欧州B型肝炎感染症市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

3.27 Billion

USD

4.73 Billion

2024

2032

USD

3.27 Billion

USD

4.73 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 4.73 Billion | |

|

|

|

|

欧州B型肝炎感染症市場のセグメンテーション、タイプ別(慢性および急性)、治療別(ワクチン、抗ウイルス薬、免疫調節 薬、手術) - 2032年までの業界動向と予測

欧州B型肝炎感染症市場規模

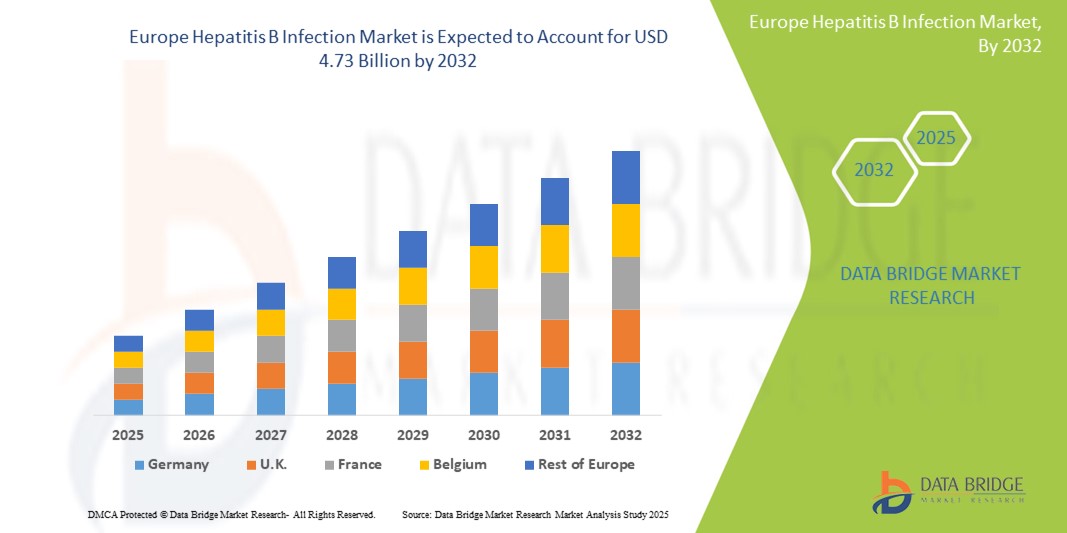

- ヨーロッパのB型肝炎感染市場規模は2024年に32億7000万米ドルと評価され、予測期間中に4.70%のCAGRで成長し、2032年には47億3000万米ドル に達すると予想されています 。

- 市場の成長は、B型肝炎に対する高度な診断技術と治療の革新の採用の増加と、欧州全域での電子医療システムのデジタル化と統合の増加によって主に推進されている。

- さらに、正確でアクセスしやすく、予防的なソリューションに対する消費者と公衆衛生の需要の高まりにより、B型肝炎管理プロトコルは医療政策の中心的な焦点として確立されつつあります。これらの要因が重なり、ワクチン接種、スクリーニング、抗ウイルス療法の導入が加速し、地域全体のB型肝炎感染症市場の成長を大幅に押し上げています。

欧州B型肝炎感染症市場分析

- B型肝炎の治療と診断は、感染に関する意識の高まり、検査へのアクセス性の向上、抗ウイルス療法の進歩により、特に病院と外来の両方において、ヨーロッパの公衆衛生インフラのますます重要な要素となっている。

- 効果的なB型肝炎管理に対する需要の高まりは、主に政府のワクチン接種プログラム、HBV-HDVの重複感染スクリーニングの増加、そして高齢化社会における慢性肝疾患の負担の増加によって促進されている。

- ドイツは、2024年にはヨーロッパのB型肝炎感染症市場において最大の収益シェア34.7%を獲得し、市場を席巻しました。その特徴は、強力な公衆衛生政策、先進的な診断ツールの早期導入、そして高いHBV検査率です。また、啓発活動や保険償還制度の改善により、特に高リスク層や移民の間で治療利用率が大幅に増加しています。

- 英国は、プライマリケア現場へのHBV検査の導入と強力な国家予防接種戦略の推進により、欧州のB型肝炎感染症市場において最も急速に成長する地域になると予想されています。NHS(国民保健サービス)による成人および小児の予防接種プログラムへの重点的な取り組みは、市場拡大の重要な要因となっています。

