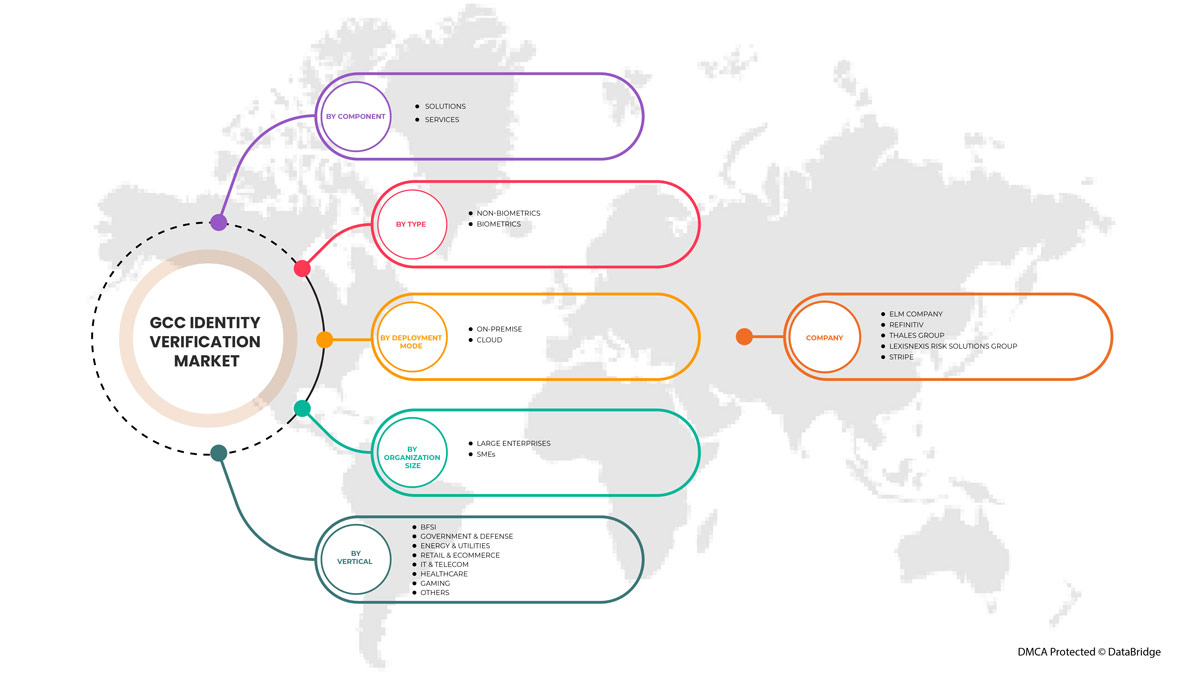

GCC の ID 検証市場、コンポーネント (ソリューションとサービス)、タイプ (非生体認証と生体認証)、展開モード (オンプレミスとクラウド)、組織規模 (大企業と中小企業)、業種 (BFSI、政府と防衛、エネルギーと公共事業、小売と電子商取引、IT と通信、ヘルスケア、ゲーム、その他) 別、2029 年までの業界動向と予測。

GCC の本人確認市場の分析と規模

GCC の本人確認市場の成長は、顧客によるデジタル決済の採用の増加によって大きく促進されています。業界における技術革新の拡大が市場の成長を後押ししています。本人確認には、インストール、メンテナンス、その他の技術的専門知識のコストのために多額の初期資本が必要であり、これが市場にとって大きな抑制要因となっています。

Data Bridge Market Research の分析によると、GCC の ID 検証市場は、予測期間中に 11.9% の CAGR で成長し、2029 年までに 996,843.09 千米ドルに達すると予想されています。ID 検証ソリューションは、最も顕著なモジュール モード セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術の進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

基準年 |

2021 |

|

予測期間 |

2022年から2029年 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

千米ドル |

|

対象セグメント |

コンポーネント (ソリューションとサービス)、タイプ (非生体認証と生体認証)、展開モード (オンプレミスとクラウド)、組織規模 (大企業と中小企業)、業種 (BFSI、政府および防衛、エネルギーと公共事業、小売および電子商取引、IT と通信、ヘルスケア、ゲーム、その他) 別。 |

|

対象国 |

UAE、サウジアラビア王国、カタール、クウェート、オマーン、バーレーン |

|

対象となる市場プレーヤー |

Experian Information Solutions, Inc. (Experian plc の子会社)、LexisNexis Risk Solutions Group、Onfido、GB Group plc (「GBG」)、Acuant, Inc.、IDEMIA、Thales Group、Shufti Pro、Uqudo、Western Union Holdings, Inc.、Plaid Inc.、IDMERIT.、AccuraTechnolabs、Ping Identity、IDnow.、AML UAE.、Stripe、Elm Company、Refinitiv、Trulioo.、QlikTech International AB など。 |

