インドのデジタル聴診器市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

5.70 Million

USD

8.62 Million

2024

2032

USD

5.70 Million

USD

8.62 Million

2024

2032

| 2025 –2032 | |

| USD 5.70 Million | |

| USD 8.62 Million | |

|

|

|

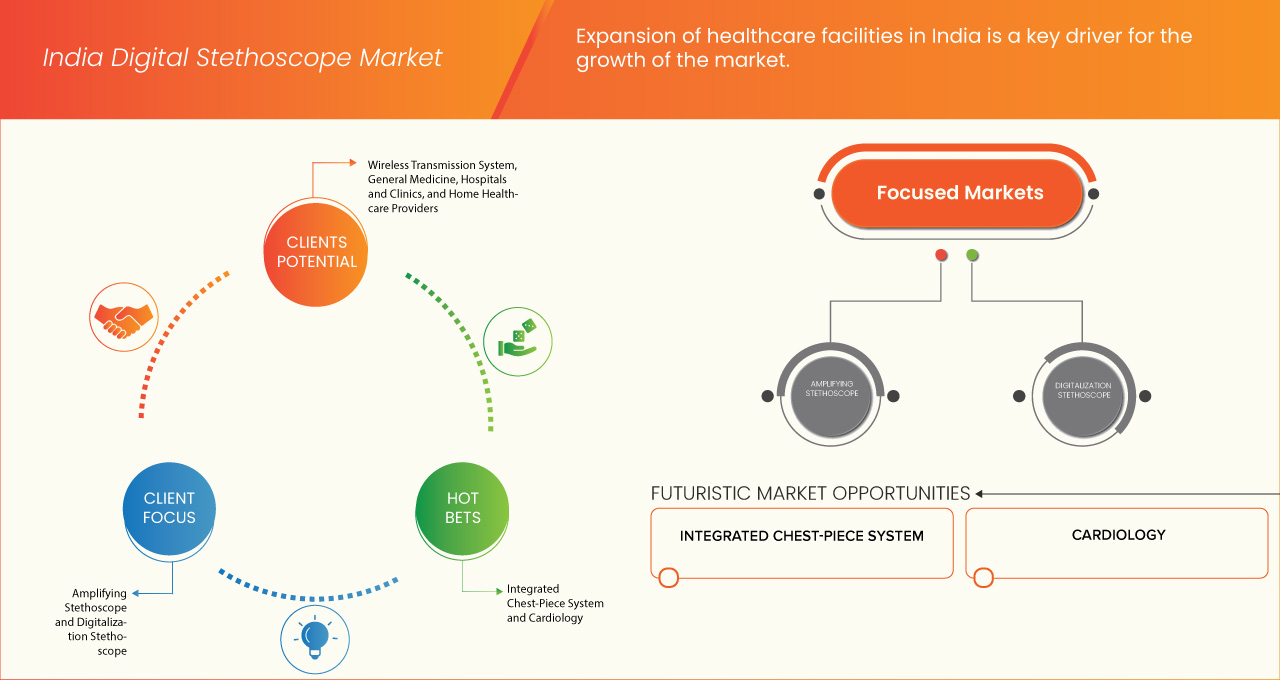

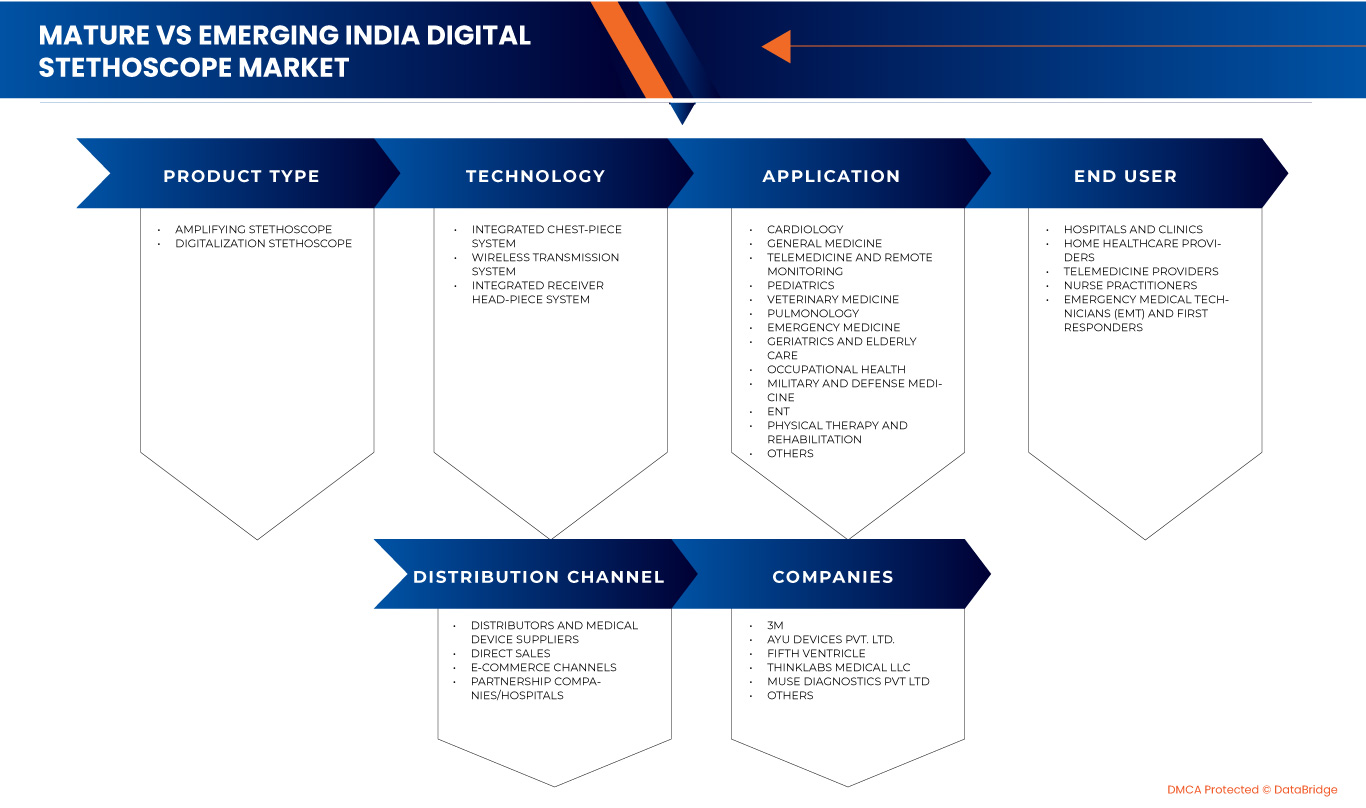

インドのデジタル聴診器市場のセグメンテーション、製品タイプ(増幅聴診器とデジタル化聴診器)、技術(一体型チェストピースシステム、ワイヤレス伝送システム、一体型レシーバーヘッドピースシステム)、用途(心臓病学、一般内科、遠隔医療および遠隔モニタリング、小児科、獣医学、呼吸器学、救急医療、老年医学および高齢者介護、産業保健、軍事および防衛医療、耳鼻咽喉科、理学療法およびリハビリテーション、その他)、エンドユーザー(病院および診療所、在宅医療提供者、遠隔医療提供者、看護師、救急救命士(EMT)および救急隊員)、流通チャネル(販売代理店および医療機器サプライヤー、直接販売、電子商取引チャネル、提携企業/病院)– 2032年までの業界動向と予測

