アジア太平洋臨床試験用品市場、サービス別(保管、製造、包装、ラベリング、流通)、臨床段階(第3相、第2相、第4相、第1相)、治療用途(腫瘍学、心血管疾患、皮膚科、代謝障害、感染症、呼吸器疾患、中枢神経系および精神疾患、血液疾患、その他)、エンドユーザー(契約研究機関、製薬およびバイオテクノロジー企業)、業界動向および2029年までの予測。

市場分析と洞察: アジア太平洋臨床試験用品市場

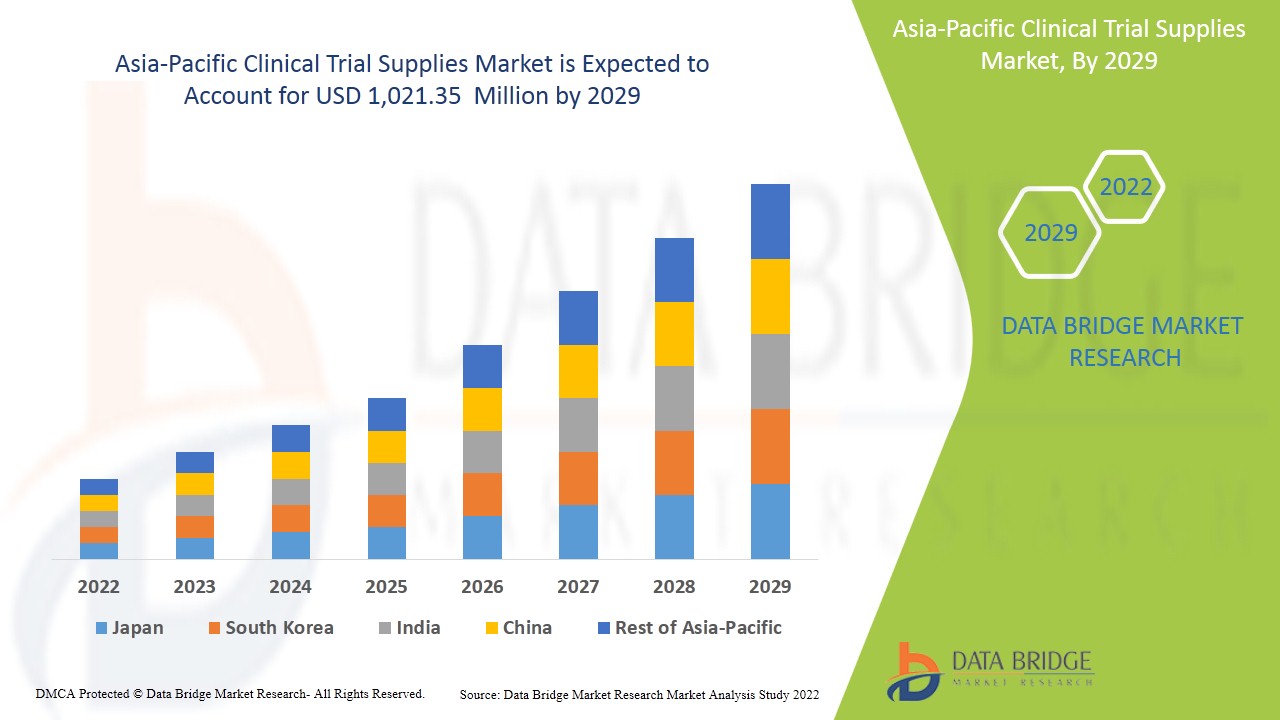

アジア太平洋地域の臨床試験用品市場は、2022年から2029年の予測期間に市場が成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に9.2%のCAGRで成長し、2029年までに10億2,135万米ドルに達すると分析しています。臨床試験用品市場の成長を牽引する主な要因は、世界中の臨床試験の需要の増加、病気の発生率の増加、研究開発投資への政府資金、個別化医療などの新しい治療法の開発であり、臨床試験用品市場は将来的に成長します。

臨床試験とは、医療戦略、治療、またはデバイスが人間にとって安全で、効果的で、有用であるかどうかを判断する調査研究です。これらの研究は、特定の病気に対してどの医療アプローチ実験が最適かを見つけるのに役立ちます。臨床試験は、医療上の意思決定に最適なデータを提供します。

