アジア太平洋地域の食品原料(酸味料)市場

Market Size in USD Billion

CAGR :

%

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

| 2022 –2029 | |

| USD 17,583.40 Million | |

| USD 28,133.40 Million | |

|

|

|

アジア太平洋地域の食品成分(酸味料)市場、タイプ別(クエン酸、乳酸、酢酸、フマル酸、酒石酸、リンゴ酸、グルコン酸、リン酸および塩、コハク酸、クエン酸ナトリウム、クエン酸カリウム、タンニン酸、ギ酸、その他)、形態別(乾燥および液体)、機能別(pH制御、酸性風味増強剤、防腐剤、その他)、流通チャネル別(B2BおよびB2C)、エンドユーザー別(食品加工部門、食品サービス部門、および家庭/小売)の2029年までの業界動向および予測。

市場分析と洞察

アジア太平洋地域の食品原料(酸味料)市場は、食品・飲料業界の成長と風味付き飲料や食品の需要増加により、大幅な成長を遂げています。ワインなどのアルコール飲料の酸味料の需要増加も、アジア太平洋地域の食品原料(酸味料)市場の成長を後押ししています。ただし、酸味料に関連する厳格な政府規制と、リン酸などの一部の酸味料に関連する健康リスクにより、予測期間中の酸味料市場の成長は抑制されると予想されます。

