中東およびアフリカのジオシンセティック市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

1.04 Billion

USD

1.89 Billion

2024

2032

USD

1.04 Billion

USD

1.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.04 Billion | |

| USD 1.89 Billion | |

|

|

|

|

中東およびアフリカのジオシンセティックス市場セグメンテーション、製品別(ジオテキスタイル、ジオメンブレン、ジオグリッド、ジオセル、ジオネット、その他) - 業界動向と2032年までの予測

中東およびアフリカのジオシンセティック市場規模

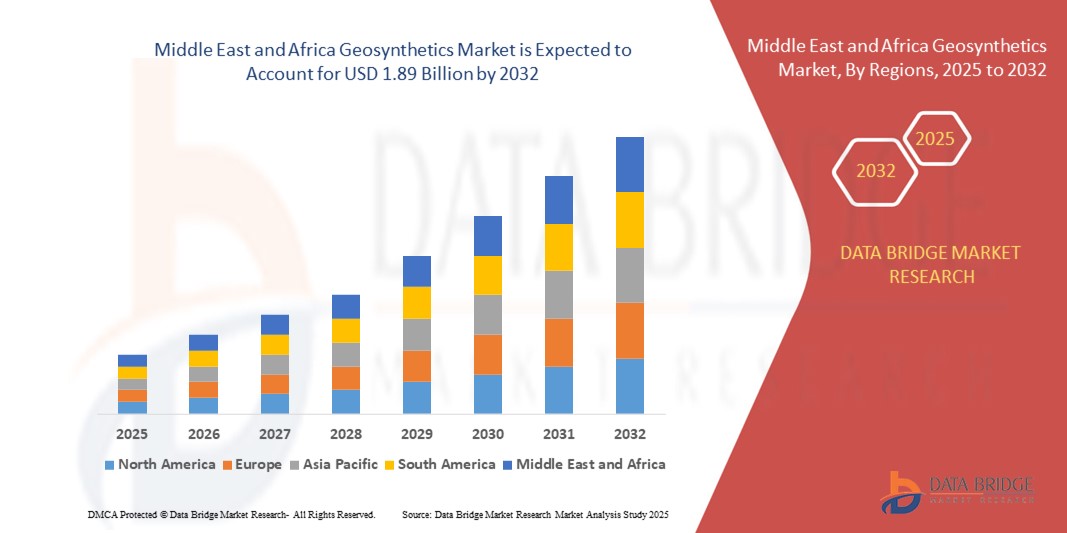

- 中東およびアフリカのジオシンセティック市場規模は2024年に10億4000万米ドルと評価され、予測期間中に7.80%のCAGRで成長し、2032年までに18億9000万米ドル に達すると予想されています 。

- 市場の成長は、インフラ開発への投資の増加、持続可能な建設慣行への重点の高まり、乾燥地域における土壌安定化と浸食防止の必要性の高まりによって主に推進されている。

- 急速な都市化と効果的な廃棄物管理および水資源保全システムの必要性により、この地域では輸送、鉱業、農業などの分野でジオシンセティックスの適用が拡大しています。

中東およびアフリカのジオシンセティック市場分析

- 市場は、UAE、サウジアラビア、南アフリカなどの国における都市の拡大、高速道路や鉄道網のプロジェクト、大規模な水資源管理の取り組みにより、大きな勢いを見せています。

- ジオテキスタイル、ジオメンブレン、ジオグリッドなどのジオシンセティックスの需要は、補強、濾過、封じ込めソリューションが重要な石油・ガスパイプライン、埋立地、採掘事業の建設によっても推進されている。

- サウジアラビアは、ビジョン2030に基づく積極的なインフラ開発イニシアチブにより、中東およびアフリカのジオシンセティックス市場を支配し、2024年には最大の収益シェアを占めるだろう。

- 南アフリカは、道路、鉱業、都市開発への投資増加により、中東およびアフリカのジオシンセティック市場において最も高い年平均成長率(CAGR)を記録すると予想されています。環境の持続可能性への関心の高まりと、費用対効果が高く耐久性のある建設資材の採用が、公共部門と民間部門の両方のプロジェクトにおけるジオシンセティックスの使用増加に貢献しています。

- ジオテキスタイル分野は、2024年に市場を席巻し、最大の収益シェアを獲得しました。これは主に、道路建設、埋立地、浸食防止における広範な用途によるものです。その費用対効果、ろ過特性、土壌安定化能力により、乾燥地帯および半乾燥地帯のインフラ整備や環境プロジェクトにおいて、ジオテキスタイルは好まれる素材となっています。地域全体での道路開発と都市拡大の増加も、この分野の堅調な需要をさらに支えています。

レポートの範囲と中東およびアフリカのジオシンセティック市場のセグメンテーション

|

属性 |

中東およびアフリカのジオシンセティックス主要市場分析 |

|

対象セグメント |

|

|

対象国 |

中東およびアフリカ

|

|

主要な市場プレーヤー |

• Mattex Group(サウジアラビア) |

|

市場機会 |

• 廃棄物管理用途におけるジオシンセティックスの拡大 |

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力の概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

