

インテリジェントな洋服ハンガーは、機械モーターと電子回路の配置において科学的かつ革新的です。しかし、ハイテクの急速な発展により、インテリジェントなハンガーは今後数年間で広く採用されるでしょう。現在の市場環境に応じて、人々は贅沢な習慣、ライフスタイル、消費レベルへと移行しています。さらに、人々は本当に役に立ち、予算内で購入できる人工的な発明を受け入れています。

- 商業セグメントの増加と製品のアクセシビリティ

The commercial category has continued to thrive during the previous few years. The business sector is booming as a result of the high demand for retail and wholesale premises. The section makes it an appealing gamble, and this scenario is expected to continue in the next years. When a city's residential population begins to grow, the commercial sector begins to migrate. Social infrastructures such as malls, retail centers, restaurants, and workplaces are being built to assist people. It will occur in all areas of the world that develop in accordance with the rise of area civilization. This infrastructure creates a potential for branded and non-branded clothing retailers, wholesalers, and all other items. This will provide prospects for the hangers industry to thrive.

Restraints/Challenges

- ONLINE SALES WILL HAVE AN EFFECT ON CONVENTIONAL WHOLESALERS AND RETAILERS' SALES

The fashion business is a continuously changing, ever-evolving beast that is fuelled by the newest trends, technology, and ideas. However, there is no disputing that technology has harmed the fashion business. One of the primary reasons is online shopping; the arrival of the Internet as a marketing medium has altered the commercial connection between suppliers and customers.

People are increasingly purchasing online for a variety of reasons. It's easy, frequent sales or discounts exist, and anyone can locate everything they want with only a few clicks. However, this convenience has come at the price of conventional retail outlets. With the growth of internet shopping and social media and the resulting surge in sales, many brick-and-mortar companies have struggled to stay up. Indeed, numerous well-known stores have had to declare bankruptcy in recent years. This is due to the fact that consumers are just not shopping at physical stores as frequently as they used to. Small and independent fashion firms have been devastated by online shopping and rapid fashion development.

- FLUCTUATING RAW MATERIAL PRICES AND PROHIBITION ON PLASTIC USAGE

In recent days, it has been impossible to predict where raw material costs would go. They rise and fall in an erratic fashion with no discernable pattern. The prices of various raw materials might change, growing or decreasing, which can affect the prices of the goods that utilize them. There are five primary considerations: decreased supply, higher demand, sustainability difficulties, excessive price inflation in transportation and commerce, and more tax duties.

Wood, wire, metal, and plastics may all be used to make hangers. Raw material costs that fluctuate dramatically and inadequate pricing management might jeopardize a company's success. Plastic hangers are inexpensive and widely available. However, the price of plastics is variable, not only because the price of oil highly influences it but also because other market factors influence it.

Plastics are also prohibited in several nations owing to their negative impact on health and the environment. Every year, millions of plastic hangers are delivered to other nations. Plastic manufacturing has a significant environmental impact and generates much plastic trash once clothing is purchased.

RECENT DEVELOPMENTS

- In July 2021, MAINETTI introduced the Paperform Hanger line, which provides merchants with a sustainable and renewable complement to its hanger inventory. The hanger is 100% plastic-free, recyclable, and made from recycled paper and steel upon request. The revolutionary collection is available in a variety of hanger designs designed by the supply chain solutions provider. This assists the firm in gaining greater awareness and increasing product output.

- In November 2021, MAINETTI, a Middle East and Africa retail solutions provider, announced a collaboration with UBQ Materials Ltd. to establish a new benchmark for product innovation and sustainability in the fashion sector. The cooperation will use UBQ's proprietary thermoplastic to manufacture sustainable items for retailers Middle East and Africa utilizing climate-positive raw materials. This collaboration allows the firm to expand its product line, innovate, and develop.

