Global Automotive Curtain Airbags Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

16.71 Billion

USD

34.66 Billion

2025

2033

USD

16.71 Billion

USD

34.66 Billion

2025

2033

| 2026 –2033 | |

| USD 16.71 Billion | |

| USD 34.66 Billion | |

|

|

|

|

Global Automotive Curtain Airbags Market Segmentation, By Application (Torso Curtain Airbags, Head Curtain Airbags, and Combo Curtain Airbags), End-User (OEM and Aftermarket), Vehicle Type (Hatchback, Sedan, Sports Utility Vehicles, and Other Passenger Cars)- Industry Trends and Forecast to 2033

Automotive Curtain Airbags Market Size

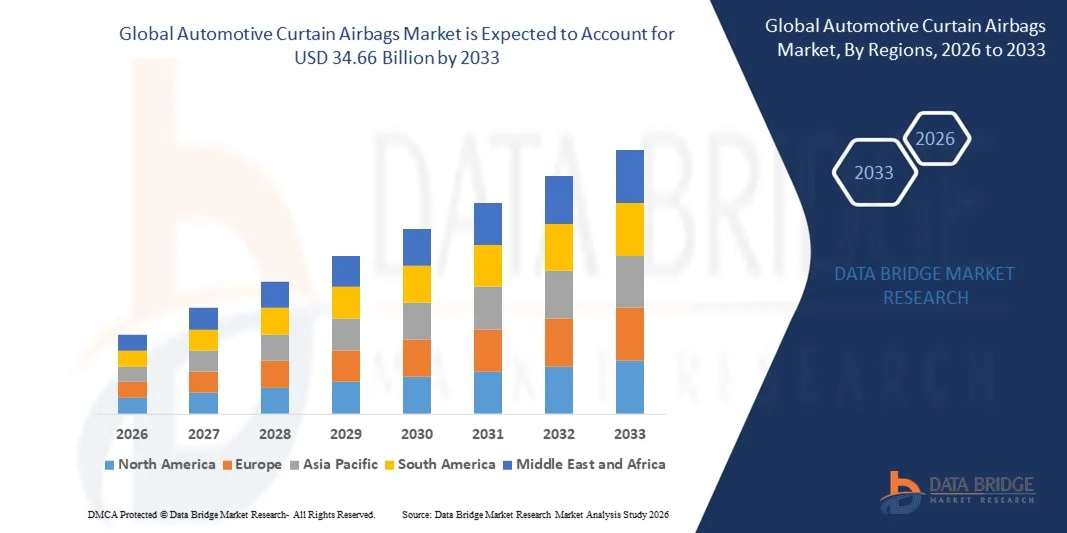

- The global automotive curtain airbags market size was valued at USD 16.71 billion in 2025 and is expected to reach USD 34.66 billion by 2033, at a CAGR of 9.55% during the forecast period

- The market growth is largely fuelled by the increasing emphasis on vehicle safety regulations, rising consumer demand for advanced passive safety systems, and growing production of passenger cars and commercial vehicles

- Rising awareness about occupant protection during collisions and government mandates for side-impact safety features are further driving the adoption of curtain airbags

Automotive Curtain Airbags Market Analysis

- The market is witnessing steady growth due to stringent safety standards across developed and emerging economies, pushing OEMs to integrate curtain airbags as standard features in vehicles

- Increasing consumer preference for vehicles equipped with advanced safety features and connected technologies is encouraging automotive manufacturers to adopt innovative airbag solutions

- North America dominated the automotive curtain airbags market with the largest revenue share of 38.75% in 2025, driven by stringent vehicle safety regulations, rising consumer awareness regarding side-impact protection, and increasing adoption of advanced safety features in passenger vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive curtain airbags market, driven by rapid urbanization, rising automotive sales, government initiatives promoting vehicle safety, and increasing adoption of advanced airbag systems in both passenger and commercial vehicles

- The Head Curtain Airbags segment held the largest market revenue share in 2025, driven by the increasing focus on passenger safety and stringent government regulations mandating side-impact protection. Head curtain airbags provide enhanced protection during rollover and side-impact collisions, making them a preferred choice among OEMs for passenger vehicles

Report Scope and Automotive Curtain Airbags Market Segmentation

|

Attributes |

Automotive Curtain Airbags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Curtain Airbags Market Trends

Rising Adoption Of Advanced Vehicle Safety Systems

- The growing emphasis on vehicle safety is significantly shaping the automotive curtain airbags market, as consumers increasingly prioritize occupant protection during collisions. Curtain airbags are gaining traction due to their ability to reduce head injuries in side-impact accidents and rollovers. This trend strengthens their adoption across passenger cars, SUVs, and commercial vehicles, encouraging manufacturers to integrate advanced airbag systems in new models

