中東およびアフリカの手袋市場

Market Size in USD Billion

CAGR :

%

USD

576.77 Million

USD

971.83 Million

2021

2029

USD

576.77 Million

USD

971.83 Million

2021

2029

| 2022 –2029 | |

| USD 576.77 Million | |

| USD 971.83 Million | |

|

|

|

|

中東およびアフリカの手袋市場、製品タイプ別(ニトリル手袋、ラテックス手袋、ビニール手袋、ポリエチレン手袋、綿織物手袋、耐穿刺手袋、ブチル手袋、アルミ加工手袋、ネオプレン手袋、ケブラー手袋、革手袋など)、タイプ別(使い捨ておよび再利用可能)、用途別(生物、化学、機械、熱、帯電防止など)、エンドユーザー別(医療およびヘルスケア、食品および飲料、防火、建設、製造業、金属加工、電子機器など)、流通チャネル別(オンライン、オフラインなど) - 2029年までの業界動向および予測。

中東およびアフリカの手袋市場の分析と洞察

手袋は、手を快適に保ち、極端な温度、病気、化学物質、摩耗、摩擦による害から手を守ります。また、素手で触れてはいけない物体に対するガードとしても機能します。医療従事者は、汚染防止と衛生上の理由から、ラテックス、ニトリルゴム、またはビニールの使い捨て手袋を頻繁に着用します。犯罪現場で証拠を破壊しないように、警察官は勤務中に頻繁に手袋を着用します。また、電気作業中や有害な化学物質を扱う専門家が火傷を防ぐのにも役立ちます。