臨床試験の目的は、厳格な科学的基準を研究することです。これらの基準は患者を保護し、信頼できる研究結果を生み出すのに役立ちます。

臨床試験は、薬剤または医療機器を問わず、特定の病気について科学者または研究者が実施する長期にわたる慎重な研究プロセスにおける薬剤開発の最終段階です。薬剤開発のプロセスは多くの場合、科学者が最初に病気の治療に関連する新しいアイデアを開発し、テストする研究室で始まります。

アジア太平洋臨床試験用品市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から見た機会の分析が提供されます。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

サービス別(保管、製造、包装、ラベル付け、流通)、臨床段階別(第 III 相、第 II 相、第 IV 相、第 I 相)、治療用途別(腫瘍学、心血管疾患、皮膚科学、代謝疾患、感染症、呼吸器疾患、中枢神経系および精神疾患、血液疾患、その他)、エンドユーザー別(契約研究機関、製薬およびバイオテクノロジー企業) |

|

対象国 |

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部として南アフリカ、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米。 |

|

対象となる市場プレーヤー |

Movianto (米国)、Sharp (米国)、Thermo Fisher Scientific Inc. (米国)、Catalent, Inc (米国)、PCI Pharma Services (米国)、Almac Group (英国)、PAREXEL International Corporation (米国)、Bionical Ltd. (英国)、Alium Medical Limited (英国)、Myonex (英国)、Clinigen Group plc (英国)、Ancillare, LP (米国)、SIRO Clinpharm (インド)、CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (米国)、Biocair (英国) など。 |

臨床試験用品市場の動向

ドライバー

- 世界中で高まる臨床試験の需要

臨床試験の需要の高まりは、北米、ヨーロッパ、アジアなどの発展途上国だけで82%に達しています。これらの医薬品は臨床試験後に市場に出るため、医薬品や機器の種類に応じて、すべての企業が臨床試験を実施しています。そのため、治療市場の成長率の拡大につながる主要な原動力として機能します。

- 慢性疾患の発生率増加

人口の急激な増加と人々の間の感染症により、慢性疾患の蔓延が世界中で見られます。これらの疾患は、医薬品開発の臨床試験の分野で大きな役割を果たしています。医薬品は、人間の消費前に利用可能になるために、すべての標準的な臨床段階を通過する必要があります。したがって、人間の慢性疾患を治療するには、医薬品は安全でなければなりません。

- 研究開発投資における政府資金

機器、労働力、研究者に危害が及んだ場合の医療管理、保険、輸送、倫理委員会の費用、データ処理、その他の消耗品は、臨床試験にかかる大きなコストにつながります。臨床試験は、病気の予防と治療のアイデアを評価するものであり、治療市場の成長をさらに促進します。

機会

- 新興国における新薬開発試験の増加

Clinical trial for drug efficacy is the primary key for drugs development for diseases treatment before launching in the market for human consumption. Additionally, the new drugs have to meet license extensions and international standards before selling and distribution. Increasing the prevalence and incidence of diseases and the rise in the patient’s numbers are the factors leading to emerging trends of clinical trial for drug development in developing countries over the past period.

Also, Governments in emerging markets (China, Brazil, Russia, India, and South Africa) reform public healthcare and grant more accessible access to medicine. These two factors working in unison mean greater freedom for market developments and increased innovation in clinical research in emerging markets.

Restraints/Challenges

Adverse drug reactions are the unwanted or harmful effects that can be experienced after the administration of a drug under normal conditions of use in humans. The drug reactions generally occur in jaundice, anaemia, rashes and lead to a decrease in the white blood cell count, damaged kidney, and nerve injury that caused impaired vision or hearing.

Many of the adverse effects may be ascertained from physical examinations during the clinical phase of testing. Thus, reporting adverse effects during clinical trial is the major leading restraints factor for the supplies market. Despite high time and cost investments for developing biologics and new drugs, it is estimated that lower procedure time and rate for approval of drug is creating a biggest challenge for the market, which may hamper the market growth.