- Increasing awareness of road safety and stringent government regulations on vehicle safety standards have accelerated the demand for curtain airbags. Automotive manufacturers are actively incorporating curtain airbags in compliance with side-impact and rollover protection mandates, prompting collaborations with airbag suppliers to enhance performance and reliability

- Safety and regulatory compliance trends are influencing purchasing decisions, with manufacturers emphasizing innovative designs, multi-chamber configurations, and high-strength materials. These factors are helping automakers differentiate vehicles in a competitive market and build consumer trust, while also driving investments in R&D for improved occupant protection technologies

- For instance, in 2023, Toyota in Japan and Ford in the U.S. introduced models equipped with enhanced multi-chamber curtain airbags. These launches were in response to rising consumer and regulatory demand for superior side-impact protection, with inclusion across premium, mid-range, and entry-level vehicles. The airbags were also marketed as advanced safety features, enhancing brand reputation and customer confidence

- While demand for automotive curtain airbags is growing, sustained market expansion depends on cost-effective production, lightweight materials, and maintaining functional performance across diverse vehicle types. Manufacturers are also focusing on improving supply chain efficiency, airbag sensor integration, and innovative deployment mechanisms for broader adoption

Automotive Curtain Airbags Market Dynamics

Driver

Growing Focus On Vehicle Safety And Regulatory Compliance

- Rising consumer demand for advanced safety features is a major driver for the automotive curtain airbags market. Manufacturers are increasingly integrating curtain airbags to meet side-impact and rollover protection standards, enhance vehicle safety ratings, and comply with regional and global safety regulations

- Expanding adoption across passenger cars, SUVs, and commercial vehicles is influencing market growth. Curtain airbags help minimize head injuries and fatalities during side collisions, enabling manufacturers to meet consumer expectations for high-quality, safe vehicles. The increasing focus on smart and connected vehicle safety systems further reinforces this trend

- Automotive OEMs are actively promoting vehicles with advanced curtain airbag systems through marketing campaigns, safety certifications, and crash test ratings. These efforts are supported by government safety regulations and rising consumer awareness, and they also encourage partnerships between vehicle manufacturers and airbag system suppliers to improve safety performance

- For instance, in 2023, Volvo in Sweden and Honda in Japan reported increased incorporation of multi-chamber curtain airbags in their vehicle lineups. This expansion followed higher consumer demand for improved crash protection and vehicle safety ratings, driving repeat purchases and brand loyalty. Both companies also highlighted safety innovations in marketing campaigns to strengthen consumer trust

- Although the emphasis on vehicle safety and regulations supports growth, wider adoption depends on cost optimization, technological advancements, and scalable production processes. Investment in lightweight materials, airbag deployment systems, and integration with advanced sensors will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Production Costs And Complexity Of Deployment Systems

- The relatively higher cost of curtain airbags compared to basic airbag systems remains a key challenge, limiting adoption among cost-sensitive vehicle segments. Higher raw material costs, complex sensor integration, and intricate deployment mechanisms contribute to elevated pricing

- Variations in safety regulations across regions create additional design and certification complexities for manufacturers. Ensuring compliance while maintaining uniform quality and performance increases development timelines and costs

- Supply chain and integration challenges also impact market growth, as curtain airbags require precise coordination between sensor systems, airbag modules, and vehicle interiors. Logistical complexities and safety testing protocols increase operational costs. Companies must invest in quality control, assembly precision, and regulatory compliance to maintain product integrity

- For instance, in 2024, some mid-range vehicle manufacturers in India and Brazil reported slower incorporation of advanced curtain airbags due to cost constraints and technical deployment challenges. Integration with sensor systems and compliance with international safety standards were additional barriers. These factors also prompted selective inclusion in premium models only, affecting market penetration

- Overcoming these challenges will require cost-efficient production, standardized integration methods, and continued R&D in lightweight and modular airbag systems. Collaboration with sensor and material suppliers can help unlock the long-term growth potential of the global automotive curtain airbags market. Furthermore, developing cost-competitive, high-performance airbags and strengthening marketing strategies around safety benefits will be essential for broader adoption

Automotive Curtain Airbags Market Scope

The market is segmented on the basis of application, end-user, and vehicle type.

- By Application

On the basis of application, the automotive curtain airbags market is segmented into Torso Curtain Airbags, Head Curtain Airbags, and Combo Curtain Airbags. The Head Curtain Airbags segment held the largest market revenue share in 2025, driven by the increasing focus on passenger safety and stringent government regulations mandating side-impact protection. Head curtain airbags provide enhanced protection during rollover and side-impact collisions, making them a preferred choice among OEMs for passenger vehicles.

