欧州医療機器倉庫・物流市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

9.74 Billion

USD

13.86 Billion

2024

2032

USD

9.74 Billion

USD

13.86 Billion

2024

2032

| 2025 –2032 | |

| USD 9.74 Billion | |

| USD 13.86 Billion | |

|

|

|

|

欧州医療機器倉庫・物流市場:サービス、ハードウェア、ソフトウェア、温度(常温、冷蔵・冷蔵、冷凍、その他)、輸送モード(海上貨物物流、航空貨物物流、陸上物流)、用途(診断機器、治療機器、モニタリング機器、外科機器、その他)、最終用途(病院・診療所、医療機器企業、学術研究機関、リファレンス・診断研究所、救急医療サービス企業、その他)、流通チャネル(従来型物流およびサードパーティ)によるセグメンテーション - 2032年までの業界動向と予測

欧州の医療機器倉庫・物流市場規模

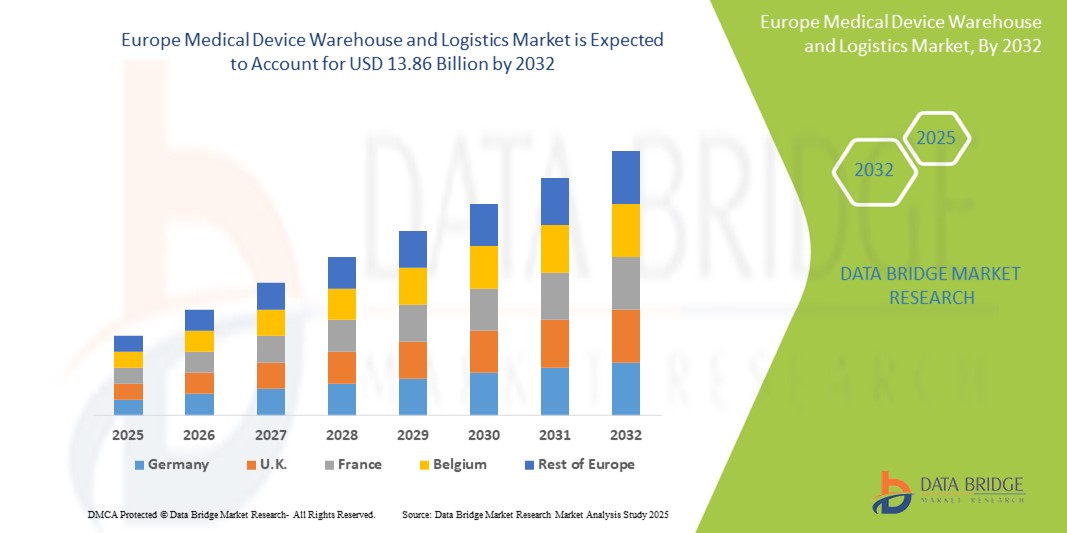

- ヨーロッパの医療機器倉庫および物流市場規模は2024年に97億4000万米ドルと評価され、予測期間中に4.50%のCAGRで成長し、2032年までに138億6000万米ドル に達すると予想されています 。

- 市場の成長は、高度なサプライチェーン技術の導入の増加と医療物流のデジタル変革によって主に推進されており、欧州全域での医療機器の保管と配送の効率化につながっています。

- さらに、温度に敏感で高価な医療機器の需要の高まりと、医療機器のトレーサビリティと安全性に関する厳格な規制遵守が相まって、欧州における医療機器倉庫および物流ソリューションの導入を促進しています。これらの要因が重なり、テクノロジーを活用した物流プラットフォームの導入が加速し、業界の成長を大きく後押ししています。

欧州医療機器倉庫・物流市場分析

- 医療機器の倉庫および物流サービスは、複雑な医療技術をタイムリーかつコンプライアンスに準拠し、温度管理された状態で配送することへの需要の高まりにより、特に病院、外来、在宅ケアの現場において、ヨーロッパの医療インフラにおいてますます重要な構成要素となっています。これらのサービスは、地域全体で機器の入手可能性、トレーサビリティ、そして規制の整合性を確保する上で重要な役割を果たしています。