デジタル聴診器市場分析

インドのデジタル聴診器市場とは、インドの医療システムにおけるデジタル聴診器の開発、流通、そして活用を含むセクターを指します。この市場は、医療技術の進歩、心臓・呼吸器系の健康に対する意識の高まり、そして医療従事者による高度な診断ツールへの需要の高まりにより、大きな成長を遂げています。インドのデジタル聴診器は、音声増幅、デジタル録音、スマートフォンやパソコンとの接続による分析・データ共有などの機能を備えており、患者ケアの向上と医療現場の効率化に貢献しています。さらに、この市場は、遠隔医療の発展、遠隔患者モニタリングのニーズ、そして全国的な医療インフラへの投資増加といった要因にも影響を受けています。

デジタル聴診器の市場規模

インドのデジタル聴診器市場は、2024年の570万米ドルから2032年には862万米ドルに達し、2025年から2032年の予測期間に5.4%のCAGRで成長すると予想されています。市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、データブリッジ市場調査がまとめた市場レポートには、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

デジタル聴診器市場の 動向

「人工知能(AI)と機械学習技術の統合の拡大」

デジタル聴診器市場における顕著なトレンドの一つは、人工知能(AI)と機械学習技術の統合が進んでいることです。医療従事者がより効率的な診断ツールを求める中、AI対応のデジタル聴診器が開発され、聴診音をリアルタイムで分析し、様々な病状の診断に役立つ知見を提供しています。これらのデバイスは膨大な音声データから学習し、心音や肺音のパターンや異常を特定する能力を向上させます。このトレンドは、従来の聴診の精度を高めるだけでなく、自動分析とサポートを提供することで臨床現場におけるワークフローを合理化し、最終的には医療従事者がより多くの情報に基づいた意思決定を行い、患者の治療成果を向上させるのに役立ちます。さらに、遠隔医療の重要性の高まりにより、これらの革新的な聴診器の導入がさらに加速し、遠隔診療やモニタリングが容易になっています。

レポートの範囲とデジタル聴診器市場の セグメンテーション

|

属性 |

デジタル聴診器市場の 洞察 |

|

対象セグメント |

|

|

主要な市場プレーヤー |

3M(米国)、Ayu Devices Pvt. Ltd.(インド)、Fifth Ventricle(インド)、Thinklabs Medical LLC(米国)、MUSE DIAGNOSTICS PVT LTD.(インド)、Cardionics Inc.(米国)、HD Medical Inc.(米国)、Hulu Devices(米国)、MCM INSTRUMENTS(インド)、Rijuven Corp.(米国)、VJ Industries(米国)など |

|

市場機会 |

|

|

付加価値データ情報セット |

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。 |

デジタル聴診器市場の 定義

デジタル聴診器は、心臓音と肺音をデジタル技術で増幅・記録し、より正確で詳細な診断を可能にする聴診器の一種です。通常、聴診器ヘッドが音波を電気信号に変換し、デジタル回路で処理・増幅されます。増幅された音は画面に表示されるか、後で確認するために保存されるため、医療従事者はリアルタイムまたは事後的に音を視覚化し分析することができます。デジタル聴診器は、ノイズ低減、フィルタリング、圧縮などの高度な機能を備えていることが多く、医療従事者は特定の音に焦点を絞り、より効果的に病状を診断することができます。

デジタル聴診器市場の 動向

ドライバー

- インドにおける医療施設の拡大

インド、特に都市部および準都市部における医療インフラの拡充は、デジタル聴診器を含む高度な診断機器の導入を促進する上で重要な役割を果たしています。インドは質の高い医療サービスへの需要の高まりに対応するため、医療施設の整備を進めており、診断の精度と効率性を高める最新技術の導入に向けた明確なシフトが見られます。都市部では、病院や診療所が国際的な医療基準に沿うよう機器のアップグレードを進めており、ノイズキャンセリング、高音質化、データ記録機能といった高度な機能を備えたデジタル聴診器は、この移行において不可欠な要素となっています。準都市部における医療インフラの改善もこの傾向に貢献しており、新設の医療センターは増加する患者数に対応するために最新の診断ツールの提供を目指しています。このシフトは、医療へのアクセスと質の向上を目的とした政府および民間セクターの投資によってさらに後押しされています。結果として、高度な医療施設の利用可能性の向上はデジタル聴診器の導入を直接的に加速させ、都市部および準都市部の両方で最新の診断ツールへの需要を高めることで、デジタル聴診器が市場の主要な牽引役としての地位を確立しています。