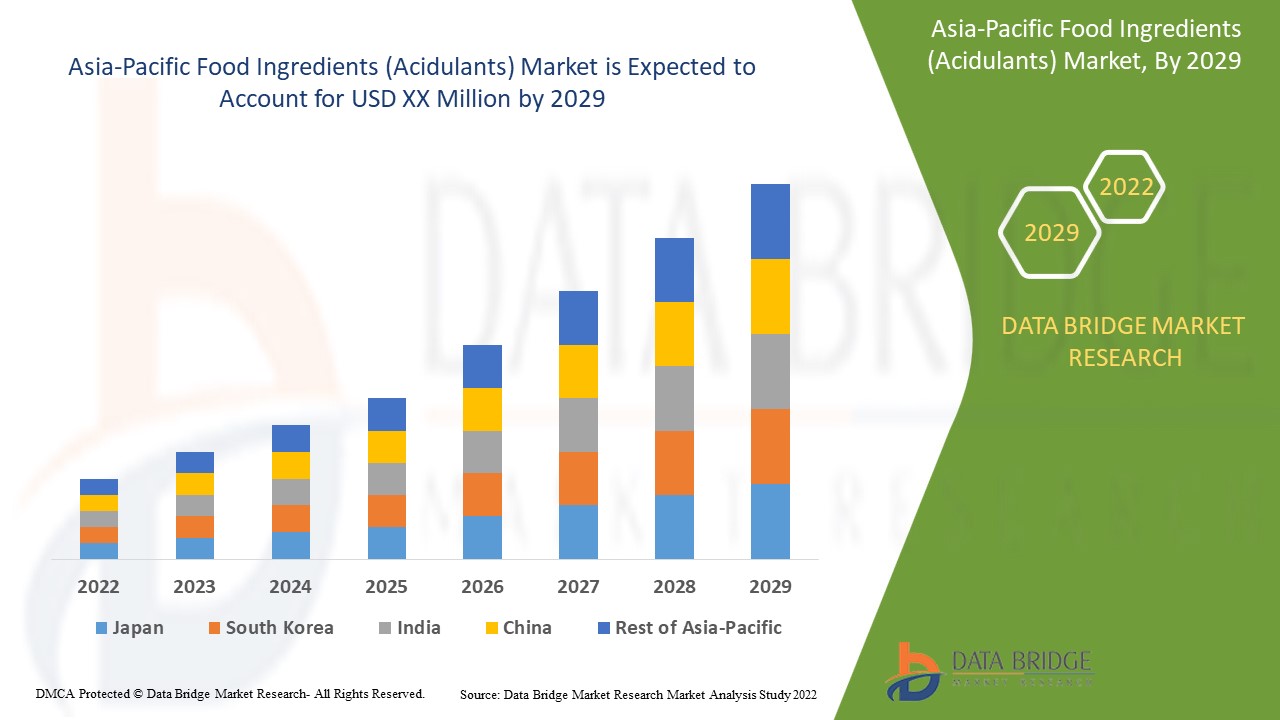

データブリッジマーケットリサーチは、アジア太平洋地域の食品原料(酸味料)市場は、2022年から2029年の予測期間中に6.1%のCAGRで成長すると予測しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別(クエン酸、乳酸、酢酸、フマル酸、酒石酸、リンゴ酸、グルコン酸、リン酸および塩、コハク酸、クエン酸ナトリウム、クエン酸カリウム、タンニン酸、ギ酸、その他)、形態別(乾燥および液体)、機能別(pHコントロール、酸性風味増強剤、保存料、その他)、流通チャネル別(B2BおよびB2C)、エンドユーザー別(食品加工部門、食品サービス部門、家庭/小売) |

|

対象国 |

中国、日本、インド、韓国、タイ、フィリピン、インドネシア、シンガポール、ベトナム、マレーシア、オーストラリア、ニュージーランド、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

カーギル社、ブレンタグSE、テイト&ライル、ADM、フードケムインターナショナルコーポレーション、コービオン、バーテックイングリディエンツ社、濰坊エンサインインダストリー株式会社、ケムベラスペシャルティケミカルズ株式会社、ホーキンスワッツリミテッド、リッチストグループ、サントラン、アルシャイン製薬株式会社、インダストリアルテクニカペクアリアSA、アリハントケミカルズなど |

市場の定義

酸味料は、食品に酸っぱい、すっぱい、または酸性の風味を与えたり、食品の甘味を強めたりする化合物です。酸味料は、加工食品によっては膨張剤や乳化剤としても機能します。酸味料は pH を下げることができますが、食品の安定性や食品中の酵素を変更することを目的とした食品添加物である酸度調整剤とは異なります。一般的な酸味料は酢酸 (ピクルスなど) とクエン酸です。コーラなどの多くの飲料にはリン酸が含まれています。酸っぱいキャンディーにはリンゴ酸が配合されていることがよくあります。食品製造に使用されるその他の酸味料には、フマル酸、酒石酸、乳酸、グルコン酸などがあります。

アジア太平洋地域の食品原料(酸味料)市場の動向

ドライバー

- インスタント食品の需要増加は、食品酸味料業界の成長に有利に働く可能性が高い。

酸味料は、さわやかな風味、食感と酸味の改善、製品の味の向上などのために、インスタント食品の製造に使用される重要な成分です。忙しいライフスタイルや消費者の嗜好の変化により、インスタント食品やすぐに食べられる食品の需要が高まっており、食品加工メーカーは、その需要を満たすために食品に添加する酸味料のさらなる増加を求めています。

- クエン酸とリンゴ酸は、新興のアルコール飲料やノンアルコール飲料の用途で広く使用されています。

ほとんどの飲料では、クエン酸が酸味料として第一に選ばれています。これは、比較的マイルドからわずかにシャープな酸味と、ほとんどのフルーツフレーバーに対する爽快感です。さらに、リンゴ酸は、強い風味強化が期待される場合に使用され、ほとんどの場合、クエン酸と組み合わせて使用されます。これらの酸味料の他に、リン酸とコハク酸も飲料用途で使用されます。リン酸は、主にコーラなどの炭酸飲料で使用され、特定の味覚プロファイルとpHへの強い効果をもたらします。これらすべての要因が、アジア太平洋地域の食品成分(酸味料)市場の成長を促進すると予想されます。

機会

- インドや中国などの新興国における食品加工産業の成長による酸味料の需要増加

インドと中国では、インスタント食品、調理済み食品、インスタント飲料、加工肉製品、菓子などの需要増加により、食品加工産業が着実に成長しています。消費者の忙しいライフスタイルにより可処分所得が増加し、消費者はより多くのお金を使い、さまざまな味の新しい、より良い食品を味わいたいという欲求に駆られます。

酸味料は、スポーツドリンクの爽快感、チーズのクリームのとろけ具合、ゼリーなどの食品のゲル状の食感を作り出すのに役立ちます。これにより、食品加工業界での酸味料の需要が増加し、酸味料市場にチャンスが生まれます。

例えば、

- 投資家ポータルによると、2021年にはインドの食品加工産業における総付加価値は2016年から2021年の5年間で175億8,340万米ドルから281億3,340万米ドルに増加した。

