Global Large Format Display (LFD) Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

9.60 Billion

USD

18.20 Billion

2024

2032

USD

9.60 Billion

USD

18.20 Billion

2024

2032

| 2025 –2032 | |

| USD 9.60 Billion | |

| USD 18.20 Billion | |

|

|

|

|

Global Large Format Display (LFD) Market, By Offering (Displays, Controllers, Mounts and Other Accessories, Consulting and Other Services), Display Type (Video Wall, Standalone Display), Display Size (32–40 Inches, 41–60 Inches, 61–70 Inches, 71–80 Inches, More Than 80 Inches), Display Brightness (Less than 500 Nits, 501-1000 Nits, 1001-2000 Nits, 2001-3000 Nits, More than 3000 Nits), Application (Indoor, Outdoor), End User (Commercial, Infrastructural, Institutional, Industrial). Industry Trends and Forecast to 2032

Large Format Display (LFD) Market Size

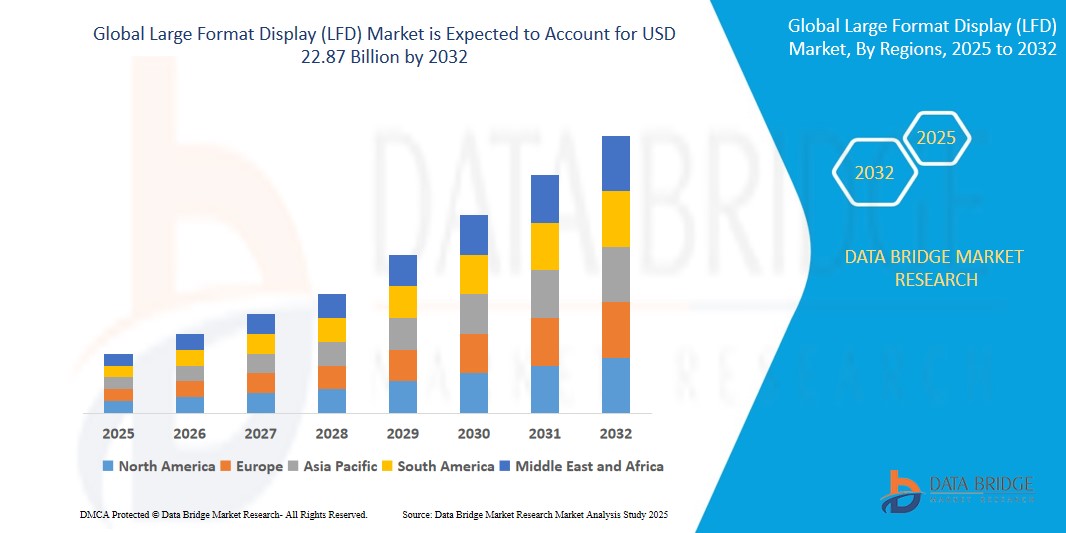

- The global Large Format Display (LFD) market size was valued atUSD 14.23 billion in 2024 and is expected to reachUSD 22.87 billion by 2032, at aCAGR of 6.1% during the forecast period.

- This growth is driven by increasing demand for high-resolution displays in digital signage, retail advertising, corporate environments, and public infrastructure, along with advancements in OLED and LED technologies and the rising adoption of 4K and 8K displays in commercial and institutional applications.

Large Format Display (LFD) Market Analysis

- Large Format Displays (LFDs) are high-resolution screens typically larger than 32 inches, used for digital signage, advertising, information dissemination, and interactive applications. Unlike traditional displays, LFDs offer superior brightness, durability, and scalability for indoor and outdoor environments.

- Key factors driving market growth include the rise of smart cities, increasing adoption of digital advertising in retail and hospitality, and the need for immersive displays in education, corporate, and transportation sectors. The integration of AI-driven content management and interactive touch capabilities further accelerates market expansion.