- 慢性セグメントは、その持続性、長期のモニタリングと治療の必要性、および強化されたスクリーニングイニシアチブによる検出率の上昇により、2024年に62.4%の市場シェアでヨーロッパのB型肝炎感染市場を支配しました。

レポートの範囲とヨーロッパのB型肝炎感染症市場のセグメンテーション

|

属性 |

欧州におけるB型肝炎感染症の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

ヨーロッパ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

欧州B型肝炎感染症市場動向

「統合ケアと高度な治療アクセスによる利便性の向上」

- 欧州のB型肝炎感染症市場において、重要かつ加速しているトレンドとして、多科医療モデルの統合と、集中型医療システムによる高度な治療へのアクセスの拡大が挙げられます。このトレンドは、一般開業医、肝臓専門医、公衆衛生機関間のシームレスなコミュニケーションを可能にすることで、患者の転帰と服薬遵守率を大幅に向上させています。

- 例えば、西欧諸国のいくつかの国では、患者が単一の調整された枠組みの下で早期診断、抗ウイルス治療、定期的なフォローアップケアを受けられるよう、国家肝炎行動計画を実施しています。例えばドイツの統合ケアモデルは、診断から治療までの効率的な連携を可能にし、病気の進行率を低下させています。

- 集中化された患者登録、デジタル健康記録システム、合理化された紹介経路などの取り組みにより、タイムリーな介入とモニタリングが可能になり、B型肝炎感染管理が最適化されています。これらのシステムにより、医療従事者は肝機能、治療への反応、そしてD型肝炎などの合併感染をリアルタイムで追跡できます。

- 高度な診断と日常的なプライマリケアサービスの統合により、急性期および慢性期の症例の早期発見が容易になります。この集中的なアプローチと、より安価な抗ウイルス療法へのアクセスを組み合わせることで、個々の患者ケアとより広範な公衆衛生監視の両方が向上します。

- より合理化され、調整され、テクノロジーに支えられたB型肝炎ケアへのこの傾向は、各国の医療制度における期待を根本的に変革しつつあります。その結果、多くの欧州政府は、移民、静脈内薬物使用者、高齢者といった脆弱でリスクの高い集団を中心に、ウイルス性肝炎スクリーニングへのアクセスを拡大しています。

- 関係者が長期的な疾病管理と世界保健機関の2030年肝炎撲滅目標との整合性にますます重点を置くようになるにつれ、アクセスしやすく、効率的で統合的なB型肝炎治療モデルの需要は、公的および民間の医療部門の両方で急速に高まっています。

欧州B型肝炎感染症市場の動向

ドライバ

「疾病負担の増加と予防医療の導入によるニーズの高まり」

- ヨーロッパ全土におけるB型肝炎感染の増加と肝疾患に対する意識の高まりにより、早期診断、ワクチン接種、治療ソリューションの需要が大幅に高まっています。

- 例えば、2024年4月、グラクソ・スミスクライン(GSK)は、地域の医療システムとの戦略的提携を通じて、欧州におけるB型肝炎ワクチンの供給を拡大し、高リスク集団の予防接種率の向上を目指しました。主要市場プレーヤーによるこのような取り組みは、予測期間中の欧州B型肝炎感染症市場の成長を促進すると予想されます。

- 公衆衛生当局と消費者が、肝硬変や肝臓がんなどの慢性B型肝炎に関連する長期合併症についてより深く認識するにつれて、ワクチン接種や早期スクリーニングなどの予防戦略の採用が増加し続けています。

- さらに、B型肝炎検査を日常の健康診断に統合し、ポイントオブケア診断技術の普及が進むことで、B型肝炎管理はヨーロッパ全体でよりアクセスしやすく、効率的になっています。

- 効果的なワクチン、経口抗ウイルス薬、そして高度な免疫調節薬の開発により、疾病管理の改善が可能になっています。政府の資金援助、保険償還政策、そしてWHO主導の肝炎撲滅目標も、公的医療現場と民間医療現場の両方で導入率を押し上げています。

抑制/挑戦

「治療へのアクセス性と先進治療の高額な費用に関する懸念」

- 医学の進歩にもかかわらず、ヨーロッパの一部の地域では、高度な抗ウイルス療法や免疫調節剤へのアクセスが限られており、特に医療格差が残る東ヨーロッパや南ヨーロッパでは依然として課題となっている。

- 例えば、2024年初頭に発表された研究によると、一部のEU加盟国では依然としてB型肝炎ワクチンの不足や、調達と償還の問題による新しい治療法へのアクセスの制限に直面している。

