世界の石灰石焼成粘土セメント市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

767.19 Million

USD

1,241.00 Million

2024

2032

USD

767.19 Million

USD

1,241.00 Million

2024

2032

| 2025 –2032 | |

| USD 767.19 Million | |

| USD 1,241.00 Million | |

|

|

|

|

世界の石灰石焼成粘土セメント市場、製品タイプ別(LC3混合セメント、LC3コンクリート、LC3モルタル)、用途別(住宅用、商業用、工業用)、エンドユーザー別(建設、インフラ、その他)、クリンカー代替率別(低代替率(15~30%)、中代替率(30~50%)、高代替率(50%以上))、流通チャネル別(セメントサプライヤー、建設資材販売業者、小売店) - 2032年までの業界動向と予測。

石灰石焼成粘土セメント市場規模

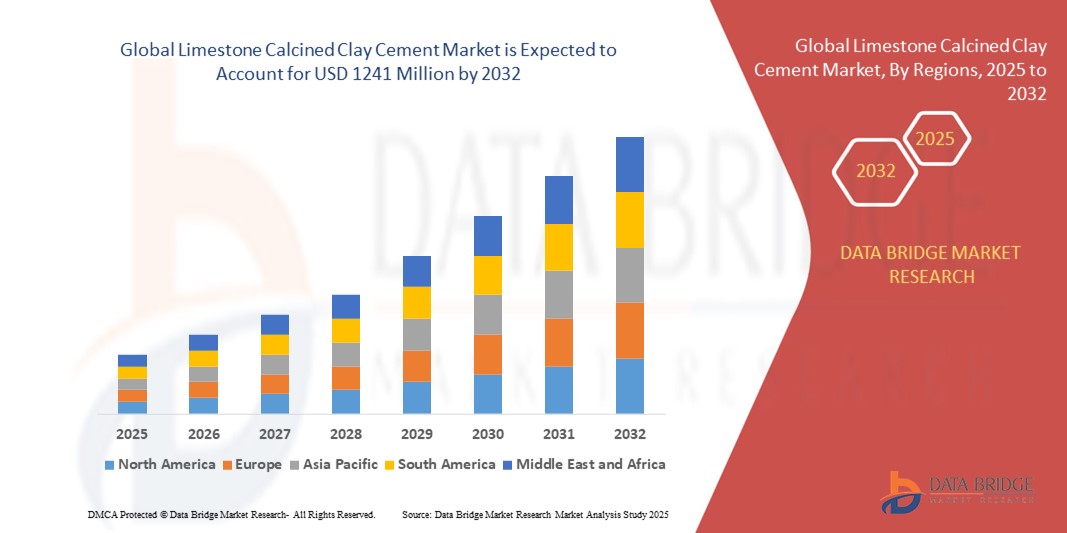

- 世界の石灰石焼成粘土セメント市場規模は2024年に7億6,719万米ドルと評価され、予測期間中に6.20%のCAGRで成長し、2032年には12億4,100万米ドル に達すると予想されています 。

- 市場の成長は、持続可能で低炭素のセメント代替品に対する需要の増加、建設活動の増加、CO2排出量の削減などの環境上の利点に対する意識の高まりによって主に推進されています。

- 環境に優しい建設資材の採用の増加とグリーンビルディングの実践を促進する政府の取り組みにより、住宅と商業の両方の用途でLC3の需要がさらに高まっています。

石灰石焼成粘土セメント市場分析

- 石灰石焼成粘土セメント市場は、持続可能な建設資材を求める世界的な動きとセメント生産における炭素排出量削減の必要性により、堅調な成長を遂げています。

- 住宅、商業、インフラプロジェクトからの需要の高まりにより、メーカーは耐久性、費用対効果、環境上の利点を提供する高性能LC3ソリューションで革新を起こすよう促されています。

- ヨーロッパは、厳しい環境規制、先進的な建設手法、持続可能な材料の広範な採用により、2024年には石灰石焼成粘土セメント市場で最大の収益シェア44.9%を占める。

- 北米は、インフラ投資の増加、低炭素セメントソリューションへの意識の高まり、特に米国とカナダにおける政府の支援政策に後押しされ、予測期間中に最も急速に成長する地域になると予想されています。

- LC3混合セメントセグメントは、石灰石と焼成粘土をクリンカーと混合する能力により建設業で広く採用され、性能を維持しながら炭素排出量を削減したことで、2024年に60.2%の最大の市場収益シェアを占めました。

レポートの範囲と石灰石焼成粘土セメント市場のセグメンテーション

|

属性 |

石灰石焼成粘土セメントの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

ヨーロッパ

アジア太平洋

中東およびアフリカ

南アメリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力の概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