市場の定義

本人確認とは、運転免許証、パスポート、国が発行した身分証明書などの、個人の身分証明書や文書の真正性を検証するために使用されるサービスとソリューションを指します。本人確認は、個人の身分証明書が本来の本人と一致することを確認する重要なプロセスです。本人確認ソリューションとサービスは、プロセスの背後で実在の人物が行動し、本人であることを証明していることを保証し、偽の身分証明書や詐欺を防止します。本人確認は、多くのビジネス プロセスと手順で不可欠な要件です。

GCC の本人確認市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

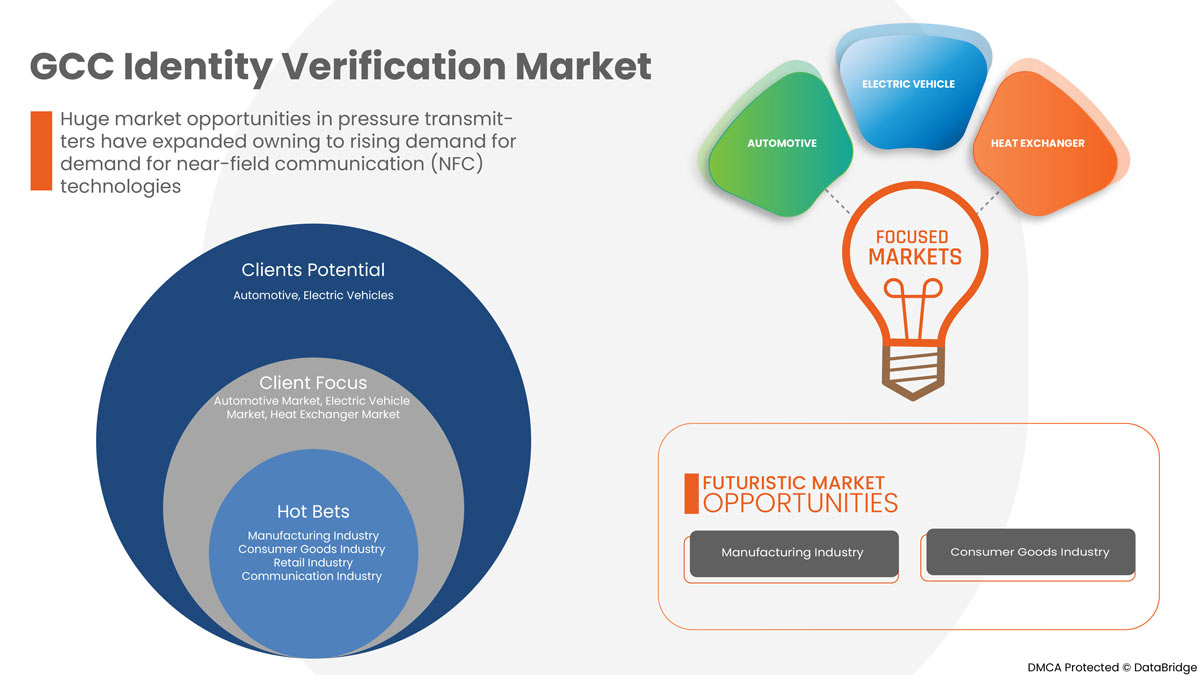

- 近距離無線通信(NFC)技術の需要増加

近距離無線通信(NFC)は、動作周波数が13.56MHzの無線周波数(RF)に基づく非接触通信技術です。NFC技術は、簡単なタッチで2つの電子機器間でデータを交換できるように設計されています。最近では、世界中でCOVIDが流行していることや、流行中にこれらの機器が提供する非接触型サービスなどの要因により、NFC技術は絶大な人気を得ています。

