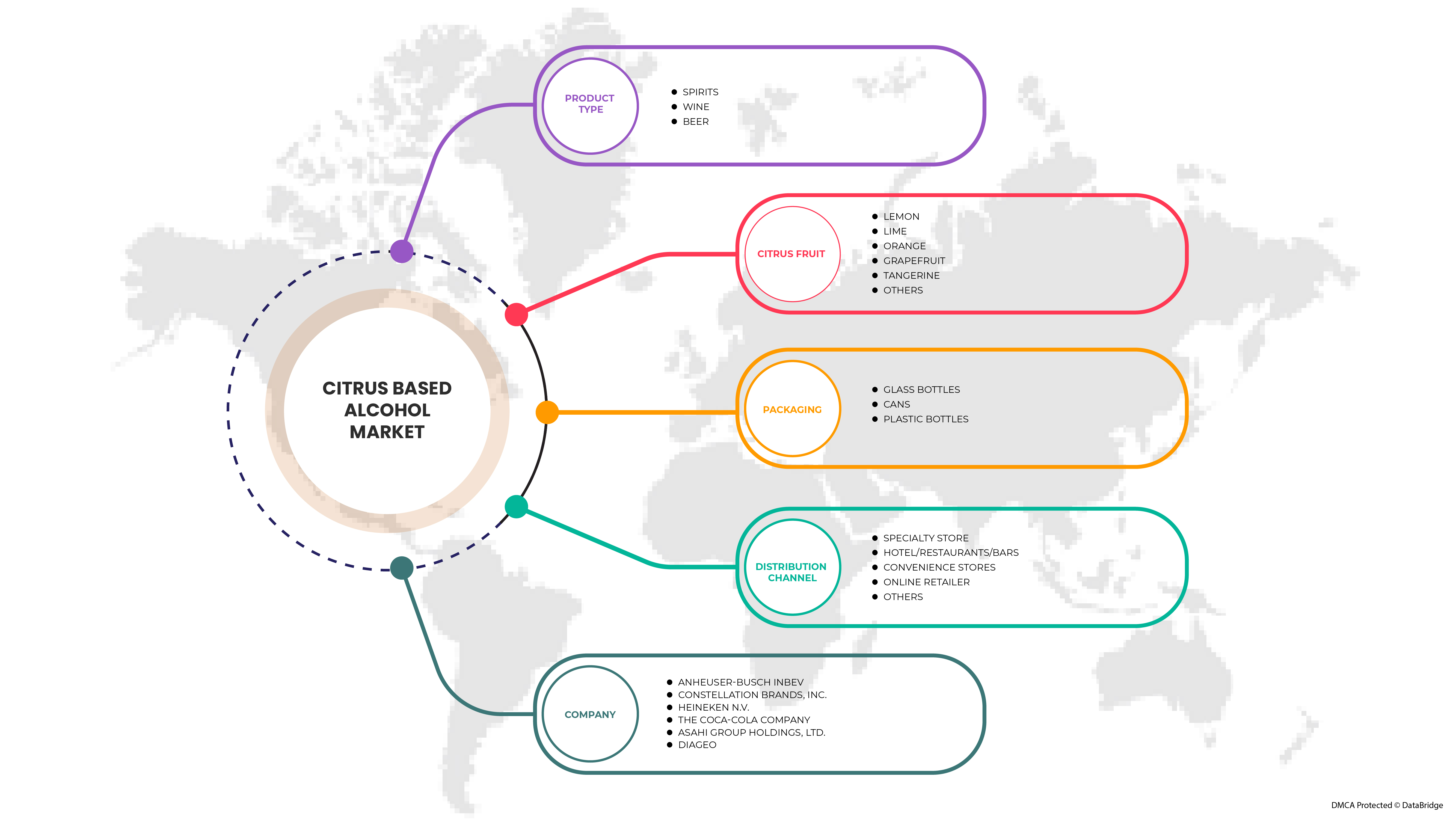

ヨーロッパの柑橘系アルコール市場 - 製品タイプ別 (スピリッツ、ワイン、ビール)、柑橘類 (レモン、ライム、オレンジ、グレープフルーツ、タンジェリン、その他)、パッケージ (ガラス瓶、缶、プラスチックボトル)、流通チャネル (専門店、ホテル/レストラン/バー、コンビニエンスストア、オンライン小売店、その他)、業界動向、2029年までの予測。

