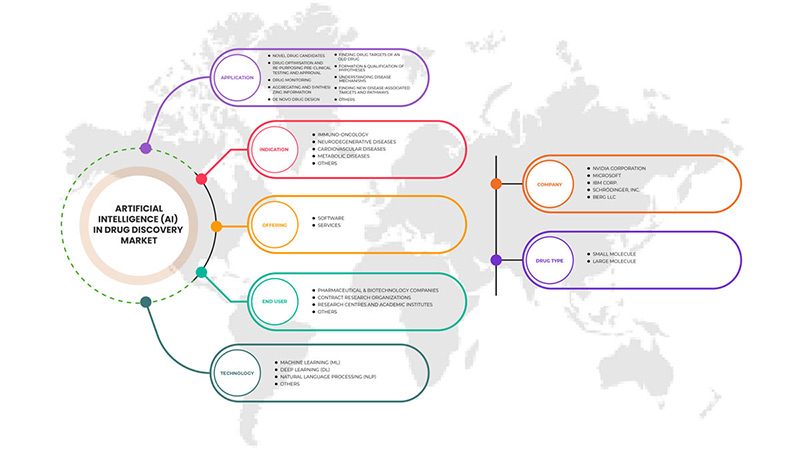

ヨーロッパの創薬市場における人工知能 (AI)、アプリケーション別 (新薬候補、薬物の最適化と転用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と適格性、デノボ薬物設計、古い薬物の薬物ターゲットの発見など)、テクノロジー別 (機械学習、ディープラーニング、自然言語処理など)、薬物タイプ別 (小分子と巨大分子)、提供内容別 (ソフトウェアとサービス)、適応症別 (免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患など)、最終用途別 (開発業務受託機関 (CRO)、製薬およびバイオテクノロジー企業、研究センターと学術機関など) 業界動向と2029年までの予測。

欧州の創薬市場における人工知能(AI)の分析と洞察

人工知能 (AI) は、ヘルスケア業界では利益を生む技術になると期待されています。AI の導入により、医薬品製造プロセスにおける研究開発ギャップが縮小し、ターゲットを絞った医薬品の製造に役立ちます。そのため、バイオ医薬品企業は市場シェアの拡大に AI を活用しています。医薬品発見のための AI は、機械を使用して人間の知能をシミュレートし、医薬品開発プロセスにおける複雑な課題を解決する技術です。

臨床試験プロセスに AI ソリューションを導入すると、起こり得る障害が排除され、臨床試験のサイクル時間が短縮され、臨床試験プロセスの生産性と精度が向上します。医薬品の発見における AI の技術的進歩と医薬品の発見プロセスにかかる総時間の短縮は、予測期間中の市場の成長を促進する他の要因です。ただし、利用可能なデータの品質が低く一貫性がない場合は、市場の成長が妨げられます。また、テクノロジーに関連するコストの高さと技術的な制限により、市場の成長が抑制されます。

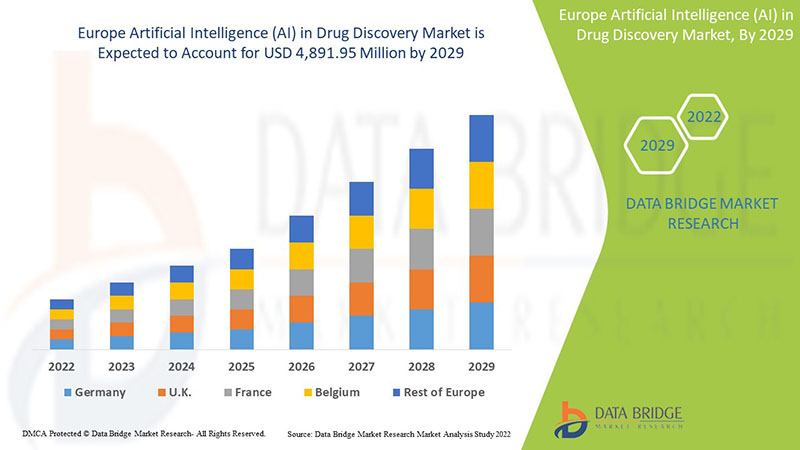

Data Bridge Market Research は、欧州の創薬における人工知能 (AI) 市場は、予測期間中に 52.0% の CAGR で成長し、2029 年までに 48 億 9,195 万ドルの価値に達すると予測しています。創薬市場での AI の利用を商業化するための技術進歩が急速に進んでいるため、ソフトウェアは市場で最大の技術セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