- 欧州における効率的な医療機器物流の需要の高まりは、主に医療機器製造拠点の拡大、コールドチェーン技術の進歩、医療用品の電子商取引の拡大、MDRやGDPガイドラインなどの厳格な欧州規制によって推進されています。

- ドイツは、高度な医療インフラ、集中型配送ハブ、そして医療機器の生産と輸出におけるリーダーシップにより、2024年にはヨーロッパの医療機器倉庫・物流市場において28.3%という最大の収益シェアを獲得し、市場を席巻しました。自動化、RFID追跡、温度管理倉庫への投資は、特に大手物流業者の間で市場の成熟を加速させています。

- フランスは、政府支援による医療改革、大手物流サービスプロバイダーの存在、コールドチェーンソリューションの統合、慢性疾患ケア機器の需要増加に支えられ、予測期間中に医療機器倉庫および物流市場で最も急速に成長する地域となり、CAGR 5.8%で成長すると予想されています。

- 常温保管セグメントは、温度管理を必要としない医療機器の幅広い種類を網羅しているため、2024年にはヨーロッパの医療機器倉庫・物流市場において52.3%の市場シェアを占め、市場を席巻しました。その費用対効果、取り扱いやすさ、そして標準的な保管・輸送条件への適合性から、ヨーロッパ全域において、手術器具、診断キット、耐久医療機器などの製品の保管・配送において、常温保管セグメントは最適な選択肢となっています。

レポートの範囲とヨーロッパの医療機器倉庫および物流市場のセグメンテーション

|

属性 |

欧州医療機器倉庫・物流の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

ヨーロッパ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

欧州医療機器倉庫・物流市場動向

「自動化とデジタル追跡による効率的な業務」

- 欧州の医療機器倉庫・物流市場において、高度な自動化技術とデジタル追跡技術の導入が重要かつ加速しています。これらのイノベーションは、業務効率の向上、手作業によるミスの削減、サプライチェーン全体にわたる在庫のリアルタイム可視化を実現しています。

- 例えば、多くのサードパーティロジスティクスプロバイダー(3PL)は、デジタル倉庫管理システム(WMS)とRFIDおよびバーコードスキャン技術を統合し、医療機器の保管、取り出し、配送を最適化しています。これにより、規制遵守が確保され、在庫の差異が最小限に抑えられ、注文処理が迅速化されます。

- さらに、クラウドベースの物流プラットフォームの導入により、関係者は出荷状況をリアルタイムで監視し、自動アラートを受信し、税関や規制文書を合理化できるため、遅延が削減され、顧客満足度が向上します。

- 倉庫における温度監視および湿度制御システムの自動化は、診断キット、インプラント機器、外科用器具など、温度に敏感で高価な医療機器にとって特に重要です。これらのシステムは、製品の完全性を維持するために、一貫した環境条件を確保します。

- ジャストインタイム(JIT)在庫と需要主導型物流の好ましさが高まっているため、メーカーや流通業者は、拡張性と柔軟性に優れた倉庫ソリューションを提供できる物流パートナーと緊密に連携するようになっています。

- その結果、DBシェンカー、CEVAロジスティクス、キューネ・ナーゲルなどの主要企業は、欧州全域のメーカーや医療提供者の進化するニーズを満たすために、専用のインフラストラクチャを備えたGDP準拠の医療機器専用倉庫に投資しています。

欧州医療機器倉庫・物流市場の動向

ドライバ

「効率的なコールドチェーンと規制遵守の需要の高まりによるニーズの高まり」

- 温度に敏感な医療機器の需要の増加と、欧州全域での医療機器の取り扱いと流通に関する厳格な規制は、欧州の医療機器倉庫および物流市場の拡大の大きな原動力となっている。

- 例えば、UPSヘルスケアは2024年4月、医療機器や生物製剤のコンプライアンス遵守と温度管理輸送の需要増加に対応するため、欧州におけるコールドチェーン物流能力の拡大を発表しました。主要企業によるこのような投資は、予測期間中の市場成長を牽引すると予想されます。

