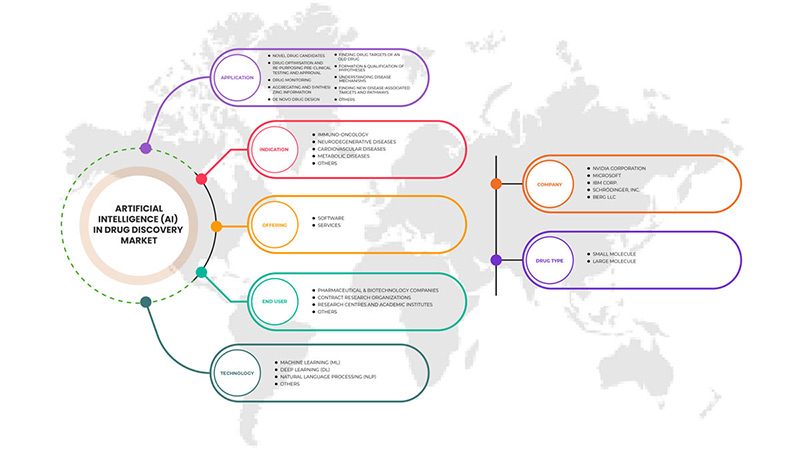

アジア太平洋地域の創薬における人工知能 (AI) 市場、アプリケーション別 (新薬候補、薬物の最適化と転用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と適格性、デノボ薬物設計、古い薬物の薬物ターゲットの発見など)、テクノロジー別 (機械学習、ディープラーニング、自然言語処理など)、薬物タイプ別 (小分子と巨大分子)、提供内容別 (ソフトウェアとサービス)、適応症別 (免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患など)、最終用途別 (開発業務受託機関 (CRO)、製薬およびバイオテクノロジー企業、研究センターと学術機関など) 業界動向と 2029 年までの予測。

アジア太平洋地域の創薬市場における人工知能(AI)の分析と洞察

人工知能 (AI) は、ヘルスケア業界では利益を生む技術になると期待されています。AI の導入により、医薬品製造プロセスにおける研究開発ギャップが縮小し、ターゲットを絞った医薬品の製造に役立ちます。そのため、バイオ医薬品企業は市場シェアの拡大に AI を活用しています。医薬品発見のための AI は、機械を使用して人間の知能をシミュレートし、医薬品開発プロセスにおける複雑な課題を解決する技術です。

臨床試験プロセスに AI ソリューションを導入すると、起こり得る障害が排除され、臨床試験のサイクル時間が短縮され、臨床試験プロセスの生産性と精度が向上します。医薬品の発見における AI の技術的進歩と医薬品の発見プロセスにかかる総時間の短縮は、予測期間中の市場の成長を促進する他の要因です。ただし、利用可能なデータの品質が低く一貫性がない場合は、市場の成長が妨げられます。また、テクノロジーに関連するコストの高さと技術的な制限により、市場の成長が抑制されます。