ヨーロッパの柑橘系アルコール市場の分析と洞察

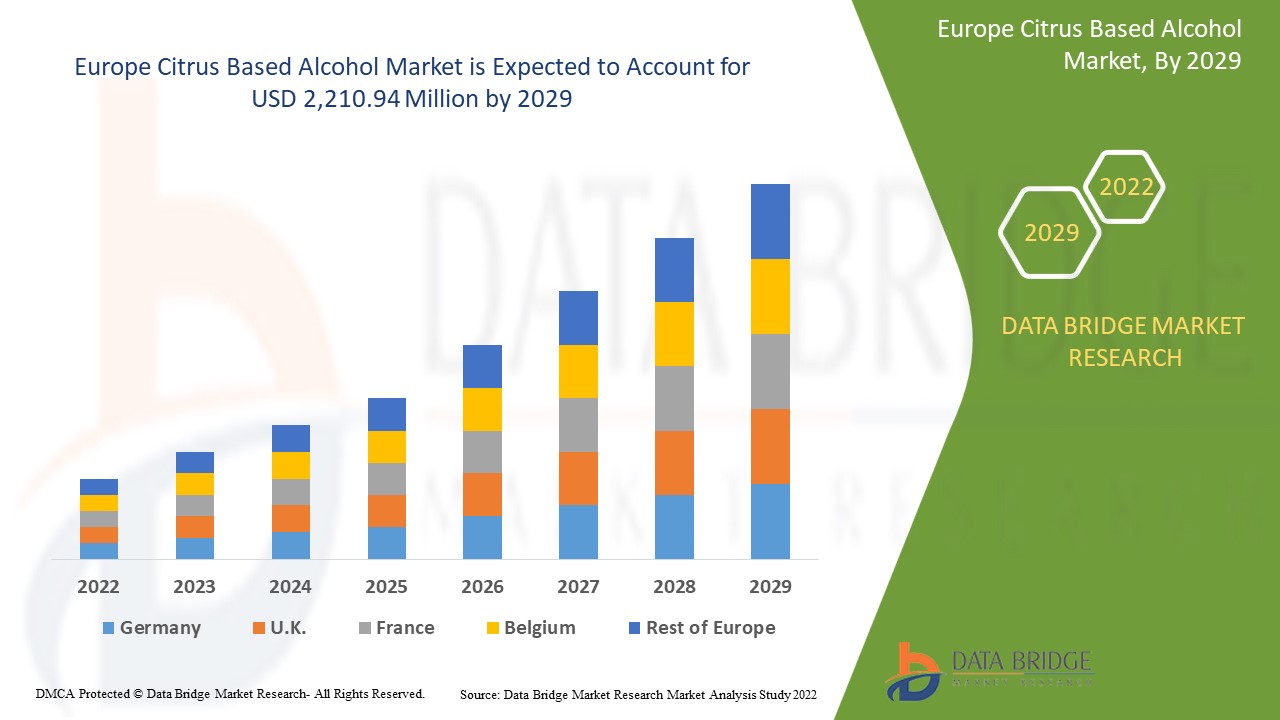

柑橘系アルコール市場は、2022年から2029年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.9%のCAGRで成長し、2029年までに22億1,094万米ドルに達すると分析しています。柑橘系アルコール市場の成長を牽引する主な要因は、クラフトスピリッツのトレンドが拡大していることと、コスト効率の高い原料の採用です。

