中東およびアフリカの特定用途向け集積回路 (ASIC) 市場、設計タイプ別 (フルカスタム、セミカスタム、プログラマブル)、プログラミング技術別 (スタティック RAM、EPROM、EEPROM、アンチヒューズ、その他)、アプリケーション別 (民生用電子機器、データセンターおよびコンピューティング、IT および通信、医療、マルチメディア、自動車、産業)、国別 (サウジアラビア、UAE、イスラエル、南アフリカ、エジプト、その他の中東およびアフリカ)、2029 年までの市場動向および予測。

市場分析と洞察:中東およびアフリカの特定用途向け集積回路(ASIC)市場

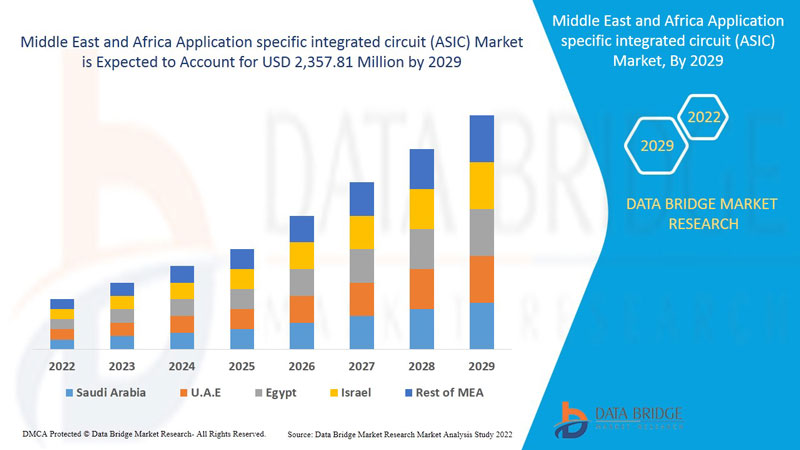

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場は、2022 年から 2029 年の予測期間に市場の成長が見込まれています。Data Bridge Market Research は、市場は 2022 年から 2029 年の予測期間に 6.9% の CAGR で成長し、2029 年までに 23 億 5,781 万米ドルに達すると分析しています。

ASIC (特定用途向け集積回路) は、幅広い用途向けに設計されているのではなく、特定のアプリケーションに合わせて調整された IC チップです。ASIC は、たとえば、デジタル音声レコーダーや高効率ビデオ エンコーダ (AMD VCE など) で実行されるチップです。ASSP (特定用途向け標準製品) チップは、ASIC と 7400 シリーズや 4000 シリーズなどの業界標準集積回路の中間に位置します。MOS 集積回路チップである ASIC チップは、通常、FPGA を含む金属酸化膜半導体 (MOS) テクノロジを使用して製造されます。ASIC で利用できる最大の複雑さ (したがって有用性) は、機能サイズが縮小し、設計ツールが時間の経過とともに改善されるにつれて、5,000 ロジック ゲートから 1 億以上に拡大しました。マイクロプロセッサ、ROM、RAM、EEPROM、フラッシュ メモリなどのメモリ ブロック、およびその他の重要なビルディング ブロックは、最新の ASIC によく含まれています。SoC は、このような ASIC (システム オン チップ) の一般的な呼び名です。 Verilog や VHDL などのハードウェア記述言語 (HDL) は、デジタル ASIC の設計者が ASIC の機能を定義するためによく使用されます。

市場を牽引している要因としては、ASIC 駆動の IoT デバイスの出現と自動車アプリケーション向けメカトロニクスの採用の急増が挙げられます。しかし、カスタマイズされた回路の製造に関連する高コストが抑制要因となる可能性があります。さらに、AI の駆動に ASIC 技術の利用が増えているため、ヨーロッパの特定用途向け集積回路 (ASIC) 市場も拡大しています。

この特定用途向け集積回路 (ASIC) 市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から見た機会の分析が提供されます。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場の範囲と市場規模