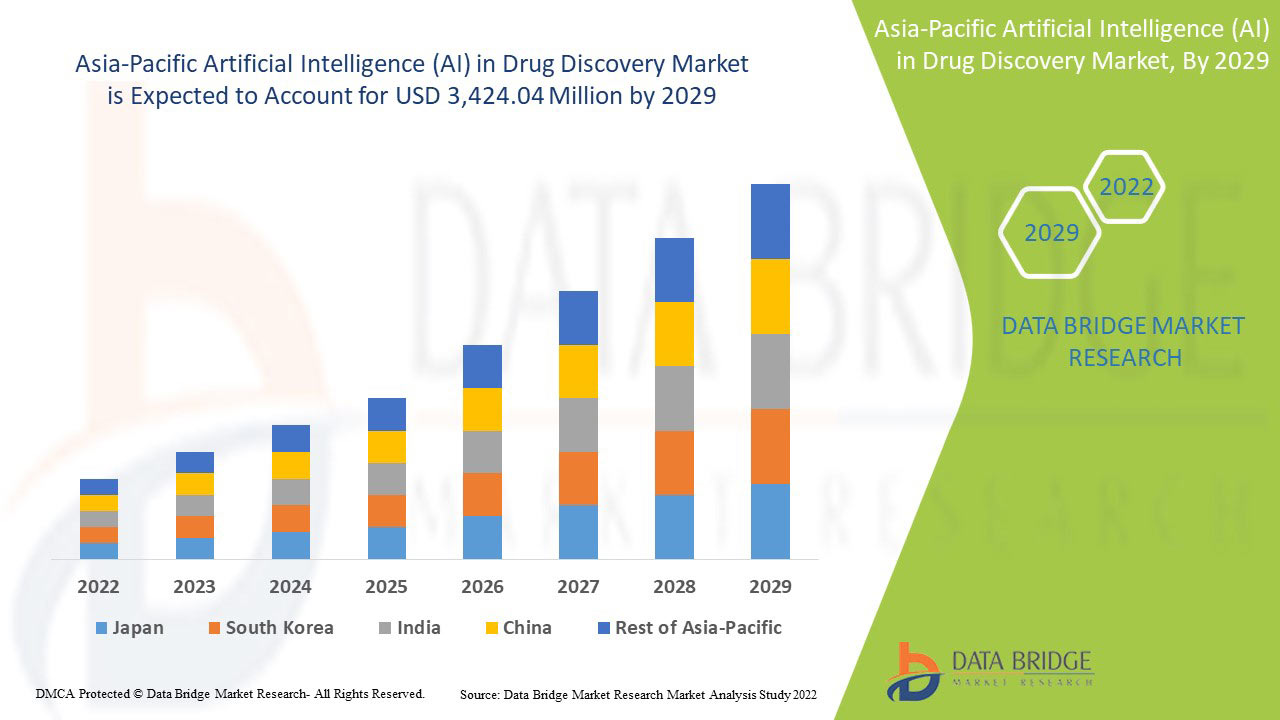

データブリッジ市場調査は、アジア太平洋地域の創薬における人工知能(AI)市場は、予測期間中に50.9%のCAGRで成長し、2029年までに34億2,404万米ドルの価値に達すると予測しています。創薬市場でのAIの利用を商業化するための技術進歩が急速に進んでいるため、ソフトウェアは市場で最大の技術セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

アプリケーション別(新薬候補、薬物の最適化と転用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と適格性、新規薬物設計、旧薬の薬物ターゲットの発見など)、テクノロジー別(機械学習、ディープラーニング、自然言語処理など)、薬物タイプ別(小分子と巨大分子)、提供内容別(ソフトウェアとサービス)、適応症別(免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患など)、最終用途別(開発業務受託機関(CRO)、製薬・バイオテクノロジー企業、研究センターと学術機関など) |

|

対象国 |

中国、日本、インド、韓国、シンガポール、タイ、マレーシア、オーストラリア、ニュージーランド、フィリピン、インドネシア、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

市場で活動している主要企業としては、NVIDIA Corporation、IBM Corp.、Atomwise Inc.、Microsoft、Benevolent AI、Aria Pharmaceuticals, Inc.、DEEP GENOMICS、Exscientia、Cloud、Insilico Medicine、Cyclica、NuMedii, Inc.、Envisagenics、Owkin Inc.、BERG LLC、Schrödinger, Inc.、XtalPi Inc.、BIOAGE Inc.などが挙げられます。 |

アジア太平洋地域の創薬市場における人工知能(AI)の定義

AI はここ数年、医療技術従事者の注目を集めており、多くの企業や大手研究機関がこれらの技術を臨床で使用できるよう完成させようと取り組んできました。AI (ディープラーニング (DL)、機械学習 (ML)、人工ニューラルネットワーク (ANN) とも呼ばれる) が臨床医をどのように支援できるかを示す最初の商用化デモが現在利用可能です。これらのシステムは、臨床医のワークフローにパラダイムシフトをもたらし、生産性を向上させると同時に、治療と患者のスループットを向上させる可能性があります。創薬のための AI は、機械を使用して人間の知能をシミュレートし、医薬品開発手順における複雑な課題を解決する技術です。臨床試験プロセスに AI ソリューションを採用すると、起こり得る障害が排除され、臨床試験のサイクルタイムが短縮され、臨床試験プロセスの生産性と精度が向上します。そのため、創薬プロセスにおけるこれらの高度な AI ソリューションの採用は、ライフサイエンス業界の関係者の間で人気が高まっています。製薬分野では、新しい化合物の発見、治療ターゲットの特定、カスタマイズされた医薬品の開発に役立ちます。創薬に使用される AI プラットフォームは、さまざまな慢性疾患を治療し、その重症度を最小限に抑える医薬品の発見に関する洞察を得るための実現可能な選択肢となる可能性があります。