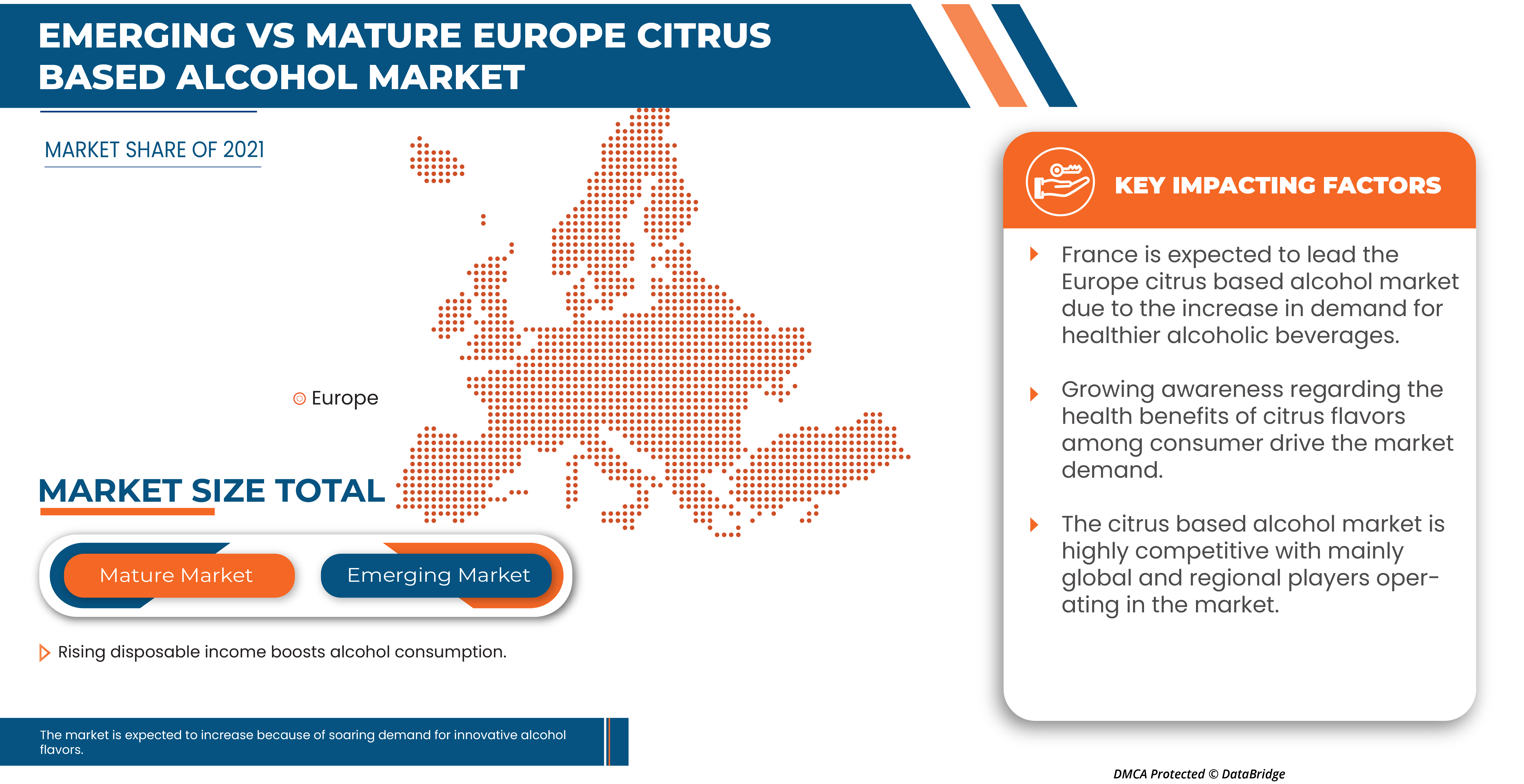

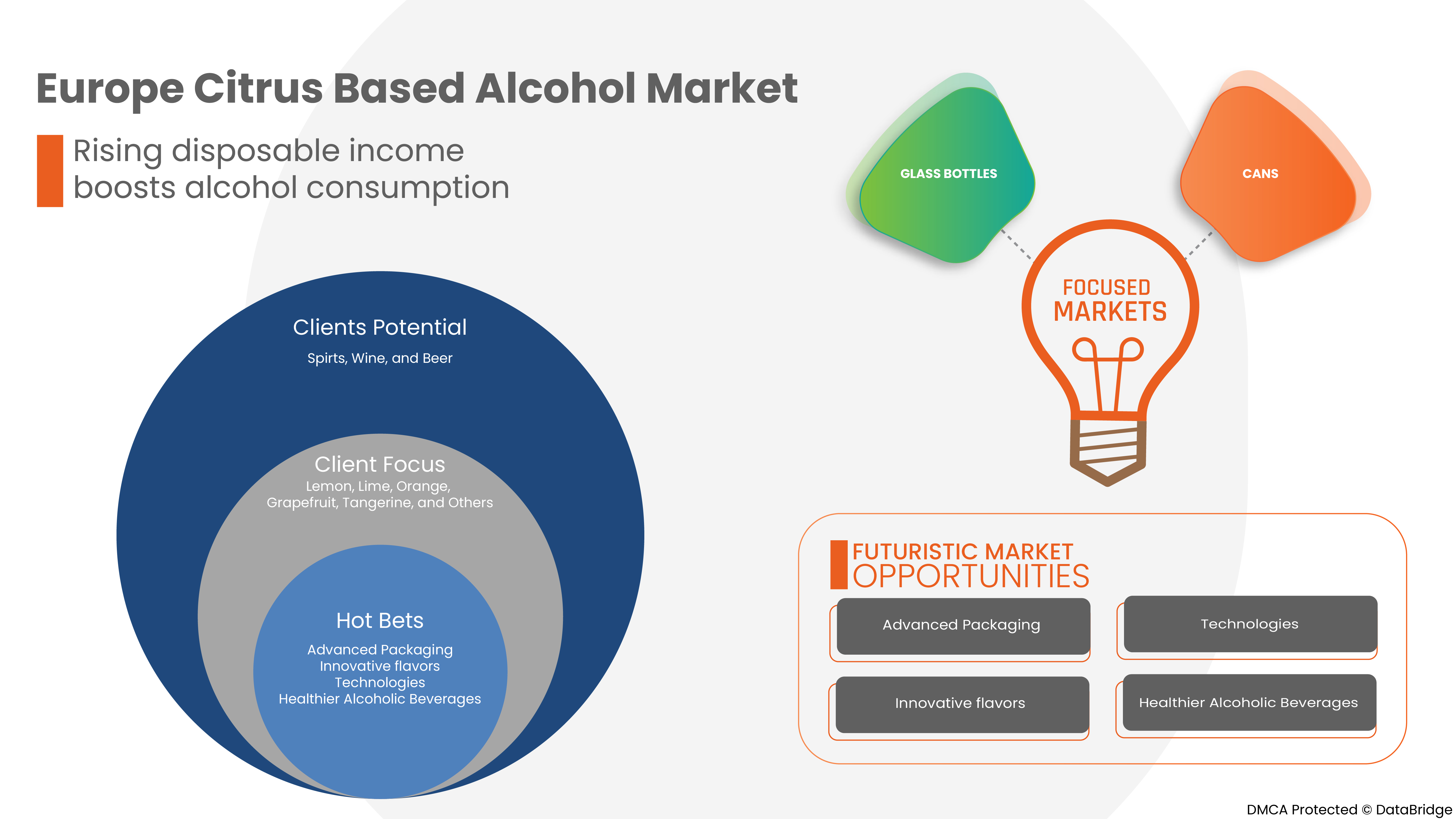

クラフトスピリッツの需要と人気が高まり、コスト効率の高い原料が採用されていることが、ヨーロッパの柑橘系アルコール市場の重要な推進力となっています。可処分所得の増加によりアルコール消費量が増加し、消費者の間で柑橘系フレーバーの健康効果に関する認識が高まることで、ヨーロッパの柑橘系アルコール市場の成長が促進されると予想されます。

柑橘系アルコール市場レポートでは、市場シェア、新しい展開、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別(スピリッツ、ワイン、ビール)、柑橘類別(レモン、ライム、オレンジ、グレープフルーツ、タンジェリン、その他)、パッケージ別(ガラス瓶、缶、ペットボトル)、流通チャネル別(専門店、ホテル/レストラン/バー、コンビニエンスストア、オンライン小売店、その他)。 |

|

対象国 |

英国、ロシア、フランス、スペイン、イタリア、ドイツ、トルコ、オランダ、スイス、ベルギー、その他のヨーロッパ諸国。 |

|

対象となる市場プレーヤー |

アンハイザー・ブッシュ・インベブ、コンステレーション・ブランズ、ハイネケン、コカ・コーラ カンパニー、アサヒグループホールディングス、アンハイザー・ブッシュ・カンパニーズ、ボストンビールカンパニー、ディアジオ、ビームサントリー、ラディコ・カイタン、エドリントン、サントリーホールディングス、アコレードワインズ、ウィリアム・グラント&サンズ、カールスバーグ・ブリュワリーズ A/S、ヘイルウッド・アーティザナル・スピリッツ、ペルノ・リカール、ユナイテッド・ブリュワリーズ、ブラウン・フォーマン、KALS ディスティラリーズ プライベート リミテッド、バカルディ リミテッド |

市場の定義

柑橘系アルコールは、主にレモン、ライム、グレープフルーツ、オレンジなどの柑橘類から製造されています。柑橘類はその風味と強い酸味から、ビールやワイン、ラム酒、ジンなどの蒸留酒を含むアルコール飲料に欠かせないものとなり、カクテルのバランスをとるために使用されています。同様に、柑橘系アルコールはアルコール製造のベースおよび風味添加物として使用されています。柑橘系アルコール飲料は、レモン、ライム、オレンジ、グレープフルーツ、タンジェリンなどの柑橘類から製造された栄養プロファイルを受け継いでいます。柑橘類はビタミン C が豊富で、これは細胞をフリーラジカルによる損傷から保護する強力な抗酸化物質であり、糖尿病、ガン、神経疾患などの症状の予防に重要な役割を果たします。

クラフト スピリッツは主にフルーツの風味を注入して開発されています。クラフト スピリッツから生まれたイノベーションは、飲料業界では他に類を見ないものです。クラフト製品は、非常に多様性と芸術性があるため、消費者からより創造的で機敏でニッチな製品とみなされています。クラフト スピリッツの成長は、蒸留製品に柑橘類を取り入れることで、柑橘系アルコールの成長を後押ししています。柑橘類に加えて、スピリッツにはシナモン、バニラ、ショウガ、コショウなどのさまざまなスパイスが注入され、味と香りが向上します。柑橘類の原料を採用することは、スピリッツの製造にとってより健康的でコスト効率の高い方法です。

柑橘系アルコール市場の動向

ドライバー

- クラフトスピリッツのトレンド拡大とコスト効率の高い原料の採用

As the drinks industry continues to expand and develop, the rise of craft spirits, among craft beers and ciders, cannot be ignored. From rum to gin, 'there's plenty in the way of craft spirits, both online and in-store – all of which embody something different. So much so that many prefer craft spirits to more traditionally commercial brands, which is also likely down to the consumer trend of buying locally from smaller distilleries and breweries. The rapid demand for premium quality craft spirits owing to changing cultural attitudes of the young and affluent population is a major contributor to the growth of the craft spirits market worldwide. Craft spirit consumers prefer products made using natural or organic flavors while small-scale distillers differentiate themselves with clean labels authentic handpicked ingredients such as spring water and non-GMO grains and unique flavor combinations. The most popular craft rum is spiced rum, infused with various spices including cinnamon, ginger, vanilla, nutmeg, and pepper. This adoption of the ingredients is healthier and cost-effective for the production of craft spirits.