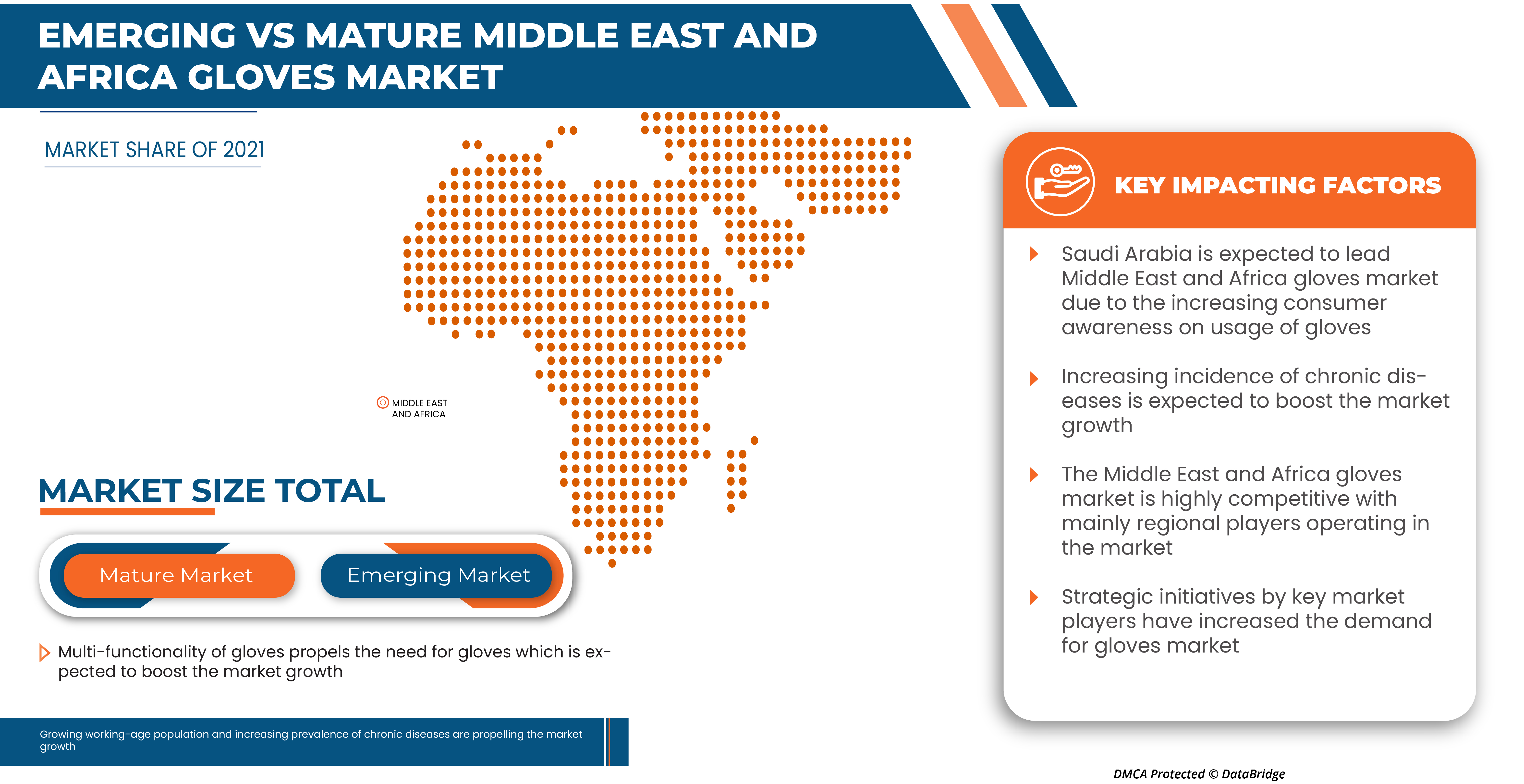

中東およびアフリカの手袋市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に6.7%のCAGRで成長し、2021年の5億7,677万米ドルから2029年には9億7,183万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別(ニトリル手袋、ラテックス手袋、ビニール手袋、ポリエチレン手袋、綿織物手袋、耐穿刺手袋、ブチル手袋、アルミ加工手袋、ネオプレン手袋、ケブラー手袋、革手袋など)、タイプ別(使い捨ておよび再利用可能)、用途別(生物、化学、機械、熱、帯電防止など)、エンドユーザー別(医療およびヘルスケア、食品および飲料、防火、建設、製造業、金属加工、電子機器など)、流通チャネル別(オンライン、オフラインなど) |

|

対象国 |

南アフリカ、サウジアラビア、UAE、エジプト、イスラエル、その他の中東およびアフリカ諸国 |

|

対象となる市場プレーヤー |

Tenacious Holdings, Inc.、MCR Safety、Cardinal Health、Lakeland Inc.、Shamrock Manufacturing Co. Inc、VIP GLOVE SDN BHD (Malaysia)、Midas Safety、Superior Glove、Hartalega Holdings、Rubberex Corporation (M) Berhad、3M、Kimberly-Clark Worldwide, Inc、ANSELL LTD.、Honeywell International Inc、DuPont de Nemours Inc.、Top Glove Corporation Bhd、Kossan Rubber Industries Bhd、Comfort Rubber Gloves Industries Sdn Bhd、DELTA PLUS など |

市場の定義

手袋は、手を覆う衣服です。親指と各指には通常、開口部または鞘があります。手袋 (鎖帷子など) の材料には、布、ニットまたはフェルトウール、革、ゴム、ラテックス、ネオプレン、シルク、金属などがあります。ケブラー製の手袋は、着用者を切傷から守ります。月まで旅したアポロ/スカイラブ A7L のような圧力服や宇宙服では、手袋と長手袋は不可欠な部分です。宇宙服用の手袋は、ある程度の感度と柔軟性に加えて、硬度と環境保護性を兼ね備えています。

手袋市場の動向

中東およびアフリカの手袋市場の推進要因、機会、制約/課題は次のとおりです。

- 手袋の使用に関する消費者の意識向上

医療従事者が自分自身と患者を感染から守ろうとする中で、手袋の慎重な使用と十分な備蓄は依然として重要です。これらの手袋は微生物と手の間にバリアを作ります。手袋は医療従事者を伝染性感染から守る盾の役割を果たします。手術中、外科医やその他の専門家は患者とともに感染の危険にさらされます。医療用手袋は、医師と医療従事者を二次汚染から守るのに役立ちます。さらに、病院内で手袋を着用することは、環境中の微生物の拡散を防ぐのに役立つと推奨されています。さらに、ここ数十年、市場の圧力や、食中毒の増加に見られる健康や環境への懸念などの他の要因への反応として、食品の品質問題に対する意識が高まり、高品質の食品に対する需要が高まっています。食品関連疾患の発生率の増加により、消費者は食生活やライフスタイルに重大な変化をもたらし、これまで以上に健康に気を配るようになりました。食品の安全性は、消費者の健康だけでなく、食品業界全体や規制当局にとっても重要です。

例えば、

- 国連食糧農業機関(UNFAO)によると、イタリア開発協力は、食品安全と食糧安全保障のためのFAO信託基金に1,400万ユーロの追加拠出を行った。

食品安全を推進するために政府当局が講じる取り組みの増加と、消費者の食品安全に対する意識の高まりが、市場の成長を後押しするでしょう。したがって、欧州、米国、中国、インド、ベトナムなどの低所得国および中所得国などの国々における食品安全の近代化は、食品安全に対する消費者の全体的な期待の高さと、改善を求める消費者の要求をさらに強めた重大な病気の発生の組み合わせによって推進されており、市場の需要が増加すると予想されます。

- 慢性疾患の発生率増加

慢性疾患の有病率が高いのは、人口の急激な増加によるもので、感染症は世界中で見られます。したがって、高齢者の慢性疾患と急性疾患の有病率の増加は、入院の増加につながります。これにより、市場での手袋の需要が高まっています。消毒剤の使用と滅菌方法による消毒と滅菌は、医療器具や手術器具が患者に感染性病原体を伝染させないようにするために不可欠です。疾患の評価により、手術室で使用される医療用手袋の需要がさらに高まります。

