中東およびアフリカの環境に優しい包装市場、タイプ別(リサイクル包装、再利用可能包装、分解性包装)、材料タイプ(紙および板紙、プラスチック、金属、ガラス、デンプン系材料、その他)、製品タイプ(バッグ、ポーチおよびサシェ、ボックス、コンテナ、フィルム、トレイ、チューブ、ボトルおよびジャー、缶、その他)、技術(アクティブ包装、成形包装、代替繊維包装、その他)、層(一次包装、二次包装、三次包装)、用途(食品、飲料、医薬品、パーソナルケア、ホームケア、その他)、国別(UAE、サウジアラビア、エジプト、イスラエル、南アフリカ)、業界動向および2029年までの予測

市場分析と洞察:中東およびアフリカの環境に優しい包装市場

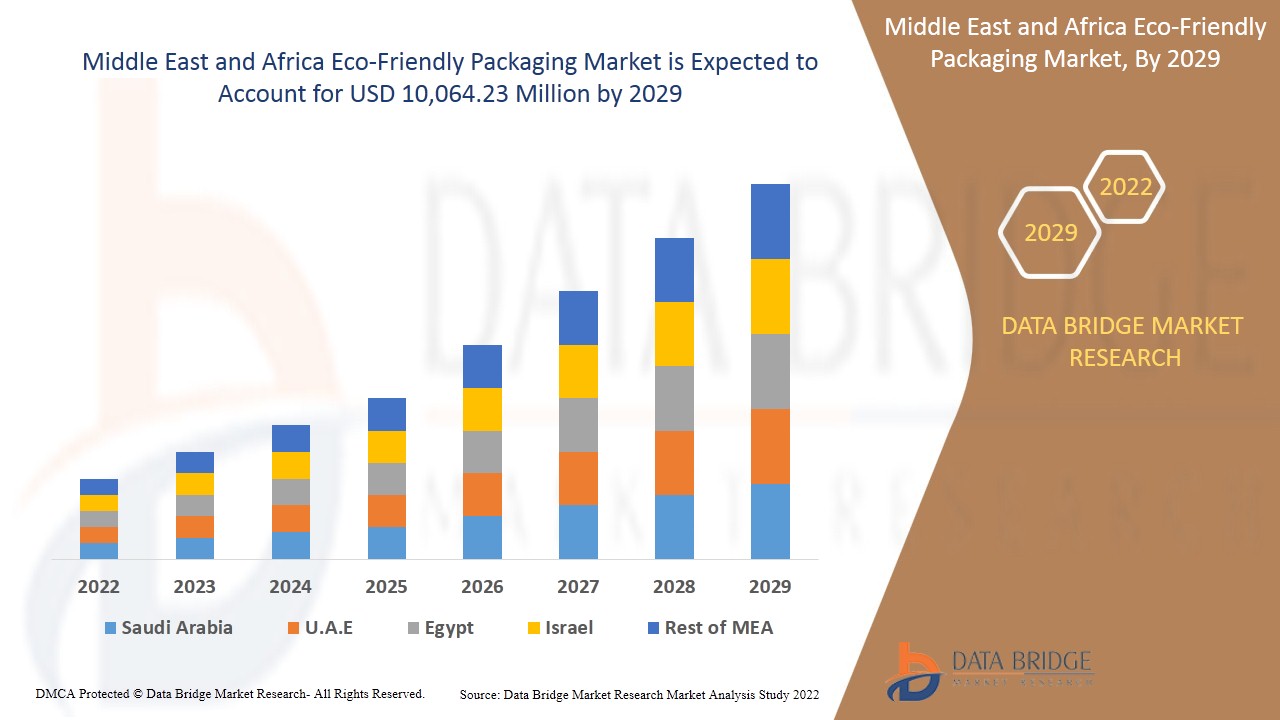

中東およびアフリカの環境に優しい包装市場は、2022年から2029年の予測期間に市場の成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.4%のCAGRで成長し、2029年までに100億6,423万米ドルに達すると分析しています。

環境に優しい包装とは、リサイクルしやすく、人や環境にとって安全で、リサイクルされた材料から作られた包装のことです。エネルギー消費と天然資源への影響を最小限に抑えた材料と製造方法を使用しています。消費者は包装の環境への影響についてますます懸念しています。企業は消費者や政府から、製品に環境に優しい包装を使用するよう圧力を受けています。

環境に優しいパッケージングソリューションの目的は、製品パッケージの量を減らし、再生可能/再利用可能な材料の使用を促進し、パッケージ関連の費用を削減し、パッケージの製造時に有毒材料の使用を排除し、パッケージを簡単にリサイクルするオプションを提供することです。