- Rising disposable income boosts alcohol consumption

But nowadays alcohol became more affordable in the majority of countries, because of the rising disposable income of the people. The change in real income was greater than the change in the relative price of alcohol. This shows that the growth in real income was the main driver of affordability. The growth of alcohol is large for the age sector between 18 to 80. Especially amongst the youth. The increasing employment and rising disposable income coupled with the decreasing unemployment rates are driving the demand for alcohol. In the modern world, everywhere people need alcohol to enjoy their days and night for their vacations, party, and also leisure time. Increasing IT sectors and people trying to become more social among colleagues. This socialization mostly needs alcohol. In order to ease this, alcohol is not only available in liquor shops or stores, high-end hotels, and restaurants are keen to bring craft spirit into their portfolio.

- Growing awareness regarding the health benefits of citrus flavors among consumer

Citrus-flavored alcohol drinks are becoming increasingly popular among most people worldwide because of their multiple health benefits and taste-enhancing ability. Citrus fruits, such as lemons and oranges, are high in vitamin C, a powerful antioxidant protecting cells from free radical damage. Bone production, connective tissue healing, and gum health all require mainly vitamin C which one gets from citrus-flavored drinks. Vitamin C found in citrus also aids in the prevention of wrinkles, dry skin from aging, and sun damage. Moreover, it also catalyzes the production of collagen, which is vital for skin health.

Opportunities

- Soaring demand for innovative alcohol flavors

There are many ways to upgrade a pure alcoholic beverage using fruit flavors. Citrus oils are widely used for beverage flavoring. This fruit belongs to Rutaceae family and consists of about 140 tribes and 1300 species, such as: green Lemon, grapefruit, oranges, yellow Lemon, mandarins, pomelo, bergamot and citron. Citrus oils are stored in leaves, peels, and juice. Terpenes, sesquiterpenes, aldehydes, alcohols, esters, and sterols are among the many chemicals found in these excellent essential oils. They are also known as hydrocarbon mixtures, oxygen-containing chemicals, and non-volatile residue compounds. Citrus flavors are popular in drinks, particularly wheat beer. One of the wheat beer fermentation products are esters which give the fruit taste and aroma to the beer itself, so it perfectly fits with citrus flavors and almost hides the flavor and aroma provided by hops. The most popular beer cocktails are mixed with citrus fruits such as lemon, orange juice, or flavorings.

- Increasing focus of the key manufacturer to upgrade the existing technologies

The alcoholic beverage market is in a rapid transition with the expanding consumption of the citrus based alcoholic drinks. The production technique of citrus fermented alcoholic drinks such as citrus wine and citrus brandy belong to the citrus deep processing field uses citrus fruit as raw material, and adopts the following steps: pressing juice, centrifuging, standing still and clarifying, regulating sugar-acid ratio, and low-temp. Primary fermentation, post-fermentation, filtering and ageing, blending, freezing and filtering, ultra-high temperature flash-pasteurization, and thermal filling to obtain the citrus fermented wine; and then making the dry type citrus fermented wine undergo the processes of distillation, making-up, filtering, aging, blending, freezing and filtering to obtain the invented citrus brandy. Said citrus brandy is clear and transparent, possesses citrus fragrance and natural color, and tastes rich and palate full. And also, other existing technologies are available for manufacturing the citrus-based alcoholic drinks.

Restraints/Challenges

- Price volatility in citrus fruits

柑橘類やその原材料の価格は、柑橘系アルコール市場で大きな役割を果たしています。アルコールに柑橘類の香料を使用することで、かなり健康的でおいしい飲み物が市場で生産・販売されているからです。世界中でアルコール消費量が増加したことにより、柑橘類を天然のフルーツ風味でミックスした柑橘系アルコール飲料の消費量も増加しています。柑橘系アルコールの製造に使用される基本的な主原材料は柑橘類です。柑橘類には、オレンジ、レモン、ライム、グレープフルーツなどがあります。これらの柑橘類は市場で広く入手可能であるにもかかわらず、いくつかの国のインフレ率、気候条件、輸出入に関する法律や関税、輸送に使用される石油製品価格の変動性、その他の要因が大きな影響を与え、価格変動を引き起こします。

- アルコール消費を制限することを目的とした厳しい規則

アルコール消費量を減らすために用いられる主要な厳格な政策には、統一税、従量税(容積税)、その他のアルコール物品税など、アルコール価格をターゲットとする課税をいくつかの「国」が用いることが含まれます。これらの税金に加えて、一部の政府は最低単位価格設定(MUP)にますます関心を持つようになっています。MUPは、安価なアルコール飲料を対象に、アルコールまたは標準飲料1単位あたりの最低価格を強制的に設定する政策ツールです。カナダを含むいくつかの国がMUPを実施しました。アルコールの入手可能性を制限して摂取量に影響を与え、人々がアルコールを購入して消費する機会を制限することができます。たとえば、インドのタミル・ナードゥ州では、酒類販売店の営業時間は午後12時から午後10時までです。