- クラウドIDおよびアクセス管理ソリューションへの依存度を高める

アイデンティティおよびアクセス管理 (IAM) ソリューションは、適切な個人が適切な目的で適切なコンテンツにアクセスできるようにする一連のセキュリティ規律です。アイデンティティおよびアクセス管理ソリューションは、コンテンツの使用前にユーザーのアイデンティティを確認します。アイデンティティおよびアクセス管理 (IAM) ソリューションは、かなり前から存在しています。当初、企業や大企業は、アイデンティティおよびアクセス戦略を管理するためにオンプレミスのアイデンティティおよびアクセス管理 (IAM) ソフトウェアを導入していました。しかし、最近では、技術の進歩により、クラウドベースのアイデンティティおよびアクセス管理 (IAM) ソリューションやクラウドベースの Identity-as-a-Service (IDaaS) が成長しています。人工知能 (AI)、機械学習 (ML)、ディープラーニングを活用したクラウド テクノロジーは、オンプレミス テクノロジーよりも優位に立っています。

- 本人確認ソリューションの採用拡大

本人確認とは、運転免許証、パスポート、国が発行した身分証明書などの、個人の身元や文書を検証および認証するために使用されるサービスとソリューションを指します。本人確認は、個人の身元が本来のものと一致することを確認する重要なプロセスです。

制約/課題

- 詐欺行為の急増

本人確認ソリューションとサービスは、プロセスの背後に実在の人物がいることを保証し、その人物が本人であることを証明して、偽の身元による詐欺行為を防止します。本人確認と認証は、さまざまなビジネスにおいて不可欠な要件です。

- 本人確認ソリューションに関する認識不足

さまざまな国の業界全体で、デジタル化と技術の進歩に対する需要が非常に高まっています。ID 検証および認証ソリューションにより、組織は新規顧客と既存顧客のデジタル ID を迅速に検証できます。

- 初期コストが高い

本人確認には、プロセスの背後で実際の人物が操作していることを保証するソフトウェア、ソリューション、およびサービスが含まれます。個人の本人確認と認証は、ビジネスにとって極めて重要なプロセスであり、高いコストがかかります。

COVID-19後のGCC本人確認市場への影響

COVID-19はGCCの本人確認市場に大きな影響を与え、ほぼすべての国が必需品の生産を扱う施設を除くすべての生産施設の閉鎖を選択しました。政府はCOVID-19の拡散を防ぐために、非必需品の生産と販売の停止、国際貿易の遮断など、いくつかの厳しい措置を講じました。このパンデミック中に営業していた唯一のビジネスは、開業とプロセスの運営が許可された必須サービスでした。

COVID-19後の国際貿易を促進する政府の政策により、市場の成長は高まっています。また、コストとルートを最適化するために産業用ホースが提供する利点により、市場の需要が高まっています。ただし、貿易ルートと貿易制限に関連する一部の国の混雑により、市場の成長が抑制されています。パンデミック中の生産施設の閉鎖は、市場に大きな影響を与えました。

メーカーは、COVID-19後の回復に向けてさまざまな戦略的決定を下しています。各社は、産業用ホースに関わる技術を向上させるために、複数の研究開発活動を行っています。各社は、市場に先進的で正確なソリューションをもたらすでしょう。さらに、国際貿易を促進する政府の取り組みも市場の成長につながっています。

最近の動向

- 2022年9月、エルムはリヤドで開催されたグローバルAIサミットに参加しました。この参加により、同社は人工知能の将来の側面を模索し、複雑な問題を解決することができました。これは同社のブランドイメージの向上に役立ちます。

- Refinitivは2019年9月、デジタルID技術とKYCデューデリジェンスを統合した「QUAL-ID」の発売を発表した。このソリューションは不正行為を回避し、データを保護するために開始された。同社は新たなカバー市場に参入し、より多くの顧客を引き付けることができるようになるだろう。

GCC 本人確認市場の範囲

GCC の ID 検証市場は、コンポーネント、タイプ、展開モード、組織規模、および業種に基づいて 5 つの主要なセグメントに分割されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