例えば、

2024年6月、国際貿易局が発表した記事によると、インドのヘルスケアセクターは急速な変革期を迎えており、質の高い医療とインフラへのアクセス向上に重点を置き、インフラへの多額の投資が2024年度予算で12.59%増加しました。この発展は、デジタル聴診器などの高度な診断ツールの導入を促進し、市場の成長を牽引しています。

- インドにおける心血管疾患の有病率の増加

インドにおける心血管疾患(CVD)の罹患率の増加は、デジタル聴診器を含む高度な診断ツールの需要増加に大きく寄与しています。心臓病、高血圧、その他の心血管疾患に罹患する患者数の増加に伴い、医療従事者はより正確で効率的な診断方法を求めています。従来の聴診器は効果的ではあるものの、微細な心音の検出には限界があり、デジタル聴診器が代替手段として好まれています。これらの高度な機器は、優れた音の増幅、ノイズ低減、そして遠隔診療のためのデータ記録・送信機能を備えており、心血管疾患の診断とモニタリングに不可欠なものとなっています。CVDの負担が増加するにつれ、正確で信頼性の高い高度な診断機器へのニーズが高まっています。この傾向は、病院、診療所、診断センターにおけるデジタル聴診器の導入を促進し、市場を牽引する重要な要因となっています。心血管疾患の増加に伴い、デジタル聴診器の需要は高まり、市場における存在感はさらに拡大するでしょう。

例えば、

2020年1月、NCBIが発表した論文によると、「世界の疾病負担」研究によると、インドにおける年齢標準化心血管疾患(CVD)による死亡率は人口10万人あたり272人で、世界平均の235人よりも高いことが報告されています。さらに、アジア系インド人の冠動脈疾患(CAD)による死亡率は、他の人口層よりも20~50%高くなっています。CVDの有病率の上昇は、デジタル聴診器などの高度な診断ツールの需要を促進し、市場の成長を後押ししています。

機会

- 高齢化によるデジタル聴診器の利用増加

インドにおける高齢化の進展は、デジタル聴診器市場にとって大きなビジネスチャンスをもたらします。高齢者は一般的に慢性疾患、特に心血管疾患にかかりやすいためです。高齢者人口の増加に伴い、定期的な健康状態のモニタリングと疾患の早期発見を可能にする高度な診断ツールへの需要が高まっています。強化された音声機能と統合型テクノロジーによるデータ管理の向上により、医療従事者はより正確な診断を実施できます。この傾向は、積極的な医療管理を促進し、高齢者特有のニーズに応える革新的な医療機器の必要性を高めています。

例えば、

2024年7月、「インドの高齢者人口は2050年までに倍増する見込み:UNFPAインド事務所長」という記事によると、60歳以上の高齢者の数は2050年までに倍増し、3億4,600万人に達すると予測されており、医療、住宅、年金制度への投資拡大が急務となっています。この増加は、最終的には人口全体の慢性疾患の増加につながり、市場の成長につながるでしょう。

- ウェアラブル技術の統合

ウェアラブル技術をヘルスケアエコシステムに統合することで、インドのデジタル聴診器市場は大きなビジネスチャンスを掴むことができます。これらのデバイスは、バイタルサインを継続的にモニタリングすることで、従来の診断ツールを補完できるからです。スマートウォッチやフィットネストラッカーなどのウェアラブルデバイスは、心拍数、活動レベル、その他の健康指標に関するデータを収集でき、これらのデータをデジタル聴診器と同期させることで、患者の包括的な健康プロファイルを作成できます。この機能により、デジタル聴診器の機能が充実し、より汎用性が高まるだけでなく、医療提供者はリアルタイムデータに基づいてより情報に基づいた意思決定を行うことができます。これらの統合機能を提供することで、メーカーは、特に技術に精通した医療専門家や、積極的な健康管理ソリューションを求める若い患者の間で、製品の魅力を高めることができます。