プラスチックなどの従来の包装による環境問題や汚染に対する一般の意識の高まりにより、環境に優しい包装の需要が高まり、中東およびアフリカの環境に優しい包装市場の成長が促進されると見込まれています。主な制約は、環境に優しい包装製品の利点に関する認識の欠如です。包装製品の大幅な革新により、市場にチャンスがもたらされると期待されています。リサイクル プロセスのコストの高さとインフラの貧弱さが、中東およびアフリカの環境に優しい包装市場の課題となる可能性があります。

この中東およびアフリカの環境に優しいパッケージング市場レポートでは、市場シェア、新しい開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点からの機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、希望する目標を達成できるようお手伝いします。

中東およびアフリカの環境に優しい包装市場の 範囲と市場規模

中東およびアフリカの環境に優しい包装市場は、タイプ、材料タイプ、製品タイプ、技術、層、および用途に基づいて、6 つの主要なセグメントに分割されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コア アプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- タイプに基づいて、中東およびアフリカの環境に優しい包装市場は、リサイクル内容の包装、再利用可能な包装、および分解可能な包装に分類されます。 2022年には、特性を損なうことなく何度も使用できるという性質上、再利用可能な包装セグメントが市場を支配すると予想されます。

- 材料の種類に基づいて、中東およびアフリカの環境に優しい包装市場は、紙および板紙、プラスチック、金属、ガラス、デンプンベースの材料、およびその他のカテゴリに分類されます。 2022年には、紙および板紙セグメントが、環境への影響が少ない包装ソリューションに対して100%自然分解性であるため、中東およびアフリカの環境に優しい包装市場を支配すると予想されます。

- 製品タイプに基づいて、中東およびアフリカの環境に優しい包装市場は、バッグ、ポーチとサシェ、ボックス、コンテナ、フィルム、トレイ、チューブ、ボトルとジャー、缶、その他に分類されます。 2022年には、箱は梱包された材料を非常に効率的に保護し、重量物に耐える優れた強度を備えているため、箱セグメントが中東およびアフリカの環境に優しい包装市場を支配すると予想されます。

- 技術に基づいて、中東およびアフリカの環境に優しい包装市場は、アクティブ包装、成形包装、代替繊維包装、その他に分類されます。 2022年には、代替繊維包装が中東およびアフリカの環境に優しい包装市場を支配し、紙に代わる環境に優しい代替品となることが期待されています。 また、環境と人間の健康の両方に有害なポリスチレンに代わる、待望の代替品を提供します。

- 中東・アフリカの環境に優しい包装市場は、層に基づいて、一次包装、二次包装、三次包装に分類されます。2022年には、一次包装セグメントが中東・アフリカの環境に優しい包装市場を支配すると予想されます。これは、一次包装セグメントでは、外部環境条件によって製品が変化することなく、そのままの状態で保存できるためです。

- 用途に基づいて、中東およびアフリカの環境に優しい包装市場は、食品、飲料、医薬品、パーソナルケア、ホームケア、その他に分類されます。2022年には、この地域の食品産業が急成長し、食品業界で環境に優しい使い捨て包装の使用が増えているため、食品セグメントが中東およびアフリカの環境に優しい包装市場を支配すると予想されています。

中東およびアフリカの環境に優しい包装市場の国別分析

中東およびアフリカの環境に優しい包装市場が分析され、国、タイプ、材料タイプ、製品タイプ、技術、層、および用途別に市場規模の情報が提供されます。

中東およびアフリカの環境に優しい包装市場レポートで取り上げられている国は、南アフリカ、エジプト、サウジアラビア、アラブ首長国連邦、イスラエル、およびその他の中東およびアフリカです。2022年には、アラブ首長国連邦が中東およびアフリカの環境に優しい包装市場を支配すると予想されています。これは、日用消費財の需要が高く、消費者が環境に優しい包装を好む傾向にあるため、この地域での環境に優しい包装の成長が加速するためです。南アフリカは、環境への懸念の高まりと環境に優しい製品に関する国民の意識の高まりにより、成長すると予想されています。サウジアラビアは、ほとんどの政府がビニール袋に対して厳格な規制を実施しているため、中東およびアフリカの環境に優しい包装市場で成長すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

中東・アフリカの環境に優しい包装市場の成長

中東およびアフリカの環境に優しい包装市場では、市場向けのさまざまな種類の製品のインストールベースの各国の成長、ライフライン曲線を使用したテクノロジーの影響、乳児用調合乳の規制シナリオの変更、およびそれらが環境に優しい包装市場に与える影響に関する詳細な市場分析も提供されます。データは、2011年から2019年までの履歴期間で利用できます。