- 人工香料の健康への有害な影響に対する懸念が高まる

人工香料には栄養価がありません。必須ビタミンやミネラルによる健康効果も得られません。人体の健康に有害な影響を及ぼします。香料入りアルコール飲料の大量摂取の主な影響は、ガンのリスクが高くなるほか、高血圧、心臓病、脳卒中、肝臓病、免疫力の低下などにもつながります。

- アルコール使用障害(AUD)の有病率が高い

アルコール使用障害の原因は、遺伝、幼少期の出来事、精神的苦痛を和らげようとする試みが組み合わさったものと思われます。アルコールを頻繁に大量に摂取したり、幼少期から飲酒を始めたり、身体的または性的虐待などのトラウマを経験したり、アルコール使用障害の家族歴があったり、悲しみ、不安、うつ病、摂食障害、心的外傷後ストレス障害などの精神衛生上の問題を抱えていたり、体重の問題で胃バイパス手術を受けたりした人は、アルコール使用障害を発症する可能性が高くなります。

- 柑橘類の代替品の入手可能性

カクテルのバランスをとるために、新鮮な柑橘類ジュースの代わりになるものはたくさんあり、それらは天然の酸の形で存在します。おそらくご存知のものはクエン酸です。しかし、他にもいくつかあります。リンゴ酸(リンゴ、アプリコット、桃に含まれる)、酒石酸(ブドウ、バナナ)、乳酸(乳製品)など、ほんの数例を挙げると、いくつかあります。さらに、酢、糖蜜、ベルジュースは、柑橘類や粉末酸とは異なる種類の酸味と酸味を提供できます。非常に低い割合の酸を使用することで、風味が自然に劣化するシロップやジュースを安定させ、保存期間を大幅に延ばすことができます。

最近の開発

- クラフトスピリッツによると、2021年10月、柑橘系の缶入り即飲カクテル「SunDaze」が、南カリフォルニアのロサンゼルス郡のPinkDotとTotal Wineの店舗と、オンラインで消費者に直接配送される全国(合法な場所)で発売されることが発表されました。この発売により、同社のヨーロッパ市場での事業が強化されるでしょう。

- スピリッツビジネスによると、2022年7月、英国を拠点とするシェイクスピア蒸留所は、限定版の蒸留所スペシャルシリーズの一部としてシトラスウォッカを発売しました。このシトラスウォッカは、蒸留所で手作業で皮をむいた新鮮なオレンジとレモンの強い風味を持っています。

柑橘系アルコール市場の展望

柑橘系アルコール市場は、製品タイプ、柑橘類、パッケージ、流通チャネルに基づいて分類されています。これらのセグメントの成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品タイプ

- スピリッツ

- ワイン

- ビール

製品タイプに基づいて、柑橘系アルコール市場は、ビール、ワイン、スピリッツの 3 つのセグメントに分類されます。

柑橘類

- レモン

- ライム

- オレンジ

- グレープフルーツ

- タンジェリン

- その他

柑橘類をベースとしたアルコール市場は、柑橘類に基づいて、レモン、ライム、オレンジ、グレープフルーツ、タンジェリンなどの 6 つのセグメントに分類されます。

パッケージ

- ガラス瓶

- 缶

- ペットボトル

包装に基づいて、柑橘系アルコール市場は、ガラス瓶、缶、ペットボトルの 3 つのセグメントに分類されます。

流通チャネル

- 専門店

- ホテル/レストラン/バー

- コンビニエンスストア

- オンライン小売業者

- その他

流通チャネルに基づいて、柑橘系アルコール市場は、専門店、ホテル/レストラン/バー、コンビニエンスストア、オンライン小売店、その他の 5 つのセグメントに分類されます。

柑橘系アルコール市場の地域分析/洞察

柑橘系アルコール市場は、製品タイプ、柑橘類、パッケージ、流通チャネルに基づいて分類されています。

柑橘系アルコール市場が存在する国は、英国、ロシア、フランス、スペイン、イタリア、ドイツ、トルコ、オランダ、スイス、ベルギー、その他のヨーロッパ諸国です。

ヨーロッパでは、クラフトスピリッツのトレンドが高まっているため、フランスがヨーロッパの柑橘系アルコール市場を支配すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境と柑橘系アルコール市場シェア分析

柑橘系アルコール市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、柑橘系アルコール市場に関連する会社の焦点にのみ関連しています。