例えば、

2022年5月の記事「自動疾患診断用に設計されたソフトウェアラブル聴診器による完全ポータブルな連続リアルタイム聴診」によると、ソフトウェアラブル聴診器は様々な疾患の定量的な疾患診断ツールとして利用されています。このソフトデバイスは、ノイズを最小限に抑えながら連続的な心肺音を検出し、リアルタイムの信号異常を分類することができます。また、ウェアラブルデジタル聴診器デバイスは、遠隔医療などの遠隔医療診断へのアクセスを容易にし、継続的なモニタリングを通じて心血管疾患や呼吸器疾患の早期発見を可能にします。

制約/課題

- デジタル聴診器を効果的に使用するための追加トレーニング

インドの医療環境は多様で、しばしばリソースが限られているため、デジタル聴診器を効果的に使用するための追加トレーニングは、デジタル聴診器市場にとって大きな課題となっています。特に地方や小規模都市では、多くの医療従事者がこのトレーニングを必要としています。機器を効果的に操作し、データを正確に解釈するには、このトレーニングが不可欠です。音声増幅、デジタルストレージ、接続オプションといった高度な機能への習熟不足は、機器の機能を十分活用できないことにつながり、最終的には臨床現場における機器の価値を低下させる可能性があります。

例えば、

2023年4月、国立医学図書館に掲載された記事によると、高齢で経験豊富な医療従事者にとって、従来の聴診器に慣れているため、より新しく複雑なデジタル聴診器システムに統合して移行することは困難であり、最新の状態を保つには複数回の医療機器トレーニングセッションが必要になる可能性があるとのことです。

- メンテナンスおよびテクニカルサポートの要件

インドのデジタル聴診器市場において、メンテナンスと技術サポートの必要性は、特に運用の持続可能性とユーザーの信頼という点で大きな課題となっています。デジタル聴診器は高度な技術を搭載した機器であるため、最適なパフォーマンスを維持するためには定期的なメンテナンスが必要です。これには、ソフトウェアのアップデート、キャリブレーション、そして技術的な不具合に対処するためのトラブルシューティングが含まれます。医療施設は厳しい予算と限られた人員で運営されていることが多い国では、継続的なメンテナンスのためのリソースを確保することは困難な作業となり得ます。地方の小規模クリニックや医療機関では、こうした技術的ニーズに対応できるインフラが不足している場合があり、機器が故障した場合やユーザーが問題解決方法を理解できない場合、機器が十分に活用されない可能性があります。

この市場レポートは、最近の新たな動向、貿易規制、輸出入分析、生産分析、バリューチェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリー市場の成長、アプリケーションのニッチと優位性、製品承認、製品発売、地理的拡大、市場における技術革新など、詳細な情報を提供しています。市場に関する詳細情報については、Data Bridge Market Researchまでアナリストブリーフをご請求ください。当社のチームが、市場成長を実現するための情報に基づいた意思決定をお手伝いいたします。

デジタル聴診器市場の展望

市場は、製品タイプ、アプリケーション、テクノロジー、エンドユーザー、流通チャネルに基づいて、5つの主要なセグメントに細分化されています。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