アジア太平洋地域の創薬市場における人工知能(AI)の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 慢性疾患の発症率の上昇により、創薬におけるAIの必要性が高まっている

慢性疾患の発症率は世界中で急速に増加しています。米国疾病管理予防センター (CDC) によると、米国の成人 10 人中 6 人が慢性疾患を患っています。さらに、CDC は、心臓病や糖尿病などの慢性疾患が米国における主な死亡原因であることも強調しています。このような統計は、慢性疾患の蔓延が拡大していることと、これらの疾患による死亡率を下げる必要性を明らかにしています。

創薬に使用される AI プラットフォームは、さまざまな慢性疾患を治療し、その重症度を最小限に抑える医薬品の発見に関する洞察を得るための実現可能なオプションであることが証明されています。したがって、これらの要因は、予測期間中に市場の成長の原動力として機能することが期待されています。

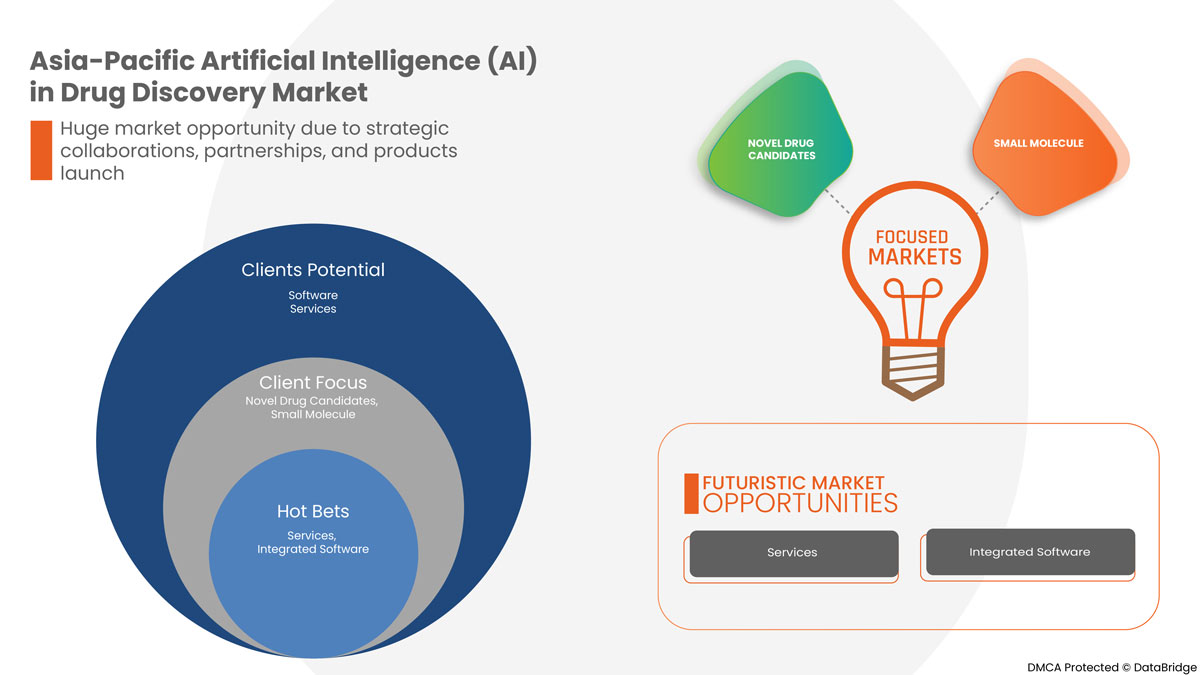

- 戦略的コラボレーション、パートナーシップ、製品の発売

AI は、R&D のタイムラインを急速に加速し、医薬品開発をより安価かつ迅速にし、承認の可能性を高めることで、医薬品の発見を変革する可能性があります。AI は医薬品の再利用研究の有効性を高めることもできます。

業界間の提携や協力の増加が市場を牽引しています。医薬品の発見と開発における AI の重要性の高まり、医薬品研究分野における AI 技術を含む研究開発活動への資金の急増が、世界市場の成長を牽引すると予測されています。したがって、業界間の協力やパートナーシップの増加が市場を牽引しています。