コンポーネント別

- ソリューション

- サービス

GCC の ID 検証市場は、コンポーネントに基づいてソリューションとサービスに分類されています。

タイプ別

- 非生体認証

- 生体認証

タイプに基づいて、GCC の ID 検証市場は、生体認証と非生体認証に分類されています。

展開モード別

- オンプレミス

- 雲

展開モードに基づいて、GCC ID 検証市場はクラウドとオンプレミスに分割されています。

組織規模別

- 大企業

- 中小企業

組織の規模に基づいて、GCC の ID 検証市場は大企業と中小企業に分類されています。

垂直方向

- 英国

- 政府と防衛

- エネルギー・公益事業

- 小売業と電子商取引

- ITと通信

- 健康管理

- ゲーム

- その他

垂直に基づいて、GCC の ID 検証市場は、BFSI、政府および防衛、エネルギーおよび公共事業、小売および電子商取引、IT および通信、ヘルスケア、ゲーム、その他に分類されています。

GCC 本人確認市場地域分析/洞察

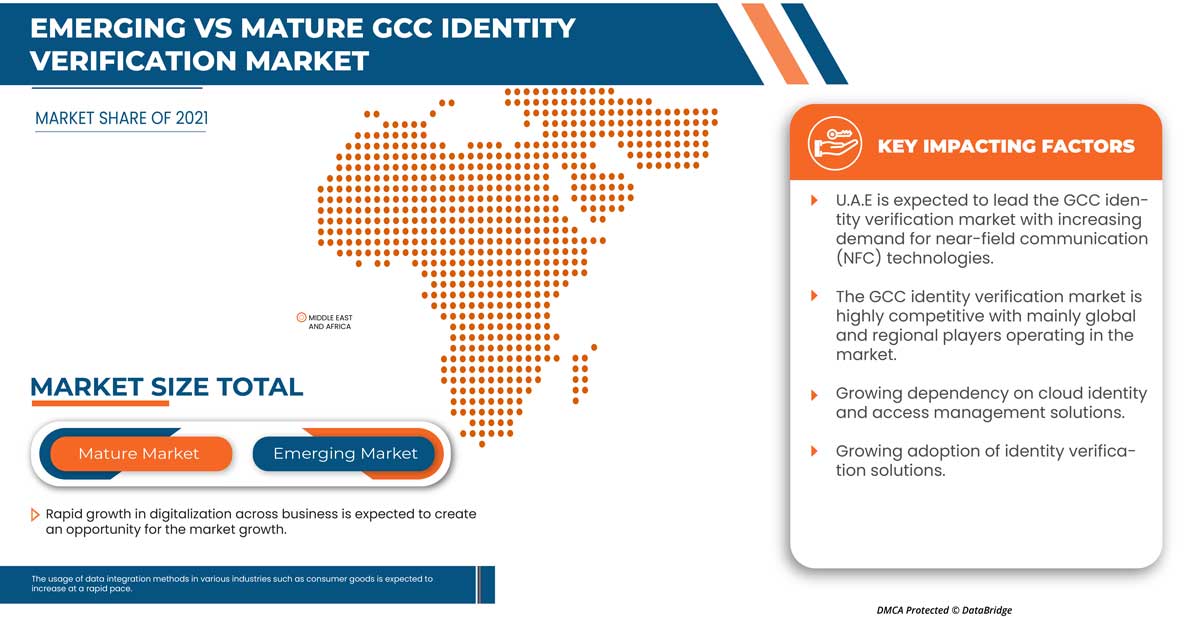

GCC の ID 検証市場が分析され、上記のように国、コンポーネント、タイプ、展開モード、組織規模、および業種別に市場規模の洞察と傾向が提供されます。

GCC の身元確認市場に含まれる国としては、UAE、サウジアラビア王国、カタール、クウェート、オマーン、バーレーンなどがあります。

UAE は、主要な市場プレーヤーが多数存在する技術的に進んだ地域であるため、市場での成長が見込まれており、その結果、本人確認の採用が増加します。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、GCC ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響を考慮しながら、国別データの予測分析を提供します。

競争環境とGCCの本人確認市場シェア分析

GCC の ID 検証市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、GCC の ID 検証市場に関連する会社の焦点にのみ関連しています。

GCC の ID 検証市場で活動している主要企業には、Experian Information Solutions, Inc. (Experian plc の子会社)、LexisNexis Risk Solutions Group、Onfido、GB Group plc (「GBG」)、Acuant, Inc.、IDEMIA、Thales Group、Shufti Pro、Uqudo、Western Union Holdings, Inc.、Plaid Inc.、IDMERIT.、AccuraTechnolabs、Ping Identity、IDnow.、AML UAE.、Stripe、Elm Company、Refinitiv、Trulioo.、QlikTech International AB などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GCC IDENTITY VERIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1.1 AI