製品タイプ

- 増幅聴診器

- 電子ベースアンプ

- 音響ベースのアンプ

- デジタル化聴診器

- 有線式の従来型聴診器とデジタル聴診器

- USB接続

- 直接アナログ変換

- ワイヤレス対応聴診器

- Bluetooth接続

- Wi-Fi接続

- スマート聴診器

- AI搭載聴診器

- 自己診断機能

- データ分析とリモート監視機能

- 有線式の従来型聴診器とデジタル聴診器

テクノロジー

- 一体型チェストピースシステム

- 無線伝送システム

- 短距離無線

- 長距離ワイヤレス

- クラウドベースのデータ保存および転送機能

- 一体型レシーバーヘッドピースシステム

- 組み込みデジタル受信機

- デュアルモード受信機

- リアルタイムデジタル可視化

応用

- 心臓病学

- 一般内科

- 遠隔医療と遠隔モニタリング

- 小児科

- 獣医学

- 呼吸器科

- 救急医療

- 老年医学と高齢者ケア

- 労働衛生

- 軍事および防衛医学

- 耳鼻咽喉科

- 理学療法とリハビリテーション

- その他

エンドユーザー

- 病院と診療所

- 私立病院

- 公立病院および医療機関

- 小規模クリニックと診療所

- 在宅医療提供者

- 遠隔医療提供者

- 三次遠隔医療プラットフォーム

- 二次医療遠隔医療提供者

- 患者に直接遠隔医療を提供するアプリケーション

- 看護師

- 救急救命士(EMT)と救急隊員

流通チャネル

- 販売代理店および医療機器サプライヤー

- 直接販売

- Eコマースチャネル

- 提携企業/病院

デジタル聴診器の市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、グローバルプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

市場で活動するデジタル聴診器のマーケットリーダーは次のとおりです。

- 3M(米国)

- Ayu Devices Pvt. Ltd.(インド)

- 第五脳室(インド)

- シンクラボメディカルLLC(米国)

- MUSE DIAGNOSTICS PVT LTD.(インド)

- カーディオニクス社(米国)

- HDメディカル社(米国)

- Huluデバイス(米国)

- MCMインストゥルメンツ(インド)

- リジュベン社(米国)

- VJインダストリーズ(米国)

デジタル聴診器市場の最新動向

- 3Mは2024年3月、新たな経営陣の任命を発表しました。同社は成長とイノベーションへのコミットメントを強化するため、主要ポジションに新たな幹部を任命しました。これらの変更は、株主価値の向上と様々な事業分野における業績向上という戦略的優先事項に沿って、3Mの経営陣を強化することを目的としています。

- 2022年5月、Huluデバイス、Stemoscope PROを含むステモスコープデバイス、およびコンパニオンアプリが医療機器としてFDAの承認を取得しました。このマイルストーンは、デジタル聴診の大きな進歩を示すものであり、医療現場での活用が拡大しています。

- 2021年6月、HDメディカルは、心電図機能搭載のHD Stethインテリジェント聴診器について、Stethoscope.comと販売契約を締結しました。ネルソン・B・シラー医師は、その音質と診断能力を高く評価しました。アルビンド・ティアガラジャン氏は、心臓ケアの向上を目指すこの提携に期待を表明しました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA DIGITAL STETHOSCOPE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 INDIA DIGITAL STETHOSCOPE MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF HEALTHCARE FACILITIES IN INDIA

6.1.2 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES IN INDIA

6.1.3 ENHANCED DIAGNOSTICS AND PRECISION OVER TRADITIONAL STETHOSCOPES

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN DIGITAL STETHOSCOPES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DIGITAL STETHOSCOPES

6.2.2 RURAL AREAS FACE UNDERDEVELOPED HEALTHCARE INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 INCREASED USAGE OF DIGITAL STETHOSCOPES DUE TO THE AGING POPULATION