中東およびアフリカのジオシンセティック市場動向

インフラおよび環境プロジェクトにおけるジオシンセティックスの統合の増加

- 中東・アフリカ地域では、高速道路、空港、港湾、鉄道といった大規模インフラ開発への投資増加に伴い、ジオシンセティックスの需要が高まっています。これらの資材は、土壌の強化、排水、分離において重要な役割を果たし、構造物の寿命と耐久性の向上に貢献します。アラブ首長国連邦やサウジアラビアなどの国々は、高度な地盤工学的ソリューションを必要とする大規模プロジェクトが進行中であり、この傾向に大きく貢献しています。

- 環境への配慮も、廃棄物管理や水資源保全へのジオシンセティックスの活用を促進しています。ジオメンブレンとジオテキスタイルは、特に水不足に悩む地域で、埋立地のライナー、浸出水収集システム、貯水池などに広く利用されています。費用対効果の高い封じ込めと環境悪化の抑制を可能にするこれらの素材は、持続可能なプロジェクト計画に不可欠です。

- 例えば、2023年には、サウジアラビアの紅海プロジェクトにおいて、リゾート建設中に沿岸生態系を保護するためにジオシンセティックライナーが採用され、この地域における環境に配慮したインフラ開発のベンチマークとなりました。この応用は、この素材の環境耐性と極端な気候条件への適応性を実証しました。

- サハラ以南のアフリカでは、急速な都市化により、排水・洪水対策プロジェクトにおけるジオシンセティックスソリューションの需要が高まっています。ラゴスやナイロビなどの都市では、季節的な洪水対策と強靭なインフラ整備を支援するため、ジオテキスタイルを用いた雨水管理システムへの投資が進んでいます。

- 各国政府が持続可能性と気候変動に強い建設を重視する中、ジオシンセティックス市場は引き続き拡大すると予想されます。地域生産可能な耐久性のある素材の革新と、性能重視の設計の普及は、地域全体の長期的な成長にとって不可欠です。

中東およびアフリカのジオシンセティック市場の動向

ドライバ

インフラ開発の拡大と環境持続可能性を重視する規制

• 中東およびアフリカにおける政府主導のインフラ整備計画の急増は、ジオシンセティックスの需要を大幅に押し上げています。道路や鉄道の拡張からエネルギーや水道プロジェクトに至るまで、ジオシンセティックスは構造の健全性の確保、材料消費量の削減、そして維持管理コストの最小化に不可欠です。基盤補強や路盤分離にジオシンセティックスを使用することで、困難な土壌条件におけるプロジェクトのパフォーマンスを最適化することができます。

• 湾岸協力会議(GCC)諸国を中心に、環境保護規制が厳格化しており、埋立地、採掘作業、石油・ガスの封じ込めにおいて、ジオメンブレン、ジオテキスタイル、ジオネットの使用が増加しています。これらの資材は、浸出水の浸出防止、地下水の保全、そしてゼロ・ウェイスト政策の推進に不可欠です。

• 政府の入札やインフラ基準では、設計・調達の枠組みにおいてジオシンセティックスがますます指定されるようになっています。この正式な承認により、市場での認知度が向上し、地域全体の製造能力への投資が促進されます。

• 例えば、エジプト政府は2022年に、すべての主要道路建設プロジェクトにおいてジオシンセティックスの使用を義務付ける国家土質工学イニシアチブを開始しました。この取り組みにより、建設効率が向上しただけでなく、プロジェクト報告書によると、長期的なメンテナンス費用が20%以上削減されました。

• インフラ投資が加速し、環境目標の優先順位が高まるにつれ、ジオシンセティックスの需要は着実に増加すると予想されます。市場の勢いを維持するためには、関係者は地域に密着した製品ソリューション、技術者や請負業者への研修、そして規制当局との連携に注力する必要があります。

抑制/挑戦

遠隔地では設置コストが高く、技術的専門知識も限られている

• 長期的なメリットがあるにもかかわらず、ジオシンセティックス材の初期費用とその設置は、特に価格に敏感な国や資源が限られている国では依然として課題となっています。アフリカ諸国の予算制約により、特に国際的な資金やドナーからの支援がない公共部門のプロジェクトでは、高性能ジオシンセティックスの導入が制限されています。

• ジオシンセティックスの施工には、確実な性能を得るために熟練した作業員と精密な技術が必要です。しかし、中東およびアフリカのいくつかの地域では、訓練を受けた人材が不足しており、その結果、施工が最適でなかったり、システムが早期に故障したりするケースが多々あります。このことが、この技術への信頼を損ない、市場への浸透を遅らせています。

• 物流とサプライチェーンの制約は、遠隔地や内陸地における材料のタイムリーな入手にも影響を及ぼします。輸送コストの高騰、通関手続きの遅延、そして不安定な販売網により、プロジェクトを予定通り予算内で遂行することが困難になっています。

• 例えば、2023年には、エチオピアとウガンダのインフラ請負業者は、資格のある設置業者の不足とジオグリッドの調達の課題により高速道路の安定化プロジェクトに遅延が生じ、プロジェクトのスケジュールに影響を及ぼし、コストが15%以上膨らんだと報告しました。