競争環境と中東・アフリカの環境に優しい包装市場シェア分析

中東およびアフリカの環境に優しい包装市場の競争環境は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、会社の強みと弱み、製品の発売、臨床試験パイプライン、ブランド分析、製品承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。上記のデータ ポイントは、中東およびアフリカの環境に優しい包装市場への会社の重点にのみ関連しています。

中東およびアフリカの環境に優しいパッケージングレポートで取り上げられている主要企業には、Mondi、Sealed Air、Crown Holdings、Inc.、Tetra Pak、Huhtamaki、Berry Global Inc.、Amcor plc、Ball Corporation、Pactiv Evergreen Inc.、Plastipak Holdings、Inc.、Nampak Ltd.、Elopak、UFlex Limited などがあります。DBMR アナリストは、競争上の強みを理解し、各競合他社の競合分析を個別に提供します。

例えば、

- 2021年10月、モンディはフィンランドの高級ドッグフード分野で最も認知されているブランドの1つであるハウハウチャンピオン向けに、リサイクル可能なモノマテリアルペットフードパッケージの供給を開始しました。この開発により、モンディはパッケージソリューションのためにさらに多くのペットフード企業を買収できるようになります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SINGLE-USE PLASTIC BAN HAS HEIGHTENED DEMAND FOR ECO-FRIENDLY PACKAGING

5.1.2 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS

5.1.3 RISE IN AWARENESS REGARDING ENVIRONMENTAL CONSERVATION AND SUSTAINABLE LIVING

5.1.4 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL SUSTAINABILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY OF RAW MATERIALS

5.2.2 CONSTRAINT IN PRODUCTION CAPACITIES

5.2.3 LACK OF KNOWLEDGE AND LOW ACCEPTANCE FOR SUSTAINABLE PACKAGING IN DEVELOPING ECONOMIES

5.3 OPPORTUNITIES

5.3.1 CONSIDERABLE INNOVATIONS IN PACKAGING PRODUCTS

5.3.2 SIGNIFICANT GOVERNMENT INITIATIVES TO PROMOTE USE OF ECO-FRIENDLY PACKAGING

5.3.3 INCREASE IN GROWTH POTENTIAL IN PACKAGING MARKET AND RISING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 HIGH COST OF ECO-FRIENDLY PACKAGING AS COMPARED TO CONVENTIONAL PRODUCTS

5.4.2 HIGH COST AND POOR INFRASTRUCTURE FOR RECYCLING PROCESSES

6 COVID 19 IMPACT ON THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 REUSABLE PACKAGING

7.3 RECYCLED CONTENT PACKAGING

7.4 DEGRADABLE PACKAGING

8 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER & PAPER BOARD

8.2.1 PAPER & PAPER BOARD, BY MATERIAL TYPE

8.2.1.1 RECYCLED (COATED AND UNCOATED)

8.2.1.2 SOLID BLEACH SULFATE (SBS)

8.2.1.3 COATED UNBLEACHED KRAFT (CUK)

8.2.1.4 OTHERS

8.3 PLASTIC

8.3.1 PLASTIC, BY MATERIAL TYPE

8.3.1.1 BIO-BASED PLASTIC

8.3.1.2 BIODEGRADABLE PLASTIC

8.3.1.3 OTHERS

8.4 GLASS

8.4.1 GLASS, BY MATERIAL TYPE

8.4.1.1 SODA ASH

8.4.1.2 SAND

8.4.1.3 LIMESTONE

8.5 METAL

8.5.1 METAL, BY MATERIAL TYPE

8.5.1.1 ALUMINIUM

8.5.1.2 STEEL

8.5.1.3 OTHER

8.6 STARCH-BASED MATERIALS

8.7 OTHERS

9 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BOXES

9.3 BAGS

9.4 POUCHES & SACHETS

9.5 CONTAINERS

9.6 BOTTLES & JARS

9.7 CANS

9.8 FILMS

9.9 TUBES

9.1 TRAYS

9.11 OTHERS

10 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 ALTERNATE FIBER PACKAGING

10.2.1 ALTERNATE FIBER PACKAGING, BY TECHNIQUE

10.2.1.1 BAMBOO FIBER

10.2.1.2 MUSHROOM PACKAGING

10.2.1.3 OTHERS

10.3 MOLDED PACKAGING

10.3.1 MOLDED PACKAGING, BY TECHNIQUE

10.3.1.1 TRANSFER MOLDED PULP PACKAGING

10.3.1.2 THICK WALL PULP PACKAGING

10.3.1.3 THERMOFORMED PULP PACKAGING

10.3.1.4 PROCESSED PULP PACKAGING

10.4 ACTIVE PACKAGING

10.4.1 ACTIVE PACKAGING, BY TECHNIQUE

10.4.1.1 MODIFIED ATMOSPHERE PACKAGING (MAP)

10.4.1.2 ANTIMICROBIAL PACKAGING

10.4.1.3 BARRIER PACKAGING

10.5 OTHERS

11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY APPLICATION

12.2.1.1 BAKERY & CONFECTIONARY

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 READY TO EAT FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 FRUITS & VEGETABLES