- 医療提供者が診断機器や治療機器のタイムリーで安全な配送を優先する中、物流パートナーはトレーサビリティ、シリアル化、状態監視に関する機能を強化し、EU MDRおよびGDPガイドラインへの準拠を確保しています。

- さらに、低侵襲機器や在宅医療ソリューションへの移行により、ラストマイル配送、効率的な在庫管理、特殊な梱包の必要性が高まっており、倉庫と物流サービスは医療機器のサプライチェーンにおいて重要なリンクとなっています。

- 慢性疾患や外科手術の増加、臨床試験や診断サービスの増加に伴い、医療技術に求められる特定の保管条件やターンアラウンド時間に合わせた、機敏で拡張性の高い倉庫ソリューションの必要性がさらに高まっています。

抑制/挑戦

「高い運用コストと複雑な規制環境」

- 欧州の医療機器倉庫・物流市場は、コールドチェーンインフラ、専門スタッフのトレーニング、規制遵守に伴う高コストにより課題に直面しています。特に冷蔵・冷凍分野において、GDPに準拠した施設と輸送ネットワークの構築と維持には、多額の投資が必要です。

- さらに、複数の欧州諸国にまたがる複雑かつ進化する規制枠組みを順守することは、運用上のハードルとなります。メーカーや物流業者は、一元的な可視性とコンプライアンスを確保しながら、各国の多様な要件に適応する必要があります。

- 例えば、書類の誤りや税関手続きの違いによる国境を越えた輸送の遅延は、特に温度に敏感な機器の場合、配送スケジュールや製品の完全性に影響を与える可能性があります。

- さらに、中小規模の医療機器メーカーは、コストとコンプライアンスの要求を満たすのに苦労することが多く、サードパーティロジスティクス(3PL)プロバイダーに大きく依存することになります。これによりリーチは向上しますが、品質と納期に対する直接的な管理が制限される可能性もあります。

- これらの制約を克服するために、業界関係者は自動化、デジタル追跡システム、そして従業員研修への投資に加え、規制当局との連携強化を図る必要があります。また、地域倉庫ハブの拡大と標準化されたデジタルプラットフォームの導入も、業務の効率化と長期的な成長を支える上で不可欠です。

欧州医療機器倉庫・物流市場の概要

市場は、提供内容、温度、輸送モード、用途、最終用途、流通チャネルに基づいてセグメント化されています。

• 供物によって

欧州の医療機器倉庫・物流市場は、提供内容に基づき、サービス、ハードウェア、ソフトウェアの3つに分類されます。物流機能のアウトソーシングの増加と専門的な取り扱いに対する需要に牽引され、サービス分野は2024年には48.6%という最大の収益シェアを占める見込みです。

ソフトウェアセグメントは、WMSやTMSプラットフォームなどのデジタル物流ツールの利用増加により、予測期間中に23.5%という最も高いCAGRを達成すると予想されています。

•温度別

温度に基づいて、欧州の医療機器倉庫・物流市場は、常温、冷蔵/冷蔵、冷凍、その他に分類されます。温度制御を必要としない機器が多数存在するため、常温セグメントは2024年には52.3%と最大のシェアを占めました。

冷蔵/冷蔵セグメントは、繊細な医療機器のコールドチェーン物流の需要増加により、2025年から2032年にかけて21.1%という最も高いCAGRで成長すると予測されています。

• 交通手段別

輸送手段に基づいて、欧州の医療機器倉庫・物流市場は、海上貨物物流、航空貨物物流、陸上物流に分類されます。欧州全域に整備された道路・鉄道網により、陸上物流セグメントは2024年に45.7%の収益シェアを占め、市場をリードしました。

航空貨物物流セグメントは、迅速で高価値の医療品輸送の需要増加に支えられ、予測期間中に19.4%という最高のCAGRで成長すると予想されています。

• 用途別

用途別に見ると、欧州の医療機器倉庫・物流市場は、診断機器、治療機器、モニタリング機器、外科機器、その他の機器に分類されます。診断機器セグメントは、使用量の増加と定期的な補充サイクルを背景に、2024年には34.2%と最大のシェアを占めました。