石灰石焼成粘土セメント市場の動向

持続可能な建設資材の採用拡大

- 世界の石灰石焼成粘土セメント(LC3)市場は、世界的な環境問題への懸念から、持続可能な建設資材の採用に向けた大きなトレンドを経験しています。

- LC3は、クリンカー、焼成粘土、石灰石、石膏をブレンドしたもので、従来のポートランドセメントに比べてCO2排出量を最大40%削減するため、環境に配慮した建設プロジェクトに最適です。

- 高度な研究開発により、LC3配合が強化され、圧縮強度や耐久性などの機械的特性が向上し、住宅、商業、産業建設などの多様な用途での使用がサポートされています。

- 例えば、インドのJKセメントのような企業は、環境に優しいプロファイルを活用して、主要なインフラプロジェクトをターゲットにLC3の生産を開始しました。

- LC3をインドのIS 18189:2023などの建築基準に統合することで、その信頼性が高まり、世界市場での採用が促進される。

- この傾向により、持続可能性の目標を達成することを目指す建設会社や政府にとって、LC3の魅力が高まっており、特に厳しい環境規制により市場を支配しているヨーロッパなどの地域では、LC3の魅力が高まっています。

石灰石焼成粘土セメント市場の動向

ドライバ

低炭素建設ソリューションの需要の高まり

- 気候変動と二酸化炭素排出量削減の必要性に対する世界的な意識の高まりは、従来のセメントに比べてCO2排出量を大幅に削減できるLC3市場にとって大きな推進力となっている。

- LC3のクリンカー含有量は通常50%以下と低く、性能を損なうことなく持続可能性をサポートし、住宅、商業、インフラ用途に適しています。

- 特に欧州では、欧州グリーンディールなどの政府の政策や取り組みにより、低炭素材料の使用が義務付けられ、建設プロジェクトにおけるLC3の採用が促進されています。

- 最も急速に成長している市場である北米などの地域でグリーンビルディング認証とインセンティブが普及し、インフラと建設分野でLC3の需要がさらに加速しています。

- ラファージュホルシムやアンブジャセメントなどの大手セメントメーカーは、持続可能な建築資材の需要の高まりに対応するため、LC3生産に投資している。

抑制/挑戦

高額な初期投資と規制の複雑さ

- 焼成設備や品質管理システムを含むLC3生産施設の設置コストの高さは、特に資本が限られている新興市場では大きな障壁となっている。

- LC3を既存のセメント生産ラインに統合するには大幅な変更が必要となり、従来のポルトランドセメントから移行するメーカーのコストが増加する。

- クリンカー代替率と材料基準をめぐる規制の複雑さは地域によって異なり、国際的な製造業者のコンプライアンスを複雑にし、市場拡大を制限しています。

- LC3生産に不可欠な高品質のカオリナイト粘土の入手可能性は、一部の地域では制約となり、拡張性と費用対効果に影響を与える可能性がある。

- これらの課題は、コストに敏感な市場や持続可能な建設資材に関する規制枠組みがあまり整備されていない地域での導入を遅らせる可能性がある。

石灰石焼成粘土セメント市場の展望

市場は、製品タイプ、用途、エンドユーザー、クリンカー代替率、流通チャネルに基づいてセグメント化されています。

- 製品タイプ別

製品タイプ別に見ると、世界の石灰石焼成粘土セメント市場は、LC3混合セメント、LC3コンクリート、LC3モルタルに分類されます。LC3混合セメントセグメントは、2024年には60.2%という最大の市場収益シェアを占めました。これは、石灰石と焼成粘土をクリンカーと混合することで性能を維持しながら炭素排出量を削減できるため、建設分野で広く採用されていることが要因です。このセグメントは、既存のセメント生産インフラとの互換性という利点があり、費用対効果が高く拡張性の高いソリューションとなっています。

LC3コンクリートセグメントは、住宅、商業、インフラプロジェクトにおける環境に優しいコンクリートの需要増加に支えられ、2025年から2032年にかけて7.8%という最も高い成長率を達成すると予想されています。配合設計の進歩と、より少ないクリンカー含有量で高い圧縮強度を実現できる能力により、持続可能な建設における魅力が高まります。

- アプリケーション別

用途別に見ると、世界の石灰石焼成粘土セメント市場は、住宅用、商業用、工業用の3つに分類されます。住宅用セグメントは、特に都市化が進む地域における住宅プロジェクトにおけるLC3の使用増加に牽引され、2024年には市場収益シェアの38.5%を占め、市場を牽引するでしょう。その費用対効果と環境へのメリットは、持続可能な住宅建設への世界的な取り組みと合致しています。

商業部門は、2025年から2032年にかけて最も高いCAGR(年平均成長率)8.2%の成長が見込まれています。これは、持続可能性認証と低炭素材料が重視されるオフィスや小売スペースなどの商業ビルにおける採用の増加に支えられています。注目度の高いプロジェクトにおけるLC3の採用は、その市場浸透をさらに促進します。