This clinical trial supplies market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on clinical trial supplies market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In February 2022, Catalent Inc. announced that the company has expanded the capacity for temperature-controlled storage and distribution of clinical supplies across China. This lead to increase in Clinical Supply for optimize development, launch and better treatments in different morbidities as well as secondary packaging capabilities

Asia-Pacific Clinical Trial Supplies Market Scope

Asia-Pacific clinical trial supplies market is categorized based on services, clinical phase, therapeutic uses and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

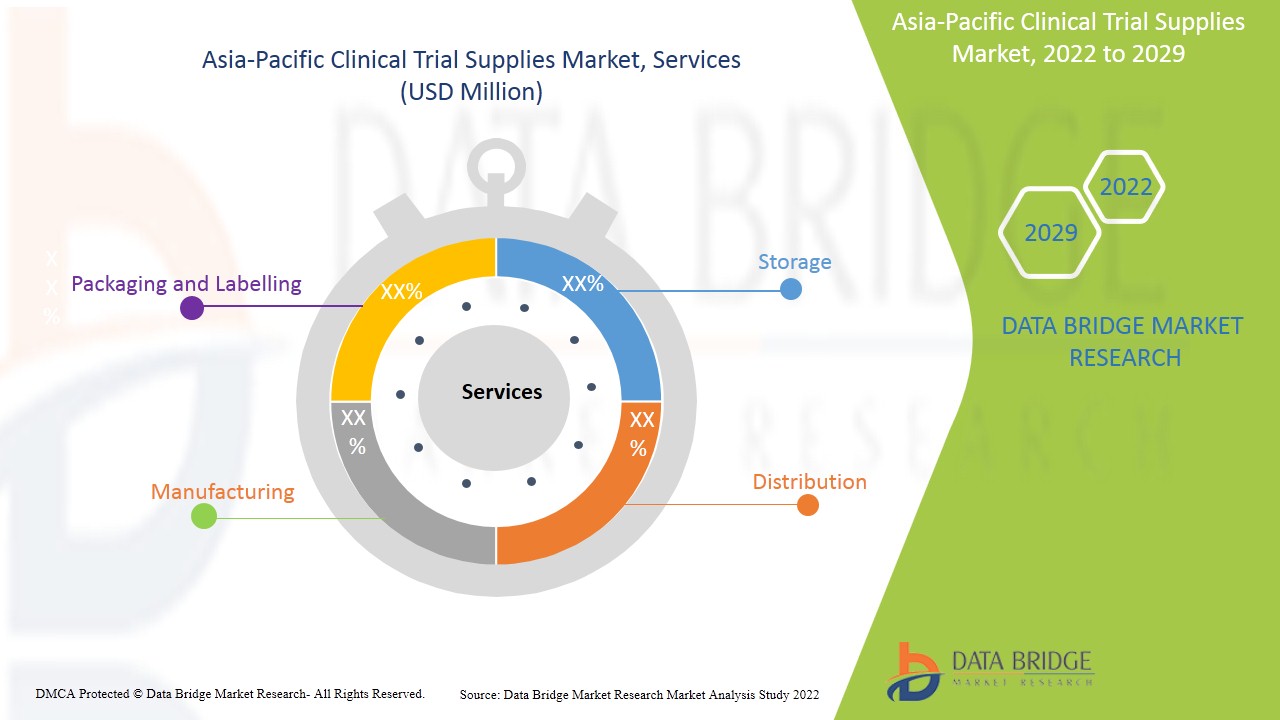

Service

- Manufacturing

- Distribution

- Storage

- Packaging and Labelling

On the basis of services the Asia-Pacific clinical trial supplies market is segmented into manufacturing, distribution, storage, and packaging and labelling.

Clinical Phase

- Phase I

- Phase II

- Phase III

- Phase IV

On the basis of clinical phase the Asia-Pacific clinical trial supplies market is segmented into phase I, phase II, phase III and phase IV.

Therapeutic Uses

- Oncology

- CNS

- Mental Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Respiratory Diseases

- Blood Disorder

- Dermatology

- Others

On the basis of therapeutic uses, the Asia-Pacific clinical trial supplies market is segmented into oncology, CNS and mental disorders, cardiovascular diseases, infectious disease, respiratory diseases, metabolic disorders, blood disorders, dermatology and others.

End User

- Contract research organization

- Pharmaceutical and biotechnology companies

On the basis of end user, the Asia-Pacific clinical trial supplies market is segmented into contract research organizations and pharmaceutical and biotechnology companies.

Clinical Trial Supplies Market Regional Analysis/Insights

The Asia-Pacific Clinical trial supplies market is further segmented into major countries such as Japan, China, South Korea, India, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, rest of Asia-Pacific.