6.3.2 INTEGRATION OF WEARABLE TECHNOLOGY

6.3.3 GROWING TELEMEDICINE AND REMOTE MONITORING MARKET

6.4 CHALLENGES

6.4.1 ADDITIONAL TRAINING TO EFFECTIVELY USE DIGITAL STETHOSCOPES

6.4.2 REQUIREMENTS OF MAINTENANCE AND TECHNICAL SUPPORT

7 INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 AMPLIFYING STETHOSCOPE

7.2.1 ELECTRONIC-BASED AMPLIFIERS

7.2.2 ACOUSTIC-BASED AMPLIFIERS

7.3 DIGITALIZATION STETHOSCOPE

7.3.1 WIRED CONVENTIONAL AND DIGITAL STETHOSCOPES

7.3.1.1 USB CONNECTIVITY

7.3.1.2 DIRECT ANALOG CONVERSION

7.3.2 WIRELESS-ENABLED STETHOSCOPES

7.3.2.1 BLUETOOTH CONNECTIVITY

7.3.2.2 WI-FI CONNECTIVITY

7.3.3 SMART STETHOSCOPES

7.3.3.1 AI-INTEGRATED STETHOSCOPES

7.3.3.2 SELF-DIAGNOSING CAPABILITIES

7.3.3.3 DATA ANALYTICS AND REMOTE MONITORING FUNCTIONS

8 INDIA DIGITAL STETHOSCOPE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 INTEGRATED CHEST-PIECE SYSTEM

8.3 WIRELESS TRANSMISSION SYSTEM

8.3.1 SHORT-RANGE WIRELESS

8.3.2 LONG-RANGE WIRELESS

8.3.3 CLOUD-BASED DATA STORAGE AND TRANSMISSION FEATURES

8.4 INTEGRATED RECEIVER HEAD-PIECE SYSTEM

8.4.1 EMBEDDED DIGITAL RECEIVERS

8.4.2 DUAL-MODE RECEIVERS

8.4.3 REAL-TIME DIGITAL VISUALIZATION

9 INDIA DIGITAL STETHOSCOPE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CARDIOLOGY

9.3 GENERAL MEDICINE

9.4 TELEMEDICINE AND REMOTE MONITORING

9.5 PEDIATRICS

9.6 VETERINARY MEDICINE

9.7 PULMONOLOGY

9.8 EMERGENCY MEDICINE

9.9 GERIATRICS AND ELDERLY CARE

9.1 OCCUPATIONAL HEALTH

9.11 MILITARY AND DEFENSE MEDICINE

9.12 ENT

9.13 PHYSICAL THERAPY AND REHABILITATION

9.14 OTHERS

10 INDIA DIGITAL STETHOSCOPE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS AND CLINICS

10.2.1 PRIVATE HOSPITALS

10.2.2 GOVERNMENT HOSPITALS AND MEDICAL INSTITUTIONS

10.2.3 SMALL CLINICS AND PRACTICES

10.3 HOME HEALTHCARE PROVIDERS

10.4 TELEMEDICINE PROVIDERS

10.4.1 TERTIARY TELEHEALTH PLATFORMS

10.4.2 SECONDARY CARE TELEHEALTH PROVIDERS

10.4.3 DIRECT-TO-PATIENT TELEMEDICINE APPLICATIONS

10.5 NURSE PRACTITIONERS

10.6 EMERGENCY MEDICAL TECHNICIANS (EMT) AND FIRST RESPONDERS

11 INDIA DIGITAL STETHOSCOPE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DISTRIBUTORS AND MEDICAL DEVICE SUPPLIERS