慢性疾患には、心血管疾患、脳卒中、がん、慢性呼吸器疾患、糖尿病などがあり、心血管疾患は世界中で主な死亡原因となっています。外科的介入には滅菌手術用手袋が必要です。中心血管カテーテル挿入などの一部の非外科的治療手順でも、手術用手袋の使用が必要です。ヘルスケア部門は、天然ゴムラテックス手袋の主要なエンドユーザーの1つです。パウダーフリーのニトリル手袋は、医療環境に最適です。ラテックス以外の手の保護具を使用する場合でも、パウダー付きの素材はお勧めできません。ニトリルは、簡単に取り外せるなど、パウダー付きと同じ利点を持つように特別な処理を経ます。この製品は手術室で使用されており、医療従事者と患者の感染の可能性を減らすことができるため、手袋の需要が増加しています。

手袋は、医療施設でのケアやハウスキーピング活動にも使用できるように設計されています。これらの感染性疾患のリスクが増加すると、そのような疾患を減らすために必要な手袋の需要が直接的に高まります。したがって、慢性疾患の増加は市場の成長の原動力となることが期待されます。

- 政府の取り組みと規制の改善

政府はさまざまな組織や製造会社と連携して、手袋やマスクを含むPPE用品を医療分野に提供してきました。したがって、政府の取り組みにより、医療従事者や産業従事者の安全のために手袋の供給量が増えることになります。また、健康組織やPPEベースの企業との連携を確保し、セミナーやシンポジウムを開催し、製品ポートフォリオを展示して個人の間で意識を高め、市場成長の原動力となることが期待されます。

さらに、食品業界では、手袋は食品や食品接触面への手の接触を防ぐだけでなく、作業員を怪我や汚染から守り、熱、寒さ、湿気から作業員を守り、快適さを提供するためにも使用されています。米国疾病管理予防センターによると、毎年、アメリカ人のおよそ 6 人に 1 人 (4,800 万人) が食中毒で病気になり、3,000 人が死亡し、128,000 人が入院しています。企業が基準を満たしていれば、消費者は購入する製品の安全性と品質を信頼できます。また、輸入業者は、注文した食品が仕様を満たしていると信頼できます。そのため、今日では食品の安全性は大きな関心事です。多くの政府が食品の安全性、品質、公正な取引のためにイニシアチブを取っています。

米国では、FDA の協調的アウトブレイク対応評価 (CORE) ネットワークが開発され、FDA が規制するヒト用栄養補助食品や食品に関連する複数の疾病を伴うインシデントに関する食中毒アウトブレイクの監視、対応、対応後の活動を調整しています。このように、政府は食中毒の蔓延を防ぐための安全対策としてさまざまな取り組みを行っており、これが市場の成長に寄与すると期待されています。