外科用デバイスセグメントは、手術件数の増加と精密デバイス取り扱い要件の増加に支えられ、予測期間中に 20.2% という最速の CAGR で拡大すると予測されています。

• 最終用途別

欧州の医療機器倉庫・物流市場は、最終用途に基づいて、病院・診療所、医療機器企業、学術・研究機関、リファレンス・ラボ・診断ラボ、救急医療サービス企業、その他に分類されます。病院・診療所セグメントは、機器の消費率の高さと集中調達により、2024年には39.6%と最も高い収益シェアを獲得しました。

医療機器企業セグメントは、専門のサードパーティプロバイダーに物流をアウトソーシングするケースが増えているため、予測期間中に22.8%という最も高いCAGRで成長すると予想されています。

• 流通チャネル別

流通チャネルに基づいて、欧州の医療機器倉庫・物流市場は、従来型物流とサードパーティロジスティクスに分類されます。医療機器メーカーがコスト効率が高く柔軟な流通モデルに移行する中、サードパーティロジスティクス分野は2024年に61.2%と最大のシェアを獲得しました。

従来型物流セグメントは、予測期間中に13.9%という最も速いCAGRで成長し、社内または規制固有の流通システムを備えた地域での関連性を維持すると予想されます。

欧州医療機器倉庫・物流市場地域分析

- 医療機器倉庫および物流市場は、2024年に38.7%という最大の収益シェアでヨーロッパが優位を占めました。これは、この地域の確立された医療インフラ、強力な物流ハブネットワーク、そして安全でコンプライアンスに準拠した医療機器の保管と配送をサポートする厳格な規制基準によるものです。

- この地域では、コールドチェーンの完全性、デジタル追跡システム、物流の持続可能性に重点を置いており、高度な医療倉庫および配送ソリューションの需要に大きく貢献しています。

- 大手製薬企業や医療技術企業の存在と、物流業務における自動化、ロボット工学、リアルタイム在庫監視の導入増加が相まって、市場の成長をさらに促進しています。

ドイツの医療機器倉庫・物流市場に関する洞察

ドイツの医療機器倉庫・物流市場は、先進的な医療インフラ、強力な物流ネットワーク、そして医療機器取り扱いにおける自動化の広範な導入に牽引され、2024年にはヨーロッパ市場において最大の収益シェア28.3%を獲得し、市場を席巻しました。ヨーロッパにおける戦略的な立地と規制遵守への注力により、ドイツは倉庫・配送拠点として最適な選択肢となっています。

フランスの医療機器倉庫・物流市場に関する洞察

フランスでは、政府支援による医療改革、大手物流サービスプロバイダーの存在、コールドチェーンソリューションの統合、慢性疾患ケア機器の需要増加に支えられ、予測期間中に医療機器倉庫および物流市場が着実に成長し、2025年から2032年にかけて5.8%のCAGRで成長すると予測されています。

英国の医療機器倉庫および物流市場の洞察

英国の医療機器倉庫・物流市場は、ラストマイル配送におけるイノベーション、ブレグジットに関連したサプライチェーンの再編、そして診断機器の需要増加に牽引され、大幅な拡大が見込まれています。英国はデジタル化された倉庫管理と持続可能な物流ソリューションに注力しています。

オランダ ヨーロッパ医療機器倉庫・物流市場インサイト

オランダの医療機器倉庫・物流市場は、港湾と空港の優れた接続性により、重要な物流ハブとして台頭しています。欧州の医療機器倉庫・物流市場は、強力な官民連携、通関効率、そして3PLプロバイダーの集中によって支えられています。

欧州医療機器倉庫・物流市場シェア

ヨーロッパの医療機器倉庫および物流業界は、主に次のような定評のある企業によって牽引されています。

- ドイツポストAG(ドイツ)

- フェデックス(米国)

- ユナイテッド・パーセル・サービス・オブ・アメリカ(米国)

- キューネ・ナーゲル(英国)

- DBシェンカー(ドイツ)

- アロガ(英国)

- CHロビンソンワールドワイド社(米国)

- CEVA(フランス)

- ディメルコ(台湾)