制約/課題

- リン酸ベースの製品の過剰使用により生じる問題

リンは多くの食品に自然に含まれており、リン酸は酸味料として使用されます。したがって、ほとんどの人は食事から十分なリンを摂取しています。正常な身体機能に必要なリンの 1 日の推奨摂取量 (RDA) は 700 mg です。天然の食品から簡単に摂取できます。タンパク質を多く含む食品 (肉、豆、卵、鶏肉、魚など) には、通常、リンが多く含まれています。つまり、加工食品やソーダから摂取する追加のリン酸は、身体が必要とする量を超えていることになります。

しかし、不健康な食品や保存食品の消費が増えたため、リン酸の摂取量が通常レベルより高くなっています。

例えば、

ソーダ1本には最大500mgのリン酸が含まれている可能性がある

1日あたり4,000mgのリンを摂取する人は、リンに関連する健康への悪影響のリスクが高いと考えられています。

このアジア太平洋食品原料(酸味料)市場レポートは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリュー チェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場成長、アプリケーションのニッチと優位性、製品承認、製品発売、地理的拡大、市場における技術革新の詳細を提供します。アジア太平洋食品原料(酸味料)市場の詳細については、アナリスト ブリーフについて Data Bridge Market Research にお問い合わせください。当社のチームが、市場成長を達成するための情報に基づいた市場決定を行うお手伝いをいたします。

COVID-19後のアジア太平洋地域の食品原料(酸味料)市場への影響

パンデミック後、移動制限がなくなり、製品の供給が容易になるため、酸味料の需要が増加しています。さらに、特に若い世代の間で、新しい料理やソフトドリンク、コンブチャ、ケフィア、ウォーターケフィア、テパチェ、ボザなどの発酵飲料を試す傾向が高まっており、市場の成長を促進するでしょう。

発酵飲料の需要増加により、メーカーは革新的で風味豊かな発酵飲料を発売できるようになり、最終的には酸味料の需要も増加し、市場の成長に貢献しています。

最近の開発

- 2022年3月、Brenntag SEはイスラエルの特殊化学品販売業者YS Ashkenazi Agencies Ltdとその子会社Biochem Tradingを買収しました。この買収はBrenntagのイスラエル市場への参入を意味します。この買収により、同社ののれんは増加します。

アジア太平洋地域の食品原料(酸味料)市場の範囲

アジア太平洋地域の食品原料(酸味料)市場は、タイプ、形態、機能、流通チャネル、エンドユーザーに分類されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

タイプ

- クエン酸

- クエン酸ナトリウム

- クエン酸カリウム

- 酢酸

- ギ酸

- グルコン酸

- フマル酸

- リンゴ酸

- リン酸および塩

- 酒石酸

- 乳酸

- タンニン酸

- コハク酸

- その他

タイプ別に見ると、アジア太平洋地域の食品成分(酸味料)市場は、クエン酸、クエン酸ナトリウム、クエン酸カリウム、酢酸、ギ酸、グルコン酸、リンゴ酸、リン酸および塩、酒石酸、乳酸、タンニン、フマル酸、コハク酸などに分類されます。

形状

- ドライ

- 液体

形態に基づいて、アジア太平洋地域の食品原料(酸味料)市場は乾燥型と液体型に分類されます。

関数

- pHコントロール

- 酸性調味料

- 防腐剤

- その他

機能に基づいて、アジア太平洋地域の食品成分(酸味料)市場は、pH制御、酸性調味料、防腐剤、その他に分類されます。

流通チャネル

- 企業向け

- B2C

流通チャネルに基づいて、アジア太平洋地域の食品原料(酸味料)市場は、B2BとB2Cに分類されます。

エンドユーザー

- 家庭用/小売

- 食品加工部門

- 食品サービス部門

エンドユーザーに基づいて、アジア太平洋地域の食品原料(酸味料)市場は、家庭用/小売、食品加工部門、食品サービス部門に分類されます。

アジア太平洋地域の食品原料(酸味料)市場の地域分析/洞察

アジア太平洋地域の食品原料(酸味料)市場が分析され、上記のように国、種類、形態、機能、エンドユーザー、流通チャネル別に市場規模の洞察と傾向が提供されます。

アジア太平洋地域の食品原料(酸味料)市場レポートで取り上げられている国には、中国、日本、インド、韓国、タイ、フィリピン、インドネシア、シンガポール、ベトナム、マレーシア、オーストラリア、ニュージーランド、その他のアジア太平洋地域が含まれます。