機会

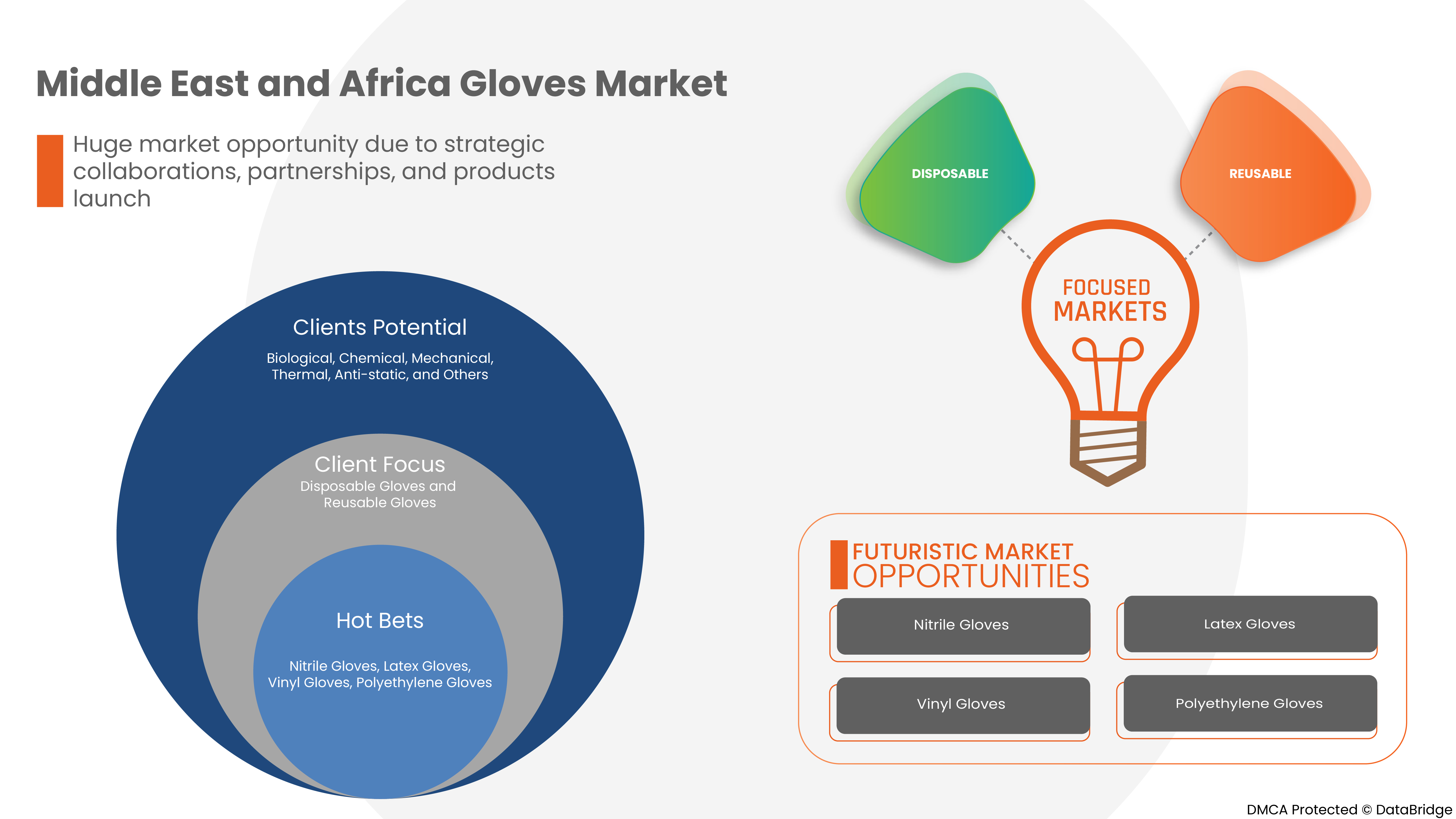

手袋の多機能性

現在、さまざまな危険から身を守るために、多くの種類の手袋が販売されています。手袋の多機能性は、さまざまな用途に貢献しています。

一般的に、手袋は次の 4 つのグループに分類されます。

革、キャンバス、または金属メッシュの手袋

- 金属メッシュ、革、またはキャンバスで作られた丈夫な手袋は、切り傷や火傷から保護します。革やキャンバスの手袋は、持続的な熱からも保護します。

- 革手袋は、火花、中程度の熱、打撃、破片、粗い物体から保護します。

布製およびコーティング布製手袋

- 布製手袋とコーティングされた布製手袋は、さまざまなレベルの保護を提供するために綿またはその他の布で作られています。

- 布製手袋は、汚れ、破片、擦れ、擦り傷から手袋を保護します。粗い素材、鋭い素材、重い素材を扱う場合、十分な保護力はありません。プラスチックコーティングを施すと、布製手袋の強度が増すことがあります。

耐薬品性・耐液体性手袋

- Chemical-resistant gloves are made with different kinds of rubber: natural, butyl, neoprene, nitrile and fluorocarbon (Viton); or various kinds of plastic: Polyvinyl Chloride (PVC), polyvinyl alcohol and polyethylene. These materials can be blended or laminated for better performance. As a general rule, the thicker the glove material, the greater the chemical resistance but thick gloves may impair grip and dexterity, having a negative impact on safety.

- Butyl gloves are made of synthetic rubber and protect against a wide variety of chemicals, such as peroxide, rocket fuels, highly corrosive acids (nitric acid, sulfuric acid, hydrofluoric acid and red-fuming nitric acid), strong bases, alcohols, aldehydes, ketones, esters and nitro compounds. Butyl gloves also resist oxidation, ozone corrosion and abrasion and remain flexible at low temperatures.

- Insulating Rubber Gloves

- Natural (latex) rubber gloves are comfortable to wear, which makes them popular general-purpose gloves. They feature outstanding tensile strength, elasticity and temperature resistance. In addition to resisting abrasions caused by grinding and polishing, these gloves protect employees’ hands from most water solutions of acids, alkalis, salts and ketones.

- Neoprene gloves are made of synthetic rubber and offer good pliability, finger dexterity, high density and tear resistance. They protect against hydraulic fluids, gasoline, alcohol, organic acids and alkalis. They generally have chemical and wear resistance properties superior to those made of natural rubber.

This wide range of varieties and multi-functionality of the gloves act as a great opportunity for market growth.