• 研修プログラムや現地生産によってこれらの問題に対処することは可能ですが、持続可能なサプライチェーンと技術知識を構築するには、業界間の連携が不可欠です。ライフサイクルコスト削減に関する意識向上と、ジオシンセティックスの専門知識を地域に展開する拠点の設置が、これらの障壁を克服する鍵となります。

中東およびアフリカのジオシンセティックス市場の範囲

市場は、製品タイプに基づいて、ジオテキスタイル、ジオメンブレン、ジオグリッド、ジオセル、ジオネットなどに分類されています。

- 製品別

中東・アフリカのジオシンセティックス市場は、製品別にジオテキスタイル、ジオメンブレン、ジオグリッド、ジオセル、ジオネット、その他に分類されます。ジオテキスタイルは、道路建設、埋立地、浸食防止といった幅広い用途で広く利用されていることから、2024年には市場を牽引し、最大の収益シェアを獲得しました。その費用対効果、ろ過特性、土壌安定化能力の高さから、乾燥地帯および半乾燥地帯のインフラ整備や環境プロジェクトにおいて、ジオテキスタイルは特に好まれる素材となっています。また、地域全体で道路開発と都市開発が進んでいることも、このセグメントの堅調な需要を支えています。

ジオメンブレン分野は、2025年から2032年にかけて、水封じ込め、鉱業、廃棄物管理用途での採用増加を背景に、最も高い成長率を達成すると予想されています。これらの不浸透性ライナーは、特に地下水保護が不可欠な水不足の環境において、浸透と汚染の抑制に不可欠です。環境規制の強化と持続可能なインフラの必要性の高まりに伴い、中東およびアフリカ市場全体でジオメンブレンの需要は急増し続けています。

中東およびアフリカのジオシンセティック市場地域分析

- サウジアラビアは、ビジョン2030に基づく積極的なインフラ開発イニシアチブにより、中東およびアフリカのジオシンセティックス市場を支配し、2024年には最大の収益シェアを占めるだろう。

- NEOM、ザ・ライン、大規模輸送回廊などのメガプロジェクトに国が注力していることで、土壌強化、排水、環境封じ込めにおける高度なジオシンセティックソリューションの需要が大幅に高まっています。

- 持続可能な材料を統合するための規制義務と相まって、公共部門の支援は、埋立地でのジオメンブレン、道路でのジオテキスタイル、水管理システムでのジオネットの広範な使用を促進しています。

- さらに、国際的なエンジニアリング会社や技術プロバイダーとの連携により、現地での実行能力と製品イノベーションが向上しています。

- サウジアラビアは都市変革と並んで生態学的持続可能性を優先し続けており、ジオシンセティックス市場はインフラの耐久性を確保し、環境リスクを軽減し、複数のセクターにわたるプロジェクト効率を向上させる上で重要な役割を果たすことが期待されています。

南アフリカのジオシンセティック市場に関する洞察

南アフリカは、インフラの改修、鉱業活動、環境保護への取り組みの増加により、2025年から2032年にかけて最も高い成長率を達成すると予想されています。政府が道路、埋立地、水管理システムの改良に注力していることから、ジオテキスタイル、ジオメンブレン、ジオグリッドの需要が高まっています。さらに、持続可能な建設手法の導入と、都市開発プロジェクトと農村開発プロジェクトの両方における侵食防止と土壌安定化のニーズの高まりが、予測期間中の南アフリカ市場の力強い成長を支えると予想されます。

中東およびアフリカのジオシンセティック市場シェア

中東およびアフリカのジオシンセティックス業界は、主に次のような定評のある企業によって牽引されています。

• Mattex Group(サウジアラビア)

• Fibertex Nonwovens A/S(南アフリカ)

• Africor Construction and Civils(南アフリカ)

• Geotextiles Africa(南アフリカ)

• TenCate Geosynthetics Middle East(UAE)

• Kaytech Engineered Fabrics(南アフリカ)

• Atarfil Middle East FZ-LLC(UAE)

• Naue GmbH & Co. KG – Middle East Division(UAE)

• Maccaferri Middle East(UAE)

• Solmax Middle East(サウジアラビア)

中東およびアフリカのジオシンセティック市場の最新動向

- 2023年3月、マカフェリは革新的な土壌浸食防止ソリューションを提供することで、タンザニアの主要鉄道インフラの完成に重要な役割を果たしました。この開発は、地域と世界市場との連携を強化し、持続可能なインフラの実現を支援します。同社の関与は、中東およびアフリカのジオシンセティックス分野における市場プレゼンスの強化と収益成長の促進につながると期待されています。

- 2022年3月、フロイデンベルグ・パフォーマンス・マテリアルズは、建築・建設分野における屋根材製品の段階的な値上げを発表しました。2022年4月1日より価格は9%上昇し、2022年5月1日にはさらに6%上昇します。この値上げは、生産コストの上昇を相殺し、品質基準を維持するために実施されました。これにより、利益率の向上と長期的な市場競争力の強化が期待されます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。