- Asia-Pacific is expected to dominate the LFD market due to rapid urbanization, large-scale infrastructure projects, and the presence of major display manufacturers in countries like China, South Korea, and Japan.

- North America is projected to be the fastest-growing region, driven by high demand for advanced digital signage in retail, healthcare, and corporate sectors, coupled with technological advancements in 4K and 8K displays.

- The LED segment is expected to dominate the Large Format Display (LFD) market, with a market share of 38.5% during the forecast period. This leadership is driven by the increasing demand for high-brightness, energy-efficient, and scalable display solutions, growing adoption in digital signage, retail, and public infrastructure, and ongoing advancements in LED technology enhancing durability and visual performance.

Report Scope and Large Format Display (LFD) Market Segmentation

|

Attributes |

Large Format Display (LFD)Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Large Format Display (LFD) Market Trends

“Adoption of High-Resolution 4K and 8K Displays with Interactive Features”

- The LFD market is witnessing a shift toward ultra-high-definition 4K and 8K displays, offering enhanced clarity and immersive experiences for digital signage, advertising, and corporate applications.

- Advancements in LED and OLED technologies are enabling brighter, energy-efficient, and thinner displays with superior color accuracy and contrast

- For instance, in February 2025, Samsung introduced its 8K QLED LFD series for commercial use, featuring AI-driven upscaling and modular MicroLED panels, targeting retail and corporate environments.

- Interactive touch-enabled LFDs are gaining traction in retail, education, and hospitality, enhancing user engagement through dynamic content delivery and real-time interaction devices

Large Format Display (LFD) Market Dynamics

Driver

“Growing Demand for Digital Signage in Retail and Smart Cities”

- The rise of digital advertising in retail, hospitality, and transportation sectors is fueling demand for LFDs, offering dynamic and customizable content delivery.

- Smart city initiatives, particularly in Asia-Pacific and the Middle East, are driving the deployment of LFDs for public information systems, traffic management, and urban advertising.

- Enhanced durability, drop resistance, and energy efficiency in foldable devices are accelerating their adoption across premium electronics.

- For instance, In January 2025, Dubai’s RTA integrated 4K LFDs across metro stations for real-time commuter updates and advertising, boosting regional market growth.

- The rise of hybrid working, gaming-on-the-go, and multi-screen functionality makes foldable displays a key growth driver in consumer and enterprise segments.

Opportunity

“Integration of LFDs in Smart City Infrastructure”

- LFDs are increasingly used in smart city projects for real-time information displays, wayfinding, and public safety announcements, creating new revenue streams for manufacturers.

- The adoption of IoT-enabled LFDs with cloud-based content management systems enhances scalability and operational efficiency in urban environments.

- Large Format Display (LFD) panels are also enhancing design freedom, enabling slimmer and more ergonomic cabin layouts.

- For instance, In March 2025, Singapore deployed LG’s outdoor OLED LFDs in its Smart Nation initiative, offering interactive maps and real-time transit updates.

- As EVs and connected vehicles rise, this trend opens new revenue streams for display manufacturers targeting next-gen automotive design and UX innovation.

Restraint/Challenge

“High Initial Costs and Maintenance Challenges”

- The high cost of advanced LFDs, particularly OLED and 8K models, limits adoption in price-sensitive markets and small-scale businesses.

- Outdoor LFDs face challenges related to weather resistance, power consumption, and maintenance, increasing operational costs

- Dependency on a limited number of suppliers for flexible substrates and encapsulation materials creates supply chain bottlenecks and reduces scalability

- For instance, In December 2024, a major European retailer reported delays in LFD deployment due to high installation costs and supply chain disruptions for high-resolution panels.

- Additionally, repairability and recyclability remain major concerns, as flexible screens are more vulnerable to scratches, creases, and structural fatigue over time—raising questions about long-term durability and sustainability.