- DSV(デンマーク)

- FMロジスティック(フランス)

- Hellmann Worldwide Logistics SE & Co. KG(ドイツ)

- インペリアル(南アフリカ)

- モヴィアント(オランダ)

- OIAグローバル(米国)

- オムニロジスティクスLLC(米国)

- puracon GmbH(ドイツ)

- レヌスグループ(ドイツ)

- セコ(米国)

- TIBA(スペイン)

- トール・ホールディングス・リミテッド(オーストラリア)

- XPO社(米国)

欧州医療機器倉庫・物流市場の最新動向

- DHLエクスプレスは2023年11月、香港に拡張されたセントラルアジアハブを正式に開設しました。これは、成長する世界貿易に対応するため、5億6,200万ユーロを投資し、能力を強化するものです。アジアと世界を結ぶ上で重要なこのハブは、ピーク時の貨物取扱能力を約70%向上させ、2004年の開設以来6倍の取扱量に対応できるようになりました。この拡張は、顧客の成長を支援し、香港を主要な国際航空ハブとしての地位を確固たるものにするというDHLのコミットメントを強調するものです。

- DHLサプライチェーンは2022年12月、台湾北部における倉庫機能の拡張のため、1,093万米ドルを投資すると発表しました。特に半導体、ライフサイエンス、ヘルスケア分野に重点を置きます。新たに開設された桃園物流センター(建国)により、桃園におけるDHLの倉庫総面積は1万平方メートル増加し、3万7,000平方メートルとなります。この施設は、効率的な物流業務のための接続性を高め、2027年までに台湾における総面積20万平方メートルを達成するという同社の目標達成を支援します。

- フェデックスは2024年9月、データ駆動型コマースソリューション「fdxプラットフォーム」を立ち上げ、米国企業向けに提供を開始しました。このプラットフォームは、フェデックスのネットワークを活用し、需要の伸び、コンバージョン率、フルフィルメントの最適化を改善することで、顧客体験を向上させます。注目すべき機能としては、配送予測、サステナビリティに関する洞察、ブランド化された注文追跡、返品プロセスの簡素化などが挙げられます。フェデックスCEOのラージ・スブラマニアム氏は、Dreamforce 2024イベントにおいて、よりスマートなサプライチェーンにおけるこのプラットフォームの役割を強調しました。

- UPSヘルスケアは2024年3月、UPS Supply Chain Symphony Rを発表しました。これは、様々な業務システムからヘルスケアサプライチェーンのデータを統合・管理するために設計されたクラウドベースのプラットフォームです。このツールは、ヘルスケア業界のお客様に物流の完全な可視性を提供し、情報に基づいた意思決定、計画の改善、そして正確な予測を可能にします。このプラットフォームは、管理、効率性、透明性を高めることで、ヘルスケアにおける合理化されたサプライチェーンの重要なニーズをサポートします。ケイト・ガットマン氏は、グローバルオペレーションと患者ケアの最適化におけるこのプラットフォームの変革の可能性を強調しました。

- 大手物流会社であるキューネ・ナーゲルは、2024年9月、トロントからわずか50kmのオンタリオ州ミルトンに、メドトロニック向けの新しい温度管理フルフィルメントセンターを開設しました。25,000平方メートルの敷地面積を誇るこの施設は、病院への医療機器の配送を行うほか、メドトロニックの機器のサービス、修理、予防保守センターも併設されます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 COST ANALYSIS BREAKDOWN