アプリケーション別(新薬候補、薬物の最適化と転用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と適格性、新規薬物設計、旧薬の薬物ターゲットの発見など)、テクノロジー別(機械学習、ディープラーニング、自然言語処理など)、薬物タイプ別(小分子と巨大分子)、提供内容別(ソフトウェアとサービス)、適応症別(免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患など)、最終用途別(開発業務受託機関(CRO)、製薬・バイオテクノロジー企業、研究センターと学術機関など) |

|

対象国 |

ドイツ、フランス、イギリス、イタリア、スペイン、ロシア、トルコ、ベルギー、オランダ、スイス、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

市場で活動している主要企業としては、NVIDIA Corporation、IBM Corp.、Atomwise Inc.、Microsoft、Benevolent AI、Aria Pharmaceuticals, Inc.、DEEP GENOMICS、Exscientia、Cloud、Insilico Medicine、Cyclica、NuMedii, Inc.、Envisagenics、Owkin Inc.、BERG LLC、Schrödinger, Inc.、XtalPi Inc.、BIOAGE Inc.などが挙げられます。 |

欧州の創薬市場における人工知能(AI)の定義

AI はここ数年、医療技術従事者の注目を集めており、多くの企業や大手研究機関がこれらの技術を臨床で使用できるよう完成させようと取り組んできました。AI (ディープラーニング (DL)、機械学習 (ML)、人工ニューラルネットワーク (ANN) とも呼ばれる) が臨床医をどのように支援できるかを示す最初の商用化デモが現在利用可能です。これらのシステムは、臨床医のワークフローにパラダイムシフトをもたらし、生産性を向上させると同時に、治療と患者のスループットを向上させる可能性があります。創薬のための AI は、機械を使用して人間の知能をシミュレートし、医薬品開発手順における複雑な課題を解決する技術です。臨床試験プロセスに AI ソリューションを採用すると、起こり得る障害が排除され、臨床試験のサイクルタイムが短縮され、臨床試験プロセスの生産性と精度が向上します。そのため、創薬プロセスにおけるこれらの高度な AI ソリューションの採用は、ライフサイエンス業界の関係者の間で人気が高まっています。製薬分野では、新しい化合物の発見、治療ターゲットの特定、カスタマイズされた医薬品の開発に役立ちます。創薬に使用される AI プラットフォームは、さまざまな慢性疾患を治療し、その重症度を最小限に抑える医薬品の発見に関する洞察を得るための実現可能な選択肢となる可能性があります。

欧州の創薬市場における人工知能(AI)の動向

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in incidence of chronic diseases propels need for AI in drug discovery

The incidence of chronic diseases is increasing at a rapid pace across the globe. According to the Centers for Disease Control and Prevention (CDC), six in 10 adults in the U.S. have a chronic disease. Furthermore, the CDC also highlights that chronic diseases such as heart disease and diabetes are the leading causes of death in the U.S. Such statistics shed light on the growing prevalence of chronic diseases and the need to bring down the fatality rate caused due to these diseases.

AI platforms used for drug discovery can prove to be a feasible option for deriving insights into the discovery of drugs to treat and minimize the severity of various chronic diseases. Thus, these factors are expected to act as a driver for the market growth during the forecast period.