Restraint/Challenge

However, the barriers to the gloves market are health hazards caused by gloves and in some regions may impede the growth of the gloves hampering the market growth. Additionally, high competition in industries and long lead time for overseas qualification can be challenging factors for market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions and technological innovations in the market. To gain more info on the Middle East and Africa gloves market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In March 2020, as much of the nation began shutting down businesses as a result of COVID-19, Luginbill and Matt Hayes, founder and owner of Unmanned Propulsion Development, recognized that as Tech Port entrepreneurs, they were in an ideal position to help. They initially created gloves, masks, shields, and gowns, but quickly realized the materials would run out long before the end of the pandemic. So for help, eight companies were approached to help and two local companies based in Southern Maryland, Burch Oil, and Triton Defense, where the box was built which is capable of disinfecting 24,000 N95 masks per day, or other PPE equipment, the “hot box” could provide healthcare personnel the ability to reuse their gear at least 20 times.

Middle East and Africa Gloves Market Scope

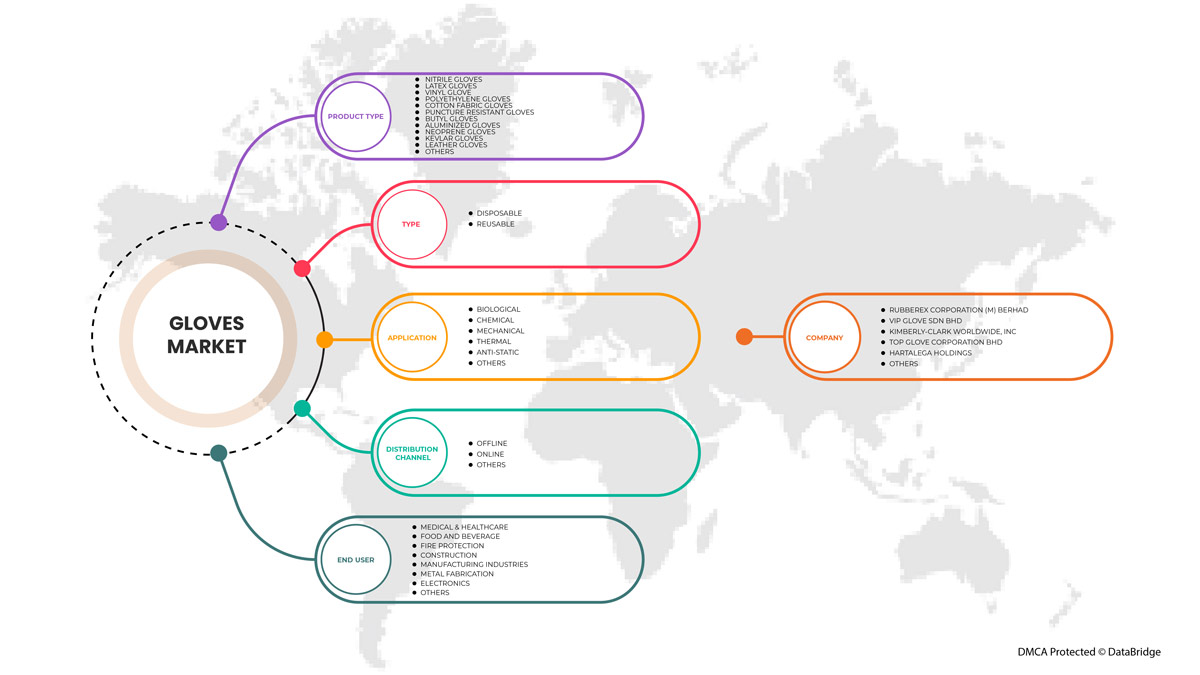

The Middle East and Africa gloves market is segmented into product type, type, application, end user and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PRODUCT TYPE

- Nitrile Gloves

- Latex Gloves

- Vinyl Glove

- Polyethylene Gloves

- Cotton Fabric Gloves

- Puncture Resistant Gloves

- Butyl Gloves

- Aluminized Gloves

- Neoprene Gloves

- Kevlar Gloves

- Leather Gloves

- Others

Based on product type, the market is segmented into nitrile gloves, latex gloves, vinyl glove, polyethylene gloves, cotton fabric gloves, puncture resistant gloves, butyl gloves, aluminized gloves, neoprene gloves, kevlar gloves, leather gloves and others.

BY TYPE

- Disposable

- Reusable

Based on type, the market is segmented into disposable and reusable.

BY APPLICATION

- Biological

- Chemical

- Mechanical

- Thermal

- Anti-Static

- Others

Based on application, the market is segmented into biological, chemical, mechanical, thermal, anti-static and others.

BY END USER

- Medical & Healthcare

- Food & Beverage

- Fire Protection

- Construction

- Manufacturing Industries

- Metal Fabrication

- Electronics

- Others

Based on end user, the market is segmented into medical & healthcare, food & beverage, fire protection, construction, manufacturing industries, metal fabrication, electronics and others.