中国は、市場シェアと収益の面でアジア太平洋地域の食品原料(酸味料)市場を支配すると予想されており、予測期間中もその優位性を維持し続けるでしょう。これは、ライフスタイルの変化と時間的制約により、食品および飲料製品、特に加工食品の需要が急増しているためです。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境とアジア太平洋地域の食品原料(酸味料)市場シェア分析

アジア太平洋地域の食品原料(酸味料)市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、アジア太平洋地域の食品原料(酸味料)市場への企業の重点にのみ関連しています。

アジア太平洋地域の食品原料(酸味料)市場で事業を展開している主要企業としては、Cargill, Incorporated、Brenntag SE、Tate & Lyle、ADM、Foodchem International Corporation、Corbion、Bartek Ingredients Inc.、Weifang Ensign Industry Co., Ltd、Chemvera Specialty Chemicals Pvt. Ltd.、Hawkins Watts Limited、Richest Group、Suntran.cn、Arshine Pharmaceutical Co.、INDUSTRIAL TECNICA PECUARIA, SA、Arihant Chemicals などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、アジア太平洋と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 FACTORS INFLUENCING PURCHASING DECISION

4.2.1 PRICING OF FOOD INGREDIENTS (ACIDULANTS)

4.2.2 QUALITY AND PURITY OF ACIDULANTS

4.2.3 CERTIFIED FOOD INGREDIENTS (ACIDULANTS)

4.3 REGULATORY OR LEGAL RISK COVERAGE

4.4 NEW PRODUCT LAUNCH STRATEGIES

4.5 PATENT ANALYSIS

4.6 RAW MATERIAL ANALYSIS – TOP 10 ACIDULANTS

4.6.1 CITRIC ACID

4.6.2 ACETIC ACID

4.6.3 SODIUM CITRATE

4.6.4 LACTIC ACID

4.6.5 FUMARIC ACID

4.6.6 TARTARIC ACID

4.6.7 MALIC ACID

4.6.8 GLUCONIC ACID

4.6.9 PHOSPHORIC ACID AND SALT

4.7 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

4.8 RISK ANALYSIS OF ACIDULANTS

4.8.1 CITRIC ACID

4.8.2 SODIUM CITRATE

4.8.3 ACETIC ACID

4.8.4 SUCCINIC ACID

4.8.5 MALIC ACID

4.8.6 TARTARIC ACID

4.8.7 POTASSIUM CITRATE

4.8.8 GLUCONIC ACID

4.8.9 FUMARIC ACID

4.8.10 LACTIC ACID

4.8.11 TANNIC ACID

4.8.12 FORMIC ACID

4.8.13 PHOSPHORIC ACID AND SALTS

4.9 RUSSIA AND UKRAINE WAR IMPACT

4.9.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

4.9.2 RISK OF CIVIL UNREST

4.1 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 FOOD INGREDIENT (ACIDULANTS) PRODUCTION/PROCESSING

4.10.3 DISTRIBUTION

4.10.4 END-USERS

4.11 SUPPLIER DEEP DIVE – PART 1

4.12 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID-

4.13 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID-

4.14 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID-

4.15 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID-

4.16 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID-

4.17 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID-

4.18 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID-

4.19 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT-

4.2 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID-

4.21 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE –

4.22 SUPPLIERS DEEP DIVE – PART 2

4.22.1 PRODUCTION LOCATIONS

4.22.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.3 MARKETS THEY SELL TO

4.22.4 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.5 MARKETS THEY SELL TO

4.22.6 PRODUCTION LOCATIONS

4.23 ADM

4.23.1 PRODUCTION LOCATIONS

4.23.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.23.3 MARKETS THEY SELL TO

4.24 CORBION N.V

4.24.1 PRODUCTION LOCATIONS

4.24.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.24.3 MARKETS THEY SELL TO

4.25 TATE & LYLE

4.25.1 PRODUCTION LOCATIONS

4.25.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.25.3 MARKETS THEY SELL TO

4.26 JUNGBUNZLAUER SUISSE AG

4.26.1 PRODUCTION LOCATIONS

4.26.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.26.3 MARKETS THEY SELL TO

4.27 BARTEK INGREDIENTS INC.

4.27.1 PRODUCTION LOCATIONS

4.27.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.27.3 MARKETS THEY SELL TO