The Torso Curtain Airbags segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer awareness regarding side-impact injuries and advancements in airbag deployment technologies. Torso curtain airbags offer targeted protection to the upper body and ribs, complementing other airbag systems to improve overall vehicle safety ratings and passenger confidence.

- By End-User

On the basis of end-user, the market is segmented into OEM and Aftermarket. The OEM segment dominated the market in 2025, attributed to the integration of curtain airbags as standard safety features in new vehicles to comply with global safety standards.

The Aftermarket segment is projected to grow at a notable CAGR from 2026 to 2033, supported by the increasing number of vehicle retrofits and rising demand for upgrading older vehicles with advanced safety systems.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Hatchback, Sedan, Sports Utility Vehicles, and Other Passenger Cars. The SUV segment accounted for the largest share in 2025, owing to the higher adoption of advanced safety features in larger vehicles and the rising popularity of SUVs in global markets.

The Sedan segment is expected to register the fastest growth rate from 2026 to 2033, driven by increasing safety consciousness among consumers and the inclusion of curtain airbags in mid-size and premium sedans across multiple regions.

Automotive Curtain Airbags Market Regional Analysis

- North America dominated the automotive curtain airbags market with the largest revenue share of 38.75% in 2025, driven by stringent vehicle safety regulations, rising consumer awareness regarding side-impact protection, and increasing adoption of advanced safety features in passenger vehicles

- Consumers in the region highly value the enhanced protection offered by curtain airbags in side-impact and rollover collisions, contributing to the overall vehicle safety ratings

- This widespread adoption is further supported by strong automotive manufacturing infrastructure, high disposable incomes, and the preference for premium safety features, establishing curtain airbags as a standard safety solution in both passenger and commercial vehicles

U.S. Automotive Curtain Airbags Market Insight

The U.S. automotive curtain airbags market captured the largest revenue share in 2025 within North America, fueled by strict federal safety regulations and the increasing demand for passenger safety in new vehicles. Consumers are prioritizing vehicles equipped with side-impact and rollover protection systems. The rising trend of premium vehicles and SUVs, coupled with technological advancements in airbag deployment, further propels market growth. Moreover, automakers’ focus on achieving high safety ratings and consumer demand for comprehensive safety packages is significantly contributing to market expansion.

Europe Automotive Curtain Airbags Market Insight

The Europe automotive curtain airbags market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent Euro NCAP safety standards and increasing consumer awareness regarding passenger safety. Growing urbanization and the demand for technologically advanced vehicles are fostering curtain airbag adoption. European consumers are also attracted to vehicles offering high crash-test ratings, with the market seeing significant growth across sedans, SUVs, and premium passenger cars.

U.K. Automotive Curtain Airbags Market Insight

The U.K. automotive curtain airbags market is expected to witness the fastest growth rate from 2026 to 2033, driven by growing safety concerns and the increasing popularity of vehicles with advanced passive safety features. Consumers’ emphasis on side-impact protection and rollover safety is encouraging both OEMs and aftermarket providers to adopt curtain airbags. The robust automotive manufacturing and retail ecosystem in the U.K. further supports market growth.

Germany Automotive Curtain Airbags Market Insight

The Germany automotive curtain airbags market is expected to witness the fastest growth rate from 2026 to 2033, fueled by stringent vehicle safety regulations, technological advancements in airbag systems, and rising awareness regarding occupant protection. Germany’s focus on innovation, high automotive production standards, and strong safety culture promotes curtain airbag adoption, particularly in premium and commercial vehicles. Integration with advanced safety systems and sensor technologies is also becoming increasingly prevalent.

Asia-Pacific Automotive Curtain Airbags Market Insight

The Asia-Pacific automotive curtain airbags market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid vehicle production, rising safety awareness, and government initiatives promoting automotive safety in countries such as China, Japan, and India. The region’s increasing adoption of SUVs and premium passenger cars, along with technological advancements and growing middle-class demand for safer vehicles, is boosting market penetration.

Japan Automotive Curtain Airbags Market Insight

The Japan automotive curtain airbags market is expected to witness the fastest growth rate from 2026 to 2033 due to high safety standards, technological advancements, and growing consumer preference for vehicles with advanced passive safety systems. The market is supported by increasing production of smart and connected vehicles equipped with curtain airbags, while the aging population is encouraging demand for enhanced protection and user-friendly safety solutions.