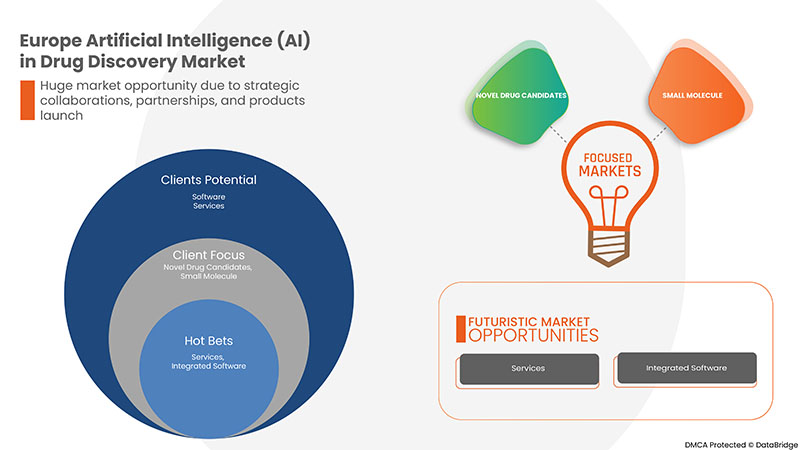

- Strategic collaborations, partnerships, and products launch

AI has the potential to transform drug discovery by rapidly accelerating the R&D timeline, making drug development cheaper and faster, and improving the probability of approval. AI can also increase the effectiveness of drug repurposing research.

An increase in cross-industry alliances and collaborations drives the market. Rise in relevance of AI in drug discovery & development, and a surge in funding for R&D activities, including AI technology in the field of drug research, are projected to propel the global market growth. Hence, increase in cross-industry collaborations and partnerships is driving the market.

Restraint

- High cost associated with technology and technical limitations

The current healthcare sector is facing several complex challenges, such as the increased cost of drugs and therapies, and society needs specific significant changes in this area. The entire success of AI depends on the availability of a substantial amount of data because these data are used for the subsequent training provided to the system. Access to data from various database providers can incur extra costs for a company. Clinical trials are directed towards establishing the safety and efficacy of a drug product in humans for a particular disease condition and require six to seven years along with a substantial financial investment. However, only one out of ten molecules entering these trials gain successful clearance, which is a massive loss for the industry. These failures can result from inappropriate patient selection, shortage of technical requirements, and poor infrastructure. Thus, increasing costs with the technology is acting as a restraint for the market growth.

Opportunity

-

Rise in the investments for R&D

The rise in R&D activities and increasing adoption of cloud-based services and applications will provide beneficial opportunities for market growth.

The industry of AI in biopharma continues to grow after a long period of sepsis. This is reflected in the ongoing flow of investments and increase in the number of collaborations between pharmaceutical corporations and AI companies in 2021 to the previous years. The Biopharma industry’s growth is largely influenced by the active engagement of leading pharmaceutical corporations in AI-related investments. The number of scientific publications in the field of AI in Biopharma, and research collaborations between pharma companies and AI-expertise vendors are rapidly increasing, yet, some pharma corporations are still critical of AI applications. ML and AI applications in the pharmaceutical and healthcare industries lead to the formation of a new interdisciplinary field of data-driven drug discovery in healthcare. Thus, rise in investment in R&D activities is acting as an opportunity for market growth.

Challenge

- Lack of skilled professionals

The shortage of skilled professionals is expected to hamper the market growth. The employees have to re-train or learn new skill sets to work efficiently on the complex AI machines to get the desired results for the drug. This challenge that prevents full-fledged adoption of AI in the pharmaceutical industry includes the lack of skilled personnel to operate AI-based platforms, limited budget for small organizations, apprehension of replacing humans leading to job loss, skepticism about the data generated by AI, and the black box phenomenon (that is, how the conclusions are reached by the AI platform). The shortage of skills acts as a major hindrance to drug discovery through AI, discouraging companies to adopt AI-based machines for drug discovery.

As skill demands are too high, it has manifested as a challenge to retain and manage skill-specified professionals. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. There is an urgent need for the education of professionals for AI-based technology. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. It is therefore apparent that the availability of professionals equipped with adequate skills is challenging the market growth.

Post-COVID-19 Impact on Europe Artificial Intelligence (AI) in Drug Discovery Market

The COVID-19 outbreak had a beneficial impact on the expansion of AI in drug discovery industry due to its widespread use by various organizations for the identification as well as screening of existing medicines used in the treatment of COVID-19. AI is useful in detecting active chemicals for the prevention of SARS-CoV, HIV, SARS-CoV-2, influenza virus, and others. During the pandemic, economies all over the world relied on AI-based medication discovery rather than traditional vaccine detection processes, which take years to create and are equally expensive, contributing to the growth of the market.