BY DISTRIBUTION CHANNEL

- Online

- Offline

- Others

Based on distribution channel, the market is segmented into online, offline and others.

Middle East and Africa Gloves Market Regional Analysis/Insights

The Middle East and Africa gloves market is analyzed and market size insights and trends are provided by country, product type, type, application, end user, and distribution channel as referenced above.

Middle East and Africa gloves market comprises of the countries South Africa, Saudi Arabia, U.A.E, Egypt, Israel and rest of Middle East and Africa.

南アフリカは、市場シェアと市場収益の面で中東およびアフリカの手袋市場を支配しており、予測期間中もその優位性を維持し続けるでしょう。これは、この地域での手袋の需要の高まりと市場の急速な成長によるものです。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、中東およびアフリカのブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境と中東・アフリカの手袋市場シェア分析

中東およびアフリカの手袋市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、市場に対する会社の重点にのみ関連しています。

この市場で活動している主要企業としては、Tenacious Holdings, Inc.、MCR Safety、Cardinal Health、Lakeland Inc.、Shamrock Manufacturing Co. Inc、VIP GLOVE SDN BHD (Malaysia)、Midas Safety、Superior Glove、Hartalega Holdings、Rubberex Corporation (M) Berhad、3M、Kimberly-Clark Worldwide, Inc、ANSELL LTD.、Honeywell International Inc、DuPont de Nemours Inc.、Top Glove Corporation Bhd、Kossan Rubber Industries Bhd、Comfort Rubber Gloves Industries Sdn Bhd、DELTA PLUS などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、中東およびアフリカと地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLOVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 PREMIUM INSIGHTS

3.1 PORTER'S FIVE FORCES MODEL

3.2 BRAND COMPETITIVE ANALYSIS: MIDDLE EAST & AFRICA GLOVES MARKET

3.3 MIDDLE EAST & AFRICA GLOVES MARKET: BUYING BEHAVIOUR

3.3.1 RESEARCH

3.3.2 OCCUPATIONAL HEALTH AND ALLERGY CONCERNS

3.3.3 TYPE OF MATERIAL

3.3.4 APPLICATION IN VARIOUS INDUSTRIES

3.3.5 ENVIRONMENTAL ISSUES

3.4 FACTORS INFLUENCING BUYING DECISION

3.5 MIDDLE EAST & AFRICA GLOVES MARKET: PRODUCT ADOPTION SCENARIO

3.5.1 TYPE OF MATERIAL

3.5.2 SAFETY CONCERNS

3.6 IMPACT OF ECONOMIC SLOWDOWN

3.6.1 IMPACT ON PRICES

3.6.2 IMPACT ON SUPPLY CHAIN

3.6.3 IMPACT ON SHIPMENT

3.6.4 IMPACT ON DEMAND

3.6.5 IMPACT ON STRATEGIC DECISIONS

3.7 SUPPLY CHAIN: MIDDLE EAST & AFRICA GLOVES MARKET

3.7.1 RAW MATERIAL PROCUREMENT

3.7.2 MANUFACTURING

3.7.3 MARKETING & DISTRIBUTION

3.7.4 END USERS

3.7.5 LOGISTIC COST SCENARIO

3.7.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

4 MIDDLE EAST & AFRICA GLOVES MARKET: REGULATIONS

4.1 CANADA REGULATION

4.1.1 MEDICAL GLOVES

4.1.2 NON-MEDICAL GLOVES

4.2 WORLD HEALTH ORGANIZATION STANDARDS

4.2.1 GLOVES EXAMINATION (NON-STERILE)-

4.2.2 GLOVES EXAMINATION (NON-STERILE)-

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMER AWARENESS ON USAGE OF GLOVES