拘束

- 技術に関連する高コストと技術的制限

現在のヘルスケア分野は、医薬品や治療法のコスト増加など、いくつかの複雑な課題に直面しており、社会はこの分野で具体的かつ大幅な変化を必要としています。AI の成功は、大量のデータが利用可能かどうかにかかっています。これらのデータは、システムに提供されるその後のトレーニングに使用されるためです。さまざまなデータベース プロバイダーのデータにアクセスすると、企業に追加コストが発生する可能性があります。臨床試験は、特定の病状に対する医薬品の安全性と有効性を人間で確立することを目的としており、6 ~ 7 年の歳月と多額の資金投資が必要です。ただし、これらの試験に参加する分子のうち、承認に成功するのは 10 個のうち 1 個のみであり、これは業界にとって大きな損失です。これらの失敗は、不適切な患者選択、技術要件の不足、インフラストラクチャの貧弱さが原因である可能性があります。したがって、テクノロジーのコスト増加は、市場の成長の抑制要因となっています。

機会

-

研究開発への投資の増加

研究開発活動の増加とクラウドベースのサービスおよびアプリケーションの採用の増加は、市場の成長に有益な機会をもたらすでしょう。

The industry of AI in biopharma continues to grow after a long period of sepsis. This is reflected in the ongoing flow of investments and increase in the number of collaborations between pharmaceutical corporations and AI companies in 2021 to the previous years. The Biopharma industry’s growth is largely influenced by the active engagement of leading pharmaceutical corporations in AI-related investments. The number of scientific publications in the field of AI in Biopharma, and research collaborations between pharma companies and AI-expertise vendors are rapidly increasing, yet, some pharma corporations are still critical of AI applications. ML and AI applications in the pharmaceutical and healthcare industries lead to the formation of a new interdisciplinary field of data-driven drug discovery in healthcare. Thus, rise in investment in R&D activities is acting as an opportunity for market growth.

Challenge

- Lack of skilled professionals

The shortage of skilled professionals is expected to hamper the market growth. The employees have to re-train or learn new skill sets to work efficiently on the complex AI machines to get the desired results for the drug. This challenge that prevents full-fledged adoption of AI in the pharmaceutical industry includes the lack of skilled personnel to operate AI-based platforms, limited budget for small organizations, apprehension of replacing humans leading to job loss, skepticism about the data generated by AI, and the black box phenomenon (that is, how the conclusions are reached by the AI platform). The shortage of skills acts as a major hindrance to drug discovery through AI, discouraging companies to adopt AI-based machines for drug discovery.

As skill demands are too high, it has manifested as a challenge to retain and manage skill-specified professionals. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. There is an urgent need for the education of professionals for AI-based technology. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. It is therefore apparent that the availability of professionals equipped with adequate skills is challenging the market growth.

Post-COVID-19 Impact on Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market

The COVID-19 outbreak had a beneficial impact on the expansion of AI in drug discovery industry due to its widespread use by various organizations for the identification as well as screening of existing medicines used in the treatment of COVID-19. AI is useful in detecting active chemicals for the prevention of SARS-CoV, HIV, SARS-CoV-2, influenza virus, and others. During the pandemic, economies all over the world relied on AI-based medication discovery rather than traditional vaccine detection processes, which take years to create and are equally expensive, contributing to the growth of the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve the technology involved in the Wireless microphone. With this, the companies will bring advanced and accurate AI software to the market.

Recent Developments

- In March 2022, NVIDIA Corporation launched Clara Holoscan MGX to develop and deploy real-time AI applications. Clara Holoscan MGX expands the Clara Holoscan platform to provide an all-in-one, medical-grade reference architecture, as well as long-term software support, to accelerate innovation in the medical device industry. This will help the company for better AI performance in health sector for surgery, diagnostics, and drug discovery.

- In May 2022, Benevolent AI, a leading clinical-stage AI-enabled drug discovery company, announced that AstraZeneca has selected an additional novel target for Idiopathic Pulmonary Fibrosis (IPF) for its drug development portfolio, resulting in a milestone payment to Benevolent AI. This is the third novel target from the collaboration that has been identified using the Benevolent Platform across two disease areas, IPF and chronic kidney disease, and subsequently validated and selected for portfolio entry by AstraZeneca. This builds upon the recent extension of the collaboration with AstraZeneca to include two new disease areas, systemic lupus erythematosus, and heart failure, signed in January 2022. This has helped the company to make its collaboration stronger.

Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Scope

Asia-Pacific Artificial Intelligence (AI) in drug discovery market is segmented into application, technology, drug type, offering, indication, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

APPLICATION

- Novel Drug Candidates

- Drug Optimization and Repurposing Preclinical Testing and Approval

- Drug Monitoring

- Finding New Diseases Associated Targets and Pathways

- Understanding Disease Mechanisms

- Aggregating and Synthesizing Information

- Formation & Qualification of Hypotheses

- De Novo Drug Design

- Finding Drug Targets of an Old Drug

- Others

アプリケーションに基づいて、市場は、新薬候補、薬物の最適化と再利用、前臨床試験と承認、薬物モニタリング、新しい疾患関連ターゲットと経路の発見、疾患メカニズムの理解、情報の集約と統合、仮説の形成と認定、新規薬物設計、古い薬物の薬物ターゲットの発見、その他に分類されます。

テクノロジー

- 機械学習(ML)

- ディープラーニング(DL)

- 自然言語処理 (NLP)

- その他

テクノロジーに基づいて、市場は機械学習 (ML)、ディープラーニング (DL)、自然言語処理 (NLP) などに分類されます。

薬剤の種類

- 小分子

- 巨大分子

薬物の種類に基づいて、市場は低分子と高分子に分類されます。

提供

- ソフトウェア

- サービス

提供内容に基づいて、市場はソフトウェアとサービスに分類されます。

表示

- 免疫腫瘍学

- 神経変性疾患

- 心血管疾患

- 代謝性疾患

- その他

適応症に基づいて、市場は免疫腫瘍学、神経変性疾患、心血管疾患、代謝性疾患、その他に分類されます。

最終使用

- 製薬・バイオテクノロジー企業

- 契約研究機関(CRO)

- 研究センターおよび学術機関

- その他

最終用途に基づいて、市場は製薬およびバイオテクノロジー企業、契約研究機関(CRO)、研究センターおよび学術機関、その他に分類されます。

アジア太平洋地域の創薬市場における人工知能(AI)の地域分析/洞察

アジア太平洋地域の創薬市場における人工知能 (AI) が分析され、アプリケーション、テクノロジー、薬剤の種類、提供、適応症、最終用途別に市場規模の情報が提供されます。

この市場レポートで取り上げられている国は、中国、日本、インド、韓国、シンガポール、タイ、マレーシア、オーストラリアとニュージーランド、フィリピン、インドネシア、その他のアジア太平洋諸国です。

- 2022年には、患者数の増加と人々の意識の高まりにより感染症診断キットの需要が高まり、アジア太平洋地域が3番目に優勢な地域となります。中国は、創薬のためのAIの技術的進歩の高まりにより成長すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

創薬市場シェア分析における競争環境とアジア太平洋地域の人工知能(AI)

アジア太平洋地域の創薬における人工知能 (AI) 市場の競争状況では、競合他社ごとに詳細が提供されます。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータ ポイントは、アジア太平洋地域の創薬における人工知能 (AI) 市場への会社の重点にのみ関連しています。

この市場で活動している主要企業としては、NVIDIA Corporation、IBM Corp.、Atomwise Inc.、Microsoft、Benevolent AI、Aria Pharmaceuticals, Inc.、DEEP GENOMICS、Exscientia、Cloud、Insilico Medicine、Cyclica、NuMedii, Inc.、Envisagenics、Owkin Inc.、BERG LLC、Schrödinger, Inc.、XtalPi Inc.、BIOAGE Inc.などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORETSR’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN INCIDENCE OF CHRONIC DISEASES PROPELS NEED FOR ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY

5.1.2 STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND PRODUCTS LAUNCH

5.1.3 REDUCTION IN TOTAL TIME INVOLVED IN DRUG DISCOVERY PROCESS

5.1.4 ADVANCEMENT OF ARTIFICIAL INTELLIGENCE IN THE HEALTHCARE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH TECHNOLOGY AND TECHNICAL LIMITATIONS