メーカー各社は、COVID-19後の回復に向けてさまざまな戦略的決定を下しています。各社は、ワイヤレスマイクに関わる技術を向上させるために、複数の研究開発活動を行っています。これにより、各社は高度で正確なAIソフトウェアを市場に投入することになります。

最近の動向

- 2022 年 3 月、NVIDIA Corporation はリアルタイム AI アプリケーションの開発と展開のために Clara Holoscan MGX をリリースしました。Clara Holoscan MGX は Clara Holoscan プラットフォームを拡張し、オールインワンの医療グレードのリファレンス アーキテクチャと長期的なソフトウェア サポートを提供し、医療機器業界のイノベーションを加速します。これにより、同社は手術、診断、創薬などの医療分野で AI パフォーマンスを向上させることができます。

- 2022年5月、臨床段階のAIを活用した創薬のリーディングカンパニーであるBenevolent AIは、AstraZenecaが特発性肺線維症(IPF)の新たなターゲットを医薬品開発ポートフォリオに追加選択し、Benevolent AIにマイルストーンペイメントを支払ったことを発表しました。これは、IPFと慢性腎臓病の2つの疾患領域にわたってBenevolentプラットフォームを使用して特定され、その後AstraZenecaによって検証され、ポートフォリオへの参入が選択された、コラボレーションによる3番目の新たなターゲットです。これは、2022年1月に締結された、全身性エリテマトーデスと心不全の2つの新しい疾患領域を含むAstraZenecaとのコラボレーションの最近の拡張に基づいています。これにより、同社はコラボレーションを強化することができました。

欧州の創薬市場における人工知能(AI)の範囲

欧州の創薬市場における人工知能 (AI) は、アプリケーション、テクノロジー、薬剤の種類、提供、適応症、最終用途に分類されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コアアプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

応用

- 新薬候補

- 医薬品の最適化と再利用 前臨床試験と承認

- 薬物モニタリング

- 新たな疾患に関連する標的と経路の発見

- 病気のメカニズムを理解する

- 情報の集約と統合

- 仮説の形成と検証

- 新規医薬品設計

- 古い薬の薬物ターゲットを見つける

- その他

アプリケーションに基づいて、市場は、新薬候補、薬物の最適化と再利用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と認定、新規薬物設計、古い薬物の薬物ターゲットの発見、その他に分類されます。

テクノロジー

- 機械学習(ML)

- ディープラーニング(DL)

- 自然言語処理 (NLP)

- その他

テクノロジーに基づいて、市場は機械学習 (ML)、ディープラーニング (DL)、自然言語処理 (NLP) などに分類されます。

薬剤の種類

- 小分子

- 巨大分子

薬物の種類に基づいて、市場は低分子と高分子に分類されます。

提供

- ソフトウェア

- サービス

提供内容に基づいて、市場はソフトウェアとサービスに分類されます。

表示

- 免疫腫瘍学

- 神経変性疾患

- 心血管疾患

- 代謝性疾患

- その他

適応症に基づいて、市場は免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患、その他に分類されます。

最終使用

- 製薬・バイオテクノロジー企業

- 契約研究機関(CRO)

- 研究センターおよび学術機関

- その他

最終用途に基づいて、市場は製薬およびバイオテクノロジー企業、契約研究機関(CRO)、研究センターおよび学術機関、その他に分類されます。

欧州の創薬市場における人工知能 (AI) の地域分析/洞察

欧州の医薬品発見市場における人工知能 (AI) が分析され、アプリケーション、テクノロジー、医薬品の種類、提供、適応症、最終用途別に市場規模の情報が提供されます。