5.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

5.1.3 GOVERNMENT INITIATIVES AND IMPROVED REGULATIONS

5.1.4 RISE IN NUMBER OF MANUFACTURING UNIT

5.2 RESTRAINTS

5.2.1 UNREGULATED DISPOSAL AND WASTAGE OF PERSONAL PROTECTIVE EQUIPMENT (PPE)

5.2.2 HEALTH HAZARDS ASSOCIATED WITH GLOVES

5.3 OPPORTUNITIES

5.3.1 GROWING WORKING-AGE POPULATION

5.3.2 WORK PLACE SAFETY REGULATIONS

5.3.3 MULTI-FUNCTIONALITY OF GLOVES

5.4 CHALLENGES

5.4.1 MANUFACTURING OF POOR QUALITY GLOVES

5.4.2 SHIPMENT DELAYS

6 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 NITRILE GLOVES

6.2.1 DISPOSABLE

6.2.2 REUSABLE

6.3 LATEX GLOVES

6.3.1 DISPOSABLE

6.3.2 REUSABLE

6.4 VINYL GLOVES

6.4.1 DISPOSABLE

6.4.2 REUSABLE

6.5 POLYETHYLENE GLOVES

6.5.1 DISPOSABLE

6.5.2 REUSABLE

6.6 COTTON FABRIC GLOVES

6.6.1 DISPOSABLE

6.6.2 REUSABLE

6.7 PUNCTURE RESISTANT GLOVES

6.7.1 DISPOSABLE

6.7.2 REUSABLE

6.8 BUTYL GLOVES

6.8.1 DISPOSABLE

6.8.2 REUSABLE

6.9 ALUMINIZED GLOVES

6.9.1 DISPOSABLE

6.9.2 REUSABLE

6.1 NEOPRENE GLOVES

6.10.1 DISPOSABLE

6.10.2 REUSABLE

6.11 KEVLAR GLOVES

6.11.1 DISPOSABLE

6.11.2 REUSABLE

6.12 LEATHER GLOVES

6.12.1 DISPOSABLE

6.12.2 REUSABLE

6.13 OTHERS

6.13.1 DISPOSABLE

6.13.2 REUSABLE

7 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE

7.1 OVERVIEW

7.2 DISPOSABLE

7.3 REUSABLE

8 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOLOGICAL

8.3 CHEMICAL

8.4 MECHANICAL

8.4.1 AUTOMOTIVE

8.4.2 CHEMICAL

8.4.3 OIL & GAS

8.4.4 OTHERS

8.5 THERMAL

8.6 ANTI-STATIC

8.7 OTHERS

9 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER

9.1 OVERVIEW

9.2 MEDICAL & HEALTHCARE

9.2.1 BY END USE

9.2.1.1 HOSPITALS

9.2.1.2 AMBULATORY SURGERY

9.2.1.3 DIAGNOSTIC CENTERS

9.2.1.4 CLINICS

9.2.1.5 REHABILITATION CENTERS

9.2.1.6 OTHERS

9.2.2 BY PRODUCT TYPE

9.2.2.1 NITRILE GLOVES

9.2.2.2 LATEX GLOVES

9.2.2.3 VINYL GLOVES

9.2.2.4 POLYETHYLENE GLOVES

9.2.2.5 COTTON FABRIC GLOVES

9.2.2.6 PUNCTURE RESISTANT GLOVES

9.2.2.7 BUTYL GLOVES

9.2.2.8 ALUMINIZED GLOVES

9.2.2.9 NEOPRENE GLOVES

9.2.2.10 KEVLAR GLOVES

9.2.2.11 LEATHER GLOVES

9.2.2.12 OTHERS

9.3 FOOD AND BEVERAGE

9.3.1 NITRILE GLOVES

9.3.2 LATEX GLOVES

9.3.3 VINYL GLOVES

9.3.4 POLYETHYLENE GLOVES

9.3.5 COTTON FABRIC GLOVES

9.3.6 PUNCTURE RESISTANT GLOVES

9.3.7 BUTYL GLOVES

9.3.8 ALUMINIZED GLOVES

9.3.9 NEOPRENE GLOVES

9.3.10 KEVLAR GLOVES

9.3.11 LEATHER GLOVES

9.3.12 OTHERS

9.4 FIRE PROTECTION

9.4.1 NITRILE GLOVES

9.4.2 LATEX GLOVES

9.4.3 VINYL GLOVES

9.4.4 POLYETHYLENE GLOVES

9.4.5 COTTON FABRIC GLOVES

9.4.6 PUNCTURE RESISTANT GLOVES

9.4.7 BUTYL GLOVES

9.4.8 ALUMINIZED GLOVES

9.4.9 NEOPRENE GLOVES

9.4.10 KEVLAR GLOVES

9.4.11 LEATHER GLOVES

9.4.12 OTHERS

9.5 CONSTRUCTION

9.5.1 NITRILE GLOVES

9.5.2 LATEX GLOVES

9.5.3 VINYL GLOVES

9.5.4 POLYETHYLENE GLOVES

9.5.5 COTTON FABRIC GLOVES

9.5.6 PUNCTURE RESISTANT GLOVES

9.5.7 BUTYL GLOVES

9.5.8 ALUMINIZED GLOVES

9.5.9 NEOPRENE GLOVES

9.5.10 KEVLAR GLOVES

9.5.11 LEATHER GLOVES

9.5.12 OTHERS

9.6 MANUFACTURING INDUSTRIES

9.6.1 NITRILE GLOVES

9.6.2 LATEX GLOVES

9.6.3 VINYL GLOVES

9.6.4 POLYETHYLENE GLOVES

9.6.5 COTTON FABRIC GLOVES

9.6.6 PUNCTURE RESISTANT GLOVES

9.6.7 BUTYL GLOVES

9.6.8 ALUMINIZED GLOVES

9.6.9 NEOPRENE GLOVES

9.6.10 KEVLAR GLOVES

9.6.11 LEATHER GLOVES

9.6.12 OTHERS

9.7 METAL FABRICATION

9.7.1 NITRILE GLOVES

9.7.2 LATEX GLOVES

9.7.3 VINYL GLOVES

9.7.4 POLYETHYLENE GLOVES

9.7.5 COTTON FABRIC GLOVES

9.7.6 PUNCTURE RESISTANT GLOVES

9.7.7 BUTYL GLOVES

9.7.8 ALUMINIZED GLOVES

9.7.9 NEOPRENE GLOVES

9.7.10 KEVLAR GLOVES

9.7.11 LEATHER GLOVES

9.7.12 OTHERS

9.8 ELECTRONICS

9.8.1 NITRILE GLOVES

9.8.2 LATEX GLOVES

9.8.3 VINYL GLOVES

9.8.4 POLYETHYLENE GLOVES

9.8.5 COTTON FABRIC GLOVES

9.8.6 PUNCTURE RESISTANT GLOVES

9.8.7 BUTYL GLOVES

9.8.8 ALUMINIZED GLOVES

9.8.9 NEOPRENE GLOVES

9.8.10 KEVLAR GLOVES

9.8.11 LEATHER GLOVES

9.8.12 OTHERS

9.9 OTHERS

9.9.1 NITRILE GLOVES

9.9.2 LATEX GLOVES

9.9.3 VINYL GLOVES

9.9.4 POLYETHYLENE GLOVES

9.9.5 COTTON FABRIC GLOVES

9.9.6 PUNCTURE RESISTANT GLOVES

9.9.7 BUTYL GLOVES

9.9.8 ALUMINIZED GLOVES

9.9.9 NEOPRENE GLOVES

9.9.10 KEVLAR GLOVES

9.9.11 LEATHER GLOVES

9.9.12 OTHERS

10 MIDDLE EAST & AFRICA GLOVES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 DIRECT SALES

10.2.2 SUPERMARKETS/HYPERMARKETS

10.2.3 MEDICAL STORES

10.2.4 OTHERS

10.3 ONLINE

10.3.1 E-COMMERCE

10.3.2 BRAND WEBSITES

10.3.3 OTHERS

10.4 OTHERS

11 MIDDLE EAST & AFRICA GLOVES MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RUBBEREX CORPORATION (M) BERHAD (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VIP GLOVE SDN BHD (MALAYSIA) (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KIMBERLY-CLARK WORLDWIDE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 TOP GLOVE CORPORATION BHD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HARTALEGA HOLDINGS BERHAD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DUPONT DE NEMOURS INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 HONEYWELL INTERNATIONAL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 KOSSAN RUBBER INDUSTRIES BHD