4.4 COST BENCHMARK ANALYSIS

4.4.1 COST METRICS OVERVIEW:

4.4.1.1 AVERAGE WAREHOUSE COST PER SQ FT (USD)

4.4.1.2 AVERAGE WAREHOUSE COST PER ORDER:

4.4.1.3 AVERAGE TRANSPORT COST PER SHIPMENT (USD)

4.5 HEALTHCARE ECONOMY

4.6 INDUSTRY INSIGHT

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATIONS

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.1.1 JOINT VENTURES

4.7.1.2 MERGERS AND ACQUISITIONS

4.7.1.3 LICENSING AND PARTNERSHIP

4.7.1.4 TECHNOLOGY COLLABORATIONS

4.7.1.5 STRATEGIC DIVESTMENTS

4.7.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.7.8 CONCLUSION

4.8 OPPORTUNITY MAP ANALYSIS

4.9 REIMBURSEMENT FRAMEWORK

4.1 TECHNOLOGICAL ROADMAP

4.11 VALUE CHAIN ANALYSIS

5 REGULATORY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR MEDICAL DEVICES

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN MEDICAL TECHNOLOGY

6.1.3 INCREASED SPENDING ON HEALTHCARE INFRASTRUCTURE BY GOVERNMENTS AND PRIVATE SECTORS

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN DISRUPTIONS

6.2.2 HIGH OPERATIONAL COSTS OF MEDICAL DEVICE LOGISTICS AND WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF ADVANCED TECHNOLOGIES IN LOGISTICS MANAGEMENT

6.3.2 STRATEGIC PARTNERSHIPS AND MERGERS BETWEEN MEDICAL DEVICE MANUFACTURERS AND LOGISTICS AND E-COMMERCE COMPANIES

6.4 CHALLENGES

6.4.1 COMPLEX REGULATORY REQUIREMENTS FOR LOGISTICS PROVIDERS TO ENSURE COMPLIANCE

6.4.2 SHORTAGE OF SKILLED LABOR IN LOGISTICS AND WAREHOUSE OPERATIONS CAN CREATE INEFFICIENCIES AND DELAYS

7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

7.1 OVERVIEW

7.2 SERVICES

7.3 HARDWARE

7.4 SOFTWARE

8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION

8.1 OVERVIEW

8.2 SEA FREIGHT LOGISTICS

8.3 AIR FREIGHT LOGISTICS

8.4 OVERLAND LOGISTICS

9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 OTHERS

10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DIAGNOSTIC DEVICES

10.3 THERAPEUTIC DEVICES

10.4 MONITORING DEVICES

10.5 SURGICAL DEVICES

10.6 OTHERS DEVICES

11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 MEDICAL DEVICES COMPANIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 REFERENCE & DIAGNOSTIC LABORATORIES

11.6 EMERGENCY MEDICAL SERVICES COMPANIES

11.7 OTHERS

12 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 CONVENTIONAL LOGISTICS

12.3 THIRD PARTY

13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 SWITZERLAND

13.1.6 NETHERLANDS

13.1.7 RUSSIA

13.1.8 BELGIUM

13.1.9 FINLAND

13.1.10 DENMARK

13.1.11 POLAND

13.1.12 NORWAY

13.1.13 HUNGARY

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 DEUTSCHE POST AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 FEDEX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 UNITED PARCEL SERVICE OF AMERICA, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DB SCHENKER

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALLOGA

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AWL INDIA PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 C.H. ROBINSON WORLDWIDE, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CAVALIER LOGISTICS

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CEVA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROWN LSP GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DIMERCO

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 DSV

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 FM LOGISTIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HANSA INTERNATIONAL

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

16.16.1 COMPANY SNAPSHOT

16.16.2 SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMPERIAL

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MERCURY BUSINESS SERVICES

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MOVIANTO

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MURPHY LOGISTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 SERVICE PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OIA EUROPE

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OMNI LOGISTICS, LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PURACON GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 RHENUS GROUP

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 SEKO

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TIBA

16.26.1 COMPANY SNAPSHOT

16.26.2 SERVICE PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 TOLL HOLDINGS LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 SERVICE PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 WAREHOUSE ANYWHERE