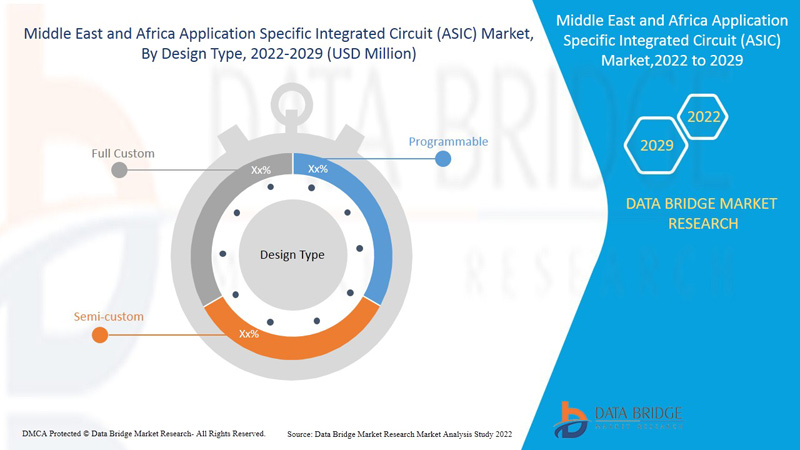

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場は、設計タイプ、プログラミング技術、およびアプリケーションに基づいてセグメント化されています。セグメント間の成長は、ニッチな成長分野と市場へのアプローチ戦略を分析し、コアアプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- 中東およびアフリカの特定用途向け集積回路(ASIC)市場は、設計タイプに基づいて、フルカスタム、セミカスタム、およびプログラマブルに分類されています。2022年には、消費者によるデータやコンテンツに対する需要の高まりに対応するために高度なデータセンターに対する需要が高まり、自動車、製造、医療、マルチメディアなどのさまざまなアプリケーションに使用できるセミカスタムASICテクノロジーの要件が高まっているため、セミカスタムセグメントが中東およびアフリカの特定用途向け集積回路(ASIC)市場を支配すると予想されています。

- プログラミング技術セグメントに基づいて、中東およびアフリカの特定用途向け集積回路 (ASIC) 市場は、スタティック RAM、EPROM、EEPROM、アンチヒューズなどに分割されています。2022 年には、スマート ウェアラブル電子デバイスの需要の高まりと、データ駆動型ヘルスケア デバイスの需要の高まりにより、スタティック RAM セグメントが中東およびアフリカの特定用途向け集積回路 (ASIC) 市場を支配すると予想されています。これらの技術は、これらの電子デバイスの処理機能を強化する上で重要な役割を果たしているため、市場の成長を後押しする可能性があります。

- アプリケーションセグメントに基づいて、中東およびアフリカの特定用途向け集積回路(ASIC)市場は、民生用電子機器、データセンターおよびコンピューティング、ITおよび通信、医療、マルチメディア、自動車、および産業に分類されています。 2022年には、消費者からの大規模なストリーミングおよびブロードキャストコンテンツの増加と、これらの需要に対応する高速インフラストラクチャの利用可能性により、スマートな民生用電子機器製品が促進されているため、民生用電子機器が中東およびアフリカの特定用途向け集積回路(ASIC)市場を支配すると予想されています。 ASICテクノロジーは、高性能ICを使用して高速データコンテンツ伝送を提供するのに役立ちます。

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場の国別分析

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場が分析され、設計タイプ、プログラミング技術、およびアプリケーション別に市場規模の情報が提供されます。

中東およびアフリカの特定用途向け集積回路 (ASIC) 市場レポートで取り上げられている国は、南アフリカ、エジプト、UAE、サウジアラビア、イスラエル、およびその他の中東およびアフリカの国々です。

イスラエルは、消費者の間での ASIC 駆動型 IoT デバイスの出現や自動車アプリケーション向けメカトロニクスの採用の急増など、さまざまな要因により、特定用途向け集積回路 (ASIC) 市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