Middle East and Africa Hangers Market Scope

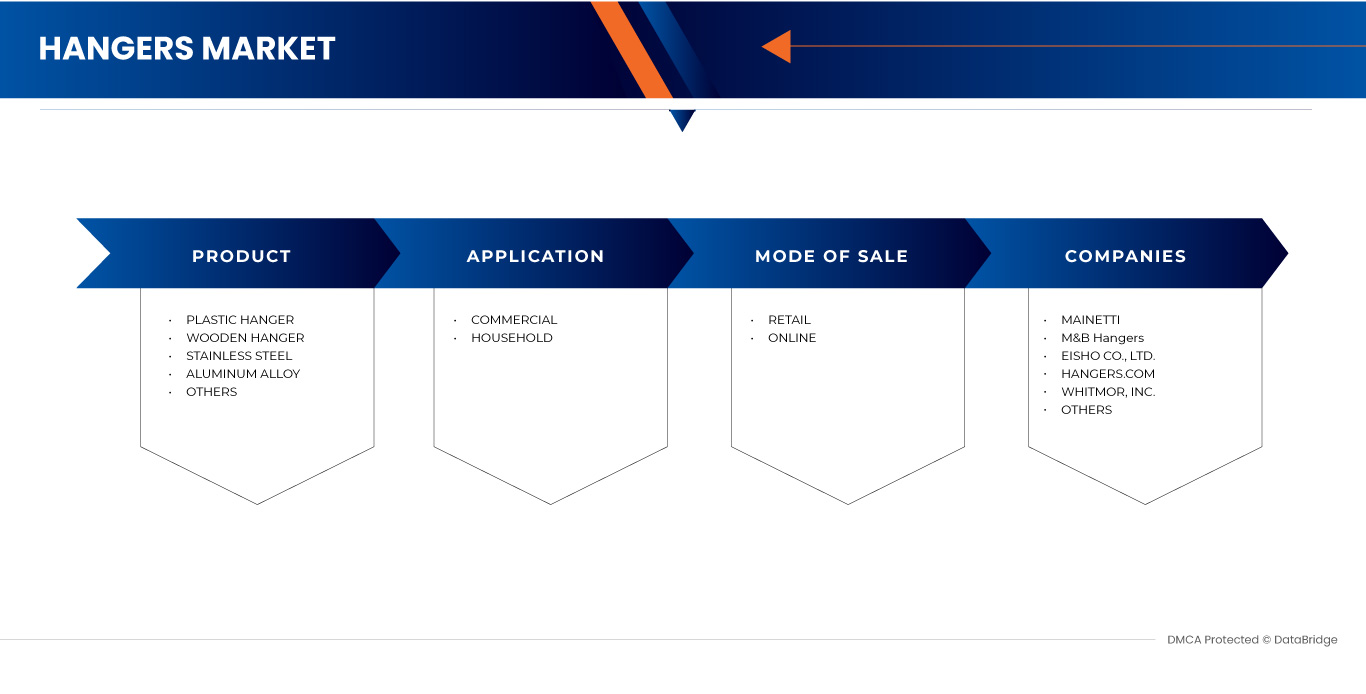

The Middle East and Africa hangers market is categorized based on product, application and mode of sale. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Plastic Hanger

- Wooden Hanger

- Stainless Steel

- Aluminum Alloy

- Others

Based on product, the Middle East and Africa hangers market is segmented into plastic hanger, wooden hanger, stainless steel, aluminum alloy, and others.

Application

- Commercial

- Household

Based on application, the Middle East and Africa hangers market is segmented into commercial and household.

Mode of Sale

- Retail

- Online

Based on the mode of sale, the Middle East and Africa hangers market is segmented into retail and online.

Middle East and Africa Hangers Market Regional Analysis/Insights

The Middle East and Africa hangers market is segmented on the basis of product, application, and mode of sale.

The countries in the Middle East and Africa hangers market is segmented into South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the Rest of the Middle East and Africa. The United Arab Emirates is dominating the Middle East and Africa hangers market in terms of market share and market revenue due to the increasing usage of various types of hangers in households.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、各国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、新しいブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境と中東・アフリカのハンガー市場シェア分析

中東およびアフリカのハンガー市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の長所と短所、製品の発売、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、製品のライフライン曲線などがあります。提供されている上記のデータ ポイントは、中東およびアフリカのハンガー市場に関連する企業の焦点にのみ関連しています。

中東およびアフリカのハンガー市場で活動している著名な企業としては、MAINETTI、M&B Hangers、EISHO CO., LTD.、hangers.com、Whitmor, Inc.、GUILIN IANGO HOME COLLECTION CO.,LTD.、mawa-hangers.com.、NAHANCO、Bend & Hook、Concept Mannequins などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA HANGERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 BRAND SHARE ANALYSIS

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.2 COMPLEX BUYING BEHAVIOR

4.3.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.4 HABITUAL BUYING BEHAVIOR

4.3.5 VARIETY SEEKING BEHAVIOR

4.3.6 CONCLUSION

4.4 FACTORS AFFECTING BUYING DECISION

4.4.1 ECONOMIC FACTOR

4.4.2 FUNCTIONAL FACTOR

4.5 CONSUMER PRODUCT ADSORPTION

4.5.1 OVERVIEW

4.5.2 PRODUCT AWARENESS

4.5.3 PRODUCT INTEREST

4.5.4 PRODUCT EVALUATION

4.5.5 PRODUCT TRIAL

4.5.6 PRODUCT ADOPTION

4.5.7 CONCLUSION

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.6.1 IMPACT ON PRICE

4.6.2 IMPACT ON SUPPLY CHAIN

4.6.3 IMPACT ON SHIPMENT

4.6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.7 IMPORT EXPORT SCENARIO