- このギャップを埋めるには、EUレベルの資金援助、価格交渉、規制承認の合理化などを通じて、すべての欧州諸国でB型肝炎治療基準を調和させるための政策レベルの取り組みが必要である。

- さらに、第一選択の抗ウイルス薬はより手頃な価格になってきている一方で、有効性が向上した新世代の治療法はコストが高くなることが多く、無保険者や低所得者層への普及が制限される可能性がある。

- 特にパンデミック後のヨーロッパでは、国民の不信感やワクチンへの躊躇が、啓発キャンペーンや医療提供者の関与を通じて対処しなければならないもう一つの障壁となっている。

- 保険適用範囲の拡大、官民連携、地域医療インフラへの投資増加を通じてこれらの課題を克服することが、ヨーロッパのB型肝炎感染症市場の長期的な成長を持続させる上で極めて重要となる。

欧州B型肝炎感染症市場の範囲

市場はタイプと処理に基づいて細分化されています。

• タイプ別

欧州のB型肝炎感染症市場は、種類別に慢性と急性に分類されます。慢性セグメントは、主に慢性HBV症例の有病率の高さと、抗ウイルス療法とモニタリングによる生涯にわたる疾患管理の必要性により、2024年には62.4%という最大の市場収益シェアを占めました。

急性セグメントは、早期スクリーニングの取り組みの強化、公衆衛生イニシアチブ、およびタイムリーな診断と治療につながる意識の高まりにより、2025年から2032年にかけて6.4%のCAGRで最も高い成長率を示すことが予想されています。

• 治療によって

欧州のB型肝炎感染症市場は、治療に基づいて、ワクチン、抗ウイルス薬、免疫調節薬、手術に分類されます。ワクチン分野は、国家によるワクチン接種推進、出生時予防接種の増加、そして高リスク成人層における接種率の上昇に支えられ、2024年には41.2%と最大の収益シェアを占めました。

抗ウイルス薬セグメントは、慢性 HBV 患者プールの拡大、経口療法の進歩、有利な償還ポリシーにより、2025 年から 2032 年にかけて 7.1% という最も高い CAGR を達成すると予測されています。

欧州B型肝炎感染症市場の地域分析

- 強力な公衆衛生インフラ、高いワクチン接種率、B型肝炎の感染と予防に関する意識の高まりにより、ヨーロッパは2024年に33.27%という最大の収益シェアでB型肝炎感染市場を支配しました。

- この地域は、高度な診断能力、確立された予防接種プログラム、そして政府主導の活発な肝炎監視活動によって特徴づけられている。

- この予防および治療措置の広範な採用は、ユニバーサルヘルスケアへのアクセス、継続的な研究開発投資、早期スクリーニングと疾病管理への重点の高まりによってさらにサポートされ、ヨーロッパは世界のB型肝炎感染市場への主要な貢献者として位置付けられています。

ドイツのB型肝炎感染症市場に関する洞察

ドイツのB型肝炎感染症市場は、2024年には34.7%という最大の収益シェアを獲得し、ヨーロッパで圧倒的なシェアを占める見込みです。これは、堅牢な医療インフラ、強力な公衆衛生プログラム、そしてB型肝炎ワクチン接種およびスクリーニングの早期導入によるものです。ドイツは、高度な診断ネットワーク、医療従事者の高い認知度、そして抗ウイルス療法への広範なアクセスといった恩恵を受けており、これらが堅調な市場需要を支えています。ドイツの国家予防接種戦略と、B型肝炎の研究・治療への継続的な資金提供が相まって、疾病管理の成果向上に貢献し続けています。

フランスのB型肝炎感染症市場に関する洞察

フランスのB型肝炎感染市場は、2024年に地域全体の収益シェアの14.2%を占めました。この成長は、政府主導の肝炎サーベイランスプログラムと高いワクチン接種率に支えられています。効果的な出生前スクリーニングと新生児ワクチン接種は、早期予防に貢献しています。抗ウイルス療法への研究開発投資と啓発キャンペーンの拡大は、さらなる市場拡大を促進すると予想されます。

英国のB型肝炎感染症市場に関する洞察

英国のB型肝炎感染症市場は、2024年に欧州のB型肝炎感染症市場における収益シェアの13.5%を占めました。市場は予測期間中、プライマリケアへのHBV検査の統合と強力な国家予防接種戦略を背景に、年平均成長率6.8%で成長すると予測されています。NHS(国民保健サービス)による成人および小児の予防接種への重点的な取り組みは、重要な成長要因となっています。