この市場レポートで取り上げられている国は、ドイツ、フランス、英国、イタリア、スペイン、ロシア、トルコ、ベルギー、オランダ、スイス、その他のヨーロッパ諸国です。

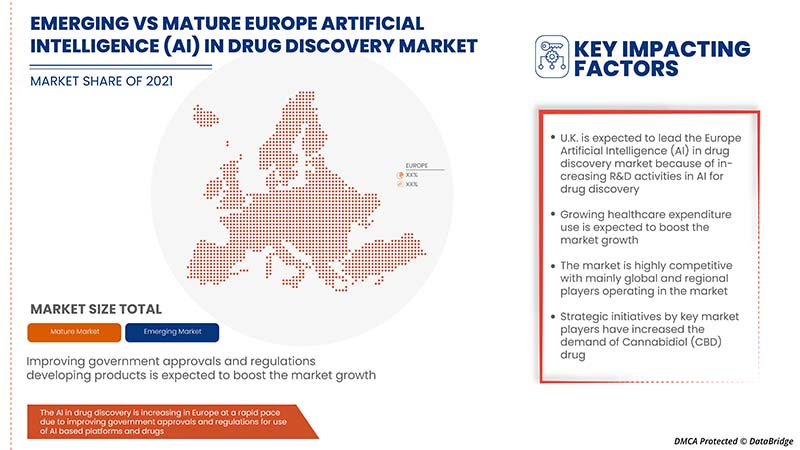

2022年には、政府の資金援助の増加と医療費の上昇により、ヨーロッパが優勢になります。英国は、R&D活動の増加と創薬のためのAIの技術的進歩により成長すると予想されます。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパ ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と欧州の創薬市場シェア分析における人工知能 (AI)

欧州の医薬品発見における人工知能 (AI) 市場の競争状況では、競合他社ごとに詳細が提供されます。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、欧州の医薬品発見における人工知能 (AI) 市場への会社の重点にのみ関連しています。

この市場で活動している主要企業としては、NVIDIA Corporation、IBM Corp.、Atomwise Inc.、Microsoft、Benevolent AI、Aria Pharmaceuticals, Inc.、DEEP GENOMICS、Exscientia、Cloud、Insilico Medicine、Cyclica、NuMedii, Inc.、Envisagenics、Owkin Inc.、BERG LLC、Schrödinger, Inc.、XtalPi Inc.、BIOAGE Inc.などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORETSR’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN INCIDENCE OF CHRONIC DISEASES PROPELS NEED FOR ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY

5.1.2 STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND PRODUCTS LAUNCH

5.1.3 REDUCTION IN TOTAL TIME INVOLVED IN DRUG DISCOVERY PROCESS

5.1.4 ADVANCEMENT OF ARTIFICIAL INTELLIGENCE IN THE HEALTHCARE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH TECHNOLOGY AND TECHNICAL LIMITATIONS

5.2.2 DISADVANTAGES AND RISKS ASSOCIATED WITH AI IN DRUG DISCOVERY

5.2.3 LACK OF AVAILABLE QUALITY DATA

5.3 OPPORTUNITIES

5.3.1 RISE IN THE INVESTMENTS FOR R&D

5.3.2 RISING HEALTHCARE INFRASTRUCTURE

5.3.3 DEVELOPMENT OF NOVEL TOOLS

5.4 CHALLENGES

5.4.1 THE EUROPE SHORTAGE OF AI TALENT

5.4.2 ETHICAL, LEGAL, AND REGULATORY ISSUES FOR AI ADOPTION IN THE PHARMACEUTICAL SCIENCES

6 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

7 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING (ML)