4.28 DAIRYCHEM

4.28.1 PRODUCTION LOCATIONS

4.28.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.28.3 MARKETS THEY SELL TO

4.29 WEIANG ENSIGN INDUSTRY CO.,LTD.

4.29.1 PRODUCTION LOCATIONS

4.29.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.29.3 MARKETS THEY SELL TO

4.3 INDUSTRIAL TECNICA PECUARIA, S.A.

4.30.1 PRODUCTION LOCATIONS

4.30.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.30.3 MARKETS THEY SELL TO

4.31 PRODUCTION CAPACITY – TOP FIVE PLAYERS

4.32 PRICING ANALYSIS FOR FOOD INGREDIENTS (ACIDULANTS)

4.33 SWOT ANALYSIS – TOP 10 ACIDULANTS

4.33.1 CITRIC ACID –

4.33.2 ACETIC ACID –

4.33.3 SODIUM CITRATE –

4.33.4 SUCCINIC ACID –

4.33.5 LACTIC ACID –

4.33.6 FUMARIC ACID –

4.33.7 TARTARIC ACID –

4.33.8 MALIC ACID –

4.33.9 GLUCONIC ACID –

4.33.10 PHOSPHORIC ACID AND SALTS -

5 REGULATIONS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH

6.1.2 WIDE USE OF CITRIC ACID AND MALIC ACID IN EMERGING ALCOHOLIC AS WELL AS NON-ALCOHOLIC BEVERAGE APPLICATIONS

6.1.3 RISE IN DEMAND FOR ACIDULANTS SUCH AS MALIC ACID, LACTIC ACID, AND SODIUM LACTATE IN THE CONFECTIONERY INDUSTRY

6.1.4 GROWING DEMAND FOR INSTANT BEVERAGES, CARBONATED DRINKS, AND FERMENTED DRINKS IS LIKELY TO FAVOR ACIDULANTS MARKET GROWTH

6.2 RESTRAINTS:

6.2.1 RULES AND REGULATION OF FOOD REGULATORY BODIES ON ACIDULANTS PRODUCTS

6.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR ACIDULANTS FROM THE RISING FOOD PROCESSING INDUSTRY IN EMERGING ECONOMIES SUCH AS INDIA AND CHINA