特定用途向け集積回路 (ASIC)の需要の増加。

特定用途向け集積回路 (ASIC) 市場では、売上、コンポーネント売上、特定用途向け集積回路 (ASIC) の技術開発の影響、特定用途向け集積回路 (ASIC) 市場へのサポートに関する規制シナリオの変化など、各国の産業成長に関する詳細な市場分析も提供しています。データは、2012 年から 2020 年までの履歴期間について入手できます。

競争環境と特定用途向け集積回路 (ASIC) 市場シェア分析

特定用途向け集積回路 (ASIC) 市場の競争状況では、競合他社ごとに詳細が提供されます。詳細には、企業概要、企業財務、収益、市場の可能性、研究開発への投資、新規市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点および施設、企業の強みと弱み、製品の発売、製品試験パイプライン、製品承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供されている上記のデータ ポイントは、中東およびアフリカの特定用途向け集積回路 (ASIC) 市場に関連する企業の焦点にのみ関連しています。

このレポートで取り上げられている主要企業は、Intel Corporation、Infineon Technologies AG、NXP Semiconductors、Qualcomm Technologies、Microchip Technology Inc.、Analog Devices などです。DBMR のアナリストは、競争力を理解しており、各競合他社の競争力分析を個別に提供しています。世界中の企業によって多くの製品開発も開始されており、これも特定用途向け集積回路 (ASIC) 市場の成長を加速させています。

例えば、

- 2021年11月、Qualcomm Technologies, Inc.は、 PEUGEOT 308車両向けのSnapdragon自動車コックピットプラットフォームを発売しました。この製品発売の主な特徴は、ドライバーと乗客にプレミアムな体験を提供するためのデジタルおよび自動車技術を提供することでした。このプロセッサは、この車両専用に設計されています。これにより、同社は自動車業界での評判を高めることができました。

パートナーシップ、契約、合弁事業、その他の戦略により、対象範囲とプレゼンスが拡大し、企業の市場シェアが高まります。また、組織は規模範囲の拡大により、特定用途向け集積回路 (ASIC) 市場向けの提供内容を改善できるというメリットも得られます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SMARTPHONES AND TABLETS

5.1.2 INCREASE IN DEMAND FROM SMART CONSUMER DEVICES

5.1.3 EMERGENCE OF ASIC DRIVEN IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONICS DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN ADOPTION OF MECHATRONICS FOR AUTOMOTIVE APPLICATIONS

5.3.3 RISE IN DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.3.4 GROW IN PARTNERSHIP, ACQUISITIONS, AND MERGERS FOR ASIC

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIA

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION SPECIFIC CIRCUITS

6 IMPACT OF COVID-19 PANDEMIC ON MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 SEMI-CUSTOM

7.2.1 STANDARD –CELL-BASED ASICS

7.2.2 GATE-ARRAY-BASED ASICS

7.2.2.1 CHANNEL LESS GATE ARRAYS

7.2.2.2 STRUCTURED GATE ARRAYS

7.2.2.3 CHANNELLED GATE ARRAYS

7.3 PROGRAMMABLE

7.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY)