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ANSELL LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 CARDINAL HEALTH

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 3M

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 COMFORT RUBBER GLOVES INDUSTRIES SDN BHD

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 DELTA PLUS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SUPERIOR GLOVE.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MCR SAFETY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TENACIOUS HOLDINGS, INC. (DBA ERGODYNE)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MIDAS SAFETY

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 LAKELAND INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SHAMROCK MANUFACTURING CO. INC.,

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA GLOVES MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 3 MIDDLE EAST & AFRICA NITRILE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA NITRILE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA LATEX GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LATEX GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA VINYL GLOVE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA VINYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA POLYETHYLENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA POLYETHYLENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COTTON FABRIC GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COTTON FABRIC GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BUTYL GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BUTYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ALUMINIZED GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ALUMINIZED GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA NEOPRENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA NEOPRENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA KEVLAR GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA KEVLAR GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LEATHER GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LEATHER GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 29 MIDDLE EAST & AFRICA DISPOSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REUSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 33 MIDDLE EAST & AFRICA BIOLOGICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CHEMICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA MECHANICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MECHANICAL IN GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA THERMAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ANTI-STATIC IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER, 2015-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER, VOLUME,2015-2029 (UNITS,KILO TONNES)

TABLE 42 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FIRE PROTECTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FIRE PROTECTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA CONSTRUCTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA CONSTRUCTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA METAL FABRICATION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA METAL FABRICATION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA ELECTRONICS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ELECTRONICS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 61 MIDDLE EAST & AFRICA OFFLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA OFFLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ONLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA ONLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA GLOVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLOVES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLOVES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLOVES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLOVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA GLOVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA GLOVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA GLOVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA GLOVES MARKET: SEGMENTATION

FIGURE 11 RISING MANUFACTURING UNITS AND INCREASING CHRONIC DISEASES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA GLOVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NITRILE GLOVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLOVES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA GLOVES MARKET

FIGURE 14 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, 2021

FIGURE 23 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA GLOVES MARKET: SNAPSHOT (2021)

FIGURE 35 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2021)

FIGURE 36 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA GLOVES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。