16.28.1 COMPANY SNAPSHOT

16.28.2 SERVICE PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 XPO, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SERVICE PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 2 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE AMBIENT IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE CHILLED/REFRIGERATED IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE FROZEN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE DIAGNOSTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE THERAPEUTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE MONITORING DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE SURGICAL DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE OTHERS DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE HOSPITALS & CLINICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE MEDICAL DEVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE ACADEMIC & RESEARCH INSTITUTES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE REFERENCE & DIAGNOSTIC LABORATORIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE EMERGENCY MEDICAL SERVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE CONVENTIONAL LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE THIRD PARTY IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 64 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 76 GERMANY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 GERMANY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 GERMANY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 84 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 85 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 86 U.K. SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 U.K. LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 U.K. PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 105 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 FRANCE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 FRANCE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 FRANCE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 FRANCE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 115 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 116 FRANCE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 FRANCE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 FRANCE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 123 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 124 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 125 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 126 ITALY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 ITALY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 ITALY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 ITALY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 ITALY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 135 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 136 ITALY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 ITALY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 ITALY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 143 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 144 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SPAIN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 155 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 156 SPAIN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 SPAIN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SPAIN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 164 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 165 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 SWITZERLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 SWITZERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 SWITZERLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 SWITZERLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 SWITZERLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 175 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 176 SWITZERLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 SWITZERLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 SWITZERLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 183 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 184 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 185 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 186 NETHERLANDS SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 NETHERLANDS LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 NETHERLANDS PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 NETHERLANDS HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 NETHERLANDS SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 195 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 196 NETHERLANDS SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 NETHERLANDS AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 NETHERLANDS OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 203 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 204 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 205 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 RUSSIA SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 RUSSIA LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 RUSSIA PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 RUSSIA HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 RUSSIA SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 215 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 216 RUSSIA SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 RUSSIA AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 RUSSIA OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 224 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 225 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 226 BELGIUM SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 227 BELGIUM LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 BELGIUM PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 BELGIUM HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 BELGIUM SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 235 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 236 BELGIUM SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BELGIUM AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BELGIUM OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 244 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 245 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 FINLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 FINLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 FINLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 FINLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 FINLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 255 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 256 FINLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 FINLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 259 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 FINLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 263 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 264 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 265 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 266 DENMARK SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 DENMARK LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 DENMARK PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 DENMARK HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 DENMARK SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 275 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 276 DENMARK SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 DENMARK AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 DENMARK OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 282 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 284 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 285 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 286 POLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 POLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 291 POLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 292 POLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 POLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 295 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 296 POLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 POLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 300 POLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 302 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 303 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 304 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 305 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 306 NORWAY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 307 NORWAY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 308 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 309 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 310 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 311 NORWAY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 312 NORWAY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 313 NORWAY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 314 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 315 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 316 NORWAY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 317 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 318 NORWAY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 319 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 320 NORWAY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 321 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 322 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 323 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 324 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 325 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 326 HUNGARY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 327 HUNGARY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 328 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 329 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 330 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 331 HUNGARY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 332 HUNGARY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 333 HUNGARY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 334 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 335 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 336 HUNGARY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 337 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 338 HUNGARY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 339 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 340 HUNGARY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 341 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 342 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 343 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 344 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 345 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 346 SWEDEN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 347 SWEDEN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 348 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 349 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 350 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 351 SWEDEN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 352 SWEDEN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 353 SWEDEN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 354 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 355 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 356 SWEDEN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 357 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 358 SWEDEN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 359 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 360 SWEDEN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 361 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 362 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 363 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 364 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 365 REST OF EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

図表一覧

FIGURE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 2 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 RISING DEMAND FOR MEDICAL DEVICES IS EXPECTED TO DRIVE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 20 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2023

FIGURE 21 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2024-2031

FIGURE 22 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, CAGR (2024-2031)

FIGURE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, LIFELINE CURVE

FIGURE 24 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2023

FIGURE 25 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2024-2031

FIGURE 26 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, CAGR (2024-2031)

FIGURE 27 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, LIFELINE CURVE

FIGURE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2023

FIGURE 29 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2024-2031

FIGURE 30 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, CAGR (2024-2031)

FIGURE 31 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, LIFELINE CURVE

FIGURE 32 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2023

FIGURE 33 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2024-2031

FIGURE 34 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 35 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 36 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2023

FIGURE 37 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2024-2031

FIGURE 38 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, CAGR (2024-2031)

FIGURE 39 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, LIFELINE CURVE

FIGURE 40 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 41 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031

FIGURE 42 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 43 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: SNAPSHOT (2023)

FIGURE 45 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY SHARE 2023 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。