4.8 PRODUCTION CAPACITY OUTLOOK

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 METAL

4.10.2 PLASTICS

4.10.3 WOOD

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 A THRIVING RETAIL AND HOSPITALITY SECTOR LEADS TO CONTINUOUS GROWTH

6.1.2 THE PREFERENCE FOR WOODEN HANGERS IS TRENDING IN THE HANGERS MARKET

6.1.3 THE USE OF VARIOUS TYPES OF HANGERS IN HOUSEHOLDS IS INCREASING

6.2 RESTRAINTS

6.2.1 ONLINE SALES HAVE AN EFFECT ON CONVENTIONAL WHOLESALERS AND RETAILERS' SALES

6.2.2 A CHEAP AND EASY ALTERNATIVE FOR HANGERS

6.3 OPPORTUNITIES

6.3.1 INNOVATIONS OF INTELLIGENCE HANGERS ARE THE NEW CHOICE FOR DRYING CLOTHES

6.3.2 INCREASE IN THE COMMERCIAL SEGMENT AND PRODUCT ACCESSIBILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES AND PROHIBITION ON PLASTIC USAGE

6.4.2 PROBLEMS ASSOCIATED WITH THE DIFFERENT TYPES OF HANGERS

7 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PLASTIC HANGERS

7.3 WOODEN HANGER

7.4 STAINLESS STEEL

7.5 ALUMINUM ALLOY

7.6 OTHERS

8 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMMERCIAL

8.2.1 COMMERCIAL, BY PRODUCT

8.2.1.1 PLASTIC HANGER

8.2.1.2 WOODEN HANGER

8.2.1.3 STAINLESS STEEL

8.2.1.4 ALUMINUM ALLOY

8.2.1.5 OTHERS

8.3 HOUSEHOLD

8.3.1 HOUSEHOLD, BY PRODUCT

8.3.1.1 PLASTIC HANGER

8.3.1.2 WOODEN HANGER

8.3.1.3 STAINLESS STEEL

8.3.1.4 ALUMINUM ALLOY

8.3.1.5 OTHERS

9 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE

9.1 OVERVIEW

9.2 RETAIL

9.3 ONLINE

10 MIDDLE EAST & AFRICA HANGERS MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 UNITED ARAB EMIRATES

10.1.2 SOUTH AFRICA

10.1.3 SAUDI ARABIA

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11.2 PRODUCT LAUNCH

11.3 PARTNERSHIP

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 MAINETTI

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 M&B HANGERS

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 EISHO CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 HANGERS.COM

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 WHITMOR, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 BEND & HOOK

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 CONCEPT MANNEQUINS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 GUILIN IANGO HOME COLLECTION CO., LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAWA-HANGERS.COM.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAHANC0

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

表のリスト

TABLE 1 IMPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA PLASTIC HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA WOODEN HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA STAINLESS STEEL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ALUMINIUM ALLOY IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST & AFRICA COMMERCIAL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA HOUSEHOLD IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RETAIL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA ONLINE IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA HANGERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HANGERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 24 MIDDLE EAST AND AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 26 MIDDLE EAST AND AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 31 UNITED ARAB EMIRATES HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 33 UNITED ARAB EMIRATES COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 36 SOUTH AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 SOUTH AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 38 SOUTH AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 40 SOUTH AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 43 SAUDI ARABIA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 SAUDI ARABIA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 45 SAUDI ARABIA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 47 SAUDI ARABIA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 50 EGYPT HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 EGYPT HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 52 EGYPT HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 EGYPT HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 54 EGYPT COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 55 EGYPT HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 EGYPT HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 57 ISRAEL HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 ISRAEL HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 59 ISRAEL HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 ISRAEL HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 61 ISRAEL COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 ISRAEL HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 ISRAEL HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 64 REST OF MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 REST OF MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA HANGERS MARKET

FIGURE 2 MIDDLE EAST & AFRICA HANGERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HANGERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HANGERS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HANGERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA HANGERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA HANGERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA HANGERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA HANGERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA HANGERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA HANGERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA HANGERS MARKET: SEGMENTATION

FIGURE 14 THRIVING RETAIL AND HOSPITALITY SECTOR LEAD TO CONTINUOUS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA HANGERS MARKET IN THE FORECAST PERIOD

FIGURE 15 PLASTIC HANGER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HANGERS MARKET IN 2023 & 2030

FIGURE 16 MIDDLE EAST & AFRICA HANGERS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 17 MIDDLE EAST & AFRICA HANGERS MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA HANGERS MARKET

FIGURE 20 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2022

FIGURE 21 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2022

FIGURE 22 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE, 2022

FIGURE 23 MIDDLE EAST AND AFRICA HANGERS MARKET: BY SNAPSHOT (2022)

FIGURE 24 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2022)

FIGURE 25 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA HANGERS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 28 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。