- エンドユーザー別

エンドユーザー別に見ると、世界の石灰石焼成粘土セメント市場は、建設、インフラ、その他に分類されます。建設分野は、従来のポートランドセメントと比較してCO2排出量を最大40%削減できることから、建物やプレキャスト部材を含む一般建設活動においてLC3が広く使用されるようになり、2024年には45.3%という最大の市場収益シェアを獲得しました。

インフラ分野は、高速道路、橋梁、ダムといった大規模インフラプロジェクトにおけるLC3の採用増加に牽引され、2025年から2032年にかけて7.5%のCAGR(年平均成長率)で力強い成長を遂げると予想されています。この材料は耐久性と塩化物侵入などの環境要因に対する耐性に優れており、インフラ用途に最適です。

- クリンカー置換率別

クリンカー置換率に基づき、世界の石灰石焼成粘土セメント市場は、低置換率(15~30%)、中置換率(30~50%)、高置換率(50%以上)に分類されます。中置換率(30~50%)セグメントは、環境への配慮と性能のバランスが取れており、強度や耐久性を損なうことなく幅広い用途に適しているため、2024年には市場収益シェアの52.7%を占め、市場を牽引するでしょう。

高置換度(50%以上)セグメントは、機械的特性を犠牲にすることなくクリンカー代替率を高めるLC3技術の進歩に牽引され、2025年から2032年にかけて8.5%という最も高い成長率で成長すると予測されています。このセグメントは、厳格な炭素削減目標を掲げる地域において特に魅力的です。

- 流通チャネル別

流通チャネルに基づいて、世界の石灰石焼成粘土セメント市場は、セメントサプライヤー、建設資材販売業者、小売店に分類されます。セメントサプライヤーセグメントは、セメントメーカーとの直接的な関係と、建設・インフラプロジェクトへの大量供給能力により、2024年には55.8%という最大の市場収益シェアを獲得しました。

建設資材販売業者セグメントは、持続可能な建設資材が注目を集めている新興経済国を中心に、LC3 の多様な市場への展開において販売業者が重要な役割を果たすため、2025 年から 2032 年にかけて最も急速な成長 (CAGR 7.9%) が見込まれています。

石灰石焼成粘土セメント市場の地域分析

- ヨーロッパは、厳しい環境規制、先進的な建設手法、持続可能な材料の広範な採用により、2024年には石灰石焼成粘土セメント市場で最大の収益シェア44.9%を占める。

- 消費者は、特に持続可能性の目標と都市開発プロジェクトが強い地域で、低炭素フットプリント、優れた耐久性、エネルギー効率のためにLC3を優先しています。

- 成長は、クリンカー代替率の向上や生産プロセスの改善などLC3技術の進歩、そして住宅およびインフラプロジェクトの両方での採用の増加によって支えられています。

英国の石灰石焼成粘土セメント市場の洞察

英国のLC3市場は、持続可能な建設資材への需要と、都市部および郊外における建物の性能向上を背景に、大幅な成長が見込まれています。CO2排出量の削減やエネルギー効率といったLC3の環境的利点に対する認知度の高まりが、採用を促進しています。クリンカー代替と性能基準のバランスをとる規制の進化は、消費者の選択にさらなる影響を与えています。

ドイツの石灰石焼成粘土セメント市場の洞察

ドイツは、先進的な建設セクターと、持続可能性とエネルギー効率に対する消費者の高い関心により、欧州におけるLC3の主要市場となっています。ドイツの消費者は、炭素排出量を削減し、エネルギーコストの削減に貢献する、クリンカー代替率の高いLC3製品を好んでいます。高級建設プロジェクトやアフターマーケット用途におけるLC3の導入は、市場の持続的な成長を支えています。

米国石灰石焼成粘土セメント市場の洞察

米国の石灰石焼成粘土セメント市場は、炭素排出削減への意識の高まりと建設業界における堅調な需要に支えられ、大幅な成長が見込まれています。持続可能な建設手法へのトレンドと、環境に優しい材料に対する政府の優遇措置も、市場拡大をさらに後押ししています。新築および改修プロジェクトにおけるLC3の導入と、アフターマーケットの需要が相まって、多様な製品エコシステムが形成されています。

アジア太平洋地域の石灰石焼成粘土セメント市場の洞察

アジア太平洋地域では、中国、インド、日本などの国々における建設活動の拡大と環境意識の高まりを背景に、LC3市場の急速な成長が見込まれています。低炭素セメントソリューションの需要増加と、持続可能なインフラを推進する政府の取り組みが相まって、市場浸透が促進されています。カオリナイト粘土などの豊富な原材料の供給も、市場の成長をさらに後押ししています。