市場で活動している主要な市場プレーヤーには、アンハイザー・ブッシュ・インベブ、コンステレーション・ブランズ、ハイネケン、コカ・コーラ、アサヒグループホールディングス、アンハイザー・ブッシュ・カンパニー、ボストン・ビール・カンパニー、ディアジオ、ビーム・サントリー、ラディコ・カイタン、エドリントン、サントリー・ホールディングス、アコレード・ワインズ、ウィリアム・グラント・アンド・サンズ、カールスバーグ・ブリュワリーズ A/S、ヘイルウッド・アーティザナル・スピリッツ、ペルノ・リカール、ユナイテッド・ブリュワリーズ、ブラウン・フォーマン、KALS ディスティラリーズ・プライベート・リミテッド、バカルディ・リミテッドなどがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、ヨーロッパ対地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CITRUS BASED ALCOHOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.2 GROWTH STRATEGIES OF THE KEY MARKET PLAYERS

4.3 IMPACT OF THE ECONOMY ON MARKET

4.3.1 IMPACT ON PRICE

4.3.2 IMPACT ON SUPPLY CHAIN

4.3.3 IMPACT ON SHIPMENT

4.3.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT

4.6 FOB & B2B PRICES – EUROPE CITRUS BASED ALCOHOL MARKET

4.7 B2B PRICES – EUROPE CITRUS BASED ALCOHOL MARKET

4.8 VALUE CHAIN ANALYSIS:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS

6.1.2 RISING DISPOSABLE INCOME BOOSTS ALCOHOL CONSUMPTION

6.1.3 GROWING AWARENESS REGARDING THE HEALTH BENEFITS OF CITRUS FLAVORS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY IN CITRUS FRUITS

6.2.2 STRICT RULES AIMED AT LIMITING ALCOHOL CONSUMPTION

6.2.3 GROWING CONCERNS ABOUT THE HARMFUL EFFECTS OF ARTIFICIAL FLAVORS ON HEALTH

6.3 OPPORTUNITIES

6.3.1 SOARING DEMAND FOR INNOVATIVE ALCOHOL FLAVORS

6.3.2 INCREASING FOCUS OF THE KEY MANUFACTURER TO UPGRADE THE EXISTING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 A HIGH PREVALENCE OF ALCOHOL USE DISORDER (AUD)

6.4.2 AVAILABILITY OF SUBSTITUTES FOR CITRUS

7 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPIRITS

7.2.1 DISTILLED SPIRITS

7.2.1.1 VODKA

7.2.1.2 WHISKEY

7.2.1.3 RUM

7.2.1.3.1 LIGHT RUM

7.2.1.3.2 GOLD RUM

7.2.1.3.3 DARK RUM

7.2.1.3.4 OVER-PROOF RUM

7.2.1.3.5 SPICED RUM

7.2.1.3.6 CACHACA

7.2.1.3.7 FLAVORED RUM

7.2.1.4 TEQUILA

7.2.1.4.1 BLANCO

7.2.1.4.2 REPOSADO

7.2.1.4.3 ANEJO

7.2.1.4.4 EXTRA-ANEJO

7.2.1.5 BRANDY

7.2.1.5.1 COGNAC

7.2.1.5.2 ARMAGNAC

7.2.1.5.3 SPANISH BRANDY

7.2.1.5.4 AMERICAN BRANDY

7.2.1.5.5 GRAPPA

7.2.1.5.6 EAU-DE-VIE

7.2.1.5.7 FLAVORED BRANDY

7.2.1.6 GIN

7.2.1.6.1 LONDON DRY GIN

7.2.1.6.2 PLYMOUTH GIN

7.2.1.6.3 OLD TOM GIN

7.2.1.6.4 GENEVER

7.2.1.6.5 NEW AMERICAN

7.2.2 NON-DISTILLED SPIRITS

7.3 WINE

7.3.1 RED WINE

7.3.1.1 CABERNET SAUVIGNON

7.3.1.2 PINOT NOIR

7.3.1.3 ZINFANDEL

7.3.1.4 SYRAH

7.3.2 WHITE WINE

7.3.2.1 CHARDONNAY

7.3.2.2 RIESLING

7.3.2.3 PINOT GRIS

7.3.2.4 SAUVIGNON BLANC

7.3.3 ROSE WINE

7.3.4 SPARKLING WINE

7.3.5 DESSERT WINE

7.4 BEER

7.4.1 ALE

7.4.1.1 BROWN ALE

7.4.1.2 PALE ALE

7.4.1.3 INDIA PALE ALE

7.4.1.4 SOUR ALE

7.4.2 LAGER

7.4.3 PORTER

7.4.4 STOUT

7.4.5 WHEAT

7.4.6 PILSNER

8 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT

8.1 OVERVIEW

8.2 LEMON

8.3 LIME

8.4 ORANGE

8.5 GRAPEFRUIT

8.6 TANGERINE

8.7 OTHERS

9 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 GLASS BOTTLES

9.3 CANS

9.4 PLASTIC BOTTLES

10 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 HOTEL/RESTAURANTS/BARS

10.4 CONVENIENCE STORES

10.5 ONLINE RETAILERS

10.6 OTHERS

11 EUROPE CITRUS BASED ALCOHOL MARKET, BY REGION

11.1 EUROPE

11.1.1 FRANCE

11.1.2 SPAIN

11.1.3 GERMANY

11.1.4 U.K.

11.1.5 SWITZERLAND

11.1.6 BELGIUM

11.1.7 NETHERLANDS

11.1.8 ITALY

11.1.9 RUSSIA

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE CITRUS BASED ALCOHOL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 AGREEMENTS