5.2.2 DISADVANTAGES AND RISKS ASSOCIATED WITH AI IN DRUG DISCOVERY

5.2.3 LACK OF AVAILABLE QUALITY DATA

5.3 OPPORTUNITIES

5.3.1 RISE IN THE INVESTMENTS FOR R&D

5.3.2 RISING HEALTHCARE INFRASTRUCTURE

5.3.3 DEVELOPMENT OF NOVEL TOOLS

5.4 CHALLENGES

5.4.1 THE ASIA PACIFIC SHORTAGE OF AI TALENT

5.4.2 ETHICAL, LEGAL, AND REGULATORY ISSUES FOR AI ADOPTION IN THE PHARMACEUTICAL SCIENCES

6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING (ML)

7.2.1 SUPERVISED LEARNING

7.2.2 UNSUPERVISED LEARNING

7.2.3 REINFORCEMENT LEARNING

7.3 DEEP LEARNING

7.4 NATURAL LANGUAGE PROCESSING (NLP)

7.5 OTHERS

8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY DRUG TYPE

8.1 OVERVIEW

8.2 SMALL MOLECULE

8.3 LARGE MOLECULE

9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NOVEL DRUG CANDIDATES

9.2.1 PREDICT BIOACTIVITY OF SMALL MOLECULE

9.2.2 IDENTIFY BIOLOGICS TARGET

9.2.3 OTHERS

9.3 DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL

9.4 DRUG MONITORING

9.5 AGGREGATING AND SYNTHESIZING INFORMATION

9.6 DE NOVO DRUG DESIGN

9.7 FINDING DRUG TARGETS OF AN OLD DRUG

9.8 FORMATION & QUALIFICATION OF HYPOTHESES

9.9 UNDERSTANDING DISEASE MECHANISMS

9.1 FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS

9.11 OTHERS

10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

10.1 OVERVIEW

10.2 IMMUNE-ONCOLOGY

10.2.1 BREAST CANCER

10.2.2 LUNG CANCER

10.2.3 COLORECTAL CANCER

10.2.4 PROSTATE CANCER

10.2.5 PANCREATIC CANCER

10.2.6 BRAIN CANCER

10.2.7 LEUKEMIA

10.2.8 OTHERS

10.3 NEURODEGENERATIVE DISEASES

10.4 CARDIOVASCULAR DISEASES

10.5 METABOLIC DISEASES

10.6 OTHERS

11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY END USE

11.1 OVERVIEW

11.2 CONTRACT RESEARCH ORGANIZATIONS

11.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.4 RESEARCH CENTERS AND ACADEMIC INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NVIDIA CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SCHRÖDINGER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BERG LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ARDIGEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EXSCIENTIA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ARIA PHARMACEUTICALS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ATOMWISE INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BENEVOLENT AI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 BIOAGE INC.,

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CLOUD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CYCLICA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEEP GENOMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ENVISAGENICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INSILICO MEDICINE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NUMEDII, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OWKIN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XTALPI INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DEEP LEARNING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC NATURAL LANGUAGE PROCESSING (NLP) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SMALL MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LARGE MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC DRUG MONITORING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AGGREGATING AND SYNTHESIZING INFORMATION IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DE NOVO DRUG DESIGN IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FINDING DRUG TARGETS OF AN OLD DRUG IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FORMATION & QUALIFICATION OF HYPOTHESES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UNDERSTANDING DISEASE MECHANISMS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC NEURODEGENERATIVE DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC CARDIOVASCULAR DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC METABOLIC DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOB ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RESEARCH CENTRES AND ACADEMIC INSTITUTES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 CHINA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 52 CHINA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 JAPAN SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 JAPAN MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 JAPAN NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 67 JAPAN IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 INDIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 INDIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 INDIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 INDIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 88 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE AARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 THAILAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 THAILAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 149 REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING NEED TO CURB DRUG DISCOVERY COSTS AND REDUCE TIME INVOLVED IN THE DRUG DEVELOPMENT PROCESS, THE RISING ADOPTION OF CLOUD-BASED APPLICATIONS AND SERVICES, AND THE IMPENDING PATENT EXPIRY OF BLOCKBUSTER DRUGS ARE EXPECTED TO DRIVE THE GROWTH OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

FIGURE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2021

FIGURE 15 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2021

FIGURE 19 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2021

FIGURE 23 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2021

FIGURE 27 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2021

FIGURE 31 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2021

FIGURE 35 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING (2022-2029)

FIGURE 43 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。