12.2.1.6 MEAT PRODUCTS

12.2.1.7 OTHERS

12.2.2 FOOD, BY TYPE

12.2.2.1 REUSABLE PACKAGING

12.2.2.2 RECYCLED CONTENT PACKAGING

12.2.2.3 DEGRADABLE PACKAGING

12.3 BEVERAGES

12.3.1 BEVERAGES, BY APPLICATION

12.3.1.1 NON-ALCOHOLIC

12.3.1.2 ALCOHOLIC

12.3.2 BEVERAGES, BY TYPE

12.3.2.1 REUSABLE PACKAGING

12.3.2.2 RECYCLED CONTENT PACKAGING

12.3.2.3 DEGRADABLE PACKAGING

12.4 PHARMACEUTICALS

12.4.1 PHARMACEUTICALS, BY TYPE

12.4.1.1 REUSABLE PACKAGING

12.4.1.2 RECYCLED CONTENT PACKAGING

12.4.1.3 DEGRADABLE PACKAGING

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY TYPE

12.5.1.1 REUSABLE PACKAGING

12.5.1.2 RECYCLED CONTENT PACKAGING

12.5.1.3 DEGRADABLE PACKAGING

12.6 HOME CARE

12.6.1 HOME CARE, BY TYPE

12.6.1.1 REUSABLE PACKAGING

12.6.1.2 RECYCLED CONTENT PACKAGING

12.6.1.3 DEGRADABLE PACKAGING

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 REUSABLE PACKAGING

12.7.1.2 RECYCLED CONTENT PACKAGING

12.7.1.3 DEGRADABLE PACKAGING

13 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 UNITED ARAB EMIRATE

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 AWARD

14.6 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 WEST ROCK COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 CROWN HOLDING, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AMCOR PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 TETRA PAK

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BERRY MIDDLE EAST & AFRICA INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 SMUFIT KAPPA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DS SMITH

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 MONDI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ARDAGH GROUP S.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 BALL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ELOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATES

16.12 EMERALD PACKAGING

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATES

16.13 HUHTAMAKI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NAMPAK LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 PACTIV EVERGREEN INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 PLASTIPAK HOLDINGS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

16.17 PRINTPACK

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 SEALED AIR

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SONOCO PRODUCTS COMPANY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 UFLEX LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE - 4819 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE – 4819 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 7 MIDDLE EAST & AFRICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 9 MIDDLE EAST & AFRICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA STARCH-BASED MATERIALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BOXES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BAGS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA POUCHES & SACHETS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONTAINERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA BOTTLES & JARS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CANS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA FILMS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TUBES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA TRAYS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PRIMARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SECONDARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA TERTIARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 62 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 64 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 86 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 87 UNITED ARAB EMIRATE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 UNITED ARAB EMIRATE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 89 UNITED ARAB EMIRATE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 90 UNITED ARAB EMIRATE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 93 UNITED ARAB EMIRATE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 94 UNITED ARAB EMIRATE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 95 UNITED ARAB EMIRATE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 UNITED ARAB EMIRATE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 UNITED ARAB EMIRATE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 108 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 115 SAUDI ARABIA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 117 SAUDI ARABIA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 SAUDI ARABIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 130 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 131 SOUTH AFRICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH AFRICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 152 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 153 EGYPT PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 EGYPT PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 155 EGYPT METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 156 EGYPT GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 157 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 159 EGYPT ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 160 EGYPT MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 161 EGYPT ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 162 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 163 EGYPT ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 EGYPT FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 EGYPT FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 EGYPT BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 EGYPT PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 EGYPT PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 EGYPT HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 EGYPT OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 174 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 175 ISRAEL PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 176 ISRAEL PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 177 ISRAEL METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 178 ISRAEL GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 181 ISRAEL ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 182 ISRAEL MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 ISRAEL ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 185 ISRAEL ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 ISRAEL FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 187 ISRAEL FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 ISRAEL BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 ISRAEL BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 ISRAEL PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 ISRAEL PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 ISRAEL HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 ISRAEL OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 2 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS IS DRIVING MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 REUSABLE PACKAGING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 18 PLASTIC WASTE GENERATED BY KEY COUNTRIES, 2021

FIGURE 19 CARDBOARD COSTS IN MONTH OF MAY 2020 & 2021

FIGURE 20 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2021

FIGURE 24 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2021

FIGURE 25 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 26 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST AND AFRICA ECO-FRIENDLY PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA ECO-FRIENDLY PACKAGING MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。