7.3.1.1 BY TYPE

7.3.1.1.1 HIGH-END FPGAS

7.3.1.1.2 LOW-END FPGAS

7.3.1.1.3 MID-RANGE FPGAS

7.3.1.2 BY NODE SIZE

7.3.1.2.1 LESS THAN 28 NM

7.3.1.2.2 28-90 NM

7.3.1.2.3 MORE THAN 90 NM

7.3.1.3 BY APPLICATION

7.3.1.3.1 FILTERING AND COMMUNICATION

7.3.1.3.2 MEDICAL IMAGING

7.3.1.3.3 COMPUTER HARDWARE EMULATION

7.3.1.3.4 SOFTWARE-DEFINED RADIO

7.3.1.3.5 BIOINFORMATICS

7.3.1.3.6 DIGITAL SIGNAL PROCESSING

7.3.1.3.7 VOICE RECOGNITION

7.3.1.3.8 CRYPTOGRAPHY

7.3.1.3.9 INTEGRATING MULTIPLE SPLDS

7.3.1.3.10 ASIC PROTOTYPING

7.3.1.3.11 DEVICE CONTROLLERS

7.3.2 PLDS (PROGRAMMABLE LOGIC DEVICES)

7.3.2.1 BY TYPE

7.3.2.1.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

7.3.2.1.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

7.4 FULL CUSTOM

8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY

8.1 OVERVIEW

8.2 STATIC RAM

8.3 ANTIFUSE

8.4 EEPROM

8.5 EPROM

8.6 OTHERS

9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSUMER ELECTRONICS

9.2.1 SMARTPHONES AND TABLETS

9.2.2 WIRELESS VIRTUAL REALITY DEVICES

9.2.3 OTHERS

9.3 IT & TELECOMMUNICATION

9.3.1 WIRELESS COMMUNICATION

9.3.2 WIRED COMMUNICATION

9.4 DATA CENTER & COMPUTING

9.5 MEDICAL

9.5.1 IMAGING DIAGNOSTICS

9.5.2 WEARABLE DEVICES

9.5.3 OTHERS

9.6 INDUSTRIAL

9.6.1 BY SECTOR

9.6.1.1 MILITARY, AEROSPACE & DEFENSE

9.6.1.2 SATELLITE & SPACE

9.6.1.3 AVIATION

9.6.1.4 POWER GENERATION

9.6.1.5 OIL & GAS

9.6.2 BY APPLICATION

9.6.2.1 MACHINE VISION

9.6.2.2 ROBOTICS

9.6.2.3 INDUSTRIAL SENSOR

9.6.2.4 INDUSTRIAL NETWORKING

9.6.2.5 INDUSTRIAL MOTOR CONTROL

9.6.2.6 VIDEO SURVEILLANCE

9.7 AUTOMOTIVE

9.7.1 ADAS

9.7.2 AUTOMOTIVE INFOTAINMENT & DRIVER INFORMATION SYSTEM

9.8 MULTIMEDIA

9.8.1 COMMUNICATIONS

9.8.2 VIDEO PROCESSING

9.8.3 AUDIO

10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 ISRAEL

10.1.2 U.A.E.

10.1.3 SAUDI ARABIA

10.1.4 SOUTH AFRICA

10.1.5 EGYPT

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INTEL CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INFINEON TECHNOLOGIES AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCTS PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ANALOG DEVICES, INC.

13.3.1 COMPANY SNAPHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NXP SEMICONDUCTORS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MICROCHIP TECHNOLOGY INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TEXAS INSTRUMENTS INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ACHRONIX SEMICONDUCTOR CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVNET ASIC ISRAEL LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COBHAM LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ENSILICA

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCTS PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GOWIN SEMICONDUCTOR

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCTS PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 HONEYWELL INTERNATIONAL INC.

13.12.1 COMPANY SNAPHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 LATTICE SEMICONDUCTOR

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 MAXIM INTEGRATED

13.14.1 COMPANY SNAPHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 MEGACHIPS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCTS PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 QUALCOMM TECHNOLOGIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCTS PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 QUICKLOGIC CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 RENESAS ELECTRONICS CORPORATION

13.18.1 COMPANY SNAPHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCTS PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOCIONEXT INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 XILINX

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCTS PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FULL CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STATIC RAM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ANTIFUSE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EEPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA EPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DATA CENTER & COMPUTING IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 202O-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYP APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 120 EGYPT SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 EGYPT GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 EGYPT PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 EGYPT PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 EGYPT CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EGYPT IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 EGYPT MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 133 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 EGYPT AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 EGYPT MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR SMARTPHONES AND TABLETS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SEMI-CUSTOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY PROGRAMMING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。