India dominates the Asia-Pacific clinical trial supplies market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. This is due to the increasing patient pool, rising investment in the healthcare sector and growing government support in this region

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Clinical Trial Supplies Market Share Analysis

アジア太平洋臨床試験サプライ市場の競争環境は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務、収益、市場の可能性、研究開発への投資、新しい市場イニシアチブ、生産拠点と施設、会社の長所と短所、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供された上記のデータポイントは、臨床試験サプライ市場に関連する企業の焦点にのみ関連しています。

アジア太平洋地域の臨床試験用品市場で活動している主な著名企業は、Movianto(米国)、Sharp(米国)、Thermo Fisher Scientific Inc.(米国)、Catalent, Inc(米国)、PCI Pharma Services(米国)、Almac Group(英国)、PAREXEL International Corporation(米国)、Bionical Ltd.(英国)、Alium Medical Limited(英国)、MYODERM(英国)、Clinigen Group plc(英国)、Ancillare, LP(米国)、SIRO Clinpharm(インド)、CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC.(米国)、Biocair(英国)などです。

調査方法: アジア太平洋臨床試験用品市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、グローバル対地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE

6.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.3 GOVERNMENT FUNDS IN R&D INVESTMENTS

6.1.4 ADVANCEMENT OF TECHNOLOGY IN CLINICAL TRIALS SUPPLIES

6.2 RESTRAINTS

6.2.1 ADVERSE EFFECTS OF CLINICAL TRIALS

6.2.2 TRANSPORTATION ISSUE IN CLINICAL TRIAL SUPPLIES

6.2.3 HIGH COST ASSOCIATED WITH THE CLINICAL TRIALS

6.3 OPPORTUNITIES

6.3.1 INCREASING NEW DRUG DEVELOPMENT TRIALS IN EMERGING COUNTRIES

6.3.2 INCREASING DEMAND FOR INNOVATIVE SOLUTIONS IN CLINICAL TRIALS SERVICES

6.3.3 EVOLUTION IN SUPPLY CHAIN MANAGEMENT FOR CLINICAL TRIALS

6.4 CHALLENGES

6.4.1 LOWER PROCEDURE TIME OF CLINICAL TRIALS APPROVAL

6.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES

7.1 OVERVIEW

7.2 STORAGE

7.3 MANUFACTURING

7.4 PACKAGING AND LABELLING

7.5 DISTRIBUTION

8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASES

8.1 OVERVIEW

8.2 PHASE III

8.3 PHASE II

8.4 PHASE IV

8.5 PHASE I

9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE

9.1 OVERVIEW

9.2 ONCOLOGY

9.3 CARDIOVASCULAR DISEASES

9.4 DERMATOLOGY

9.5 METABOLIC DISORDERS

9.6 INFECTIOUS DISEASES

9.7 RESPIRATORY DISEASES

9.8 CNS AND MENTAL DISORDERS

9.9 BLOOD DISORDERS

9.1 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATIONS

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

11 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 THAILAND

11.1.7 MALAYSIA

11.1.8 SINGAPORE

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.1.5.1 PARTNERSHIP

14.2 ALMAC GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 CATALENT INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.3.5.1 SERVICE EXPANSION

14.4 CLINIGEN GROUP PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.4.5.1 PARTNERSHIP

14.5 MOVIANTO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 SERVICE PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.5.4.1 ACQUISITION

14.6 PCI PHARMA SERVICES

14.6.1 COMPANY SNAPSHOT

14.6.2 SERVICE PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 SHARP

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ALIUM MEDICAL LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICE PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANCILLARE, LP

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICE PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 BIOCAIR

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BIONICAL LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.11.3.1 SERVICE LAUNCH

14.12 CLINICAL SUPPLIES MANAGEMENT HOLDINGS,INC

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICE PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KLIFO

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICE PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.13.3.1 ACQUISTION

14.14 MYONEX

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICE PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PAREXEL INTERNATIONAL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICE PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.15.3.1 COLLABORATION

14.16 SIRO CLINPHARM PRIVATE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 LOCATIONS OF REGISTERED STUDIES

TABLE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC STORAGE IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANUFACTURING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC PACKAGING AND LABELLING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DISTRIBUTION IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PHASE III IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PHASE II IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PHASE IV IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHASE I IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CARDIOVASCULAR DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC METABOLIC DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC INFECTIOUS DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC RESPIRATORY DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CNS AND MENTAL DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BLOOD DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 31 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 32 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 36 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 40 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 41 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 43 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 48 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 49 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 52 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 53 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 55 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 56 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 57 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 61 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 68 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 69 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 REST OF ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE AND INCREASING INCIDENCES OF DISEASES IS DRIVING THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

FIGURE 14 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2021

FIGURE 15 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2021

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2021

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SNAPSHOT (2021)

FIGURE 31 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021)

FIGURE 32 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES (2022-2029)

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。