オランダのB型肝炎感染症市場に関する洞察

オランダのB型肝炎感染症市場は、2024年に欧州のB型肝炎感染症市場収益の6.8%を占めました。市場は、特に高リスク層を対象とした包括的なワクチン接種キャンペーンとターゲットスクリーニングの取り組みの恩恵を受けています。官学連携により、診断と早期治療戦略におけるイノベーションが促進されています。

ヨーロッパにおけるB型肝炎感染症の市場シェア

ヨーロッパの B 型肝炎感染症業界は、主に、次のような定評のある企業によって牽引されています。

- ギリアド・サイエンシズ(米国)

- GSK plc(英国)

- ダイナバックス・テクノロジーズ(米国)

- F. ホフマン・ラ・ロシュ社(スイス)

- ブリストル・マイヤーズ スクイブ社(米国)

- メルク社(米国)

- ノバルティスAG(スイス)

- アローヘッド・ファーマシューティカルズ社(米国)

- アルビュータス・バイオファーマ(カナダ)

- テバ・ファーマシューティカルズ社(イスラエル)

- ザイダス・ファーマシューティカルズ(インド)

- オーロビンドファーマ(インド)

- ルピン・ファーマシューティカルズ社(インド)

欧州B型肝炎感染症市場の最新動向

- 2024年9月、ギリアド・サイエンシズとジェネシス・セラピューティクスは、ジェネシスのGEMS AIプラットフォームを活用した新規低分子治療薬の発見と開発に向けた戦略的提携を発表しました。ギリアドはこの提携により、製品の開発および商業化に関する独占的権利を取得しました。

- 2024年7月、ギリアド・サイエンシズ社は、ヒスパニック系/ラテン系の人々や併存疾患を有する高齢者を含む、多様なHIV感染者集団におけるビクタルビの長期的な有効性と安全性を示す研究データを発表しました。また、1日1回投与および週1回投与の治験薬レジメンについても強調されました。

- GSKは2024年2月、重症喘息治療薬として有望なモノクローナル抗体AIO-001を含むAiolos Bioの買収を完了しました。GSKは10億ドルの前払金と最大4億ドルのマイルストーンペイメントを支払い、呼吸器系生物製剤のポートフォリオを拡大しました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEPATITIS B INFECTION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 THERAPEUTICS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 EUROPE HEPATITIS B INFECTION MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 MIDDLE EAST AND AFRICA REGULATORY SCENARIO