11.2.1 NATIONAL DISTRIBUTORS (LARGE-SCALE, MULTI-BRAND)

11.2.2 REGIONAL DISTRIBUTORS (LOCALIZED, FOCUSED ON RURAL AREAS)

11.2.3 SPECIALIZED DISTRIBUTORS (FOCUSING EXCLUSIVELY ON DIGITAL OR HIGH-TECH MEDICAL EQUIPMENT)

11.3 DIRECT SALES

11.3.1 DIRECT SALES TO HOSPITALS AND CLINICS

11.3.2 DIRECT SALES TO GOVERNMENT HEALTH PROGRAMS

11.4 E-COMMERCE CHANNELS

11.4.1 MAJOR ONLINE RETAIL PLATFORMS (E.G., AMAZON INDIA, FLIPKART)

11.4.2 SPECIALIZED MEDICAL EQUIPMENT E-COMMERCE PLATFORMS

11.4.3 OEM WEBSITES AND BRAND-SPECIFIC ONLINE STORES

11.5 PARTNERSHIP COMPANIES/HOSPITALS

11.5.1 PRIVATE HOSPITAL CHAINS WITH IN-HOUSE MEDICAL DEVICE PROCUREMENT

11.5.2 MEDICAL COLLEGES AND TEACHING HOSPITALS

11.5.3 PUBLIC-PRIVATE PARTNERSHIPS (PPP) FOR DIGITAL HEALTH EQUIPMENT

12 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: INDIA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AYU DEVICES PVT. LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 FIFTH VENTRICLE

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 THINKLABS MEDICAL LLC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 MUSE DIAGNOSTICS PVT LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 CARDIONICS INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 HULU DEVICES

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 HD MEDICAL INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 MCM INSTRUMENTS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 RIJUVEN CORP.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 V J INDUSTRIES

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 INDIA AMPLIFYING STETHOSCOPE IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 INDIA DIGITALIZATION STETHOSCOPE IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 INDIA WIRED CONVENTIONAL AND DIGITAL STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 INDIA WIRELESS-ENABLED STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 INDIA SMART STETHOSCOPES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 INDIA DIGITAL STETHOSCOPE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 8 INDIA WIRELESS TRANSMISSION SYSTEM IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 INDIA INTEGRATED RECEIVER HEAD-PIECE SYSTEM IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 INDIA DIGITAL STETHOSCOPE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 INDIA DIGITAL STETHOSCOPE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 12 INDIA HOSPITALS AND CLINICS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 INDIA TELEMEDICINE PROVIDERS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 INDIA DIGITAL STETHOSCOPE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 INDIA DISTRIBUTORS AND MEDICAL DEVICE SUPPLIERS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 INDIA DIRECT SALES IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 INDIA E-COMMERCE CHANNELS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 INDIA PARTNERSHIP COMPANIES/HOSPITALS IN DIGITAL STETHOSCOPE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

図表一覧

FIGURE 1 INDIA DIGITAL STETHOSCOPE MARKET: SEGMENTATION

FIGURE 2 INDIA DIGITAL STETHOSCOPE MARKET: DATA TRIANGULATION

FIGURE 3 INDIA DIGITAL STETHOSCOPE MARKET: DROC ANALYSIS

FIGURE 4 INDIA DIGITAL STETHOSCOPE MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA DIGITAL STETHOSCOPE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA DIGITAL STETHOSCOPE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 INDIA DIGITAL STETHOSCOPE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA DIGITAL STETHOSCOPE MARKET: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE INDIA DIGITAL STETHOSCOPE MARKET, BY PRODUCT TYPE

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 EXPANSION OF HEALTHCARE FACILITIES IN INDIA IS DRIVING THE GROWTH OF THE INDIA DIGITAL STETHOSCOPE MARKET FROM 2025 TO 2032

FIGURE 14 THE AMPLIFYING STETHOSCOPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA DIGITAL STETHOSCOPE MARKET IN 2025 AND 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, 2024

FIGURE 17 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 18 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 19 INDIA DIGITAL STETHOSCOPE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, 2024

FIGURE 21 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 22 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 INDIA DIGITAL STETHOSCOPE MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, 2024

FIGURE 25 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 26 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 INDIA DIGITAL STETHOSCOPE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, 2024

FIGURE 29 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 30 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 INDIA DIGITAL STETHOSCOPE MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 33 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 34 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 35 INDIA DIGITAL STETHOSCOPE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 INDIA DIGITAL STETHOSCOPE MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。