China Automotive Curtain Airbags Market Insight

The China automotive curtain airbags market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid vehicle production, strict safety regulations, and rising consumer safety awareness. China is one of the largest automotive markets globally, and curtain airbags are becoming increasingly standard in sedans, SUVs, and commercial vehicles. Government initiatives promoting vehicle safety, domestic manufacturing capabilities, and the growing middle-class demand for advanced safety features are key factors driving market growth.

Automotive Curtain Airbags Market Share

The Automotive Curtain Airbags industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- BorgWarner Inc (U.S.)

- TOYODA GOSEI Co., Ltd (Japan)

- DENSO CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- Visteon Corporation (U.S.)

- Nihon Plast Co., Ltd (Japan)

- Ashimori Industry Co., Ltd (Japan)

- Autoliv Inc (Sweden)

- Takata Corporation (Japan)

- Key Safety Systems (KSS) (China)

- Hyundai Mobis (South Korea)

- Faurecia (France)

Latest Developments in Global Automotive Curtain Airbags Market

- In December 2024, Autoliv and Jiangling Motors announced a strategic partnership to co-develop advanced restraint systems for next-generation EV platforms. This collaboration aims to enhance occupant safety, optimize airbag performance for electric vehicles, and accelerate the adoption of advanced safety technologies in emerging EV markets, strengthening both companies’ positions in the global curtain airbag market

- In December 2024, Forvia launched 100% bio-based polyamide airbags for curtain applications manufactured from castor oil-derived feedstocks. The new airbags offer materials similar to traditional nylon 66 while reducing carbon emissions by approximately 60%, targeting the German luxury vehicle segment. This development aligns with the automotive industry’s sustainability goals and is expected to drive the adoption of eco-friendly airbag solutions from 2026 onwards

- In November 2024, BMW issued recall 24V-856 after discovering right-side head curtain airbag gas generators were installed incorrectly, risking mis-deployment. The recall ensures proper airbag deployment, enhancing passenger safety and compliance with global safety standards. This corrective action reinforces trust in BMW’s safety practices and underscores the critical importance of precise airbag manufacturing

- In October 2024, Toyoda Gosei expanded its Neemrana, India airbag plant with automated processes including robot sewing, computer-controlled cutting, and vision inspection systems. The facility can produce 3-4 million curtain airbags annually to meet tightening regional safety mandates, serving Suzuki and Toyota programs. This expansion strengthens supply capacity in Asia and supports growing OEM demand for safer passenger vehicles

- In October 2024, Joyson completed the replacement of 3.2 million ammonium-nitrate-free curtain airbag inflators, improving moisture resistance and overall reliability. This milestone concludes the remediation program initiated after Takata airbag defects, enhancing consumer confidence in airbag safety and stabilizing the global curtain airbag market

- In September 2024, Bosch released a unified AI-enabled safety ECU capable of monitoring up to 16 sensors and reducing false inflations by 30-40%. The ECU conforms to ASIL-D safety standards and will be used in 2026 vehicle programs. This innovation advances intelligent airbag deployment, reduces risk of unnecessary inflations, and positions Bosch as a leader in smart safety solutions

- In August 2024, Hyundai Mobis and OMNIVISION began developing integrated occupant monitoring and curtain airbag control systems using RGB-IR cameras for EV platforms launching in 2026-2027. The system enhances passenger protection, enables real-time monitoring, and supports automated safety responses. This collaboration highlights growing trends in AI-driven and sensor-integrated automotive safety

- In July 2024, Continental introduced hybrid-propellant curtain airbag inflators combining pyrotechnic gas generation and electronically controlled compressed gas release. The technology enables precise inflation across crash severities and improves occupant protection, with production readiness planned for 2027-2028. This advancement strengthens Continental’s position in high-performance airbag systems for global OEMs

- In June 2024, Toyoda Gosei inaugurated its Tianjin curtain airbag facility featuring fully automated production lines with robot sewing, vision inspection, and computer-controlled cutting. The plant will produce 3-4 million airbags annually to support Chinese OEMs, meeting rising demand for safe passenger vehicles. This facility enhances production efficiency and supply reliability in Asia’s automotive safety market

- In June 2024, Honda Motor Co., Ltd. announced the N-VAN e mini-EV in Japan will include side curtain airbags as standard for front seats. The move improves commercial vehicle safety, meets regulatory requirements, and sets a precedent for future light EVs in Japan. This initiative is expected to drive market adoption of advanced safety features in small commercial vehicles

- In March 2023, Chery Australia Pty Ltd. launched the Chery Omoda 5 in Australia with seven airbags, including side head (curtain), side chest, dual frontal, and front-center airbags, achieving a five-star ANCAP safety rating. This highlights increasing consumer demand for comprehensive safety systems and encourages broader adoption of curtain airbags in mid-range vehicles

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。