7.2.1 SUPERVISED LEARNING

7.2.2 UNSUPERVISED LEARNING

7.2.3 REINFORCEMENT LEARNING

7.3 DEEP LEARNING

7.4 NATURAL LANGUAGE PROCESSING (NLP)

7.5 OTHERS

8 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY DRUG TYPE

8.1 OVERVIEW

8.2 SMALL MOLECULE

8.3 LARGE MOLECULE

9 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NOVEL DRUG CANDIDATES

9.2.1 PREDICT BIOACTIVITY OF SMALL MOLECULE

9.2.2 IDENTIFY BIOLOGICS TARGET

9.2.3 OTHERS

9.3 DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL

9.4 DRUG MONITORING

9.5 AGGREGATING AND SYNTHESIZING INFORMATION

9.6 DE NOVO DRUG DESIGN

9.7 FINDING DRUG TARGETS OF AN OLD DRUG

9.8 FORMATION & QUALIFICATION OF HYPOTHESES

9.9 UNDERSTANDING DISEASE MECHANISMS

9.1 FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS

9.11 OTHERS

10 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

10.1 OVERVIEW

10.2 IMMUNE-ONCOLOGY

10.2.1 BREAST CANCER

10.2.2 LUNG CANCER

10.2.3 COLORECTAL CANCER

10.2.4 PROSTATE CANCER

10.2.5 PANCREATIC CANCER

10.2.6 BRAIN CANCER

10.2.7 LEUKEMIA

10.2.8 OTHERS

10.3 NEURODEGENERATIVE DISEASES

10.4 CARDIOVASCULAR DISEASES

10.5 METABOLIC DISEASES

10.6 OTHERS

11 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY END USE

11.1 OVERVIEW

11.2 CONTRACT RESEARCH ORGANIZATIONS

11.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.4 RESEARCH CENTERS AND ACADEMIC INSTITUTES

11.5 OTHERS

12 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION

12.1 EUROPE

12.1.1 U.K.

12.1.2 FRANCE

12.1.3 GERMANY

12.1.4 SPAIN

12.1.5 ITALY

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 SWITZERLAND

12.1.9 TURKEY

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NVIDIA CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SCHRÖDINGER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BERG LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ARDIGEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EXSCIENTIA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ARIA PHARMACEUTICALS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ATOMWISE INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BENEVOLENT AI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 BIOAGE INC.,

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CLOUD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CYCLICA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEEP GENOMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ENVISAGENICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INSILICO MEDICINE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NUMEDII, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OWKIN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XTALPI INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 EUROPE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SERVICES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 EUROPE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DEEP LEARNING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE NATURAL LANGUAGE PROCESSING (NLP) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE SMALL MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LARGE MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE DRUG MONITORING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AGGREGATING AND SYNTHESIZING INFORMATION IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE DE NOVO DRUG DESIGN IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE FINDING DRUG TARGETS OF AN OLD DRUG IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE FORMATION & QUALIFICATION OF HYPOTHESES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE UNDERSTANDING DISEASE MECHANISMS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE NEURODEGENERATIVE DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE CARDIOVASCULAR DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE METABOLIC DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOB EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE RESEARCH CENTRES AND ACADEMIC INSTITUTES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 EUROPE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 U.K. SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 52 U.K. MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.K. NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 57 U.K. IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 U.K. ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 FRANCE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 FRANCE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 FRANCE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 67 FRANCE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 68 FRANCE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 GERMANY SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 GERMANY MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 74 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 GERMANY NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 77 GERMANY IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 78 GERMANY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 SPAIN SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 SPAIN MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SPAIN NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 SPAIN IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 88 SPAIN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 ITALY SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 ITALY MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 94 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 ITALY NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 97 ITALY IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 98 ITALY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 104 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 RUSSIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 129 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 130 TURKEY SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 TURKEY MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 TURKEY NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 137 TURKEY IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 138 TURKEY ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 149 REST OF EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING NEED TO CURB DRUG DISCOVERY COSTS AND REDUCE TIME INVOLVED IN THE DRUG DEVELOPMENT PROCESS, THE RISING ADOPTION OF CLOUD-BASED APPLICATIONS AND SERVICES, AND THE IMPENDING PATENT EXPIRY OF BLOCKBUSTER DRUGS ARE EXPECTED TO DRIVE THE GROWTH OF THE EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

FIGURE 14 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2021

FIGURE 15 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 17 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 18 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2021

FIGURE 19 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2021

FIGURE 23 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, CAGR (2022-2029)

FIGURE 25 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, LIFELINE CURVE

FIGURE 26 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2021

FIGURE 27 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 28 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2021

FIGURE 31 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 32 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 33 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 34 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2021

FIGURE 35 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 36 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, CAGR (2022-2029)

FIGURE 37 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, LIFELINE CURVE

FIGURE 38 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 39 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 40 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING (2022-2029)

FIGURE 43 EUROPE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。