12.6 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CONSTELLATION BRANDS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HEINEKEN N.V.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THE COCA-COLA COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ASHAHI GROUP HOLDINGS, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ANHEUSER-BUSCH COMPANIES, LLC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 THE BOSTON BEER COMPANY

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 DIAGEO

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BEAM SUNTORY INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ACCOLADE WINES LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BACARDI LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BROWN-FORMAN

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 CARLSBERG BREWERIES A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EDRINGTON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HALEWOOD ARTISANAL SPIRITS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 KALS DISTILLERIES PRIVATE LIMITED.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PERNOD RICARD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 RADICO KHAITAN LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SUNTORY HOLDINGS LIMITED

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 UNITED BREWERIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 WILLIAM GRANT & SONS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 3 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 5 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 13 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 16 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 18 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LEMON IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LIME IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ORANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE GRAPEFRUIT IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE TANGERINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 28 EUROPE GLASS BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CANS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE PLASTIC BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY STORES RANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE HOTEL/RESTAURANTS/BARS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CONVENIENCE STORES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE ONLINE RETAILERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (MILLION LITRES)

TABLE 39 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 41 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 43 EUROPE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 49 EUROPE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 51 EUROPE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 53 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 FRANCE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 57 FRANCE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 58 FRANCE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 59 FRANCE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 65 FRANCE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 66 FRANCE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 FRANCE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 69 FRANCE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 70 FRANCE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SPAIN CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 73 SPAIN SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SPAIN RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 76 SPAIN TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 77 SPAIN BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 78 SPAIN GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 79 SPAIN WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 80 SPAIN RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 81 SPAIN WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 82 SPAIN BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 SPAIN ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 85 SPAIN CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SPAIN CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 GERMANY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 89 GERMANY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 GERMANY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 GERMANY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 93 GERMANY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 95 GERMANY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 97 GERMANY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 98 GERMANY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 99 GERMANY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 GERMANY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 101 GERMANY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 102 GERMANY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 U.K. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 105 U.K. SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 U.K. DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 107 U.K. RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 108 U.K. TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 109 U.K. BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 110 U.K. GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 111 U.K. WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 112 U.K. RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 113 U.K. WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 114 U.K. BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 115 U.K. ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.K. CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 117 U.K. CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 118 U.K. CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 121 SWITZERLAND SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 137 BELGIUM SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 153 NETHERLANDS SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 ITALY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 ITALY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 169 ITALY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 170 ITALY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 171 ITALY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 172 ITALY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 173 ITALY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 174 ITALY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 175 ITALY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 176 ITALY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 177 ITALY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 178 ITALY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 179 ITALY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 ITALY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 181 ITALY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 182 ITALY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 185 RUSSIA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 187 RUSSIA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 188 RUSSIA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 189 RUSSIA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 190 RUSSIA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 191 RUSSIA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 192 RUSSIA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 193 RUSSIA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 194 RUSSIA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 195 RUSSIA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 RUSSIA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 197 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 198 RUSSIA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 TURKEY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 TURKEY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 201 TURKEY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 202 TURKEY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 TURKEY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 204 TURKEY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 205 TURKEY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 206 TURKEY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 207 TURKEY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 208 TURKEY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 209 TURKEY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 210 TURKEY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 211 TURKEY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 TURKEY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 213 TURKEY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 214 TURKEY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 REST OF EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

図表一覧

FIGURE 1 EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 2 EUROPE CITRUS BASED ALCOHOL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CITRUS BASED ALCOHOL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CITRUS BASED ALCOHOL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CITRUS BASED ALCOHOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CITRUS BASED ALCOHOL MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE CITRUS BASED ALCOHOL MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE CITRUS BASED ALCOHOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE CITRUS BASED ALCOHOL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE CITRUS BASED ALCOHOL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE CITRUS BASED ALCOHOL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE CITRUS BASED ALCOHOL MARKET: SEGMENTATION

FIGURE 13 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS IS EXPECTED TO DRIVE EUROPE CITRUS BASED ALCOHOL MARKET IN THE FORECAST PERIOD

FIGURE 14 SPIRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CITRUS BASED ALCOHOL MARKET IN 2022 & 2029

FIGURE 15 SUPPLY CHAIN ANALYSIS – EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 17 EUROPE CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE CITRUS BASED ALCOHOL MARKET: BY CITRUS FRUIT, 2021

FIGURE 19 EUROPE CITRUS BASED ALCOHOL MARKET: BY PACKAGING, 2021

FIGURE 20 EUROPE CITRUS BASED ALCOHOL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 EUROPE CITRUS BASED ALCOHOL MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 EUROPE CITRUS BASED ALCOHOL MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。