Large Format Display (LFD) Market Scope

The market is segmented on the By Offering, Display Type, Display Size, Display Brightness, Application, End User

|

Segmentation |

Sub-Segmentation |

|

By By Offering |

|

|

ByDisplay Type |

|

|

ByDisplay Size |

|

|

ByDisplay Brightness |

|

|

ByApplication |

|

|

End User |

|

In 2025, the OLED is projected to dominate the market with a largest share inbytype segment

The LED segment is expected to dominate the Large Format Display (LFD) market, with a market share of 38.5% during the forecast period. This leadership is driven by the increasing demand for high-brightness, energy-efficient, and scalable display solutions, growing adoption in digital signage, retail, and public infrastructure, and ongoing advancements in LED technology enhancing durability and visual performance.

The LCDis expected to account for the largest share during the forecast period inLarge Format Display (LFD) market

In 2025, the LCD segment in the Large Format Display (LFD) Market is projected to hold the largest share of approximately 35.87%. This dominance is driven by the widespread availability, cost-effectiveness, and mature production technology of LCD panels, along with their extensive use in applications such as signage, monitors, and consumer electronics across both consumer and commercial sectors..

Large Format Display (LFD)Market Regional Analysis

“Asia-Pacific Holds the Largest Share in theLarge Format Display (LFD) Market”

- Asia-Pacific dominates the Large Format Display (LFD) Market, driven by the presence of major display panel manufacturers, increasing demand for flexible and foldable smartphones, and technological advancements in countries such as China, South Korea, and Japan.

- China and South Korea are major contributors due to their massive electronics manufacturing ecosystems, strong R&D focus, and aggressive expansion into next-gen OLED and AMOLED technologies.

- Japan, with its advanced infrastructure and legacy in display technology, plays a key role in supplying high-quality flexible components for wearables, automotive dashboards, and digital signage.

- The region’s dominance is further reinforced by government-backed initiatives promoting smart manufacturing, smart cities, and digital transformation across public and private sectors.

“North America is Projected to Register the Highest CAGR in theLarge Format Display (LFD)Market”

- North America is expected to witness the fastest growth in the Large Format Display (LFD) Market, driven by rising adoption of advanced consumer electronics, smart home technologies, and automotive infotainment systems.

- The U.S. leads the region due to the presence of major tech companies like Apple, Corning, and Universal Display Corporation that are investing heavily in foldable devices, wearable tech, and AR/VR applications powered by flexible displays.

- The integration of flexible displays into smart vehicles, next-gen laptops, and innovative commercial displays is accelerating regional demand.

- Additionally, growing consumer preference for sleek, high-performance, and space-saving devices and a strong ecosystem of startups and R&D labs support long-term growth prospects in the region.

Large Format Display (LFD) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- Sony Corporation (Japan)

- Sharp Corporation (Japan)

- NEC Corporation (Japan)

- Panasonic Corporation (Japan)

- Barco NV (Belgium)

- ViewSonic Corporation (U.S.)

- BenQ Corporation (Taiwan)

- Christie Digital Systems (U.S.)

- Planar Systems, Inc. (U.S.)

- Delta Electronics, Inc. (Taiwan)

- Leyard Optoelectronic Co., Ltd. (China)

- E Ink Holdings Inc. (Taiwan)

- AU Optronics Corp. (Taiwan)

Latest Developments in Global Large Format Display (LFD) Market

- On March 10, 2025, flexible displays and wearable technology emerged as transformative forces in the consumer electronics landscape, breaking traditional boundaries and redefining how users interact with devices. These innovations are driven by advancements in materials science, miniaturization, and next-gen manufacturing techniques.

- On November 11, 2024, LG unveiled the world’s first stretchable display, capable of expanding from 12 to 18 inches without image loss. Built on microLED tech, it endures 10,000 stretch cycles and supports touch gestures. This ultra-thin, wearable-ready innovation challenges Samsung's foldables and sets a new benchmark in Large Format Display (LFD) technology across smartphones, tablets, and wearables.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。