日本における石灰石焼成粘土セメント市場の洞察

日本のLC3市場は、建設の持続可能性と性能を向上させる高品質で低炭素のセメントソリューションに対する消費者の嗜好により、力強い成長が見込まれています。大手建設会社の存在とインフラプロジェクトにおけるLC3の導入は、市場導入を加速させています。環境に優しい建設資材への関心の高まりも、市場拡大に貢献しています。

中国石灰石焼成粘土セメント市場洞察

中国は、急速な都市化、建設活動の増加、そして持続可能な建築手法への強い関心を背景に、アジア太平洋地域のLC3市場で最大のシェアを占めています。同国のインフラ投資の拡大と炭素削減への注力は、LC3製品の採用を後押ししています。競争力のある国内製造能力とコスト効率の高い生産は、市場へのアクセスを向上させています。

石灰石焼成粘土セメントの市場シェア

石灰石焼成粘土セメント業界は、主に、以下を含む定評のある企業によって牽引されています。

- HOLCIM(スイス)

- ハイデルベルグセメント(ドイツ)

- セメックス(メキシコ)

- CRH(アイルランド)

- 安徽コンチセメント株式会社(中国)

- 中国建材集団公司(中国)

- 太平洋セメント株式会社(日本)

- ウルトラテックセメント株式会社(インド)

- ダンゴート・セメント社(ナイジェリア)

- Buzzi SpA(イタリア)

- ヴォトランティン・シメントス(ブラジル)

- EUROCEMENTグループ(ロシア)

- タイタンセメント(ギリシャ)

- SCG(タイ)

- 双龍C&E(韓国)

- シュリーセメントリミテッド(インド)

- COLACEM(イタリア)

- Grupo Argos SA(コロンビア)

世界の石灰石焼成粘土セメント市場の最近の動向は何ですか?

- トーゴのセメント生産者は2025年7月、パリ協定の目標に沿って、2050年までに二酸化炭素排出量を削減するための包括的なロードマップを策定しました。主要戦略の一つは、セメントのクリンカー係数を65%から40%に削減するLC3(石灰石焼成粘土セメント)の大規模導入です。これにより、性能を損なうことなく排出量を最大40%削減できる可能性があります。ロードマップには、石炭を農業廃棄物や都市廃棄物に代替燃料として置き換えることも含まれています。これらの対策は、需要の増加により2050年までに排出量が倍増する可能性があるのを抑制することを目的としています。

- 2025年5月、ハイデルベルグマテリアルズとCBIガーナは、ガーナのテマに世界最大の焼成粘土工場を稼働させました。この工場は年間40万トンの生産能力を誇ります。この工場では地元産の原材料を使用することで、輸入クリンカーへの依存を大幅に削減し、低炭素セメントの生産を支援します。この取り組みは、ハイデルベルグのグローバル脱炭素化戦略の重要な部分であり、CO₂排出量を最大40%削減することを目指しています。また、このプロジェクトは300人以上の地元雇用を創出し、石灰岩の埋蔵量が限られている地域における持続可能なセメント生産の青写真となっています。

- 2025年4月、Supacem(CBIガーナ)は、ガーナのテマに1億ドルを投資し、同国のクリンカー不足と輸入コストの高騰に対処することを目指したLC3(石灰石焼成粘土セメント)工場を新設しました。この工場の立ち上げは、ガーナ規格局が国内外の機関と共同で策定したGS PAS 5:2024 LC3規格を採用したことで実現しました。地元産の原材料を使用することで、この工場は輸入クリンカーへの依存を軽減し、セメント供給の安定性を高め、環境の持続可能性を支援します。また、このプロジェクトは160人以上の直接雇用を創出し、経済成長と気候変動対策に貢献しています。

- JKラクシュミ・セメント社は、2023年11月、インドおよびアジアで初めてLC3(石灰石焼成粘土セメント)の商業生産を開始する準備を進めていることを発表しました。この画期的な取り組みは、ノイダ国際空港プロジェクトにおけるチューリッヒ・エアポート・インターナショナル社との戦略的パートナーシップの一環であり、同空港の二酸化炭素排出量の大幅な削減を目指しています。LC3の配合設計は、クリンカーの最大50%を代替し、最大35%のCO₂削減に貢献します。この取り組みは、パリ協定に基づくインドの気候変動対策へのコミットメントを支援するものであり、持続可能なインフラにおけるインドとスイスの協力を示すものです。

- 2023年2月、ホルシムはフランスのサンピエール・ラクール工場に欧州初の焼成粘土セメント工場を開設しました。この工場では、ホルシム独自のProximA Tech技術を用いてECOPlanetグリーンセメントを生産し、従来のセメントと比較してCO₂排出量を50%削減した低炭素セメントを年間最大50万トン生産します。バイオマス燃料と廃熱回収システムのみで稼働するこの工場は、ホルシムの建設の脱炭素化と欧州全域における持続可能な材料の普及に向けた戦略における大きな一歩となります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。