6.3.2 BIOLOGICAL PRODUCTION OF CITRIC ACID AND ACETIC ACID

6.4 CHALLENGES

6.4.1 GROWING HEALTH CONCERNS REGARDING ACIDULANTS

6.4.2 HIGH PRICES OF ACIDULANTS

7 IMPACT OF COVID-19 ON THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

7.1 IMPACT ON DEMAND AND SUPPLY CHAIN

7.2 IMPACT ON PRICE

7.3 CONCLUSION

8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 LACTIC ACID

8.4 ACETIC ACID

8.5 FUMARIC ACID

8.6 TARTARIC ACID

8.7 MALLIC ACID

8.8 GLUCONIC ACID

8.9 PHOSPHORIC ACID

8.1 SUCCINIC ACID

8.11 SODIUM CITRATE AND SALT

8.12 POTASSIUM CITRATE AND SALT

8.13 TANNIC ACID AND SALT

8.14 FORMIC ACID AND SALT

8.15 OTHERS

9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 PH CONTROL

10.3 ACIDIC FLAVOR ENHANCER

10.4 PRESERVATIVES

10.5 OTHERS

11 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.2.1 WHOLESALERS

11.2.2 ONLINE

11.3 B2C

11.3.1 SUPERMARKET

11.3.2 ONLINE

11.3.3 HYPERMARKET

11.3.4 DEPARTMENTAL STORES

11.3.5 SPECIALTY STORES

11.3.6 OTHERS

12 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD PROCESSING SECTOR

12.2.1 FOOD

12.2.1.1 PROCESSED MEAT PRODUCTS

12.2.1.1.1 POULTRY

12.2.1.1.2 PORK

12.2.1.1.3 BEEF

12.2.1.1.4 OTHERS

12.2.1.2 DAIRY PRODUCTS

12.2.1.2.1 CHEESE

12.2.1.2.2 MILK-POWDER

12.2.1.2.3 ICE CREAM

12.2.1.2.4 SPREADS

12.2.1.2.5 OTHERS

12.2.1.3 CONVENIENCE FOOD

12.2.1.3.1 READY TO EAT PRODUCTS

12.2.1.3.2 SOUPS & SAUCES

12.2.1.3.3 SEASONING & DRESSING

12.2.1.3.4 NOODLES & PASTA

12.2.1.3.5 OTHERS

12.2.1.4 BAKERY

12.2.1.4.1 CAKES & PASTRIES

12.2.1.4.2 BREAD

12.2.1.4.3 BISCUITS & COOKIES

12.2.1.4.4 MUFFINS

12.2.1.4.5 OTHERS

12.2.1.5 CONFECTIONERY

12.2.1.5.1 CHOCOLATE

12.2.1.5.2 GUMS & JELLY

12.2.1.5.3 HARD & SOFT CANDY

12.2.1.5.4 CREAM FILLINGS

12.2.1.5.5 OTHERS

12.2.1.5.6 SEAFOOD PRODUCTS

12.2.1.5.7 PROCESSED FOOD

12.2.1.5.8 SPORTS NUTRITION

12.2.1.5.9 DIETARY SUPPLEMENTS

12.2.1.5.10 INFANT FORMULA

12.2.1.6 BEVERAGES

12.2.1.6.1 NON-ALCOHOLIC BEVERAGES

12.2.1.6.1.1 RTD

12.2.1.6.1.2 FRUIT JUICES

12.2.1.6.1.3 SOFT DRINKS

12.2.1.6.1.4 DAIRY DRINKS

12.2.1.6.1.5 FLAVORED DRINKS

12.2.1.6.1.6 OTHERS

12.2.1.6.1.7 ALCOHOLIC BEVERAGES

12.3 FOOD SERVICE SECTOR

12.3.1 RESTAURANTS

12.3.2 CAFÉS

12.3.3 HOTELS

12.3.4 CANTEEN/CAFETERIA

12.3.5 CLOUD KITCHEN

12.4 HOUSEHOLD/RETAIL

13 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 PHILIPPINES

13.1.7 INDONESIA

13.1.8 SINGAPORE

13.1.9 VIETNAM

13.1.10 MALAYSIA

13.1.11 NEW ZEALAND

13.1.12 AUSTRALIA

13.1.13 REST OF ASIA-PACIFIC

14 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 COMPANY PROFILE

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TATE & LYLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ADM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 JUNGBUNZLAUER SUISSE AG

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BRENNTAG SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARIHANT CHEMICALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ARSHINE PHARMACEUTICAL CO.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BARTEK INGREDIENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHEMVERA SPECIALTY CHEMICALS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CORBION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 DAIRYCHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DIRECT FOOD INGREDIENTS LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FBC INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

1.13.3 RECENT DEVELOPMENTS 343

15.14 FOODCHEM INTERNATIONAL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HAWKINS WATTS LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INDUSTRIAL TECNICA PECUARIA, S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 INNOVA CORPORATE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICHEST GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SUNTRAN.CN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 WEIFANG ENSIGN INDUSTRY CO.,LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY OR LEGAL RISK COVERAGE FRAMEWORK

TABLE 2 MICROORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 3 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 4 CITRIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 5 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 6 ACETIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 7 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 8 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 9 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 10 SUCCINIC ACID APPLICATION IN THE FOOD AND BEVERAGES INDUSTRY

TABLE 11 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 12 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 13 LACTIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 14 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 15 FUMARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 16 TARTARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 17 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 18 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 19 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 20 RAW MATERIAL FOR DIFFERENT FOOD INGREDIENTS (ACIDULANTS)-

TABLE 21 MARKET SHARE OF CITRIC ACID

TABLE 22 MARKET SHARE OF LACTIC ACID

TABLE 23 MARKET SHARE OF FUMARIC ACID

TABLE 24 MARKET SHARE OF TARTARIC ACID

TABLE 25 MARKET SHARE OF MALIC ACID

TABLE 26 CATEGORY AND THEIR FUNCTIONALITY

TABLE 27 ACIDULANTS IN VARIOUS FOOD FUNCTIONALITY

TABLE 28 ACIDULANTS PRODUCTS AND THEIR APPLICATIONS

TABLE 29 ASIA PACIFIC AVERAGE SELLING PRICES OF ACIDULANTS

TABLE 30 THE BELOW TABLE SHOWS THE ACIDULANTS AND THEIR APPLICATIONS IN BEVERAGES

TABLE 31 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 32 THE TABLE BELOW SHOWS CITRIC ACID-PRODUCING MICROORGANISMS AND THEIR SPECIES:

TABLE 33 BELOW TABLE SHOWS THE SIDE EFFECTS OF ACIDULANTS:

TABLE 34 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 36 ASIA PACIFIC CITRIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC LACTIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ACETIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC FUMARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC TARTARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MALLIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC GLUCONIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PHOSPHORIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SUCCINIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SODIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC POTASSIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC TANNIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC FORMIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 THE TABLE BELOW SHOWS THE FUNCTIONS OF DIFFERENT ACIDULANTS IN SOLID FORM:

TABLE 52 ASIA PACIFIC DRY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 THE BELOW TABLE SHOWS THE FUNCTIONS OF LIQUID ACIDULANTS IN THE FOOD PROCESSING INDUSTRY:

TABLE 54 ASIA PACIFIC LIQUID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC PH CONTROL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC ACIDIC FLAVOR ENHANCER IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC PRESERVATIVES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HOUSEHOLD/RETAIL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 80 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 82 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 ASIA-PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ASIA-PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 88 ASIA-PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ASIA-PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 ASIA-PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ASIA-PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ASIA-PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ASIA-PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ASIA-PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 ASIA-PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 ASIA-PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 101 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 CHINA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CHINA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 CHINA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CHINA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 CHINA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CHINA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CHINA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CHINA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CHINA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CHINA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CHINA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CHINA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 117 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 INDIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 122 INDIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 INDIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 INDIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 135 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 JAPAN B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 JAPAN B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 139 JAPAN FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 JAPAN FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 JAPAN FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 JAPAN DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 JAPAN BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 JAPAN CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 JAPAN PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 JAPAN CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 JAPAN BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 JAPAN NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 THAILAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 173 THAILAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 THAILAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 THAILAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 THAILAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 THAILAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 THAILAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 THAILAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 THAILAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 THAILAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 185 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 186 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 187 PHILIPPINES B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 190 PHILIPPINES FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 207 INDONESIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 INDONESIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 INDONESIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 INDONESIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 INDONESIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 INDONESIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 INDONESIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 INDONESIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 INDONESIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 INDONESIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 219 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 220 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 221 SINGAPORE B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SINGAPORE B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 224 SINGAPORE FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SINGAPORE FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 226 SINGAPORE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 SINGAPORE DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SINGAPORE BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 SINGAPORE CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SINGAPORE PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 SINGAPORE CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SINGAPORE BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SINGAPORE NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 236 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 237 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 VIETNAM B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 VIETNAM B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 241 VIETNAM FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 VIETNAM FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 VIETNAM FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 VIETNAM DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 VIETNAM CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 VIETNAM BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 253 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 254 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 255 MALAYSIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 MALAYSIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 258 MALAYSIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 MALAYSIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 MALAYSIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MALAYSIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MALAYSIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 270 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 271 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 272 NEW ZEALAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 NEW ZEALAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 275 NEW ZEALAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 NEW ZEALAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 277 NEW ZEALAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 NEW ZEALAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 NEW ZEALAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 NEW ZEALAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 NEW ZEALAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 NEW ZEALAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 NEW ZEALAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 287 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 AUSTRALIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 AUSTRALIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 AUSTRALIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 REST OF ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH WHICH IS DRIVING THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN THE FORECAST PERIOD

FIGURE 13 CITRIC ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN 2022 & 2029

FIGURE 14 UKRAINE AND RUSSIA’S SHARE OF ASIA PACIFIC TRADE (2018-2020)-

FIGURE 15 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 17 THE BELOW GRAPH SHOWS THE ASIA PACIFIC MARKET SIZE FOR BEVERAGES

FIGURE 18 THE BELOW GRAPH SHOWS THE SALES OF ASIA PACIFIC NON-ALCOHOLIC BEVERAGES FROM 2018 TO 2022:

FIGURE 19 THE BELOW GRAPH SHOWS THE SALES OF NON-ALCOHOLIC BEVERAGES IN U.S. FROM 2019 TO 2021-

FIGURE 20 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE, 2021

FIGURE 21 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FORM, 2021

FIGURE 22 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FUNCTION, 2021

FIGURE 23 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY END-USER, 2021

FIGURE 25 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE (2022 & 2029)

FIGURE 30 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。