5.5 SOUTH AMERICA REGULATORY SCENARIO

6 PIPELINE ANALYSIS

7 EPIDEMILIOGY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING PREVALENCE OF HEPATITIS B INFECTIONS

8.1.2 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTICS

8.1.3 DEVELOPMENT OF COMBINATION THERAPIES FOR HEPATITIS B

8.1.4 STRATEGIC INITIATIVES BY COMPANIES FOR HEPATITIS B INFECTION

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS AND DRUG RESISTANCE

8.2.2 INSUFFICIENT VACCINE COVERAGE FOR HEPATITIS B INFECTION

8.3 OPPORTUNITY

8.3.1 RISING NEW DRUG RELEASES AND INCREASING NEW DRUG PERMITS FOR HEPATITIS B

8.3.2 GOVERNMENT PROGRAMS TO RAISE AWARENESS OF HEPATITIS B INFECTION

8.3.3 ADVANCED RESEARCH AND DEVELOPMENT FOR CLINICAL TRIALS

8.4 CHALLENGES

8.4.1 THE COST OF HEPATITIS B TREATMENTS IS HIGH

8.4.2 STRINGENT REGULATORY POLICIES AND REGIONAL DISPARITIES IN TREATMENT ACCESS

9 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

9.1 OVERVIEW

9.2 CHRONIC

9.3 ACUTE

10 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 VACCINE

10.2.1 HOSPITAL PHARMACIES

10.2.2 DRUGS STORES AND RETAIL PHARMACIES

10.2.3 ONLINE PHARMACIES

10.3 ANTIVIRAL DRUGS

10.3.1 TENOFOVIR ALAFENAMIDE FUMARATE (TAF)

10.3.2 TENOFOVIR DISOPROXIL FUMARATE (TDF)

10.3.3 ENTECAVIR

10.3.4 OTHERS

10.4 IMMUNE MODULATOR DRUGS

10.4.1 PEGYLATED INTERFERON

10.4.2 INTERFERON ALPHA

10.5 SURGERY

11 EUROPE HEPATITIS B INFECTION MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K

11.1.3 TURKEY

11.1.4 RUSSIA

11.1.5 SPAIN

11.1.6 ITALY

11.1.7 SWEDEN

11.1.8 BELGIUM

11.1.9 POLAND

11.1.10 FRANCE

11.1.11 SWITZERLAND

11.1.12 NETHERLANDS

11.1.13 NORWAY

11.1.14 DENMARK

11.1.15 FINLAND

11.1.16 REST OF EUROPE

12 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GILEAD SCIENCES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 GLAXOSMITHKLINE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 DYNAVAX TECHNOLOGIES CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 F. HOFFMAN-LA ROCHE LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BRISTOL-MYERS SQUIBB COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ARROWHEAD PHARMACEUTICALS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ARBUTUS BIOPHARMA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATES

14.8 AUROBINDO PHARMA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATES

14.9 LUPIN PHARMACEUTICALS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 MERCK & CO., INC.,

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 NOVARTIS AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 TEVA PHARMACEUTICAL INDUSTRIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ZYDUS PHARMACEUTICALS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE

14.13.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 EUROPE CLINICAL TRIAL AND PIPELINE A-LYSIS AS PER THE COMPANY

TABLE 2 DISTRIBUTION OF PRODUCTS OR PROJECTS BY PHASE

TABLE 3 COUNTRY WISE EPIDEMIOLOGY FOR HEPATITIS B

TABLE 4 COST OF HEPATITIS B MEDICATIONS: BRAND VS. GENERIC PRICES

TABLE 5 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 EUROPE CHRONIC IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 EUROPE ACUTE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 9 EUROPE VACCINE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 11 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 13 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 15 EUROPE SURGERY IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 EUROPE HEPATITIS B INFECTION MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 17 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 19 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 20 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 21 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 22 GERMANY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 23 GERMANY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 24 GERMANY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 25 GERMANY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 26 GERMANY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 27 U.K. HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 28 U.K. HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 29 U.K. ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 30 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 31 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 32 TURKEY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 TURKEY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 34 TURKEY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 35 TURKEY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 36 TURKEY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 37 RUSSIA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 RUSSIA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 39 RUSSIA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 40 RUSSIA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 41 RUSSIA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 42 SPAIN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 43 SPAIN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 44 SPAIN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 45 SPAIN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 46 SPAIN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 47 ITALY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 48 ITALY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 49 ITALY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 50 ITALY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 51 ITALY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 SWEDEN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 53 SWEDEN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 54 SWEDEN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 55 SWEDEN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 56 SWEDEN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 57 BELGIUM HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 58 BELGIUM HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 59 BELGIUM ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 60 BELGIUM IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 61 BELGIUM VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 62 POLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 63 POLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 64 POLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 65 POLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 66 POLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 67 FRANCE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 FRANCE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 69 FRANCE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 70 FRANCE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 71 FRANCE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 73 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 74 SWITZERLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 75 SWITZERLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 76 SWITZERLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 77 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 78 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 79 NETHERLANDS ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 80 NETHERLANDS IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 81 NETHERLANDS VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 NORWAY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 83 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 84 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 85 NORWAY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 86 NORWAY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 DENMARK HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 88 DENMARK HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 89 DENMARK ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 90 DENMARK IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 91 DENMARK VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FINLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 93 FINLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 94 FINLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 95 FINLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 96 FINLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 97 REST OF EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

図表一覧

FIGURE 1 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEPATITIS B INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEPATITIS B INFECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEPATITIS B INFECTION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEPATITIS B INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEPATITIS B INFECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HEPATITIS B INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HEPATITIS B INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEPATITIS B INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EUROPE HEPATITIS B INFECTION MARKET

FIGURE 15 CHRONIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEPATITIS B INFECTION MARKET IN 2024 & 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 BURDEN OF HBV INFECTION IN THE GENERAL POPULATION BY WHO REGION, 2019

FIGURE 18 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2023

FIGURE 19 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 20 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 21 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2023

FIGURE 23 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2024-2031 (USD MILLION)

FIGURE 24 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 25 EUROPE HEPATITIS B INFECTION MARKET BY TREATMENT, LIFELINE CURVE

FIGURE 26 EUROPE HEPATITIS B INFECTION MARKET, SNAPSHOT

FIGURE 27 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY SHARE 2023 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。