4.1.2 INTERNET OF THINGS (IOT)

4.1.3 5G & LTE

4.1.4 NFC TECHNOLOGY

4.1.5 SMART BIOMETRIC TECHNOLOGIES

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING

4.2.3 MARKETING AND DISTRIBUTION

4.2.4 END USERS

4.3 USE CASE

4.3.1 FINANCIAL SERVICES

4.3.2 E-COMMERCE AND RETAIL

4.3.3 HEALTHCARE

4.3.4 GOVERNMENT

4.3.5 EDUCATION

4.4 REGULATION COVERAGE

4.5 KEY FEATURES OFFERED BY IDENTITY VERIFICATION SOLUTIONS

4.5.1 DIGITAL ONBOARDING

4.5.2 E KYC

4.5.3 REGTECH SOLUTIONS

4.6 PORTER'S MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES

5.1.2 HIGH DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.3 GROWING ADOPTION OF IDENTITY VERIFICATION SOLUTIONS

5.1.4 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINTS

5.2.1 SURGE IN FRAUDULENT ACTIVITIES

5.2.2 LACK OF AWARENESS REGARDING IDENTITY VERIFICATION SOLUTIONS

5.2.3 HIGH INITIAL COST

5.3 OPPORTUNITIES

5.3.1 HIGH ADOPTION OF RAZOR-SHARP BIOMETRICS IDENTITY VERIFICATION SOLUTIONS

5.3.2 INCREASING DEMAND FOR IDENTITY VERIFICATION SERVICES IN SMARTPHONES

5.3.3 WIDE RANGE ADOPTION OF IDENTITY VERIFICATION SOLUTIONS ACROSS BFSI

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS WHILE OFFERING SERVICE FOR IDENTITY VERIFICATION SOLUTIONS

5.4.2 STORAGE CHALLENGE FOR HUGE VARIANTS OF DATA/INFORMATION

6 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 DOCUMENT/ID VERIFICATION

6.2.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION

6.2.3 AUTHENTICATION

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 IMPLEMENTATION

6.3.2.2 TRAINING AND SUPPORT

6.3.2.3 CONSULTING

6.3.3 INTEGRATION SERVICES

7 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

8 GCC IDENTITY VERIFICATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIOMETRICS

8.3 NON-BIOMETRICS

9 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 GOVERNMENT AND DEFENSE

10.2.1 SOFTWARE

10.2.2 SERVICES

10.3 BFSI

10.3.1 SOFTWARE

10.3.2 SERVICES

10.4 RETAIL AND ECOMMERCE

10.4.1 SOFTWARE

10.4.2 SERVICES

10.5 HEALTHCARE

10.5.1 SOFTWARE

10.5.2 SERVICES

10.6 IT AND TELECOM

10.6.1 SOFTWARE

10.6.2 SERVICES

10.7 ENERGY AND UTILITIES

10.7.1 SOFTWARE

10.7.2 SERVICES

10.8 GAMING

10.8.1 SOFTWARE

10.8.2 SERVICES

10.9 OTHERS

10.9.1 SOFTWARE

10.9.2 SERVICES

11 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY

11.1 UAE

11.2 KINGDOM OF SAUDI ARABIA

11.3 QATAR

11.4 KUWAIT

11.5 OMAN

11.6 BAHRAIN

12 GCC IDENTITY VERIFICATION MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GCC

12.2 COMPANY SHARE ANALYSIS: UAE

12.3 COMPANY SHARE ANALYSIS: KSA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ELM COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 REFINITIV

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 THALES GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 LEXISNEXIS RISK SOLUTIONS GROUP.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 STRIPE

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 GB GROUP PLC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AML UAE.

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICES PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ACCURATECHNOLABS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 ACUANT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 EXPERIAN INFORMATION SOLUTIONS, INC. (A SUBSIDIARY OF EXPERIAN PLC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 SOLUTION PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 IDNOW.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 IDMERIT.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 IDEMIA

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 JUMIO

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 NUANCE COMMUNICATIONS, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 ONESPAN.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 ONFIDO

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PLAID INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PING IDENTITY.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 QLIKTECH INTERNATIONAL AB

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 SHUFTI PRO

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 TRULIOO.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 UQUDO

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 WESTERN HOLDING INC

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 BELOW MENTIONED ARE A FEW REGULATORY LANDSCAPES FOLLOWED IN GCC:

TABLE 2 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 3 GCC SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 GCC SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 GCC PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 7 GCC IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 9 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 10 GCC GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GCC BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GCC RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 GCC HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 GCC IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 GCC ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GCC GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GCC OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 19 U.A.E. IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 20 U.A.E. SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 U.A.E. SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 U.A.E. PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 U.A.E. IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 24 U.A.E IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 U.A.E. IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 26 U.A.E. IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 27 U.A.E. GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 U.A.E. BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 U.A.E. RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 U.A.E. HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 U.A.E. IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 U.A.E. ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 U.A.E. GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 U.A.E. OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 36 KINGDOM OF SAUDI ARABIA (KSA) SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 KINGDOM OF SAUDI ARABIA (KSA) SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 KINGDOM OF SAUDI ARABIA (KSA) PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 40 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 43 KINGDOM OF SAUDI ARABIA (KSA) GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 KINGDOM OF SAUDI ARABIA (KSA) BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 KINGDOM OF SAUDI ARABIA (KSA) RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 KINGDOM OF SAUDI ARABIA (KSA) HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 KINGDOM OF SAUDI ARABIA (KSA) IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 KINGDOM OF SAUDI ARABIA (KSA) ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 KINGDOM OF SAUDI ARABIA (KSA) GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 KINGDOM OF SAUDI ARABIA (KSA) OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 QATAR IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 52 QATAR SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 QATAR SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 QATAR PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 QATAR IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 56 QATAR IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 QATAR IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 QATAR IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 59 QATAR GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 QATAR BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 QATAR RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 QATAR HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 QATAR IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 QATAR ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 QATAR GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 QATAR OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 KUWAIT IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 68 KUWAIT SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 KUWAIT SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 KUWAIT PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 KUWAIT IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 KUWAIT IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 KUWAIT IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 74 KUWAIT IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 75 KUWAIT GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 KUWAIT BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 KUWAIT RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 KUWAIT HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 KUWAIT IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 KUWAIT ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 KUWAIT GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 KUWAIT OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 OMAN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 84 OMAN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 OMAN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 OMAN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 OMAN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 88 OMAN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 OMAN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 90 OMAN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 91 OMAN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 OMAN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 OMAN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 OMAN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 OMAN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 OMAN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 OMAN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 OMAN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BAHRAIN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 100 BAHRAIN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BAHRAIN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 BAHRAIN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 BAHRAIN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 104 BAHRAIN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 BAHRAIN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 106 BAHRAIN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 107 BAHRAIN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 BAHRAIN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 BAHRAIN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BAHRAIN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BAHRAIN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BAHRAIN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BAHRAIN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BAHRAIN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

図表一覧

FIGURE 1 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 2 GCC IDENTITY VERIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 GCC IDENTITY VERIFICATION MARKET: DROC ANALYSIS

FIGURE 4 GCC IDENTITY VERIFICATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC IDENTITY VERIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC IDENTITY VERIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GCC IDENTITY VERIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GCC IDENTITY VERIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES IS EXPECTED TO DRIVE GCC IDENTITY VERIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GCC IDENTITY VERIFICATION MARKET IN 2022 & 2029

FIGURE 12 TECHNOLOGICAL TRENDS IN IDENTITY VERIFICATION SOLUTIONS

FIGURE 13 SUPPLY CHAIN OF GCC IDENTITY VERIFICATION MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GCC IDENTITY VERIFICATION MARKET

FIGURE 15 FIGURE 2 GROWTH IN NFC TECHNOLOGIES USAGE

FIGURE 16 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMERS

FIGURE 17 FIGURE 4 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 18 GCC IDENTITY VERIFICATION MARKET: BY COMPONENT, 2021

FIGURE 19 GCC IDENTITY VERIFICATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 GCC IDENTITY VERIFICATION MARKET: BY TYPE, 2021

FIGURE 21 GCC IDENTITY VERIFICATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 GCC IDENTITY VERIFICATION MARKET: BY VERTICAL, 2021

FIGURE 23 GCC IDENTITY VERIFICATION MARKET: SNAPSHOT (2021)

FIGURE 24 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021)

FIGURE 25 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 GCC IDENTITY VERIFICATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 29 UAE GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 30 KSA GCC Identity Verification MARKET: company share 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。